Key Insights

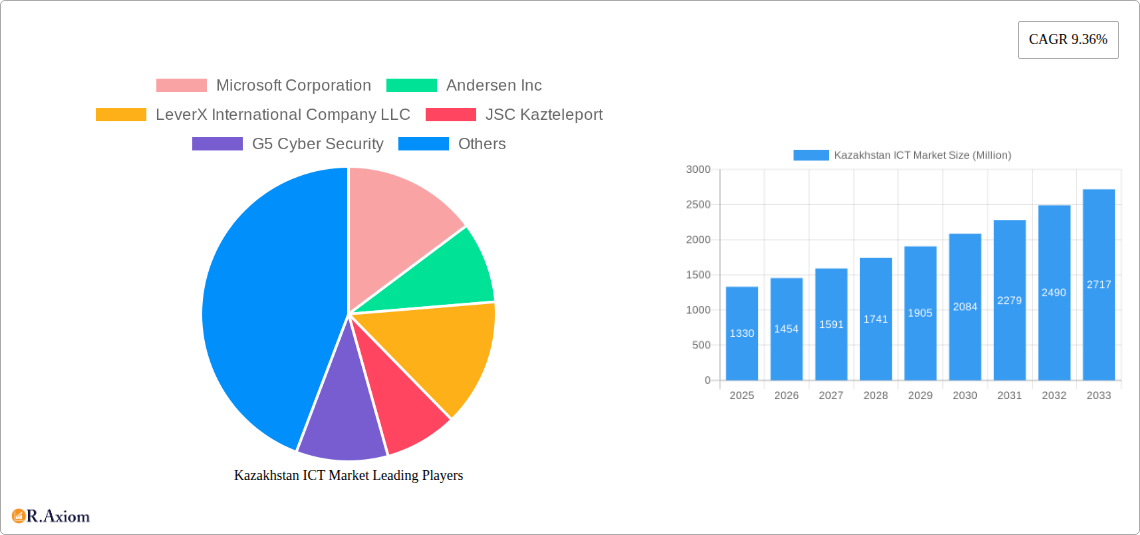

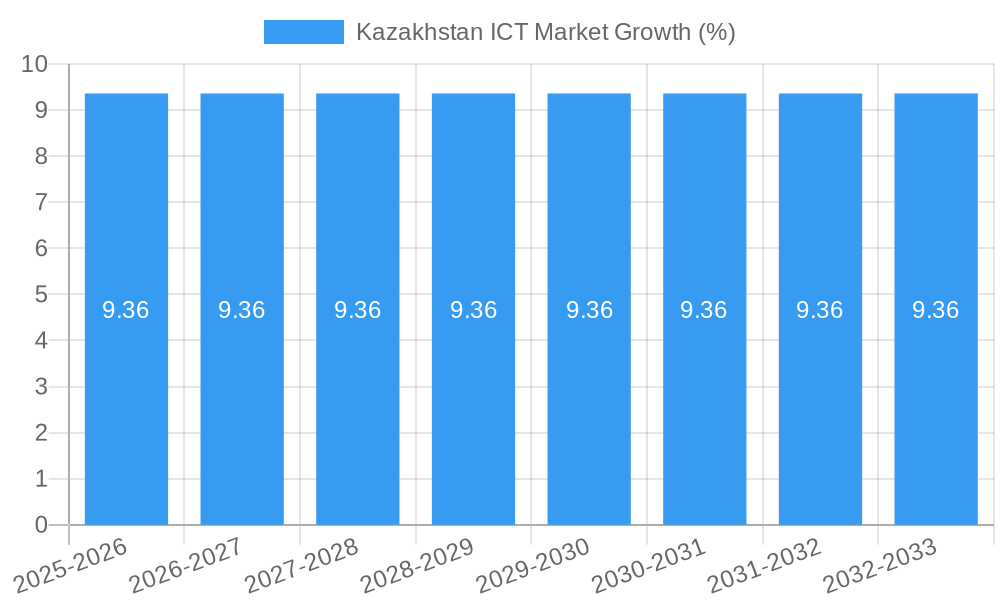

The Kazakhstan ICT market is poised for substantial growth, projected to reach a market size of $1.33 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 9.36% anticipated through 2033. This robust expansion is fueled by a confluence of dynamic drivers, including the increasing adoption of digital transformation initiatives across various sectors, a growing demand for cloud-based solutions, and significant government investments in developing a digitally inclusive infrastructure. Furthermore, the proliferation of advanced technologies such as AI, IoT, and cybersecurity solutions is creating new avenues for market penetration. The market is segmented across Hardware, Software, Services, and Telecommunication Services, with Small and Medium Enterprises (SMEs) and Large Enterprises alike contributing to this demand. Key industry verticals like BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, and Energy and Utilities are actively embracing ICT solutions to enhance operational efficiency and customer engagement. This dynamic landscape is further shaped by the strategic presence and competitive strategies of major players like Microsoft Corporation, Hewlett Packard Enterprise (HPE), and Kazakhtelekom AO, all contributing to the innovation and accessibility of ICT offerings within Kazakhstan.

The sustained growth trajectory of the Kazakhstan ICT market is further underpinned by its strategic focus on innovation and digital advancement. Emerging trends such as the widespread implementation of 5G networks, the rise of data analytics for informed decision-making, and the increasing emphasis on cybersecurity to protect digital assets are creating a fertile ground for ICT service providers. While the market benefits from strong governmental support and a rapidly digitizing economy, certain restraints, such as the need for enhanced digital literacy and the initial capital investment required for cutting-edge technology adoption, will need to be addressed. However, the overall outlook remains exceptionally positive, with ongoing efforts to bridge the digital divide and foster a competitive business environment expected to propel the market towards its projected valuations. The strategic importance of Kazakhstan as a regional hub for technology adoption and innovation will continue to attract both domestic and international investment, solidifying its position as a significant player in the global ICT landscape.

This in-depth report provides an exhaustive analysis of the Kazakhstan Information and Communications Technology (ICT) market, offering critical insights for stakeholders aiming to capitalize on this dynamic sector. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this report delves into market size, segmentation, key trends, growth drivers, challenges, and competitive landscape. Leveraging high-traffic keywords such as "Kazakhstan digital transformation," "Central Asia IT market," "Kazakhstan broadband expansion," "AI in Kazakhstan," and "telecom infrastructure Kazakhstan," this report aims to enhance search visibility and engage industry professionals, investors, and policymakers.

Kazakhstan ICT Market Market Concentration & Innovation

The Kazakhstan ICT market exhibits a moderate level of concentration, with a few dominant players in the telecommunications and software segments, alongside a growing ecosystem of innovative startups. Innovation is primarily driven by government initiatives focused on digitalizing the economy, such as the "Digital Kazakhstan" program, and increasing investments in artificial intelligence (AI) and cybersecurity. Regulatory frameworks are evolving to support digital growth, attracting foreign investment and fostering a competitive environment. Product substitutes are increasingly present, particularly in cloud services and software solutions, forcing established companies to focus on differentiation and value-added offerings. End-user trends show a strong demand for cloud-based solutions, mobile connectivity, and advanced data analytics across all enterprise sizes. Mergers and acquisitions (M&A) activities are on the rise, indicating consolidation and strategic expansion, with deal values projected to reach several hundred million dollars by 2028. Key market share holders are expected to maintain their positions through strategic partnerships and continuous product development, contributing to a projected market share growth of over 15% annually for leading software providers.

Kazakhstan ICT Market Industry Trends & Insights

The Kazakhstan ICT market is poised for significant expansion, fueled by a robust compound annual growth rate (CAGR) of approximately 12.5% from 2025 to 2033. This growth is largely attributed to the government's unwavering commitment to digital infrastructure development, aiming to achieve over 85% internet penetration by 2030. Technological disruptions are a constant force, with the rapid adoption of cloud computing, artificial intelligence, and the Internet of Things (IoT) reshaping business operations and consumer experiences. Consumer preferences are shifting towards on-demand services, seamless connectivity, and personalized digital experiences, driving demand for advanced software and robust telecommunication services. Competitive dynamics are intensifying, with both local and international players vying for market share. The increasing adoption of digital payment systems and the burgeoning e-commerce sector are further accelerating the market's evolution. The focus on cybersecurity solutions is also paramount, with businesses and government entities investing heavily to protect sensitive data and critical infrastructure. The rollout of 5G networks and the expansion of broadband infrastructure in rural areas are expected to unlock new opportunities and further integrate Kazakhstan into the global digital economy. Market penetration for essential ICT services in large enterprises is already exceeding 90%, while the SME segment is rapidly catching up, presenting a substantial growth avenue.

Dominant Markets & Segments in Kazakhstan ICT Market

The Telecommunication Services segment is a dominant force within the Kazakhstan ICT market, driven by substantial government investment in broadband expansion and digital infrastructure. The Government and IT and Telecom industry verticals are the primary consumers of ICT solutions, accounting for a significant portion of market expenditure, estimated at over 30% of total ICT spending in 2025. Small and Medium Enterprises (SMEs) are increasingly adopting digital solutions, presenting a rapidly growing segment with projected market growth exceeding 15% annually.

- Telecommunication Services: Key drivers include government-led initiatives to bridge the digital divide, the expansion of fiber-optic networks, and the ongoing deployment of 5G technology. The substantial investment in rural broadband connectivity by entities like Hughes Network Systems, LLC is a prime example.

- Software: Demand for enterprise resource planning (ERP), customer relationship management (CRM), and cybersecurity software is escalating across all industry verticals. The development of AI platforms like ai.astanahub.com signifies a growing focus on intelligent solutions.

- Services: Cloud computing services, IT consulting, and managed IT services are experiencing robust growth as businesses seek to optimize operations and enhance efficiency. The increasing reliance on third-party IT expertise fuels this segment's expansion.

- Hardware: While traditional hardware sales might see moderate growth, the demand for high-performance computing, data storage, and networking equipment remains strong, particularly for infrastructure upgrades and enterprise deployments.

The BFSI sector also represents a significant market, driven by the increasing adoption of digital banking, fintech solutions, and enhanced cybersecurity needs. The Energy and Utilities sector is investing in smart grid technologies and data analytics for operational efficiency. The Retail and E-commerce vertical is witnessing rapid digitalization, boosting demand for e-commerce platforms and digital payment solutions. The Manufacturing industry is progressively adopting Industry 4.0 technologies, including automation and IoT, further contributing to ICT market growth.

Kazakhstan ICT Market Product Developments

Product developments in the Kazakhstan ICT market are increasingly focused on AI-powered solutions, cloud-native applications, and enhanced cybersecurity offerings. Companies are innovating with localized software tailored to the specific needs of Kazakh businesses and government agencies. The emphasis is on creating integrated platforms that offer comprehensive solutions, from cloud infrastructure to data analytics and AI-driven insights. Competitive advantages are being built through user-friendly interfaces, robust security features, and scalable architectures that cater to both SMEs and large enterprises. The integration of AI in customer service, predictive maintenance, and business process automation is a key trend, driving the adoption of advanced technologies and expanding the market reach of innovative products.

Kazakhstan ICT Market Scope & Segmentation Analysis

The Kazakhstan ICT market is segmented across several key categories. The Hardware segment, encompassing servers, networking devices, and end-user computing, is projected to grow at a CAGR of approximately 7% during the forecast period. The Software segment, including system software, application software, and analytics tools, is expected to witness a CAGR of around 14%. The Services segment, comprising IT consulting, cloud services, and managed services, is a high-growth area with a projected CAGR of over 15%. Telecommunication Services, covering broadband, mobile, and fixed-line services, are anticipated to expand at a CAGR of approximately 10%.

Within enterprise size, Small and Medium Enterprises (SMEs) represent a rapidly expanding segment, driven by digital adoption initiatives and the availability of scalable cloud solutions, with a projected CAGR exceeding 16%. Large Enterprises continue to be significant contributors, with a focus on advanced analytics, cybersecurity, and digital transformation projects, showing a CAGR of approximately 11%.

Industry verticals such as IT and Telecom and Government will continue to lead ICT spending, with BFSI, Retail and E-commerce, Manufacturing, and Energy and Utilities exhibiting substantial growth. The Other Industry Verticals segment will also contribute to market expansion as digitalization efforts permeate diverse sectors.

Key Drivers of Kazakhstan ICT Market Growth

- Government Digitalization Initiatives: The "Digital Kazakhstan" program and related policies are a primary catalyst, promoting widespread adoption of ICT solutions across public and private sectors.

- Increasing Broadband Penetration: Investments in expanding high-speed internet access to rural and remote areas, as exemplified by the Hughes JUPITER System deployment, are crucial for digital inclusion.

- Growing Demand for Cloud Services: Businesses are increasingly migrating to cloud-based solutions for scalability, cost-efficiency, and enhanced collaboration.

- AI and Big Data Adoption: The national focus on AI innovation, as seen with platforms like ai.astanahub.com, is driving the demand for data analytics and intelligent solutions.

- Rise of E-commerce and Digital Payments: The burgeoning online retail sector and the adoption of digital financial services are spurring the need for robust e-commerce platforms and secure payment gateways.

Challenges in the Kazakhstan ICT Market Sector

- Digital Skills Gap: A shortage of skilled ICT professionals can hinder the implementation and adoption of advanced technologies.

- Cybersecurity Threats: The increasing sophistication of cyberattacks necessitates continuous investment in robust security measures and awareness programs.

- Infrastructure Development in Remote Areas: While progress is being made, ensuring consistent and affordable internet access in all remote regions remains a logistical challenge.

- Regulatory and Bureaucratic Hurdles: Navigating complex regulatory landscapes and obtaining necessary permits can sometimes slow down project execution.

- Limited Localized Software Solutions: While improving, there is still a need for more localized software tailored to the specific business contexts and languages prevalent in Kazakhstan.

Emerging Opportunities in Kazakhstan ICT Market

- AI-driven Business Transformation: Leveraging AI for process automation, customer insights, and predictive analytics presents significant growth opportunities for software and service providers.

- Expansion of 5G and IoT: The rollout of 5G networks will unlock new possibilities for IoT applications in smart cities, agriculture, and industrial automation.

- Digital Government Services: Enhancing e-government platforms and digital citizen services offers immense potential for innovation and market penetration.

- Fintech and Digital Banking: The continued growth of fintech solutions and digital banking services will drive demand for specialized software and secure infrastructure.

- Cybersecurity for Critical Infrastructure: As digitalization advances, the demand for advanced cybersecurity solutions to protect critical infrastructure will continue to rise.

Leading Players in the Kazakhstan ICT Market Market

- Microsoft Corporation

- Andersen Inc

- LeverX International Company LLC

- JSC Kazteleport

- G5 Cyber Security

- Hewlett Packard Enterprise (HPE)

- Kazakhtelekom AO

- Cloud Solutions LLP (24SaaS)

- JSC NAT Kazakhstan

- Core 24/

Key Developments in Kazakhstan ICT Market Industry

- March 2024: Hughes Network Systems, LLC, a subsidiary of EchoStar, revealed that Kazakhstan's Republican Center of Space Communication (RCSC), under the Ministry of Digital Development, has opted for the Hughes JUPITER System ground platform. This move underscores their commitment to bridging the digital gap in Kazakhstan. Hughes, through TIMIR LLP, is set to deploy JUPITER System equipment in over 200 villages nationwide. This initiative, part of the Digital Kazakhstan program, aims to provide broadband internet and e-government services to these communities.

- January 2024: The corporate fund Astana Hub has unveiled the digital platform ai.astanahub.com in Kazakhstan. This innovative platform harmonizes the endeavors of the government, businesses, and academia, fostering a collaborative environment for AI innovation across diverse sectors. The digital platform ai.astanahub.com seeks to inform the public about Kazakhstan's strides in artificial intelligence, granting access to crucial resources and databases. It's designed to catalyze the adoption of AI in building innovative products and services.

Strategic Outlook for Kazakhstan ICT Market Market

- Digital Skills Gap: A shortage of skilled ICT professionals can hinder the implementation and adoption of advanced technologies.

- Cybersecurity Threats: The increasing sophistication of cyberattacks necessitates continuous investment in robust security measures and awareness programs.

- Infrastructure Development in Remote Areas: While progress is being made, ensuring consistent and affordable internet access in all remote regions remains a logistical challenge.

- Regulatory and Bureaucratic Hurdles: Navigating complex regulatory landscapes and obtaining necessary permits can sometimes slow down project execution.

- Limited Localized Software Solutions: While improving, there is still a need for more localized software tailored to the specific business contexts and languages prevalent in Kazakhstan.

Emerging Opportunities in Kazakhstan ICT Market

- AI-driven Business Transformation: Leveraging AI for process automation, customer insights, and predictive analytics presents significant growth opportunities for software and service providers.

- Expansion of 5G and IoT: The rollout of 5G networks will unlock new possibilities for IoT applications in smart cities, agriculture, and industrial automation.

- Digital Government Services: Enhancing e-government platforms and digital citizen services offers immense potential for innovation and market penetration.

- Fintech and Digital Banking: The continued growth of fintech solutions and digital banking services will drive demand for specialized software and secure infrastructure.

- Cybersecurity for Critical Infrastructure: As digitalization advances, the demand for advanced cybersecurity solutions to protect critical infrastructure will continue to rise.

Leading Players in the Kazakhstan ICT Market Market

- Microsoft Corporation

- Andersen Inc

- LeverX International Company LLC

- JSC Kazteleport

- G5 Cyber Security

- Hewlett Packard Enterprise (HPE)

- Kazakhtelekom AO

- Cloud Solutions LLP (24SaaS)

- JSC NAT Kazakhstan

- Core 24/

Key Developments in Kazakhstan ICT Market Industry

- March 2024: Hughes Network Systems, LLC, a subsidiary of EchoStar, revealed that Kazakhstan's Republican Center of Space Communication (RCSC), under the Ministry of Digital Development, has opted for the Hughes JUPITER System ground platform. This move underscores their commitment to bridging the digital gap in Kazakhstan. Hughes, through TIMIR LLP, is set to deploy JUPITER System equipment in over 200 villages nationwide. This initiative, part of the Digital Kazakhstan program, aims to provide broadband internet and e-government services to these communities.

- January 2024: The corporate fund Astana Hub has unveiled the digital platform ai.astanahub.com in Kazakhstan. This innovative platform harmonizes the endeavors of the government, businesses, and academia, fostering a collaborative environment for AI innovation across diverse sectors. The digital platform ai.astanahub.com seeks to inform the public about Kazakhstan's strides in artificial intelligence, granting access to crucial resources and databases. It's designed to catalyze the adoption of AI in building innovative products and services.

Strategic Outlook for Kazakhstan ICT Market Market

- Microsoft Corporation

- Andersen Inc

- LeverX International Company LLC

- JSC Kazteleport

- G5 Cyber Security

- Hewlett Packard Enterprise (HPE)

- Kazakhtelekom AO

- Cloud Solutions LLP (24SaaS)

- JSC NAT Kazakhstan

- Core 24/

Key Developments in Kazakhstan ICT Market Industry

- March 2024: Hughes Network Systems, LLC, a subsidiary of EchoStar, revealed that Kazakhstan's Republican Center of Space Communication (RCSC), under the Ministry of Digital Development, has opted for the Hughes JUPITER System ground platform. This move underscores their commitment to bridging the digital gap in Kazakhstan. Hughes, through TIMIR LLP, is set to deploy JUPITER System equipment in over 200 villages nationwide. This initiative, part of the Digital Kazakhstan program, aims to provide broadband internet and e-government services to these communities.

- January 2024: The corporate fund Astana Hub has unveiled the digital platform ai.astanahub.com in Kazakhstan. This innovative platform harmonizes the endeavors of the government, businesses, and academia, fostering a collaborative environment for AI innovation across diverse sectors. The digital platform ai.astanahub.com seeks to inform the public about Kazakhstan's strides in artificial intelligence, granting access to crucial resources and databases. It's designed to catalyze the adoption of AI in building innovative products and services.

Strategic Outlook for Kazakhstan ICT Market Market

The strategic outlook for the Kazakhstan ICT market is exceptionally promising, driven by a confluence of government support, technological advancements, and increasing market demand. The ongoing digitalization of public services, coupled with private sector investment in advanced technologies like AI and cloud computing, will continue to fuel market expansion. Opportunities for strategic partnerships and M&A activities will grow as companies seek to consolidate their market positions and expand their service offerings. The focus on bridging the digital divide through infrastructure development will open new avenues for service providers in previously underserved regions. Continued investment in cybersecurity will be paramount, creating a steady demand for advanced security solutions. The market is well-positioned for sustained growth, attracting both domestic and international players eager to capitalize on Kazakhstan's digital transformation journey.

Kazakhstan ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Kazakhstan ICT Market Segmentation By Geography

- 1. Kazakhstan

Kazakhstan ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Implementation of 5G is Back on Track; Growing demand for Cloud Technology

- 3.3. Market Restrains

- 3.3.1. Implementation of 5G is Back on Track; Growing demand for Cloud Technology

- 3.4. Market Trends

- 3.4.1. Growing demand for Cloud Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kazakhstan ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kazakhstan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Microsoft Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Andersen Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LeverX International Company LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JSC Kazteleport

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 G5 Cyber Security

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hewlett Packard Enterprise (HPE)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kazakhtelekom AO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cloud Solutions LLP (24SaaS)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JSC NAT Kazakhstan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Core 24/

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Microsoft Corporation

List of Figures

- Figure 1: Kazakhstan ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kazakhstan ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Kazakhstan ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kazakhstan ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Kazakhstan ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Kazakhstan ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Kazakhstan ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 6: Kazakhstan ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 7: Kazakhstan ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 8: Kazakhstan ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 9: Kazakhstan ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Kazakhstan ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Kazakhstan ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Kazakhstan ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Kazakhstan ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 14: Kazakhstan ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 15: Kazakhstan ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 16: Kazakhstan ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 17: Kazakhstan ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Kazakhstan ICT Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kazakhstan ICT Market?

The projected CAGR is approximately 9.36%.

2. Which companies are prominent players in the Kazakhstan ICT Market?

Key companies in the market include Microsoft Corporation, Andersen Inc, LeverX International Company LLC, JSC Kazteleport, G5 Cyber Security, Hewlett Packard Enterprise (HPE), Kazakhtelekom AO, Cloud Solutions LLP (24SaaS), JSC NAT Kazakhstan, Core 24/.

3. What are the main segments of the Kazakhstan ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Implementation of 5G is Back on Track; Growing demand for Cloud Technology.

6. What are the notable trends driving market growth?

Growing demand for Cloud Technology.

7. Are there any restraints impacting market growth?

Implementation of 5G is Back on Track; Growing demand for Cloud Technology.

8. Can you provide examples of recent developments in the market?

March 2024: Hughes Network Systems, LLC, a subsidiary of EchoStar, revealed that Kazakhstan's Republican Center of Space Communication (RCSC), under the Ministry of Digital Development, has opted for the Hughes JUPITER System ground platform. This move underscores their commitment to bridging the digital gap in Kazakhstan. Hughes, through TIMIR LLP, is set to deploy JUPITER System equipment in over 200 villages nationwide. This initiative, part of the Digital Kazakhstan program, aims to provide broadband internet and e-government services to these communities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kazakhstan ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kazakhstan ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kazakhstan ICT Market?

To stay informed about further developments, trends, and reports in the Kazakhstan ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence