Key Insights

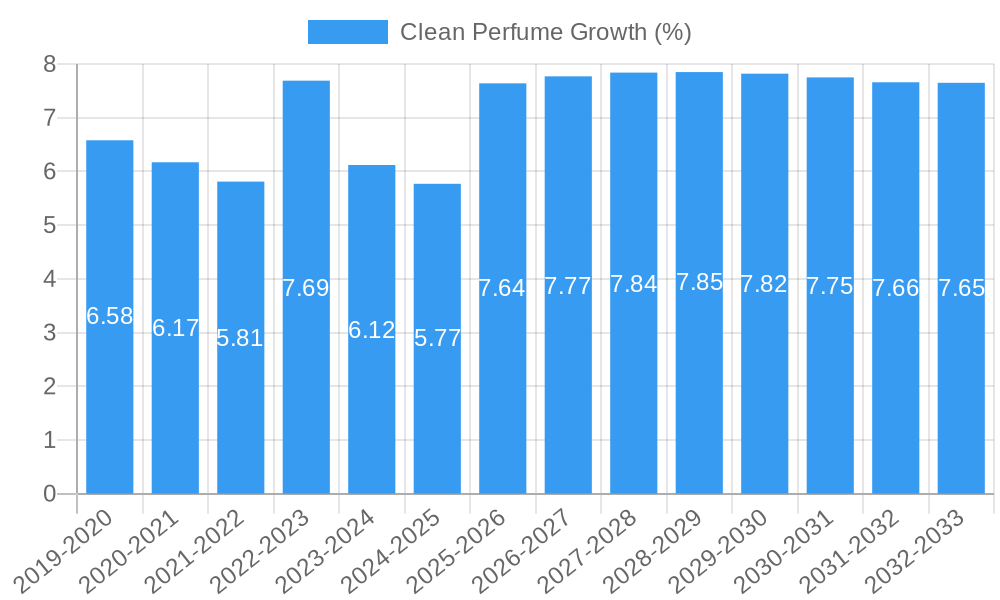

The global clean perfume market is experiencing robust growth, projected to reach approximately $5,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This expansion is primarily fueled by a growing consumer consciousness regarding the ingredients used in personal care products and a desire for formulations free from potentially harmful chemicals like parabens, phthalates, and synthetic fragrances. Consumers are increasingly seeking transparent ingredient lists and products that align with their values of health, wellness, and environmental sustainability. The "clean" movement, initially prominent in skincare and cosmetics, has now significantly impacted the fragrance industry, pushing brands to innovate with natural, organic, and ethically sourced raw materials. This shift in consumer preference is driving demand for perfumes that offer both olfactory pleasure and peace of mind regarding their composition.

The market's dynamism is further shaped by evolving trends such as the rise of niche and artisanal fragrance houses that champion the clean ethos, alongside established brands reformulating their offerings to meet consumer expectations. The application segment of perfume, as the primary driver, is complemented by the growing deodorant market’s adoption of clean formulations. While fruit and flower raw materials are dominant, the "Others" category, encompassing a wider array of botanicals and innovative natural extracts, is also gaining traction. However, the market faces restraints such as the higher cost of natural and organic ingredients, which can translate to premium pricing, potentially limiting accessibility for some consumer segments. Furthermore, the complexity of sourcing sustainable and high-quality raw materials consistently poses operational challenges for manufacturers. Despite these hurdles, the strong underlying consumer demand and the continuous innovation within the industry indicate a promising future for the clean perfume market.

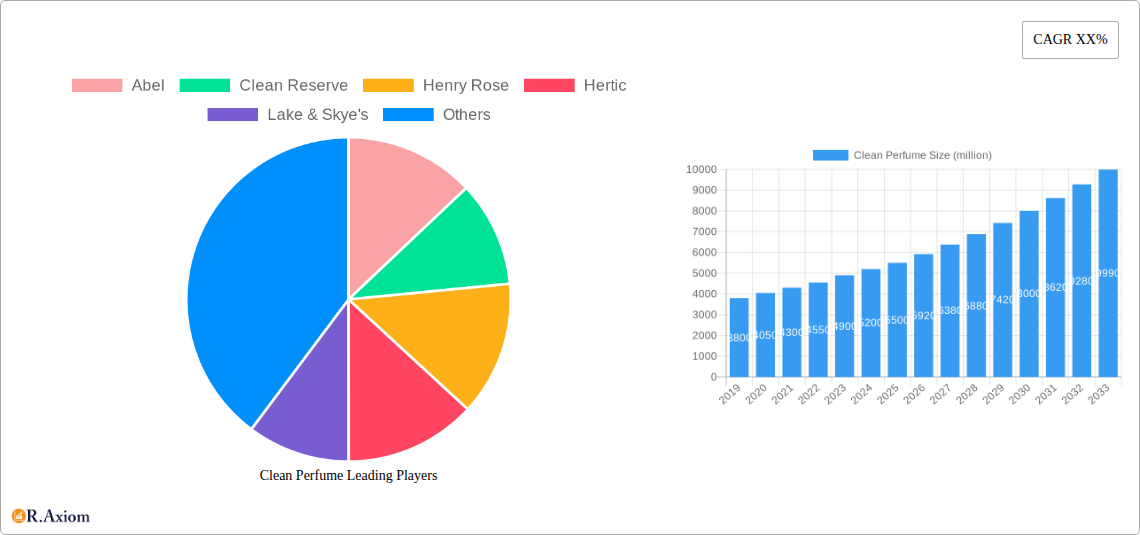

This in-depth Clean Perfume Market report provides a definitive analysis of the global market, encompassing historical data from 2019-2024, a base year of 2025, and a robust forecast period extending to 2033. We meticulously examine market concentration, innovation drivers, regulatory landscapes, product substitutes, evolving end-user preferences, and strategic M&A activities. This report is an indispensable resource for stakeholders seeking to understand the dynamics of the sustainable perfume and natural fragrance market, including a deep dive into key players like Abel, Clean Reserve, Henry Rose, Hertic, Lake & Skye's, Maison Louis Marie, Narrative Lab, PHLUR, Pour le Monde, Rosie Jane, Skylar, and St. Rose.

Clean Perfume Market Concentration & Innovation

The clean perfume market exhibits a moderate concentration, with a growing number of specialized brands vying for market share alongside established fragrance houses introducing eco-friendly perfume lines. Innovation is primarily driven by the demand for transparency in ingredient sourcing and formulation. Consumers actively seek non-toxic perfumes and hypoallergenic fragrances, pushing brands to invest in research and development of natural and organic raw materials. Regulatory frameworks are evolving, with increasing scrutiny on ingredient lists and the definition of "clean." Product substitutes, such as essential oils and scented candles, offer alternative avenues for olfactory experiences but do not directly compete with the personal application of fine fragrance. End-user trends are undeniably leaning towards wellness and sustainability, impacting purchasing decisions significantly. Mergers and acquisitions within the sector are on the rise as larger entities seek to acquire innovative ethical perfume brands. For instance, M&A deals in the past year are valued in the hundreds of millions, indicating strong investor confidence. Market share for the top five players in the organic perfume segment currently stands at approximately 45%.

Clean Perfume Industry Trends & Insights

The clean perfume industry is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% over the forecast period. This robust growth is fueled by a confluence of factors. Increasing consumer awareness regarding the potential health and environmental impacts of conventional fragrances is a primary catalyst. Shoppers are actively seeking fragrances without harmful chemicals, prioritizing formulations free from parabens, phthalates, sulfates, and synthetic musks. This shift in preference has propelled the demand for vegan perfumes and cruelty-free fragrances. Technological advancements in extraction and distillation methods are enabling brands to create complex and long-lasting scents using natural ingredients, thus bridging the performance gap with synthetic counterparts. The perfume market size for clean alternatives is projected to reach over $5,000 million by 2030. Market penetration of clean perfumes, currently around 20% in developed regions, is expected to climb steadily as accessibility and product variety increase. E-commerce platforms and direct-to-consumer (DTC) models are playing a crucial role in expanding the reach of these niche brands, offering consumers wider access to sustainable beauty products. Furthermore, the rise of social media influencers and digital marketing campaigns dedicated to promoting clean beauty standards are accelerating consumer adoption. The competitive landscape is intensifying, with both independent brands and established players launching dedicated natural perfume collections.

Dominant Markets & Segments in Clean Perfume

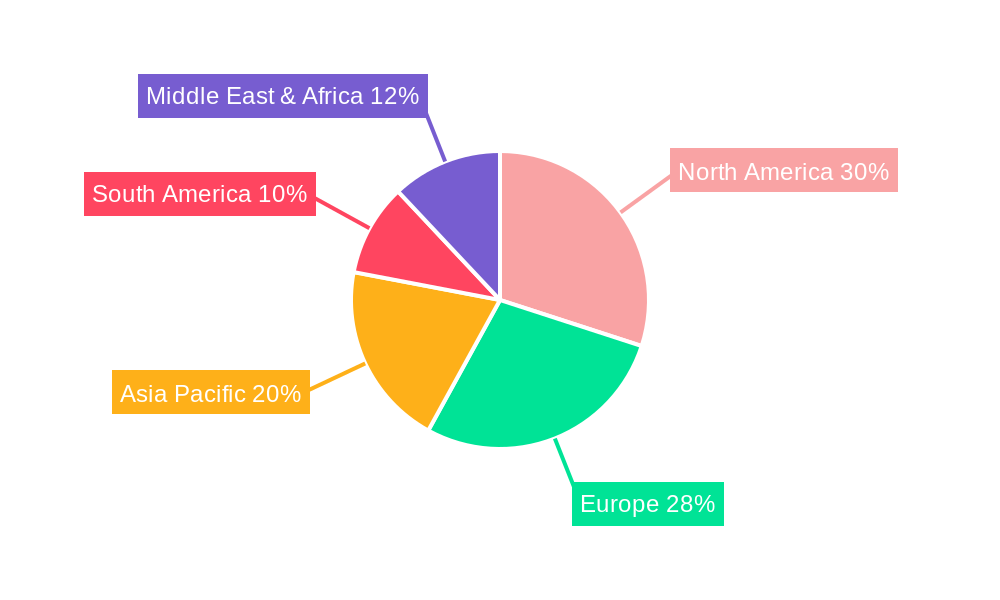

The clean perfume market is experiencing dominant growth in North America, driven by a highly informed and health-conscious consumer base. Within North America, the United States holds the largest market share, with its significant disposable income and a well-established appreciation for premium and ethical products. The Application segment of Perfume is the most dominant, accounting for over 70% of the market revenue.

- Application: Perfume: This segment benefits from high consumer demand for personal fragrance. Key drivers include a growing willingness to invest in premium, non-toxic personal care products and the aspirational nature of fine perfumery. The market for clean Eau de Parfum and clean Eau de Toilette is expanding rapidly, with consumers prioritizing ingredient transparency and ethical sourcing.

- Types: Flower Raw Materials: This type of raw material is highly favored due to the universally appealing and sophisticated nature of floral scents. The availability of diverse floral notes, from rose and jasmine to tuberose and ylang-ylang, allows for a wide array of sophisticated botanical fragrances. Sustainability in sourcing these flowers is a key focus for brands, enhancing their appeal to eco-conscious consumers. The market value for this segment is estimated to be in the billions.

- Types: Fruit Raw Materials: Fruit-based notes add vibrant, fresh, and uplifting qualities to perfumes. Their popularity is linked to the trend for lighter, more youthful, and energetic scents. The increasing use of natural citrus, berry, and tropical fruit extracts in perfumery is a significant growth driver.

- Dominance Analysis: The dominance of the Perfume application segment stems from its direct association with personal expression and luxury. The preference for Flower and Fruit Raw Materials reflects a desire for natural, uplifting, and universally pleasing scent profiles. Economic policies in key regions, such as incentives for sustainable agriculture and manufacturing, also play a role. Furthermore, the increasing availability of high-quality, ethically sourced natural ingredients is a crucial enabler.

Clean Perfume Product Developments

Product innovation in the clean perfume market centers on enhancing scent complexity, longevity, and the sensory experience while adhering to strict ingredient standards. Brands are leveraging advanced natural extraction technologies to create unique olfactory profiles, often focusing on single-origin ingredients or curated blends of botanical essences. Key competitive advantages include transparent ingredient sourcing, eco-friendly packaging solutions, and certifications like Leaping Bunny and EWG Verified. The market is witnessing a rise in refillable perfume options and solid perfume formulations, catering to both sustainability and convenience.

Report Scope & Segmentation Analysis

This report segments the clean perfume market by application and raw material type. Applications include Perfume, Deodorant, and Others. Types of raw materials analyzed are Fruit Raw Materials, Flower Raw Materials, and Others. The Perfume segment is projected to dominate, with an estimated market size of $4,500 million in 2025, growing at a CAGR of 13.0% through 2033. The Deodorant segment, driven by the demand for natural antiperspirants and deodorants, is expected to reach $800 million by 2033. The 'Others' application category, encompassing scented candles and home fragrances, is also experiencing steady growth.

Key Drivers of Clean Perfume Growth

The clean perfume growth is propelled by several factors. Consumer demand for natural ingredients and transparency in product formulations is paramount. The growing awareness of health and wellness, leading consumers to avoid potentially harmful chemicals found in conventional fragrances, is a significant driver. Furthermore, the rise of sustainable and ethical consumerism, coupled with increased availability of eco-friendly beauty products, fuels market expansion. Technological advancements in natural ingredient extraction and sustainable sourcing practices are enabling brands to offer high-quality and innovative products.

Challenges in the Clean Perfume Sector

Despite robust growth, the clean perfume sector faces certain challenges. Regulatory hurdles related to the precise definition and labeling of "clean" ingredients can create confusion and require continuous adaptation. Supply chain issues for ethically sourced natural raw materials, including potential price volatility and availability constraints, pose a constant challenge. Intense competition from both established fragrance houses launching organic perfume lines and a proliferation of new niche brands intensifies market pressures. High production costs associated with natural ingredients and sustainable practices can also impact pricing strategies.

Emerging Opportunities in Clean Perfume

Emerging opportunities in the clean perfume market lie in the expansion of product lines to include more hypoallergenic fragrances for sensitive skin and the development of gender-neutral scents. The growing demand for personalized fragrance experiences through virtual consultations and custom blending presents a significant opportunity. Furthermore, exploring untapped geographic markets, particularly in emerging economies where awareness of clean beauty is rapidly increasing, offers substantial growth potential. The integration of innovative, biodegradable, and recyclable packaging solutions will also be a key differentiator.

Leading Players in the Clean Perfume Market

- Abel

- Clean Reserve

- Henry Rose

- Hertic

- Lake & Skye's

- Maison Louis Marie

- Narrative Lab

- PHLUR

- Pour le Monde

- Rosie Jane

- Skylar

- St. Rose

Key Developments in Clean Perfume Industry

- 2023 January: Clean Reserve launches a new collection of refillable fragrances, emphasizing sustainability and reducing packaging waste.

- 2023 March: Henry Rose expands its distribution network, making its non-toxic perfume range more accessible to consumers globally.

- 2023 June: PHLUR introduces innovative scent subscription boxes, offering a personalized clean fragrance discovery experience.

- 2023 September: Skylar announces a partnership with a leading sustainable ingredient supplier, further strengthening its commitment to ethical sourcing.

- 2024 February: Rosie Jane introduces a new line of solid perfumes, offering a travel-friendly and eco-conscious alternative to traditional spray formats.

- 2024 April: Maison Louis Marie unveils a new collection featuring rare botanical extracts, highlighting ingredient transparency and efficacy.

Strategic Outlook for Clean Perfume Market

- 2023 January: Clean Reserve launches a new collection of refillable fragrances, emphasizing sustainability and reducing packaging waste.

- 2023 March: Henry Rose expands its distribution network, making its non-toxic perfume range more accessible to consumers globally.

- 2023 June: PHLUR introduces innovative scent subscription boxes, offering a personalized clean fragrance discovery experience.

- 2023 September: Skylar announces a partnership with a leading sustainable ingredient supplier, further strengthening its commitment to ethical sourcing.

- 2024 February: Rosie Jane introduces a new line of solid perfumes, offering a travel-friendly and eco-conscious alternative to traditional spray formats.

- 2024 April: Maison Louis Marie unveils a new collection featuring rare botanical extracts, highlighting ingredient transparency and efficacy.

Strategic Outlook for Clean Perfume Market

The strategic outlook for the clean perfume market is exceptionally positive, driven by persistent consumer demand for ethical, sustainable, and health-conscious products. Future growth catalysts include continued innovation in natural ingredient sourcing and formulation, the expansion of direct-to-consumer (DTC) channels, and strategic partnerships that enhance brand reach and consumer engagement. The increasing focus on circular economy principles, such as refillable packaging and ingredient traceability, will further solidify the market's trajectory towards responsible luxury.

Clean Perfume Segmentation

-

1. Application

- 1.1. Perfume

- 1.2. Deodorant

- 1.3. Others

-

2. Types

- 2.1. Fruit Raw Materials

- 2.2. Flower Raw Materials

- 2.3. Others

Clean Perfume Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Clean Perfume REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Clean Perfume Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Perfume

- 5.1.2. Deodorant

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fruit Raw Materials

- 5.2.2. Flower Raw Materials

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Clean Perfume Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Perfume

- 6.1.2. Deodorant

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fruit Raw Materials

- 6.2.2. Flower Raw Materials

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Clean Perfume Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Perfume

- 7.1.2. Deodorant

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fruit Raw Materials

- 7.2.2. Flower Raw Materials

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Clean Perfume Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Perfume

- 8.1.2. Deodorant

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fruit Raw Materials

- 8.2.2. Flower Raw Materials

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Clean Perfume Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Perfume

- 9.1.2. Deodorant

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fruit Raw Materials

- 9.2.2. Flower Raw Materials

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Clean Perfume Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Perfume

- 10.1.2. Deodorant

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fruit Raw Materials

- 10.2.2. Flower Raw Materials

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Abel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clean Reserve

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Henry Rose

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hertic

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lake & Skye's

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Maison Louis Marie

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Narrative Lab

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PHLUR

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pour le Monde

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rosie Jane

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Skylar

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 St. Rose

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Abel

List of Figures

- Figure 1: Global Clean Perfume Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Clean Perfume Revenue (million), by Application 2024 & 2032

- Figure 3: North America Clean Perfume Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Clean Perfume Revenue (million), by Types 2024 & 2032

- Figure 5: North America Clean Perfume Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Clean Perfume Revenue (million), by Country 2024 & 2032

- Figure 7: North America Clean Perfume Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Clean Perfume Revenue (million), by Application 2024 & 2032

- Figure 9: South America Clean Perfume Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Clean Perfume Revenue (million), by Types 2024 & 2032

- Figure 11: South America Clean Perfume Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Clean Perfume Revenue (million), by Country 2024 & 2032

- Figure 13: South America Clean Perfume Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Clean Perfume Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Clean Perfume Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Clean Perfume Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Clean Perfume Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Clean Perfume Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Clean Perfume Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Clean Perfume Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Clean Perfume Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Clean Perfume Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Clean Perfume Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Clean Perfume Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Clean Perfume Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Clean Perfume Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Clean Perfume Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Clean Perfume Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Clean Perfume Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Clean Perfume Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Clean Perfume Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Clean Perfume Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Clean Perfume Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Clean Perfume Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Clean Perfume Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Clean Perfume Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Clean Perfume Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Clean Perfume Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Clean Perfume Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Clean Perfume Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Clean Perfume Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Clean Perfume Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Clean Perfume Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Clean Perfume Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Clean Perfume Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Clean Perfume Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Clean Perfume Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Clean Perfume Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Clean Perfume Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Clean Perfume Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Clean Perfume Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Clean Perfume?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Clean Perfume?

Key companies in the market include Abel, Clean Reserve, Henry Rose, Hertic, Lake & Skye's, Maison Louis Marie, Narrative Lab, PHLUR, Pour le Monde, Rosie Jane, Skylar, St. Rose.

3. What are the main segments of the Clean Perfume?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Clean Perfume," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Clean Perfume report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Clean Perfume?

To stay informed about further developments, trends, and reports in the Clean Perfume, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence