Key Insights

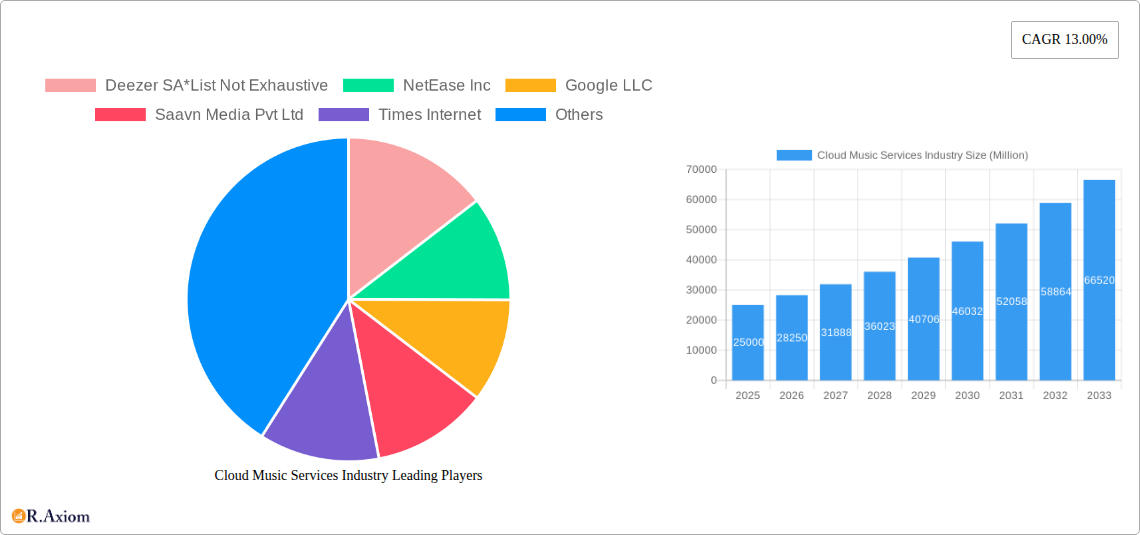

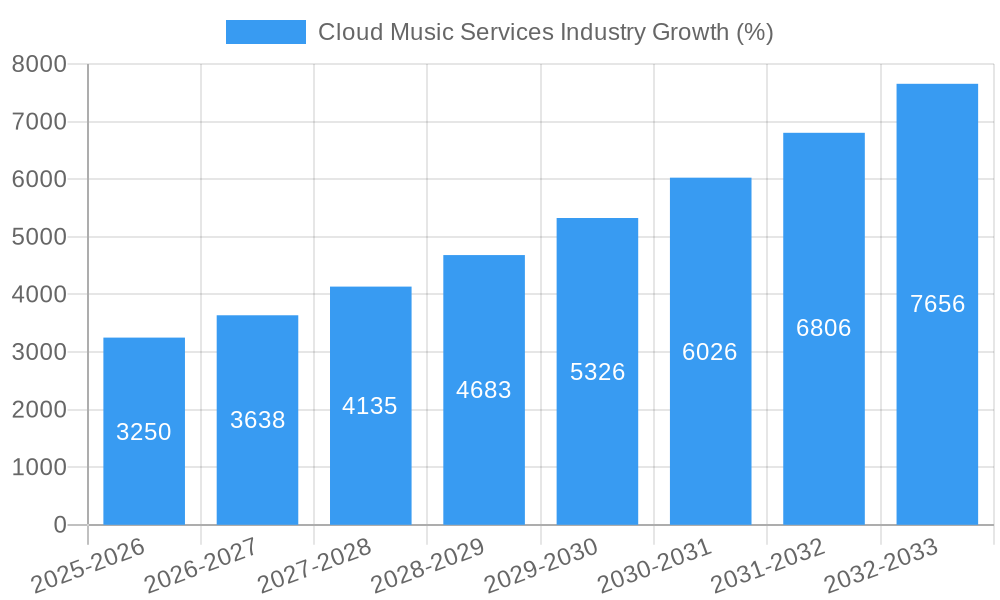

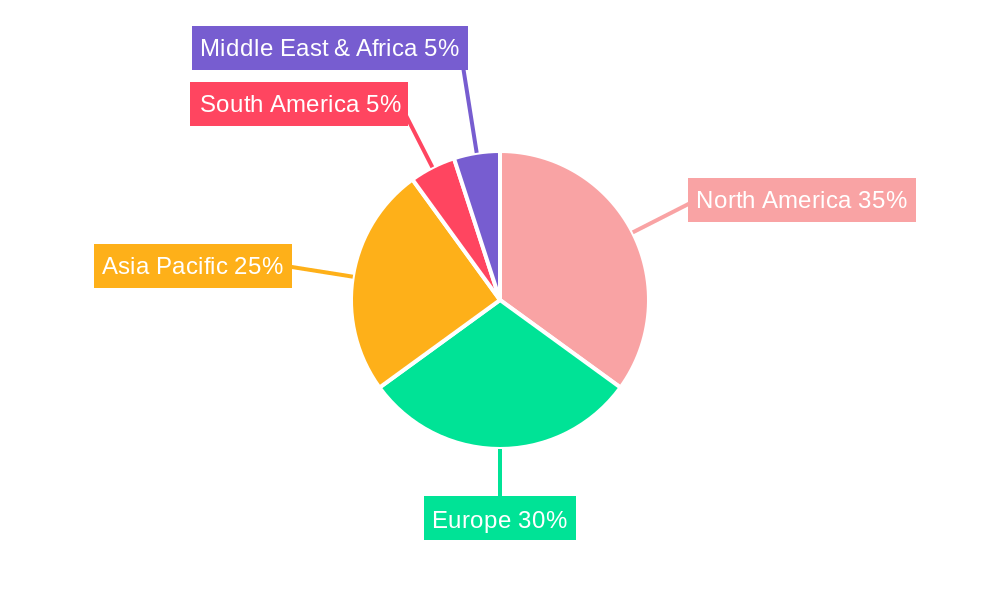

The global cloud music services market is experiencing robust growth, projected to reach a substantial size driven by increasing smartphone penetration, affordable data plans, and the rising popularity of on-demand music streaming. The market's Compound Annual Growth Rate (CAGR) of 13% from 2019 to 2024 suggests a consistently expanding user base and market value. The segment breakdown reveals that streaming services dominate the market, contributing significantly to its overall value. This dominance is further fueled by the convenience and affordability offered by subscription-based models. While download services maintain a presence, their share is likely declining as streaming gains traction. Hardware devices, such as smart speakers and headphones integrated with music services, represent a crucial growth driver, enhancing user experience and expanding market reach. The end-user segment analysis indicates that individuals constitute the largest user base, followed by families and businesses using cloud music services for background music or employee engagement. Geographic distribution shows strong market penetration in North America and Europe, with Asia-Pacific emerging as a rapidly expanding region. Competitive pressures among established players such as Spotify, Apple Music, Amazon Music, and emerging local players continue to drive innovation and affordability, further accelerating market expansion.

The forecast period (2025-2033) anticipates continued growth fueled by technological advancements, including enhanced audio quality (Hi-Fi streaming), personalized recommendations powered by AI, and the integration of music services into various smart home ecosystems. However, challenges such as piracy, copyright issues, and varying levels of internet access across different regions might act as restraints. Nevertheless, ongoing innovation and strategic partnerships within the industry are poised to mitigate these challenges. The increasing penetration of cloud music services in developing economies, propelled by growing smartphone adoption and decreasing data costs, suggests substantial future growth potential. The continued evolution of streaming technologies and personalized listening experiences promises to further consolidate the dominance of cloud-based music platforms in the coming years.

Cloud Music Services Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Cloud Music Services Industry, encompassing market size, growth projections, competitive landscape, and key industry trends from 2019 to 2033. The report leverages extensive data analysis to offer actionable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The base year for this report is 2025, with a forecast period extending to 2033 and a historical period covering 2019-2024. The total market value in 2025 is estimated at xx Million.

Cloud Music Services Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, substitute products, end-user trends, and mergers & acquisitions (M&A) activities within the cloud music services industry. The global market is characterized by a high degree of concentration, with a few major players holding significant market share. For example, Spotify, with its 205 Million premium subscribers as of January 2023, commands a substantial portion of the streaming market. However, the market is also witnessing significant innovation, driven by factors such as advancements in artificial intelligence for personalized music recommendations, the rise of high-fidelity audio streaming, and the integration of music services with other platforms.

The regulatory landscape varies significantly across regions, impacting licensing, pricing, and content availability. The emergence of alternative entertainment options, such as podcasts and video streaming services, presents a significant challenge to the industry. The ongoing M&A activity, with deal values reaching xx Million in recent years, reflects the industry's dynamic nature and the pursuit of scale and diversification. Many deals involve strategic partnerships to expand user bases and content libraries, as seen in Deezer’s collaboration with Dazn. Analyzing these market dynamics helps companies adapt to evolving market conditions.

- Market Share: Spotify holds the largest market share in streaming, followed by Apple Music and Amazon Music. Precise figures are dependent on proprietary data and are not fully public.

- M&A Deal Values: Recent M&A activity in the industry shows significant investment, with deals totaling xx Million between 2022-2024.

- Innovation Drivers: AI-powered personalization, high-fidelity audio, and integration with smart devices are key drivers.

- Regulatory Frameworks: Vary significantly across geographical locations, impacting content licensing and pricing.

Cloud Music Services Industry Industry Trends & Insights

The cloud music services market is experiencing robust growth, driven by increasing smartphone penetration, rising internet speeds, and a growing preference for on-demand digital music consumption. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), indicating substantial market expansion. This growth is fueled by several factors: The rise of mobile streaming, cost-effective data plans, and innovative business models like freemium tiers are increasing market penetration. Technological advancements like lossless audio streaming and immersive audio experiences are enhancing user engagement. However, competitive intensity remains high, with established players constantly innovating to retain market share and new entrants disrupting the market. Consumer preferences are shifting towards personalized experiences, interactive features, and high-quality audio, pushing innovation within the industry. This section dives deeper into the CAGR, market penetration rates, and evolving consumer preferences impacting the overall market trajectory.

Dominant Markets & Segments in Cloud Music Services Industry

The global cloud music services market demonstrates significant regional variations in adoption and growth. North America and Europe currently lead in terms of market revenue, driven by high internet penetration, disposable income, and early adoption of digital music services. However, Asia-Pacific is expected to witness the fastest growth in the forecast period due to expanding internet access and a rapidly growing young population.

By Type:

- Streaming Services: This segment dominates the market, driven by convenience and affordability. Growth is projected at xx Million by 2033.

- Download Services: This segment is experiencing slower growth compared to streaming, but remains relevant for users with limited internet access or offline listening preferences.

- Hardware Devices: Smart speakers and other connected devices are contributing to market expansion by providing new access points to cloud music services.

By End User:

- Individuals: This is the largest user segment, with market growth driven by individual subscription models and free-tier usage.

- Families: Family plans are becoming increasingly popular, driving the growth of this segment.

- Businesses: Commercial usage, particularly for background music in businesses, is a growing area of the market.

Key Drivers:

- Economic Factors: Disposable income, cost of internet access, and affordability of subscription services.

- Technological Infrastructure: Internet penetration, smartphone adoption, and the development of smart devices.

- Government Policies: Regulatory frameworks around music licensing and digital content distribution.

Cloud Music Services Industry Product Developments

Recent product innovations in the cloud music services industry focus on enhancing user experience, improving audio quality, and expanding content offerings. Lossless audio streaming and spatial audio technologies are improving the listening experience, while personalized recommendations and interactive features are enhancing user engagement. The integration of music services with other platforms and devices, like smart homes, creates new access points and expands market reach. The competitive advantage lies in offering a unique combination of high-quality audio, compelling content, and a seamless user experience.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the cloud music services market, segmented by type (streaming services, download services, hardware devices) and end-user (individuals, families, businesses). Each segment is analyzed individually, detailing growth projections, market size, and competitive dynamics. The streaming segment is expected to be the fastest growing and largest in terms of market value. The download segment is expected to continue seeing a decline as consumers gravitate to streaming services. The hardware segment’s growth is driven by increased smart speaker adoption. The individual user segment remains dominant, but family and business segments offer substantial growth potential.

Key Drivers of Cloud Music Services Industry Growth

The growth of the cloud music services industry is propelled by several key factors: the increasing affordability and accessibility of mobile data plans, which facilitates mobile streaming; the rapid proliferation of smartphones and smart devices, which provide seamless access to these services; the ongoing evolution of streaming technology, resulting in higher audio quality and immersive listening experiences; and the persistent rise in demand for digital entertainment across all demographics.

Challenges in the Cloud Music Services Industry Sector

The cloud music services industry faces significant challenges, including intense competition amongst established and emerging players, leading to price wars and margin compression. Royalties and licensing costs constitute significant expenses for music platforms, and fluctuations in these costs can impact profitability. Furthermore, the industry must constantly innovate and adapt to changing consumer preferences and technological advancements to remain competitive. Data security and privacy concerns represent another key challenge and may influence regulatory scrutiny.

Emerging Opportunities in Cloud Music Services Industry

Emerging opportunities within this industry include the increasing adoption of Artificial Intelligence and Machine Learning (AI/ML) for personalized recommendation systems and content discovery. Expansion into new geographic markets, especially in developing regions, holds immense potential. The growing interest in high-fidelity audio and immersive audio experiences, such as spatial audio, creates opportunities for premium offerings and enhanced user engagement.

Leading Players in the Cloud Music Services Industry Market

- Deezer SA

- NetEase Inc

- Google LLC

- Saavn Media Pvt Ltd

- Times Internet

- Spotify AB

- ASPIRO AB

- Amazon com Inc

- Apple Inc

- Pandora Media Inc

Key Developments in Cloud Music Services Industry Industry

- November 2022: Amazon Prime expanded its music catalog to 100 Million songs, matching Apple Music's offering and enhancing its Prime membership value proposition.

- November 2022: Deezer partnered with Dazn in Italy, offering Dazn subscribers access to Deezer's music library, expanding both platforms' reach.

- January 2023: Spotify's premium subscriber base reached 205 Million, demonstrating its dominant market position and the growth of the premium music streaming market. Its $100 Million investment in underrepresented creators showcases a commitment to diversity and content expansion.

Strategic Outlook for Cloud Music Services Industry Market

The cloud music services market is poised for continued growth, driven by increasing smartphone penetration, improving internet infrastructure, and the ongoing demand for digital entertainment. The industry's future rests on its ability to deliver innovative products and services that meet evolving consumer preferences while navigating the challenges of intense competition and maintaining a delicate balance between cost and revenue. The incorporation of AI, high-fidelity audio, and personalized experiences will be pivotal in shaping the future of the industry.

Cloud Music Services Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Cloud Music Services Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Cloud Music Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Demand for In-App Purchase Driving the Market; Market Growth Aided by Robust Smart Phone Penetration and Internet Coverage

- 3.3. Market Restrains

- 3.3.1. Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers

- 3.4. Market Trends

- 3.4.1. Increasing Penetration of Smartphones and Tablets drives the Market for Cloud Music Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Latin America

- 5.6.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Latin America Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Middle East Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. North America Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Taiwan

- 13.1.6 Australia

- 13.1.7 Rest of Asia-Pacific

- 14. South America Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East & Africa Cloud Music Services Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 UAE

- 15.1.2 South Africa

- 15.1.3 Saudi Arabia

- 15.1.4 Rest of MEA

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Deezer SA*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 NetEase Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Google LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Saavn Media Pvt Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Times Internet

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Spotify AB

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 ASPIRO AB

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Amazon com Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Apple Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Pandora Media Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Deezer SA*List Not Exhaustive

List of Figures

- Figure 1: Cloud Music Services Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Cloud Music Services Industry Share (%) by Company 2024

List of Tables

- Table 1: Cloud Music Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Cloud Music Services Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Cloud Music Services Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Cloud Music Services Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Cloud Music Services Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Cloud Music Services Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Cloud Music Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Cloud Music Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Cloud Music Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Germany Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Cloud Music Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Taiwan Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Asia-Pacific Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Cloud Music Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Cloud Music Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: UAE Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: South Africa Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Saudi Arabia Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of MEA Cloud Music Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Cloud Music Services Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 38: Cloud Music Services Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 39: Cloud Music Services Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 40: Cloud Music Services Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 41: Cloud Music Services Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 42: Cloud Music Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Cloud Music Services Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 44: Cloud Music Services Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 45: Cloud Music Services Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 46: Cloud Music Services Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 47: Cloud Music Services Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 48: Cloud Music Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Cloud Music Services Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 50: Cloud Music Services Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 51: Cloud Music Services Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 52: Cloud Music Services Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 53: Cloud Music Services Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 54: Cloud Music Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Cloud Music Services Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 56: Cloud Music Services Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 57: Cloud Music Services Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 58: Cloud Music Services Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 59: Cloud Music Services Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 60: Cloud Music Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 61: Cloud Music Services Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 62: Cloud Music Services Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 63: Cloud Music Services Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 64: Cloud Music Services Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 65: Cloud Music Services Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 66: Cloud Music Services Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Music Services Industry?

The projected CAGR is approximately 13.00%.

2. Which companies are prominent players in the Cloud Music Services Industry?

Key companies in the market include Deezer SA*List Not Exhaustive, NetEase Inc, Google LLC, Saavn Media Pvt Ltd, Times Internet, Spotify AB, ASPIRO AB, Amazon com Inc, Apple Inc, Pandora Media Inc.

3. What are the main segments of the Cloud Music Services Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Demand for In-App Purchase Driving the Market; Market Growth Aided by Robust Smart Phone Penetration and Internet Coverage.

6. What are the notable trends driving market growth?

Increasing Penetration of Smartphones and Tablets drives the Market for Cloud Music Services.

7. Are there any restraints impacting market growth?

Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers.

8. Can you provide examples of recent developments in the market?

January 2023: With 14% YoY growth, Spotify announced its premium subscriber base touched 205 million, making it the world's first music streaming player with such a large user base. At the beginning of 2022, Spotify announced an investment of $100 million in the licensing, development, and marketing of music and audio content from historically underrepresented creators. These factors helped Spotify reach a milestone in the music industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Music Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Music Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Music Services Industry?

To stay informed about further developments, trends, and reports in the Cloud Music Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence