Key Insights

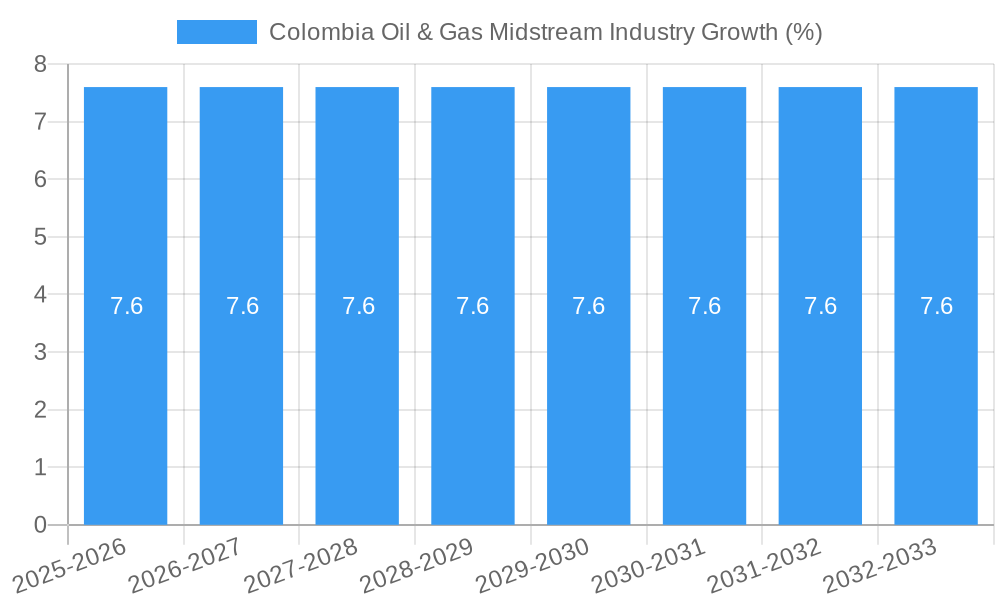

The Colombian Oil & Gas Midstream sector, encompassing LNG terminals, transportation, and storage, presents a compelling investment landscape. With a current market size estimated at $XX million (assuming a reasonable value based on regional comparables and the provided CAGR), the industry exhibits robust growth potential, driven by increasing domestic energy demand and the country's strategic geographical location for regional energy exports. A Compound Annual Growth Rate (CAGR) exceeding 1.52% projects a steady expansion over the forecast period (2025-2033). Key drivers include ongoing infrastructure development to support growing production and export capacity, coupled with government initiatives aimed at modernizing the energy sector. This includes investments in pipeline networks and LNG terminal expansion to cater to both domestic needs and international markets. However, the industry faces challenges including fluctuating global oil prices, environmental regulations, and potential infrastructure limitations. The segmentation highlights the importance of LNG terminals as a crucial component for facilitating increased exports and diversification of energy sources. Major players like Ecopetrol SA, Shell Colombia SA, Exxon Mobil Corporation, Chevron Corporation, and Fluor Corporation are actively shaping the market's evolution. The strong presence of international energy giants underscores Colombia's strategic importance in the Latin American energy sector.

The sustained growth in the midstream sector is further underpinned by expanding exploration and production activities in Colombia, leading to increased demand for efficient and reliable transportation and storage solutions. The government's commitment to attracting foreign investment and fostering a competitive business environment complements these positive factors. Strategic partnerships between domestic and international players are anticipated to continue shaping the sector's trajectory, accelerating infrastructure modernization and driving further market expansion. Despite potential restraints, the overall outlook for the Colombian Oil & Gas Midstream industry remains optimistic, with projected growth promising substantial returns for stakeholders and contributing significantly to Colombia's economic development. Further analysis into specific segment growth rates and regional variations would provide a more granular understanding of this dynamic market.

Colombia Oil & Gas Midstream Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Colombia Oil & Gas Midstream Industry, covering the period 2019-2033, with a focus on market dynamics, key players, and future growth prospects. The report leverages extensive primary and secondary research, offering actionable insights for industry stakeholders, investors, and strategic decision-makers. Key segments analyzed include LNG Terminals, Transportation, and Storage, providing a granular understanding of the market landscape.

Colombia Oil & Gas Midstream Industry Market Concentration & Innovation

This section analyzes the competitive landscape of Colombia's oil and gas midstream sector, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The study period (2019-2024) reveals a moderately concentrated market with Ecopetrol SA holding a significant market share (estimated at xx%). Other key players include Shell Colombia SA, Exxon Mobil Corporation, Chevron Corporation, and Fluor Corporation. However, the market is characterized by ongoing consolidation, with several M&A deals valued at approximately xx Million in recent years driving changes in market share. Innovation is driven by the need for improved efficiency, cost reduction, and environmental sustainability, leading to investments in new technologies such as pipeline optimization and advanced analytics. The regulatory framework, while supportive of the industry's growth, presents certain challenges related to environmental regulations and permitting processes. The industry faces increasing pressure from product substitutes like renewable energy sources, necessitating strategic adaptation. End-user trends indicate a growing demand for natural gas, primarily for power generation and industrial applications.

- Market Share: Ecopetrol SA (xx%), Shell Colombia SA (xx%), Exxon Mobil (xx%), Others (xx%).

- M&A Deal Value (2019-2024): Approximately xx Million.

- Key Innovation Drivers: Efficiency improvements, cost reduction, environmental sustainability.

- Regulatory Challenges: Environmental regulations, permitting processes.

Colombia Oil & Gas Midstream Industry Industry Trends & Insights

The Colombia Oil & Gas Midstream industry is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing domestic demand for natural gas, infrastructure development initiatives, and government support for energy security. Technological disruptions, particularly in areas like pipeline monitoring and automation, are enhancing operational efficiency and reducing environmental impact. Consumer preferences are shifting towards cleaner energy sources, prompting the industry to explore innovative solutions for carbon capture and storage (CCS). The competitive landscape is dynamic, with both domestic and international players vying for market share. Market penetration of advanced technologies remains relatively low, presenting opportunities for early adopters. The overall market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Dominant Markets & Segments in Colombia Oil & Gas Midstream Industry

The dominant segment within Colombia's oil and gas midstream industry is currently natural gas transportation, driven by robust demand from power generation and industrial sectors. The key region for this segment is the Caribbean coast and its surrounding areas, owing to the presence of significant gas reserves and proximity to major demand centers.

LNG Terminals: Overview

- Key Drivers: Government incentives for LNG infrastructure development, growing demand for imported LNG.

- Dominance Analysis: Limited LNG import capacity currently limits market dominance, but future expansion is anticipated.

Transportation: Overview

- Key Drivers: Increasing demand for natural gas, expansion of pipeline networks, strategic location.

- Dominance Analysis: This segment holds the most significant market share due to extensive pipeline networks and strong demand.

Storage: Overview

- Key Drivers: Need for gas storage to ensure reliable supply, rising domestic consumption.

- Dominance Analysis: The market is relatively less developed compared to transportation, but capacity expansion is expected to increase its dominance.

Colombia Oil & Gas Midstream Industry Product Developments

Recent product innovations focus on enhancing pipeline efficiency and safety through advanced monitoring systems, leak detection technologies, and automation. These innovations aim to reduce operational costs, minimize environmental risks, and improve the overall reliability of the midstream infrastructure. The adoption of these technologies provides a competitive advantage by increasing operational efficiency and reducing environmental footprint, aligning with growing global demand for sustainable energy practices.

Report Scope & Segmentation Analysis

This report segments the Colombian oil and gas midstream market by type of infrastructure (LNG Terminals, Transportation, Storage) and by geographic region. The Transportation segment is projected to experience the highest growth, driven by increasing domestic natural gas demand. The LNG Terminal segment is expected to see moderate growth, contingent on government policies and investments in import infrastructure. Storage capacity is projected to expand to meet the growing demand for natural gas. Competitive dynamics within each segment vary, with large integrated players dominating transportation, while LNG terminals may see more competitive bidding for contracts and capacity allocation.

Key Drivers of Colombia Oil & Gas Midstream Industry Growth

Key growth drivers include increased domestic demand for natural gas, ongoing infrastructure development projects aimed at expanding pipeline networks and storage facilities, and supportive government policies promoting energy security. Technological advancements leading to improved efficiency and safety also contribute to growth. Furthermore, investments in pipeline modernization and expansion are expected to boost transportation capacity.

Challenges in the Colombia Oil & Gas Midstream Industry Sector

The industry faces challenges such as security risks, environmental regulations, and high infrastructure investment costs. Furthermore, access to financing for large-scale projects presents an obstacle to expansion. The potential for social conflicts related to pipeline construction and operation further complicates the landscape. These factors collectively impact growth projections and necessitate strategic risk mitigation plans.

Emerging Opportunities in Colombia Oil & Gas Midstream Industry

Emerging opportunities exist in developing new LNG import terminals to address growing gas demand, enhancing existing infrastructure with smart technologies, and expanding storage capacity to improve supply reliability. Moreover, the integration of renewable energy sources and exploration of carbon capture and storage (CCS) technologies offer significant growth potentials.

Leading Players in the Colombia Oil & Gas Midstream Industry Market

- Ecopetrol SA

- Shell Colombia SA

- Exxon Mobil Corporation

- Chevron Corporation

- Fluor Corporation

Key Developments in Colombia Oil & Gas Midstream Industry Industry

- October 2022: Shanghai Engineering and Technology Corp. (SETCO) was contracted to construct a 289-km natural gas pipeline from Canacol Energy Ltd.'s Jobo gas processing plant to Medellin, with an initial capacity of 100 MMscfd. This development significantly boosts natural gas transportation capacity in Colombia.

- May 2022: Construction of the Jobo-Medellin natural gas pipeline commenced, aiming to transport 100 MMcf/d by December 2024. This project further enhances natural gas accessibility and reinforces energy security.

Strategic Outlook for Colombia Oil & Gas Midstream Industry Market

The Colombian oil and gas midstream industry is poised for significant growth, driven by increasing domestic demand for natural gas, ongoing infrastructure development, and supportive government policies. The strategic focus will be on expanding capacity, modernizing existing infrastructure, and embracing new technologies to enhance efficiency and sustainability. Opportunities exist in developing new LNG import terminals and expanding storage facilities to meet growing demand and ensure reliable energy supplies. The adoption of smart technologies will play a crucial role in optimizing operations and reducing environmental impact.

Colombia Oil & Gas Midstream Industry Segmentation

-

1. Transportation

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Storage

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

-

3. LNG Terminals

-

3.1. Overview

- 3.1.1. Existing Infrastructure

- 3.1.2. Projects in Pipeline

- 3.1.3. Upcoming Projects

-

3.1. Overview

Colombia Oil & Gas Midstream Industry Segmentation By Geography

- 1. Colombia

Colombia Oil & Gas Midstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Pipeline Sector is Likely to Remain Stagnant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.1.1. Existing Infrastructure

- 5.3.1.2. Projects in Pipeline

- 5.3.1.3. Upcoming Projects

- 5.3.1. Overview

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ecopetrol SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shell Colombia SA*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chevron Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fluor Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Ecopetrol SA

List of Figures

- Figure 1: Colombia Oil & Gas Midstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Colombia Oil & Gas Midstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Transportation 2019 & 2032

- Table 3: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Storage 2019 & 2032

- Table 4: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 5: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Transportation 2019 & 2032

- Table 8: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Storage 2019 & 2032

- Table 9: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 10: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Oil & Gas Midstream Industry?

The projected CAGR is approximately > 1.52%.

2. Which companies are prominent players in the Colombia Oil & Gas Midstream Industry?

Key companies in the market include Ecopetrol SA, Shell Colombia SA*List Not Exhaustive, Exxon Mobil Corporation, Chevron Corporation, Fluor Corporation.

3. What are the main segments of the Colombia Oil & Gas Midstream Industry?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems.

6. What are the notable trends driving market growth?

Pipeline Sector is Likely to Remain Stagnant.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

October 2022: The construction of a 289-km OD natural gas pipeline from Canacol Energy Ltd's 300-MMscfd Jobo gas processing plant to Medellin, Colombia, was contracted out to Shanghai Engineering and Technology Corp. (SETCO). The pipeline's initial capacity is expected to be 100 MMscfd.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Oil & Gas Midstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Oil & Gas Midstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Oil & Gas Midstream Industry?

To stay informed about further developments, trends, and reports in the Colombia Oil & Gas Midstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence