Key Insights

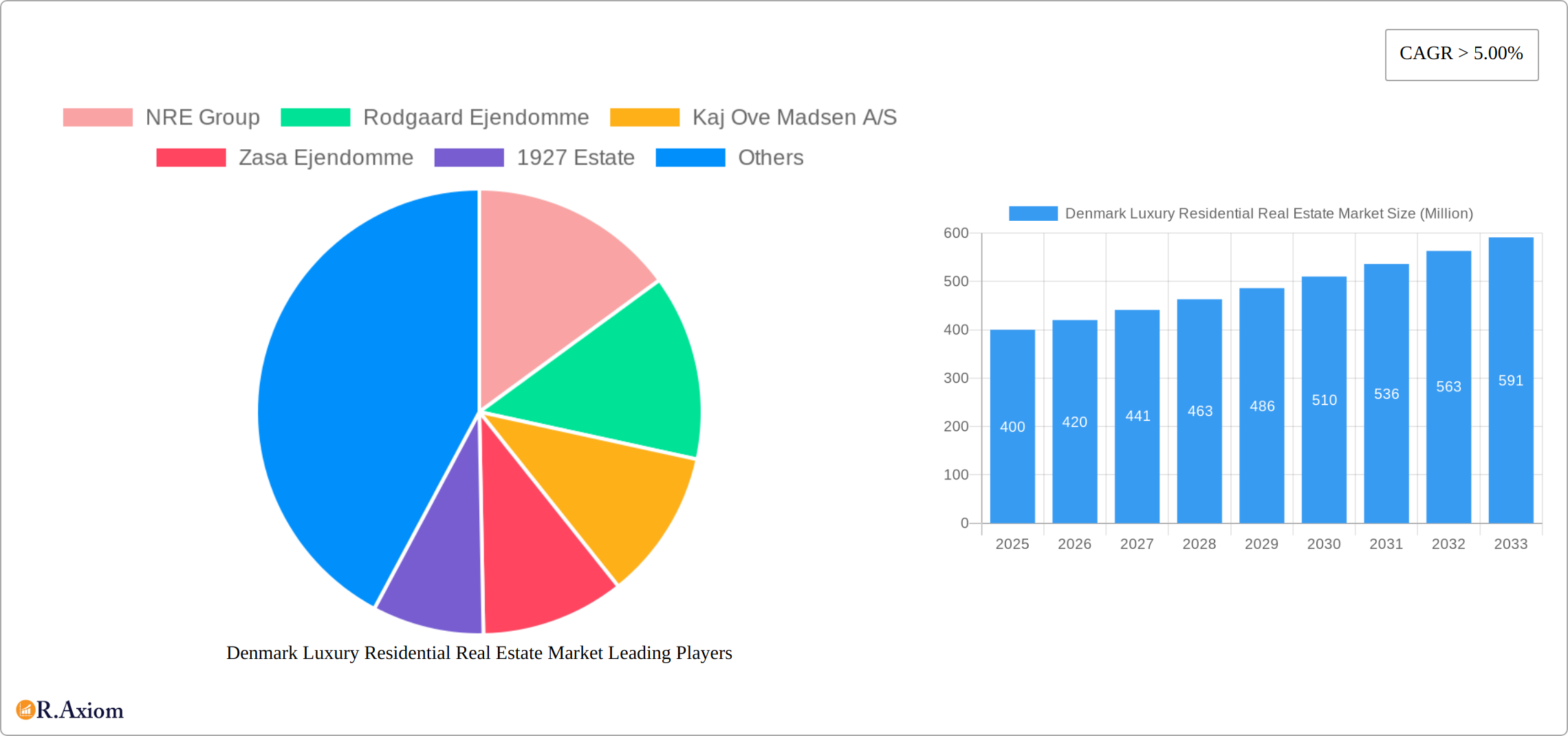

The Denmark luxury residential real estate market exhibits robust growth potential, fueled by a confluence of factors. The market, currently valued in the hundreds of millions (a precise figure requires more data, but considering a 5%+ CAGR and the presence of numerous high-value developers, a reasonable estimate would place the 2025 market size in the range of €300-500 million), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This growth is driven by several key factors, including a rising high-net-worth individual (HNWI) population, increasing disposable incomes, and a preference for upscale properties among affluent Danes. Furthermore, Denmark's strong economy, stable political climate, and attractive lifestyle contribute to its appeal as a desirable location for luxury real estate investment. The market is segmented primarily into villas/landed houses and condominiums/apartments, with both segments experiencing healthy growth. Competition exists among established players like NRE Group, Rodgaard Ejendomme, and others, suggesting a dynamic market with opportunities for both existing and emerging developers.

The market's growth is not without challenges. Potential restraints include fluctuations in the overall Danish economy, interest rate changes impacting mortgage affordability, and stringent building regulations. However, the overall positive economic outlook and continued demand for high-end properties suggest that these challenges are unlikely to significantly impede the long-term growth trajectory. The historical period (2019-2024) likely saw market fluctuations influenced by global events and domestic economic conditions, providing valuable context for understanding the current growth momentum. Understanding these dynamics is crucial for developers, investors, and stakeholders seeking to navigate the opportunities and challenges presented by this expanding market segment.

Denmark Luxury Residential Real Estate Market: 2019-2033 Report

This comprehensive report provides an in-depth analysis of the Denmark luxury residential real estate market, covering the period 2019-2033, with a focus on the year 2025. It offers invaluable insights for investors, developers, and industry stakeholders seeking to navigate this dynamic market. The report leverages rigorous data analysis and industry expertise to deliver actionable intelligence, covering market concentration, emerging trends, key players, and future growth projections.

Denmark Luxury Residential Real Estate Market Concentration & Innovation

This section analyzes the competitive landscape of Denmark's luxury residential real estate market. Market concentration is moderate, with several key players holding significant shares, but also a number of smaller, specialized firms. Innovation is driven by sustainable building practices, smart home technologies, and evolving architectural designs catering to high-net-worth individuals' preferences for bespoke luxury. The regulatory framework, while generally supportive of the market, introduces complexities related to planning permissions and environmental regulations. Product substitutes include luxury rentals and high-end vacation properties, while end-user trends show a preference for properties with eco-friendly features and proximity to green spaces. M&A activity has been steady, with deal values fluctuating based on market conditions. For example, Orange Capital Partners' acquisition of a significant portfolio of apartments in 2022 illustrates the ongoing consolidation within the market.

- Market Share: NRE Group holds an estimated xx% market share, followed by Rodgaard Ejendomme with xx%. Other significant players like Kaj Ove Madsen A/S and Zasa Ejendomme collectively account for approximately xx%.

- M&A Activity (2019-2024): Total deal value estimated at xx Million. Significant transactions include the Orange Capital Partners acquisition in June 2022 (undisclosed sum) and several smaller acquisitions by firms like 1927 Estate and Krobi (values not publicly disclosed).

Denmark Luxury Residential Real Estate Market Industry Trends & Insights

The Denmark luxury residential real estate market is experiencing significant and sustained growth, underpinned by a confluence of powerful economic and societal drivers. A robust Danish economy, coupled with a burgeoning population of high-net-worth individuals (HNWIs) and a growing appreciation for unparalleled quality of living, are the primary catalysts fueling this expansion. The market is also at the forefront of technological integration, with smart home systems becoming increasingly sophisticated and the adoption of sustainable construction techniques moving from a niche preference to a mainstream expectation. Prospective buyers are placing a premium on environmentally conscious features, exceptional energy efficiency, and seamless access to verdant green spaces, reflecting a broader societal shift towards mindful living. The competitive landscape is dynamic, marked by strategic consolidation through mergers and acquisitions as established players bolster their portfolios, while agile, specialized firms continue to differentiate themselves through bespoke offerings and innovative approaches to luxury living.

- Compound Annual Growth Rate (CAGR) (2019-2024): [Insert Specific CAGR % Here]%

- Market Penetration of Smart Home Technologies: [Insert Specific % Here]%

Dominant Markets & Segments in Denmark Luxury Residential Real Estate Market

The Copenhagen and Aarhus regions dominate the luxury residential market, driven by economic strength, high disposable incomes, and robust infrastructure. Within segment types, Villas/Landed Houses command a higher average price point, representing a significant portion of the market. However, Condominiums/Apartments, especially those located in prime city-center areas, also hold significant market share.

Key Drivers for Copenhagen & Aarhus:

- Strong economic activity and high employment rates.

- Well-developed infrastructure, including transport links.

- High concentration of high-net-worth individuals.

- Desirable lifestyle and amenities.

Villas/Landed Houses: Demand is driven by a desire for spacious living, privacy, and large gardens. Higher construction and land costs mean fewer units are available compared to condominiums.

Condominiums/Apartments: Popular due to their convenience, security, and often luxurious amenities in prime locations. High demand in central areas results in competitive pricing.

Denmark Luxury Residential Real Estate Market Product Developments

Innovation within the Danish luxury residential real estate sector is sharply focused on a trifecta of sustainability, cutting-edge technology integration, and highly personalized, bespoke design. New developments are increasingly showcasing advanced smart home ecosystems, sophisticated renewable energy solutions, and the thoughtful incorporation of sustainable building materials. These forward-thinking features not only offer a significant competitive edge but also resonate deeply with an environmentally conscious demographic of discerning buyers. Architects and developers are dedicated to crafting distinctive and uniquely tailored living environments, meticulously designed to satisfy the diverse and evolving preferences of the affluent clientele who seek more than just a home, but an elevated lifestyle.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the Denmark luxury residential real estate market into two primary categories: Villas/Landed Houses and Condominiums/Apartments, providing granular insights into each segment.

-

Villas/Landed Houses: This segment is projected to constitute [Insert Specific % Here]% of the total market value in 2025. It is anticipated to experience a robust Compound Annual Growth Rate (CAGR) of [Insert Specific CAGR % Here]% during the forecast period from 2025 to 2033. The competitive dynamics within this segment are characterized by a persistent scarcity of prime properties and exceptionally high demand from affluent buyers.

-

Condominiums/Apartments: This segment is estimated to represent [Insert Specific % Here]% of the market share in 2025. It is forecast to achieve a Compound Annual Growth Rate (CAGR) of [Insert Specific CAGR % Here]% from 2025 through 2033. The competition in this segment is notably intense, with leading developers actively differentiating their offerings through an array of premium amenities, exquisite finishes, and unparalleled service to attract and secure a sophisticated buyer base.

Key Drivers of Denmark Luxury Residential Real Estate Market Growth

The sustained upward trajectory of the Denmark luxury residential market is propelled by a combination of potent economic fundamentals, a growing cohort of high-net-worth individuals, and rising disposable incomes. Additionally, supportive government initiatives that champion and incentivize sustainable construction practices play a crucial role. The relentless pace of technological advancement, particularly in the realm of smart home functionalities and the widespread adoption of energy-efficient building materials, further solidifies and amplifies this growth, ensuring the market remains dynamic and attractive to discerning investors and homeowners alike.

Challenges in the Denmark Luxury Residential Real Estate Market Sector

Challenges include the limited supply of land in prime locations, stringent building regulations, and increasing construction costs. Competition among developers is fierce, impacting profit margins. Furthermore, fluctuations in interest rates and economic uncertainty can influence buyer sentiment and investment decisions.

Emerging Opportunities in Denmark Luxury Residential Real Estate Market

Emerging opportunities lie in the growing demand for sustainable and technologically advanced luxury housing. There's increasing potential for developers to capitalize on the demand for eco-friendly features and smart home integration. Expanding into smaller Danish cities may also open new market opportunities.

Leading Players in the Denmark Luxury Residential Real Estate Market Market

- NRE Group

- Rodgaard Ejendomme

- Kaj Ove Madsen A/S

- Zasa Ejendomme

- 1927 Estate

- Krobi

- Juvel Ejendomme

- Bruce Turner

- Fink Ejendomme

- Unika Ejendomme ApS

Key Developments in Denmark Luxury Residential Real Estate Market Industry

November 2022: AkademikerPension announced a significant shift in its real estate portfolio, increasing its residential allocation to 50% by 2026, indicating a strong investor confidence in the residential sector.

June 2022: Orange Capital Partners' acquisition of a large residential portfolio from NREP demonstrates increased investment activity and market consolidation.

Strategic Outlook for Denmark Luxury Residential Real Estate Market Market

The Denmark luxury residential real estate market is poised for sustained growth. Continued economic stability, rising high-net-worth individuals, and technological advancements in sustainable building practices present significant opportunities for developers and investors. Strategic focus on sustainable design and smart home integration will be crucial for achieving a competitive advantage.

Denmark Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Villas/Landed Houses

- 1.2. Condominiums/Apartments

-

2. Geography

- 2.1. Copenhagen

- 2.2. Aarhus

- 2.3. Odense

- 2.4. Aalborg

- 2.5. Rest of Denmark

Denmark Luxury Residential Real Estate Market Segmentation By Geography

- 1. Copenhagen

- 2. Aarhus

- 3. Odense

- 4. Aalborg

- 5. Rest of Denmark

Denmark Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance

- 3.3. Market Restrains

- 3.3.1. 4.; Rising cost of construction materials.

- 3.4. Market Trends

- 3.4.1. Increasing demand for luxury residences driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas/Landed Houses

- 5.1.2. Condominiums/Apartments

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Copenhagen

- 5.2.2. Aarhus

- 5.2.3. Odense

- 5.2.4. Aalborg

- 5.2.5. Rest of Denmark

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Copenhagen

- 5.3.2. Aarhus

- 5.3.3. Odense

- 5.3.4. Aalborg

- 5.3.5. Rest of Denmark

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Copenhagen Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Villas/Landed Houses

- 6.1.2. Condominiums/Apartments

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Copenhagen

- 6.2.2. Aarhus

- 6.2.3. Odense

- 6.2.4. Aalborg

- 6.2.5. Rest of Denmark

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Aarhus Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Villas/Landed Houses

- 7.1.2. Condominiums/Apartments

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Copenhagen

- 7.2.2. Aarhus

- 7.2.3. Odense

- 7.2.4. Aalborg

- 7.2.5. Rest of Denmark

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Odense Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Villas/Landed Houses

- 8.1.2. Condominiums/Apartments

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Copenhagen

- 8.2.2. Aarhus

- 8.2.3. Odense

- 8.2.4. Aalborg

- 8.2.5. Rest of Denmark

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Aalborg Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Villas/Landed Houses

- 9.1.2. Condominiums/Apartments

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Copenhagen

- 9.2.2. Aarhus

- 9.2.3. Odense

- 9.2.4. Aalborg

- 9.2.5. Rest of Denmark

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Denmark Denmark Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Villas/Landed Houses

- 10.1.2. Condominiums/Apartments

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Copenhagen

- 10.2.2. Aarhus

- 10.2.3. Odense

- 10.2.4. Aalborg

- 10.2.5. Rest of Denmark

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NRE Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rodgaard Ejendomme

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kaj Ove Madsen A/S

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zasa Ejendomme

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 1927 Estate

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Krobi**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Juvel Ejendomme

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bruce Turner

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fink Ejendomme

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unika Ejendomme ApS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NRE Group

List of Figures

- Figure 1: Denmark Luxury Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Luxury Residential Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Denmark Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Luxury Residential Real Estate Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Denmark Luxury Residential Real Estate Market?

Key companies in the market include NRE Group, Rodgaard Ejendomme, Kaj Ove Madsen A/S, Zasa Ejendomme, 1927 Estate, Krobi**List Not Exhaustive, Juvel Ejendomme, Bruce Turner, Fink Ejendomme, Unika Ejendomme ApS.

3. What are the main segments of the Denmark Luxury Residential Real Estate Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance.

6. What are the notable trends driving market growth?

Increasing demand for luxury residences driving the market.

7. Are there any restraints impacting market growth?

4.; Rising cost of construction materials..

8. Can you provide examples of recent developments in the market?

November 2022: The AkademikerPension expands real estate allocation. Whereas the portfolio currently consists primarily of offices in Copenhagen, the distribution in 2026 should be 50% residential, 30% offices, and various construction projects. Most investments will be made in Copenhagen and Aarhus, but approximately 25% of the real estate investments will be made in smaller Danish cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Denmark Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence