Key Insights

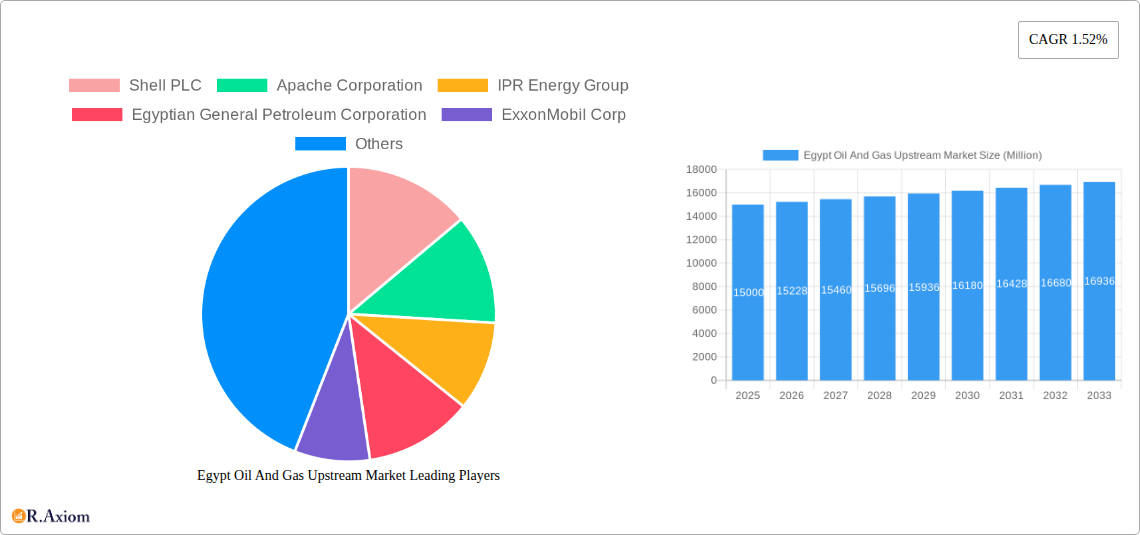

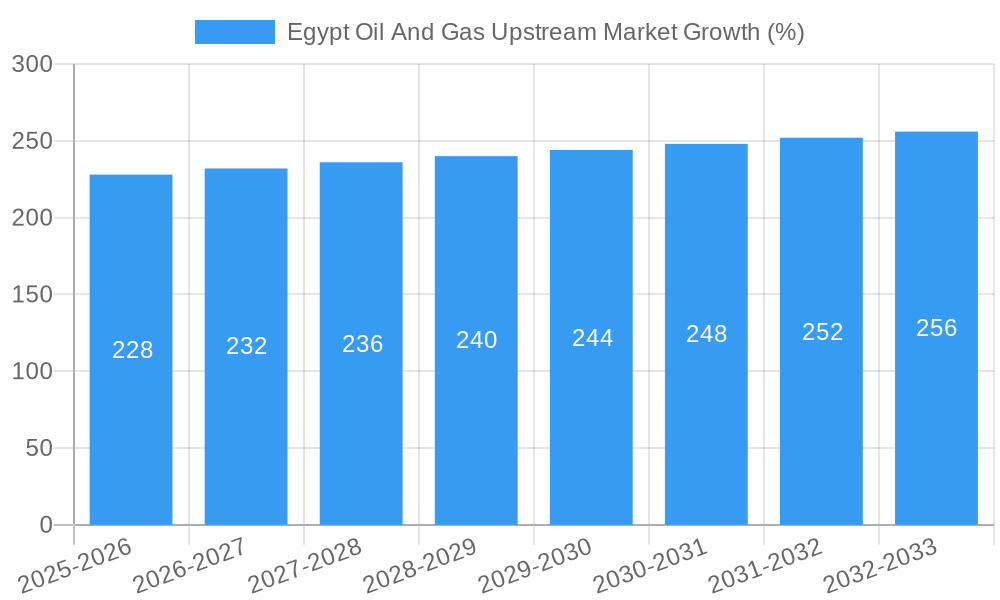

The Egypt Oil and Gas Upstream market, valued at approximately $15 billion in 2025 (estimated based on provided CAGR and market trends), is projected to experience steady growth with a compound annual growth rate (CAGR) of 1.52% from 2025 to 2033. This growth is driven by increasing domestic energy demand, ongoing exploration and production activities by major international and national oil companies (IOCs and NOCs), and government initiatives aimed at boosting energy security. Key players like Shell PLC, ExxonMobil Corp, and BP PLC, alongside Egyptian General Petroleum Corporation, are significantly influencing market dynamics through their investments in new projects and technological advancements in exploration and extraction techniques. The onshore segment currently holds a larger market share compared to the offshore sector due to established infrastructure and relatively lower exploration costs. However, growing investments in offshore exploration and the potential discovery of new reserves are expected to gradually increase the offshore segment's contribution in the forecast period. The market is segmented by product type, with Crude Oil and Natural Gas representing the most significant portions. While challenges remain, such as fluctuating global oil prices and geopolitical uncertainties, the Egyptian government's commitment to developing its oil and gas resources ensures continued growth in the upstream sector, albeit at a moderate pace.

The moderate growth rate reflects a balanced market outlook. While increasing demand provides a positive impetus, global market pressures and the relatively mature nature of some existing fields might temper the overall expansion. Further market expansion will likely depend on successful exploration efforts leading to new reserve discoveries and the continued investment from both international and domestic players. Technological innovation, particularly in enhanced oil recovery techniques, will also play a key role in sustaining production levels and optimizing resource utilization in the coming years. The careful management of resources and a proactive approach towards environmental sustainability will be crucial in ensuring the long-term viability and positive impact of the Egyptian Oil and Gas Upstream sector.

Egypt Oil & Gas Upstream Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Egypt Oil & Gas Upstream Market, covering the period from 2019 to 2033. It offers actionable insights for industry stakeholders, investors, and policymakers, incorporating detailed market segmentation, competitive landscapes, and future growth projections. The report leverages extensive primary and secondary research to deliver a data-driven perspective on this dynamic market.

Egypt Oil And Gas Upstream Market Concentration & Innovation

The Egyptian oil and gas upstream market exhibits a moderately concentrated structure, with both international and national players vying for market share. Key players like Shell PLC, Apache Corporation, ExxonMobil Corp, Chevron Corporation, TotalEnergies SE, Eni SpA, BP PLC, and the Egyptian General Petroleum Corporation (EGPC) hold significant positions. However, the market also accommodates smaller independent operators like IPR Energy Group and others.

Market share dynamics are influenced by exploration successes, production capacity, and government regulations. Mergers and acquisitions (M&A) activity plays a crucial role, with deal values fluctuating based on asset attractiveness and geopolitical factors. For example, the combined USD 506 Million contracts awarded to TransGlobe Energy Corporation and Pharos Energy in January 2022 highlight significant M&A opportunities. The market shows a moderate level of innovation, driven by the need to enhance efficiency, reduce costs, and explore new reserves in challenging environments. Technological advancements in exploration techniques, such as advanced seismic imaging and improved drilling technologies, are boosting production and contributing to innovation. Regulatory frameworks, while aiming to promote growth, also impact the pace of innovation and investment decisions. Product substitutes, particularly renewable energy sources, pose a long-term challenge, requiring the industry to adapt and innovate to maintain its relevance. End-user trends, primarily driven by global energy demand, directly influence the market’s trajectory.

- Key Metrics: Market share data for major players is estimated at xx% for Shell PLC, xx% for Apache Corporation, xx% for EGPC, and xx% for the remaining players. M&A deal values show a marked increase in recent years, with estimated aggregate values exceeding USD xx Million in the last five years.

Egypt Oil And Gas Upstream Market Industry Trends & Insights

The Egyptian oil and gas upstream market is experiencing moderate growth, driven by factors including increasing domestic energy demand, government initiatives to boost exploration and production, and the nation's strategic location as an energy exporter. However, global energy transition initiatives and fluctuating oil prices pose significant challenges. The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) is estimated at xx%, projected to slow slightly to xx% during the forecast period (2025-2033). Market penetration of advanced technologies like enhanced oil recovery (EOR) methods is slowly increasing, contributing to production efficiency. However, these technologies face adoption barriers owing to high initial investments. Consumer preferences for cleaner energy sources exert pressure on the industry, necessitating diversification and a focus on environmental sustainability.

Competitive dynamics are shaped by the interplay between international oil companies (IOCs) and the state-owned EGPC. IOCs bring technological expertise and financial resources, while EGPC maintains a significant role in production and market regulation. Technological disruptions, driven by digitalization and automation, are gradually transforming operational efficiency and exploration techniques. These trends are leading to increased efficiency in exploration and production, cost reduction, and ultimately influencing market competitiveness. The strategic partnerships between IOCs and EGPC and the exploration of new unconventional resources such as shale gas are key drivers for sustaining growth.

Dominant Markets & Segments in Egypt Oil And Gas Upstream Market

The Egyptian oil and gas upstream market presents a diverse landscape across various segments.

Location: Both onshore and offshore segments contribute significantly. However, the offshore segment holds higher potential, given the significant yet underexplored reserves in the Mediterranean Sea. Offshore exploration and production present numerous challenges, requiring advanced technologies and higher investment costs, contributing to its current dominant position. Onshore operations benefit from established infrastructure, but face limitations due to land availability and environmental concerns.

Product: Crude oil and natural gas remain the dominant products. Crude oil production contributes the most to revenue, while natural gas production holds immense potential owing to its expanding domestic and export markets. Other products, including natural gas liquids (NGLs) and condensates, represent niche segments with growth potential. This segment has a high growth rate because of a multitude of factors including domestic and export market demand, and government's support for production, and exploration.

Key Drivers: Favorable government policies promoting exploration and production, along with substantial investments by both IOCs and EGPC, are key drivers of growth across all segments. The development of crucial oil and gas infrastructure, including pipelines and processing facilities, adds to the growth momentum. These key factors are supporting this dominance and further driving market expansion.

Egypt Oil And Gas Upstream Market Product Developments

Technological advancements are leading to the adoption of enhanced oil recovery (EOR) techniques, improved drilling technologies, and advanced seismic imaging for exploration. These innovations enhance production efficiency, reduce costs, and unlock reserves in previously challenging areas. The focus is shifting towards sustainable practices, emphasizing environmental responsibility and reducing the carbon footprint of operations. These innovative technologies provide a clear competitive advantage to the leading players by helping them increase production efficiency and expand into new, previously inaccessible reserves.

Report Scope & Segmentation Analysis

This report covers the Egypt Oil & Gas Upstream Market across various segments:

Location: Onshore and Offshore, with individual market size and growth projections for each. The competitive landscape within each segment is also analyzed.

Product: Crude Oil, Natural Gas, and Other Products (NGLs, condensates). Growth projections, market sizes, and competitive dynamics are presented for each product category.

Each segment's analysis includes detailed information on market size, growth rate, key players, and future outlook.

Key Drivers of Egypt Oil And Gas Upstream Market Growth

Several factors fuel the growth of Egypt's oil and gas upstream market. Government policies encouraging investment and exploration, rising domestic energy demand, strategic location for regional energy exports, and the discovery of new reserves in both onshore and offshore areas all significantly contribute. The increasing adoption of advanced technologies to improve production efficiency and reduce costs further bolsters growth. International partnerships between national and foreign oil companies drive technological advancements and financial investments.

Challenges in the Egypt Oil And Gas Upstream Market Sector

The industry faces significant challenges including fluctuating global oil and gas prices, increasing competition from renewable energy sources, and the need to meet stringent environmental regulations. Geopolitical instability and security concerns in the region also pose risks. Supply chain disruptions caused by global events and the complexity of regulatory frameworks can hinder investments and slow down growth. These challenges contribute to reduced market growth rate.

Emerging Opportunities in Egypt Oil And Gas Upstream Market

The market presents several emerging opportunities. The exploration and development of unconventional resources like shale gas and the growing demand for natural gas both represent significant growth pathways. Investments in renewable energy technologies alongside oil and gas operations offer diversification and environmental responsibility. Strengthening partnerships with international players to leverage their technological expertise and investments opens new avenues for expansion.

Leading Players in the Egypt Oil And Gas Upstream Market Market

- Shell PLC

- Apache Corporation

- IPR Energy Group

- Egyptian General Petroleum Corporation

- ExxonMobil Corp

- Chevron Corporation

- Wintershall AG

- TotalEnergies SE

- Eni SpA

- BP PLC

Key Developments in Egypt Oil & Gas Upstream Market Industry

- May 2023: Dana Gas plans to drill 11 new wells, adding 80 bcf of reserves and production, with a USD 100 Million investment. This signifies significant confidence in the Egyptian market and potential for increased output.

- June 2022: BP awarded an offshore exploration block, indicating ongoing interest in Egypt's offshore potential.

- January 2022: TransGlobe Energy Corporation and Pharos Energy awarded contracts worth at least USD 506 Million, plus a USD 67 Million grant, for oil exploration in the Western and Eastern Deserts. This underlines the government's commitment to exploration and investment in the sector.

Strategic Outlook for Egypt Oil And Gas Upstream Market Market

The Egyptian oil and gas upstream market exhibits a positive outlook driven by sustained domestic energy demand, ongoing exploration activities, and the potential for further discoveries, particularly in the offshore sector. Strategic partnerships between international and national players will be crucial in leveraging technological advancements, attracting foreign investment, and ensuring the responsible development of Egypt's oil and gas resources. The sector's future success depends on adapting to the global energy transition by investing in cleaner technologies and pursuing sustainable practices.

Egypt Oil And Gas Upstream Market Segmentation

-

1. Location

- 1.1. Onshore

- 1.2. Offshore

-

2. Product

- 2.1. Crude Oil

- 2.2. Natural Gas

- 2.3. Other Products

Egypt Oil And Gas Upstream Market Segmentation By Geography

- 1. Egypt

Egypt Oil And Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in the Oil and Gas Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Inclination Toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Natural Gas Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Oil And Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Crude Oil

- 5.2.2. Natural Gas

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Apache Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IPR Energy Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Egyptian General Petroleum Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ExxonMobil Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chevron Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wintershall AG*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TotalEnergies SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eni SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BP PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: Egypt Oil And Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Oil And Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Oil And Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Region 2019 & 2032

- Table 3: Egypt Oil And Gas Upstream Market Revenue Million Forecast, by Location 2019 & 2032

- Table 4: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Location 2019 & 2032

- Table 5: Egypt Oil And Gas Upstream Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Product 2019 & 2032

- Table 7: Egypt Oil And Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Region 2019 & 2032

- Table 9: Egypt Oil And Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 11: Egypt Oil And Gas Upstream Market Revenue Million Forecast, by Location 2019 & 2032

- Table 12: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Location 2019 & 2032

- Table 13: Egypt Oil And Gas Upstream Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Product 2019 & 2032

- Table 15: Egypt Oil And Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Egypt Oil And Gas Upstream Market Volume Thousand Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Oil And Gas Upstream Market?

The projected CAGR is approximately 1.52%.

2. Which companies are prominent players in the Egypt Oil And Gas Upstream Market?

Key companies in the market include Shell PLC, Apache Corporation, IPR Energy Group, Egyptian General Petroleum Corporation, ExxonMobil Corp, Chevron Corporation, Wintershall AG*List Not Exhaustive, TotalEnergies SE, Eni SpA, BP PLC.

3. What are the main segments of the Egypt Oil And Gas Upstream Market?

The market segments include Location, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in the Oil and Gas Sector.

6. What are the notable trends driving market growth?

Natural Gas Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Inclination Toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

May 2023: UAE-based energy firm - Dana Gas announced its plans to start the drilling of 11 new wells in Egypt by the end of this year and projects the wells to add up to 80 bcf of reserves and production. The company has allocated investments of approximately USD 100 million to drill these wells, indicating that the company has four concessions in Egypt and is seeking to include them in one concession within an agreement awaiting approval by the House of Representatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Oil And Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Oil And Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Oil And Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Egypt Oil And Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence