Key Insights

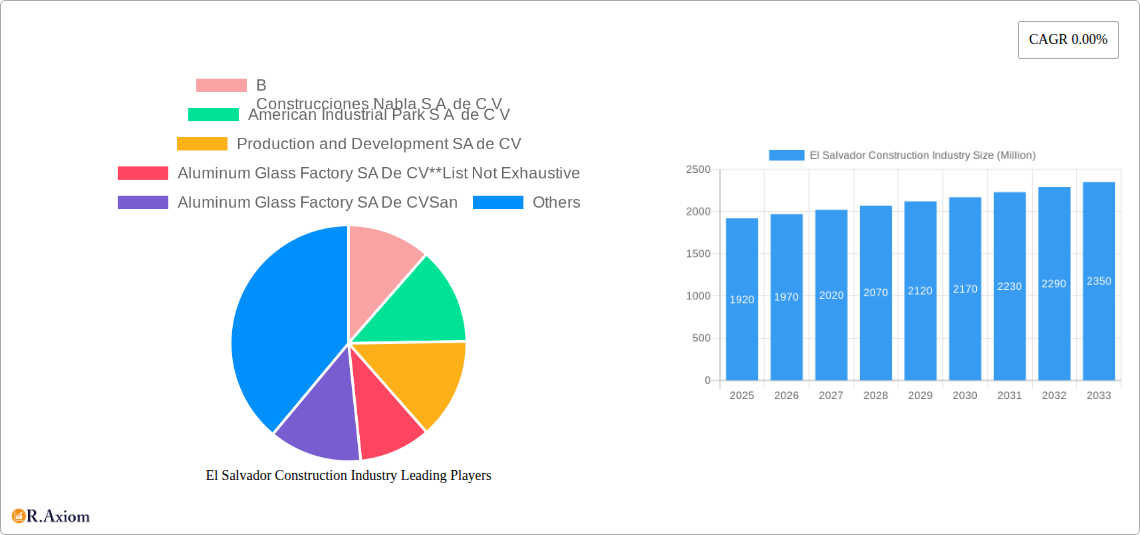

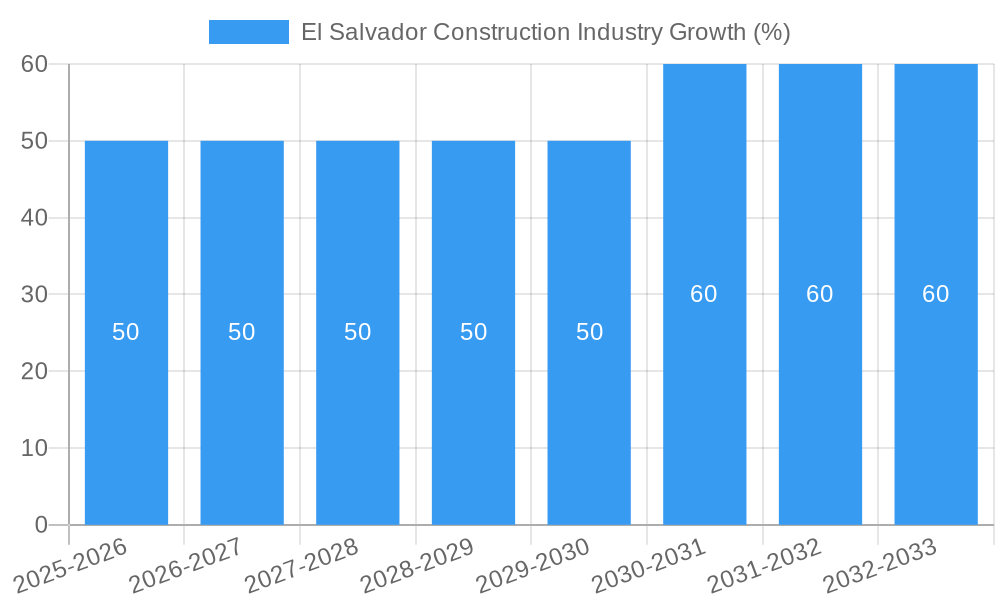

The El Salvador construction industry, valued at $1.92 billion in 2025, presents a complex picture. While the current Compound Annual Growth Rate (CAGR) is reported as 0.00%, this likely reflects a temporary plateau rather than stagnation. Several factors suggest underlying potential for future growth. Government infrastructure projects, particularly in transportation and energy, are likely to stimulate demand. Furthermore, a growing residential sector, driven by urbanization and population increase, will continue to fuel construction activity. However, economic instability and potential challenges related to material sourcing and skilled labor availability represent significant restraints. The industry is segmented across commercial, industrial, residential, infrastructure (transportation), and energy and utilities sectors, each with its unique growth trajectory and contributing factors. The presence of established players like B Construcciones Nabla S A de C V and American Industrial Park S A de C V indicates a degree of market maturity, but also a potential for competition and consolidation in the coming years. Strategic investments in sustainable building practices and technological advancements could help mitigate challenges and unlock greater growth opportunities.

The forecast period (2025-2033) presents an opportunity for strategic planning and investment. While a 0.00% CAGR suggests caution, a more realistic projection incorporating likely infrastructure projects and residential growth might suggest a modest, positive CAGR (e.g., 2-3%). This would be influenced by factors such as successful government initiatives, economic stability, and effective management of resource constraints. Analyzing the performance of key players and their expansion strategies within specific segments will be crucial for understanding future market dynamics and identifying potential investment opportunities. Furthermore, studying global trends in construction technology and sustainable practices will help anticipate adaptations within the El Salvadorian market.

El Salvador Construction Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the El Salvador construction industry, offering valuable insights for investors, industry stakeholders, and businesses operating within or seeking to enter this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, key players, and future growth potential. The report utilizes extensive data analysis and expert insights to provide a clear and actionable understanding of this rapidly evolving sector.

El Salvador Construction Industry Market Concentration & Innovation

The El Salvador construction market exhibits a moderately concentrated structure, with a few large players dominating specific segments. While precise market share figures for individual companies are unavailable (xx%), companies like Construcciones Nabla S A de C V and Consolidated Developments SA de CV likely hold significant positions. The level of innovation varies across sectors, with infrastructure projects showcasing a greater adoption of advanced technologies compared to residential construction. The regulatory framework, while generally supportive of development, faces ongoing challenges in streamlining processes and promoting transparency. Product substitution is limited due to the specialized nature of construction materials; however, the increasing use of prefabricated components represents a notable change. End-user trends point towards a growing demand for sustainable and resilient infrastructure, driven by both government initiatives and environmental concerns. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values averaging xx Million USD annually (2019-2024). Future M&A activity is expected to increase due to market consolidation and investment in large-scale infrastructure projects.

El Salvador Construction Industry Industry Trends & Insights

The El Salvador construction industry is experiencing a period of moderate growth, with a projected Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033. This growth is primarily fueled by increasing government investment in infrastructure projects, particularly in transportation and energy. Technological disruptions are gradually impacting the sector, with the adoption of Building Information Modeling (BIM) and other digital technologies becoming more prevalent, although market penetration remains relatively low (xx%). Consumer preferences are shifting towards sustainable and energy-efficient buildings, creating new opportunities for companies offering green building solutions. Competitive dynamics are characterized by both intense competition among domestic firms and the increasing entry of international players. Market growth is also influenced by factors like fluctuating material costs, labor availability, and macroeconomic conditions. The market penetration of sustainable building materials is still relatively low (xx%), but is expected to grow in the coming years.

Dominant Markets & Segments in El Salvador Construction Industry

The infrastructure segment, specifically transportation, represents the most dominant sector within the El Salvador construction industry. This dominance is primarily driven by substantial government spending on road improvements and expansion projects, such as the USD 410 Million Los Chorros highway extension.

- Key Drivers for Infrastructure Dominance:

- Significant government investment in transportation infrastructure.

- Demand for improved connectivity and logistics networks.

- Funding from international development agencies.

The commercial and industrial sectors are also experiencing notable growth, fuelled by foreign direct investment and the expansion of manufacturing and logistics activities. The residential sector displays steady growth, albeit at a slower pace than infrastructure. The energy and utilities sector is undergoing modernization and expansion, contributing to construction activity.

El Salvador Construction Industry Product Developments

Recent product innovations have focused on improving efficiency, sustainability, and cost-effectiveness. The increased utilization of prefabricated components, advanced construction materials, and digital technologies such as BIM are enhancing project management, minimizing waste, and accelerating construction timelines. These innovations offer competitive advantages by improving project quality, reducing costs, and enhancing sustainability.

Report Scope & Segmentation Analysis

This report segments the El Salvador construction industry by sector:

- Commercial: This segment includes the construction of office buildings, shopping malls, and other commercial structures. Growth is projected at xx% CAGR (2025-2033), driven by FDI and economic expansion. Competition is moderate.

- Industrial: This sector encompasses industrial parks, factories, and warehouses. Growth is expected at xx% CAGR (2025-2033), primarily due to increased manufacturing activity and logistics investments. Competition is moderate to high.

- Residential: This segment covers residential buildings, apartments, and housing developments. Growth is projected at xx% CAGR (2025-2033), driven by population growth and urbanization. Competition is high.

- Infrastructure (Transportation): This segment focuses on roads, bridges, railways, and other transportation infrastructure. Growth is projected to be the highest at xx% CAGR (2025-2033) due to significant government investment. Competition is moderate.

- Energy and Utilities: This segment includes power plants, water treatment facilities, and other utility infrastructure. Growth is projected at xx% CAGR (2025-2033), driven by the need for improved energy infrastructure and sustainable energy solutions. Competition is moderate.

Key Drivers of El Salvador Construction Industry Growth

Several factors contribute to the growth of the El Salvador construction industry: increased government spending on infrastructure projects, particularly in transportation and energy; foreign direct investment (FDI) in various sectors; population growth and urbanization, driving demand for residential and commercial construction; and the development of industrial parks and logistics hubs.

Challenges in the El Salvador Construction Industry Sector

The El Salvador construction industry faces challenges including bureaucracy and regulatory hurdles that often lead to project delays; supply chain disruptions impacting material costs and availability; a shortage of skilled labor; and intense competition, both domestically and from international contractors. These factors have a quantifiable negative impact on profitability and project timelines, estimated to be xx% on average in recent years.

Emerging Opportunities in El Salvador Construction Industry

Emerging opportunities include the growing demand for sustainable and green building solutions; the increasing adoption of digital technologies such as BIM; the expansion of the tourism sector driving hospitality construction; and the potential for public-private partnerships (PPPs) to accelerate infrastructure development.

Leading Players in the El Salvador Construction Industry Market

- Construcciones Nabla S A de C V

- American Industrial Park S A de C V

- Production and Development SA de CV

- Aluminum Glass Factory SA De CV

- Consolidated Developments SA de CV

- Road and Industrial Signaling of El Salvador SA de CV

- Aggregates of El Salvador SA de CV

- Inversiones Roble S A de C V

- Salazar Romero Sociedad Anonima de Capital Variable

Key Developments in El Salvador Construction Industry Industry

- July 2023: Grupo Ternova commenced construction of a USD 100 Million logistics park in Nejapa, boosting industrial development.

- April 2023: Dongbu Corporation completed the USD 410 Million Los Chorros highway extension, significantly upgrading the country's infrastructure.

- February 2023: Amdocs' partnership with Telefónica Móviles El Salvador highlights technological advancements in the telecommunications sector, indirectly impacting related construction activities.

Strategic Outlook for El Salvador Construction Industry Market

The El Salvador construction industry is poised for continued growth, driven by ongoing government investments, FDI, and a growing population. Opportunities in sustainable construction, technological advancements, and strategic partnerships offer significant potential for market expansion and increased profitability. Addressing regulatory challenges and enhancing the skilled labor pool will be key to maximizing this potential.

El Salvador Construction Industry Segmentation

-

1. Sector

- 1.1. Commercial

- 1.2. Industrial

- 1.3. Residential

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities

El Salvador Construction Industry Segmentation By Geography

- 1. El Salvador

El Salvador Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Rise in road investment projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. El Salvador Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial

- 5.1.2. Industrial

- 5.1.3. Residential

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. El Salvador

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America El Salvador Construction Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe El Salvador Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific El Salvador Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Middle East El Salvador Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Rest of the world El Salvador Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 B

Construcciones Nabla S A de C V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 American Industrial Park S A de C V

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Production and Development SA de CV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aluminum Glass Factory SA De CV**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aluminum Glass Factory SA De CVSan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Consolidated Developments SA de CV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Road and Industrial Signaling of El Salvador SA de CV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aggregates of El Salvador SA de CV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inversiones Roble S A de C V

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Salazar Romero Sociedad Anonima de Capital Variable

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 B

Construcciones Nabla S A de C V

List of Figures

- Figure 1: El Salvador Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: El Salvador Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: El Salvador Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: El Salvador Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: El Salvador Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: El Salvador Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: El Salvador Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: El Salvador Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: El Salvador Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: El Salvador Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: El Salvador Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: El Salvador Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: El Salvador Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: El Salvador Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: El Salvador Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: El Salvador Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 15: El Salvador Construction Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the El Salvador Construction Industry?

The projected CAGR is approximately 0.00%.

2. Which companies are prominent players in the El Salvador Construction Industry?

Key companies in the market include B Construcciones Nabla S A de C V, American Industrial Park S A de C V, Production and Development SA de CV, Aluminum Glass Factory SA De CV**List Not Exhaustive, Aluminum Glass Factory SA De CVSan, Consolidated Developments SA de CV, Road and Industrial Signaling of El Salvador SA de CV, Aggregates of El Salvador SA de CV, Inversiones Roble S A de C V, Salazar Romero Sociedad Anonima de Capital Variable.

3. What are the main segments of the El Salvador Construction Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Rise in road investment projects.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

July 2023: Grupo Ternova started construction of a USD 100 million logistics park in El Salvador. The park will be located in Nejapa municipality and will include four industrial warehouses between 17,700 m2 and 34,700 m2 in size. It will also include two-lane internal roads for transportation of containers and light-vehicle traffic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "El Salvador Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the El Salvador Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the El Salvador Construction Industry?

To stay informed about further developments, trends, and reports in the El Salvador Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence