Key Insights

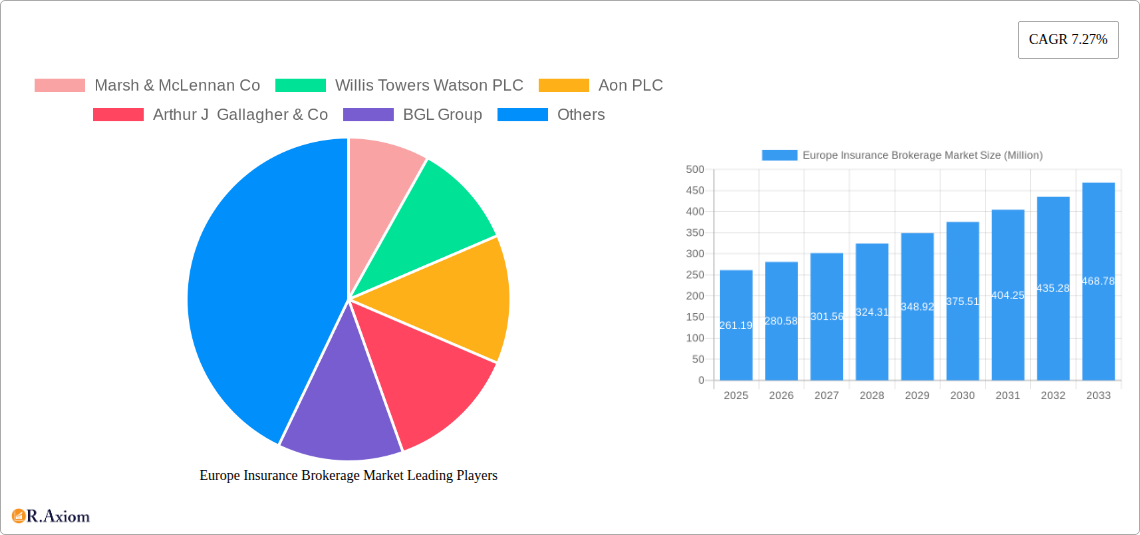

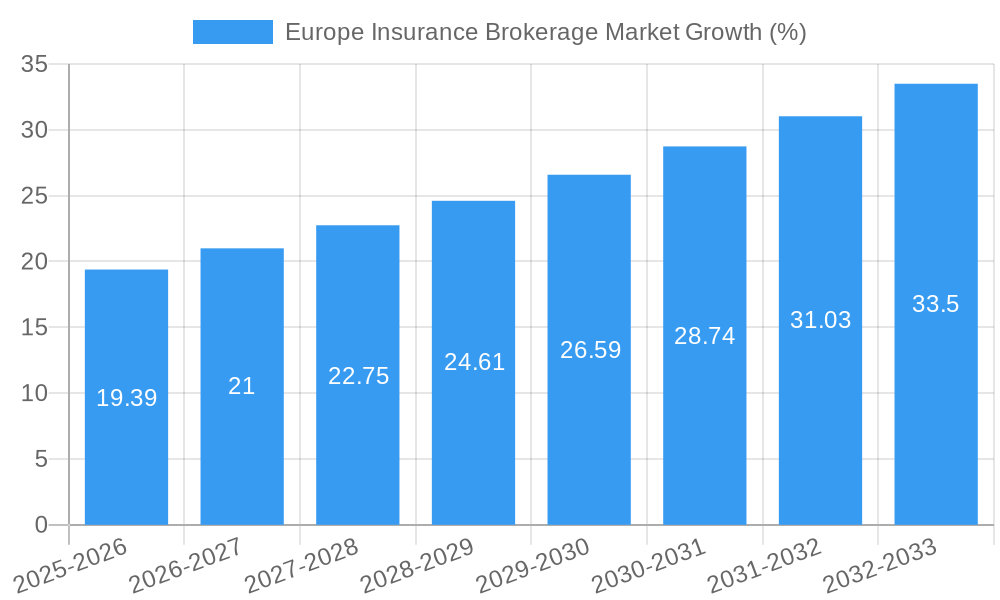

The European insurance brokerage market, valued at €261.19 million in 2025, is projected to experience robust growth, driven by several key factors. Increasing complexities in insurance products and regulations are prompting businesses and individuals to seek professional brokerage services for risk management and optimal coverage. The rising adoption of digital technologies within the insurance sector, including insurtech solutions and online platforms, is streamlining operations and expanding market access. Furthermore, a growing awareness of insurance needs, particularly among SMEs and high-net-worth individuals, fuels demand for specialized brokerage services. Strong economic growth in key European markets contributes to this positive trend, as businesses invest more in risk mitigation strategies. Competitive pressures among established players, including Marsh & McLennan, Willis Towers Watson, Aon, and Arthur J Gallagher, are driving innovation and efficiency improvements across the sector.

However, the market's growth is not without challenges. Stringent regulatory frameworks and compliance requirements impose significant operational costs on brokerage firms. Economic downturns or geopolitical instability could negatively impact insurance demand, leading to a temporary slowdown in market expansion. The increasing prevalence of direct-to-consumer insurance offerings presents competition to traditional brokerage models. Successfully navigating these challenges requires brokers to adapt to evolving customer preferences, embrace technology, and demonstrate value-added services beyond simple product placement. Focusing on specialized niche markets and leveraging data analytics to offer personalized solutions will be crucial for sustained growth in the competitive European landscape. The projected CAGR of 7.27% suggests a substantial expansion of the market over the forecast period (2025-2033), indicating significant opportunities for established players and new entrants alike.

Europe Insurance Brokerage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Insurance Brokerage Market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth prospects, enabling stakeholders to make informed strategic decisions. The report leverages extensive data analysis, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. This report is essential for insurance brokers, investors, and industry analysts seeking a clear understanding of this dynamic market.

Europe Insurance Brokerage Market Market Concentration & Innovation

The European insurance brokerage market exhibits a moderately concentrated landscape, dominated by a few global players and a larger number of regional and niche brokers. Market share data from 2024 reveals that the top five players (Marsh & McLennan Co, Willis Towers Watson PLC, Aon PLC, Arthur J Gallagher & Co, and BGL Group) collectively hold approximately xx% of the market, indicating considerable consolidation. However, the emergence of agile Insurtech companies and the increasing prevalence of digital brokerage platforms are challenging this established order.

Innovation Drivers:

- Technological advancements like AI, big data analytics, and blockchain are transforming operations and enhancing customer experiences.

- The growing demand for specialized insurance solutions tailored to specific industry sectors fuels innovation in product development.

- Regulatory changes, such as the implementation of GDPR and PSD2, are driving innovation in data security and customer privacy practices.

M&A Activity: The insurance brokerage sector has witnessed significant M&A activity in recent years, with deal values reaching xx Million in 2024. This consolidation is driven by companies seeking to expand their market reach, gain access to new technologies, and diversify their service offerings. For example, the acquisition of smaller regional players by large multinational brokers is a common trend, resulting in increased market concentration.

Regulatory Frameworks: Stringent regulatory frameworks governing insurance brokerage activities in Europe influence market dynamics. Compliance requirements can affect operational costs and limit market entry for new players. However, robust regulations also promote market stability and consumer protection.

Product Substitutes & End-User Trends: The increasing adoption of online insurance platforms and direct-to-consumer sales models presents a competitive threat to traditional brokers. Consumers are increasingly demanding digital-first experiences and personalized solutions, putting pressure on brokers to adapt and innovate.

Europe Insurance Brokerage Market Industry Trends & Insights

The Europe Insurance Brokerage Market is projected to experience robust growth during the forecast period (2025-2033), with a CAGR of xx%. Several factors contribute to this growth trajectory. Increased insurance penetration driven by rising middle-class incomes and increased awareness of risk management are significant contributors. Furthermore, technological disruptions, like the proliferation of Insurtech solutions, are revolutionizing insurance distribution and customer interaction, fueling market expansion.

The market penetration of digital insurance platforms is steadily rising, exceeding xx% in 2024. While traditional brokerage channels remain crucial, the shift towards digital platforms necessitates adaptation and the integration of new technologies within the established brokerage models. Competition is intensifying, with established players facing challenges from both agile Insurtech companies and large multinational corporations expanding their insurance brokerage operations. Consumer preferences are increasingly focused on personalized, seamless, and transparent insurance solutions, demanding innovation in both product offerings and customer service strategies. The changing regulatory landscape and heightened focus on compliance further impact market dynamics.

Dominant Markets & Segments in Europe Insurance Brokerage Market

The United Kingdom remains the largest market within the Europe Insurance Brokerage Market, accounting for approximately xx% of the total market value in 2024. Its robust economy, developed insurance sector, and high insurance penetration rates contribute to its dominant position. Germany and France are also significant markets, with substantial growth potential.

Key Drivers of UK Dominance:

- Strong economic performance and high disposable incomes

- Well-established insurance infrastructure and a sophisticated regulatory framework

- High insurance penetration rates across various segments

- Presence of major global brokerage firms and a thriving ecosystem of niche players

Other key European markets, such as Italy, Spain, and the Nordic countries, are also showing steady growth, although at a slower pace than the UK. This disparity in growth is primarily due to variations in economic conditions, regulatory environments, and levels of insurance awareness across different regions. The report also analyzes segment-wise data providing granular insights into the market performance across specific product categories and customer segments.

Europe Insurance Brokerage Market Product Developments

Recent product innovations focus on leveraging technology to enhance efficiency, personalize customer experiences, and improve risk management. AI-powered platforms offer automated underwriting and claims processing, while data analytics facilitate more accurate risk assessment. The integration of Insurtech solutions into traditional brokerage models is accelerating, leading to more personalized and accessible insurance products. The use of blockchain technology for improved transparency and security in transactions is also gaining traction. These developments are aimed at providing competitive advantages by offering faster, more efficient, and customer-centric solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis across various aspects of the market. The market is segmented geographically by key European countries, including the UK, Germany, France, Italy, Spain, and the Nordics. Additionally, segmentation is performed based on insurance type (e.g., property & casualty, life & health, specialty insurance), customer type (e.g., individuals, corporates, SMEs), and service type (e.g., risk management, claims management, insurance advisory). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed. This granular approach offers insights into the specific drivers and challenges within each segment, empowering strategic planning and investment decisions.

Key Drivers of Europe Insurance Brokerage Market Growth

Several factors are driving the growth of the European insurance brokerage market. The increasing complexity of insurance products and the growing need for specialized risk management expertise are prompting businesses and individuals to engage brokers. Technological advancements are streamlining operations and enhancing customer experiences, leading to higher efficiency and accessibility. Furthermore, favorable regulatory changes and supportive economic conditions in certain regions are contributing to market expansion. The rising awareness of insurance needs, coupled with increasing disposable incomes, is fueling demand for diverse insurance products across Europe.

Challenges in the Europe Insurance Brokerage Market Sector

The European insurance brokerage market faces several challenges. Intense competition from established players and emerging Insurtech firms puts pressure on margins and necessitates constant innovation. Strict regulatory compliance requirements impose significant operational burdens. Cybersecurity risks and data protection regulations necessitate substantial investments in IT infrastructure and security protocols. Economic fluctuations in certain European regions can impact insurance demand and overall market growth. Furthermore, the integration of new technologies and attracting and retaining skilled professionals poses ongoing challenges for brokers.

Emerging Opportunities in Europe Insurance Brokerage Market

The European insurance brokerage market presents numerous opportunities. The expansion of Insurtech solutions offers potential for innovative product development and improved customer engagement. The rising demand for specialized insurance solutions tailored to specific industries (e.g., renewable energy, cybersecurity) opens niche market opportunities. The growing popularity of digital platforms presents possibilities for increased efficiency and broader market reach. Developing expertise in emerging risk areas, such as climate change and cyber threats, will offer substantial value to clients. Lastly, exploring cross-border brokerage opportunities across the European Union presents significant growth potential.

Leading Players in the Europe Insurance Brokerage Market Market

- Marsh & McLennan Co

- Willis Towers Watson PLC

- Aon PLC

- Arthur J Gallagher & Co

- BGL Group

- AmWINS Group Inc

- Assured Partners Inc

- NFP Corp

- Lockton Companies

- HUB International Ltd

Key Developments in Europe Insurance Brokerage Market Industry

- March 2022: Marsh & McLennan, the world's largest insurance broker, planned to exit all its businesses in Russia. This decision reflects the geopolitical instability and demonstrates the impact of global events on market players.

- March 2022: Aon PLC acquired the actuarial software platform Tyche. This acquisition significantly strengthens Aon's technological capabilities and expands its service offerings to re/insurer clients. It showcases the strategic importance of technological advancements within the insurance brokerage sector.

Strategic Outlook for Europe Insurance Brokerage Market Market

The Europe Insurance Brokerage Market is poised for continued growth, driven by technological advancements, shifting consumer preferences, and evolving risk landscapes. Companies that successfully integrate technology, personalize customer experiences, and offer specialized risk management solutions will be well-positioned for success. Strategic partnerships with Insurtech firms and expansion into new geographical markets and niche segments are critical to capturing significant market share. Focus on data analytics and compliance with stringent regulations will be crucial for long-term sustainability and profitability.

Europe Insurance Brokerage Market Segmentation

-

1. Type of Insurance

- 1.1. Life Insurance

- 1.2. Non-life Insurance

Europe Insurance Brokerage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Insurance Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Demand for Insurance Policies Driving the Insurance Brokerage Market in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Insurance Brokerage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 5.1.1. Life Insurance

- 5.1.2. Non-life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Marsh & McLennan Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Willis Towers Watson PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aon PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Arthur J Gallagher & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BGL Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AmWINS Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Assured Partners Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NFP Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lockton Companies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HUB International Ltd**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Marsh & McLennan Co

List of Figures

- Figure 1: Europe Insurance Brokerage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Insurance Brokerage Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Insurance Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Insurance Brokerage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Europe Insurance Brokerage Market Revenue Million Forecast, by Type of Insurance 2019 & 2032

- Table 4: Europe Insurance Brokerage Market Volume Billion Forecast, by Type of Insurance 2019 & 2032

- Table 5: Europe Insurance Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Insurance Brokerage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Europe Insurance Brokerage Market Revenue Million Forecast, by Type of Insurance 2019 & 2032

- Table 8: Europe Insurance Brokerage Market Volume Billion Forecast, by Type of Insurance 2019 & 2032

- Table 9: Europe Insurance Brokerage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Insurance Brokerage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: Germany Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 15: France Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Spain Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Belgium Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Sweden Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Norway Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Norway Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Poland Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Poland Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Denmark Europe Insurance Brokerage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Insurance Brokerage Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Insurance Brokerage Market?

The projected CAGR is approximately 7.27%.

2. Which companies are prominent players in the Europe Insurance Brokerage Market?

Key companies in the market include Marsh & McLennan Co, Willis Towers Watson PLC, Aon PLC, Arthur J Gallagher & Co, BGL Group, AmWINS Group Inc, Assured Partners Inc, NFP Corp, Lockton Companies, HUB International Ltd**List Not Exhaustive.

3. What are the main segments of the Europe Insurance Brokerage Market?

The market segments include Type of Insurance.

4. Can you provide details about the market size?

The market size is estimated to be USD 261.19 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Demand for Insurance Policies Driving the Insurance Brokerage Market in Europe.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022: Marsh & McLennan, the world's largest insurance broker, was planning to exit all of its businesses in Russia, while its rival Aon suspended operations in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Insurance Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Insurance Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Insurance Brokerage Market?

To stay informed about further developments, trends, and reports in the Europe Insurance Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence