Key Insights

The European self-storage market is experiencing robust growth, driven by several key factors. The increasing urbanization across major European cities leads to a higher demand for flexible and accessible storage solutions, particularly among individuals and businesses operating in space-constrained environments. E-commerce expansion further fuels this demand, with businesses needing more warehousing space for inventory management and order fulfillment. The rising popularity of co-living and smaller living spaces also contributes to the market's expansion, as individuals seek external storage for belongings they cannot accommodate at home. Finally, improved infrastructure and technological advancements in the self-storage sector, such as online booking platforms and enhanced security measures, are enhancing customer convenience and trust, fostering market growth.

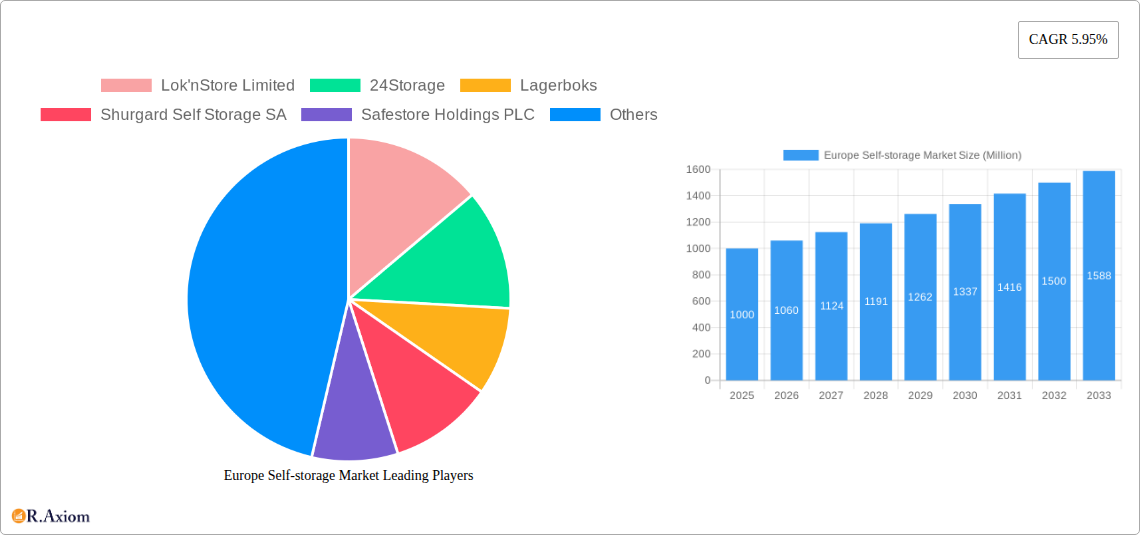

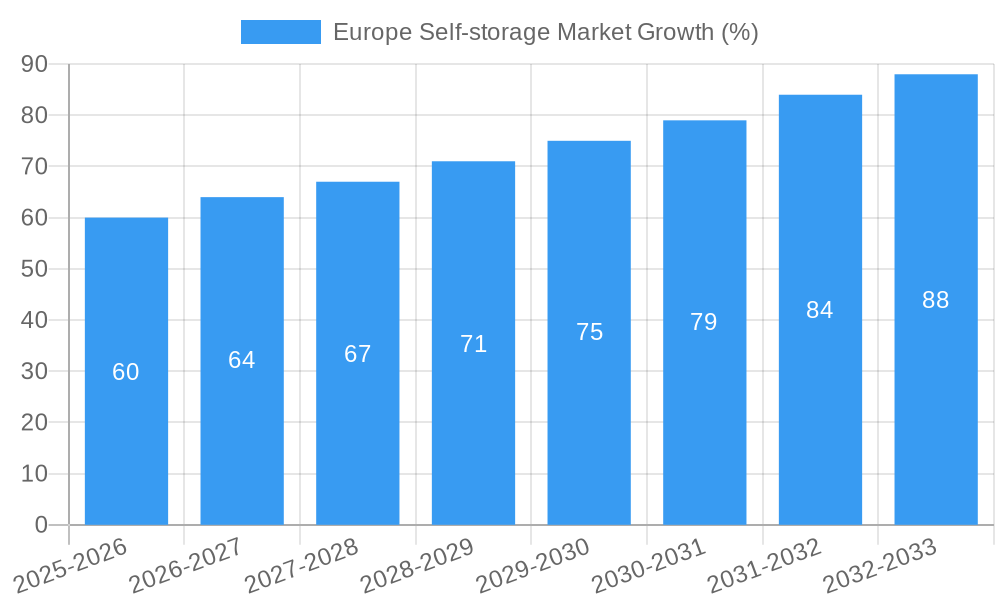

While the market shows considerable potential, certain challenges exist. Economic fluctuations and potential downturns can influence consumer spending on non-essential services like self-storage. Competition among established players and the emergence of new entrants requires ongoing innovation and strategic differentiation to maintain a strong market position. Regulatory changes related to land use and environmental concerns may also present hurdles for self-storage facility development and operation. Considering a CAGR of 5.95% and the provided base year of 2025, the market is poised for continued expansion, with a projected substantial increase in market value over the forecast period (2025-2033). Strategic expansion into underserved regions and the adoption of innovative business models will be crucial for players to capitalize on the market opportunities and navigate the challenges. The diverse segments, including personal and business users across various European countries, present opportunities for tailored marketing strategies and product offerings.

Europe Self-Storage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe self-storage market, offering invaluable insights for industry stakeholders, investors, and market entrants. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects.

Europe Self-storage Market Market Concentration & Innovation

The European self-storage market exhibits a moderately concentrated landscape, with several key players holding significant market share. While exact figures are proprietary to the full report, Lok'nStore Limited, Safestore Holdings PLC, and Big Yellow Group PLC are amongst the leading companies, though the level of their dominance varies across different countries. Market share calculations are based on revenue and facility size, reflecting a complex interplay of organic growth and strategic acquisitions.

M&A activity has been a significant driver of market consolidation. Recent deals, including the acquisition of xx Million worth of self storage assets in the UK in late 2022, illustrate the ongoing consolidation trend. The average deal value in the last five years is estimated at xx Million, with transaction volumes fluctuating year-on-year depending on macroeconomic conditions.

Innovation within the sector is driven by factors such as the increasing demand for flexible and secure storage solutions, technological advancements in security and access control, and a growing focus on sustainability. Regulatory frameworks, varying significantly across European countries, impact both market entry and operational practices. The rise of online booking platforms and self-service technologies is changing customer interactions and providing competitive advantages. Substitutes, such as traditional warehousing and home storage, exist but face challenges in meeting the convenience and security offered by self-storage units. End-user trends show a growing preference for flexible contracts and convenient locations, particularly in urban areas.

Europe Self-storage Market Industry Trends & Insights

The European self-storage market is experiencing robust growth, driven by several key factors. The rising urbanization trend, population growth in major cities, and increasing e-commerce activities all contribute to a higher demand for storage solutions. The CAGR for the period 2019-2024 is estimated at xx%, while the forecast period (2025-2033) projects a CAGR of xx%, indicating sustained growth momentum. Market penetration is highest in established markets such as the UK and Germany, but significant untapped potential exists in other European countries with developing economies and rising middle classes. Technological disruptions, such as smart access systems and online platforms, are improving efficiency and customer experience, enhancing the overall market attractiveness. Changing consumer preferences, including a demand for eco-friendly facilities and flexible payment options, are shaping the competitive dynamics.

Dominant Markets & Segments in Europe Self-storage Market

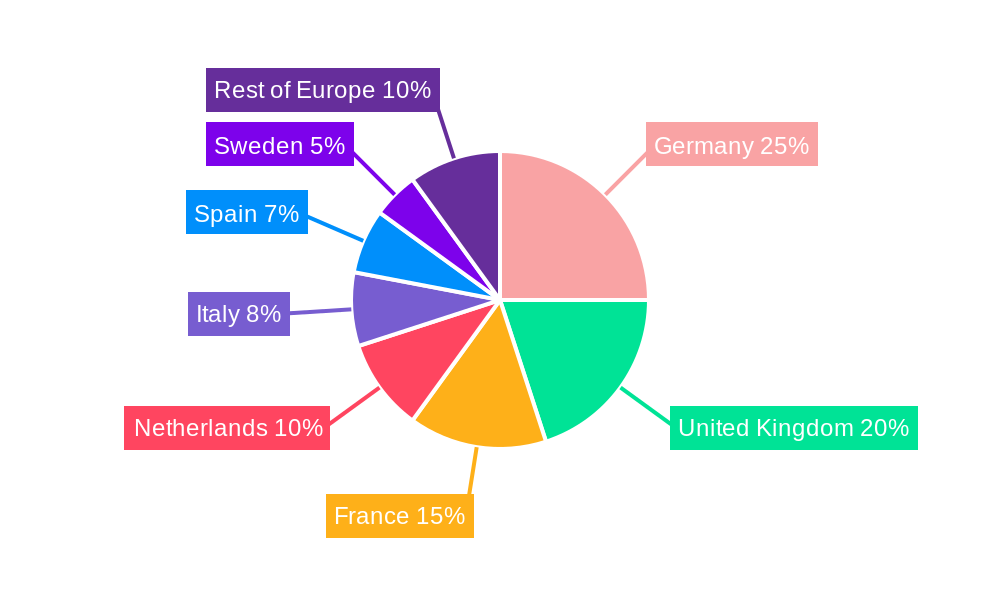

The United Kingdom consistently ranks as the leading market in Europe for self-storage, driven by robust economic growth, high population density in urban centers, and a well-established self-storage infrastructure. Germany, France, and the Netherlands also represent substantial markets, albeit with slightly lower market penetration compared to the UK.

- Key Drivers for UK Dominance: Strong economy, high population density in urban areas, well-developed real estate market, high consumer spending.

- Key Drivers for Germany Dominance: Large population, strong economy, increasing urbanization, robust logistics sector.

- Key Drivers for France Dominance: Large population, growing economy, increasing urbanization, substantial investment in logistics infrastructure.

- Key Drivers for Netherlands Dominance: High population density, strong economy, excellent logistics infrastructure, high levels of e-commerce activity.

The personal segment is currently the largest, reflecting individuals' needs for storage during relocation, home renovations, or decluttering. However, the business segment is exhibiting faster growth, driven by the increasing number of small and medium-sized enterprises (SMEs) and the rising demand for flexible warehousing solutions.

Europe Self-storage Market Product Developments

Product innovation is evident in the introduction of climate-controlled units, enhanced security features, and improved accessibility. Technological advancements, such as mobile applications for online booking and access control, are enhancing customer experience and efficiency. These developments cater to the growing demand for flexible, convenient, and secure storage solutions, fostering greater market penetration and driving competitive differentiation.

Report Scope & Segmentation Analysis

This report segments the European self-storage market by user type (personal and business) and by country (Germany, United Kingdom, France, Netherlands, Italy, Spain, Norway, Denmark, Sweden, and Rest of Europe). Detailed analysis within each segment includes current market sizes, growth projections, and competitive landscapes. For example, the UK personal storage segment is projected to show xx% growth in the forecast period, while the business segment in Germany is expected to grow at xx%. Competitive dynamics vary significantly across segments and countries, with some markets exhibiting higher levels of consolidation and others experiencing greater fragmentation.

Key Drivers of Europe Self-storage Market Growth

The growth of the European self-storage market is propelled by several key factors: the rise of e-commerce and the associated need for fulfillment centers and inventory storage; urbanization leading to increased demand for storage in densely populated areas; economic growth driving consumer spending and disposable income; and government policies promoting the development of logistics infrastructure.

Challenges in the Europe Self-storage Market Sector

The European self-storage market faces several challenges, including rising land costs impacting facility development, stringent regulatory approvals causing delays, and intense competition amongst existing players and new entrants. Supply chain disruptions can also lead to increased costs and delays in obtaining essential materials, negatively affecting project timelines and profitability. Furthermore, varying regulations across different European countries increase complexity and require significant market-specific adaptations.

Emerging Opportunities in Europe Self-storage Market

Emerging opportunities include the expansion of self-storage into underserved markets within Europe, the integration of innovative technologies such as AI-powered security and management systems, and the growing demand for eco-friendly and sustainable self-storage facilities. Focus on niche markets, such as art storage or specialized equipment storage, can offer further growth opportunities. The growing adoption of online booking systems and contactless access provides opportunities for enhanced customer convenience.

Leading Players in the Europe Self-storage Market Market

- Lok'nStore Limited

- 24Storage

- Lagerboks

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Pelican Self Storage

- Casaforte (SMC Self-Storage Management)

- Big Yellow Group PLC

- Nettolager

- W Wiedmer AG

- Self Storage Group ASA

- Access Self Storage

- SureStore Ltd

- W P Carey Inc

Key Developments in Europe Self-storage Market Industry

- October 2022: Big Yellow Group PLC opened two new stores in Harrow and Kingston North, adding over 1,000 storage units. This expansion reflects increasing demand and a strategic move to capture market share in these areas.

- October 2022: Padlock Partners UK Fund III and Cinch Self Storage acquired a facility near Watford for approximately GBP 9 million (USD 10.79 billion), demonstrating significant investment in the UK market. The planned opening in Summer 2023 signifies considerable confidence in future growth.

Strategic Outlook for Europe Self-storage Market Market

The European self-storage market is poised for continued growth, driven by sustained urbanization, economic expansion, and the increasing adoption of e-commerce. Strategic initiatives focusing on technological innovation, operational efficiency, and sustainable practices will be crucial for success. Expansion into new markets and the development of specialized storage solutions will present significant opportunities for industry players.

Europe Self-storage Market Segmentation

-

1. User Type

- 1.1. Personal

- 1.2. Business

Europe Self-storage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Self-storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Greater Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior

- 3.3. Market Restrains

- 3.3.1. Increasing Network Complexity

- 3.4. Market Trends

- 3.4.1. Business Storage Expected to Gain Market Popularity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 5.1.1. Personal

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 6. Germany Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Lok'nStore Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 24Storage

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Lagerboks

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Shurgard Self Storage SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Safestore Holdings PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Pelican Self Storage

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Casaforte (SMC Self-Storage Management)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Big Yellow Group PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Nettolager

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 W Wiedmer AG*List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Self Storage Group ASA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Access Self Storage

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 SureStore Ltd

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 W P Carey Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Lok'nStore Limited

List of Figures

- Figure 1: Europe Self-storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Self-storage Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Self-storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Self-storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 3: Europe Self-storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Self-storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Self-storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 13: Europe Self-storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Self-storage Market?

The projected CAGR is approximately 5.95%.

2. Which companies are prominent players in the Europe Self-storage Market?

Key companies in the market include Lok'nStore Limited, 24Storage, Lagerboks, Shurgard Self Storage SA, Safestore Holdings PLC, Pelican Self Storage, Casaforte (SMC Self-Storage Management), Big Yellow Group PLC, Nettolager, W Wiedmer AG*List Not Exhaustive, Self Storage Group ASA, Access Self Storage, SureStore Ltd, W P Carey Inc.

3. What are the main segments of the Europe Self-storage Market?

The market segments include User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Greater Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior.

6. What are the notable trends driving market growth?

Business Storage Expected to Gain Market Popularity.

7. Are there any restraints impacting market growth?

Increasing Network Complexity.

8. Can you provide examples of recent developments in the market?

October 2022: Big Yellow Group PLC has announced the opening of two new stores in Harrow and Kingston North. The two recent locations offer over 1,000 safe and secure storage rooms ranging from 9 sq ft to 500 sq ft - introducing more space into those living and working in Harrow, Kingston North, and the immediate surrounding areas. From short-term storage when renovating or moving home to flourishing businesses needing more space to store merchandise, we welcome the use of our rooms for both personal and business purposes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Self-storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Self-storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Self-storage Market?

To stay informed about further developments, trends, and reports in the Europe Self-storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence