Key Insights

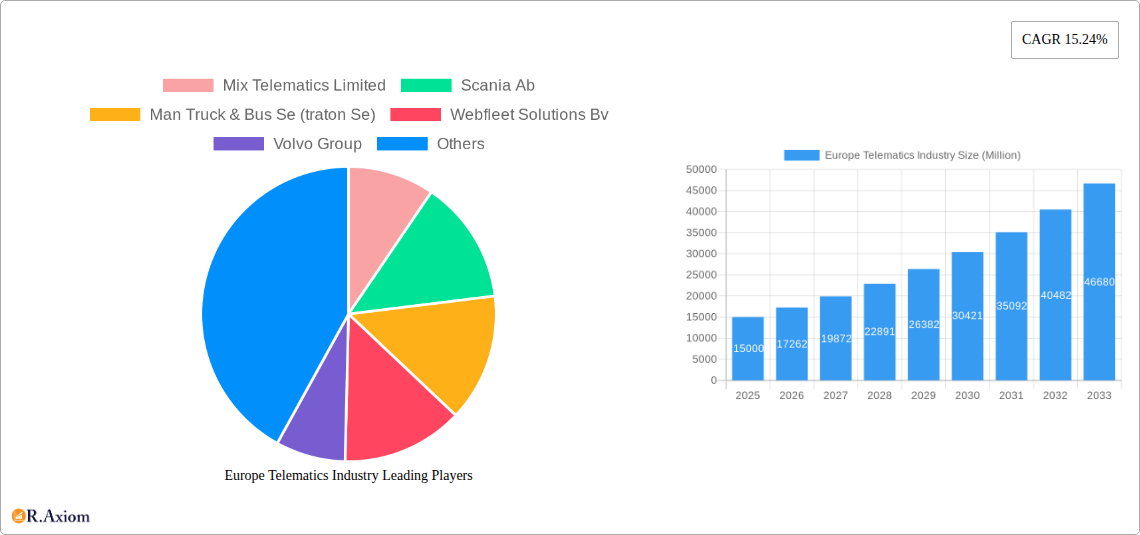

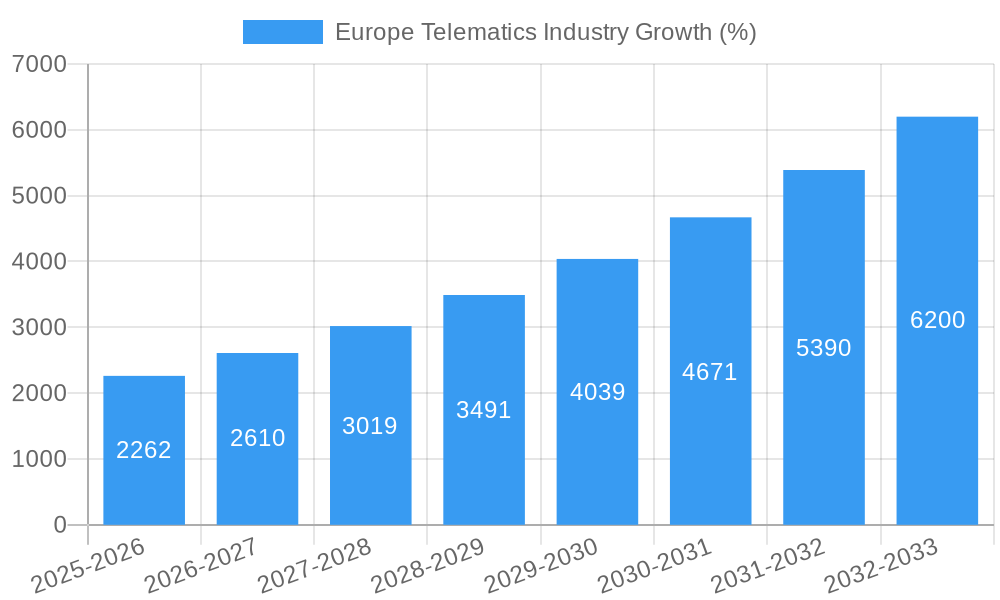

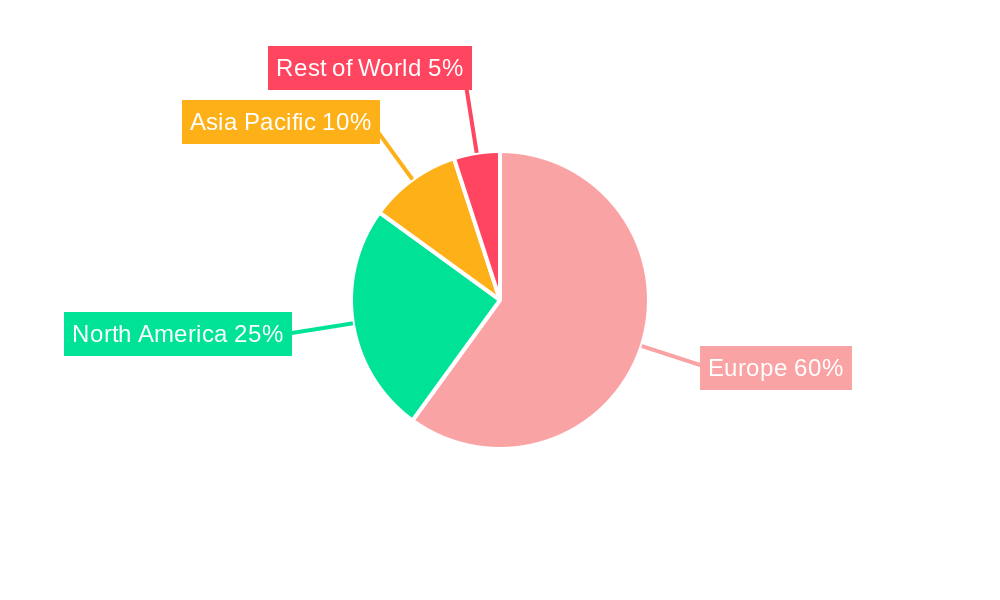

The European telematics market, encompassing both commercial and passenger vehicle segments, is experiencing robust growth, projected to maintain a 15.24% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of connected vehicle technologies driven by regulations mandating safety features and enhanced fleet management efficiency is a major driver. Furthermore, the rising demand for real-time data analytics for optimized logistics, improved driver behavior, and reduced operational costs are significantly contributing to market expansion. The commercial vehicle segment, particularly within the light commercial vehicle (LCV) sector, shows higher penetration of telematics systems compared to medium and heavy commercial vehicles (MCV/HCV), although the latter is witnessing rapid growth owing to investments in advanced fleet management solutions. Germany, France, and the UK are currently the leading markets in Europe, benefitting from strong automotive manufacturing sectors and advanced infrastructure supporting digital technologies. However, other countries like the Netherlands and Sweden are also showing significant growth potential due to increasing government support for smart transportation initiatives and a rise in adoption among small and medium-sized enterprises (SMEs).

Competition in the European telematics market is intense, with established players like Mix Telematics, Scania, and Volvo Group facing pressure from emerging technology providers and telecommunication giants like Verizon. The market is witnessing innovation in areas such as artificial intelligence (AI)-powered predictive maintenance, advanced driver-assistance systems (ADAS) integration, and the development of comprehensive telematics platforms offering holistic fleet management capabilities. While the initial investment costs associated with implementing telematics solutions can act as a restraint, the long-term cost savings through increased efficiency, reduced fuel consumption, and improved safety are incentivizing adoption across various industries, including transportation, logistics, and construction. The increasing focus on data security and privacy regulations also presents both a challenge and an opportunity for market participants to offer robust and compliant solutions. Overall, the future outlook for the European telematics market remains positive, with significant growth anticipated across all segments and regions over the forecast period.

Europe Telematics Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe telematics industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. The report utilizes data from various sources and incorporates expert insights to provide actionable intelligence for industry stakeholders.

Europe Telematics Industry Market Concentration & Innovation

The European telematics market exhibits a moderately concentrated landscape, with several key players commanding significant market share. Mix Telematics Limited, Scania AB, MAN Truck & Bus SE (Traton SE), Webfleet Solutions BV, and Volvo Group are among the prominent players, vying for dominance across various segments. The market share of the top five players is estimated at xx%, indicating a competitive yet consolidated environment. Innovation is driven by the increasing demand for connected vehicles, stricter regulatory frameworks promoting safety and efficiency, and the need for enhanced fleet management capabilities. Significant M&A activity has been observed in recent years, with deal values exceeding xx Million in the last five years, largely driven by efforts to consolidate market share and access new technologies. This consolidation further shapes the industry dynamics and intensifies the competition. Product substitutes, such as simpler GPS tracking devices, pose a challenge, particularly in the lower-end market segments. However, the advanced functionalities and data-driven insights offered by comprehensive telematics solutions continue to drive adoption. End-user trends increasingly favor integrated systems offering real-time data, predictive analytics, and seamless integration with other business systems.

Europe Telematics Industry Industry Trends & Insights

The European telematics market is experiencing robust growth, driven by factors such as increasing fleet sizes across various industries, stringent government regulations promoting road safety and environmental sustainability, and the rising adoption of connected car technologies. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, including the emergence of 5G connectivity, advancements in artificial intelligence (AI), and the Internet of Things (IoT), are transforming the industry, enabling the development of more sophisticated and integrated telematics solutions. Consumer preferences are shifting toward user-friendly interfaces, advanced analytics capabilities, and customized solutions tailored to specific needs. The competitive landscape is characterized by fierce competition among established players and the emergence of innovative startups. The market penetration of telematics solutions varies across segments and geographies. The penetration of telematics in commercial vehicles is significantly higher than in passenger vehicles, although this gap is expected to narrow in the coming years. The growth is also fueled by the rising demand for efficient fleet management solutions and the reduction in operational costs. The market is also witnessing increasing focus on data security and privacy concerns.

Dominant Markets & Segments in Europe Telematics Industry

Commercial Vehicle Telematics: This segment dominates the European telematics market, driven by the increasing need for efficient fleet management and optimization in logistics, transportation, and other industries. Germany, France, and the UK are the leading countries in this segment, owing to robust economic activity, well-established logistics infrastructure, and a high concentration of commercial vehicle fleets.

Light Commercial Vehicles (LCVs) vs. Medium and Heavy Commercial Vehicles (MCVs/HCVs): While MCVs/HCVs currently represent a larger share of the installed base, the penetration rate in LCVs is witnessing faster growth, driven by increasing demand for optimized delivery and service operations in urban areas.

Passenger Vehicle Telematics: This segment exhibits substantial growth potential, driven by increasing adoption of embedded OEM telematics systems and the growing popularity of connected car features. This is being fueled by consumers' desire for enhanced safety, convenience, and infotainment features.

Telematics Service Revenue: The telematics service revenue is primarily generated from subscription-based services and varies significantly across countries. Germany, UK and France generate a significant portion of this revenue.

Regional Analysis: Western European countries, particularly Germany, France, and the UK, are dominant due to robust economies, well-developed infrastructure, and high vehicle ownership.

Key Drivers for dominance in these segments include supportive government policies promoting the adoption of advanced technologies, robust logistics and transportation infrastructure, high levels of vehicle ownership, and a strong focus on efficiency and safety.

Europe Telematics Industry Product Developments

Recent product innovations focus on enhancing data analytics capabilities, integrating AI and machine learning algorithms for predictive maintenance, and improving user interfaces for better accessibility. The development of cloud-based platforms enables scalable and cost-effective deployment of telematics solutions. These advancements enhance operational efficiency, fuel cost reduction, and improved driver safety, which makes telematics systems more attractive to users. The market fit for these innovations is strong, given the industry's increasing emphasis on data-driven decision-making and operational efficiency.

Report Scope & Segmentation Analysis

The report comprehensively segments the European telematics market based on vehicle type (commercial and passenger), vehicle class (LCV, MCV, HCV), telematics service type (fleet management, driver behavior monitoring, etc.), and region (Germany, France, UK, Italy, Spain, and others). Growth projections for each segment vary, with commercial vehicle telematics expected to maintain robust growth, driven by increasing fleet sizes and stringent regulations. The passenger vehicle telematics segment is projected to witness accelerated growth driven by the increasing adoption of connected car features. Competitive dynamics vary across segments, with intense competition in the commercial vehicle segment and emerging players challenging established players in the passenger vehicle segment. Market size estimates are provided for each segment, with Germany, France and UK representing large market segments.

Key Drivers of Europe Telematics Industry Growth

Several factors propel the growth of the Europe telematics industry. Government regulations emphasizing road safety and emissions reduction mandate the adoption of telematics systems in commercial fleets. The increasing need for efficient fleet management, optimized logistics, and reduced operational costs drives adoption across various sectors. Technological advancements such as 5G and AI continue to enhance the capabilities of telematics solutions, offering advanced analytics and predictive maintenance functionalities. The rise of IoT and connected car technologies further contribute to market expansion.

Challenges in the Europe Telematics Industry Sector

Despite the favorable growth outlook, several challenges hinder the industry's growth. High initial investment costs for implementing telematics systems can be a barrier, particularly for small and medium-sized businesses (SMBs). Concerns regarding data security and privacy represent a significant challenge, requiring robust security measures and adherence to strict regulations. The competitive landscape, marked by both established players and emerging startups, intensifies the pressure on margins and profitability. Supply chain disruptions can lead to delays and increased costs. Furthermore, the integration of different telematics systems and data sources poses a challenge, highlighting the need for interoperability and standardization.

Emerging Opportunities in Europe Telematics Industry

Several emerging opportunities exist for growth in the Europe telematics industry. The expanding adoption of electric vehicles (EVs) creates opportunities for developing telematics solutions tailored to the specific needs of EV fleets, such as battery management and charging optimization. The integration of AI and machine learning opens avenues for developing predictive maintenance and route optimization solutions. The growing demand for real-time data analytics for improved operational efficiency will drive the expansion of data-driven services. The increasing adoption of autonomous driving technologies will also lead to increased adoption of telematics systems for fleet and vehicle monitoring and management.

Leading Players in the Europe Telematics Industry Market

- Mix Telematics Limited

- Scania AB

- MAN Truck & Bus SE (Traton SE)

- Webfleet Solutions BV

- Volvo Group

- Verizon Communications Inc

- Targa Telematics Spa

- Masternaut Limited

- Abax UK Ltd

- DAF Trucks NV (PACCAR Inc)

- Mercedes-Benz Group AG (Daimler AG)

- Gurtam Inc

Key Developments in Europe Telematics Industry Industry

May 2023: Webfleet announced a strategic partnership with RIO, a digital service provider, to provide integrated fleet management solutions for MAN trucks using the existing OEM hardware, RIO Box. This partnership expands market reach and offers customers flexible access to advanced telematics solutions.

May 2023: Targa Telematics partnered with Service Vill, a chauffeur-driven car rental company, to monitor its fleet of high-end vehicles. This collaboration showcases the applicability of telematics solutions in the luxury car rental sector, improving operational efficiency and safety.

Strategic Outlook for Europe Telematics Industry Market

The future of the European telematics market is promising, driven by continued technological advancements, increasing demand for data-driven decision-making, and stricter regulatory requirements. The expansion of 5G networks and the broader adoption of connected car technologies will fuel market growth, creating opportunities for innovative solutions that enhance fleet management, driver safety, and overall operational efficiency. The market is poised for considerable expansion across various segments, particularly in the passenger vehicle sector, as the demand for connected car features continues to rise. The increasing focus on data security and privacy will necessitate robust security measures and compliance with stringent regulations, shaping the future landscape of the telematics industry.

Europe Telematics Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Telematics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Telematics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in EU Regulations and Local Policy Rules; Advancements Such as Route Calculation

- 3.2.2 Vehicle Tracking

- 3.2.3 and Fuel Pilferage

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Passenger Vehicles to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mix Telematics Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Scania Ab

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Man Truck & Bus Se (traton Se)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Webfleet Solutions Bv

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Volvo Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Verizon Communications Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Targa Telematics Spa

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Masternaut Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Abax Uk Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Daf Trucks Nv (paccar Inc )*List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Mercedes-benz Group Ag (daimler Ag)

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Gurtam Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Mix Telematics Limited

List of Figures

- Figure 1: Europe Telematics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Telematics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Telematics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Telematics Industry Volume Million Forecast, by Region 2019 & 2032

- Table 3: Europe Telematics Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Europe Telematics Industry Volume Million Forecast, by Production Analysis 2019 & 2032

- Table 5: Europe Telematics Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Europe Telematics Industry Volume Million Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Europe Telematics Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Europe Telematics Industry Volume Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Europe Telematics Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Europe Telematics Industry Volume Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Europe Telematics Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Europe Telematics Industry Volume Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Europe Telematics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Europe Telematics Industry Volume Million Forecast, by Region 2019 & 2032

- Table 15: Europe Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Telematics Industry Volume Million Forecast, by Country 2019 & 2032

- Table 17: Germany Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: France Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Italy Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Netherlands Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Sweden Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Sweden Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 31: Europe Telematics Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 32: Europe Telematics Industry Volume Million Forecast, by Production Analysis 2019 & 2032

- Table 33: Europe Telematics Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Europe Telematics Industry Volume Million Forecast, by Consumption Analysis 2019 & 2032

- Table 35: Europe Telematics Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Europe Telematics Industry Volume Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Europe Telematics Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: Europe Telematics Industry Volume Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 39: Europe Telematics Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 40: Europe Telematics Industry Volume Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 41: Europe Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Telematics Industry Volume Million Forecast, by Country 2019 & 2032

- Table 43: United Kingdom Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 45: Germany Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Germany Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 47: France Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 49: Italy Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Italy Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 51: Spain Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Spain Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 53: Netherlands Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Netherlands Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 55: Belgium Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Belgium Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 57: Sweden Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Sweden Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 59: Norway Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Norway Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 61: Poland Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Poland Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

- Table 63: Denmark Europe Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Denmark Europe Telematics Industry Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Telematics Industry?

The projected CAGR is approximately 15.24%.

2. Which companies are prominent players in the Europe Telematics Industry?

Key companies in the market include Mix Telematics Limited, Scania Ab, Man Truck & Bus Se (traton Se), Webfleet Solutions Bv, Volvo Group, Verizon Communications Inc, Targa Telematics Spa, Masternaut Limited, Abax Uk Ltd, Daf Trucks Nv (paccar Inc )*List Not Exhaustive, Mercedes-benz Group Ag (daimler Ag), Gurtam Inc.

3. What are the main segments of the Europe Telematics Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in EU Regulations and Local Policy Rules; Advancements Such as Route Calculation. Vehicle Tracking. and Fuel Pilferage.

6. What are the notable trends driving market growth?

Passenger Vehicles to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

May 2023: Webfleet announced a strategic partnership with RIO, a digital service provider, to provide integrated fleet management solutions for MAN trucks with the existing OEM hardware, RIO Box, from MAN. Through this partnership, both companies aim to provide customers with easy access to advanced telematics solutions and the possibility to work with leading fleet management applications independent of pre-installed hardware and mixed fleets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Telematics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Telematics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Telematics Industry?

To stay informed about further developments, trends, and reports in the Europe Telematics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence