Key Insights

The European Venture Capital (VC) industry is experiencing significant expansion, driven by a robust tech ecosystem, particularly in Fintech, Pharma, and Biotech. Strategic government initiatives and increasing funding availability from both established and emerging firms are key growth catalysts. The market is projected to see sustained upward momentum through 2033. While specific figures vary, a compound annual growth rate (CAGR) of 13.87% is anticipated, with the market size estimated at 8.74 billion in the 2025 base year, and expected to grow to 15.45 billion by 2030. Investment is concentrated across all stages, from seed to late-stage, with notable activity in the UK, Germany, and Northern European countries. Potential challenges include regulatory complexities and economic uncertainties, which may influence the growth trajectory.

Europe Venture Capital Industry Market Size (In Billion)

Segmentation by investment industry, country, and deal size offers critical insights for market participants. The competitive landscape features major players such as Atomico and Accel Partners, alongside specialized emerging firms, fostering innovation and diverse investment opportunities for startups. Successful exits and the overall health of the European tech sector contribute to the industry's ongoing expansion. Further analysis into geopolitical influences, technological advancements, and evolving investor sentiment will refine future growth projections. Adapting to regulatory changes is paramount for navigating the dynamic European VC market effectively.

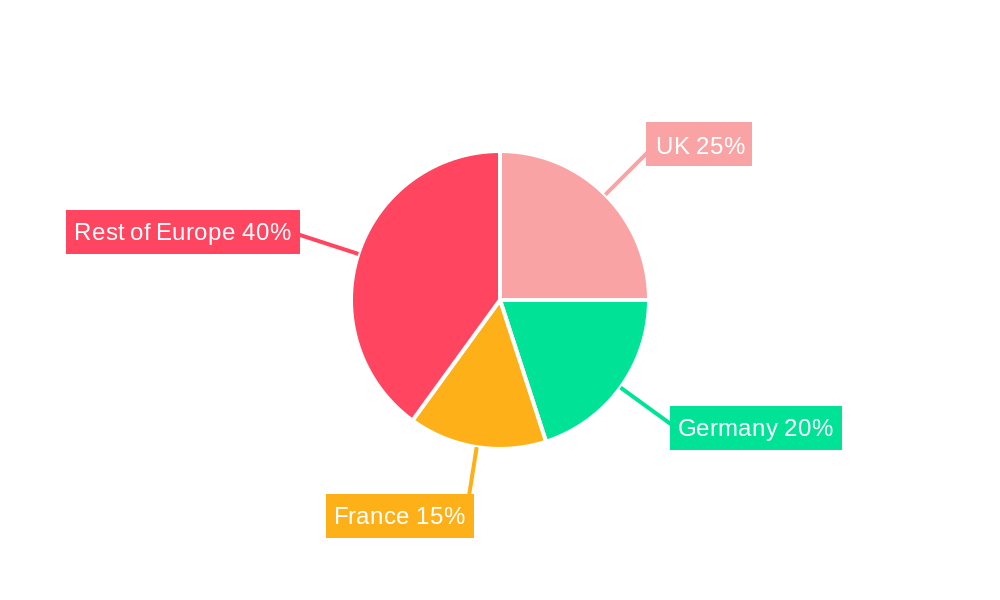

Europe Venture Capital Industry Company Market Share

This report offers a comprehensive analysis of the European VC industry, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 designated as the base year for an estimated market size of 8.74 billion. The forecast period extends from 2025 to 2033, incorporating historical data from 2019 to 2024. This analysis is vital for investors, VCs, startups, and stakeholders seeking to capitalize on opportunities within the evolving European VC landscape.

Europe Venture Capital Industry Market Concentration & Innovation

This section analyzes the concentration of the European venture capital market, examining key players’ market share and the influence of mergers and acquisitions (M&A) activity. Innovation drivers, regulatory frameworks, product substitutes, end-user trends, and competitive dynamics are also explored.

The European VC market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. However, a large number of smaller and specialized firms contribute significantly to the overall activity. Market share data for 2024 suggests that the top five firms held approximately xx% of the total investment volume. M&A activity has been steadily increasing, with deal values exceeding €xx Million in 2024, driven by consolidation among smaller firms and strategic acquisitions by larger players.

- Market Concentration: Top 5 firms hold approximately xx% of market share (2024).

- M&A Activity: Deal values exceeding €xx Million in 2024.

- Innovation Drivers: Technological advancements, government initiatives (e.g., the French €xx Billion tech fund), and increased entrepreneurial activity.

- Regulatory Frameworks: EU regulations on data privacy, competition, and investment are shaping the market landscape.

- Product Substitutes: Alternative financing sources like crowdfunding and angel investors pose competitive pressure.

- End-User Trends: Growing demand for innovative technologies across various sectors drives investment.

Europe Venture Capital Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the European venture capital industry, focusing on market growth, technological disruptions, shifting consumer preferences, and competitive dynamics. The analysis incorporates metrics such as Compound Annual Growth Rate (CAGR) and market penetration.

The European venture capital market is experiencing robust growth, driven by increasing startup activity, technological advancements, and favorable regulatory environments in certain regions. The market witnessed a CAGR of xx% during the period 2019-2024, and this growth is expected to continue, albeit at a slightly moderated pace, in the forecast period. Market penetration is highest in the UK and Germany, reflecting a robust startup ecosystem and readily available funding. Technological disruptions like AI, blockchain, and the metaverse are attracting significant investments, leading to high valuations and increased competition among VC firms. Consumer preferences for sustainable and ethical products are also influencing investment patterns.

Dominant Markets & Segments in Europe Venture Capital Industry

This section identifies the leading regions, countries, and investment segments within the European VC market. The analysis considers investments by industry (Fintech, Pharma & Biotech, Consumer Goods, Industrial/Energy, IT Hardware & Services, Other), by country (UK, Germany, Finland, Spain, Others), and by deal size (Angel/Seed, Early-stage, Later-stage).

By Industry of Investment:

- Fintech: Fintech remains a dominant sector, attracting significant capital due to its high growth potential and innovative business models.

- Pharma & Biotech: This sector attracts substantial investment, driven by the need for life-saving treatments and technological advancements in drug discovery.

- Consumer Goods: The consumer goods sector shows a substantial amount of activity due to the rising middle class and increasing online shopping.

- IT Hardware & Services: The consistent demand for advanced technology keeps this sector significant.

- Industrial/Energy: Investments reflect the need for sustainable energy solutions and industrial automation.

- Other Industries of Investment: This segment encompasses a wide range of industries that show moderate to low levels of funding.

By Country of Investment:

- UK: The UK remains a dominant force, due to its established ecosystem, favorable regulatory environment, and access to talent.

- Germany: Germany is a strong contender, showcasing strong growth in its technology scene.

- Finland: Finland's specialized tech hubs attract considerable VC investment.

- Spain: The Spanish VC market is growing rapidly, driven by government initiatives and increasing startup activity.

- Others: Several other European countries are emerging as VC hotspots, driven by unique industry strengths and government support.

By Deal Size & Stage of Investment:

- Angel/Seed Investing: Early-stage investments show a high percentage of the overall funding.

- Early-stage Investing: A considerable amount of money flows to early-stage ventures.

- Later-stage Investing: Later-stage deals command substantial investments, particularly in high-growth companies.

Europe Venture Capital Industry Product Developments

The European VC industry is characterized by constant innovation, with new products and services emerging regularly. Technological advancements, particularly in AI, big data analytics, and cloud computing, are transforming the way VC firms operate, enabling data-driven decision-making and improved portfolio management. The industry's focus is shifting towards providing added-value services beyond capital, including mentorship, network access, and strategic guidance to enhance portfolio companies' growth and success.

Report Scope & Segmentation Analysis

This report segments the European venture capital market based on industry, country, and investment stage. Growth projections, market sizes, and competitive dynamics are analyzed for each segment.

- By Industry of Investment: The report analyzes the market size and growth projections for each industry segment, highlighting the competitive landscape and key drivers for each.

- By Country of Investment: The report provides a detailed overview of the VC market in each country, considering regional factors, government policies, and the presence of major VC firms.

- By Deal Size & Stage of Investment: The report analyzes investment patterns across different stages of funding, providing insights into the characteristics and trends of each stage.

Key Drivers of Europe Venture Capital Industry Growth

The European VC industry's growth is driven by several factors:

- Technological Advancements: The emergence of innovative technologies (AI, blockchain) creates exciting investment opportunities.

- Favorable Regulatory Environment: Government initiatives and support for startups in certain countries foster growth.

- Strong Entrepreneurial Ecosystem: Europe boasts a vibrant startup scene, attracting talent and investment.

Challenges in the Europe Venture Capital Industry Sector

The European VC sector faces several challenges:

- Regulatory Hurdles: Navigating complex regulations across different countries poses a challenge.

- Competition: Increased competition from both domestic and international VC firms exerts pressure.

- Access to Talent: Attracting and retaining top talent remains a significant challenge for many startups.

Emerging Opportunities in Europe Venture Capital Industry

Emerging opportunities include:

- Sustainable Investing: Growing investor interest in sustainable and ethical investments creates new opportunities.

- Deep Tech: Investments in cutting-edge technologies (AI, quantum computing) offer high potential returns.

- Expansion into New Markets: Expanding into underserved markets within Europe presents significant potential.

Leading Players in the Europe Venture Capital Industry Market

- Atomico

- Atlantic Labs

- BGF invests

- 360 Capital

- Axon Partners Group

- Acton Capital

- Bonsai Venture Capita

- Accel Partners

- Active Venture

- AAC Capital

- Adara Ventures

Key Developments in Europe Venture Capital Industry Industry

- February 2022: France announces a €xx Billion fund to boost its tech sector, aiming to create 10 companies worth over €100 Billion by 2030.

- October 2021: Sequoia Capital shifts to a singular, permanent fund structure, impacting the industry's traditional model.

Strategic Outlook for Europe Venture Capital Industry Market

The European VC market is poised for continued growth, driven by technological innovation, increased startup activity, and supportive government policies. The focus on sustainable investments and deep tech will shape future investment patterns, while competition will remain intense. The market will likely see increased consolidation and further internationalization, with VC firms seeking opportunities across various European countries.

Europe Venture Capital Industry Segmentation

-

1. Deal Size - Stage of Investment

- 1.1. Angel/Seed Investing

- 1.2. Early-stage Investing

- 1.3. Later-stage Investing

-

2. Industry of Investment

- 2.1. Fintech

- 2.2. Pharma and Biotech

- 2.3. Consumer Goods

- 2.4. Industrial/Energy

- 2.5. IT Hardware and Services

- 2.6. Other Industries of Investment

Europe Venture Capital Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Venture Capital Industry Regional Market Share

Geographic Coverage of Europe Venture Capital Industry

Europe Venture Capital Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. United States' role in VC rounds in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deal Size - Stage of Investment

- 5.1.1. Angel/Seed Investing

- 5.1.2. Early-stage Investing

- 5.1.3. Later-stage Investing

- 5.2. Market Analysis, Insights and Forecast - by Industry of Investment

- 5.2.1. Fintech

- 5.2.2. Pharma and Biotech

- 5.2.3. Consumer Goods

- 5.2.4. Industrial/Energy

- 5.2.5. IT Hardware and Services

- 5.2.6. Other Industries of Investment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Deal Size - Stage of Investment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Atomico invests

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Atlantic Labs

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BGF invests

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 360 Capital

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Axon Partners Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Acton Capital

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bonsai Venture Capita

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Accel Partners

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Active Venture

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AAC Capital

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Adara Ventures

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Atomico invests

List of Figures

- Figure 1: Europe Venture Capital Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Venture Capital Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Venture Capital Industry Revenue billion Forecast, by Deal Size - Stage of Investment 2020 & 2033

- Table 2: Europe Venture Capital Industry Revenue billion Forecast, by Industry of Investment 2020 & 2033

- Table 3: Europe Venture Capital Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Venture Capital Industry Revenue billion Forecast, by Deal Size - Stage of Investment 2020 & 2033

- Table 5: Europe Venture Capital Industry Revenue billion Forecast, by Industry of Investment 2020 & 2033

- Table 6: Europe Venture Capital Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Venture Capital Industry?

The projected CAGR is approximately 13.87%.

2. Which companies are prominent players in the Europe Venture Capital Industry?

Key companies in the market include Atomico invests, Atlantic Labs, BGF invests, 360 Capital, Axon Partners Group, Acton Capital, Bonsai Venture Capita, Accel Partners, Active Venture, AAC Capital, Adara Ventures.

3. What are the main segments of the Europe Venture Capital Industry?

The market segments include Deal Size - Stage of Investment, Industry of Investment.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

United States' role in VC rounds in Europe.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

February 2022: France's Prime Minister, Bruno Le Maire, announced the plans of creating a new fund to boost the technological sector in Europe. The target of the fund is to establish 10 technological companies having a net worth of more than Euro 100 billion by the end of 2030. Moreover, the fund will be publicly funded to finance new technological startups emerging in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Venture Capital Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Venture Capital Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Venture Capital Industry?

To stay informed about further developments, trends, and reports in the Europe Venture Capital Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence