Key Insights

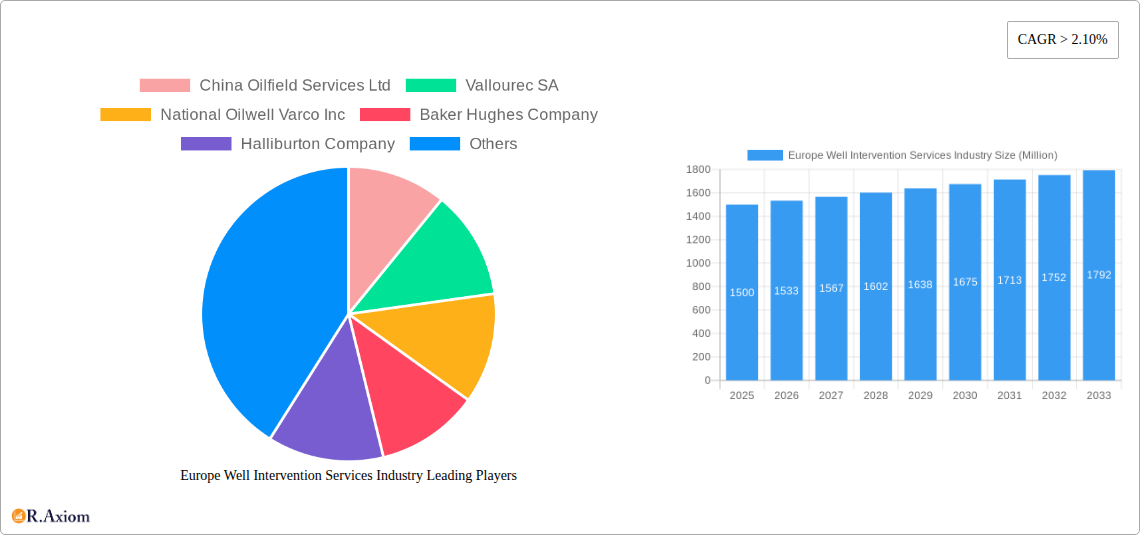

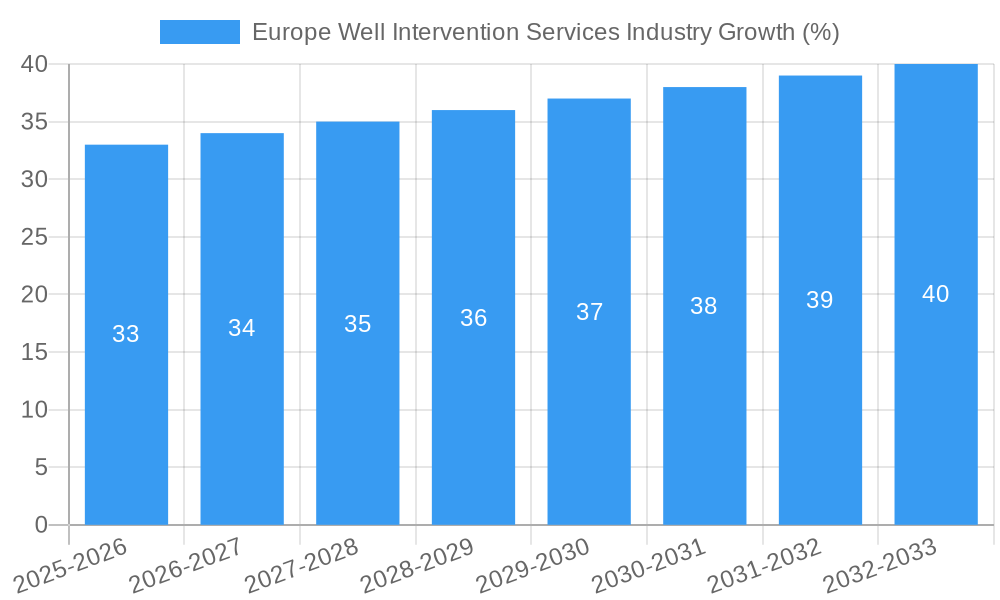

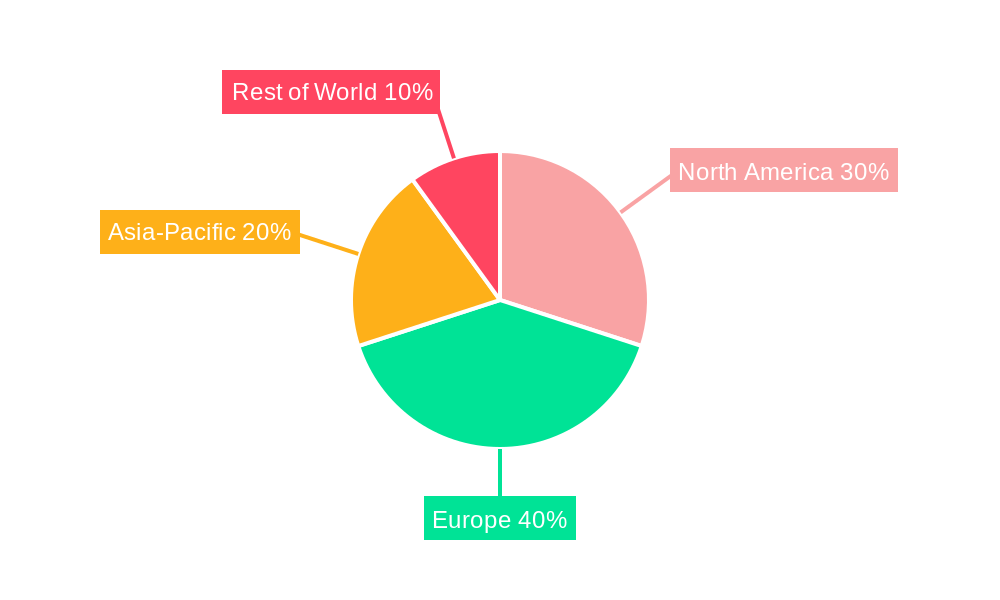

The European well intervention services market, currently experiencing robust growth, is projected to expand significantly over the forecast period (2025-2033). Driven by increasing offshore oil and gas exploration activities, particularly in the North Sea, coupled with the ongoing need for well maintenance and repair across existing infrastructure, the market demonstrates substantial potential. The CAGR of 2.10% suggests a steady, consistent expansion, although localized variations are expected based on specific regional regulatory landscapes and investment in renewable energy sources. Key players like Schlumberger, Halliburton, and Baker Hughes, along with significant regional players, are strategically positioned to capitalize on this growth. The onshore segment is likely to maintain a larger market share due to the established infrastructure and a higher density of mature wells requiring intervention services. However, the offshore segment is expected to exhibit faster growth fueled by technological advancements enabling safer and more efficient operations in challenging environments. Germany, the UK, and the Netherlands, due to their established oil and gas sectors, are expected to represent significant portions of the European market.

While the market presents significant opportunities, challenges remain. Fluctuations in oil and gas prices directly impact investment in well intervention, representing a key restraint. Additionally, the increasing focus on renewable energy transition might lead to reduced exploration and production activities in the long term, impacting the market's overall growth trajectory. However, this transition also creates opportunities for well intervention services in decommissioning activities and the development of geothermal energy resources. Therefore, a balanced approach, considering both the established fossil fuel infrastructure and the shift towards renewables, is crucial for long-term market success. The competitive landscape is characterized by both large multinational corporations and specialized niche players, leading to continuous innovation and price competition.

This comprehensive report provides an in-depth analysis of the Europe Well Intervention Services industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report leverages extensive primary and secondary research to deliver actionable insights for industry stakeholders.

Europe Well Intervention Services Industry Market Concentration & Innovation

The European well intervention services market exhibits a moderately concentrated structure, dominated by a few multinational players like Schlumberger Limited, Halliburton Company, Baker Hughes Company, and Weatherford International Ltd. These companies collectively hold approximately xx% of the market share, as of 2025. Smaller, specialized firms focus on niche segments or geographic areas. Market concentration is influenced by factors such as technological advancements, regulatory changes, and M&A activities. Recent M&A deals, while not publicly disclosed at large values, have predominantly focused on strategic acquisitions of smaller companies with specialized technologies or regional expertise. The total value of these transactions in the past five years is estimated to be around xx Million.

Innovation in the industry is driven by the need for enhanced efficiency, safety, and reduced environmental impact. Key areas of innovation include advanced drilling technologies, automation, data analytics, and sustainable solutions. Stricter regulatory frameworks, particularly concerning environmental protection and worker safety, push technological advancements. Product substitutes, while limited, exist in the form of alternative well completion and intervention methods. End-user trends indicate a growing demand for cost-effective and environmentally friendly solutions.

Europe Well Intervention Services Industry Industry Trends & Insights

The European well intervention services market is experiencing steady growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increasing oil and gas exploration and production activities, particularly in the North Sea region. Technological disruptions, such as the adoption of automation and digitalization, are transforming operational efficiency and optimizing resource allocation. Consumer preferences are shifting towards sustainable and environmentally conscious solutions, creating demand for technologies that minimize environmental impact. Competitive dynamics are intense, characterized by technological innovation, strategic partnerships, and aggressive pricing strategies. Market penetration of advanced technologies is gradually increasing, with xx% of operators adopting automated solutions as of 2025. The market's growth is further influenced by fluctuating energy prices, governmental policies regarding energy production, and geopolitical stability within Europe.

Dominant Markets & Segments in Europe Well Intervention Services Industry

The North Sea region, encompassing the UK, Norway, and Denmark, represents the dominant market for well intervention services in Europe. This dominance is largely attributable to substantial offshore oil and gas reserves and robust infrastructure to support offshore operations.

Key Drivers for the North Sea Region's Dominance:

- Extensive Offshore Reserves: The North Sea is a significant source of oil and gas, driving demand for well intervention services.

- Established Infrastructure: Well-developed port facilities, support vessels, and experienced workforce contribute to operational efficiency.

- Favorable Regulatory Environment: Supportive government policies and regulations promote investment in the energy sector.

- Technological Advancements: The region has been at the forefront of adopting new technologies, enhancing operational efficiency.

The offshore segment constitutes the larger share of the market, driven by the substantial investment in offshore exploration and production projects. Onshore activities contribute a smaller proportion, primarily concentrated in regions with established oil and gas fields.

Europe Well Intervention Services Industry Product Developments

Recent product innovations center around enhanced automation, improved data analytics capabilities, and eco-friendly techniques. These advancements deliver increased efficiency, reduced operational costs, and enhanced safety measures. Improved remote operation capabilities are also gaining traction, enhancing both safety and operational efficiency. The market fit for these innovations is strong, driven by the industry's ongoing pursuit of efficiency and sustainability.

Report Scope & Segmentation Analysis

This report segments the European well intervention services market based on location of deployment:

Onshore: The onshore segment is characterized by a more fragmented market with smaller companies catering to localized needs. Growth is projected to be moderate during the forecast period, driven by ongoing onshore exploration and production activities in specific regions. Market size in 2025 is estimated at xx Million.

Offshore: The offshore segment is characterized by significant investment and strong growth prospects. The dominance of large, multinational companies in this sector reflects the high capital expenditure requirements and specialized technical skills needed for offshore operations. Market size in 2025 is estimated at xx Million. Competitive dynamics are intense, with companies vying for market share through technological innovation and strategic partnerships.

Key Drivers of Europe Well Intervention Services Industry Growth

Several factors drive growth in the European well intervention services market:

- Rising Energy Demand: Growing energy consumption in Europe fuels increased exploration and production activities, directly impacting the demand for well intervention services.

- Technological Advancements: Continuous improvement in drilling and intervention technologies enhances operational efficiency and reduces costs.

- Government Support: Favorable government policies and regulatory frameworks incentivize investment in the energy sector, supporting industry growth.

Challenges in the Europe Well Intervention Services Industry Sector

The industry faces several challenges:

- Fluctuating Oil & Gas Prices: Price volatility directly impacts investment decisions and overall market growth. The impact is estimated at a xx% fluctuation in market activity year-on-year.

- Environmental Regulations: Increasingly stringent environmental regulations increase operational costs and necessitate investment in cleaner technologies.

- Geopolitical Uncertainty: Political instability and international conflicts can disrupt operations and negatively impact market growth.

Emerging Opportunities in Europe Well Intervention Services Industry

Several opportunities exist:

- Growth in Renewable Energy: The expansion of renewable energy sources, including geothermal, presents opportunities for well intervention services in specialized applications.

- Digitalization and Automation: Adoption of advanced digital technologies and automation provides opportunities for efficiency gains and cost optimization.

- Sustainable Solutions: The demand for environmentally conscious solutions creates opportunities for companies offering sustainable well intervention technologies.

Leading Players in the Europe Well Intervention Services Industry Market

- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Weatherford International Ltd

- China Oilfield Services Ltd

- Vallourec SA

- National Oilwell Varco Inc

- Scientific Drilling International Inc

Key Developments in Europe Well Intervention Services Industry Industry

- February 2022: Fraser Well Management (FWM) secured a well operator services contract from North Sea Natural Resources Ltd (NSNRL) for the Devil's Hole Horst appraisal well. This signifies growing demand for specialized well intervention services in the North Sea.

- February 2022 / July 2022: Maersk Drilling's contract updates highlighted increased activity in the offshore well intervention market, with TotalEnergies E&P Danmark securing a significant contract extension, indicating long-term growth potential.

Strategic Outlook for Europe Well Intervention Services Industry Market

The European well intervention services market is poised for sustained growth, driven by increasing energy demand, technological advancements, and supportive government policies. Opportunities in offshore operations, renewable energy, and the adoption of sustainable technologies will shape the future of the industry. Continued investment in research and development, and strategic partnerships to enhance technological capabilities, will be key factors in determining market leadership.

Europe Well Intervention Services Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

Europe Well Intervention Services Industry Segmentation By Geography

- 1. United Kingdom

- 2. Russia

- 3. Norway

- 4. Rest of Europe

Europe Well Intervention Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. Russia

- 5.2.3. Norway

- 5.2.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. United Kingdom Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Russia Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Norway Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Rest of Europe Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Germany Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 11. France Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe Well Intervention Services Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 China Oilfield Services Ltd

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Vallourec SA

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 National Oilwell Varco Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Baker Hughes Company

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Halliburton Company

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Weatherford International Ltd

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Schlumberger Limited

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Scientific Drilling International Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.1 China Oilfield Services Ltd

List of Figures

- Figure 1: Europe Well Intervention Services Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Well Intervention Services Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Well Intervention Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Well Intervention Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 3: Europe Well Intervention Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Well Intervention Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Well Intervention Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Well Intervention Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Well Intervention Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Well Intervention Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Well Intervention Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Well Intervention Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Well Intervention Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Well Intervention Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 13: Europe Well Intervention Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Well Intervention Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 15: Europe Well Intervention Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Well Intervention Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 17: Europe Well Intervention Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Well Intervention Services Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 19: Europe Well Intervention Services Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Well Intervention Services Industry?

The projected CAGR is approximately > 2.10%.

2. Which companies are prominent players in the Europe Well Intervention Services Industry?

Key companies in the market include China Oilfield Services Ltd, Vallourec SA, National Oilwell Varco Inc, Baker Hughes Company, Halliburton Company, Weatherford International Ltd, Schlumberger Limited, Scientific Drilling International Inc.

3. What are the main segments of the Europe Well Intervention Services Industry?

The market segments include Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

In February 2022, Fraser Well Management (FWM), a well engineering and project management specialist, won a well operator services contract from North Sea Natural Resources Ltd (NSNRL) to deliver the Devil's Hole Horst (DHH) appraisal well in the Central North Sea.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Well Intervention Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Well Intervention Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Well Intervention Services Industry?

To stay informed about further developments, trends, and reports in the Europe Well Intervention Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence