Key Insights

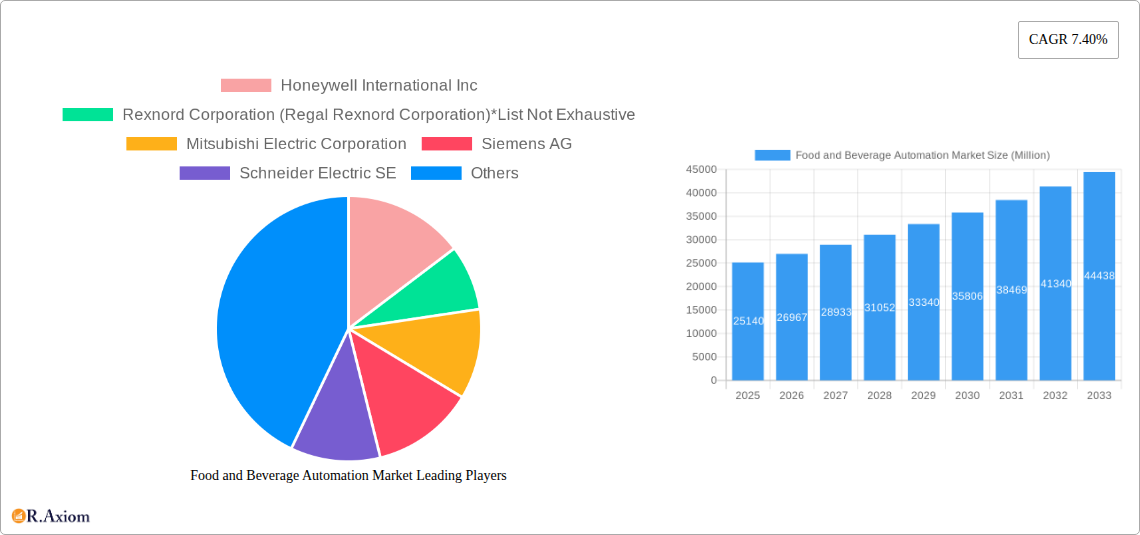

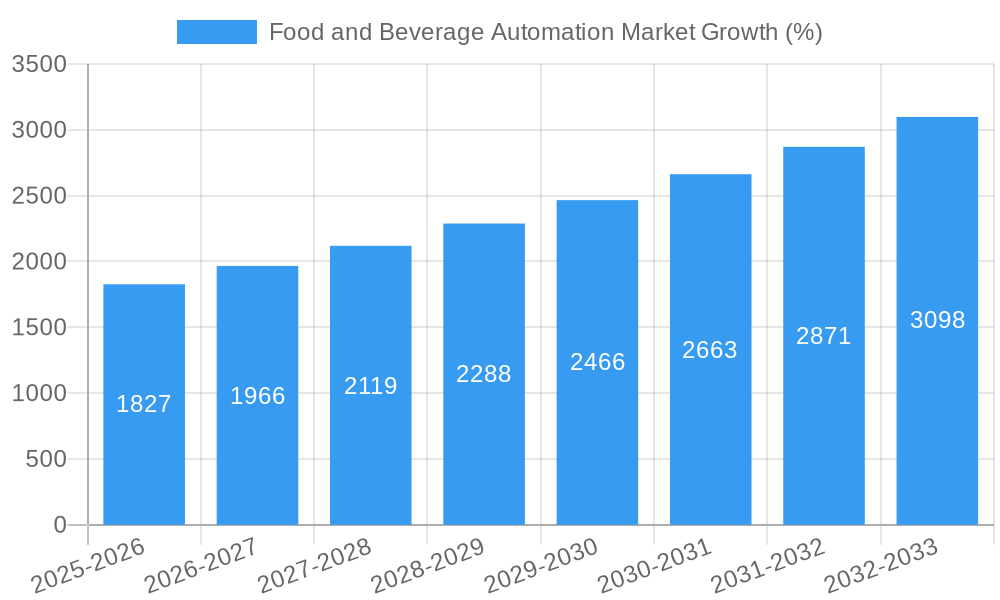

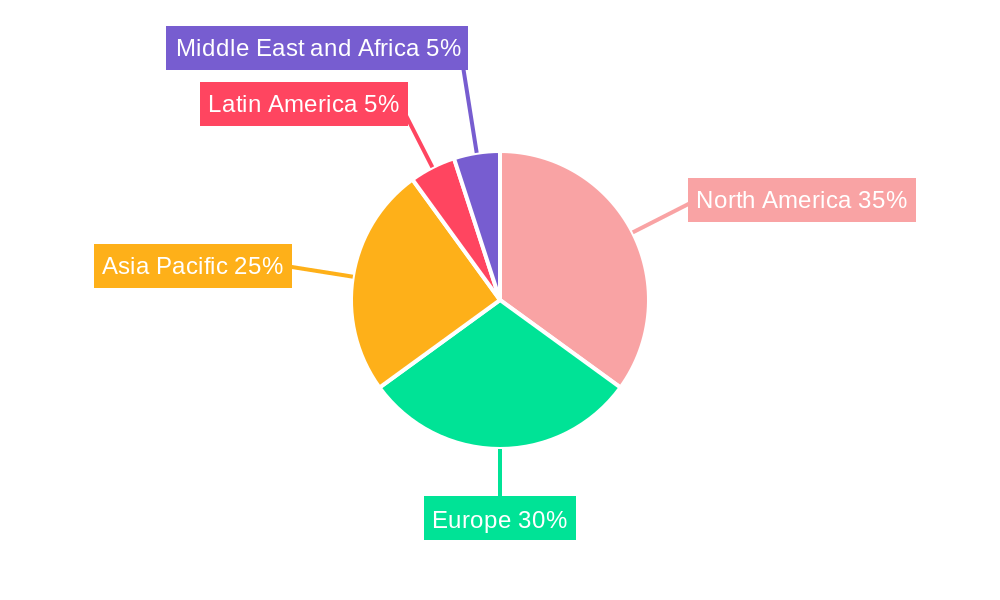

The Food and Beverage Automation market is experiencing robust growth, projected to reach \$25.14 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.40% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing consumer demand for processed food and beverages fuels the need for efficient and high-throughput automation solutions. Secondly, the industry's ongoing focus on improving product quality, reducing waste, and enhancing food safety necessitates the adoption of advanced automation technologies like robotics, sophisticated sensors, and intelligent control systems. Furthermore, labor shortages and rising labor costs are incentivizing businesses to automate processes, thereby increasing productivity and reducing operational expenses. The market segmentation reveals significant growth opportunities across various applications, including packaging and repackaging, palletizing, and sorting and grading. Within operational technologies and software, Distributed Control Systems (DCS), Manufacturing Execution Systems (MES), and industrial robotics are witnessing particularly strong demand. Major end-user segments such as dairy processing, bakery and confectionary, and meat, poultry, and seafood processing are key contributors to market growth. Geographic analysis indicates strong performance in North America and Europe, with significant potential for expansion in the Asia-Pacific region driven by rapid economic growth and increasing food processing capacity.

The competitive landscape is characterized by the presence of established players like Honeywell, Rockwell Automation, and Siemens, alongside other key technology providers. These companies are investing heavily in research and development to innovate and offer cutting-edge automation solutions tailored to the specific needs of the food and beverage industry. Continued technological advancements, such as the integration of artificial intelligence and machine learning in automation systems, are expected to further drive market growth. Despite the positive outlook, challenges remain. High initial investment costs associated with automation technologies may pose a barrier for smaller companies. Ensuring seamless integration of various automation components within existing production lines is also a crucial aspect that requires careful planning and execution. Addressing these challenges will be key for continued market expansion and wider adoption of automation within the food and beverage sector.

Food and Beverage Automation Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Food and Beverage Automation Market, offering actionable insights for stakeholders across the industry value chain. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by application, operational technology and software, and end-user, providing granular market sizing and forecasts for the period 2025-2033. Key players such as Honeywell International Inc, Rexnord Corporation (Regal Rexnord Corporation), Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, GEA Group AG, Rockwell Automation Inc, Yokogawa Electric Corporation, ABB Limited, Yaskawa Electric Corporation, and Emerson Electric Company are profiled, offering a competitive landscape analysis.

Food and Beverage Automation Market Concentration & Innovation

The Food and Beverage Automation market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. However, the presence of several smaller, specialized players contributes to dynamic competition. Market share data for 2024 suggests that the top five players collectively hold approximately xx% of the market, while the remaining share is distributed among numerous regional and niche players. Innovation is a key driver, fueled by the ongoing demand for increased efficiency, improved product quality, and reduced operational costs within food and beverage production. This is reflected in continuous advancements in robotics, AI-powered solutions, and advanced process control systems.

Several factors influence the market’s innovation landscape, including:

- Stringent regulatory frameworks: Compliance requirements related to food safety and hygiene drive the adoption of automation technologies to ensure traceability and minimize human error.

- Product substitutes: While direct substitutes for automation are limited, the choice between different automation technologies (e.g., robotic vs. automated guided vehicles (AGVs)) significantly impacts innovation.

- End-user trends: Growing consumer demand for personalized products and customized packaging necessitates flexible and adaptable automation solutions.

- Mergers and acquisitions (M&A) activities: Strategic acquisitions by larger players help to consolidate market share and accelerate innovation through technology integration. In 2024, the total value of M&A deals in the sector was estimated at $xx Million, indicating a strong interest in consolidating the market landscape.

Food and Beverage Automation Market Industry Trends & Insights

The Food and Beverage Automation Market is experiencing robust growth, driven by several key factors. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing demand for automation in various aspects of food and beverage production, from raw material handling to packaging. Technological disruptions, such as the adoption of artificial intelligence (AI), machine learning (ML), and the Industrial Internet of Things (IIoT), are significantly altering the industry's operational landscape. These technologies improve efficiency, optimize resource utilization, and enhance product quality.

Consumer preferences are also shaping the market's trajectory. The rising demand for customized products and smaller batch sizes is pushing manufacturers to adopt flexible automation systems. The competitive dynamics within the market remain intense, with established players facing competition from both smaller, specialized automation providers and emerging technology companies. The market penetration of advanced automation technologies such as robotics and AI-powered systems is gradually increasing, although high initial investment costs remain a barrier for some smaller businesses. This is particularly true within segments like the dairy and meat processing industry, where traditional methods of food processing are still prevalent.

Dominant Markets & Segments in Food and Beverage Automation Market

The North American region currently holds a leading position in the global Food and Beverage Automation market. This dominance is driven by several factors, including:

- Advanced technological infrastructure: The region has a strong technological infrastructure supporting the implementation and adoption of advanced automation solutions.

- High level of automation adoption: The presence of large food and beverage processing facilities with advanced automation systems contributes to the high adoption rate.

- Government initiatives: Government support for technological advancements within the industry further accelerates market growth.

Key Drivers for Regional Dominance:

- Strong economic conditions

- Favorable regulatory frameworks

- High level of automation adoption in existing industries

Within the market segmentation, the Packaging and Repackaging application segment demonstrates the highest growth potential. High consumer demand for convenience, coupled with stringent quality and safety regulations, drives the need for efficient and reliable packaging automation. In terms of operational technology and software, the Industrial Robotics segment is witnessing significant growth, driven by advancements in robotic dexterity and AI-powered vision systems. The Beverages end-user segment exhibits the highest growth rate, owing to the large-scale production requirements and need for consistency and speed in the beverage manufacturing process.

Food and Beverage Automation Market Product Developments

Recent years have witnessed significant product innovations, particularly in robotics, vision systems, and advanced control software. New robotic systems offer enhanced dexterity, precision, and speed, adapting to varied product shapes and sizes, thereby improving efficiency. AI-powered vision systems enhance product quality control and improve sorting accuracy. Advanced control software provides real-time monitoring, predictive maintenance capabilities, and better integration between different automation components. These technological advancements are driving market growth by offering increased efficiency, reduced operational costs, and better product quality, resulting in improved market fit.

Report Scope & Segmentation Analysis

This report comprehensively segments the Food and Beverage Automation Market across three key dimensions:

By Application: Packaging and Repackaging (Market size: $xx Million in 2024, projected CAGR: xx%), Palletizing ($xx Million, xx%), Sorting and Grading ($xx Million, xx%), Processing ($xx Million, xx%), and Other Applications ($xx Million, xx%). The Packaging and Repackaging segment exhibits the highest growth owing to its crucial role in product safety and consumer appeal.

By Operational Technology and Software: Distributed Control System (DCS) ($xx Million, xx%), Manufacturing Execution Systems (MES) ($xx Million, xx%), Variable-frequency Drive (VFD) ($xx Million, xx%), Valves and Actuators ($xx Million, xx%), Electric Motors ($xx Million, xx%), Sensors and Transmitters ($xx Million, xx%), Industrial Robotics ($xx Million, xx%), and Other Technologies ($xx Million, xx%). Industrial Robotics is projected to register the highest growth due to its versatility and capacity for handling diverse tasks.

By End User: Dairy Processing ($xx Million, xx%), Bakery and Confectionary ($xx Million, xx%), Meat, Poultry, and Seafood ($xx Million, xx%), Fruits and Vegetables ($xx Million, xx%), Beverages ($xx Million, xx%), and Other End Users ($xx Million, xx%). The Beverages segment demonstrates the highest growth due to the sector's high-volume production and need for automation to ensure consistency.

Key Drivers of Food and Beverage Automation Market Growth

Several key factors drive the growth of the Food and Beverage Automation Market:

- Increasing labor costs: Automation helps mitigate labor shortages and reduces labor costs.

- Demand for enhanced production efficiency: Automation boosts production capacity and minimizes downtime.

- Stringent food safety regulations: Automation ensures traceability and hygiene compliance.

- Technological advancements: Continuous innovation in automation technologies offers improved efficiency and precision.

Challenges in the Food and Beverage Automation Market Sector

Despite significant growth potential, challenges persist:

- High initial investment costs: The upfront investment for automation can be substantial, posing a barrier for smaller companies.

- Integration complexities: Integrating different automation systems can be complex and time-consuming.

- Cybersecurity risks: Connected automation systems increase vulnerability to cyberattacks. This risk translates into downtime costs, data loss, and potential reputational damage, impacting profitability.

Emerging Opportunities in Food and Beverage Automation Market

Emerging trends present promising opportunities:

- Adoption of AI and machine learning: AI-powered solutions offer predictive maintenance, process optimization, and improved product quality.

- Growth of the cloud-based automation solutions: Cloud-based solutions offer improved scalability and data management capabilities.

- Increased demand for flexible automation systems: Flexible systems cater to the growing need for customized products and smaller batch sizes.

Leading Players in the Food and Beverage Automation Market Market

- Honeywell International Inc. (Honeywell)

- Rexnord Corporation (Regal Rexnord Corporation) (Rexnord)

- Mitsubishi Electric Corporation (Mitsubishi Electric)

- Siemens AG (Siemens)

- Schneider Electric SE (Schneider Electric)

- GEA Group AG (GEA)

- Rockwell Automation Inc. (Rockwell Automation)

- Yokogawa Electric Corporation (Yokogawa)

- ABB Limited (ABB)

- Yaskawa Electric Corporation (Yaskawa)

- Emerson Electric Company (Emerson)

Key Developments in Food and Beverage Automation Industry

- March 2023: ForgeOS integration with Rockwell's Logix controllers and design and simulation software simplifies robot integration and reduces time-to-market for industrial automation deployments.

- January 2023: Teway Food's adoption of ABB's automated solution, including 3D vision-assisted robot positioning, showcases advanced automation in compound seasoning production, setting a new industry benchmark.

Strategic Outlook for Food and Beverage Automation Market Market

The Food and Beverage Automation Market is poised for sustained growth, driven by ongoing technological advancements, increasing demand for efficiency and quality, and stringent regulatory requirements. The integration of AI, machine learning, and cloud-based solutions will further transform the sector, creating opportunities for innovative players to capture significant market share. The focus will shift toward flexible, adaptable automation solutions that meet the growing demand for customization and smaller batch sizes within the food and beverage sector.

Food and Beverage Automation Market Segmentation

-

1. Operational Technology and Software

- 1.1. Distributed Control System (DCS)

- 1.2. Manufacturing Execution Systems (MES)

- 1.3. Variable-frequency Drive (VFD)

- 1.4. Valves and Actuators

- 1.5. Electric Motors

- 1.6. Sensors and Transmitters

- 1.7. Industrial Robotics

- 1.8. Other Technologies

-

2. End User

- 2.1. Dairy Processing

- 2.2. Bakery and Confectionary

- 2.3. Meat, Poultry, and Seafood

- 2.4. Fruits and Vegetables

- 2.5. Beverages

- 2.6. Other End Users

-

3. Application

- 3.1. Packaging and Repackaging

- 3.2. Palletizing

- 3.3. Sorting and Grading

- 3.4. Processing

- 3.5. Other Applications

Food and Beverage Automation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Food and Beverage Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Food Safety and Rising Demand for Processed Food

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental and Safety Regulations; Increasing Competition from the Unorganized Sectors

- 3.4. Market Trends

- 3.4.1. Beverages End-user Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 5.1.1. Distributed Control System (DCS)

- 5.1.2. Manufacturing Execution Systems (MES)

- 5.1.3. Variable-frequency Drive (VFD)

- 5.1.4. Valves and Actuators

- 5.1.5. Electric Motors

- 5.1.6. Sensors and Transmitters

- 5.1.7. Industrial Robotics

- 5.1.8. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Dairy Processing

- 5.2.2. Bakery and Confectionary

- 5.2.3. Meat, Poultry, and Seafood

- 5.2.4. Fruits and Vegetables

- 5.2.5. Beverages

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Packaging and Repackaging

- 5.3.2. Palletizing

- 5.3.3. Sorting and Grading

- 5.3.4. Processing

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 6. North America Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 6.1.1. Distributed Control System (DCS)

- 6.1.2. Manufacturing Execution Systems (MES)

- 6.1.3. Variable-frequency Drive (VFD)

- 6.1.4. Valves and Actuators

- 6.1.5. Electric Motors

- 6.1.6. Sensors and Transmitters

- 6.1.7. Industrial Robotics

- 6.1.8. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Dairy Processing

- 6.2.2. Bakery and Confectionary

- 6.2.3. Meat, Poultry, and Seafood

- 6.2.4. Fruits and Vegetables

- 6.2.5. Beverages

- 6.2.6. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Packaging and Repackaging

- 6.3.2. Palletizing

- 6.3.3. Sorting and Grading

- 6.3.4. Processing

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 7. Europe Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 7.1.1. Distributed Control System (DCS)

- 7.1.2. Manufacturing Execution Systems (MES)

- 7.1.3. Variable-frequency Drive (VFD)

- 7.1.4. Valves and Actuators

- 7.1.5. Electric Motors

- 7.1.6. Sensors and Transmitters

- 7.1.7. Industrial Robotics

- 7.1.8. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Dairy Processing

- 7.2.2. Bakery and Confectionary

- 7.2.3. Meat, Poultry, and Seafood

- 7.2.4. Fruits and Vegetables

- 7.2.5. Beverages

- 7.2.6. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Packaging and Repackaging

- 7.3.2. Palletizing

- 7.3.3. Sorting and Grading

- 7.3.4. Processing

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 8. Asia Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 8.1.1. Distributed Control System (DCS)

- 8.1.2. Manufacturing Execution Systems (MES)

- 8.1.3. Variable-frequency Drive (VFD)

- 8.1.4. Valves and Actuators

- 8.1.5. Electric Motors

- 8.1.6. Sensors and Transmitters

- 8.1.7. Industrial Robotics

- 8.1.8. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Dairy Processing

- 8.2.2. Bakery and Confectionary

- 8.2.3. Meat, Poultry, and Seafood

- 8.2.4. Fruits and Vegetables

- 8.2.5. Beverages

- 8.2.6. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Packaging and Repackaging

- 8.3.2. Palletizing

- 8.3.3. Sorting and Grading

- 8.3.4. Processing

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 9. Latin America Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 9.1.1. Distributed Control System (DCS)

- 9.1.2. Manufacturing Execution Systems (MES)

- 9.1.3. Variable-frequency Drive (VFD)

- 9.1.4. Valves and Actuators

- 9.1.5. Electric Motors

- 9.1.6. Sensors and Transmitters

- 9.1.7. Industrial Robotics

- 9.1.8. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Dairy Processing

- 9.2.2. Bakery and Confectionary

- 9.2.3. Meat, Poultry, and Seafood

- 9.2.4. Fruits and Vegetables

- 9.2.5. Beverages

- 9.2.6. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Packaging and Repackaging

- 9.3.2. Palletizing

- 9.3.3. Sorting and Grading

- 9.3.4. Processing

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 10. Middle East and Africa Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 10.1.1. Distributed Control System (DCS)

- 10.1.2. Manufacturing Execution Systems (MES)

- 10.1.3. Variable-frequency Drive (VFD)

- 10.1.4. Valves and Actuators

- 10.1.5. Electric Motors

- 10.1.6. Sensors and Transmitters

- 10.1.7. Industrial Robotics

- 10.1.8. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Dairy Processing

- 10.2.2. Bakery and Confectionary

- 10.2.3. Meat, Poultry, and Seafood

- 10.2.4. Fruits and Vegetables

- 10.2.5. Beverages

- 10.2.6. Other End Users

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Packaging and Repackaging

- 10.3.2. Palletizing

- 10.3.3. Sorting and Grading

- 10.3.4. Processing

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Operational Technology and Software

- 11. North America Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Food and Beverage Automation Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Honeywell International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Rexnord Corporation (Regal Rexnord Corporation)*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Mitsubishi Electric Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Siemens AG

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Schneider Electric SE

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 GEA Group AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Rockwell Automation Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Yokogawa Electric Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 ABB Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Yaskawa Electric Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Emerson Electric Company

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Food and Beverage Automation Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Food and Beverage Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Food and Beverage Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Food and Beverage Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Food and Beverage Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Food and Beverage Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Food and Beverage Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Food and Beverage Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Food and Beverage Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2024 & 2032

- Figure 13: North America Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2024 & 2032

- Figure 14: North America Food and Beverage Automation Market Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Food and Beverage Automation Market Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Food and Beverage Automation Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Food and Beverage Automation Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Food and Beverage Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Food and Beverage Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2024 & 2032

- Figure 21: Europe Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2024 & 2032

- Figure 22: Europe Food and Beverage Automation Market Revenue (Million), by End User 2024 & 2032

- Figure 23: Europe Food and Beverage Automation Market Revenue Share (%), by End User 2024 & 2032

- Figure 24: Europe Food and Beverage Automation Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Food and Beverage Automation Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Food and Beverage Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Food and Beverage Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2024 & 2032

- Figure 29: Asia Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2024 & 2032

- Figure 30: Asia Food and Beverage Automation Market Revenue (Million), by End User 2024 & 2032

- Figure 31: Asia Food and Beverage Automation Market Revenue Share (%), by End User 2024 & 2032

- Figure 32: Asia Food and Beverage Automation Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Food and Beverage Automation Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Food and Beverage Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Food and Beverage Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2024 & 2032

- Figure 37: Latin America Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2024 & 2032

- Figure 38: Latin America Food and Beverage Automation Market Revenue (Million), by End User 2024 & 2032

- Figure 39: Latin America Food and Beverage Automation Market Revenue Share (%), by End User 2024 & 2032

- Figure 40: Latin America Food and Beverage Automation Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Food and Beverage Automation Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Food and Beverage Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Food and Beverage Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by Operational Technology and Software 2024 & 2032

- Figure 45: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by Operational Technology and Software 2024 & 2032

- Figure 46: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by End User 2024 & 2032

- Figure 47: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by End User 2024 & 2032

- Figure 48: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by Application 2024 & 2032

- Figure 49: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by Application 2024 & 2032

- Figure 50: Middle East and Africa Food and Beverage Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Food and Beverage Automation Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food and Beverage Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2019 & 2032

- Table 3: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Food and Beverage Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2019 & 2032

- Table 24: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 25: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United States Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2019 & 2032

- Table 30: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 31: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United Kingdom Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: France Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2019 & 2032

- Table 37: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 38: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: China Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Australia and New Zealand Food and Beverage Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2019 & 2032

- Table 45: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 46: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 47: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Global Food and Beverage Automation Market Revenue Million Forecast, by Operational Technology and Software 2019 & 2032

- Table 49: Global Food and Beverage Automation Market Revenue Million Forecast, by End User 2019 & 2032

- Table 50: Global Food and Beverage Automation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Food and Beverage Automation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food and Beverage Automation Market?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Food and Beverage Automation Market?

Key companies in the market include Honeywell International Inc, Rexnord Corporation (Regal Rexnord Corporation)*List Not Exhaustive, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, GEA Group AG, Rockwell Automation Inc, Yokogawa Electric Corporation, ABB Limited, Yaskawa Electric Corporation, Emerson Electric Company.

3. What are the main segments of the Food and Beverage Automation Market?

The market segments include Operational Technology and Software, End User, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Food Safety and Rising Demand for Processed Food.

6. What are the notable trends driving market growth?

Beverages End-user Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Environmental and Safety Regulations; Increasing Competition from the Unorganized Sectors.

8. Can you provide examples of recent developments in the market?

Mar 2023: ForgeOS integrated with Rockwell's Logix controllers and design and simulation software by Rockwell and READY Robotics. The combination will make robot integration easier and reduce industrial automation deployment time to market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food and Beverage Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food and Beverage Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food and Beverage Automation Market?

To stay informed about further developments, trends, and reports in the Food and Beverage Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence