Key Insights

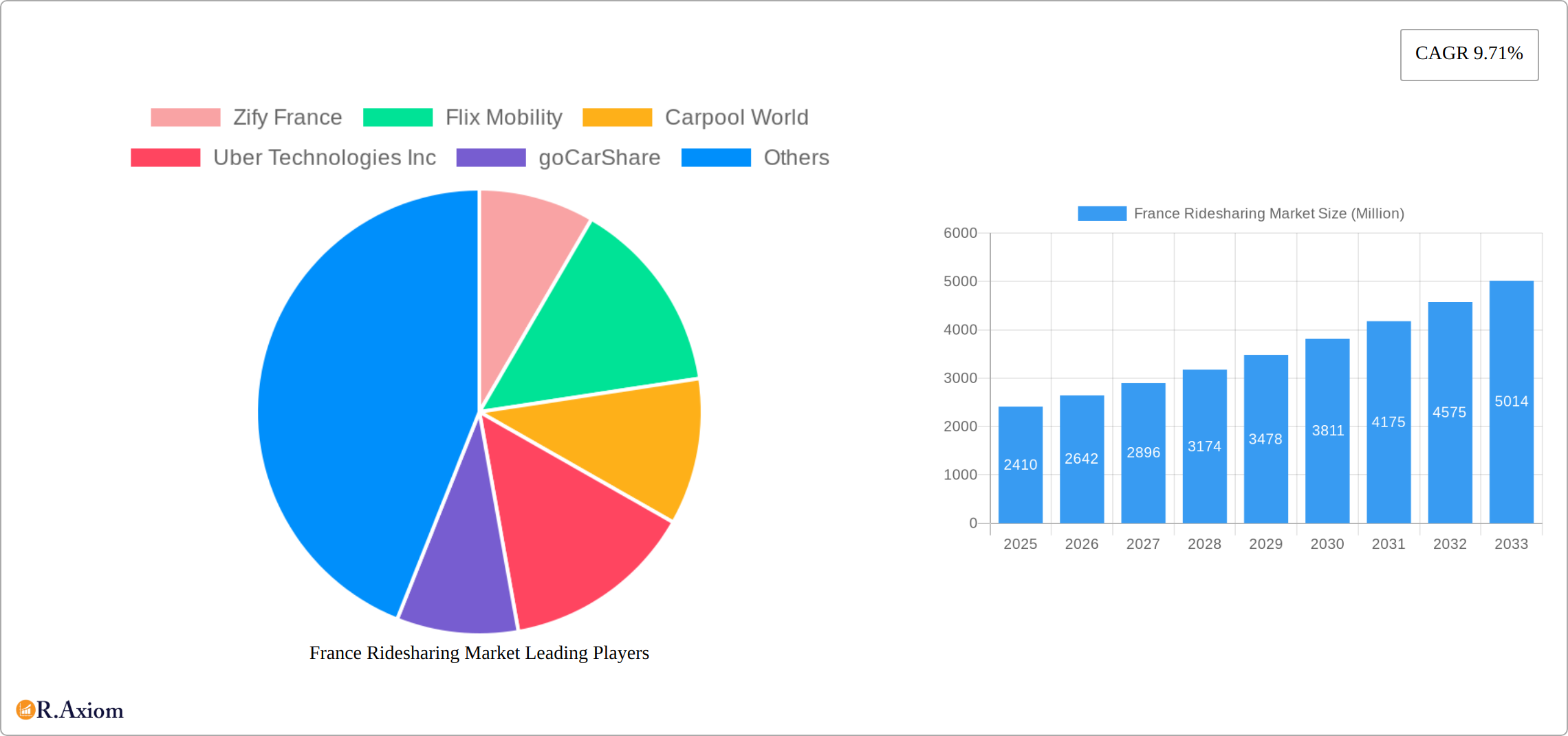

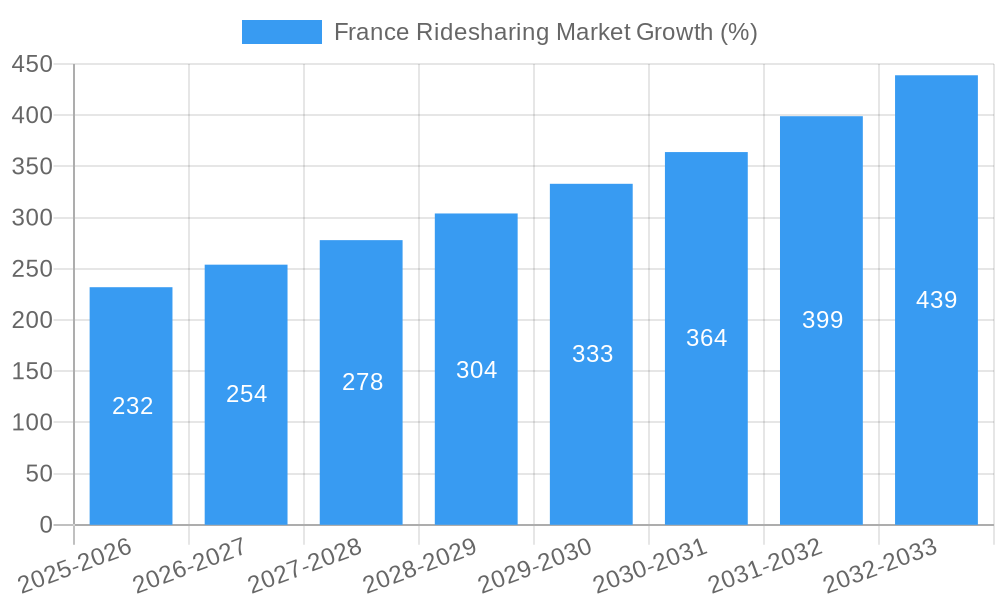

The French ridesharing market, valued at €2.41 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.71% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization and traffic congestion within French cities are pushing commuters and travelers towards convenient and cost-effective alternatives to private car ownership. Furthermore, the rising popularity of ride-sharing apps, offering ease of booking and transparent pricing, is fueling market adoption. Technological advancements, such as improved app functionalities and integration with public transportation systems, are further enhancing user experience and contributing to market growth. The diverse range of membership options, including fixed, dynamic, and corporate plans, caters to a broad spectrum of users, thereby broadening the market’s appeal. The presence of established players like Uber Technologies Inc and BlaBlaCar, alongside emerging local companies like Zify France and Flix Mobility, fosters competition and innovation within the sector. Government initiatives promoting sustainable transportation could also positively influence the market trajectory in the coming years.

However, certain challenges persist. Regulatory hurdles related to licensing, insurance, and driver background checks could impact market expansion. Fluctuations in fuel prices and economic downturns may also affect consumer spending on ridesharing services. Competition from other transportation modes, including public transit and bike-sharing programs, presents an ongoing challenge. The market’s success will hinge on operators’ ability to navigate these regulatory landscapes, effectively manage operational costs, and continuously enhance their services to meet evolving consumer expectations. Strategies focused on sustainable practices, innovative pricing models, and improved safety measures will be crucial for maintaining a strong competitive edge and driving long-term growth.

This detailed report provides a comprehensive analysis of the France Ridesharing Market, encompassing market size, segmentation, competitive landscape, and future growth projections from 2019 to 2033. The study period covers historical data (2019-2024), with the base and estimated year set at 2025, and a forecast period extending to 2033. Key players like Uber Technologies Inc, BlaBlaCar, and others are profiled, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers.

France Ridesharing Market Market Concentration & Innovation

This section analyzes the competitive landscape of the French ridesharing market, encompassing market concentration, innovation, regulatory frameworks, and M&A activities. The market is characterized by a mix of established global players and smaller, agile startups. Uber Technologies Inc. currently holds a significant market share, estimated at xx Million in 2025, followed by BlaBlaCar with xx Million, reflecting its strong presence in the carpooling segment. Other key players include Zify France, Flix Mobility, Carpool World, goCarShare, and Mobicoop (Roulexmalin), each contributing to a dynamic competitive environment.

Market concentration is moderately high, with a few dominant players, but with opportunities for smaller companies to niche. Innovation is driven by advancements in technology, such as the integration of AI for optimized routing and pricing, and the exploration of autonomous vehicles. Regulatory frameworks, including those concerning data privacy and driver regulations, significantly impact market dynamics. The increasing popularity of ride-sharing is pushing the need for robust regulations. Product substitutes, such as public transportation and personal vehicles, present competitive pressure, and consumer preferences are shifting towards sustainable and affordable options.

M&A activity is another key factor shaping the market. Recent deals, like BlaBlaCar's acquisition of Klaxit in March 2023, demonstrate the ongoing consolidation of the sector. The deal value was xx Million. This highlights strategic moves by major players to expand their market reach and service offerings. Such activities will continue to reshape the competitive landscape in the coming years.

France Ridesharing Market Industry Trends & Insights

The France Ridesharing Market is experiencing robust growth, driven by several key factors. Increasing urbanization, traffic congestion, and the rising cost of car ownership are compelling consumers to opt for convenient and affordable ride-sharing alternatives. Technological advancements, particularly in mobile app development and GPS technology, have significantly enhanced the user experience and operational efficiency of ride-sharing services. The market is also witnessing a shift in consumer preferences towards sustainable transportation options, leading to the emergence of eco-friendly ride-sharing services.

The compound annual growth rate (CAGR) for the France Ridesharing Market is projected to be xx% during the forecast period (2025-2033), indicating a significant expansion of the market. Market penetration is steadily increasing, with a growing percentage of the population utilizing ride-sharing services for daily commutes, leisure activities, and business travel. However, challenges such as regulatory hurdles, competition from established public transport systems, and concerns about driver welfare require careful consideration.

Competitive dynamics are intense, with established players constantly innovating and smaller firms attempting to differentiate through specialized services and cost-effective models. This competitive pressure fuels innovation and drives down prices, further benefiting consumers. The entry of new players and technological disruptions are also shaping the market’s trajectory.

Dominant Markets & Segments in France Ridesharing Market

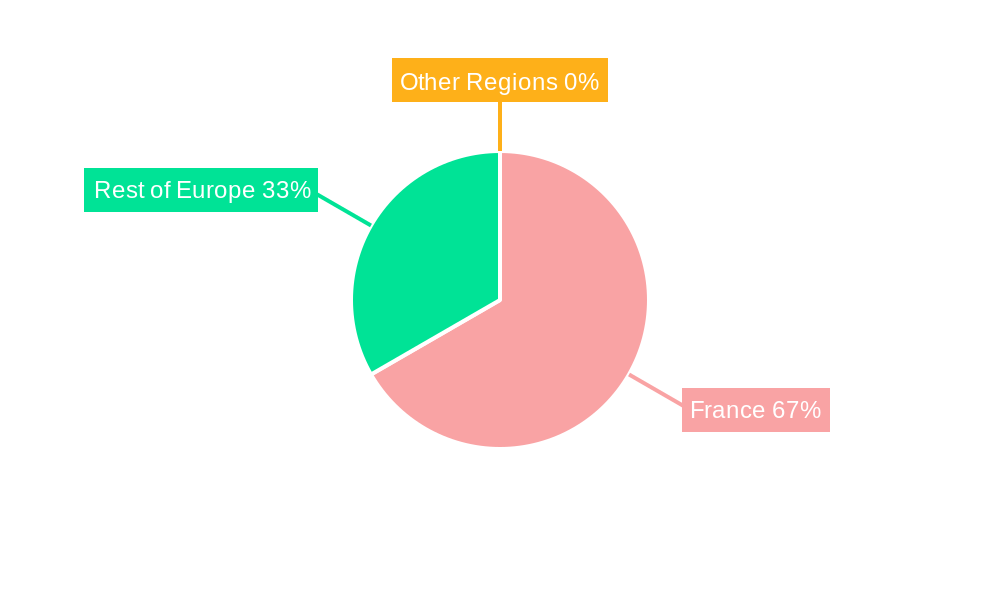

The France Ridesharing Market shows robust growth across various segments, particularly in urban areas with high population density and limited public transport options. Paris and other major cities are key contributors to the overall market size.

- By Membership Type: The dynamic membership segment is currently the largest, reflecting the flexibility it provides. Fixed membership, typically offering discounts and other perks, has a smaller market share. The corporate segment is seeing growth fueled by employee demand and corporate cost-saving initiatives.

Dominance Analysis: The dynamic segment's dominance stems from the demand for flexible and spontaneous travel arrangements. This segment’s growth is further propelled by the increasing adoption of smartphones and readily available mobile applications. The corporate segment's growth is driven by the rising number of businesses using ride-sharing services for employee transportation and client transport, driven by cost optimization and improved employee satisfaction. While the fixed membership model is presently less popular, it's expected to gain traction in the coming years.

France Ridesharing Market Product Developments

Significant innovations are shaping the French ridesharing market. Beyond improved apps and integrated payment systems, there's a growing focus on electric and hybrid vehicles to address environmental concerns and meet government sustainability goals. Features like real-time ride tracking, fare splitting, and integrated safety features enhance the customer experience. Furthermore, integration with other mobility services, creating a multi-modal transportation solution, creates a unique value proposition. Autonomous vehicle technology, although still nascent, holds immense potential for future disruption, promising increased efficiency and reduced operational costs.

Report Scope & Segmentation Analysis

This report segments the France Ridesharing Market primarily by membership type:

- Fixed Membership: This segment offers pre-paid plans for a set number of rides or a fixed monthly fee, targeting frequent users. Growth is expected to be xx Million by 2033.

- Dynamic Membership: This segment allows users to pay per ride, providing flexibility and convenience to a broader customer base. It dominates the market, projected at xx Million by 2033.

- Corporate Membership: This segment caters to businesses, offering bulk ride services and management tools for employee transport. Expected growth is xx Million by 2033.

Each segment has unique competitive dynamics, with certain players specializing in particular models.

Key Drivers of France Ridesharing Market Growth

The France Ridesharing Market's growth is fueled by several factors:

- Technological advancements: Mobile app improvements, GPS technology, and the emergence of autonomous vehicle technology are enhancing the user experience and efficiency.

- Economic factors: Rising transportation costs and increased urbanization push consumers toward affordable options.

- Regulatory environment: While regulations are a challenge, clear guidelines will allow the market to flourish.

Challenges in the France Ridesharing Market Sector

Several challenges hinder the market's growth:

- Regulatory hurdles: Licensing requirements, driver regulations, and data privacy concerns impose operational costs.

- Supply chain issues: The availability of drivers and vehicles can fluctuate, impacting service reliability.

- Intense competition: Established players and new entrants create a fiercely competitive market.

Emerging Opportunities in France Ridesharing Market

The market offers several promising opportunities:

- Expansion into rural areas: Extending services beyond major cities opens new markets.

- Integration with public transport: Collaboration with existing transport networks can enhance accessibility.

- Sustainable transportation: Eco-friendly ride-sharing options appeal to environmentally conscious consumers.

Leading Players in the France Ridesharing Market Market

- Uber Technologies Inc

- BlaBlaCar

- Zify France

- Flix Mobility

- Carpool World

- goCarShare

- Mobicoop (Roulexmalin)

Key Developments in France Ridesharing Market Industry

- June 2023: Uber plans to introduce in-app video ads in France and other markets.

- March 2023: BlaBlaCar acquires Klaxit, expanding its carpooling service.

- July 2023: Michelin tests airless tires, potentially impacting autonomous ride-sharing.

Strategic Outlook for France Ridesharing Market Market

The France Ridesharing Market displays significant future potential. Continued technological innovation, coupled with supportive regulatory frameworks, will drive market expansion. Focusing on sustainability and addressing the challenges of driver welfare and accessibility will be key to ensuring the market's long-term success and responsible growth.

France Ridesharing Market Segmentation

-

1. Membership Type

- 1.1. Fixed

- 1.2. Dynamic

- 1.3. Corporate

France Ridesharing Market Segmentation By Geography

- 1. France

France Ridesharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.71% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. France is Widely Considered to be the First Adopters of Ridesharing among major Countries in Europe; Growing Cost of Vehicle Ownership; Socio-economic and Demographic Factors are Highly Favorable to Ridesharing as the French Public is known to Rely on Shared Transport Services as one of the Key Modes of Travel; Incentives Provided by Local Agencies to Passengers and Riders of Ridesharing to Promote Development of Alternative Modes of Transport mainly Driven by Frequent Strikes by Local Train Employee Bodies; Rise in Demand for Carpool and Bike Pool Services

- 3.3. Market Restrains

- 3.3.1. Last mile connectivity remains a concern as compared to other models; Operational challenges for operators due to the dynamic nature of the industry and increasing investments in the ride hailing industry

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Carpool and Bike Pool Services is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Membership Type

- 5.1.1. Fixed

- 5.1.2. Dynamic

- 5.1.3. Corporate

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by Membership Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Zify France

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Flix Mobility

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Carpool World

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uber Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 goCarShare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bla bla Car

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mobicoop (Roulexmalin)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Zify France

List of Figures

- Figure 1: France Ridesharing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Ridesharing Market Share (%) by Company 2024

List of Tables

- Table 1: France Ridesharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Ridesharing Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: France Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 4: France Ridesharing Market Volume K Unit Forecast, by Membership Type 2019 & 2032

- Table 5: France Ridesharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: France Ridesharing Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: France Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: France Ridesharing Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: France Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 10: France Ridesharing Market Volume K Unit Forecast, by Membership Type 2019 & 2032

- Table 11: France Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: France Ridesharing Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Ridesharing Market?

The projected CAGR is approximately 9.71%.

2. Which companies are prominent players in the France Ridesharing Market?

Key companies in the market include Zify France, Flix Mobility, Carpool World, Uber Technologies Inc, goCarShare, Bla bla Car, Mobicoop (Roulexmalin).

3. What are the main segments of the France Ridesharing Market?

The market segments include Membership Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.41 Million as of 2022.

5. What are some drivers contributing to market growth?

France is Widely Considered to be the First Adopters of Ridesharing among major Countries in Europe; Growing Cost of Vehicle Ownership; Socio-economic and Demographic Factors are Highly Favorable to Ridesharing as the French Public is known to Rely on Shared Transport Services as one of the Key Modes of Travel; Incentives Provided by Local Agencies to Passengers and Riders of Ridesharing to Promote Development of Alternative Modes of Transport mainly Driven by Frequent Strikes by Local Train Employee Bodies; Rise in Demand for Carpool and Bike Pool Services.

6. What are the notable trends driving market growth?

Rise in Demand for Carpool and Bike Pool Services is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Last mile connectivity remains a concern as compared to other models; Operational challenges for operators due to the dynamic nature of the industry and increasing investments in the ride hailing industry.

8. Can you provide examples of recent developments in the market?

July 2023 - Michelin will test airless tires on French postal vans, providing more real-world experience with tire designs that could benefit EVs. Airless tires also aren't susceptible to punctures, in turn eliminating the need to change flats. That could also make them ideal for autonomous vehicles operating in ride-sharing services without human drivers onboard.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Ridesharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Ridesharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Ridesharing Market?

To stay informed about further developments, trends, and reports in the France Ridesharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence