Key Insights

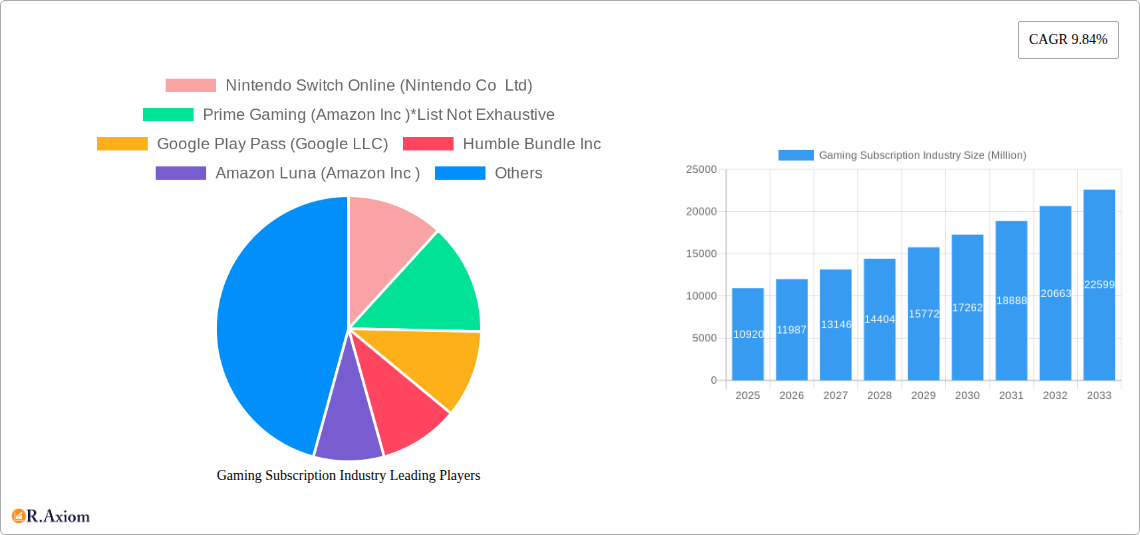

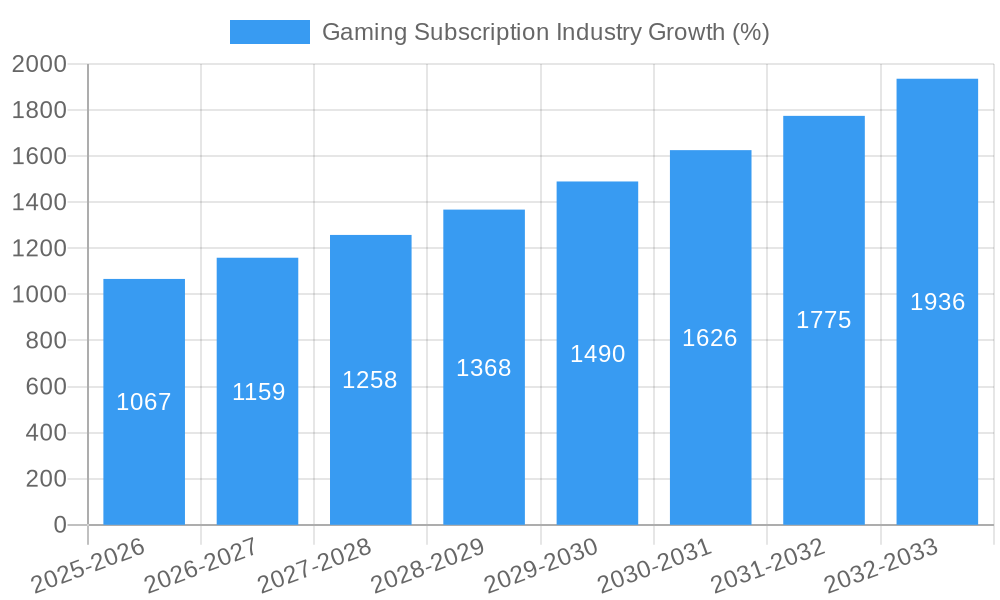

The global gaming subscription market, valued at $10.92 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 9.84% from 2025 to 2033. This surge is driven by several key factors. The increasing popularity of cloud gaming, offering seamless access to a vast library of titles without the need for expensive hardware, is a significant catalyst. Furthermore, the rising adoption of mobile gaming and the expansion of high-speed internet access globally are contributing to market expansion. The diverse range of subscription models offered, catering to various gaming preferences and budgets (from free-to-play models with in-app purchases to premium all-access passes), further fuels market growth. Competition among major players like Microsoft (Xbox Game Pass), Sony (PlayStation Now), Nintendo (Nintendo Switch Online), and others encourages innovation and keeps subscription prices competitive, broadening market appeal.

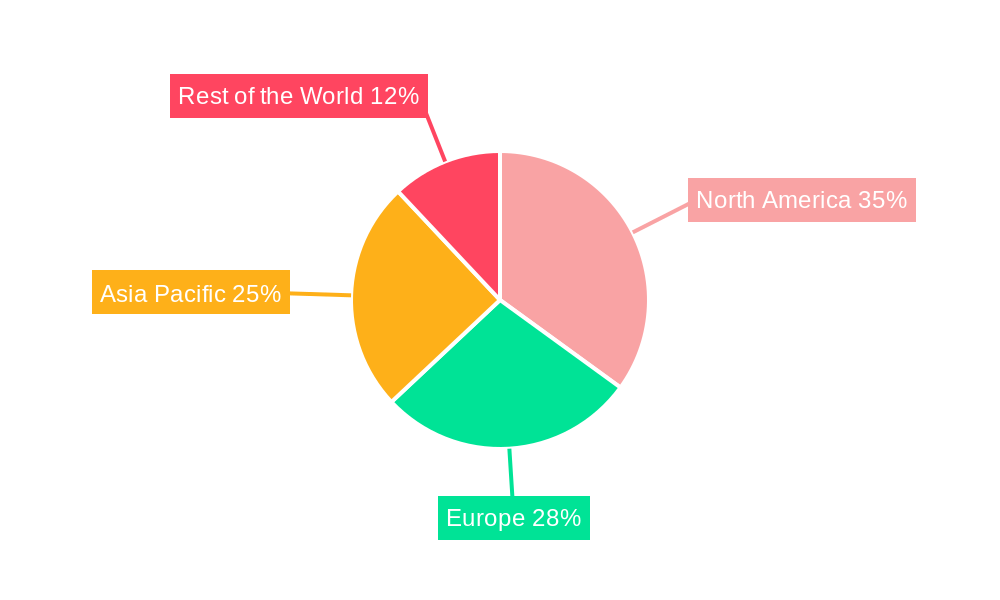

The market segmentation reveals significant contributions from various gaming platforms. Mobile gaming subscriptions are likely experiencing the fastest growth rate, driven by smartphone penetration and the casual gaming trend. PC-based gaming subscriptions hold a significant market share due to the extensive game libraries and high-fidelity gaming experiences offered. Console gaming subscriptions maintain a substantial presence, although their growth rate may be somewhat slower compared to mobile and PC, due to the higher initial investment in hardware. Regional analysis would likely show strong growth in Asia-Pacific, driven by its large and rapidly expanding gaming population and increasing disposable incomes. North America and Europe will also contribute significantly, continuing their established positions as mature markets. However, Rest of the World segment presents significant untapped potential for future expansion. The continued evolution of technology, coupled with the increasing demand for convenient and cost-effective access to games, positions the gaming subscription market for sustained, impressive growth in the coming years.

Gaming Subscription Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global gaming subscription industry, offering valuable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report projects a market valued at xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Key segments analyzed include Console Gaming, PC-based Gaming, and Mobile Gaming. Leading players like Nintendo, Amazon, Google, and Microsoft are extensively profiled, alongside emerging players.

Gaming Subscription Industry Market Concentration & Innovation

The gaming subscription market displays a moderately concentrated structure, dominated by established players like Nintendo (Nintendo Switch Online), Amazon (Prime Gaming and Amazon Luna), Google (Google Play Pass), and Microsoft (Xbox Game Pass). These companies hold a significant market share, estimated at xx% collectively in 2024. However, the market also accommodates numerous smaller players, including Humble Bundle, Ubisoft (Uplay Pass), and Epic Games, fostering competition and innovation.

Market innovation is driven by advancements in cloud gaming technology, expanding game libraries, personalized content recommendations, and cross-platform compatibility. Regulatory frameworks, while generally permissive, vary across regions, impacting market entry and operations. Product substitutes, such as individual game purchases, remain competitive, but subscription services offer value propositions centered around cost-effectiveness and access to diverse game catalogs. End-user trends reveal a growing preference for subscription models due to their affordability and convenience. M&A activity has been moderate, with deal values estimated at xx Million in 2024, primarily focused on expanding game libraries and technological capabilities.

- Market Share (2024): Nintendo: xx%; Amazon: xx%; Google: xx%; Microsoft: xx%; Others: xx%

- M&A Deal Value (2024): xx Million

Gaming Subscription Industry Industry Trends & Insights

The gaming subscription market is experiencing robust growth, driven by several key factors. The increasing affordability of high-speed internet and the proliferation of smart devices have fueled the adoption of cloud gaming services and mobile gaming subscriptions. Technological advancements, including enhanced streaming capabilities and improved game optimization, enhance the user experience and drive market expansion. Consumer preferences lean towards flexible subscription models offering curated content and diverse gaming experiences. Intense competition among established players and new entrants is spurring innovation, driving down prices and expanding the available game libraries. The market is expected to continue its rapid growth, with a projected CAGR of xx% from 2025 to 2033, resulting in a market size of xx Million by 2033. Market penetration, currently at xx%, is expected to increase significantly as more gamers embrace the convenience and value offered by subscription services.

Dominant Markets & Segments in Gaming Subscription Industry

The North American market currently dominates the global gaming subscription industry, driven by strong consumer spending power and a large base of gamers. However, Asia-Pacific, particularly China and India, shows significant growth potential due to the expanding smartphone market and increasing internet penetration.

- Key Drivers for North America: High disposable income, strong gaming culture, early adoption of new technologies.

- Key Drivers for Asia-Pacific: Rapidly growing smartphone market, increasing internet penetration, supportive government policies.

By Gaming Type:

- Console Gaming: Remains a significant segment, with Nintendo Switch Online being a key driver. The market benefits from established console ecosystems and loyal player bases. Growth is projected at xx% CAGR during the forecast period.

- PC-based Gaming: This segment benefits from a highly engaged community and sophisticated gaming hardware. Subscription services like GeForce Now cater to this market, driving growth projections of xx% CAGR.

- Mobile Gaming: Represents the fastest-growing segment, fueled by the widespread adoption of smartphones and casual gaming trends. Google Play Pass and Apple Arcade are prominent players in this segment, expected to experience a xx% CAGR during the forecast period.

Gaming Subscription Industry Product Developments

Recent product innovations focus on enhancing user experience through improved streaming technology, personalized content recommendations, and cross-platform functionality. Companies are also expanding their game libraries to offer greater diversity and cater to a broader range of player preferences. Competitive advantages stem from offering unique game catalogs, superior streaming quality, and integrated social features. The market trend indicates a shift towards cloud gaming as a dominant platform, blurring the lines between console, PC, and mobile gaming.

Report Scope & Segmentation Analysis

This report segments the gaming subscription market by gaming type: Console Gaming, PC-based Gaming, and Mobile Gaming. Each segment is further analyzed based on regional distribution and key players. Growth projections for each segment vary depending on several factors, including technological advancements, consumer preferences, and competitive dynamics. The report details market sizes for each segment and provides a competitive landscape analysis.

- Console Gaming: Market size of xx Million in 2024, projected to reach xx Million by 2033.

- PC-based Gaming: Market size of xx Million in 2024, projected to reach xx Million by 2033.

- Mobile Gaming: Market size of xx Million in 2024, projected to reach xx Million by 2033.

Key Drivers of Gaming Subscription Industry Growth

Several factors drive the growth of the gaming subscription industry. Technological advancements, such as improved streaming technology and cloud gaming platforms, significantly contribute to market expansion. Favorable economic conditions and increasing disposable income among gamers further fuel demand. Supportive regulatory frameworks in many regions also encourage market development. Finally, the increasing adoption of smartphones and widespread internet access, especially in developing economies, significantly boosts market growth.

Challenges in the Gaming Subscription Industry Sector

The gaming subscription industry faces challenges such as intense competition, potential regulatory hurdles in certain regions, reliance on high-speed internet infrastructure, and fluctuations in the global economy which can affect consumer spending on entertainment. These factors can impact market growth and profitability. Supply chain disruptions can affect the timely release of new games or affect hardware availability for cloud gaming services which could result in revenue loss.

Emerging Opportunities in Gaming Subscription Industry

Emerging opportunities include expanding into new geographic markets, particularly in developing regions with growing internet penetration, and developing innovative services like cross-platform gaming and enhanced personalization features. New technological advancements such as VR/AR integration and the metaverse offer vast potential for growth, especially for cloud-based gaming platforms. Focusing on niche gaming genres or developing subscription models tailored to specific demographics presents additional avenues for market expansion.

Leading Players in the Gaming Subscription Industry Market

- Nintendo Switch Online (Nintendo Co Ltd)

- Prime Gaming (Amazon Inc)

- Google Play Pass (Google LLC)

- Humble Bundle Inc

- Amazon Luna (Amazon Inc)

- PlayStation Now (Sony Corporation)

- EA Play (Electronic Arts Inc)

- Tencent Holdings Ltd

- Uplay Pass (Ubisoft)

- Xbox (Game Pass) (Microsoft Corporation)

- Epic games Inc

- GeForce Now (NVIDIA)

- Apple Arcade (Apple Inc)

Key Developments in Gaming Subscription Industry Industry

- March 2022: Nintendo Switch Online announced the addition of three Sega Genesis games (Light Crusader, Super Fantasy Zone, and Alien Soldier), expanding its library and attracting a wider audience.

- March 2022: Google Play Pass launched in India, expanding its reach into a rapidly growing mobile gaming market and offering a substantial library of 1000+ games.

Strategic Outlook for Gaming Subscription Industry Market

The gaming subscription market is poised for significant growth, driven by technological advancements, increasing internet penetration, and evolving consumer preferences. Cloud gaming will play a key role in shaping the future of the market, enabling seamless cross-platform experiences. Strategic partnerships, technological innovations, and targeted marketing efforts will be essential for companies to maintain a competitive edge and capture market share in this dynamic and rapidly evolving industry.

Gaming Subscription Industry Segmentation

-

1. Gaming Type

- 1.1. Console Gaming

- 1.2. PC-based Gaming

- 1.3. Mobile Gaming

Gaming Subscription Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Gaming Subscription Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Tools to Make Work Seamless and Agile; Continuous Innovation in Team Collaborative Tool Offerings

- 3.3. Market Restrains

- 3.3.1. Compliance and Governance Issues

- 3.4. Market Trends

- 3.4.1. Mobile gaming to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Gaming Type

- 5.1.1. Console Gaming

- 5.1.2. PC-based Gaming

- 5.1.3. Mobile Gaming

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Gaming Type

- 6. North America Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Gaming Type

- 6.1.1. Console Gaming

- 6.1.2. PC-based Gaming

- 6.1.3. Mobile Gaming

- 6.1. Market Analysis, Insights and Forecast - by Gaming Type

- 7. Europe Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Gaming Type

- 7.1.1. Console Gaming

- 7.1.2. PC-based Gaming

- 7.1.3. Mobile Gaming

- 7.1. Market Analysis, Insights and Forecast - by Gaming Type

- 8. Asia Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Gaming Type

- 8.1.1. Console Gaming

- 8.1.2. PC-based Gaming

- 8.1.3. Mobile Gaming

- 8.1. Market Analysis, Insights and Forecast - by Gaming Type

- 9. Australia and New Zealand Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Gaming Type

- 9.1.1. Console Gaming

- 9.1.2. PC-based Gaming

- 9.1.3. Mobile Gaming

- 9.1. Market Analysis, Insights and Forecast - by Gaming Type

- 10. Latin America Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Gaming Type

- 10.1.1. Console Gaming

- 10.1.2. PC-based Gaming

- 10.1.3. Mobile Gaming

- 10.1. Market Analysis, Insights and Forecast - by Gaming Type

- 11. Middle East and Africa Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Gaming Type

- 11.1.1. Console Gaming

- 11.1.2. PC-based Gaming

- 11.1.3. Mobile Gaming

- 11.1. Market Analysis, Insights and Forecast - by Gaming Type

- 12. North America Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Rest of the World Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Nintendo Switch Online (Nintendo Co Ltd)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Prime Gaming (Amazon Inc )*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Google Play Pass (Google LLC)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Humble Bundle Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Amazon Luna (Amazon Inc )

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 PlayStation Now (Sony Corporation)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 EA Play (Electronic Arts Inc )

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Tencent Holdings Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Uplay Pass (Ubisoft)

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Xbox (Game Pass) (Microsoft Corporation)

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Epic games Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 GeForce Now (NVIDIA)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Apple Arcade (Apple Inc )

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Nintendo Switch Online (Nintendo Co Ltd)

List of Figures

- Figure 1: Global Gaming Subscription Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 11: North America Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 12: North America Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 15: Europe Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 16: Europe Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 19: Asia Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 20: Asia Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Australia and New Zealand Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 23: Australia and New Zealand Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 24: Australia and New Zealand Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Australia and New Zealand Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Latin America Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 27: Latin America Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 28: Latin America Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Latin America Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 31: Middle East and Africa Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 32: Middle East and Africa Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East and Africa Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gaming Subscription Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 3: Global Gaming Subscription Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Gaming Subscription Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Gaming Subscription Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Gaming Subscription Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Gaming Subscription Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 13: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 15: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 17: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 19: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 21: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 23: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gaming Subscription Industry?

The projected CAGR is approximately 9.84%.

2. Which companies are prominent players in the Gaming Subscription Industry?

Key companies in the market include Nintendo Switch Online (Nintendo Co Ltd), Prime Gaming (Amazon Inc )*List Not Exhaustive, Google Play Pass (Google LLC), Humble Bundle Inc, Amazon Luna (Amazon Inc ), PlayStation Now (Sony Corporation), EA Play (Electronic Arts Inc ), Tencent Holdings Ltd, Uplay Pass (Ubisoft), Xbox (Game Pass) (Microsoft Corporation), Epic games Inc, GeForce Now (NVIDIA), Apple Arcade (Apple Inc ).

3. What are the main segments of the Gaming Subscription Industry?

The market segments include Gaming Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 10.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Tools to Make Work Seamless and Agile; Continuous Innovation in Team Collaborative Tool Offerings.

6. What are the notable trends driving market growth?

Mobile gaming to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Compliance and Governance Issues.

8. Can you provide examples of recent developments in the market?

March 2022- The Nintendo Switch Online (Nintendo Co. Ltd) announced new additions that include three Sega Genesis games. Light Crusader, Super Fantasy Zone, and Alien Soldier are among the most recent additions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gaming Subscription Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gaming Subscription Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gaming Subscription Industry?

To stay informed about further developments, trends, and reports in the Gaming Subscription Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence