Key Insights

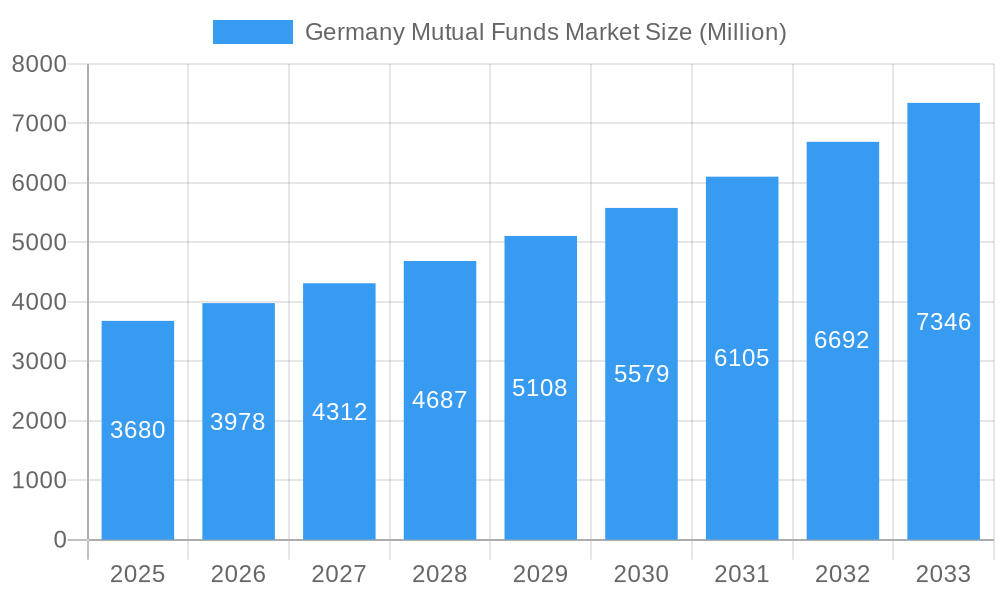

The German mutual funds market, valued at €3.68 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 8.10% from 2025 to 2033. This expansion is fueled by several key drivers. Increased investor awareness of mutual funds as a diversified investment vehicle, coupled with rising disposable incomes and a growing middle class, are contributing significantly to market expansion. Favorable regulatory frameworks and increasing financial literacy initiatives within Germany further enhance investor participation. Furthermore, the market benefits from the introduction of innovative fund products catering to diverse risk appetites and investment goals, including sustainable and ethical investment options gaining traction among environmentally conscious investors. Competitive pricing strategies among fund management companies also contribute to the market's attractiveness.

Germany Mutual Funds Market Market Size (In Billion)

However, certain market restraints exist. Economic uncertainty, geopolitical instability, and fluctuations in the global financial markets can impact investor sentiment and consequently, investment flows into mutual funds. Competition from alternative investment avenues, such as exchange-traded funds (ETFs) and direct stock investments, also poses a challenge. To maintain growth, fund managers need to leverage technology to enhance customer experience, offer personalized investment advice, and emphasize transparency to build investor trust and mitigate the risk of capital flight. The presence of established players like LINUS Digital Finance, TU Investment Club e V, and others indicates a mature market with established distribution channels and a diverse product portfolio. Geographical expansion targeting underpenetrated regions within Germany could also offer significant growth opportunities.

Germany Mutual Funds Market Company Market Share

Germany Mutual Funds Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany Mutual Funds Market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It examines market concentration, innovation, industry trends, dominant segments, product developments, key players, and emerging opportunities, equipping stakeholders with actionable insights for strategic decision-making. The report's detailed segmentation, coupled with financial metrics and qualitative analysis, offers a holistic understanding of this dynamic market. The base year for this analysis is 2025.

Germany Mutual Funds Market Market Concentration & Innovation

This section analyzes the competitive landscape of the German mutual funds market, assessing market concentration, innovation drivers, regulatory influences, and market dynamics. The market is characterized by a mix of established players and emerging fintech companies, leading to both consolidation and innovation. While precise market share data for each individual player requires extensive primary research, we can observe a moderately concentrated market with a few dominant players alongside numerous smaller firms. M&A activity has been moderate in recent years, with deal values estimated to be in the range of xx Million annually. This activity reflects both strategic consolidation and attempts to expand market share.

- Market Concentration: Moderately concentrated, with a few dominant players and a larger number of smaller firms.

- Innovation Drivers: Technological advancements (e.g., robo-advisors, fintech platforms), evolving investor preferences (e.g., ESG investing), and regulatory changes.

- Regulatory Frameworks: ESMA regulations, BaFin oversight, and MiFID II impact product offerings and market conduct.

- Product Substitutes: Alternative investment options such as ETFs, individual stocks, and bonds compete for investor capital.

- End-User Trends: Growing interest in sustainable and ethical investments, demand for digital investment platforms, and increasing financial literacy among younger investors.

- M&A Activities: Moderate level of M&A activity, with deal values estimated at xx Million annually.

Germany Mutual Funds Market Industry Trends & Insights

The German mutual funds market has experienced consistent growth, driven by a confluence of factors, including rising disposable incomes, increased awareness of investment opportunities, and a favorable regulatory environment. However, the market faces challenges including economic uncertainty, competition from alternative investment vehicles, and evolving investor expectations. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated to be xx%, with the market projected to reach xx Million by 2025. Market penetration amongst the target demographics remains xx% as of the estimated year, however this is projected to grow as the market continues to mature. Technological disruptions, primarily driven by fintech innovations, continue to reshape the industry, impacting both investment strategies and customer interaction. Consumer preferences are increasingly influenced by factors such as sustainability, transparency, and digital convenience. Competitive dynamics are marked by both cooperation and rivalry, with established players and new entrants vying for market share.

Dominant Markets & Segments in Germany Mutual Funds Market

While precise regional breakdowns require deeper analysis, the overall German market exhibits relatively even distribution across its major regions, reflecting the country's robust economic infrastructure and investor base. Key drivers for dominance include:

- Strong Economic Foundation: Germany's robust economy and stable political environment provide a supportive backdrop for investment growth.

- Well-Developed Financial Infrastructure: A sophisticated financial system, including robust regulatory frameworks, facilitates market operations.

- High Savings Rate: The German population's relatively high savings rate fuels demand for investment products.

- Increasing Financial Literacy: Growing awareness of financial planning and investment strategies among consumers drives market participation.

The dominance of the overall German market compared to sub-regions is due to its concentration of financial institutions, investor base, and economic activity. Further granular regional analysis is needed to identify specific regional variations.

Germany Mutual Funds Market Product Developments

Recent innovations in the German mutual funds market reflect a focus on meeting evolving investor preferences and leveraging technological advancements. The introduction of ESG (environmental, social, and governance) focused funds and the rise of robo-advisory platforms illustrate the industry’s response to changing investor priorities. These developments offer greater accessibility and personalized investment solutions, enhancing the market's reach and appeal. The market fit is largely positive, with increasing adoption of new product offerings.

Report Scope & Segmentation Analysis

This report segments the German mutual funds market based on several criteria, including asset class (equity, fixed income, mixed assets), investment strategy (active, passive), investor type (retail, institutional), and distribution channel (direct, indirect). Growth projections vary across segments, with some experiencing higher rates of expansion than others. Market sizes for each segment are available within the complete report. The competitive landscape also varies across segments, influenced by factors such as specialization, scale, and technological capabilities.

Key Drivers of Germany Mutual Funds Market Growth

Several factors underpin the growth trajectory of the German mutual funds market. These include:

- Increasing Disposable Incomes: Rising prosperity among German households fuels investment activity.

- Favorable Regulatory Environment: Supportive regulations promote market growth and attract investment.

- Technological Advancements: Innovations in fintech drive efficiency and accessibility.

- Growing Awareness of Investment Opportunities: Improved financial literacy promotes investor participation.

- Demand for Diversification and Risk Management: Mutual funds provide diverse investment opportunities and risk mitigation.

Challenges in the Germany Mutual Funds Market Sector

The German mutual funds market faces certain challenges that could impede its growth. These include:

- Economic Uncertainty: Global economic fluctuations can impact investor sentiment and market performance.

- Competition from Alternative Investments: ETFs, individual securities, and other investment options compete for investor capital.

- Regulatory Changes: Evolving regulatory frameworks can pose challenges for market players.

- Interest Rate Volatility: Fluctuations in interest rates can influence investor behavior and investment choices. The impact of such volatility is estimated at potentially xx Million in lost investment during periods of high volatility.

Emerging Opportunities in Germany Mutual Funds Market

The German mutual funds market presents significant opportunities for growth and innovation. These include:

- Growth of ESG Investing: Increasing demand for sustainable and responsible investments creates new market segments.

- Expansion of Digital Investment Platforms: The adoption of digital technologies presents opportunities for enhanced efficiency and customer engagement.

- Development of Niche Investment Products: Catering to specialized investor preferences opens new avenues for growth.

- Internationalization of Investment Strategies: Expanding investment reach beyond domestic markets can unlock significant potential.

Leading Players in the Germany Mutual Funds Market Market

- LINUS Digital Finance

- TU Investment Club e V

- FruitBox Africa GmbH

- Lupus alpha Asset Management AG

- Deutsche Invest Capital Partners (DICP)

- Angermann-Gruppe

- Haniel

- CONREN Land

- E1 international investment holding

- DWPT Deutsche Wertpapiertreuhand GmbH

Key Developments in Germany Mutual Funds Market Industry

- January 2023: Amundi Asset Management launched a new ETF in Germany for investments in small-cap US companies, broadening investment choices for German investors and increasing market competition.

- January 2023: The value of German government bonds on loan increased to EUR 111.1 billion (USD 121 billion), the highest level since December 2015. This reflects increased investor caution and potentially signals decreased confidence in the German economy, impacting mutual fund investment strategies.

Strategic Outlook for Germany Mutual Funds Market Market

The German mutual funds market is poised for continued growth, driven by long-term economic trends and evolving investor preferences. The increasing demand for ESG investments, the adoption of innovative technologies, and the expansion of digital platforms will create new opportunities for market players. Strategic initiatives focused on innovation, customer engagement, and adaptation to regulatory changes will be crucial for sustained success in this dynamic market. The projected market size in 2033 suggests significant growth potential, reinforcing the attractiveness of the German mutual funds sector.

Germany Mutual Funds Market Segmentation

-

1. Fund Type

- 1.1. Equity Funds

- 1.2. Bond Funds

- 1.3. Money Market Funds

- 1.4. Hybrid & Other Funds

-

2. Distribution Channel

- 2.1. Banks

- 2.2. Financial Advisors

- 2.3. Direct Sellers

- 2.4. Others

-

3. Investor Type

- 3.1. Institutional

- 3.2. Individual

Germany Mutual Funds Market Segmentation By Geography

- 1. Germany

Germany Mutual Funds Market Regional Market Share

Geographic Coverage of Germany Mutual Funds Market

Germany Mutual Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Open-Ended Spezialfonds are the leading funds of the German Fund Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity Funds

- 5.1.2. Bond Funds

- 5.1.3. Money Market Funds

- 5.1.4. Hybrid & Other Funds

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Banks

- 5.2.2. Financial Advisors

- 5.2.3. Direct Sellers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Investor Type

- 5.3.1. Institutional

- 5.3.2. Individual

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LINUS Digital Finance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TU Investment Club e V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FruitBox Africa GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lupus alpha Asset Management AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deutsche Invest Capital Partners (DICP)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Angermann-Gruppe

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haniel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CONREN Land

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 E1 international investment holding

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DWPT Deutsche Wertpapiertreuhand GmbH**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LINUS Digital Finance

List of Figures

- Figure 1: Germany Mutual Funds Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Mutual Funds Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 2: Germany Mutual Funds Market Volume Billion Forecast, by Fund Type 2020 & 2033

- Table 3: Germany Mutual Funds Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Germany Mutual Funds Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Germany Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 6: Germany Mutual Funds Market Volume Billion Forecast, by Investor Type 2020 & 2033

- Table 7: Germany Mutual Funds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Germany Mutual Funds Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Germany Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 10: Germany Mutual Funds Market Volume Billion Forecast, by Fund Type 2020 & 2033

- Table 11: Germany Mutual Funds Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Germany Mutual Funds Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Germany Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 14: Germany Mutual Funds Market Volume Billion Forecast, by Investor Type 2020 & 2033

- Table 15: Germany Mutual Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Mutual Funds Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Mutual Funds Market?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Germany Mutual Funds Market?

Key companies in the market include LINUS Digital Finance, TU Investment Club e V, FruitBox Africa GmbH, Lupus alpha Asset Management AG, Deutsche Invest Capital Partners (DICP), Angermann-Gruppe, Haniel, CONREN Land, E1 international investment holding, DWPT Deutsche Wertpapiertreuhand GmbH**List Not Exhaustive.

3. What are the main segments of the Germany Mutual Funds Market?

The market segments include Fund Type, Distribution Channel, Investor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.68 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Open-Ended Spezialfonds are the leading funds of the German Fund Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Amundi Asset Management Lists New ETF in Germany for Investments in Small Cap US Companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Mutual Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Mutual Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Mutual Funds Market?

To stay informed about further developments, trends, and reports in the Germany Mutual Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence