Key Insights

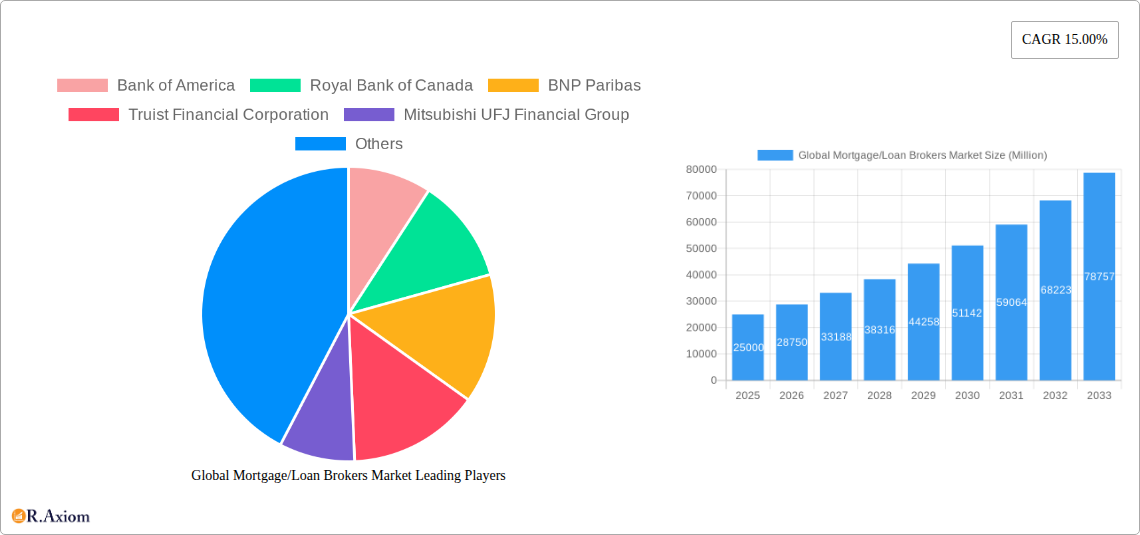

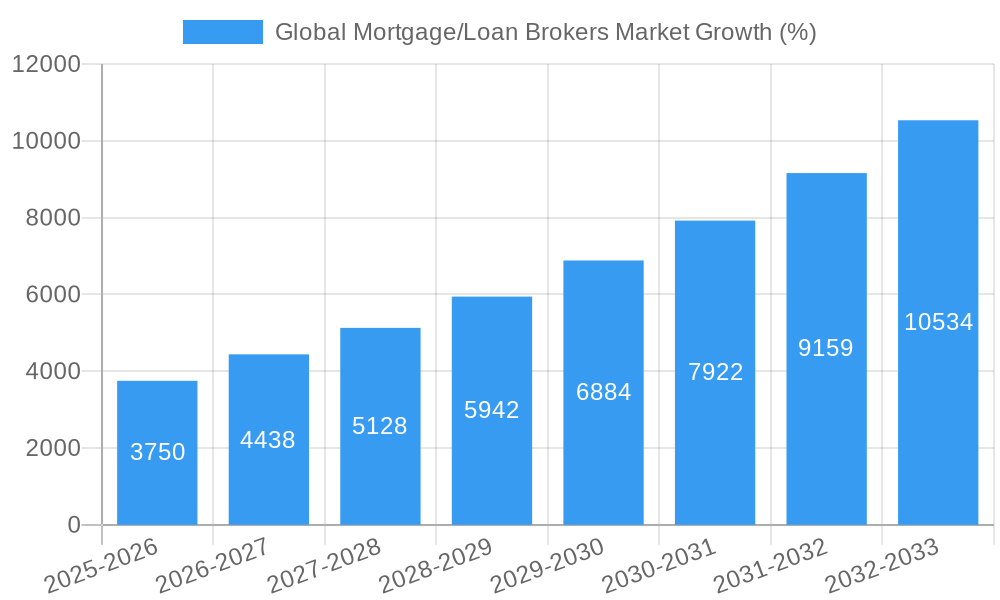

The global mortgage/loan broker market is experiencing robust growth, fueled by a compound annual growth rate (CAGR) of 15% between 2019 and 2033. This expansion is driven by several key factors. Increasing demand for homeownership, particularly amongst millennials and Gen Z, is a significant driver. Furthermore, the complexity of the mortgage process, coupled with rising interest rates and fluctuating market conditions, is leading more borrowers to seek professional assistance from brokers who can navigate the complexities and secure favorable terms. Technological advancements, including the rise of online mortgage platforms and sophisticated lending algorithms, are streamlining the process and increasing efficiency, further contributing to market growth. The market is segmented by various factors such as loan type (residential, commercial), customer demographics (age, income), and geographic location. Leading players, including Bank of America, Royal Bank of Canada, and BNP Paribas, are leveraging technology and expanding their service offerings to maintain a competitive edge. The market faces certain restraints, such as stringent regulatory environments and potential economic downturns that may impact borrowing activity. However, the overall outlook remains positive, suggesting sustained growth throughout the forecast period.

Despite challenges like regulatory hurdles and economic uncertainty, the market's growth trajectory remains robust. The increasing use of fintech solutions enhances efficiency and expands access to mortgages, benefitting both brokers and consumers. Diversification into new loan products and geographic expansion are key strategic initiatives for major players. Competition is intensifying, leading to innovation in services and pricing strategies. The market's future will largely depend on macroeconomic factors, regulatory changes, and the continued evolution of technological advancements. The projected market size in 2025 serves as a crucial benchmark for future growth estimations, offering a solid foundation for further market analysis and investment decisions. The continued focus on digitalization and enhanced customer experience will be critical for success in this dynamic and competitive market.

Global Mortgage/Loan Brokers Market: A Comprehensive Report (2019-2033)

This meticulously researched report provides a detailed analysis of the global mortgage/loan brokers market, offering invaluable insights for stakeholders, investors, and industry professionals. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages a robust data set and advanced analytical methodologies to deliver actionable intelligence and forecast market trends from 2025 to 2033. This in-depth analysis covers market concentration, innovation, industry trends, dominant segments, product developments, and key players, providing a comprehensive overview of this dynamic market.

Global Mortgage/Loan Brokers Market Market Concentration & Innovation

This section analyzes the competitive landscape of the global mortgage/loan brokers market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated structure with a few large players holding significant market share. However, the presence of numerous smaller, regional players fosters competition and innovation.

- Market Share: The top 5 players account for approximately xx% of the global market share in 2025, with Bank of America, Royal Bank of Canada, and BNP Paribas among the leading entities. Precise figures are detailed within the full report.

- M&A Activity: The market has witnessed significant M&A activity in recent years, driven by expansion strategies and the consolidation of market share. Total M&A deal value in 2024 reached approximately xx Million, with the average deal size estimated at xx Million. Specific deals and their impact on the market are discussed within the report.

- Innovation Drivers: Technological advancements, such as the rise of fintech and AI-powered platforms, are driving innovation within the industry. Regulatory changes and evolving consumer preferences also play significant roles in shaping market dynamics.

- Regulatory Frameworks: Varying regulatory frameworks across different jurisdictions affect market competition and growth. The report analyzes the impact of key regulations on market players and their strategies.

- Product Substitutes: The availability of alternative financing options, such as peer-to-peer lending and crowdfunding platforms, poses some competitive pressure on traditional mortgage brokers.

Global Mortgage/Loan Brokers Market Industry Trends & Insights

This section delves into the key industry trends and insights shaping the global mortgage/loan brokers market. The market is experiencing robust growth, driven by several factors such as increasing urbanization, rising housing prices, and favorable government policies in several regions. We examine market growth drivers, technological disruptions, shifting consumer preferences, and intense competitive dynamics.

The Compound Annual Growth Rate (CAGR) for the global mortgage/loan brokers market is projected to be xx% during the forecast period (2025-2033). Market penetration varies across different regions, with developed economies exhibiting higher penetration rates than emerging markets. The report provides a comprehensive regional breakdown, analyzing the factors influencing market growth in each region. Technological disruptions, such as the increasing adoption of online platforms and digital mortgage applications, are transforming the way mortgage services are delivered. Consumer preferences are shifting towards convenience, transparency, and personalized services. Competitive pressures necessitate continuous innovation and strategic adaptation from market players.

Dominant Markets & Segments in Global Mortgage/Loan Brokers Market

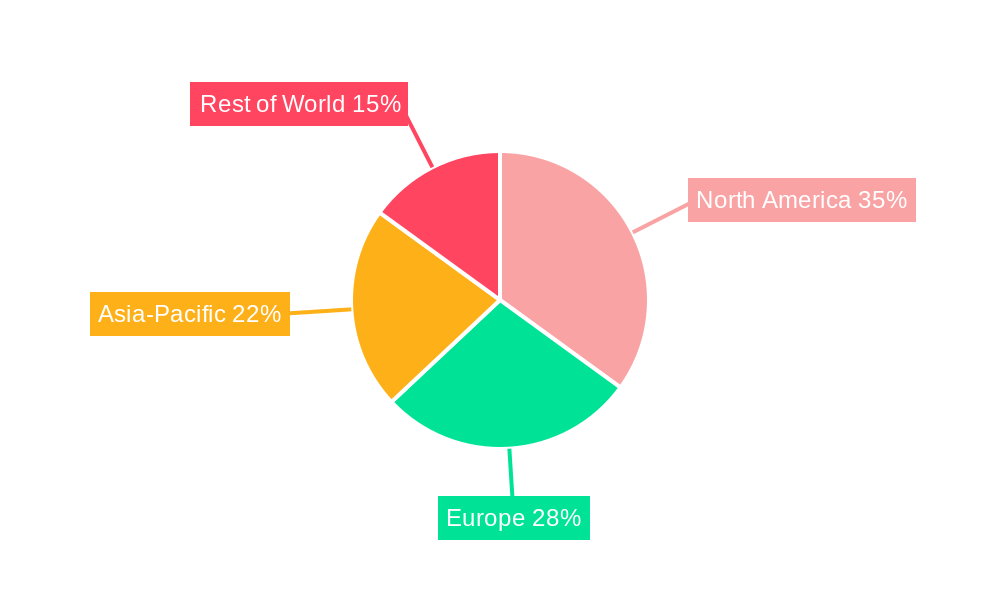

This section identifies the leading regions, countries, and market segments within the global mortgage/loan brokers market. The North American market currently holds the largest market share, driven by strong economic growth, readily available financing options, and a robust real estate sector.

Key Drivers of North American Dominance:

- Robust economic growth and consistent increase in housing prices.

- Well-developed financial infrastructure and access to capital.

- Supportive government policies and regulations conducive to mortgage lending.

Other Dominant Regions: Europe and Asia-Pacific are also significant markets, each with unique characteristics and growth drivers that are detailed in the report. Specific data on market size and growth projections for each region and segment are included in the comprehensive report.

The market is further segmented based on several factors including loan type (residential, commercial), customer type (individual, corporate), and service type (mortgage origination, mortgage servicing), providing a granular analysis of market dynamics in each segment.

Global Mortgage/Loan Brokers Market Product Developments

The global mortgage/loan brokers market is witnessing continuous product innovation driven by technological advancements and evolving customer needs. The introduction of digital mortgage platforms, AI-powered loan assessment tools, and personalized financial advice services are revolutionizing the industry. These technological advancements are improving the efficiency, speed, and transparency of mortgage processes while enhancing the customer experience. The market is moving towards integrated platforms that provide a seamless end-to-end experience for customers. The competitive advantage now lies in offering a superior customer experience, innovative product offerings, and a strong digital presence.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global mortgage/loan brokers market, segmented by region, loan type, customer type, and service type. Each segment is analyzed based on its market size, growth rate, and competitive dynamics. Projections for market size and growth are provided for each segment throughout the forecast period. Furthermore, the report details the competitive landscape within each segment, identifying key players and their market strategies.

Key Drivers of Global Mortgage/Loan Brokers Market Growth

Several key factors drive the growth of the global mortgage/loan brokers market. These include:

- Increasing Demand for Housing: Growing urbanization and population growth are fueling the demand for housing, driving the need for mortgage financing.

- Favorable Government Policies: In many countries, governments are implementing policies to support homeownership, further boosting the market.

- Technological Advancements: Digitalization and fintech are improving the efficiency and accessibility of mortgage services.

- Low-Interest Rates (Historically): Historically low-interest rates have made mortgages more affordable, leading to increased borrowing. (Note: This factor may vary depending on the specific time period analyzed in the report).

Challenges in the Global Mortgage/Loan Brokers Market Sector

Despite the growth prospects, the mortgage/loan brokers market faces certain challenges:

- Economic Fluctuations: Economic downturns can significantly impact mortgage demand and the ability of borrowers to repay their loans.

- Regulatory Changes: Stringent regulations and compliance requirements can increase the operational costs for brokers.

- Competition: The increasing number of players, including fintech companies, intensifies competition.

- Cybersecurity Threats: The digitalization of mortgage processes has increased vulnerabilities to cyberattacks.

Emerging Opportunities in Global Mortgage/Loan Brokers Market

Despite the challenges, several promising opportunities exist within the global mortgage/loan brokers market:

- Expansion into Emerging Markets: Many emerging economies present significant growth potential for mortgage brokers.

- Growth of Fintech and Digital Lending: Innovation in fintech and digital lending creates new possibilities for service delivery and efficiency.

- Sustainable Mortgages: The increasing demand for sustainable housing solutions presents a new market segment for green mortgages.

Leading Players in the Global Mortgage/Loan Brokers Market Market

- Bank of America

- Royal Bank of Canada

- BNP Paribas

- Truist Financial Corporation

- Mitsubishi UFJ Financial Group

- PT Bank Central Asia Tbk

- Qatar National Bank

- Standard Chartered PLC

- China Zheshang Bank

- Federal National Mortgage Association (FNMA)

- List Not Exhaustive

Key Developments in Global Mortgage/Loan Brokers Market Industry

- November 2022: BNP Paribas expands its operations in the United States following the acquisition of Exane.

- August 2022: Bank of America launches the Community Affordable Loan Solution, a new mortgage option targeting first-time homebuyers in designated markets.

Strategic Outlook for Global Mortgage/Loan Brokers Market Market

The global mortgage/loan brokers market is poised for continued growth, driven by a confluence of factors including increasing housing demand, technological advancements, and favorable government policies. The market's evolution towards digitalization and personalized service offerings presents significant opportunities for growth. Adaptability to regulatory changes and the effective mitigation of economic risks will be critical for sustained success in this dynamic market. The report provides a comprehensive strategic outlook, offering actionable insights for companies seeking to thrive in this competitive landscape.

Global Mortgage/Loan Brokers Market Segmentation

-

1. Enterprise

- 1.1. Large

- 1.2. Small

- 1.3. Medium- sized

-

2. Application

- 2.1. Home Loans

- 2.2. Commercial and Industrial Loans

- 2.3. Vehicle Loans

- 2.4. Loans to Governments

- 2.5. Others

-

3. End - User

- 3.1. Businesses

- 3.2. Individuals

Global Mortgage/Loan Brokers Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. South America

Global Mortgage/Loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digitization is changing the future of Mortgage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 5.1.1. Large

- 5.1.2. Small

- 5.1.3. Medium- sized

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Loans

- 5.2.2. Commercial and Industrial Loans

- 5.2.3. Vehicle Loans

- 5.2.4. Loans to Governments

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End - User

- 5.3.1. Businesses

- 5.3.2. Individuals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 6. North America Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Enterprise

- 6.1.1. Large

- 6.1.2. Small

- 6.1.3. Medium- sized

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Home Loans

- 6.2.2. Commercial and Industrial Loans

- 6.2.3. Vehicle Loans

- 6.2.4. Loans to Governments

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End - User

- 6.3.1. Businesses

- 6.3.2. Individuals

- 6.1. Market Analysis, Insights and Forecast - by Enterprise

- 7. Europe Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Enterprise

- 7.1.1. Large

- 7.1.2. Small

- 7.1.3. Medium- sized

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Home Loans

- 7.2.2. Commercial and Industrial Loans

- 7.2.3. Vehicle Loans

- 7.2.4. Loans to Governments

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End - User

- 7.3.1. Businesses

- 7.3.2. Individuals

- 7.1. Market Analysis, Insights and Forecast - by Enterprise

- 8. Asia Pacific Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Enterprise

- 8.1.1. Large

- 8.1.2. Small

- 8.1.3. Medium- sized

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Home Loans

- 8.2.2. Commercial and Industrial Loans

- 8.2.3. Vehicle Loans

- 8.2.4. Loans to Governments

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End - User

- 8.3.1. Businesses

- 8.3.2. Individuals

- 8.1. Market Analysis, Insights and Forecast - by Enterprise

- 9. Middle East Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Enterprise

- 9.1.1. Large

- 9.1.2. Small

- 9.1.3. Medium- sized

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Home Loans

- 9.2.2. Commercial and Industrial Loans

- 9.2.3. Vehicle Loans

- 9.2.4. Loans to Governments

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End - User

- 9.3.1. Businesses

- 9.3.2. Individuals

- 9.1. Market Analysis, Insights and Forecast - by Enterprise

- 10. South America Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Enterprise

- 10.1.1. Large

- 10.1.2. Small

- 10.1.3. Medium- sized

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Home Loans

- 10.2.2. Commercial and Industrial Loans

- 10.2.3. Vehicle Loans

- 10.2.4. Loans to Governments

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End - User

- 10.3.1. Businesses

- 10.3.2. Individuals

- 10.1. Market Analysis, Insights and Forecast - by Enterprise

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bank of America

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Royal Bank of Canada

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BNP Paribas

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Truist Financial Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsubishi UFJ Financial Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PT Bank Central Asia Tbk

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qatar National Bank

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Standard Chartered PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China Zheshang Bank

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Federal National Mortgage Association (FNMA)**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bank of America

List of Figures

- Figure 1: Global Global Mortgage/Loan Brokers Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Global Mortgage/Loan Brokers Market Revenue (Million), by Enterprise 2024 & 2032

- Figure 3: North America Global Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2024 & 2032

- Figure 4: North America Global Mortgage/Loan Brokers Market Revenue (Million), by Application 2024 & 2032

- Figure 5: North America Global Mortgage/Loan Brokers Market Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Global Mortgage/Loan Brokers Market Revenue (Million), by End - User 2024 & 2032

- Figure 7: North America Global Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2024 & 2032

- Figure 8: North America Global Mortgage/Loan Brokers Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Global Mortgage/Loan Brokers Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Global Mortgage/Loan Brokers Market Revenue (Million), by Enterprise 2024 & 2032

- Figure 11: Europe Global Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2024 & 2032

- Figure 12: Europe Global Mortgage/Loan Brokers Market Revenue (Million), by Application 2024 & 2032

- Figure 13: Europe Global Mortgage/Loan Brokers Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: Europe Global Mortgage/Loan Brokers Market Revenue (Million), by End - User 2024 & 2032

- Figure 15: Europe Global Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2024 & 2032

- Figure 16: Europe Global Mortgage/Loan Brokers Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Global Mortgage/Loan Brokers Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Global Mortgage/Loan Brokers Market Revenue (Million), by Enterprise 2024 & 2032

- Figure 19: Asia Pacific Global Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2024 & 2032

- Figure 20: Asia Pacific Global Mortgage/Loan Brokers Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Asia Pacific Global Mortgage/Loan Brokers Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Asia Pacific Global Mortgage/Loan Brokers Market Revenue (Million), by End - User 2024 & 2032

- Figure 23: Asia Pacific Global Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2024 & 2032

- Figure 24: Asia Pacific Global Mortgage/Loan Brokers Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Global Mortgage/Loan Brokers Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East Global Mortgage/Loan Brokers Market Revenue (Million), by Enterprise 2024 & 2032

- Figure 27: Middle East Global Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2024 & 2032

- Figure 28: Middle East Global Mortgage/Loan Brokers Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Middle East Global Mortgage/Loan Brokers Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Middle East Global Mortgage/Loan Brokers Market Revenue (Million), by End - User 2024 & 2032

- Figure 31: Middle East Global Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2024 & 2032

- Figure 32: Middle East Global Mortgage/Loan Brokers Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East Global Mortgage/Loan Brokers Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: South America Global Mortgage/Loan Brokers Market Revenue (Million), by Enterprise 2024 & 2032

- Figure 35: South America Global Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2024 & 2032

- Figure 36: South America Global Mortgage/Loan Brokers Market Revenue (Million), by Application 2024 & 2032

- Figure 37: South America Global Mortgage/Loan Brokers Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: South America Global Mortgage/Loan Brokers Market Revenue (Million), by End - User 2024 & 2032

- Figure 39: South America Global Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2024 & 2032

- Figure 40: South America Global Mortgage/Loan Brokers Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Global Mortgage/Loan Brokers Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 3: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by End - User 2019 & 2032

- Table 5: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 7: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by End - User 2019 & 2032

- Table 9: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 11: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by End - User 2019 & 2032

- Table 13: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 15: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by End - User 2019 & 2032

- Table 17: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 19: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by End - User 2019 & 2032

- Table 21: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 23: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by End - User 2019 & 2032

- Table 25: Global Mortgage/Loan Brokers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Mortgage/Loan Brokers Market?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the Global Mortgage/Loan Brokers Market?

Key companies in the market include Bank of America, Royal Bank of Canada, BNP Paribas, Truist Financial Corporation, Mitsubishi UFJ Financial Group, PT Bank Central Asia Tbk, Qatar National Bank, Standard Chartered PLC, China Zheshang Bank, Federal National Mortgage Association (FNMA)**List Not Exhaustive.

3. What are the main segments of the Global Mortgage/Loan Brokers Market?

The market segments include Enterprise, Application, End - User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digitization is changing the future of Mortgage.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2022, Following the acquisition of Exane by the largest lender in the eurozone last year, BNP Paribas is extending its operation in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Mortgage/Loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Mortgage/Loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Mortgage/Loan Brokers Market?

To stay informed about further developments, trends, and reports in the Global Mortgage/Loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence