Key Insights

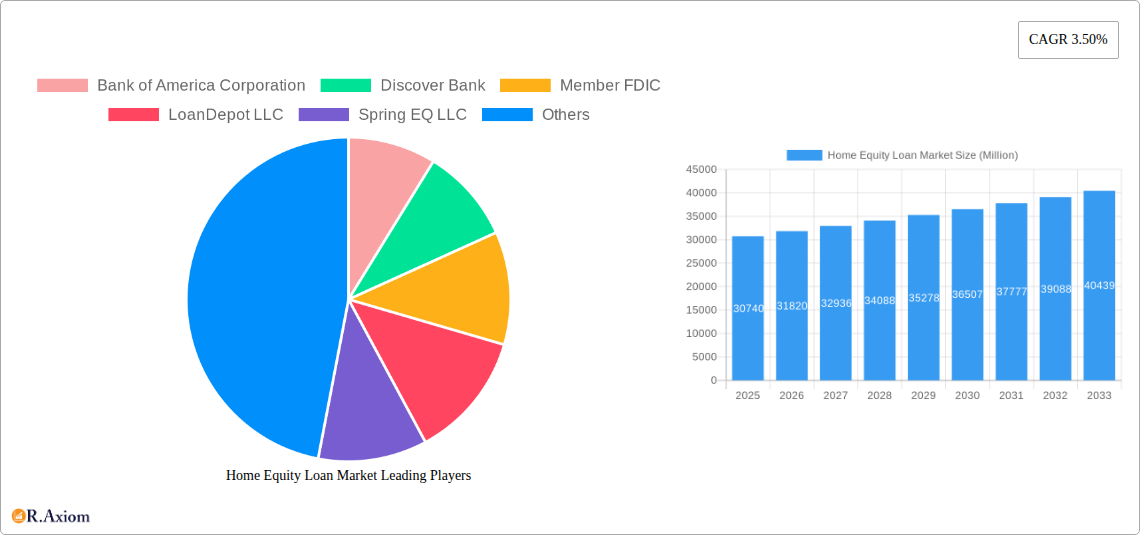

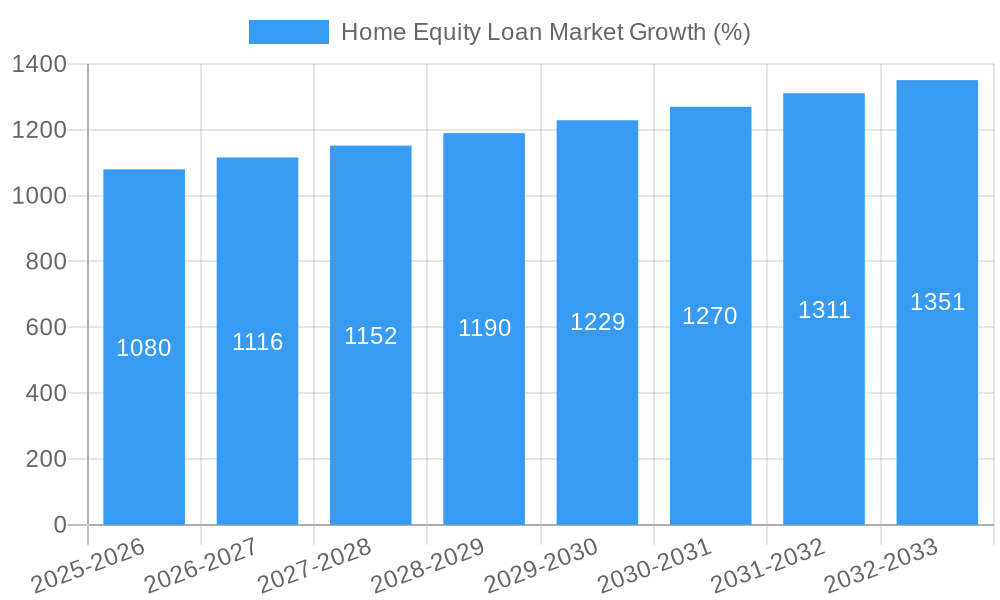

The home equity loan market, currently valued at $30.74 billion in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 3.50% from 2025 to 2033. This growth is driven by several factors. Rising home values in many regions are increasing the available equity homeowners can tap into for various needs, from home renovations and debt consolidation to funding education or business ventures. Low interest rates, although subject to fluctuation, historically have made home equity loans a more attractive borrowing option compared to other consumer loans. Furthermore, increased awareness of home equity loans as a financing tool, coupled with streamlined application processes offered by many lenders, contributes to market expansion. However, potential economic downturns, fluctuations in interest rates, and stricter lending regulations could act as restraints, impacting the overall market trajectory. The market is segmented by loan type (fixed-rate, variable-rate), loan amount, borrower demographics (age, income), and geographic location. Key players in the market, including Bank of America, Discover Bank, LoanDepot, and others, are continuously innovating to remain competitive, offering attractive loan terms and digitalized platforms to reach a broader customer base.

The competitive landscape is characterized by a mix of large national banks, smaller regional banks, credit unions, and online lenders. This diverse group caters to various customer needs and preferences. The forecast period (2025-2033) indicates continued market expansion, although the actual growth rate might deviate based on macroeconomic conditions and interest rate shifts. The historical period (2019-2024) likely reflects similar trends, showing a consistent albeit perhaps slower growth, considering the impact of recent economic events. The market's future prospects remain positive, contingent on favorable economic conditions and continued innovation within the financial services sector. Strategic partnerships and acquisitions among market players are also expected to shape the market dynamics during the forecast period.

Home Equity Loan Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Home Equity Loan Market, covering the period from 2019 to 2033. The study utilizes 2025 as the base year and offers detailed forecasts from 2025 to 2033. Key market trends, growth drivers, challenges, and opportunities are meticulously examined, along with an analysis of leading players including Bank of America Corporation, Discover Bank, Member FDIC, LoanDepot LLC, Spring EQ LLC, TBK BANK, SSB, U S Bank, Pentagon Federal Credit Union, and The PNC Financial Services Group Inc. (list not exhaustive). The report's robust data and insightful analysis make it an essential resource for industry stakeholders, investors, and strategic decision-makers. Projected market values are in Millions.

Home Equity Loan Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Home Equity Loan Market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The report assesses market share amongst key players and quantifies M&A deal values to highlight market dynamics. The xx% market share held by the top 5 players indicates a moderately concentrated market, influenced by stringent regulatory frameworks and the relatively standardized nature of home equity loan products. Innovation is driven by the increasing adoption of fintech solutions, enhancing efficiency and accessibility.

- Market Share Concentration: xx% held by top 5 players (2024).

- M&A Activity: Significant activity observed, with deals exceeding USD xx Million in 2022 alone.

- Innovation Drivers: Fintech integration, personalized loan offerings, and improved online platforms are driving innovation.

- Regulatory Landscape: Stringent regulations influence product offerings and market entry.

- End-User Trends: Growing demand for home improvements and debt consolidation is fuelling market growth.

Home Equity Loan Market Industry Trends & Insights

This section explores key trends influencing the Home Equity Loan Market, including market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The report provides detailed insights into market growth, expressed as Compound Annual Growth Rate (CAGR), and market penetration rates for different segments. The increasing adoption of online lending platforms and the rise of personalized loan options are reshaping the market. Consumer preferences shift toward streamlined application processes and competitive interest rates. Market penetration is projected to reach xx% by 2033, driven by factors including rising home values and increased awareness of home equity loan products. The CAGR for the forecast period (2025-2033) is estimated at xx%.

Dominant Markets & Segments in Home Equity Loan Market

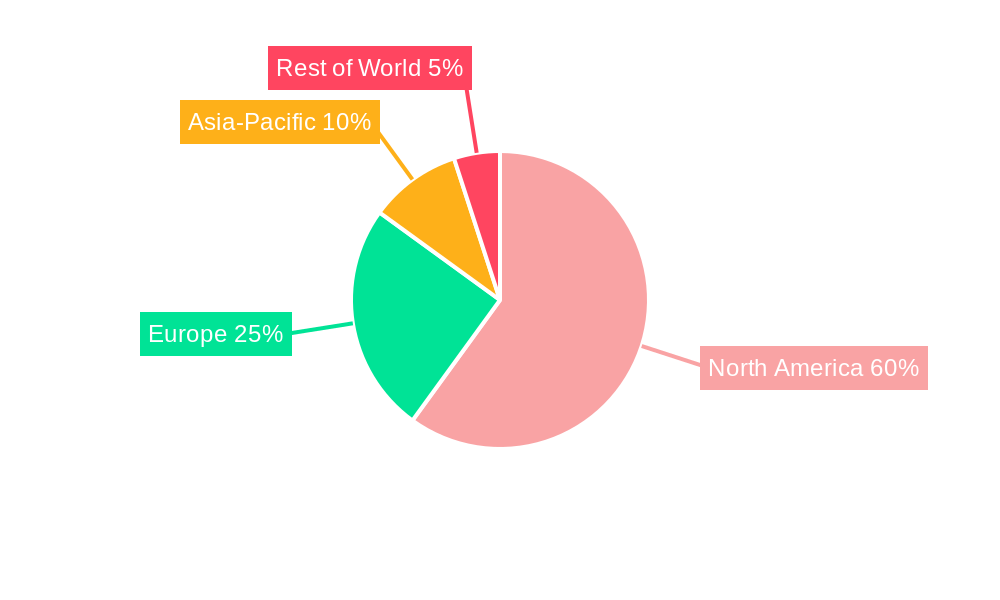

This section identifies the leading regions, countries, and segments within the Home Equity Loan Market. The dominance analysis considers factors like economic strength, regulatory environment, homeownership rates, and consumer behavior. The report further analyzes key market drivers specific to each dominant segment.

- Dominant Region: The United States is expected to maintain its dominance, driven by high homeownership rates and a robust mortgage market.

- Key Drivers:

- Strong economic growth and high disposable income.

- Favorable government policies and mortgage lending regulations.

- High levels of homeownership and increasing home values.

- Detailed Dominance Analysis: The United States holds a significant share owing to its substantial housing market and established financial infrastructure. Other regions show varying levels of market maturity, presenting opportunities for future expansion.

Home Equity Loan Market Product Developments

Recent product innovations focus on enhanced online platforms, streamlined application processes, and personalized loan offerings tailored to individual customer needs. Technological advancements in risk assessment and credit scoring are improving efficiency and reducing processing times. The integration of AI-powered chatbots and personalized financial advice tools further enhances the customer experience, increasing market accessibility and strengthening competitive advantages.

Report Scope & Segmentation Analysis

The report segments the Home Equity Loan Market based on loan type (fixed-rate, adjustable-rate), loan purpose (home improvement, debt consolidation, other), and borrower demographics (age, income). Each segment's growth projection, market size, and competitive landscape are thoroughly analyzed. Market sizes vary significantly across segments, reflecting differing demand and market penetration. The competitive dynamics also vary, influenced by the presence of specialized lenders catering to specific niche segments.

Key Drivers of Home Equity Loan Market Growth

Several factors contribute to the growth of the Home Equity Loan Market, including rising home values (increasing available equity), favorable economic conditions (supporting borrowing capacity), and the development of user-friendly online lending platforms. Government regulations play a role in maintaining market stability and responsible lending practices. Technological advancements, like AI-driven credit scoring, enhance efficiency and streamline the loan application process.

Challenges in the Home Equity Loan Market Sector

The Home Equity Loan Market faces challenges including economic downturns (impacting borrower solvency), stringent regulatory compliance requirements (increasing operational costs), and intense competition amongst lenders (necessitating strategic pricing and product differentiation). Supply chain disruptions, especially in the construction industry, can indirectly impact the market by reducing demand for home improvement loans.

Emerging Opportunities in Home Equity Loan Market

Several emerging opportunities exist within the Home Equity Loan Market, driven by factors including the increasing penetration of online channels, the rising adoption of fintech solutions, and the expanding market for specialized loan products. Opportunities lie in catering to underserved segments and broadening access to home equity lending. Developing innovative products tailored to specific needs and leveraging advancements in financial technology present substantial growth potential.

Leading Players in the Home Equity Loan Market Market

- Bank of America Corporation

- Discover Bank

- Member FDIC

- LoanDepot LLC

- Spring EQ LLC

- TBK BANK

- SSB

- U S Bank

- Pentagon Federal Credit Union

- The PNC Financial Services Group Inc

Key Developments in Home Equity Loan Market Industry

- April 2022: Redfin acquired Bay Equity Home Loans for USD 137.8 Million, expanding its real estate services.

- July 2022: Ontario Teachers’ Pension Plan Board acquired HomeQ (parent company of HomeEquity Bank), a significant player in the Canadian reverse mortgage market.

Strategic Outlook for Home Equity Loan Market Market

The Home Equity Loan Market is poised for sustained growth, driven by several factors including increasing home values, improved access through online platforms, and the development of innovative loan products. The strategic outlook emphasizes the importance of embracing technological advancements and adapting to changing consumer preferences to enhance competitiveness and capture market share. Expanding into new geographical markets and serving niche customer segments present further opportunities for growth and expansion.

Home Equity Loan Market Segmentation

-

1. Types

- 1.1. Fixed Rate Loans

- 1.2. Home Equity Line of Credit

-

2. Service Providers

- 2.1. Banks

- 2.2. Online

- 2.3. Credit Union

- 2.4. Others

Home Equity Loan Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Home Equity Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase In Sales of Household Units; Higher Duration of Repayment

- 3.3. Market Restrains

- 3.3.1. Increase In Sales of Household Units; Higher Duration of Repayment

- 3.4. Market Trends

- 3.4.1. Access to Large Amount of Loan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Equity Loan Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Fixed Rate Loans

- 5.1.2. Home Equity Line of Credit

- 5.2. Market Analysis, Insights and Forecast - by Service Providers

- 5.2.1. Banks

- 5.2.2. Online

- 5.2.3. Credit Union

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. North America Home Equity Loan Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Types

- 6.1.1. Fixed Rate Loans

- 6.1.2. Home Equity Line of Credit

- 6.2. Market Analysis, Insights and Forecast - by Service Providers

- 6.2.1. Banks

- 6.2.2. Online

- 6.2.3. Credit Union

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Types

- 7. South America Home Equity Loan Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Types

- 7.1.1. Fixed Rate Loans

- 7.1.2. Home Equity Line of Credit

- 7.2. Market Analysis, Insights and Forecast - by Service Providers

- 7.2.1. Banks

- 7.2.2. Online

- 7.2.3. Credit Union

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Types

- 8. Europe Home Equity Loan Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Types

- 8.1.1. Fixed Rate Loans

- 8.1.2. Home Equity Line of Credit

- 8.2. Market Analysis, Insights and Forecast - by Service Providers

- 8.2.1. Banks

- 8.2.2. Online

- 8.2.3. Credit Union

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Types

- 9. Middle East & Africa Home Equity Loan Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Types

- 9.1.1. Fixed Rate Loans

- 9.1.2. Home Equity Line of Credit

- 9.2. Market Analysis, Insights and Forecast - by Service Providers

- 9.2.1. Banks

- 9.2.2. Online

- 9.2.3. Credit Union

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Types

- 10. Asia Pacific Home Equity Loan Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Types

- 10.1.1. Fixed Rate Loans

- 10.1.2. Home Equity Line of Credit

- 10.2. Market Analysis, Insights and Forecast - by Service Providers

- 10.2.1. Banks

- 10.2.2. Online

- 10.2.3. Credit Union

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Types

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bank of America Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Discover Bank

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Member FDIC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LoanDepot LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Spring EQ LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TBK BANK

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SSB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 U S Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pentagon Federal Credit Union

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The PNC Financial Services Group Inc **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bank of America Corporation

List of Figures

- Figure 1: Global Home Equity Loan Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Home Equity Loan Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Home Equity Loan Market Revenue (Million), by Types 2024 & 2032

- Figure 4: North America Home Equity Loan Market Volume (Billion), by Types 2024 & 2032

- Figure 5: North America Home Equity Loan Market Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Home Equity Loan Market Volume Share (%), by Types 2024 & 2032

- Figure 7: North America Home Equity Loan Market Revenue (Million), by Service Providers 2024 & 2032

- Figure 8: North America Home Equity Loan Market Volume (Billion), by Service Providers 2024 & 2032

- Figure 9: North America Home Equity Loan Market Revenue Share (%), by Service Providers 2024 & 2032

- Figure 10: North America Home Equity Loan Market Volume Share (%), by Service Providers 2024 & 2032

- Figure 11: North America Home Equity Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Home Equity Loan Market Volume (Billion), by Country 2024 & 2032

- Figure 13: North America Home Equity Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Home Equity Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Home Equity Loan Market Revenue (Million), by Types 2024 & 2032

- Figure 16: South America Home Equity Loan Market Volume (Billion), by Types 2024 & 2032

- Figure 17: South America Home Equity Loan Market Revenue Share (%), by Types 2024 & 2032

- Figure 18: South America Home Equity Loan Market Volume Share (%), by Types 2024 & 2032

- Figure 19: South America Home Equity Loan Market Revenue (Million), by Service Providers 2024 & 2032

- Figure 20: South America Home Equity Loan Market Volume (Billion), by Service Providers 2024 & 2032

- Figure 21: South America Home Equity Loan Market Revenue Share (%), by Service Providers 2024 & 2032

- Figure 22: South America Home Equity Loan Market Volume Share (%), by Service Providers 2024 & 2032

- Figure 23: South America Home Equity Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 24: South America Home Equity Loan Market Volume (Billion), by Country 2024 & 2032

- Figure 25: South America Home Equity Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Home Equity Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Home Equity Loan Market Revenue (Million), by Types 2024 & 2032

- Figure 28: Europe Home Equity Loan Market Volume (Billion), by Types 2024 & 2032

- Figure 29: Europe Home Equity Loan Market Revenue Share (%), by Types 2024 & 2032

- Figure 30: Europe Home Equity Loan Market Volume Share (%), by Types 2024 & 2032

- Figure 31: Europe Home Equity Loan Market Revenue (Million), by Service Providers 2024 & 2032

- Figure 32: Europe Home Equity Loan Market Volume (Billion), by Service Providers 2024 & 2032

- Figure 33: Europe Home Equity Loan Market Revenue Share (%), by Service Providers 2024 & 2032

- Figure 34: Europe Home Equity Loan Market Volume Share (%), by Service Providers 2024 & 2032

- Figure 35: Europe Home Equity Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Europe Home Equity Loan Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Europe Home Equity Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Home Equity Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Home Equity Loan Market Revenue (Million), by Types 2024 & 2032

- Figure 40: Middle East & Africa Home Equity Loan Market Volume (Billion), by Types 2024 & 2032

- Figure 41: Middle East & Africa Home Equity Loan Market Revenue Share (%), by Types 2024 & 2032

- Figure 42: Middle East & Africa Home Equity Loan Market Volume Share (%), by Types 2024 & 2032

- Figure 43: Middle East & Africa Home Equity Loan Market Revenue (Million), by Service Providers 2024 & 2032

- Figure 44: Middle East & Africa Home Equity Loan Market Volume (Billion), by Service Providers 2024 & 2032

- Figure 45: Middle East & Africa Home Equity Loan Market Revenue Share (%), by Service Providers 2024 & 2032

- Figure 46: Middle East & Africa Home Equity Loan Market Volume Share (%), by Service Providers 2024 & 2032

- Figure 47: Middle East & Africa Home Equity Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Home Equity Loan Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Middle East & Africa Home Equity Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Home Equity Loan Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Home Equity Loan Market Revenue (Million), by Types 2024 & 2032

- Figure 52: Asia Pacific Home Equity Loan Market Volume (Billion), by Types 2024 & 2032

- Figure 53: Asia Pacific Home Equity Loan Market Revenue Share (%), by Types 2024 & 2032

- Figure 54: Asia Pacific Home Equity Loan Market Volume Share (%), by Types 2024 & 2032

- Figure 55: Asia Pacific Home Equity Loan Market Revenue (Million), by Service Providers 2024 & 2032

- Figure 56: Asia Pacific Home Equity Loan Market Volume (Billion), by Service Providers 2024 & 2032

- Figure 57: Asia Pacific Home Equity Loan Market Revenue Share (%), by Service Providers 2024 & 2032

- Figure 58: Asia Pacific Home Equity Loan Market Volume Share (%), by Service Providers 2024 & 2032

- Figure 59: Asia Pacific Home Equity Loan Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Asia Pacific Home Equity Loan Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Asia Pacific Home Equity Loan Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Home Equity Loan Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Home Equity Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Home Equity Loan Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Home Equity Loan Market Revenue Million Forecast, by Types 2019 & 2032

- Table 4: Global Home Equity Loan Market Volume Billion Forecast, by Types 2019 & 2032

- Table 5: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 6: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2019 & 2032

- Table 7: Global Home Equity Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Home Equity Loan Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Home Equity Loan Market Revenue Million Forecast, by Types 2019 & 2032

- Table 10: Global Home Equity Loan Market Volume Billion Forecast, by Types 2019 & 2032

- Table 11: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 12: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2019 & 2032

- Table 13: Global Home Equity Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Home Equity Loan Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: United States Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Canada Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Mexico Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Global Home Equity Loan Market Revenue Million Forecast, by Types 2019 & 2032

- Table 22: Global Home Equity Loan Market Volume Billion Forecast, by Types 2019 & 2032

- Table 23: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 24: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2019 & 2032

- Table 25: Global Home Equity Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Home Equity Loan Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Brazil Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Argentina Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Global Home Equity Loan Market Revenue Million Forecast, by Types 2019 & 2032

- Table 34: Global Home Equity Loan Market Volume Billion Forecast, by Types 2019 & 2032

- Table 35: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 36: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2019 & 2032

- Table 37: Global Home Equity Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Home Equity Loan Market Volume Billion Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Germany Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Germany Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: France Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: Italy Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 47: Spain Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Spain Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 49: Russia Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Russia Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 51: Benelux Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 53: Nordics Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 57: Global Home Equity Loan Market Revenue Million Forecast, by Types 2019 & 2032

- Table 58: Global Home Equity Loan Market Volume Billion Forecast, by Types 2019 & 2032

- Table 59: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 60: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2019 & 2032

- Table 61: Global Home Equity Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Home Equity Loan Market Volume Billion Forecast, by Country 2019 & 2032

- Table 63: Turkey Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 65: Israel Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Israel Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 67: GCC Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: GCC Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 69: North Africa Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 71: South Africa Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 75: Global Home Equity Loan Market Revenue Million Forecast, by Types 2019 & 2032

- Table 76: Global Home Equity Loan Market Volume Billion Forecast, by Types 2019 & 2032

- Table 77: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2019 & 2032

- Table 78: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2019 & 2032

- Table 79: Global Home Equity Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 80: Global Home Equity Loan Market Volume Billion Forecast, by Country 2019 & 2032

- Table 81: China Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: China Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 83: India Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: India Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 85: Japan Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Japan Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 87: South Korea Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 91: Oceania Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Home Equity Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Home Equity Loan Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Equity Loan Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Home Equity Loan Market?

Key companies in the market include Bank of America Corporation, Discover Bank, Member FDIC, LoanDepot LLC, Spring EQ LLC, TBK BANK, SSB, U S Bank, Pentagon Federal Credit Union, The PNC Financial Services Group Inc **List Not Exhaustive.

3. What are the main segments of the Home Equity Loan Market?

The market segments include Types, Service Providers.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase In Sales of Household Units; Higher Duration of Repayment.

6. What are the notable trends driving market growth?

Access to Large Amount of Loan.

7. Are there any restraints impacting market growth?

Increase In Sales of Household Units; Higher Duration of Repayment.

8. Can you provide examples of recent developments in the market?

In April 2022, Redfin a real estate company based in Seattle (United States) acquired Bay Equity Home Loans with a sum of USD 137.8 Million. The merger accelerates Redfin’s strategy for expanding its business with customers to buy, sell, rent, and finance a home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Equity Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Equity Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Equity Loan Market?

To stay informed about further developments, trends, and reports in the Home Equity Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence