Key Insights

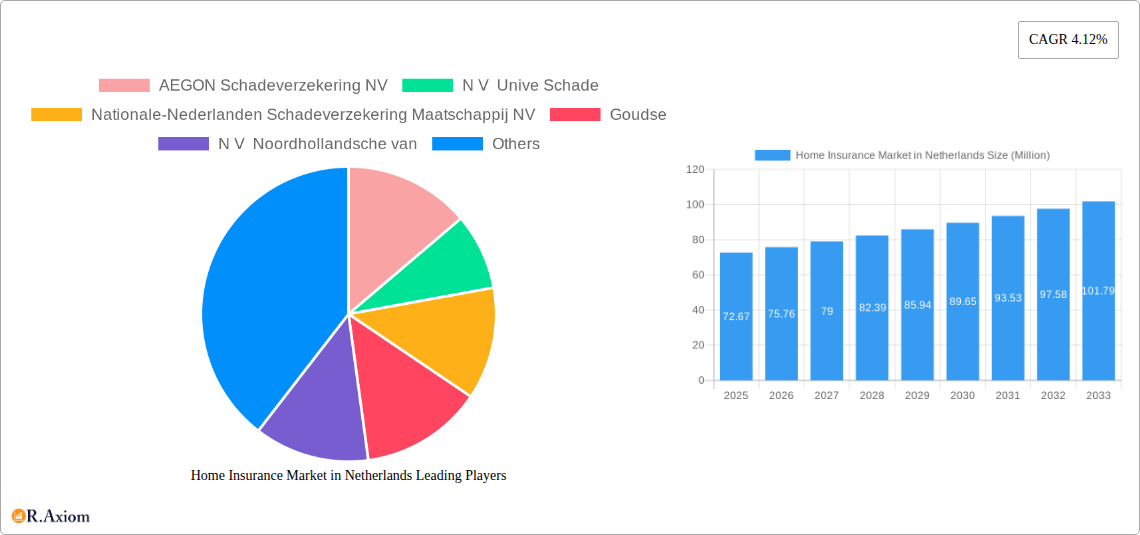

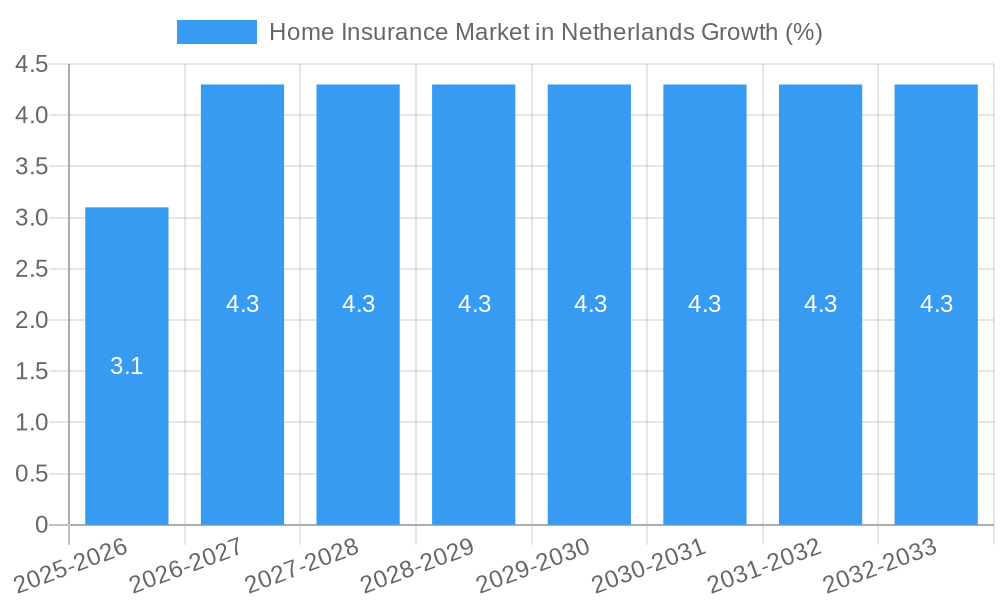

The Netherlands' home insurance market, valued at €72.67 million in 2025, exhibits steady growth, projected at a 4.12% CAGR from 2025 to 2033. This growth is driven primarily by increasing homeownership rates, rising awareness of property risks (particularly flooding in low-lying areas), and a strengthening regulatory environment mandating higher insurance coverage in certain situations. Key trends include the rising adoption of digital platforms for policy purchases and management, increasing demand for customized and bundled insurance packages, and a growing focus on sustainable home insurance offerings that incorporate green building practices and climate risk mitigation. Conversely, market growth is somewhat constrained by intense competition among established insurers, economic fluctuations impacting consumer spending, and the potential for regulatory changes that could alter the market landscape. The market is segmented by product type (e.g., building insurance, contents insurance, liability insurance) and distribution channel (direct sales, agents, brokers). Major players include AEGON Schadeverzekering NV, Unive Schade, Nationale-Nederlanden, and Achmea, among others, competing on price, service offerings, and brand reputation.

The competitive landscape is characterized by both established players and emerging InsurTech companies leveraging technology to improve efficiency and customer experience. The forecast suggests continued market expansion through 2033, driven by sustained economic activity and evolving consumer preferences. However, insurers need to adapt to changing consumer behaviors, leverage data analytics for risk assessment, and invest in innovative products and services to maintain a competitive edge. The market's success hinges on effectively addressing consumer needs related to affordability, transparency, and personalized protection against diverse property risks. The geographic focus remains primarily the Netherlands, with regional variations likely influenced by factors such as property values and risk profiles across different provinces.

This in-depth report provides a comprehensive analysis of the Netherlands' home insurance market, covering market size, segmentation, competitive landscape, and future growth prospects from 2019 to 2033. The report utilizes data from the historical period (2019-2024), the base year (2025), and the estimated year (2025) to project market trends through the forecast period (2025-2033). It is an invaluable resource for industry stakeholders, investors, and strategic decision-makers seeking to understand and navigate this dynamic market.

Home Insurance Market in Netherlands Market Concentration & Innovation

The Netherlands' home insurance market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. AEGON Schadeverzekering NV, Achmea Schadeverzekeringen NV, Nationale-Nederlanden Schadeverzekering Maatschappij NV, and Unive Schade N.V. are among the key players, collectively accounting for an estimated xx% of the market in 2025. However, smaller insurers and specialized niche players continue to compete effectively, particularly in the digital distribution channels.

Market Concentration Metrics (2025 Estimates):

- Top 5 players market share: xx%

- Herfindahl-Hirschman Index (HHI): xx

- Average market share of top 10 players: xx%

Innovation Drivers:

- Increasing adoption of Insurtech solutions, especially in areas like claims processing and customer service.

- Growing demand for personalized and customized insurance products catering to specific customer needs.

- Regulatory initiatives promoting innovation and competition within the industry.

- Strategic partnerships between traditional insurers and fintech companies.

Regulatory Framework:

The Dutch regulatory framework for insurance is relatively robust and promotes consumer protection. Recent changes focused on data privacy and digitalization are shaping the competitive landscape and driving technological innovation.

Mergers & Acquisitions (M&A) Activity:

While major M&A activity has been relatively limited recently, there's potential for consolidation, particularly among smaller players seeking to gain scale and enhance their technological capabilities. Estimated M&A deal value in the last 5 years: xx Million.

Home Insurance Market in Netherlands Industry Trends & Insights

The Netherlands' home insurance market is characterized by steady growth, driven by factors such as increasing property values, a rising middle class, and growing awareness of the importance of insurance protection. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024. Market penetration, currently at xx%, is expected to reach xx% by 2033.

Technological disruptions, particularly the increased use of digital platforms and data analytics, are transforming the industry. Consumers are increasingly demanding digital-first interactions, seamless online purchasing experiences, and personalized policy recommendations. This is placing pressure on traditional insurers to adapt and invest in digital capabilities. Competitive dynamics are fierce, with established players facing competition from new entrants in the Insurtech space. Pricing strategies and product differentiation play crucial roles in securing market share.

Dominant Markets & Segments in Home Insurance Market in Netherlands

Dominant Product Types:

- Fire Insurance: Remains the dominant segment due to legal requirements and high property values.

- Other Product Types: Includes add-ons such as flood, earthquake, and liability coverages, showing significant growth potential.

Dominant Distribution Channels:

- Agents: Continue to hold a significant share due to the personal touch and advice provided.

- Direct: Is rapidly expanding due to the convenience and cost-effectiveness offered by online platforms.

Key Drivers of Segment Dominance:

- Fire Insurance: Mandatory requirements for mortgages and increasing property values drive demand.

- Agents: Trust and personalized advice remain valuable.

- Direct: Convenience, cost-effectiveness, and accessibility via digital channels.

Home Insurance Market in Netherlands Product Developments

Recent innovations focus on leveraging technology to offer more personalized and efficient insurance products. This includes using AI-powered risk assessment tools, implementing digital claims processing, and providing customers with access to 24/7 online support. The market is witnessing the development of bundled insurance packages combining home, contents, and liability coverages. These packaged offerings offer convenience and potential cost savings, attracting a broader customer base. The incorporation of IoT devices to monitor risk and personalize pricing are emerging developments.

Report Scope & Segmentation Analysis

This report segments the Netherlands' home insurance market based on Product Type (Motor Insurance, Fire Insurance, Transportation Insurance, Other Product Types) and Distribution Channel (Direct, Agents, Brokers, Other Distribution Channels).

Product Type Segmentation: Each segment has a distinct market size and growth projection, with Fire Insurance currently being the largest. Competitive intensity varies across segments, with greater competition observed in the more established segments.

Distribution Channel Segmentation: The direct channel is experiencing the fastest growth, driven by digital adoption. However, the agent and broker channels still retain significant market share, indicating the importance of traditional distribution networks.

Key Drivers of Home Insurance Market in Netherlands Growth

Several factors contribute to the growth of the Netherlands' home insurance market. Firstly, rising property values directly correlate with increased demand for insurance coverage. Secondly, increased consumer awareness of potential risks and financial protection is a significant driver. Thirdly, government regulations and initiatives promoting financial stability indirectly boost the market. Finally, technological advancements and digitalization are enhancing customer experience and efficiency.

Challenges in the Home Insurance Market in Netherlands Sector

The market faces challenges, including increasing regulatory scrutiny around pricing transparency and data protection. Claims fraud remains a persistent issue, impacting insurers’ profitability and operational efficiency. Intense competition from both established and emerging Insurtech firms puts pressure on pricing and profitability. Natural disasters and climate change-related risks increase the frequency and severity of claims, potentially impacting the overall stability of the market.

Emerging Opportunities in Home Insurance Market in Netherlands

The Netherlands' home insurance market presents several promising opportunities. The increasing adoption of smart home technologies enables insurers to develop usage-based insurance models, and the growth of the Insurtech sector offers various collaboration and partnership possibilities. The increasing prevalence of climate change-related risks creates opportunities for innovative product development, including tailored coverage for specific climate-related events. Expansion into underserved customer segments also presents growth opportunities.

Leading Players in the Home Insurance Market in Netherlands Market

- AEGON Schadeverzekering NV

- N V Unive Schade

- Nationale-Nederlanden Schadeverzekering Maatschappij NV

- Goudse

- N V Noordhollandsche van

- Achmea Schadeverzekeringen NV

- ABN AMRO Schadeverzekering NV

- N V Schadeverzekering - Maatschappij Bovemij

- Klaverblad Schadeverzekeringsmaatschappij NV

- ASR Schadeverzekering NV

Key Developments in Home Insurance Market in Netherlands Industry

November 2023: Howden launched a specialized European cyber and technology errors and omissions line slip, significantly enhancing cyber risk coverage in the Netherlands. This is expected to increase demand for specialized cyber insurance products.

April 2022: Swiss Re's optic partnered with Independent to launch Bentley home insurance, introducing a digital-first approach impacting customer experience and potentially market share dynamics.

Strategic Outlook for Home Insurance Market in Netherlands Market

The Netherlands' home insurance market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and increasing awareness of risk. Strategic partnerships, product diversification, and a focus on digital transformation will be key for sustained success. The market's future potential lies in the ability of insurers to leverage data analytics, personalized offerings, and innovative risk management strategies to meet evolving customer needs.

Home Insurance Market in Netherlands Segmentation

-

1. Product Type

- 1.1. Motor Insurance

- 1.2. Fire Insurance

- 1.3. Transportation Insurance

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Brokers

- 2.4. Other Distribution Channels

Home Insurance Market in Netherlands Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Home Insurance Market in Netherlands REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption For Technology for Underwriting and Claims Processsing

- 3.3. Market Restrains

- 3.3.1. Cyber Securities Concerns Restraining the Market

- 3.4. Market Trends

- 3.4.1. Motor Insurance is Largest segment of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Insurance Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Motor Insurance

- 5.1.2. Fire Insurance

- 5.1.3. Transportation Insurance

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Brokers

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Home Insurance Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Motor Insurance

- 6.1.2. Fire Insurance

- 6.1.3. Transportation Insurance

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct

- 6.2.2. Agents

- 6.2.3. Brokers

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Home Insurance Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Motor Insurance

- 7.1.2. Fire Insurance

- 7.1.3. Transportation Insurance

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct

- 7.2.2. Agents

- 7.2.3. Brokers

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Home Insurance Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Motor Insurance

- 8.1.2. Fire Insurance

- 8.1.3. Transportation Insurance

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct

- 8.2.2. Agents

- 8.2.3. Brokers

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Home Insurance Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Motor Insurance

- 9.1.2. Fire Insurance

- 9.1.3. Transportation Insurance

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct

- 9.2.2. Agents

- 9.2.3. Brokers

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Home Insurance Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Motor Insurance

- 10.1.2. Fire Insurance

- 10.1.3. Transportation Insurance

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct

- 10.2.2. Agents

- 10.2.3. Brokers

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AEGON Schadeverzekering NV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 N V Unive Schade

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nationale-Nederlanden Schadeverzekering Maatschappij NV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Goudse

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 N V Noordhollandsche van

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Achmea Schadeverzekeringen NV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ABN AMRO Schadeverzekering NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 N V Schadeverzekering - Maatschappij Bovemij

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Klaverblad Schadeverzekeringsmaatschappij NV**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ASR Schadeverzekering NV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AEGON Schadeverzekering NV

List of Figures

- Figure 1: Global Home Insurance Market in Netherlands Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Netherlands Home Insurance Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 3: Netherlands Home Insurance Market in Netherlands Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Home Insurance Market in Netherlands Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America Home Insurance Market in Netherlands Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Home Insurance Market in Netherlands Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America Home Insurance Market in Netherlands Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America Home Insurance Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Home Insurance Market in Netherlands Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Home Insurance Market in Netherlands Revenue (Million), by Product Type 2024 & 2032

- Figure 11: South America Home Insurance Market in Netherlands Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: South America Home Insurance Market in Netherlands Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America Home Insurance Market in Netherlands Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America Home Insurance Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Home Insurance Market in Netherlands Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Home Insurance Market in Netherlands Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Home Insurance Market in Netherlands Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Home Insurance Market in Netherlands Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe Home Insurance Market in Netherlands Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe Home Insurance Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Home Insurance Market in Netherlands Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Home Insurance Market in Netherlands Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Middle East & Africa Home Insurance Market in Netherlands Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Middle East & Africa Home Insurance Market in Netherlands Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa Home Insurance Market in Netherlands Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa Home Insurance Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Home Insurance Market in Netherlands Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Home Insurance Market in Netherlands Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Home Insurance Market in Netherlands Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Home Insurance Market in Netherlands Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific Home Insurance Market in Netherlands Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific Home Insurance Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Home Insurance Market in Netherlands Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global Home Insurance Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Home Insurance Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Insurance Market in Netherlands?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the Home Insurance Market in Netherlands?

Key companies in the market include AEGON Schadeverzekering NV, N V Unive Schade, Nationale-Nederlanden Schadeverzekering Maatschappij NV, Goudse, N V Noordhollandsche van, Achmea Schadeverzekeringen NV, ABN AMRO Schadeverzekering NV, N V Schadeverzekering - Maatschappij Bovemij, Klaverblad Schadeverzekeringsmaatschappij NV**List Not Exhaustive, ASR Schadeverzekering NV.

3. What are the main segments of the Home Insurance Market in Netherlands?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption For Technology for Underwriting and Claims Processsing.

6. What are the notable trends driving market growth?

Motor Insurance is Largest segment of the Market.

7. Are there any restraints impacting market growth?

Cyber Securities Concerns Restraining the Market.

8. Can you provide examples of recent developments in the market?

November 2023: Howden introduced a specialized European cyber and technology errors and omissions line slip tailored for primary businesses. This innovative offering from Howden provides comprehensive coverage for both 1st and 3rd-party prior cyber and tech errors and omissions, incorporating insurer-led breach response capabilities. The package includes a 24/7 hotline and multilingual support to cater to diverse language requirements. This service is extended to businesses across various European countries, with a notable presence in the Netherlands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Insurance Market in Netherlands," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Insurance Market in Netherlands report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Insurance Market in Netherlands?

To stay informed about further developments, trends, and reports in the Home Insurance Market in Netherlands, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence