Key Insights

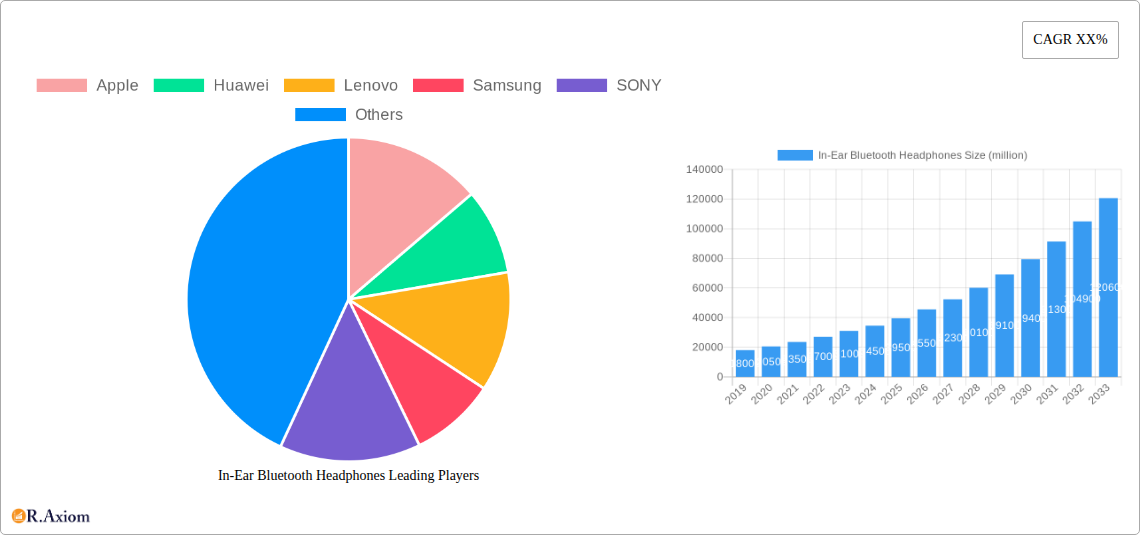

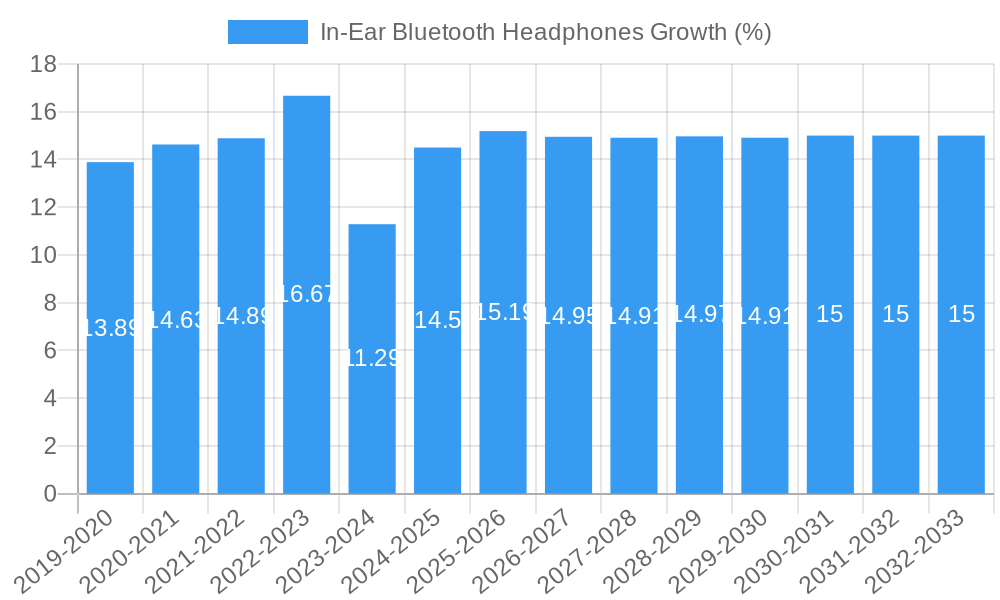

The global In-Ear Bluetooth Headphones market is projected for substantial growth, estimated at a market size of USD 35,000 million in 2025, with a Compound Annual Growth Rate (CAGR) of 15% expected through 2033. This impressive trajectory is primarily fueled by the increasing demand for wireless convenience, enhanced audio experiences, and the integration of smart features. The market is segmented by application, with "Sports" emerging as a dominant segment due to the growing popularity of fitness activities and the inherent portability and sweat-resistance of in-ear designs. "Work" applications are also witnessing significant expansion, driven by the rise of remote work and the need for hands-free communication during virtual meetings. The "Entertainment" segment remains robust, catering to consumers seeking immersive audio for music, podcasts, and gaming. The "Others" category encompasses niche applications, contributing to the overall market dynamism.

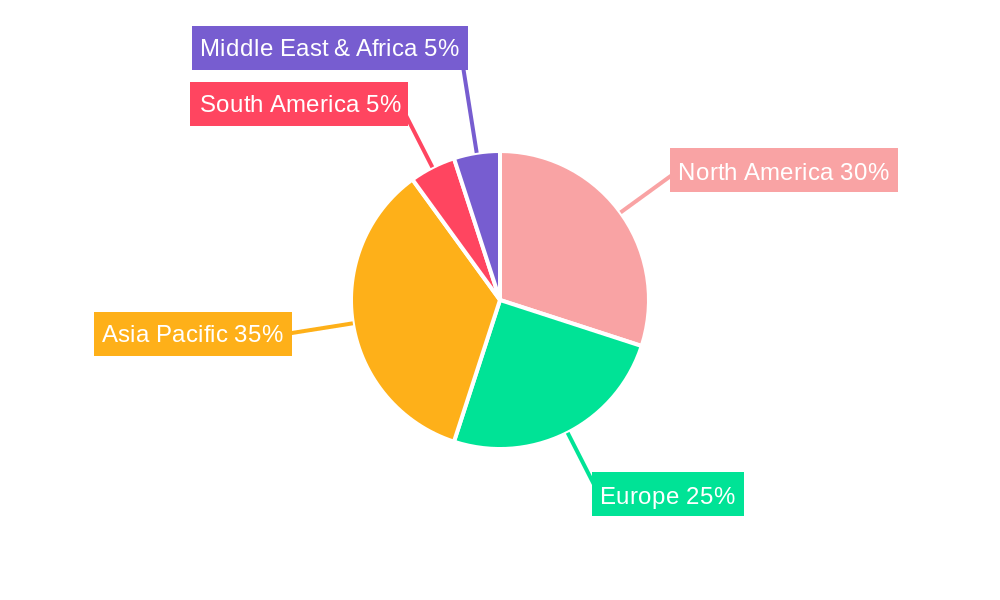

The "Earbuds Type" segment is expected to dominate the market, driven by their compact size, comfortable fit, and advanced functionalities like active noise cancellation and long battery life. While "Halter Neck" designs cater to a specific user base prioritizing security during strenuous activities, the sheer convenience and aesthetic appeal of true wireless earbuds are steering market preference. Key market restraints include concerns over battery life for some budget models and potential audio quality degradation in lower-end products. However, ongoing technological advancements in battery efficiency and audio processing are actively mitigating these challenges. Leading players such as Apple, Samsung, and Sony are continuously innovating, launching premium products that redefine user expectations and drive market expansion across key regions like North America and Asia Pacific, which are anticipated to hold significant market share.

Here is your SEO-optimized, detailed report description for In-Ear Bluetooth Headphones:

In-Ear Bluetooth Headphones Market Concentration & Innovation

The In-Ear Bluetooth Headphones market exhibits a dynamic concentration, influenced by continuous innovation and evolving consumer demands. Key players like Apple, Samsung, and SONY are consistently investing in research and development, driving technological advancements in audio quality, battery life, and active noise cancellation. The market's concentration is also shaped by stringent regulatory frameworks in major economies, ensuring product safety and compliance, alongside the significant impact of product substitutes, such as wired headphones and true wireless earbuds. End-user trends are leaning towards more integrated smart features, extended battery performance, and ergonomic designs tailored for specific applications like sports and professional use. Mergers and Acquisitions (M&A) activity, valued in the millions, plays a crucial role in consolidating market share and expanding product portfolios. For instance, strategic acquisitions by larger conglomerates aim to integrate cutting-edge audio technology and secure intellectual property. The market share of leading companies is closely monitored, with a significant portion concentrated among the top five to seven brands, demonstrating a moderately concentrated landscape.

- Innovation Drivers: Advanced audio codecs, miniaturization of technology, AI-powered features, improved battery management.

- Regulatory Frameworks: Bluetooth SIG certification, FCC, CE marking, regional import/export regulations.

- Product Substitutes: Wired in-ear headphones, over-ear Bluetooth headphones, smartwatches with audio playback.

- End-User Trends: Demand for personalized audio experiences, seamless device connectivity, robust build quality for active lifestyles.

- M&A Activities: Strategic acquisitions to gain market share, access to new technologies, and expand distribution networks. M&A deal values are projected to reach several hundred million in the forecast period.

In-Ear Bluetooth Headphones Industry Trends & Insights

The In-Ear Bluetooth Headphones industry is poised for substantial growth, driven by an amalgamation of technological advancements, evolving consumer preferences, and an expanding range of applications. The global market penetration of wireless audio devices continues to surge, fueled by the increasing adoption of smartphones and other mobile devices that rely on Bluetooth connectivity. A Compound Annual Growth Rate (CAGR) of approximately 15% is anticipated over the forecast period of 2025–2033. This upward trajectory is underpinned by significant market growth drivers, including the relentless pursuit of superior sound fidelity, enhanced comfort, and extended battery life. Technological disruptions, such as the integration of AI for personalized audio profiles, advanced noise cancellation algorithms, and improved voice assistant integration, are creating new product categories and pushing the boundaries of what consumers expect from their audio devices. Consumer preferences are increasingly gravitating towards sleek, minimalist designs, lightweight constructions, and robust durability, especially for sports and outdoor activities. The competitive dynamics within the market are intense, with established giants like Apple, Samsung, and SONY constantly innovating to maintain their market leadership, while agile new entrants like iKF and Shokz are carving out niches through specialized features and targeted marketing. The proliferation of affordable, feature-rich options from brands like Anker and Lenovo is democratizing access to premium wireless audio experiences. The market is also witnessing a growing demand for eco-friendly materials and sustainable manufacturing processes, influencing product development and brand perception. The convenience of wire-free listening, coupled with the increasing affordability of high-quality in-ear Bluetooth headphones, continues to drive adoption across all demographic segments, making it a cornerstone of personal audio technology.

Dominant Markets & Segments in In-Ear Bluetooth Headphones

The In-Ear Bluetooth Headphones market showcases distinct regional dominance and segment leadership, shaped by economic factors, technological adoption rates, and cultural preferences. North America and Europe currently represent the largest markets by revenue, driven by high disposable incomes, widespread smartphone penetration, and a strong consumer appetite for premium audio technology. Within these regions, the Earbuds Type segment overwhelmingly dominates, accounting for over 90% of the total market share.

Key drivers for this dominance include:

- Technological Advancements: Constant innovation in miniaturization, battery efficiency, and audio quality within the earbud form factor.

- Consumer Convenience: The ultra-portable and discreet nature of earbuds makes them ideal for on-the-go lifestyles.

- Application Versatility: Earbuds are highly adaptable for Sports, Work, and Entertainment applications, offering a broad appeal.

- Brand Dominance: The strong presence and marketing power of leading brands like Apple, Samsung, and SONY, who predominantly focus on earbud designs.

In terms of Application, the Entertainment segment leads, followed closely by Sports. The burgeoning use of In-Ear Bluetooth Headphones for immersive music listening, podcast consumption, and in-app audio experiences contributes significantly to this segment's growth. The Sports segment is also a major contributor, with manufacturers developing sweat-resistant, secure-fitting earbuds with features like ambient sound modes for enhanced safety. The Work segment is experiencing rapid growth, driven by the rise of remote work and the need for clear communication during conference calls, with many models now incorporating advanced microphone technology and active noise cancellation. The Others segment, encompassing general commuting and everyday use, also holds a substantial market share.

Emerging markets in Asia-Pacific, particularly China and India, are demonstrating the highest growth rates, fueled by a rapidly expanding middle class, increasing disposable incomes, and a youthful demographic eager to adopt the latest technology. Economic policies encouraging consumer electronics manufacturing and a robust digital infrastructure are also contributing to this surge.

In-Ear Bluetooth Headphones Product Developments

Product development in the In-Ear Bluetooth Headphones sector is characterized by a relentless pursuit of enhanced user experience and technological integration. Innovations are focused on improving audio fidelity through advanced drivers and codec support, extending battery life with efficient power management, and optimizing active noise cancellation (ANC) for more immersive listening. Key advancements include the integration of spatial audio for a more three-dimensional soundscape, personalized sound profiles based on individual hearing, and improved multipoint connectivity for seamless switching between devices. Durability and comfort remain paramount, with new ergonomic designs and robust materials catering to active users. Competitive advantages are being built on unique features like advanced bone conduction technology from Shokz for situational awareness, AI-driven noise reduction for crystal-clear calls, and seamless ecosystem integration, particularly by companies like Apple and Google.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the In-Ear Bluetooth Headphones market, segmented by Application and Type. The Application segments include Sports, Work, Entertainment, and Others, each offering unique growth trajectories and market dynamics. The Sports segment, projected to grow at a CAGR of 16% to reach over $15,000 million by 2033, is driven by increasing fitness consciousness and the demand for durable, sweat-proof devices. The Work segment, estimated to reach $12,000 million by 2033 with a CAGR of 14%, is propelled by the rise of remote work and the demand for clear audio for calls. The Entertainment segment, expected to surpass $20,000 million by 2033 at a CAGR of 15%, benefits from the increasing consumption of digital media. The Others segment, including general use, is projected to reach $8,000 million with a CAGR of 13%. By Type, the market is divided into Halter Neck and Earbuds Type. The Earbuds Type segment, holding over 90% market share currently, is forecast to reach over $45,000 million by 2033 at a CAGR of 15.5%, due to their inherent portability and versatility. The Halter Neck segment, while smaller, is expected to grow at a CAGR of 10% to reach $4,000 million by 2033, catering to users who prefer a secure, attached design.

Key Drivers of In-Ear Bluetooth Headphones Growth

The In-Ear Bluetooth Headphones market is experiencing robust growth driven by several interconnected factors. Technological advancements are paramount, with the continuous evolution of Bluetooth connectivity, battery efficiency, and audio processing power enabling more sophisticated features and superior sound quality. The increasing adoption of smartphones and other portable devices, which heavily rely on wireless audio, serves as a foundational driver. Growing consumer demand for convenience and a wire-free lifestyle, particularly for on-the-go activities like sports, commuting, and travel, is a significant catalyst. Furthermore, the expanding entertainment and gaming industries, coupled with the rise of remote work and online communication tools, are creating a persistent need for high-quality personal audio solutions. Economic growth in emerging markets is also contributing significantly by increasing disposable incomes and driving demand for premium consumer electronics.

Challenges in the In-Ear Bluetooth Headphones Sector

Despite the promising growth, the In-Ear Bluetooth Headphones sector faces several challenges. Intense competition among a multitude of brands, from established giants to new entrants, leads to pricing pressures and necessitates continuous innovation to maintain market share. Supply chain disruptions, as witnessed in recent years, can impact production volumes and lead times, potentially affecting availability and cost. Regulatory hurdles related to wireless spectrum usage and product safety standards in different regions can add complexity and cost to market entry. Furthermore, battery life remains a persistent concern for many consumers, and achieving significant breakthroughs in this area is crucial for user satisfaction. The rapid pace of technological obsolescence also poses a challenge, as newer models with advanced features can quickly render older ones outdated, impacting residual value and encouraging frequent upgrades.

Emerging Opportunities in In-Ear Bluetooth Headphones

Emerging opportunities in the In-Ear Bluetooth Headphones market are abundant and diverse. The integration of advanced Artificial Intelligence (AI) for personalized audio experiences, real-time language translation, and enhanced health monitoring (e.g., hearing health, posture detection) presents a significant frontier. The growing demand for sustainable and eco-friendly products, utilizing recycled materials and energy-efficient manufacturing processes, is creating a niche for environmentally conscious brands. Expansion into untapped emerging markets, particularly in Southeast Asia and Africa, where smartphone penetration is rapidly increasing, offers substantial growth potential. The continued innovation in noise cancellation technology, especially for creating more immersive and adaptable listening environments, will continue to drive demand. Moreover, the development of specialized headphones for niche applications, such as professional audio monitoring, gaming with ultra-low latency, and advanced augmented reality integration, presents exciting avenues for market expansion.

Leading Players in the In-Ear Bluetooth Headphones Market

- Apple

- Huawei

- Lenovo

- Samsung

- SONY

- JBL

- OPPO

- vivo

- Bose

- Beats

- Anker

- iKF

- Shokz

- NANK

Key Developments in In-Ear Bluetooth Headphones Industry

- 2023: Apple launches AirPods Pro (2nd generation) with enhanced noise cancellation and battery life.

- 2023: SONY introduces WF-1000XM5 with industry-leading noise cancellation and superior sound quality.

- 2024: JBL releases its new range of true wireless earbuds with improved durability and water resistance for sports enthusiasts.

- 2024: Anker expands its Soundcore line with budget-friendly options featuring ANC and long battery life.

- 2024: Shokz gains traction with its open-ear bone conduction technology for safety-conscious athletes.

- 2025: Introduction of advanced AI-powered personalized audio tuning by multiple leading brands.

- 2025: Increased focus on sustainable materials and packaging in new product launches.

Strategic Outlook for In-Ear Bluetooth Headphones Market

The strategic outlook for the In-Ear Bluetooth Headphones market remains exceptionally positive, driven by sustained innovation and evolving consumer needs. The convergence of audio technology with smart functionalities, such as AI integration for personalized experiences and health tracking, will be a key growth catalyst. Expansion into underserved emerging markets, coupled with a focus on developing eco-friendly and sustainable product lines, presents significant opportunities for market penetration. Companies that can effectively balance premium features with competitive pricing, while also offering seamless ecosystem integration and exceptional battery performance, are poised for long-term success. The continuous evolution of mobile device usage, the growing popularity of immersive entertainment, and the enduring demand for convenient, high-quality audio solutions ensure a dynamic and robust future for this market.

In-Ear Bluetooth Headphones Segmentation

-

1. Application

- 1.1. Sports

- 1.2. Work

- 1.3. Entertainment

- 1.4. Others

-

2. Types

- 2.1. Halter Neck

- 2.2. Earbuds Type

In-Ear Bluetooth Headphones Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

In-Ear Bluetooth Headphones REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sports

- 5.1.2. Work

- 5.1.3. Entertainment

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Halter Neck

- 5.2.2. Earbuds Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sports

- 6.1.2. Work

- 6.1.3. Entertainment

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Halter Neck

- 6.2.2. Earbuds Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sports

- 7.1.2. Work

- 7.1.3. Entertainment

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Halter Neck

- 7.2.2. Earbuds Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sports

- 8.1.2. Work

- 8.1.3. Entertainment

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Halter Neck

- 8.2.2. Earbuds Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sports

- 9.1.2. Work

- 9.1.3. Entertainment

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Halter Neck

- 9.2.2. Earbuds Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sports

- 10.1.2. Work

- 10.1.3. Entertainment

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Halter Neck

- 10.2.2. Earbuds Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Apple

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huawei

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lenovo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samsung

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SONY

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JBL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OPPO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 vivo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bose

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Google

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Beats

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Anker

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 iKF

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Shokz

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 NANK

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Apple

List of Figures

- Figure 1: Global In-Ear Bluetooth Headphones Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America In-Ear Bluetooth Headphones Revenue (million), by Application 2024 & 2032

- Figure 3: North America In-Ear Bluetooth Headphones Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America In-Ear Bluetooth Headphones Revenue (million), by Types 2024 & 2032

- Figure 5: North America In-Ear Bluetooth Headphones Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America In-Ear Bluetooth Headphones Revenue (million), by Country 2024 & 2032

- Figure 7: North America In-Ear Bluetooth Headphones Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America In-Ear Bluetooth Headphones Revenue (million), by Application 2024 & 2032

- Figure 9: South America In-Ear Bluetooth Headphones Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America In-Ear Bluetooth Headphones Revenue (million), by Types 2024 & 2032

- Figure 11: South America In-Ear Bluetooth Headphones Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America In-Ear Bluetooth Headphones Revenue (million), by Country 2024 & 2032

- Figure 13: South America In-Ear Bluetooth Headphones Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe In-Ear Bluetooth Headphones Revenue (million), by Application 2024 & 2032

- Figure 15: Europe In-Ear Bluetooth Headphones Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe In-Ear Bluetooth Headphones Revenue (million), by Types 2024 & 2032

- Figure 17: Europe In-Ear Bluetooth Headphones Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe In-Ear Bluetooth Headphones Revenue (million), by Country 2024 & 2032

- Figure 19: Europe In-Ear Bluetooth Headphones Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa In-Ear Bluetooth Headphones Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa In-Ear Bluetooth Headphones Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa In-Ear Bluetooth Headphones Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa In-Ear Bluetooth Headphones Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa In-Ear Bluetooth Headphones Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa In-Ear Bluetooth Headphones Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific In-Ear Bluetooth Headphones Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific In-Ear Bluetooth Headphones Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific In-Ear Bluetooth Headphones Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific In-Ear Bluetooth Headphones Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific In-Ear Bluetooth Headphones Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific In-Ear Bluetooth Headphones Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Country 2019 & 2032

- Table 41: China In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the In-Ear Bluetooth Headphones?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the In-Ear Bluetooth Headphones?

Key companies in the market include Apple, Huawei, Lenovo, Samsung, SONY, JBL, OPPO, vivo, Bose, Google, Beats, Anker, iKF, Shokz, NANK.

3. What are the main segments of the In-Ear Bluetooth Headphones?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "In-Ear Bluetooth Headphones," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the In-Ear Bluetooth Headphones report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the In-Ear Bluetooth Headphones?

To stay informed about further developments, trends, and reports in the In-Ear Bluetooth Headphones, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence