Key Insights

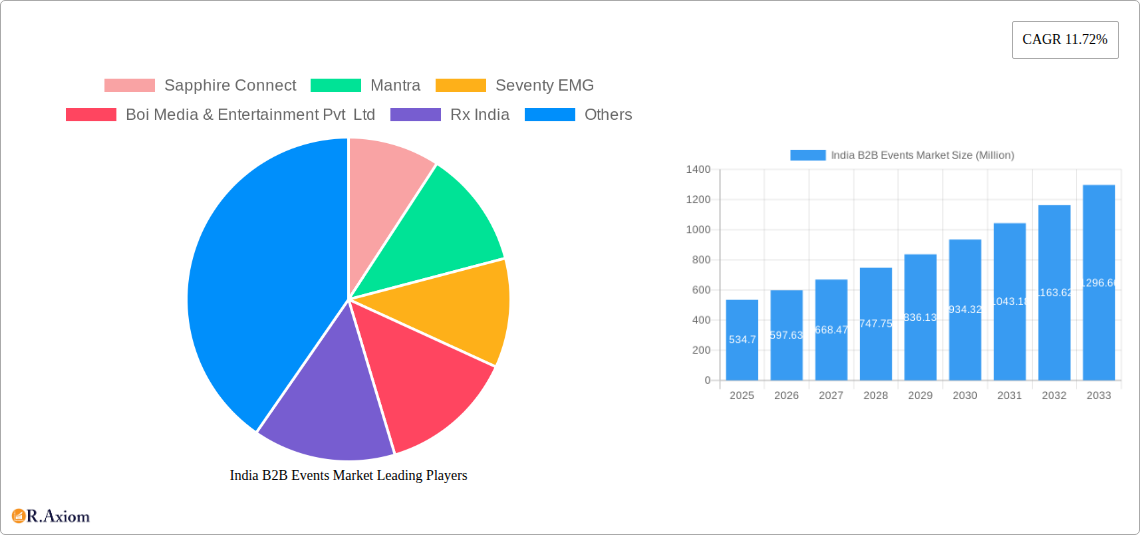

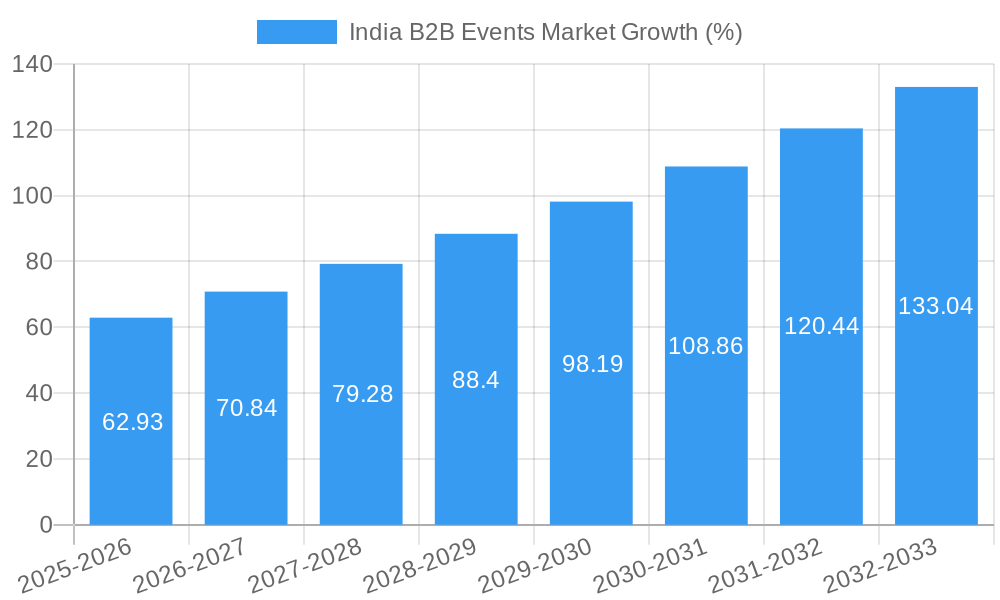

The India B2B events market is experiencing robust growth, projected to reach \$534.70 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 11.72% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the increasing adoption of digital technologies is transforming the events landscape, with virtual and hybrid formats gaining popularity, allowing for broader reach and cost-effectiveness. Secondly, a burgeoning Indian economy, especially in sectors like BFSI, FMCG, and technology, necessitates more business networking and knowledge-sharing opportunities, driving demand for specialized B2B events. Furthermore, the government's focus on infrastructure development and ease of doing business further encourages large-scale industry conferences and trade shows. However, challenges remain, including potential economic fluctuations impacting event budgets and evolving consumer preferences that necessitate creative and engaging event formats. Segmentation analysis reveals significant growth potential across various verticals. The BFSI, FMCG, and technology sectors are expected to lead, while the luxury and healthcare sectors show promising growth trajectories. Geographically, while data is not provided for specific regions (North, East, West, South India), we can infer that regions with stronger economic activity and a higher concentration of target industries will contribute more significantly to the overall market size. The competitive landscape is marked by both established players and emerging event management companies, fostering innovation and driving market dynamism. The forecast period (2025-2033) anticipates continued growth, driven by technological advancements, evolving industry needs, and the enduring value of in-person networking and relationship-building.

The success of individual companies will depend on their ability to adapt to changing industry dynamics, provide innovative and engaging event experiences, and strategically leverage digital technologies. The market's overall trajectory suggests a bright future for B2B events in India, presenting lucrative opportunities for both established and new entrants. Companies need to focus on tailored solutions catering to specific industry needs, enhancing the virtual and hybrid event experience, and focusing on data-driven insights to improve event ROI. The market is likely to see further consolidation as companies strategically expand their services and target new industry segments. The consistent growth across the forecast period signifies the India B2B events market's resilience and future potential.

India B2B Events Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India B2B events market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth drivers, challenges, and opportunities, enabling businesses to make informed strategic decisions. The report segments the market by platform (physical and virtual events), end-user verticals (Food and Beverage, PSU, Luxury, BFSI, FMCG, Retail, Healthcare, Automotive, and Other), and region (North, East, West, and South). With a base year of 2025 and an estimated year of 2025, this report projects market trends until 2033, providing a crucial roadmap for navigating this dynamic sector.

India B2B Events Market Concentration & Innovation

The India B2B events market exhibits a moderately concentrated landscape with a few large players dominating alongside numerous smaller, specialized firms. Key players such as Wizcraft Entertainment Agency Pvt Ltd, Laqshya Group (Event Capital), and Seventy EMG hold significant market share, estimated at xx%, xx%, and xx%, respectively, in 2025. However, the market also shows high fragmentation due to a large number of regional and niche players.

Innovation is driven by technological advancements like virtual and hybrid event platforms, AI-powered event management tools, and data analytics for improved attendee engagement and ROI. Regulatory frameworks, while generally supportive of the events industry, are constantly evolving, impacting licensing and safety standards. The market witnesses continuous innovation in event formats, experiential marketing techniques, and sustainable event practices.

Product substitutes, such as online webinars and virtual conferences, are increasingly challenging the traditional physical events model, forcing organizers to offer hybrid or immersive experiences. End-user trends indicate a preference for personalized, engaging events that offer networking opportunities and valuable knowledge exchange.

M&A activity has been moderate in recent years, with deal values ranging from xx Million to xx Million. Notable acquisitions include (examples to be added based on available data). This consolidation trend is expected to continue as larger players seek to expand their market reach and service offerings.

India B2B Events Market Industry Trends & Insights

The India B2B events market is experiencing robust growth, fueled by factors such as increasing business investments, rising disposable incomes, and the government's focus on promoting trade and tourism. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), with the market size estimated at xx Million in 2025 and expected to reach xx Million by 2033. Market penetration for virtual events is still relatively low, but growing rapidly at a CAGR of xx%, driven by technological advancements and cost-effectiveness. Consumer preferences are shifting towards more personalized and interactive events, with a focus on networking and knowledge sharing. Competitive dynamics are intensifying, with players focusing on differentiation through unique event formats, enhanced technology integration, and specialized services. Technological disruptions are continuously reshaping the industry, as digital tools and platforms streamline event planning, management, and attendee engagement.

Dominant Markets & Segments in India B2B Events Market

By Platform: Physical events still dominate the market, accounting for approximately xx% of the total market share in 2025. However, the virtual events segment is exhibiting significant growth, driven by the increasing adoption of technology and cost-effectiveness. This segment is expected to reach xx% market share by 2033.

By End-user Verticals: The BFSI, FMCG, and Healthcare sectors are major drivers of the market, accounting for xx%, xx%, and xx% of the total market share, respectively, in 2025. Strong growth is expected in the Food & Beverage and Automotive sectors, spurred by industry-specific events and increasing competition.

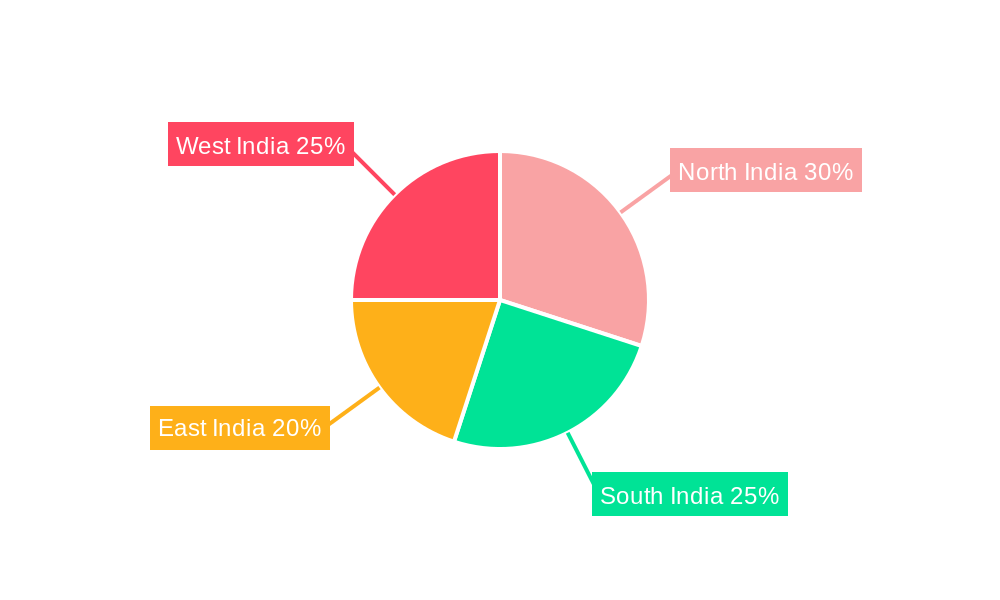

By Region: The North region currently holds the largest market share at approximately xx% due to a higher concentration of businesses and established infrastructure. However, the South region is expected to witness considerable growth driven by economic development and increasing investments.

Key drivers for the dominant segments and regions include favorable economic policies promoting trade and investment, expanding infrastructure, and the government's initiatives to support businesses and industries.

India B2B Events Market Product Developments

The India B2B events market is witnessing the rapid development and adoption of advanced technologies. Hybrid events combining physical and virtual elements are gaining traction. AI-powered solutions enhance event management, personalized experiences, and data analytics capabilities. Sustainable practices are also gaining momentum, with event organizers adopting eco-friendly strategies and focusing on reducing their carbon footprint. This aligns with the growing demand for responsible and ethical events.

Report Scope & Segmentation Analysis

This report offers a detailed analysis of the India B2B events market segmented by:

Platform: Physical and virtual events, detailing market size, growth projections, and competitive dynamics within each segment.

End-user Verticals: Food & Beverage, PSU, Luxury, BFSI, FMCG, Retail, Healthcare, Automotive, and Others, providing insights into specific industry trends and growth forecasts.

Region: North, East, West, and South, offering a geographical breakdown of market size and growth projections.

Key Drivers of India B2B Events Market Growth

The growth of the India B2B events market is propelled by several key factors:

- Economic growth: India's burgeoning economy fuels investment in business events and conferences.

- Technological advancements: The adoption of virtual and hybrid event formats is increasing reach and efficiency.

- Government initiatives: Policies promoting trade and investment boost event participation.

- Rising disposable incomes: Increased spending power fuels demand for high-quality events.

Challenges in the India B2B Events Market Sector

The India B2B events market faces challenges such as:

- Infrastructure limitations: Limited availability of suitable venues in some regions.

- Competition: Intense rivalry among event organizers necessitates continuous innovation.

- Economic volatility: Fluctuations in the economy can impact event budgets and attendance.

- Regulatory changes: Evolving regulations pose operational complexities.

Emerging Opportunities in India B2B Events Market

Significant opportunities exist in the India B2B events market, including:

- Expansion of virtual and hybrid events: Reaching wider audiences and optimizing costs.

- Growth in niche events: Catering to specialized industries and sectors.

- Leveraging technology: Using data analytics and AI for enhanced customer engagement.

- Focus on sustainability: Meeting increasing demand for eco-friendly events.

Leading Players in the India B2B Events Market Market

- Sapphire Connect

- Mantra

- Seventy EMG

- Boi Media & Entertainment Pvt Ltd

- Rx India

- TechnologyCounter

- CAB

- Hexagon Events Private Limited

- Wizcraft Entertainment Agency Pvt Ltd

- Neoniche Integrated Solutions Pvt Ltd

- Craftworld Events Management Company

- Seventy Seven Entertainment Pvt Ltd

- Experiential Marketing Solutions Pvt Ltd (Collective Heads)

- Toast

- Blackboard Communications

- Laqshya Group (Event Capital)

- XP&D (XP and Land)

Key Developments in India B2B Events Market Industry

March 2024: Bharat Tex 2024 in New Delhi, showcasing India's textile capabilities with 3,500 exhibitors and 100,000 visitors.

November 2023: A mega B2B food event in Delhi, attracting 1208 exhibitors, 14 country pavilions, and over 715 foreign buyers, highlighting advancements in the food processing industry.

Strategic Outlook for India B2B Events Market Market

The India B2B events market presents significant growth potential over the next decade. The increasing adoption of technology, coupled with a robust economy and government support, will fuel expansion. Focus on niche events, hybrid models, and sustainable practices will be key differentiators for success. The market's dynamic nature necessitates agility and innovation to capitalize on emerging opportunities.

India B2B Events Market Segmentation

-

1. Platform

- 1.1. Physical Events

- 1.2. Virtual Events

-

2. End-user Verticals

- 2.1. Food and Beverage

- 2.2. PSU

- 2.3. Luxury

- 2.4. BFSI

- 2.5. FMCG

- 2.6. Retail

- 2.7. Healthcare

- 2.8. Automotive

- 2.9. Other End-user Verticals

India B2B Events Market Segmentation By Geography

- 1. India

India B2B Events Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mobile e-commerce to be the fastest-growing retailing channel due to proliferation of mobile apps and convenience; Retailers develop mobile-friendly strategies to attract young and tech-savvy consumers

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness Among Government Organizations About New Technologies

- 3.4. Market Trends

- 3.4.1. Retail Sector to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India B2B Events Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Physical Events

- 5.1.2. Virtual Events

- 5.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.2.1. Food and Beverage

- 5.2.2. PSU

- 5.2.3. Luxury

- 5.2.4. BFSI

- 5.2.5. FMCG

- 5.2.6. Retail

- 5.2.7. Healthcare

- 5.2.8. Automotive

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North India India B2B Events Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India B2B Events Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India B2B Events Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India B2B Events Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Sapphire Connect

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mantra

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Seventy EMG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Boi Media & Entertainment Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Rx India

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 TechnologyCounter

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 CAB

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hexagon Events Private Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wizcraft Entertainment Agency Pvt Lt

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Neoniche Integrated Solutions Pvt Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 CraftworldEvents Management Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Seventy Seven Entertainment Pvt Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Experential Marketing Solutions Pvt Ltd (Collective Heads)

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Toast

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Blackboard Communications

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Laqshya Group(Event Capital)

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 XP&D (XP and Land)

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 Sapphire Connect

List of Figures

- Figure 1: India B2B Events Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India B2B Events Market Share (%) by Company 2024

List of Tables

- Table 1: India B2B Events Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India B2B Events Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 3: India B2B Events Market Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 4: India B2B Events Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India B2B Events Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India B2B Events Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India B2B Events Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India B2B Events Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India B2B Events Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India B2B Events Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 11: India B2B Events Market Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 12: India B2B Events Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India B2B Events Market?

The projected CAGR is approximately 11.72%.

2. Which companies are prominent players in the India B2B Events Market?

Key companies in the market include Sapphire Connect, Mantra, Seventy EMG, Boi Media & Entertainment Pvt Ltd, Rx India, TechnologyCounter, CAB, Hexagon Events Private Limited, Wizcraft Entertainment Agency Pvt Lt, Neoniche Integrated Solutions Pvt Ltd, CraftworldEvents Management Company, Seventy Seven Entertainment Pvt Ltd, Experential Marketing Solutions Pvt Ltd (Collective Heads), Toast, Blackboard Communications, Laqshya Group(Event Capital), XP&D (XP and Land).

3. What are the main segments of the India B2B Events Market?

The market segments include Platform, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 534.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Mobile e-commerce to be the fastest-growing retailing channel due to proliferation of mobile apps and convenience; Retailers develop mobile-friendly strategies to attract young and tech-savvy consumers.

6. What are the notable trends driving market growth?

Retail Sector to be the Largest End User.

7. Are there any restraints impacting market growth?

; Lack of Awareness Among Government Organizations About New Technologies.

8. Can you provide examples of recent developments in the market?

In March 2024, by bringing together 3,500 exhibitors from across the entire value chain under one roof for the first time, the theme of Bharat Tex 2024 emphasized India’s capability to provide end-to-end textile solutions. Spread across nearly two million square feet and attracting 100,000 visitors, this huge event, staged in New Delhi, was organized by a consortium of 11 textile export promotion councils and sponsored by the country’s Ministry of Textile.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India B2B Events Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India B2B Events Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India B2B Events Market?

To stay informed about further developments, trends, and reports in the India B2B Events Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence