Key Insights

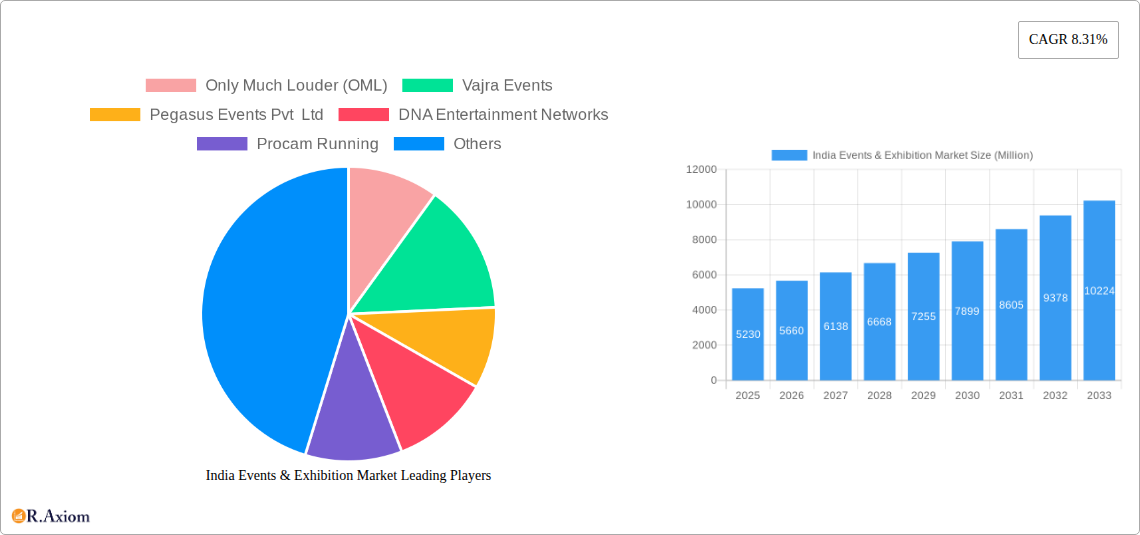

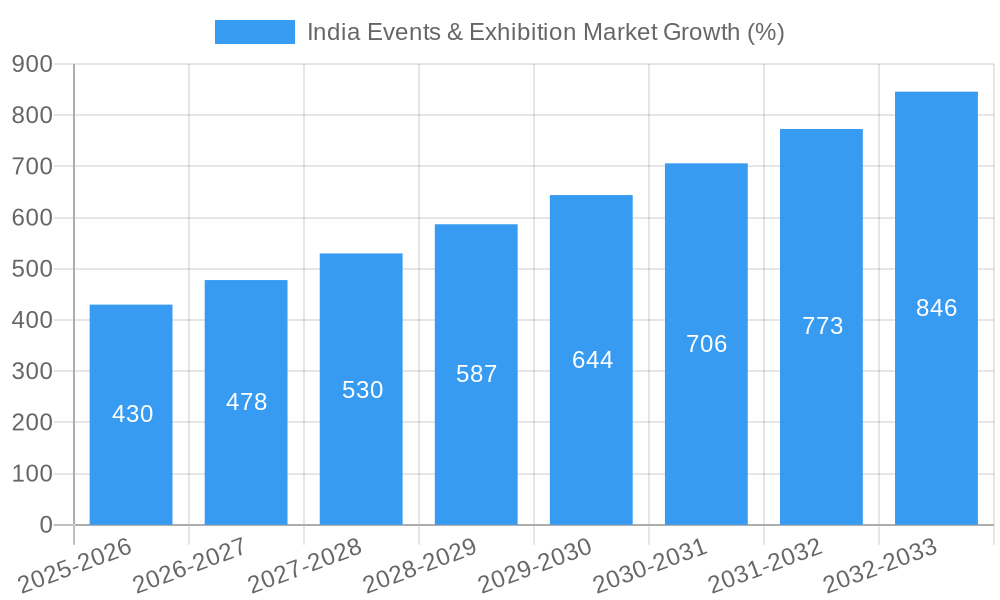

The India events and exhibition market, valued at $5.23 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.31% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning Indian economy, coupled with increasing disposable incomes and a growing middle class, fuels greater consumer spending on entertainment, leisure, and business networking opportunities. Furthermore, the government's initiatives to improve infrastructure and promote tourism are creating a favorable environment for the industry's expansion. The rise of digital marketing and technology integration within event management also contributes significantly, enhancing reach and efficiency. Diversification across various end-user segments, including consumer goods and retail, automotive, industrial sectors, and the burgeoning entertainment and hospitality industries, ensures a broad-based growth trajectory. While potential challenges such as economic fluctuations and competition from online alternatives exist, the overall outlook remains positive due to India's expanding economy and the inherent appeal of in-person networking and engagement.

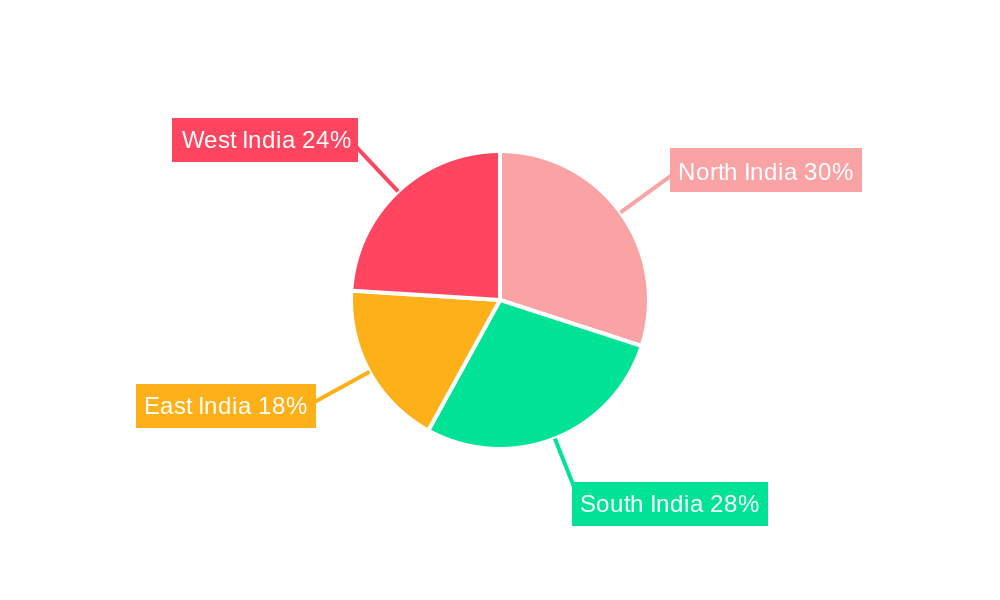

The market segmentation reveals diverse revenue streams, including exhibitor fees, sponsorship fees, and entrance fees, allowing for multiple avenues of growth and resilience. The presence of a diverse range of established players like Wizcraft, Percept Limited, and Informa, alongside emerging companies, underscores the competitive yet dynamic nature of the market. Regional variations in growth are expected, with metropolitan areas like Mumbai, Delhi, and Bangalore likely leading the charge, followed by other key urban centers across North, South, East, and West India. The forecast period (2025-2033) is expected to witness continuous expansion, fueled by sustained economic growth and evolving consumer preferences. The increasing sophistication of event management technologies and innovative event formats further contribute to the market's bright prospects, making it an attractive investment destination.

This detailed report provides a comprehensive analysis of the India Events & Exhibition Market, offering valuable insights for industry stakeholders, investors, and businesses looking to navigate this dynamic sector. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period, utilizing data from the base year 2025 and historical data from 2019-2024. The market is segmented by end-user, type, and revenue stream, providing a granular understanding of its composition and growth trajectory. The report projects a market size of xx Million by 2033, representing a significant CAGR of xx%.

India Events & Exhibition Market Market Concentration & Innovation

The Indian events and exhibition market demonstrates a moderately concentrated landscape, with a few large players like Wizcraft and Percept Limited holding significant market share, alongside numerous smaller and specialized companies. However, the market is characterized by intense competition, especially in the B2C segment. Innovation is driven by the adoption of technology – virtual and hybrid events, advanced event management software, and data analytics for audience targeting. Regulatory frameworks, while generally supportive, are subject to occasional changes, impacting operational costs and event logistics. Product substitutes, such as virtual conferences and online webinars, present challenges, though the in-person experience continues to be highly valued. End-user trends indicate increasing demand for specialized and niche events, catering to specific industry needs and consumer preferences. M&A activities have been moderate, with deal values ranging from xx Million to xx Million in recent years, indicating consolidation and expansion strategies within the sector.

- Market Share: Top 5 players hold approximately xx% of the market share (estimated).

- M&A Deal Values: Average deal value between 2019-2024: xx Million. Highest deal value: xx Million.

- Innovation Drivers: Technological advancements, evolving consumer preferences, and government support for the events sector.

- Regulatory Framework: Primarily supportive but subject to occasional changes concerning licensing and permits.

India Events & Exhibition Market Industry Trends & Insights

The Indian events and exhibition market is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and a burgeoning middle class. The CAGR for the period 2025-2033 is projected to be xx%, fueled by significant growth in the B2C segment. Technological disruptions, particularly the rise of hybrid and virtual events, are transforming the industry, presenting both opportunities and challenges. Consumer preferences are shifting towards experiential events with high levels of engagement and personalization. Competitive dynamics are intense, with companies focusing on differentiation through unique event concepts, technology integration, and superior customer service. Market penetration of hybrid events is steadily growing, currently estimated at xx% and projected to reach xx% by 2033.

Dominant Markets & Segments in India Events & Exhibition Market

The Consumer Goods and Retail segment currently dominates the Indian events and exhibition market, followed by the Automotive and Transportation sector. The B2C event type holds the largest market share, reflecting the substantial growth in consumer spending and the increasing popularity of lifestyle and entertainment events. Exhibitor fees are the primary revenue stream, followed by sponsorship and entrance fees.

Key Drivers (Consumer Goods & Retail):

- Rising disposable incomes

- Growing demand for experiential retail

- Expansion of e-commerce influencing offline events

Key Drivers (B2C):

- Growing middle class and youth population

- Increased consumer spending on entertainment and leisure

- Rising adoption of digital marketing driving event attendance

Key Drivers (Exhibitor Fees):

- High demand for exhibition space

- Increasing participation from both domestic and international exhibitors

- Strategic location advantage of major exhibition centers

India Events & Exhibition Market Product Developments

The market is witnessing significant product innovation, including the integration of virtual reality (VR) and augmented reality (AR) technologies, personalized event experiences, and advanced data analytics for improved audience engagement and ROI measurement. These developments are enhancing event effectiveness, attracting broader audiences, and improving the overall value proposition for both exhibitors and attendees. The focus is shifting towards creating immersive and interactive experiences that cater to the evolving preferences of the modern consumer.

Report Scope & Segmentation Analysis

This report segments the India Events & Exhibition Market across various dimensions:

By End User: Consumer Goods and Retail, Automotive and Transportation, Industrial, Entertainment, Real Estate and Property, Hospitality, Healthcare and Pharmaceutical, Other End Users. Each segment shows varying growth rates, with Consumer Goods and Retail exhibiting the highest.

By Type: B2B, B2C, Mixed/Hybrid. B2C events are currently dominant, but hybrid events are projected to experience rapid growth.

By Revenue Stream: Exhibitor Fee, Sponsorship Fee, Entrance Fee, Services. Exhibitor fees represent the largest revenue segment.

Growth projections vary across segments, with the fastest growth expected in the hybrid events segment within the next decade. Competitive dynamics differ based on segment, with significant competition in B2C segments and more niche competition within specialized B2B events.

Key Drivers of India Events & Exhibition Market Growth

The growth of the Indian events and exhibition market is primarily driven by economic expansion, rising disposable incomes, increasing urbanization, and government initiatives promoting tourism and infrastructure development. Technological advancements, like hybrid and virtual event platforms, further enhance market growth by expanding reach and accessibility. Favorable government policies, such as simplification of event licensing procedures, are also contributing factors.

Challenges in the India Events & Exhibition Market Sector

The sector faces challenges such as infrastructure limitations in certain regions, intense competition among event organizers, and occasional regulatory hurdles. Supply chain disruptions, particularly in logistics and event management resources, can impact operational efficiency and event costs. Fluctuations in the macroeconomic environment also influence consumer spending and exhibitor participation.

Emerging Opportunities in India Events & Exhibition Market

Emerging opportunities lie in the expansion of niche events catering to specific industry needs, the increased adoption of technology for enhanced audience engagement, and the growth of experiential events and sustainable practices. Tier 2 and 3 cities present untapped potential for event organizers. The integration of AI and data analytics holds significant promise for improving event efficiency and audience targeting.

Leading Players in the India Events & Exhibition Market Market

- Only Much Louder (OML)

- Vajra Events

- Pegasus Events Pvt Ltd

- DNA Entertainment Networks

- Procam Running

- Oxygen Entertainment

- Atrri Events

- Showtime Event

- WoodCraft Event and Entertainment

- ABEC Ltd

- Mex Exhibitions Private Limited

- Informa

- Wow Events

- Cineyug Entertainment Private Limited

- Percept Limited

- 70 EVENT MEDIA GROUP

- Bharat Exhibitions

- HostIndia Events

- E factor Entertainment Pvt Ltd

- Messe Muenchen

- Wizcraft

- TAFCON Projects (India) Pvt Ltd

Key Developments in India Events & Exhibition Market Industry

- May 2023: Globe-Tech Media Solutions launched a four-day engineering expo in Pune, showcasing the growing importance of specialized industry events.

- April 2023: Qala India’s fashion exhibition in Indore highlights the expansion of events into tier-2 cities and the increasing demand for designer goods.

Strategic Outlook for India Events & Exhibition Market Market

The Indian events and exhibition market is poised for significant growth, driven by strong economic fundamentals, evolving consumer preferences, and technological advancements. The increasing adoption of hybrid models and the expansion into new markets present substantial opportunities for industry players. Companies focusing on innovation, technological integration, and customer experience are well-positioned to capitalize on this growth trajectory.

India Events & Exhibition Market Segmentation

-

1. Type

- 1.1. B2B

- 1.2. B2C

- 1.3. Mixed/Hybrid

-

2. Reveue Stream

- 2.1. Exhibitor Fee

- 2.2. Sponsorship Fee

- 2.3. Entrance Fee

- 2.4. Services

-

3. End User

- 3.1. Consumer Goods and Retail

- 3.2. Automotive and Transportation

- 3.3. Industrial

- 3.4. Entertainment

- 3.5. Real Estate and Property

- 3.6. Hospitality

- 3.7. Healthcare and Pharmaceutical

- 3.8. Other End Users

India Events & Exhibition Market Segmentation By Geography

- 1. India

India Events & Exhibition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Geo-cloning for Exhibition Organizers; Increasing Growth of Consumer Goods Penetrating B2C Exhibition

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Energy-efficient Pumps; Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Geo-cloning for Exhibition Organizers is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Events & Exhibition Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. B2B

- 5.1.2. B2C

- 5.1.3. Mixed/Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Reveue Stream

- 5.2.1. Exhibitor Fee

- 5.2.2. Sponsorship Fee

- 5.2.3. Entrance Fee

- 5.2.4. Services

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Consumer Goods and Retail

- 5.3.2. Automotive and Transportation

- 5.3.3. Industrial

- 5.3.4. Entertainment

- 5.3.5. Real Estate and Property

- 5.3.6. Hospitality

- 5.3.7. Healthcare and Pharmaceutical

- 5.3.8. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Events & Exhibition Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Events & Exhibition Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Events & Exhibition Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Events & Exhibition Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Only Much Louder (OML)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vajra Events

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Pegasus Events Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 DNA Entertainment Networks

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Procam Running

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Oxygen Entertainment

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Atrri Events

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Showtime Event

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 WoodCraft Event and Entertainment

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ABEC Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Mex Exhibitions Private Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Informa*List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Wow Events

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Cineyug Entertainment Private Limited

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Percept Limited

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 70 EVENT MEDIA GROUP

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Bharat Exhibitions

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 HostIndia Events

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 E factor Entertainment Pvt Ltd

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Messe Muenchen

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.21 Wizcraft

- 10.2.21.1. Overview

- 10.2.21.2. Products

- 10.2.21.3. SWOT Analysis

- 10.2.21.4. Recent Developments

- 10.2.21.5. Financials (Based on Availability)

- 10.2.22 TAFCON Projects (India) Pvt Ltd

- 10.2.22.1. Overview

- 10.2.22.2. Products

- 10.2.22.3. SWOT Analysis

- 10.2.22.4. Recent Developments

- 10.2.22.5. Financials (Based on Availability)

- 10.2.1 Only Much Louder (OML)

List of Figures

- Figure 1: India Events & Exhibition Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Events & Exhibition Market Share (%) by Company 2024

List of Tables

- Table 1: India Events & Exhibition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Events & Exhibition Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Events & Exhibition Market Revenue Million Forecast, by Reveue Stream 2019 & 2032

- Table 4: India Events & Exhibition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: India Events & Exhibition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Events & Exhibition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Events & Exhibition Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Events & Exhibition Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Events & Exhibition Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Events & Exhibition Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Events & Exhibition Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Events & Exhibition Market Revenue Million Forecast, by Reveue Stream 2019 & 2032

- Table 13: India Events & Exhibition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: India Events & Exhibition Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Events & Exhibition Market?

The projected CAGR is approximately 8.31%.

2. Which companies are prominent players in the India Events & Exhibition Market?

Key companies in the market include Only Much Louder (OML), Vajra Events, Pegasus Events Pvt Ltd, DNA Entertainment Networks, Procam Running, Oxygen Entertainment, Atrri Events, Showtime Event, WoodCraft Event and Entertainment, ABEC Ltd, Mex Exhibitions Private Limited, Informa*List Not Exhaustive, Wow Events, Cineyug Entertainment Private Limited, Percept Limited, 70 EVENT MEDIA GROUP, Bharat Exhibitions, HostIndia Events, E factor Entertainment Pvt Ltd, Messe Muenchen, Wizcraft, TAFCON Projects (India) Pvt Ltd.

3. What are the main segments of the India Events & Exhibition Market?

The market segments include Type, Reveue Stream, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Geo-cloning for Exhibition Organizers; Increasing Growth of Consumer Goods Penetrating B2C Exhibition.

6. What are the notable trends driving market growth?

Growing Adoption of Geo-cloning for Exhibition Organizers is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

; High Cost of Energy-efficient Pumps; Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

May 2023 - Globe-Tech Media Solutions announced a four-day-long engineering expo at the Auto Cluster Exhibition Centre in Pune. The Engineering Expo aims to bring together innovative and dynamic stakeholders from the engineering and manufacturing industries, providing industry professionals and buyers with a unique opportunity to exchange ideas and explore the latest trends and technologies in the field.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Events & Exhibition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Events & Exhibition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Events & Exhibition Market?

To stay informed about further developments, trends, and reports in the India Events & Exhibition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence