Key Insights

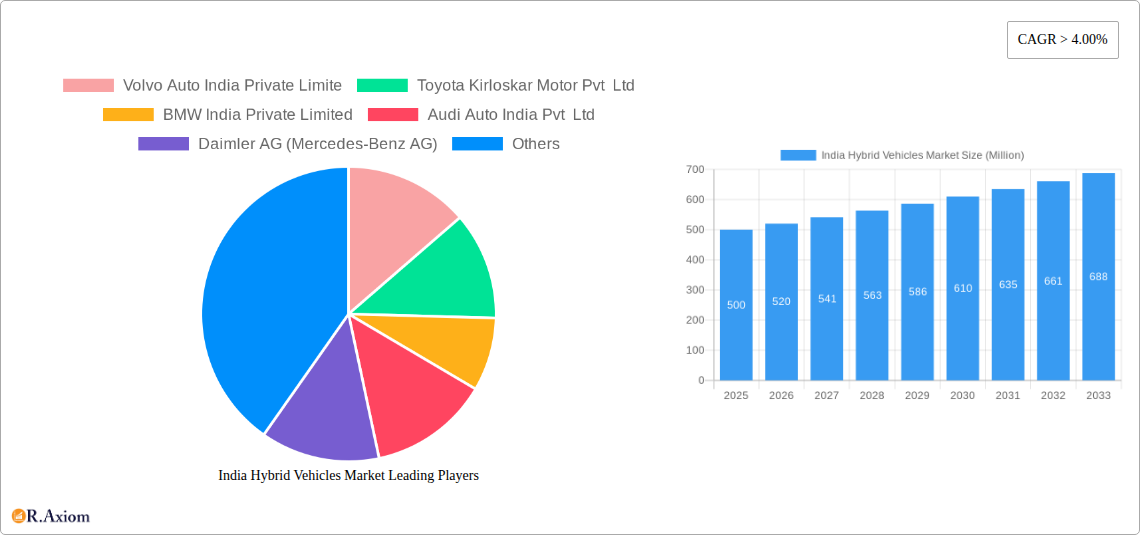

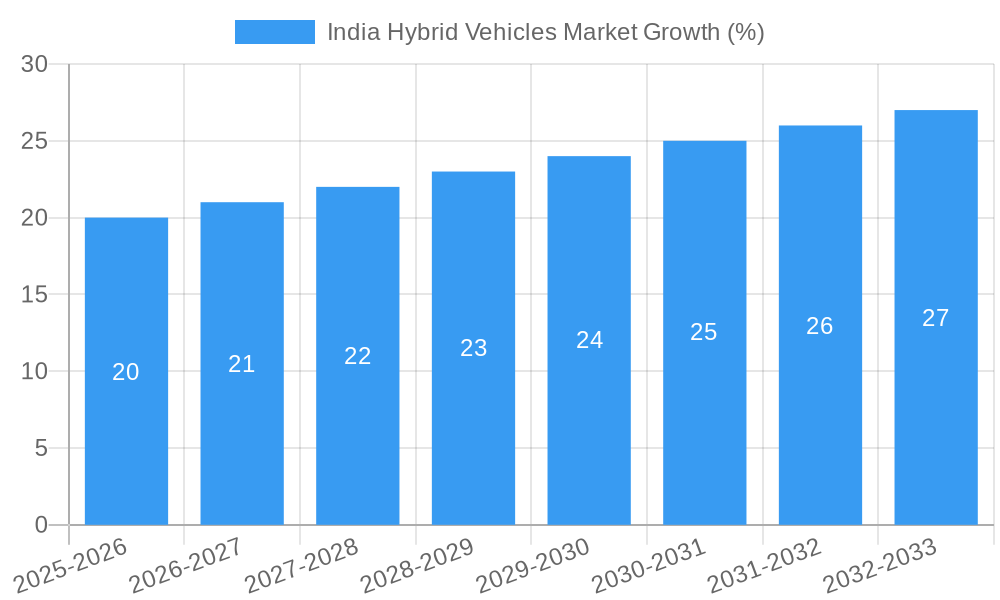

The India hybrid vehicle market is experiencing robust growth, fueled by increasing environmental concerns, stringent emission norms, and government incentives promoting fuel efficiency. With a Compound Annual Growth Rate (CAGR) exceeding 4% and a market size valued in the millions (precise figures unavailable without further specification of the "XX" value provided), this sector presents significant opportunities for automotive manufacturers. Key drivers include rising fuel prices, increasing consumer awareness of environmental issues, and the introduction of technologically advanced hybrid models offering better fuel economy and performance compared to traditional vehicles. The commercial vehicle segment is expected to contribute significantly to this growth, driven by fleet operators seeking to reduce operational costs and meet sustainability goals. Leading players like Maruti Suzuki, Hyundai, Toyota, and Volvo are actively investing in hybrid technology and expanding their product portfolios to cater to growing demand. While challenges remain, such as high initial purchase costs compared to conventional vehicles and limited charging infrastructure in some regions, the long-term outlook for the India hybrid vehicle market remains positive.

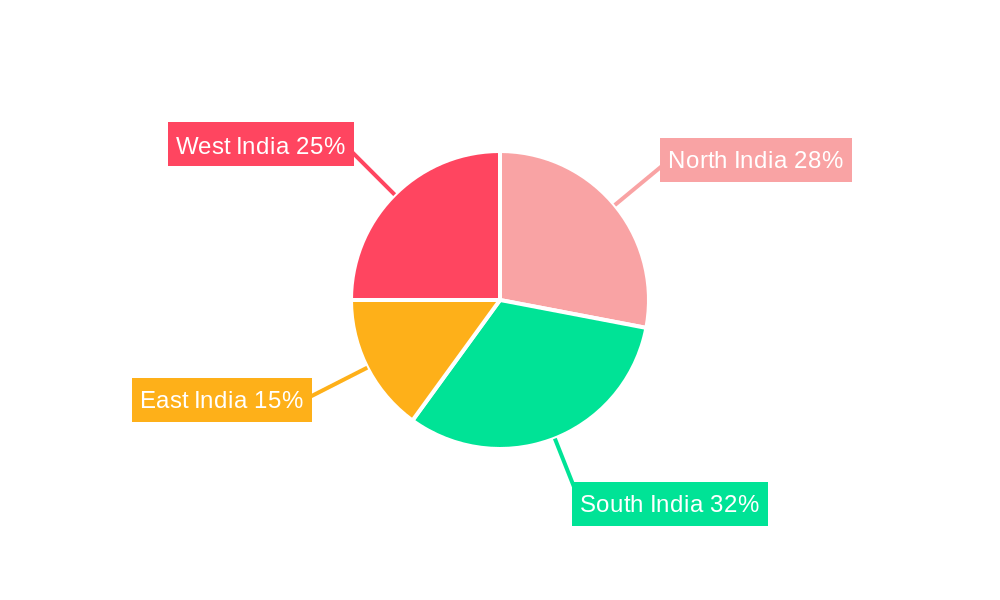

The market's regional performance varies across North, South, East, and West India, with certain regions showing faster adoption rates due to factors such as higher disposable incomes, greater awareness of environmental concerns, and government policies supporting sustainable transportation. The forecast period (2025-2033) promises sustained growth, with projections indicating a considerable increase in market value. However, potential restraints include the need for improvements in battery technology, ensuring affordability for a broader consumer base, and the development of a more robust charging infrastructure to facilitate widespread adoption. Manufacturers are addressing these challenges through technological innovations, strategic partnerships, and collaborations to accelerate market penetration and meet the evolving demands of the Indian automotive landscape.

This comprehensive report provides an in-depth analysis of the India Hybrid Vehicles Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report forecasts market trends from 2025 to 2033, building upon historical data from 2019 to 2024. Key market segments, including Commercial Vehicles, are meticulously examined, alongside prominent players like Volvo Auto India Private Limited, Toyota Kirloskar Motor Pvt Ltd, BMW India Private Limited, Audi Auto India Pvt Ltd, Daimler AG (Mercedes-Benz AG), Honda Cars India Limited, Maruti Suzuki India Limited, and Hyundai Motor India Limited.

India Hybrid Vehicles Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities within the Indian hybrid vehicle market. The market is currently characterized by a moderately concentrated structure, with a few major players holding significant market share. However, increasing participation from new entrants and technological advancements are expected to reshape the competitive landscape.

- Market Share: Maruti Suzuki and Hyundai currently hold the largest market shares in the passenger vehicle segment, while the commercial vehicle segment is dominated by a smaller number of specialized manufacturers. Precise figures are detailed within the full report.

- Innovation Drivers: Stringent emission norms, coupled with rising consumer awareness of environmental concerns, are pushing innovation in hybrid technology, leading to improved fuel efficiency and reduced emissions. Government incentives also play a significant role.

- Regulatory Framework: The Indian government's push towards electric mobility indirectly fuels hybrid vehicle adoption. Specific policies and their impact on market growth are analyzed in detail.

- Product Substitutes: Fully electric vehicles (EVs) and conventional internal combustion engine (ICE) vehicles pose the most significant competition to hybrid vehicles. The report assesses the competitive dynamics between these options.

- End-User Trends: Growing urban populations and rising disposable incomes are driving demand for hybrid vehicles, particularly in the passenger car segment. Detailed consumer preference analysis is provided.

- M&A Activities: The report tracks significant M&A activities within the Indian automotive industry, analyzing their impact on the market structure and competitive dynamics. While precise deal values are confidential in some cases, the report offers insights into the trends. xx Million in M&A activity has been recorded during the historical period.

India Hybrid Vehicles Market Industry Trends & Insights

The Indian hybrid vehicle market is witnessing substantial growth, driven by several factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, indicating significant expansion. Market penetration is currently at xx% and is anticipated to reach xx% by 2033.

Technological advancements, particularly in battery technology and hybrid powertrain systems, are continuously improving the efficiency and performance of hybrid vehicles, making them increasingly attractive to consumers. Shifting consumer preferences towards fuel-efficient and environmentally friendly vehicles are further boosting market growth. Government regulations and incentives for green vehicles are also playing a key role. Competitive dynamics are intense, with established players and new entrants vying for market share. Pricing strategies and product differentiation are key battlegrounds.

Dominant Markets & Segments in India Hybrid Vehicles Market

While data on Commercial Vehicles is limited, the report identifies key regional and segmental dominance. The analysis focuses on the factors driving this prominence, incorporating details about economic policies, infrastructure, and consumer demand.

- Key Drivers:

- Favorable government policies promoting sustainable transportation.

- Expanding infrastructure supporting hybrid vehicle adoption.

- Increasing demand from logistics and transportation sectors.

- Growing awareness of environmental responsibility.

- Cost-effectiveness compared to fully electric vehicles in specific applications.

The dominance analysis reveals that xx region currently holds the largest market share in the Commercial Vehicle segment, driven by a combination of factors described above. Further details and regional breakdowns are included in the comprehensive report.

India Hybrid Vehicles Market Product Developments

Recent product innovations have focused on improving fuel efficiency, reducing emissions, and enhancing performance. Technological advancements such as improved battery technology, more efficient hybrid powertrains, and advanced regenerative braking systems are shaping the landscape. These developments are aimed at offering superior fuel economy and a smoother driving experience, tailored to the specific needs and preferences of the Indian market.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the India Hybrid Vehicle Market, focusing on Vehicle Type (Commercial Vehicles).

- Commercial Vehicles: This segment includes hybrid trucks, buses, and other commercial vehicles. Growth projections show a steady increase in market size, primarily driven by the demand for fuel efficiency and environmental regulations. Competitive dynamics are shaped by the presence of both established players and emerging companies specializing in commercial vehicle electrification.

Key Drivers of India Hybrid Vehicles Market Growth

Several factors propel the growth of India's hybrid vehicle market. Stringent emission norms mandate reduced carbon footprints, pushing adoption. Government incentives and subsidies make hybrid vehicles more financially attractive. Technological advancements lead to improved efficiency and features. Rising consumer awareness of environmental issues and a desire for fuel efficiency drives demand.

Challenges in the India Hybrid Vehicles Market Sector

Despite the positive growth trajectory, the market faces challenges. High initial purchase costs compared to conventional vehicles remain a barrier. Limited charging infrastructure, especially outside major cities, hinders widespread adoption. Supply chain disruptions, particularly concerning battery components, can impact production and availability. Competition from fully electric vehicles and improving ICE technology creates competitive pressure. These factors together can restrict market expansion by an estimated xx% annually.

Emerging Opportunities in India Hybrid Vehicles Market

Several opportunities are shaping the future of the Indian hybrid vehicle market. Expansion into Tier II and Tier III cities presents significant growth potential. Technological advancements, such as plug-in hybrid electric vehicles (PHEVs) and improved battery technologies, offer enhanced performance and cost-effectiveness. Government initiatives and partnerships are boosting R&D and infrastructure development. Growing consumer preference for environmentally friendly options creates a positive outlook.

Leading Players in the India Hybrid Vehicles Market Market

- Volvo Auto India Private Limited

- Toyota Kirloskar Motor Pvt Ltd

- BMW India Private Limited

- Audi Auto India Pvt Ltd

- Daimler AG (Mercedes-Benz AG)

- Honda Cars India Limited

- Maruti Suzuki India Limited

- Hyundai Motor India Limited

Key Developments in India Hybrid Vehicles Market Industry

- August 2023: TVS Motor and BMW Motorrad announced discussions to expand their partnership beyond India, potentially impacting the market with new hybrid technologies or collaborations.

- August 2023: Toyota Kirloskar Motor launched the all-new MPV Vellfire strong hybrid electric vehicle (SHEV), priced between INR 11.99 million and INR 12.99 million, significantly impacting the luxury hybrid segment.

- July 2023: BMW India launched the 2023 X5 SUV, priced between INR 9.39 million and INR 10.7 million, boosting competition in the luxury SUV segment.

Strategic Outlook for India Hybrid Vehicles Market Market

The Indian hybrid vehicle market exhibits substantial growth potential. Continued government support, technological advancements, and rising consumer demand will drive expansion. Focus on improving affordability and enhancing charging infrastructure will be key to accelerating adoption. Strategic partnerships and collaborations will play a pivotal role in shaping the market's future. The market is projected to reach xx Million units by 2033.

India Hybrid Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

-

1.1. Commercial Vehicles

India Hybrid Vehicles Market Segmentation By Geography

- 1. India

India Hybrid Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Volvo Auto India Private Limite

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toyota Kirloskar Motor Pvt Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BMW India Private Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Audi Auto India Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daimler AG (Mercedes-Benz AG)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Honda Cars India Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Maruti Suzuki India Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hyundai Motor India Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Volvo Auto India Private Limite

List of Figures

- Figure 1: India Hybrid Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Hybrid Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: India Hybrid Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Hybrid Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: India Hybrid Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India Hybrid Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Hybrid Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 10: India Hybrid Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Hybrid Vehicles Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the India Hybrid Vehicles Market?

Key companies in the market include Volvo Auto India Private Limite, Toyota Kirloskar Motor Pvt Ltd, BMW India Private Limited, Audi Auto India Pvt Ltd, Daimler AG (Mercedes-Benz AG), Honda Cars India Limited, Maruti Suzuki India Limited, Hyundai Motor India Limited.

3. What are the main segments of the India Hybrid Vehicles Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

August 2023: TVS Motor and BMW Motorrad discussing expansion of partnership beyond India.August 2023: Toyota Kirloskar Motor launched the all-new MPV Vellfire strong hybrid electric vehicle (SHEV) for a starting price of INR 11.99 million and going to INR 12.99 million.July 2023: BMW India launches the 2023 X5 SUV in India for a starting price of INR 9.39 million (Drive40i xLine variant) and going to INR 10.7 million (xDrive30d M sport variant).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Hybrid Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Hybrid Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Hybrid Vehicles Market?

To stay informed about further developments, trends, and reports in the India Hybrid Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence