Key Insights

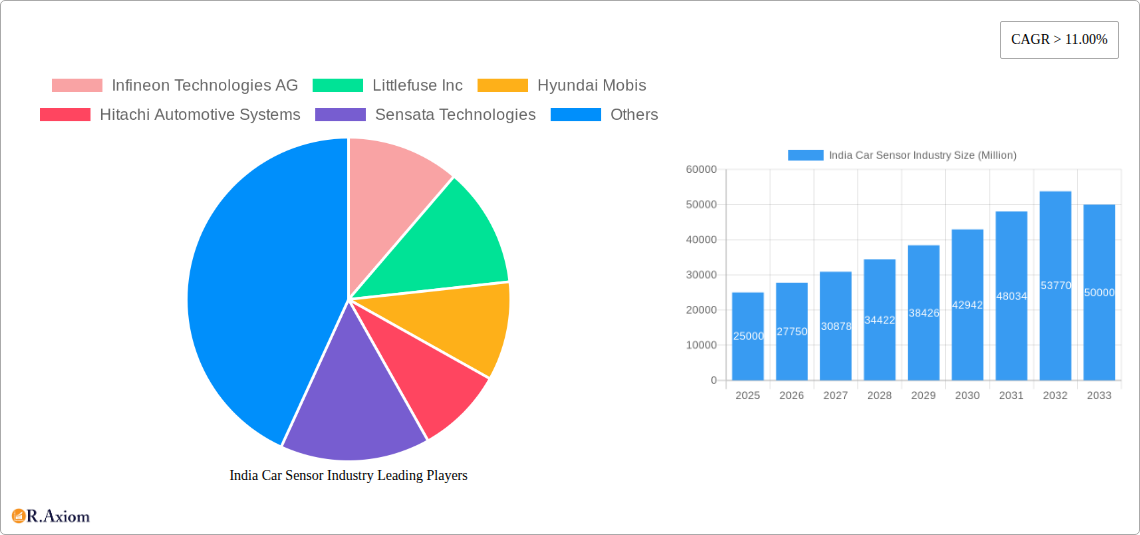

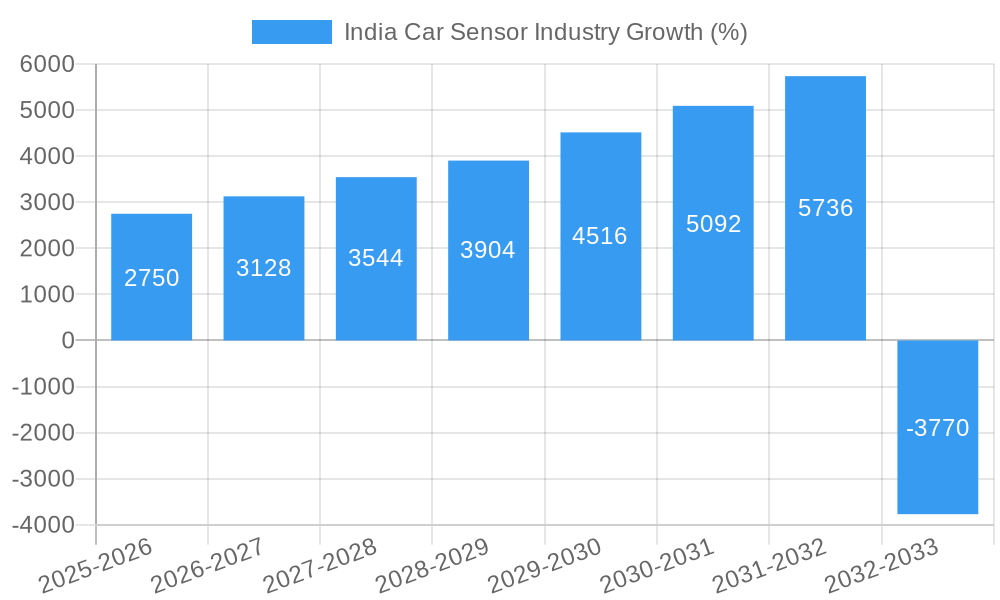

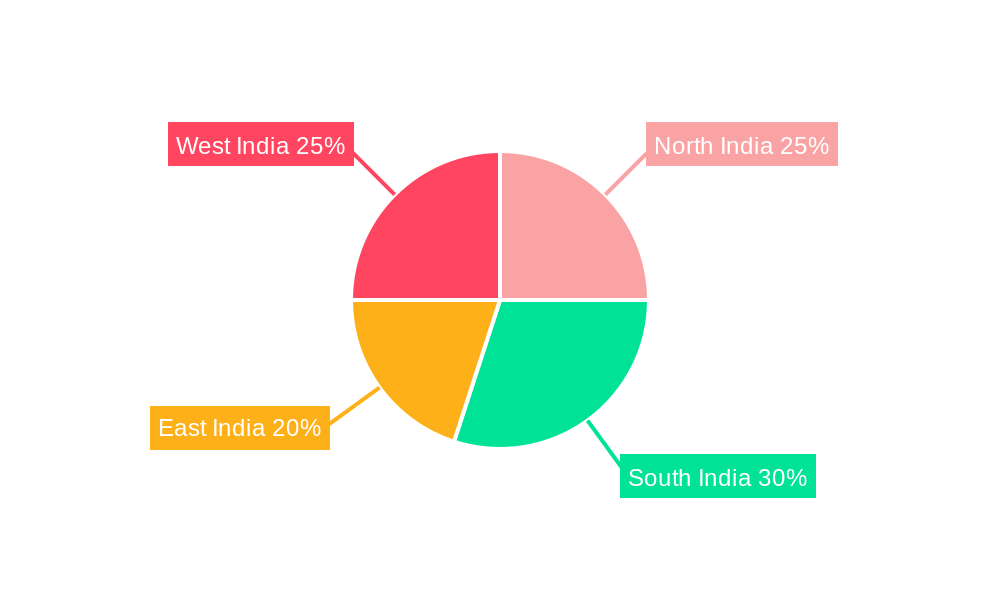

The India car sensor market is experiencing robust growth, fueled by the burgeoning automotive sector and increasing demand for advanced driver-assistance systems (ADAS) and electric vehicles (EVs). The market, valued at approximately ₹25 billion (estimated based on available CAGR and market size data) in 2025, is projected to witness a compound annual growth rate (CAGR) exceeding 11% from 2025 to 2033. This expansion is driven by several key factors, including government initiatives promoting vehicle safety and emission regulations, the rising adoption of connected car technologies, and the increasing penetration of EVs within India. The segment comprising pressure, temperature, and speed sensors is currently dominant, reflecting the widespread use of these essential components in traditional internal combustion engine (ICE) vehicles. However, significant growth opportunities exist in electro-optical and electro-magnetic sensors due to their increasing integration into advanced safety and driver assistance features. The regional distribution within India shows growth potential across all regions (North, South, East, and West), particularly in areas with burgeoning manufacturing hubs and expanding automotive infrastructure.

The competitive landscape is characterized by a mix of global and domestic players, including Infineon, Bosch, Denso, and several prominent Indian automotive component manufacturers. These companies are actively investing in research and development to enhance sensor technology and cater to the growing demand for sophisticated sensor solutions. Despite the positive growth trajectory, challenges such as high initial investment costs associated with advanced sensor technologies and the need for robust supply chain management within the Indian automotive industry could potentially constrain market expansion. Nevertheless, the long-term outlook remains highly positive, with the market poised to significantly expand in line with India's continued automotive industry growth and technological advancements. The shift towards EVs is a major catalyst, further increasing the demand for sensors with specialized applications in electric powertrains and battery management systems.

India Car Sensor Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India car sensor industry, offering valuable insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with 2025 as the base and estimated year. It examines market size, segmentation, growth drivers, challenges, and opportunities, providing a detailed forecast for 2025-2033. The report leverages extensive primary and secondary research to offer actionable intelligence on this dynamic market.

India Car Sensor Industry Market Concentration & Innovation

The Indian car sensor market exhibits a moderately concentrated landscape, dominated by global players like Infineon Technologies AG, Littlefuse Inc, Hyundai Mobis, Hitachi Automotive Systems, Sensata Technologies, Continental AG, Aptiv Plc, Robert Bosch GmbH, CTS Corporation, Hella KGaA Hueck & Co, and DENSO Corporation. These companies hold a combined market share of approximately xx%, with the top three players accounting for xx%. Market concentration is influenced by factors such as technological advancements, economies of scale, and strategic partnerships.

Innovation is driven by the increasing demand for advanced driver-assistance systems (ADAS), electric vehicles (EVs), and stricter safety regulations. Significant R&D investments are being made in developing next-generation sensors, including LiDAR, radar, and camera-based systems. The regulatory framework, particularly concerning vehicle safety and emission standards, plays a crucial role in shaping technological advancements. Product substitutes, such as alternative sensing technologies, pose a moderate threat, while end-user trends, such as preference for connected and autonomous vehicles, accelerate the adoption of sophisticated sensors. M&A activity in the industry has been relatively moderate, with deal values totaling approximately xx Million USD in the historical period (2019-2024), indicating strategic consolidation and expansion efforts by major players.

India Car Sensor Industry Industry Trends & Insights

The India car sensor market is experiencing robust growth, driven by the burgeoning automotive industry and increasing demand for advanced vehicle features. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million USD by 2033. This growth is fueled by several key factors. The rising adoption of ADAS features, including lane departure warning, adaptive cruise control, and automatic emergency braking, significantly contributes to the increased demand for sensors. Furthermore, the government's push towards electric mobility is creating substantial demand for sensors specific to EVs, such as battery management system (BMS) sensors. Technological disruptions, such as the development of more efficient and cost-effective sensor technologies, are further accelerating market growth. Consumer preferences are shifting towards vehicles with enhanced safety and convenience features, directly impacting the demand for various sensor types. The competitive landscape is characterized by intense rivalry among established players and emerging sensor manufacturers. The market penetration of advanced sensors is increasing, with xx% of new vehicles now equipped with ADAS features, highlighting the industry's impressive growth trajectory.

Dominant Markets & Segments in India Car Sensor Industry

The Indian car sensor market is predominantly driven by the ICE Vehicles segment, which currently holds a larger market share compared to the EV segment. However, the EV segment is poised for significant growth in the coming years, owing to government initiatives promoting electric mobility and rising consumer awareness of environmental concerns. Among applications, the Vehicle Safety Systems segment is witnessing the fastest growth, driven by stringent safety regulations and increasing consumer demand for advanced safety features. In terms of sensor types, Pressure Sensors hold the largest market share, primarily due to their widespread application in engine and drivetrain systems.

Key Drivers for the ICE Vehicle Segment:

- Large existing vehicle fleet

- Cost-effectiveness compared to EVs

- Established infrastructure for fuel distribution

Key Drivers for the Vehicle Safety Systems Segment:

- Increasing demand for advanced safety features

- Stringent government regulations on vehicle safety

- Rising consumer awareness of road safety

Key Drivers for the Pressure Sensor Segment:

- Essential component in engine and drivetrain systems

- Relatively mature technology with established applications

- Cost-effectiveness compared to other sensor types

The dominance of these segments is further reinforced by the presence of several major automotive manufacturing hubs in India. The conducive economic policies of the government, along with supportive infrastructure developments, are also contributing factors to the market's growth.

India Car Sensor Industry Product Developments

Recent product innovations focus on miniaturization, improved accuracy, enhanced durability, and lower power consumption. The integration of sensor fusion technologies, combining data from multiple sensors for improved performance and reliability, is also gaining traction. These advancements enhance the functionality and overall performance of ADAS and other vehicle systems, leading to increased market fit and a competitive advantage for manufacturers. Technological trends like the Internet of Things (IoT) and artificial intelligence (AI) are driving the development of intelligent sensor systems that enable connectivity and data analytics for enhanced vehicle operation and maintenance.

Report Scope & Segmentation Analysis

The report segments the India car sensor market by application (Engine and Drivetrain, Vehicle Electronics, Vehicle Safety Systems, Other Applications), sensor type (Pressure Sensors, Temperature Sensors, Speed Sensors, Electro-Optical Sensors, Electro-Magnetic Sensors, Other Sensors), and vehicle drivetrain (ICE Vehicles, Electric Vehicles). Each segment is analyzed based on its historical performance, current market size, growth projections, and competitive dynamics. For instance, the Engine and Drivetrain segment is expected to maintain a significant market share due to the high number of ICE vehicles on the road, while the Electric Vehicles segment is projected to experience the fastest growth rate due to government initiatives and technological advancements. Similarly, Pressure Sensors are anticipated to continue their dominance in the sensor type segment.

Key Drivers of India Car Sensor Industry Growth

The growth of the India car sensor industry is fueled by a combination of technological advancements, economic factors, and supportive government regulations. The increasing adoption of ADAS and connected car technologies is driving demand for sophisticated sensors. Government initiatives promoting electric mobility and investments in infrastructure development are also creating new opportunities. Furthermore, the growing middle class and rising disposable incomes are increasing car ownership and demand for high-tech features, stimulating the market's growth.

Challenges in the India Car Sensor Industry Sector

The industry faces challenges such as high import dependency for certain sensor technologies, leading to fluctuating prices and supply chain disruptions. The competitive landscape with both established global and local players requires companies to focus on innovation and cost optimization to maintain a competitive edge. Stringent quality standards and regulations introduce complexities in product development and certification. These factors present hurdles to the seamless growth of the industry.

Emerging Opportunities in India Car Sensor Industry

The emerging opportunities in the Indian car sensor market include the increasing adoption of EVs, the expansion of the ADAS market, and the growing demand for autonomous driving features. Technological innovations, such as the development of sensor fusion and AI-powered sensor systems, present further growth potential. The development of low-cost and high-performance sensors will be crucial to cater to the price-sensitive Indian market. The growing penetration of IoT and connected car technologies offers unique opportunities for sensor manufacturers.

Leading Players in the India Car Sensor Industry Market

- Infineon Technologies AG

- Littlefuse Inc

- Hyundai Mobis

- Hitachi Automotive Systems

- Sensata Technologies

- Continental AG

- Aptiv Plc

- Robert Bosch GmbH

- CTS Corporation

- Hella KGaA Hueck & Co

- DENSO Corporation

Key Developments in India Car Sensor Industry Industry

- 2022 Q4: Infineon Technologies AG announced a new sensor platform for EV applications.

- 2023 Q1: Bosch launched a new radar sensor with enhanced object detection capabilities.

- 2023 Q2: A strategic partnership between Hyundai Mobis and a local sensor manufacturer was formed to increase local production. (Further specific developments need to be added based on actual data)

Strategic Outlook for India Car Sensor Industry Market

The India car sensor market holds significant future potential, driven by the ongoing growth of the automotive industry, increasing adoption of advanced vehicle technologies, and supportive government policies. The market's expansion will be further propelled by the ongoing development of new sensor technologies and the integration of intelligent sensor systems. Opportunities exist for companies that can offer cost-effective, high-performance sensors tailored to the specific needs of the Indian market. The continuous advancement in sensor technology and the increasing demand for safety and convenience features are set to drive the market's sustained growth in the coming years.

India Car Sensor Industry Segmentation

-

1. Sensor Type

- 1.1. Pressure Sensors

- 1.2. Temperature Sensors

- 1.3. Speed Sensors

- 1.4. Electro-Optical Sensors

- 1.5. Electro-Magnetic Sensors

- 1.6. Other Sensors

-

2. Vehicle Drive-train

- 2.1. ICE Vehicles

- 2.2. Electric Vehicles

-

3. Application

- 3.1. Engine and Drivetrain

- 3.2. Vehicle Electronics

- 3.3. Vehicle Safety Systems

- 3.4. Other Applications

India Car Sensor Industry Segmentation By Geography

- 1. India

India Car Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and the Growing Emphasis on Safety is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Adoption of Steer-By-Wire System Hindering the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Emphasis on Safety Solutions to see an Increased Adoption of ADAS Systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Car Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sensor Type

- 5.1.1. Pressure Sensors

- 5.1.2. Temperature Sensors

- 5.1.3. Speed Sensors

- 5.1.4. Electro-Optical Sensors

- 5.1.5. Electro-Magnetic Sensors

- 5.1.6. Other Sensors

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Drive-train

- 5.2.1. ICE Vehicles

- 5.2.2. Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Engine and Drivetrain

- 5.3.2. Vehicle Electronics

- 5.3.3. Vehicle Safety Systems

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Sensor Type

- 6. North India India Car Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Car Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Car Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Car Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Littlefuse Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyundai Mobis

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hitachi Automotive Systems

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sensata Technologies

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Aptiv Plc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Robert Bosch GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CTS Corporatio

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hella KGaA Hueck & Co

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 DENSO Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: India Car Sensor Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Car Sensor Industry Share (%) by Company 2024

List of Tables

- Table 1: India Car Sensor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Car Sensor Industry Revenue Million Forecast, by Sensor Type 2019 & 2032

- Table 3: India Car Sensor Industry Revenue Million Forecast, by Vehicle Drive-train 2019 & 2032

- Table 4: India Car Sensor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: India Car Sensor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Car Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Car Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Car Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Car Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Car Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Car Sensor Industry Revenue Million Forecast, by Sensor Type 2019 & 2032

- Table 12: India Car Sensor Industry Revenue Million Forecast, by Vehicle Drive-train 2019 & 2032

- Table 13: India Car Sensor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: India Car Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Car Sensor Industry?

The projected CAGR is approximately > 11.00%.

2. Which companies are prominent players in the India Car Sensor Industry?

Key companies in the market include Infineon Technologies AG, Littlefuse Inc, Hyundai Mobis, Hitachi Automotive Systems, Sensata Technologies, Continental AG, Aptiv Plc, Robert Bosch GmbH, CTS Corporatio, Hella KGaA Hueck & Co, DENSO Corporation.

3. What are the main segments of the India Car Sensor Industry?

The market segments include Sensor Type , Vehicle Drive-train , Application .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and the Growing Emphasis on Safety is Driving the Market.

6. What are the notable trends driving market growth?

Rising Emphasis on Safety Solutions to see an Increased Adoption of ADAS Systems.

7. Are there any restraints impacting market growth?

Adoption of Steer-By-Wire System Hindering the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Car Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Car Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Car Sensor Industry?

To stay informed about further developments, trends, and reports in the India Car Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence