Key Insights

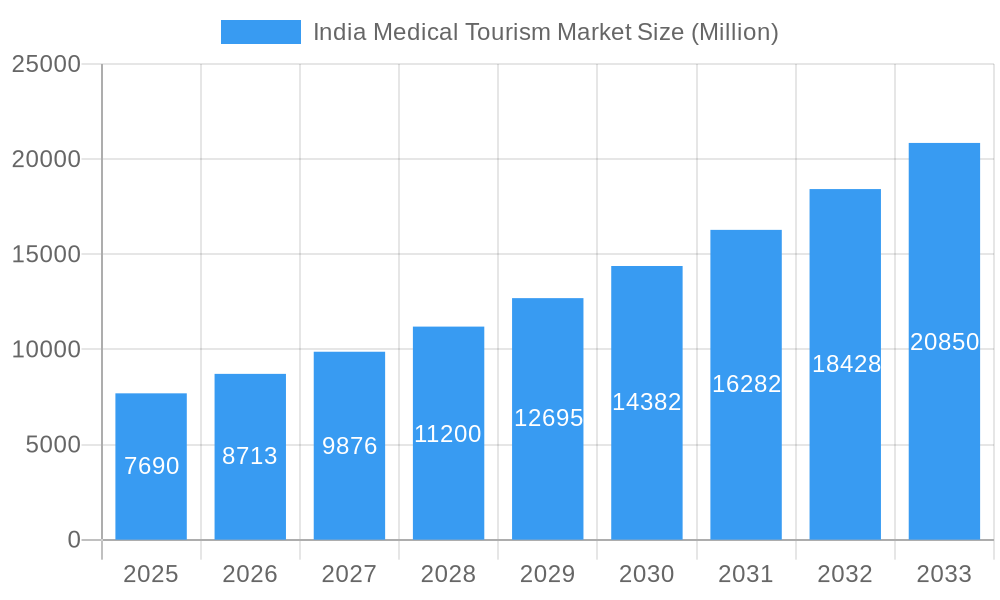

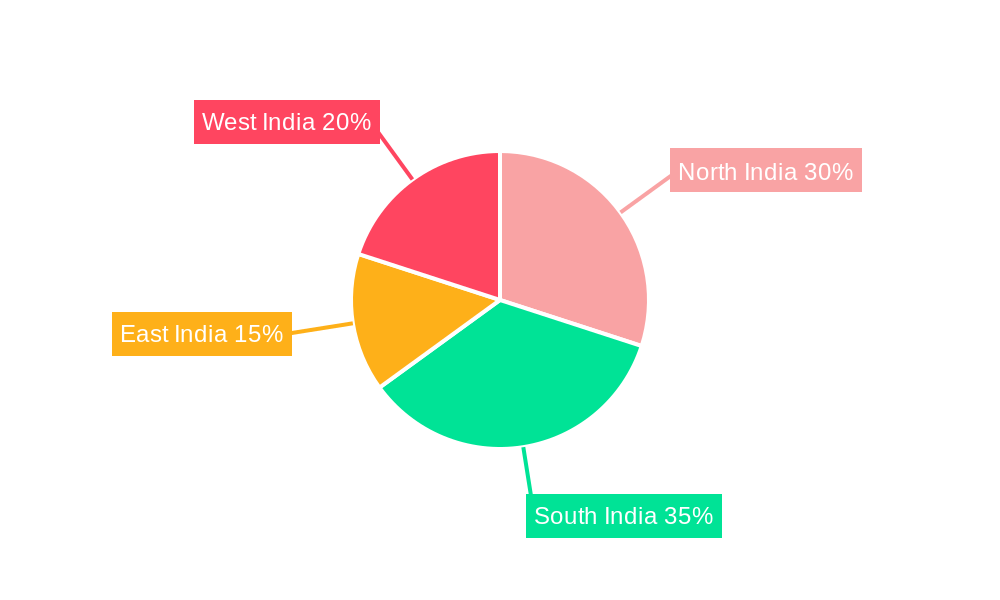

The India medical tourism market, valued at $7.69 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 13.23% from 2025 to 2033. This significant expansion is driven by several key factors. India's established medical infrastructure, offering advanced treatments at competitive prices, attracts a large number of international patients. The availability of highly skilled medical professionals, coupled with internationally accredited hospitals, further enhances its appeal. Rising healthcare costs in developed nations and a growing preference for affordable yet high-quality healthcare are also major contributors to the market's growth. Furthermore, government initiatives promoting medical tourism and improvements in healthcare infrastructure across different regions of India (North, South, East, and West) are further fueling the sector's expansion. The market is segmented by treatment type (dental, cosmetic, cardiovascular, orthopedic, neurological, cancer, fertility, and others) and service provider (public and private). While private healthcare providers currently dominate, the public sector is witnessing investments and improvements, which could impact the market share distribution in the coming years. The increasing popularity of online platforms facilitating medical tourism bookings also contributes to market growth.

India Medical Tourism Market Market Size (In Billion)

However, challenges remain. While the growth trajectory is positive, potential restraints include infrastructure limitations in certain regions, the need for improved medical tourism-specific regulations and marketing, and addressing concerns about potential risks associated with cross-border healthcare. Nevertheless, the long-term outlook remains promising. Continued investment in infrastructure, technology, and skilled professionals will likely mitigate these challenges and drive further expansion of the India medical tourism market, potentially attracting even larger numbers of international patients seeking cost-effective and high-quality healthcare solutions. The presence of numerous established players, including Tour2India4Health, MediConnect India, and Apollo Hospitals, further strengthens the market's competitive landscape and indicates substantial industry maturity and potential for continued growth.

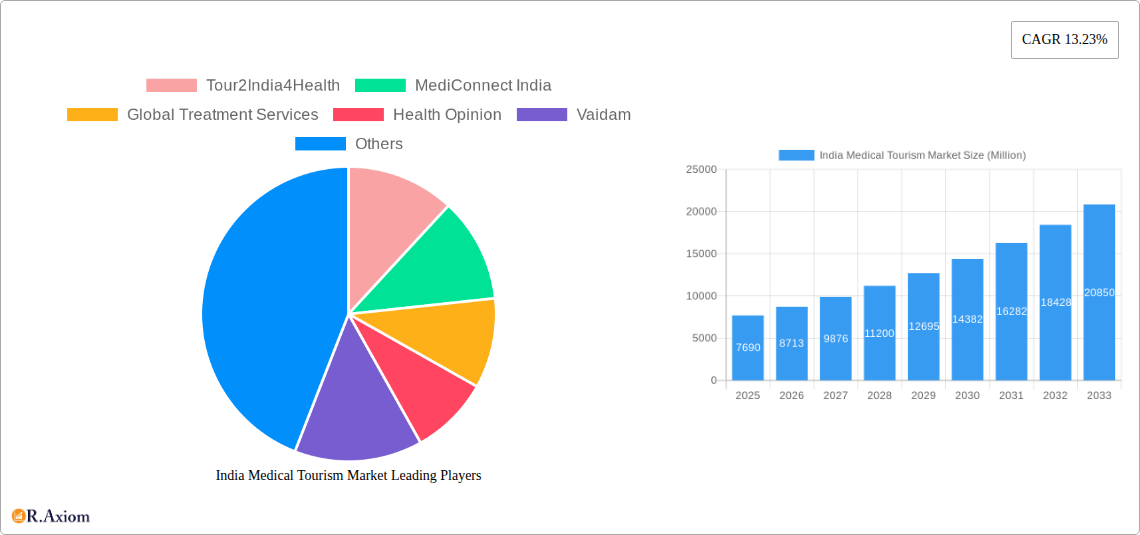

India Medical Tourism Market Company Market Share

India Medical Tourism Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Medical Tourism Market, covering its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders, investors, and policymakers. The report leverages extensive market research, incorporating data from the historical period (2019-2024) and estimates for 2025. The market is segmented by treatment type and service provider, providing a granular view of the landscape. Key players analyzed include Tour2India4Health, MediConnect India, Global Treatment Services, Health Opinion, Vaidam, ANAVARA, Apollo Hospitals, Clinicspots, Mediniq, and Forerunners Healthcare. This list is not exhaustive.

India Medical Tourism Market Concentration & Innovation

The India medical tourism market exhibits a moderately concentrated structure, with a few large players dominating alongside numerous smaller, specialized providers. Market share is currently estimated at xx% for the top 5 players in 2025, with the remaining share dispersed among a large number of smaller firms. Innovation is driven by technological advancements in medical procedures, digital health solutions, and improved healthcare infrastructure. Regulatory frameworks, though improving, remain a key aspect influencing market growth and investment. Substitutes for medical tourism include domestic healthcare options and treatments offered in other countries. End-user trends reflect an increasing preference for cost-effective, high-quality care and personalized treatment experiences. M&A activity is growing, with recent deals such as the Apollo Hospitals acquisition of a Gurugram hospital asset in August 2022 (USD 6.075 Million) demonstrating consolidation trends. The average M&A deal value in the last five years is estimated to be around USD xx Million. These activities are largely driven by the need to expand service offerings and geographic reach.

India Medical Tourism Market Industry Trends & Insights

The India medical tourism market is experiencing robust growth, driven by factors such as increasing affordability of medical treatments, rising healthcare costs in developed nations, and improving healthcare infrastructure in India. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Technological disruptions, such as advancements in minimally invasive surgeries, AI-powered diagnostics, and telemedicine, are further boosting the market. Consumer preferences are shifting toward personalized medicine and convenient, high-quality service packages. Competitive dynamics are marked by increasing competition from both established players and new entrants, leading to price wars and the development of specialized service packages to target niche markets. Market penetration is gradually increasing, with a significant portion of the population still relying on domestic healthcare. The market size in 2025 is estimated to be USD xx Million, with an expected size of USD xx Million by 2033.

Dominant Markets & Segments in India Medical Tourism Market

Leading Region/State: The dominant region within the India Medical Tourism Market is currently xx, driven by factors such as established medical infrastructure, affordability, and skilled medical professionals. This is expected to continue throughout the forecast period.

Dominant Segments:

- By Treatment Type: Dental treatment, cosmetic surgery, and cardiovascular treatments represent the largest segments, driven by high demand and comparatively affordable pricing compared to international alternatives.

- By Service Provider: The private sector dominates the market due to better infrastructure, advanced technologies, and overall higher quality of care. However, the public sector plays a vital role in affordability, catering to a broader patient base.

Key Drivers of Dominance:

- Economic Policies: Government initiatives promoting medical tourism and investments in healthcare infrastructure are crucial factors supporting growth.

- Infrastructure: The presence of internationally accredited hospitals, advanced technology, and skilled medical professionals in specific regions contributes significantly to their dominance.

- Cost Competitiveness: The overall lower cost of treatment in comparison to other countries is a major draw for medical tourists.

India Medical Tourism Market Product Developments

Recent product innovations focus on enhancing patient experience and improving treatment outcomes. This includes the integration of AI-powered diagnostic tools, minimally invasive surgical techniques, and personalized treatment plans. These developments offer competitive advantages by providing faster, more accurate diagnosis, less invasive procedures, and improved patient outcomes. Technological trends are moving towards precision medicine, remote patient monitoring, and telehealth, improving access to quality care and reducing hospital stay durations. The market fit for these innovations is strong, driven by growing patient demand for better care and reduced healthcare costs.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the India medical tourism market across the following segments:

By Treatment Type: Dental Treatment, Cosmetic Treatment, Cardiovascular Treatment, Orthopedic Treatment, Neurological Treatment, Cancer Treatment, Fertility Treatment, and Others. Each segment displays unique growth projections, varying in market size and competitive intensity. Dental and cosmetic treatments currently show the highest growth.

By Service Provider: Public and Private. The private sector dominates, due to superior infrastructure and technology but the public sector caters to the cost-sensitive segment, demonstrating unique market dynamics. Both segments have growth trajectories directly correlated with overall national economic growth.

Key Drivers of India Medical Tourism Market Growth

Several key factors propel the growth of India's medical tourism market. Firstly, the cost advantage is significant compared to western healthcare systems. Secondly, rising disposable incomes in the middle class are increasing affordability for treatment. Finally, advancements in medical technology and the presence of skilled medical professionals contribute significantly to high-quality care. Government initiatives to promote medical tourism, such as improving infrastructure and easing visa regulations, further boost market expansion.

Challenges in the India Medical Tourism Market Sector

Challenges hindering market growth include infrastructural limitations in certain regions, the need for further improvements in regulatory frameworks, and managing the complexities of international patient logistics. The perception of healthcare quality, although improving, requires sustained efforts to reach international standards. Furthermore, competition from other medical tourism destinations necessitates continuous investment in infrastructure and technology. These factors contribute to an overall complexity that influences the projected growth rate.

Emerging Opportunities in India Medical Tourism Market

Emerging opportunities arise from the growing demand for specialized treatments, particularly in areas such as oncology and fertility. The integration of digital health technologies, such as telemedicine and remote patient monitoring, offers significant potential for expanding access and improving care delivery. Untapped markets within India itself, as well as focusing on specific niche treatments represent significant opportunities for growth.

Leading Players in the India Medical Tourism Market Market

- Tour2India4Health

- MediConnect India

- Global Treatment Services

- Health Opinion

- Vaidam

- ANAVARA

- Apollo Hospitals

- Clinicspots

- Mediniq

- Forerunners Healthcare

Key Developments in India Medical Tourism Market Industry

- August 2022: Apollo Hospitals Enterprise acquired a hospital asset in Gurugram, expanding its presence and capacity. This signifies consolidation within the market and an indication of further M&A activity.

- January 2023: Alpine Health Systems launched an AI-powered solution to streamline hospital discharges, improving efficiency and patient care. This reflects the growing role of technology in enhancing the overall experience and streamlining processes for medical tourists.

Strategic Outlook for India Medical Tourism Market Market

The India medical tourism market is poised for significant growth driven by continued investment in infrastructure, technological advancements, and favorable government policies. The focus on specialized treatments, digital health integration, and targeting niche markets will be crucial for sustained expansion. The market's future potential is substantial, with the possibility of becoming a leading global destination for high-quality, affordable medical care.

India Medical Tourism Market Segmentation

-

1. Treatment Type

- 1.1. Dental Treatment

- 1.2. Cosmetic Treatment

- 1.3. Cardiovascular Treatment

- 1.4. Orthopedic Treatment

- 1.5. Neurological Treatment

- 1.6. Cancer Treatment

- 1.7. Fertility Treatment

- 1.8. Others

-

2. Service Provider

- 2.1. Public

- 2.2. Private

India Medical Tourism Market Segmentation By Geography

- 1. India

India Medical Tourism Market Regional Market Share

Geographic Coverage of India Medical Tourism Market

India Medical Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Increase in the Number of Medical Tourists in India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Medical Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 5.1.1. Dental Treatment

- 5.1.2. Cosmetic Treatment

- 5.1.3. Cardiovascular Treatment

- 5.1.4. Orthopedic Treatment

- 5.1.5. Neurological Treatment

- 5.1.6. Cancer Treatment

- 5.1.7. Fertility Treatment

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tour2India4Health

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MediConnect India

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Global Treatment Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Health Opinion

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vaidam

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ANAVARA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Apollo Hospital**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clinicspots

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mediniq

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Forerunners Healthcare

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tour2India4Health

List of Figures

- Figure 1: India Medical Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Medical Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: India Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 2: India Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 3: India Medical Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 5: India Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 6: India Medical Tourism Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Medical Tourism Market?

The projected CAGR is approximately 13.23%.

2. Which companies are prominent players in the India Medical Tourism Market?

Key companies in the market include Tour2India4Health, MediConnect India, Global Treatment Services, Health Opinion, Vaidam, ANAVARA, Apollo Hospital**List Not Exhaustive, Clinicspots, Mediniq, Forerunners Healthcare.

3. What are the main segments of the India Medical Tourism Market?

The market segments include Treatment Type, Service Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Increase in the Number of Medical Tourists in India is Driving the Market.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

January 2023: Alpine Health Systems launched a new AI-powered solution to streamline complex hospital discharge with OSF HealthCare and High Alpha Innovation support. The platform allows case managers to quickly identify at-risk patients and safely transition to an appropriate care site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Medical Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Medical Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Medical Tourism Market?

To stay informed about further developments, trends, and reports in the India Medical Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence