Key Insights

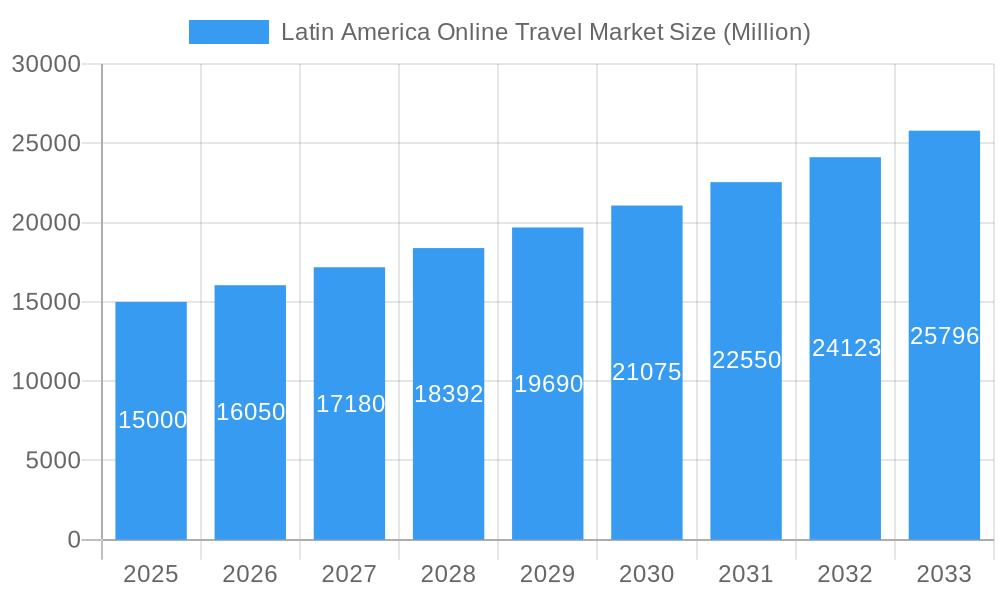

The Latin American online travel market, currently experiencing robust growth, is projected to maintain a significant upward trajectory throughout the forecast period (2025-2033). Fueled by rising disposable incomes, increased internet and smartphone penetration, and a growing preference for convenient online booking options, the market exhibits substantial potential. The accommodation booking segment, encompassing hotels, vacation rentals (like Airbnb), and other lodging options, constitutes a major portion of the market share, driven by the increasing popularity of domestic and international tourism within the region. Travel ticket bookings, encompassing both air and ground transportation, are also a substantial contributor, benefiting from the expanding low-cost airline sector and improved inter-city connectivity. Holiday package bookings, offering bundled travel services, are gaining traction, particularly among leisure travelers seeking comprehensive and cost-effective travel solutions. Growth is further driven by the expanding mobile booking segment, reflecting the increasing adoption of smartphones and mobile applications across the region. Market leaders like Booking Holdings, Despegar, and CVC Corp, alongside regional players like Hotel Urbano and Trivago, are capitalizing on these trends through aggressive marketing, technological advancements, and diverse service offerings. However, economic fluctuations and infrastructure limitations in certain areas present challenges to consistent growth.

Latin America Online Travel Market Market Size (In Billion)

Despite these challenges, the market's future remains positive. The consistent growth in e-commerce adoption across Latin America, combined with increasing trust in online payment systems, is expected to stimulate further expansion of the online travel market. The diverse segments—from accommodation booking to holiday packages, further subdivided by booking methods and platforms—provide opportunities for both established players and new entrants to specialize and cater to specific niches within this dynamic market. The continuous improvement in digital infrastructure, especially in emerging markets, will create even more opportunities for future expansion. The strategic focus on personalized travel experiences and the integration of innovative technologies, such as artificial intelligence and data analytics, will be pivotal in shaping the market's future trajectory. Competitive pricing strategies, coupled with robust customer service, will remain crucial for sustained market leadership.

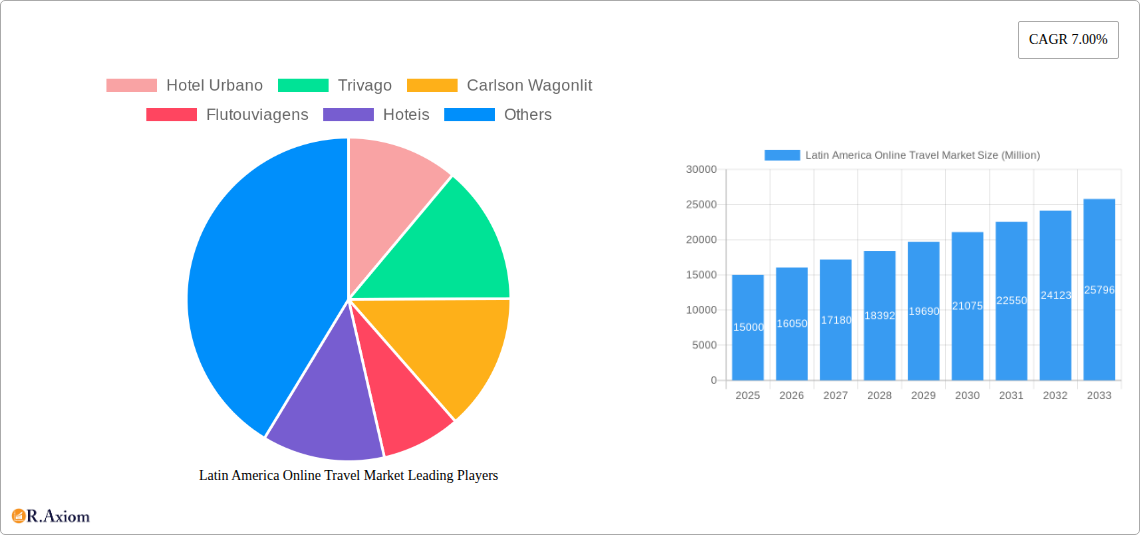

Latin America Online Travel Market Company Market Share

This comprehensive report provides an in-depth analysis of the Latin America online travel market, covering the period 2019-2033. With a focus on key market trends, competitive dynamics, and future growth prospects, this report is an essential resource for industry stakeholders, investors, and businesses operating or planning to enter this dynamic market. The report leverages extensive data analysis and expert insights to deliver actionable intelligence for strategic decision-making. The estimated market size in 2025 is xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Latin America Online Travel Market Market Concentration & Innovation

This section analyzes the level of market concentration in the Latin American online travel sector, identifying key players and their market share. It explores the drivers of innovation, including technological advancements and evolving consumer preferences. Regulatory frameworks and their impact on market dynamics are also examined, alongside an assessment of product substitutes and the role of mergers and acquisitions (M&A) activities.

Market Concentration: The Latin American online travel market exhibits a moderately concentrated structure, with major players like Booking Holdings, Despegar, and CVC Corp holding significant market share. However, numerous smaller players and niche operators also contribute to the market's dynamism. The precise market share of each company will be detailed in the full report.

Innovation Drivers: Technological advancements, such as AI-powered personalization and mobile-first design, are key drivers of innovation. The increasing adoption of mobile booking platforms is reshaping the market landscape. The growing preference for personalized travel experiences and the emergence of new service offerings, like sustainable tourism options, are also creating opportunities for innovation.

Regulatory Frameworks: Varying regulatory landscapes across Latin American countries can influence market access and operations. The report will detail specific regulatory considerations for each major market.

M&A Activities: The report analyzes recent significant M&A activities. For example, the acquisition of Viajanet by Despegar in May 2022, valued at approximately US$15 Million, highlights the consolidation trends within the market. The ongoing investigation into Booking Holdings' proposed acquisition of Etraveli further underscores the competitive intensity and strategic maneuvering within the sector. Further details on deal values and market impact will be provided.

End-User Trends: The report analyzes shifting consumer preferences and their influence on market dynamics. These include increased demand for mobile booking, personalized travel options, and sustainable travel choices.

Latin America Online Travel Market Industry Trends & Insights

This section delves into the key industry trends shaping the Latin American online travel market. The analysis includes market growth drivers, technological disruptions, evolving consumer preferences, and the competitive landscape. The report will examine specific market segments, their performance, and projected growth trajectories.

The Latin American online travel market is characterized by strong growth, driven by factors such as rising disposable incomes, increased internet and smartphone penetration, and a growing preference for online travel booking. Technological advancements such as the use of AI and big data analytics for personalized recommendations and improved customer service also contribute to this market expansion. Consumer preferences are shifting towards mobile bookings, package deals, and sustainable tourism options. This has spurred competition among online travel agencies (OTAs) and traditional players, leading to innovative offerings and competitive pricing strategies. The report includes detailed analysis of market size, revenue projections, CAGR and market penetration for different segments.

Dominant Markets & Segments in Latin America Online Travel Market

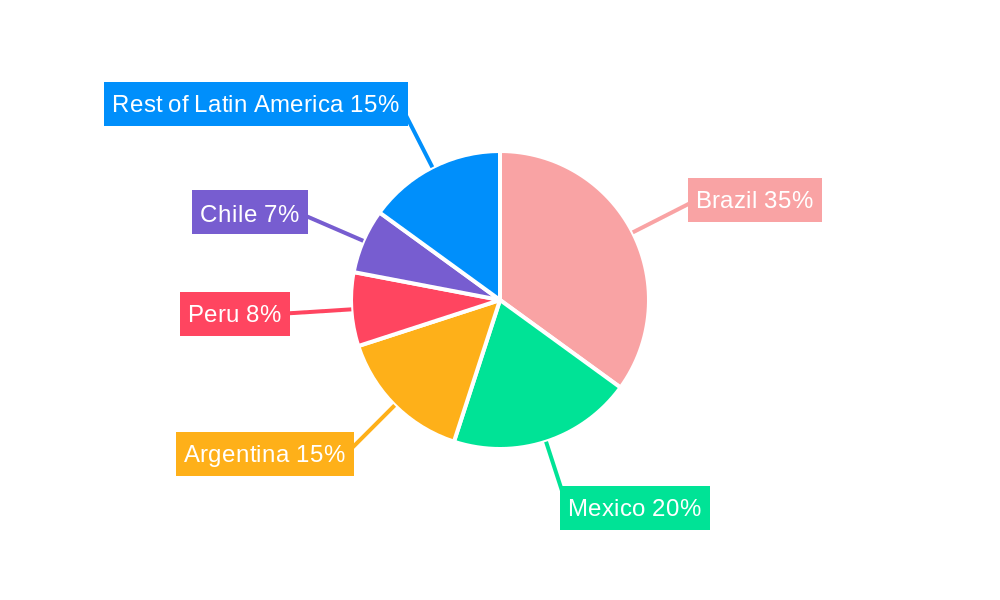

This section identifies the leading regions, countries, and market segments within the Latin American online travel market. It analyses the key drivers behind the dominance of particular markets or segments, such as economic policies, infrastructure development, and consumer behavior.

By Service Type: Accommodation bookings are currently the largest segment, followed by travel tickets and holiday packages. Other service types, such as travel insurance and activity bookings, are showing significant growth potential.

By Mode of Booking: Direct booking through OTAs continues to be the dominant mode, with a significant increase in mobile bookings. Travel agents maintain a presence, particularly for complex or high-value travel arrangements.

By Booking Platform: Mobile/tablet bookings are rapidly gaining traction, surpassing desktop bookings in market share. This highlights the increasing mobile adoption across Latin America.

Dominant Regions/Countries: Brazil, Mexico, and Argentina are leading markets, due to factors such as higher disposable incomes, substantial tourism sectors, and expanding digital infrastructure. Detailed analysis of each region and country will be provided within the full report, including consideration of each region’s economic policies and infrastructure development.

Latin America Online Travel Market Product Developments

This section summarizes the latest product innovations, applications, and competitive advantages within the Latin American online travel market. The focus is on technological trends and their impact on market fit. The increasing adoption of AI-powered personalization, mobile-optimized platforms, and integration of virtual reality (VR) and augmented reality (AR) technologies are transforming the travel booking experience. These innovations enhance user engagement and provide more customized travel solutions, leading to increased customer satisfaction and market share gains for innovative companies.

Report Scope & Segmentation Analysis

This report segments the Latin American online travel market across various dimensions:

By Service Type: Accommodation booking, Travel tickets booking, Holiday package booking, Other service types (e.g., travel insurance, activities). Each segment's market size, growth projections, and competitive dynamics will be analyzed in the full report.

By Mode of Booking: Direct booking, Travel agents. The report will detail the market share and growth trajectory of each booking mode.

By Booking Platform: Desktop, Mobile/Tablet. The report will analyze user behavior and preferences across different booking platforms and their impact on market dynamics.

Key Drivers of Latin America Online Travel Market Growth

Several factors contribute to the growth of the Latin American online travel market. These include:

- Rising Disposable Incomes: Increased purchasing power is fueling demand for leisure travel.

- Enhanced Internet Penetration: Widespread internet and mobile access enable easy online bookings.

- Technological Advancements: AI, mobile optimization, and personalized services enhance user experience.

- Government Initiatives: Tourism promotion strategies stimulate market growth.

Challenges in the Latin America Online Travel Market Sector

The market faces challenges such as:

- Economic Volatility: Fluctuations in currency and economic conditions can impact travel spending.

- Infrastructure Limitations: Inadequate infrastructure in certain regions can hinder tourism development.

- Cybersecurity Concerns: Data security and fraud prevention are crucial considerations for online travel businesses.

- Competition: The highly competitive nature of the market requires businesses to innovate continuously.

Emerging Opportunities in Latin America Online Travel Market

Opportunities exist in:

- Sustainable Tourism: Growing demand for eco-friendly travel options.

- Niche Travel Segments: Catering to specific interests, like adventure tourism or wellness travel.

- Expansion into Underserved Markets: Reaching new customer segments in less-developed regions.

- Hyper-Personalization: Leverage AI and data analytics to provide fully customized travel experiences.

Leading Players in the Latin America Online Travel Market Market

- Hotel Urbano

- Trivago

- Carlson Wagonlit

- Flutouviagens

- Hoteis

- CVC Corp

- Airbnb

- Booking Holdings

- Decolar

- Pricetravel

- Despegar

Key Developments in Latin America Online Travel Market Industry

- November 2022: The European Commission launched an investigation into Booking Holdings' acquisition of Etraveli.

- May 2022: Despegar acquired Viajanet for approximately US$15 Million.

Strategic Outlook for Latin America Online Travel Market Market

The Latin American online travel market is poised for continued expansion, driven by increasing digital adoption, rising disposable incomes, and evolving consumer preferences. Opportunities abound for companies that can leverage technological innovations, cater to evolving consumer needs, and navigate the competitive landscape effectively. The market is expected to witness further consolidation and innovation, with companies focusing on enhancing their technology offerings, improving customer experience, and expanding into new market segments to drive growth and profitability.

Latin America Online Travel Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Service Types

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Booking Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

-

4. Geography

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Rest of Latin America

Latin America Online Travel Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Rest of Latin America

Latin America Online Travel Market Regional Market Share

Geographic Coverage of Latin America Online Travel Market

Latin America Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Growing Tourism Sector is Helping the Market to Grow Further

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Booking Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Mexico

- 5.5.2. Brazil

- 5.5.3. Argentina

- 5.5.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Mexico Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Accommodation Booking

- 6.1.2. Travel Tickets Booking

- 6.1.3. Holiday Package Booking

- 6.1.4. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 6.2.1. Direct Booking

- 6.2.2. Travel Agents

- 6.3. Market Analysis, Insights and Forecast - by Booking Platform

- 6.3.1. Desktop

- 6.3.2. Mobile/Tablet

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Mexico

- 6.4.2. Brazil

- 6.4.3. Argentina

- 6.4.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Brazil Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Accommodation Booking

- 7.1.2. Travel Tickets Booking

- 7.1.3. Holiday Package Booking

- 7.1.4. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 7.2.1. Direct Booking

- 7.2.2. Travel Agents

- 7.3. Market Analysis, Insights and Forecast - by Booking Platform

- 7.3.1. Desktop

- 7.3.2. Mobile/Tablet

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Mexico

- 7.4.2. Brazil

- 7.4.3. Argentina

- 7.4.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Argentina Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Accommodation Booking

- 8.1.2. Travel Tickets Booking

- 8.1.3. Holiday Package Booking

- 8.1.4. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 8.2.1. Direct Booking

- 8.2.2. Travel Agents

- 8.3. Market Analysis, Insights and Forecast - by Booking Platform

- 8.3.1. Desktop

- 8.3.2. Mobile/Tablet

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Mexico

- 8.4.2. Brazil

- 8.4.3. Argentina

- 8.4.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Latin America Latin America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Accommodation Booking

- 9.1.2. Travel Tickets Booking

- 9.1.3. Holiday Package Booking

- 9.1.4. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 9.2.1. Direct Booking

- 9.2.2. Travel Agents

- 9.3. Market Analysis, Insights and Forecast - by Booking Platform

- 9.3.1. Desktop

- 9.3.2. Mobile/Tablet

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Mexico

- 9.4.2. Brazil

- 9.4.3. Argentina

- 9.4.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hotel Urbano

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trivago

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Carlson Wagonlit

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flutouviagens

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hoteis

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CVC Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Airbnb

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Booking Holdings

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Decolar

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Pricetravel**List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Despegar

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Hotel Urbano

List of Figures

- Figure 1: Latin America Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 4: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Latin America Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 8: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 9: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 13: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 14: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 18: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 19: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Latin America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 22: Latin America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 23: Latin America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 24: Latin America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Latin America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Online Travel Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Latin America Online Travel Market?

Key companies in the market include Hotel Urbano, Trivago, Carlson Wagonlit, Flutouviagens, Hoteis, CVC Corp, Airbnb, Booking Holdings, Decolar, Pricetravel**List Not Exhaustive, Despegar.

3. What are the main segments of the Latin America Online Travel Market?

The market segments include Service Type, Mode of Booking, Booking Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Growing Tourism Sector is Helping the Market to Grow Further.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

In November 2022, The European Commission has opened an investigation into the proposed acquisition of Sweden's Flugo Group Holdings AB which operates as Etraveli by Booking Holdings Inc.. The proposed transaction would allow Booking to strengthen its position in the market for online travel agencies, and increase the barrier to entry and expansion for rivals

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Online Travel Market?

To stay informed about further developments, trends, and reports in the Latin America Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence