Key Insights

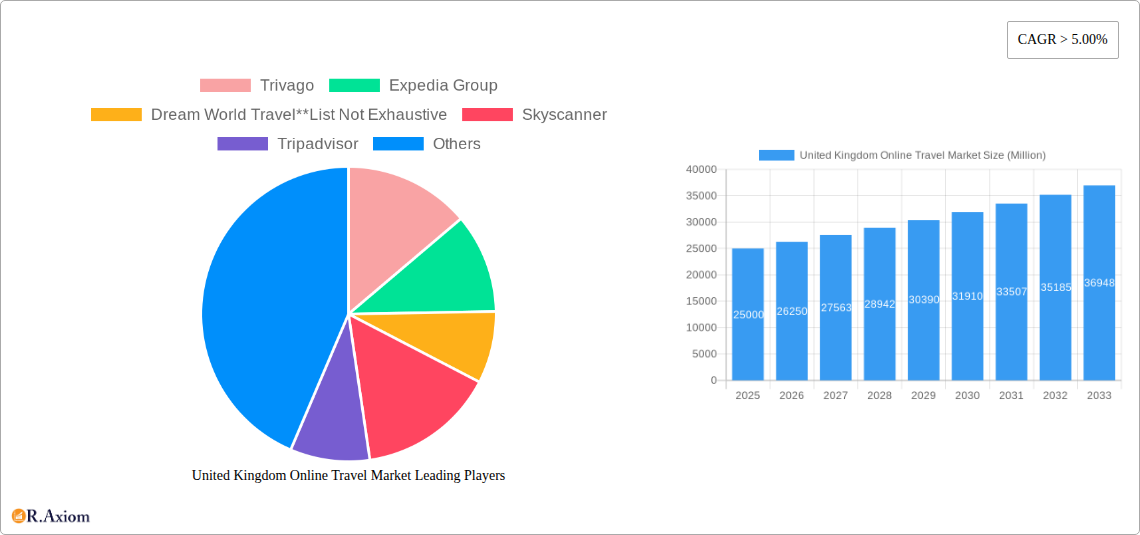

The United Kingdom online travel market is poised for significant expansion, projected to reach $2 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 10.5% through 2033. This robust growth is underpinned by increasing internet and smartphone penetration, a strong consumer preference for convenient online bookings, and the rising appeal of budget-friendly travel and unique experiences. Key growth drivers include the dominance of Online Travel Agencies (OTAs) and the accelerating adoption of mobile bookings. Enhanced online travel platforms offering personalized recommendations, competitive pricing, and streamlined booking processes further fuel market success. While economic fluctuations and currency shifts pose potential challenges, the overall outlook for the UK online travel market remains highly positive.

United Kingdom Online Travel Market Market Size (In Billion)

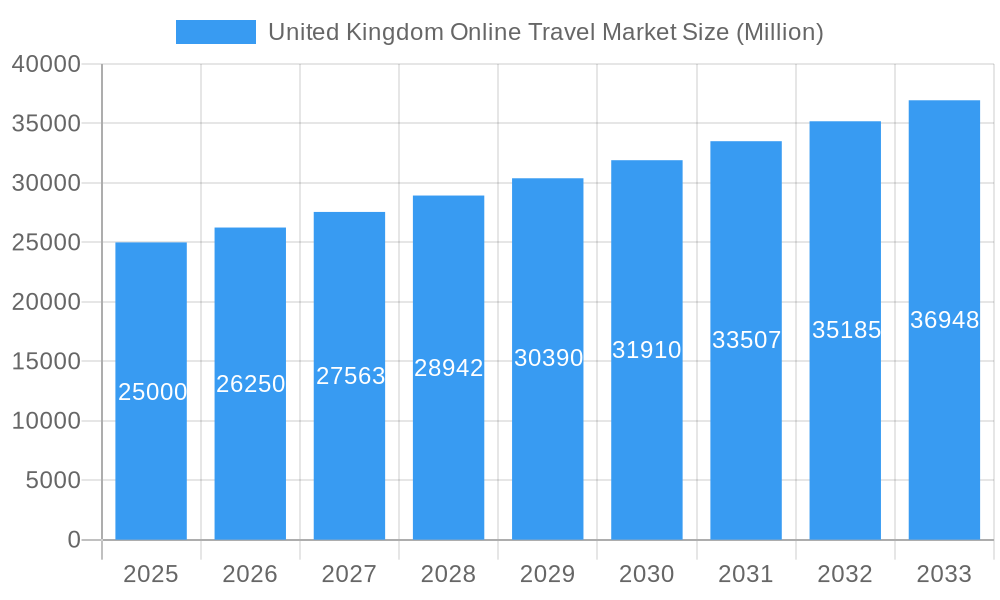

Market segmentation reveals substantial opportunities across diverse service categories within the UK online travel sector. Transportation (flights, rail, bus) and accommodation (hotels, vacation rentals) represent dominant segments. Vacation packages are gaining prominence as consumers increasingly opt for integrated travel solutions. The "Other" category, encompassing activities, tours, and travel insurance, also presents considerable growth potential, driven by demand for curated travel experiences. Online Travel Agencies (OTAs) continue to be a preferred booking channel due to their convenience and price comparison features. However, direct bookings with travel providers and the surge in mobile bookings highlight a dynamic landscape shaped by consumer preferences for personalized planning and immediate access to travel information. Leading industry players such as Booking.com, Expedia Group, and Skyscanner are strategically positioned to leverage these opportunities, alongside increasing competition from specialized niche providers.

United Kingdom Online Travel Market Company Market Share

This comprehensive report offers an in-depth analysis of the United Kingdom online travel market, providing critical insights for stakeholders, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market size, segmentation, growth catalysts, challenges, and future opportunities. The analysis is informed by extensive primary and secondary research, delivering actionable intelligence on market dynamics and competitive landscapes.

United Kingdom Online Travel Market Market Concentration & Innovation

The UK online travel market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Companies like Expedia Group, Trivago, and Booking.com dominate various segments, although the exact market share fluctuates yearly. Smaller players like Skyscanner, Tripadvisor, and Airbnb also hold substantial market presence, particularly in niche areas. Innovation is driven by advancements in mobile technology, personalized travel recommendations (AI-powered), and the increasing demand for sustainable and experiential travel options. Regulatory frameworks, such as data privacy regulations (GDPR), significantly impact market operations. Product substitutes, such as independent travel planning and peer-to-peer accommodations, are exerting pressure on traditional players. End-user trends show a growing preference for mobile bookings, personalized experiences, and value-for-money offerings. The historical period (2019-2024) witnessed significant M&A activity, with estimated deal values exceeding £xx Million, mostly focused on consolidating market share and expanding service offerings. However, the frequency of M&A activities has reduced in the last two years.

- Market Concentration: High in specific segments, moderate overall.

- Innovation Drivers: Mobile technology, AI-powered personalization, sustainable travel.

- Regulatory Framework: GDPR, consumer protection laws.

- M&A Activity (2019-2024): Estimated value exceeding £xx Million.

United Kingdom Online Travel Market Industry Trends & Insights

The UK online travel market exhibited a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024. Market penetration of online travel bookings has surpassed xx%, indicating significant digital adoption. The market is driven by rising disposable incomes, increased internet penetration, and a growing preference for convenient online booking platforms. Technological disruptions, such as the rise of mobile-first booking platforms and the increasing use of artificial intelligence for personalized recommendations, are reshaping the industry. Consumer preferences are shifting toward customized itineraries, sustainable travel options, and unique experiences. The competitive landscape is intensely dynamic, with established players and new entrants vying for market share through aggressive marketing strategies, strategic partnerships, and innovative offerings. The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated CAGR of xx%, owing to factors such as economic uncertainty and potential shifts in consumer spending habits.

Dominant Markets & Segments in United Kingdom Online Travel Market

Leading Regions/Countries: London and other major cities show the highest market concentration due to higher population density and tourism.

Service Type:

- Transportation: Airlines and trains are dominant, driven by increased connectivity and competitive pricing.

- Travel Accommodation: Hotels and short-term rentals (Airbnb) are key segments with a roughly equal market share due to increased demand in these sectors.

- Vacation Packages: Experiencing strong growth fuelled by demand for convenience and bundled deals.

- Others: Car rentals, travel insurance, and activity bookings are showing steady growth.

Booking Type:

- Online Travel Agencies (OTAs): Continue to dominate due to their extensive reach and ease of use.

- Direct Travel Suppliers: Gaining traction with consumers seeking better deals and direct customer service.

Platform:

- Mobile: Mobile booking is the fastest-growing segment, surpassing desktop bookings in recent years.

- Desktop: While still relevant, desktop bookings are gradually losing market share.

Key Drivers:

- Strong tourism industry.

- High internet and smartphone penetration.

- Government initiatives promoting tourism.

United Kingdom Online Travel Market Product Developments

Recent innovations include personalized travel itineraries created through AI, virtual reality tours, and enhanced mobile apps featuring integrated payment gateways and seamless booking processes. These developments offer superior user experience and better price comparison tools, giving companies a significant competitive edge. The focus is on leveraging technology to enhance customer experience, improving booking efficiency, and offering personalized travel solutions. The market fit for these innovations is excellent, reflecting evolving consumer preferences and the need for personalized experiences.

Report Scope & Segmentation Analysis

This report comprehensively segments the UK online travel market based on service type (Transportation, Travel Accommodation, Vacation Packages, Others), booking type (Online Travel Agencies, Direct Travel Suppliers), and platform (Desktop, Mobile). Each segment's growth projections, market size (in Millions), and competitive dynamics are analyzed extensively. The report projects a significant increase in market size across all segments during the forecast period (2025-2033), driven by factors such as increased internet and smartphone penetration, and a growing preference for online travel bookings.

Key Drivers of United Kingdom Online Travel Market Growth

Technological advancements, specifically mobile-first technologies, AI-driven personalization, and seamless booking experiences are propelling market growth. The robust UK tourism industry, coupled with the growing disposable incomes of the population, fuels demand for online travel services. Supportive government policies promoting tourism further enhance market expansion.

Challenges in the United Kingdom Online Travel Market Sector

The industry faces challenges such as intense competition, fluctuating currency exchange rates impacting pricing strategies, and rising operational costs. External factors, such as global economic uncertainty and geopolitical instability, also impact consumer spending on travel. Furthermore, maintaining customer trust and managing data privacy are crucial ongoing considerations.

Emerging Opportunities in United Kingdom Online Travel Market

The increasing demand for sustainable travel and unique experiences presents substantial opportunities. The integration of emerging technologies like blockchain for secure transactions and VR/AR for immersive travel experiences holds vast potential. Targeting niche markets and expanding into underserved regions also represents significant growth avenues.

Leading Players in the United Kingdom Online Travel Market Market

- Trivago

- Expedia Group

- Dream World Travel

- Skyscanner

- Tripadvisor

- Jet2holidays

- Thomas Cook Group

- Airbnb

- lastminute.com

- Booking.com

- Hotels.com

Key Developments in United Kingdom Online Travel Market Industry

- 2022 Q4: Expedia Group launches a new mobile app with enhanced AI-powered features.

- 2023 Q1: Booking.com implements a new sustainable travel initiative.

- 2023 Q3: Trivago expands its partnership network to include more regional airlines.

Strategic Outlook for United Kingdom Online Travel Market Market

The UK online travel market is poised for continued growth, fueled by ongoing technological innovation, evolving consumer preferences, and a thriving tourism sector. Opportunities lie in personalized travel solutions, sustainable tourism initiatives, and leveraging emerging technologies like VR/AR to enhance the customer experience. Companies that adapt to the changing dynamics and embrace innovation will be well-positioned to capture significant market share in the coming years.

United Kingdom Online Travel Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Others

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

United Kingdom Online Travel Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Online Travel Market Regional Market Share

Geographic Coverage of United Kingdom Online Travel Market

United Kingdom Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Tourism is Driving the Online Travel Market in United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trivago

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Expedia Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dream World Travel**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Skyscanner

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tripadvisor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jet2holidays

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thomas Cook Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Airbnb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 lastminute com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Booking

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hotels com

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Trivago

List of Figures

- Figure 1: United Kingdom Online Travel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Online Travel Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: United Kingdom Online Travel Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 3: United Kingdom Online Travel Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 4: United Kingdom Online Travel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Online Travel Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: United Kingdom Online Travel Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 7: United Kingdom Online Travel Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 8: United Kingdom Online Travel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Online Travel Market?

The projected CAGR is approximately 10.5%.

2. Which companies are prominent players in the United Kingdom Online Travel Market?

Key companies in the market include Trivago, Expedia Group, Dream World Travel**List Not Exhaustive, Skyscanner, Tripadvisor, Jet2holidays, Thomas Cook Group, Airbnb, lastminute com, Booking, Hotels com.

3. What are the main segments of the United Kingdom Online Travel Market?

The market segments include Service Type, Booking Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 billion as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Tourism is Driving the Online Travel Market in United Kingdom.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Online Travel Market?

To stay informed about further developments, trends, and reports in the United Kingdom Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence