Key Insights

The Italian online accommodation market is poised for significant expansion, forecasted to reach €10.1 billion by 2024, with a projected Compound Annual Growth Rate (CAGR) of 6.8% between 2024 and 2033. Key growth drivers include the increasing adoption of online travel booking platforms, especially among younger consumers, and Italy's robust tourism industry, attracting both international and domestic visitors. The proliferation of short-term rental options via platforms like Airbnb and Vrbo has diversified the market, offering travelers a wider array of choices. Furthermore, the surge in mobile booking application usage enhances convenience and fuels online reservations.

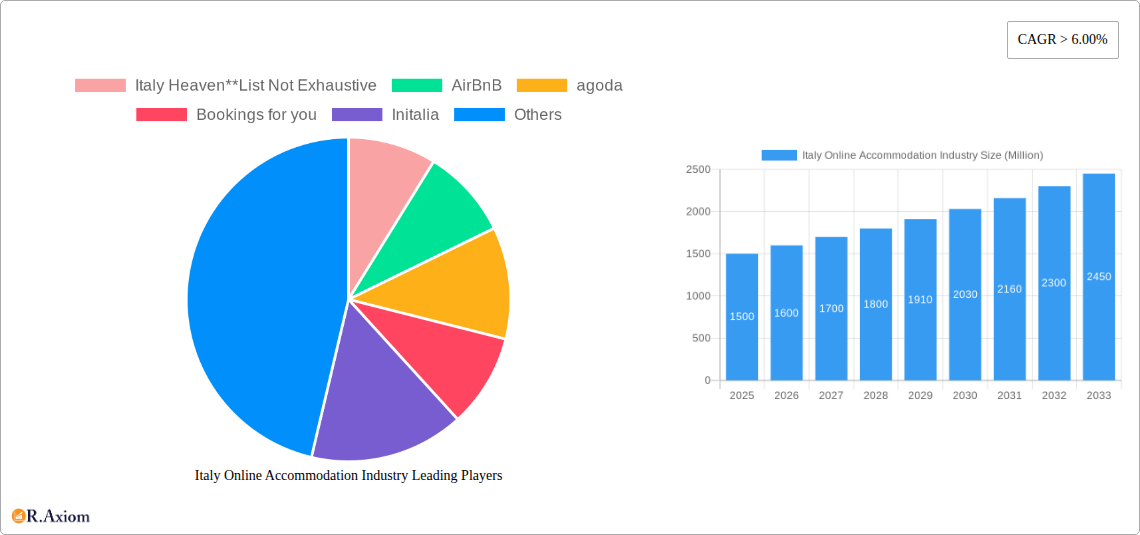

Italy Online Accommodation Industry Market Size (In Billion)

Despite positive growth prospects, the market faces hurdles such as economic volatility impacting travel expenditure and intense competition among Online Travel Agencies (OTAs), necessitating strategic pricing. Evolving regulations for short-term rentals in certain Italian regions may also present growth constraints. Nevertheless, ongoing technological innovation, shifting traveler preferences, and Italy's enduring allure as a premier tourist destination suggest a favorable long-term outlook. The market's segmentation across mobile apps, websites, third-party portals, and direct booking channels highlights its adaptability to future trends.

Italy Online Accommodation Industry Company Market Share

Italy Online Accommodation Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italy online accommodation industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this dynamic market. We project a market value of €XX Billion by 2033.

Italy Online Accommodation Industry Market Concentration & Innovation

The Italian online accommodation market exhibits a moderately concentrated structure, with key players like Booking Holdings, Expedia, and Airbnb commanding significant market share. However, a range of smaller players, including Italy Heaven, agoda, Bookings for you, Initalia, TripAdvisor, Plum Guide, and Vrbo, contribute significantly to the overall market dynamics. Market share estimations for 2025 indicate that Booking Holdings holds approximately 35%, followed by Airbnb at 25%, and Expedia at 15%. The remaining share is distributed among other players, signifying a competitive landscape.

Innovation is driven by technological advancements, including the development of sophisticated booking platforms, personalized travel recommendations, and the integration of virtual reality and augmented reality for immersive travel planning. Regulatory frameworks, such as data privacy regulations and consumer protection laws, influence innovation and business practices. Product substitutes include traditional offline travel agents and independent property rentals. End-user trends favor mobile-first booking experiences and personalized travel packages. M&A activities within the sector have been relatively modest in recent years, with a total estimated value of €XX Billion in deals recorded between 2019 and 2024. Notable deals involved smaller players consolidating within specific niches.

Italy Online Accommodation Industry Industry Trends & Insights

The Italian online accommodation market is experiencing robust growth, driven by factors such as increasing tourism, rising disposable incomes, and the growing preference for online travel booking. The Compound Annual Growth Rate (CAGR) is estimated at 7% during the forecast period (2025-2033), while market penetration has already reached 70% in major urban areas and is steadily growing in smaller towns and rural areas. Technological disruptions, such as the rise of mobile booking apps and the adoption of AI-powered recommendation systems, are reshaping customer experience and competitive dynamics. Consumer preferences are shifting towards personalized experiences, sustainable travel options, and unique local accommodations. The market exhibits intense competition, with established players investing heavily in marketing and technology to maintain their market share. The growing popularity of experience-based tourism and the increasing demand for alternative accommodations (e.g., boutique hotels, villas) are also significant market trends.

Dominant Markets & Segments in Italy Online Accommodation Industry

Leading Regions: Rome, Milan, Florence, and Venice are the dominant regions within the Italian online accommodation market due to their robust tourism infrastructure, higher disposable income levels, and strong brand recognition. Key drivers include strong economic policies supportive of the tourism sector, well-developed transportation infrastructure, and high levels of international tourist arrivals.

Platform Type: Mobile applications dominate the booking landscape, accounting for approximately 60% of all bookings in 2025, driven by convenience and accessibility. Websites continue to hold a significant share, particularly among older demographics and those who prefer desktop browsing.

Mode of Booking: Third-party online travel agents (OTAs) command a significant market share, primarily due to their wide selection of accommodations and competitive pricing. However, direct bookings through captive portals are also showing strong growth, spurred by hotels and accommodations actively promoting their own platforms. The increasing popularity of direct booking is fueled by the ability to offer exclusive deals and avoid commissions paid to OTAs.

The dominance analysis reveals that the combination of leading regions, mobile applications, and third-party OTAs creates the most lucrative segment within the Italian online accommodation sector. However, the growth in direct bookings through captive portals poses a key challenge for OTAs, triggering a greater focus on brand differentiation and customer loyalty programs.

Italy Online Accommodation Industry Product Developments

The Italian online accommodation industry demonstrates continuous product innovation, with a strong emphasis on enhanced user interfaces, personalized recommendations, and seamless booking processes. Integration of AI-powered chatbots and virtual assistants for customer support is becoming increasingly prevalent. New features, such as augmented reality tours of properties and real-time availability updates, enhance the customer experience, aligning with the increasing preference for mobile-first bookings and personalized travel solutions. The market fit is evident through the high adoption rates of innovative features and the strong customer response to enhanced booking platforms.

Report Scope & Segmentation Analysis

This report segments the Italian online accommodation market based on platform type (mobile application and website) and mode of booking (third-party online portals and direct/captive portals). Growth projections for each segment are detailed within the full report. Mobile applications are projected to maintain a high growth rate, driven by increasing smartphone penetration and the convenience of mobile booking. Websites will continue to hold a stable share. Third-party online travel portals will see a moderate growth rate, facing increasing competition from direct bookings through captive portals. Direct/captive portals are expected to experience the highest growth rate in the forecast period, demonstrating increasing willingness of travelers to book directly with accommodation providers.

Key Drivers of Italy Online Accommodation Industry Growth

The growth of the Italian online accommodation industry is driven by several key factors. Firstly, the increasing number of international and domestic tourists visiting Italy fuels demand for online booking services. Secondly, the rising adoption of smartphones and the increasing prevalence of mobile booking platforms are contributing to the growth. Thirdly, the growing penetration of the internet and increased online trust among customers have made online bookings an integral part of the travel experience. Finally, favorable government policies that promote tourism further aid this growth.

Challenges in the Italy Online Accommodation Industry Sector

The Italian online accommodation sector faces several challenges. Firstly, intense competition among various platforms and properties requires significant marketing investments to gain market share. Secondly, regulatory changes, such as those relating to data privacy and consumer protection, impose operational compliance costs. Thirdly, seasonality significantly impacts occupancy rates, creating financial instability for smaller businesses. Lastly, the reliance on third-party platforms makes accommodation providers susceptible to commissions and fee structures imposed by those platforms. These challenges significantly impact profitability and sustainability, particularly for small and medium-sized businesses.

Emerging Opportunities in Italy Online Accommodation Industry

The Italian online accommodation market presents several emerging opportunities. The rise of sustainable and eco-friendly tourism is driving demand for eco-lodges and environmentally conscious accommodations, creating a niche market. Furthermore, increasing demand for unique and personalized travel experiences is driving the growth of boutique hotels and alternative accommodations. Finally, the integration of emerging technologies, such as artificial intelligence and blockchain technology, presents opportunities for process optimization, fraud prevention, and secure transactions.

Leading Players in the Italy Online Accommodation Industry Market

- Italy Heaven

- AirBnB

- agoda

- Bookings for you

- Initalia

- Trip advisor

- Booking Holdings

- Expedia

- Plum guide

- Vrbo

Key Developments in Italy Online Accommodation Industry Industry

- June 01, 2021: Trip.com and TripAdvisor expanded their strategic partnership to include TripAdvisor Plus, enhancing customer experience.

- July 20, 2021: TripAdvisor partnered with SiteMinder, Roiback, Derbysoft, and WebHotelier, enabling broader participation in TripAdvisor Plus.

- September 13, 2021: TripAdvisor partnered with Audible, offering travel audio entertainment integration.

These partnerships significantly impacted market dynamics by enhancing customer offerings, improving technological integration for hotels, and broadening the reach of TripAdvisor's platform.

Strategic Outlook for Italy Online Accommodation Industry Market

The Italian online accommodation market demonstrates strong growth potential, driven by the continued expansion of tourism, technological advancements, and evolving consumer preferences. Future opportunities lie in catering to niche market segments, such as sustainable travel and personalized experiences. Investments in innovative technologies and strategic partnerships will be crucial for market leadership. The increasing demand for seamless booking processes and personalized recommendations will require continuous adaptation and product development. The market's future depends on addressing challenges related to seasonality and competition while capitalizing on opportunities presented by the ever-evolving travel landscape.

Italy Online Accommodation Industry Segmentation

-

1. Platform type

- 1.1. Mobile Application

- 1.2. Website

-

2. Mode of Booking type

- 2.1. Third Party Online Portals

- 2.2. Direct/Captive portals

Italy Online Accommodation Industry Segmentation By Geography

- 1. Italy

Italy Online Accommodation Industry Regional Market Share

Geographic Coverage of Italy Online Accommodation Industry

Italy Online Accommodation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Long-Distances are Physically Demanding which in return Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration has Huge Impact on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Online Accommodation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform type

- 5.1.1. Mobile Application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking type

- 5.2.1. Third Party Online Portals

- 5.2.2. Direct/Captive portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Platform type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Italy Heaven**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AirBnB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 agoda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bookings for you

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Initalia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Trip advisor

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Booking Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Expedia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plum guide

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vrbo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Italy Heaven**List Not Exhaustive

List of Figures

- Figure 1: Italy Online Accommodation Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Online Accommodation Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Online Accommodation Industry Revenue billion Forecast, by Platform type 2020 & 2033

- Table 2: Italy Online Accommodation Industry Revenue billion Forecast, by Mode of Booking type 2020 & 2033

- Table 3: Italy Online Accommodation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Online Accommodation Industry Revenue billion Forecast, by Platform type 2020 & 2033

- Table 5: Italy Online Accommodation Industry Revenue billion Forecast, by Mode of Booking type 2020 & 2033

- Table 6: Italy Online Accommodation Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Online Accommodation Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Italy Online Accommodation Industry?

Key companies in the market include Italy Heaven**List Not Exhaustive, AirBnB, agoda, Bookings for you, Initalia, Trip advisor, Booking Holdings, Expedia, Plum guide, Vrbo.

3. What are the main segments of the Italy Online Accommodation Industry?

The market segments include Platform type, Mode of Booking type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration has Huge Impact on the Market.

7. Are there any restraints impacting market growth?

Long-Distances are Physically Demanding which in return Restraining the Market.

8. Can you provide examples of recent developments in the market?

On September 13, 2021. TripAdvisor partnered with Audible for the Ultimate Travel Audio Entertainment, it makes easy for traveller to listen their favourite audio playlists with them during their next trip with just a few taps on their mobile device.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Online Accommodation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Online Accommodation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Online Accommodation Industry?

To stay informed about further developments, trends, and reports in the Italy Online Accommodation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence