Key Insights

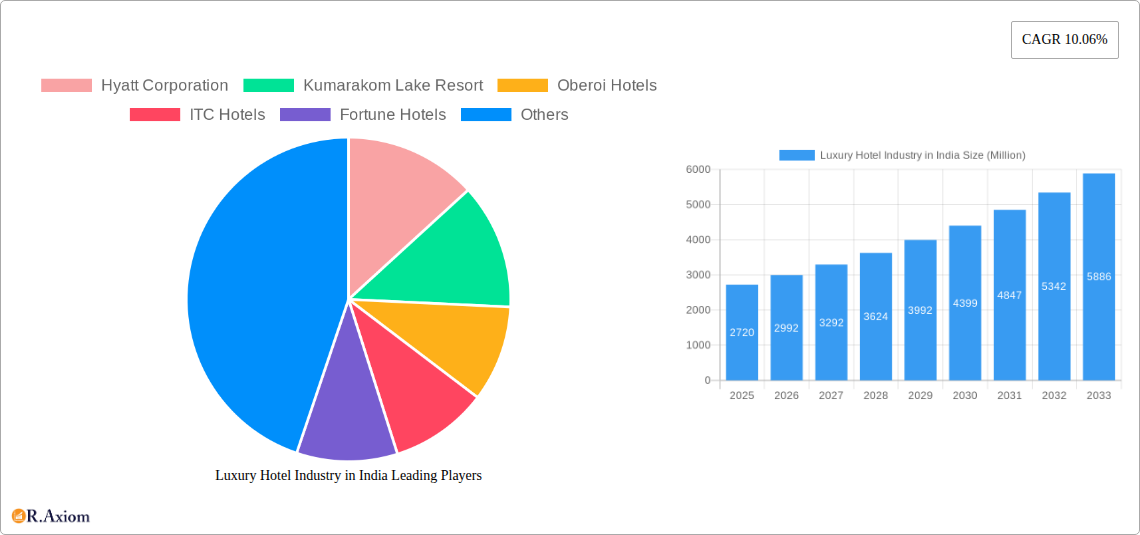

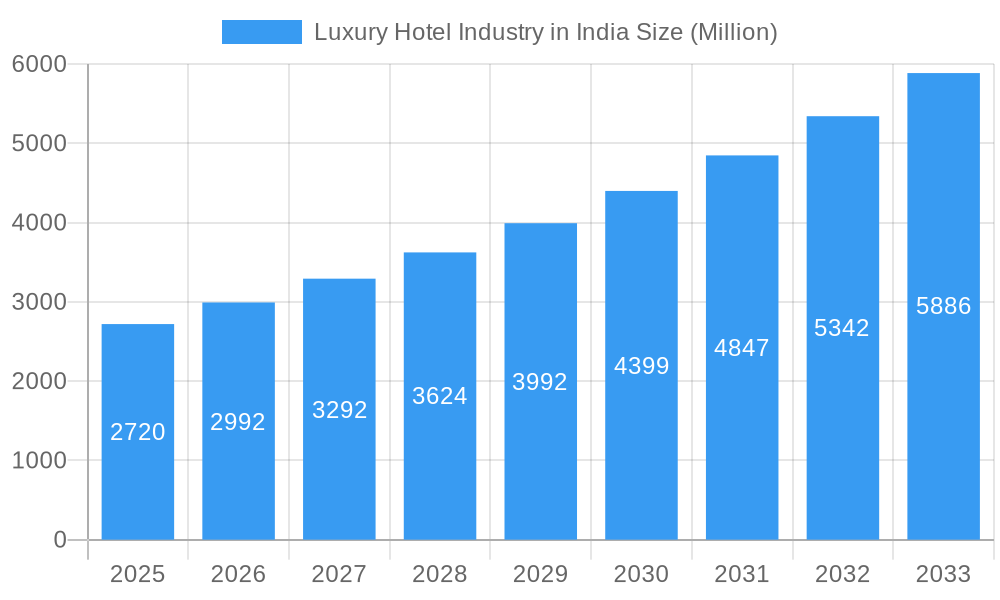

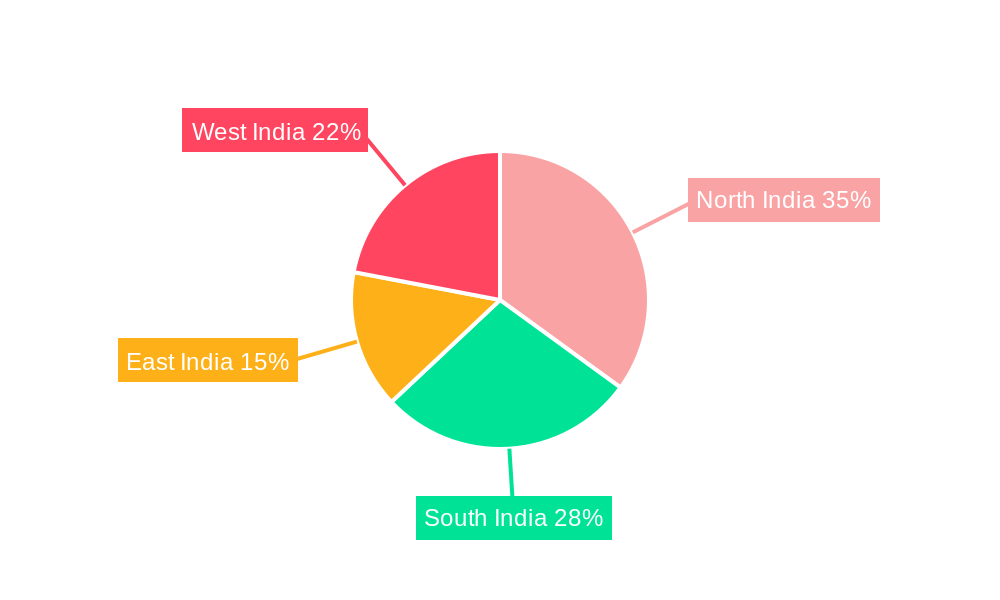

The Indian luxury hotel market, valued at $2.72 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.06% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning affluent class within India, coupled with increasing inbound tourism, particularly from high-spending international travelers, is significantly boosting demand for premium accommodations. Furthermore, a rise in experiential travel, with discerning guests seeking unique and personalized services, is shaping the luxury hotel landscape. The industry is witnessing innovative trends such as the integration of technology for enhanced guest experiences (personalized concierge services, contactless check-in/out), a focus on sustainability and wellness initiatives (eco-friendly practices, spa and wellness offerings), and strategic partnerships with luxury brands to provide elevated amenities and services. While challenges exist, such as fluctuating currency exchange rates and potential economic volatility, the overall outlook remains positive. The segmentation within the market, encompassing business hotels, suit hotels, airport hotels, resorts & spas, and others, caters to diverse customer needs, fostering further growth. The presence of established international and domestic players like Hyatt, Oberoi, ITC Hotels, and Marriott, alongside unique boutique hotels, contributes to the market's dynamism and competitive landscape. Regional variations exist, with key markets in North, South, East, and West India showcasing diverse growth trajectories based on local economic conditions and tourism patterns.

Luxury Hotel Industry in India Market Size (In Billion)

The forecast period (2025-2033) anticipates continued robust growth, driven by the aforementioned factors. Strategic investments in infrastructure, improvements in air connectivity, and government initiatives aimed at boosting tourism will further propel the market forward. The competition within the luxury hotel segment is expected to remain intense, with established players constantly innovating and smaller boutique hotels offering unique experiences to carve a niche. This competition fosters innovation, driving improvements in service quality, technological integration, and overall customer satisfaction, solidifying India's position as a leading destination for luxury travel.

Luxury Hotel Industry in India Company Market Share

Luxury Hotel Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the luxury hotel industry in India, covering market dynamics, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. The report is essential for industry stakeholders, investors, and strategic decision-makers seeking a clear understanding of this lucrative market.

Luxury Hotel Industry in India Market Concentration & Innovation

This section analyzes the concentration of the Indian luxury hotel market, identifying key players and their market share. It also explores drivers of innovation, regulatory impacts, substitute products, end-user trends, and merger & acquisition (M&A) activities. The Indian luxury hotel market exhibits moderate concentration, with several large players and a number of smaller, boutique establishments.

Market Leaders: The Indian Hotels Company Limited (IHCL), Oberoi Hotels, ITC Hotels, and Marriott International Inc hold significant market share, estimated at approximately xx Million in revenue in 2024. Other major players include Hyatt Corporation, Radisson Hotels, Shangri La Hotels and Resorts, The Leela, Fortune Hotels, and The Park Hotels. Smaller, independent luxury hotels and resorts, like Kumarakom Lake Resort and Rambagh Palace, also contribute significantly to the market's diversity.

M&A Activity: The luxury hotel segment has witnessed moderate M&A activity in recent years, primarily focused on expanding geographic reach and brand portfolio diversification. Total deal value for luxury hotel M&A in India during 2019-2024 is estimated at approximately xx Million.

Innovation Drivers: Technological advancements in hospitality technology, rising demand for personalized experiences, and increasing focus on sustainability are key drivers of innovation within the industry.

Luxury Hotel Industry in India Industry Trends & Insights

This section delves into market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics within the Indian luxury hotel market. The Indian luxury hotel market is experiencing robust growth, driven by a burgeoning affluent class, increasing inbound tourism, and rising disposable incomes.

Market Growth: The CAGR for the Indian luxury hotel market during the historical period (2019-2024) is estimated at xx%, with a projected CAGR of xx% during the forecast period (2025-2033). Market penetration currently sits at approximately xx%.

Technological Disruptions: The rise of online travel agents (OTAs), the increasing use of mobile technology for booking and service requests, and the implementation of innovative technologies such as AI-powered chatbots and personalized recommendations are transforming the customer experience.

Consumer Preferences: Indian luxury hotel guests increasingly value personalized experiences, authentic local encounters, and sustainable practices. There is also a significant trend towards wellness-focused amenities and services.

Dominant Markets & Segments in Luxury Hotel Industry in India

This section pinpoints the leading regions, countries, and segments (Business Hotel, Suite Hotels, Airport Hotel, Resorts & Spa, Others) within the Indian luxury hotel market, analyzing key success factors.

Leading Segment: Resorts & Spas currently dominate the Indian luxury hotel market, driven by increasing demand for leisure travel and wellness tourism. The business hotel segment is also significant, particularly in major metropolitan areas.

Key Drivers:

- Economic Policies: Government initiatives promoting tourism and infrastructure development have significantly contributed to the growth of the luxury hotel sector.

- Infrastructure: Improved infrastructure, including transportation networks and airport connectivity, enhances accessibility to luxury destinations.

- Tourism Growth: The rise of inbound tourism, particularly from high-spending international travelers, is a significant factor.

Dominance Analysis: The dominance of resorts and spas is attributed to several factors. India's diverse landscapes and rich cultural heritage offer a wealth of opportunities for luxurious resort development. The growing awareness of wellness and the increasing demand for holistic experiences further fuels this segment's growth. In contrast, the business hotel segment is more concentrated in major cities, driven by business travel and corporate events.

Luxury Hotel Industry in India Product Developments

This section examines recent product innovations within the luxury hotel industry in India, analyzing technological trends and their impact on market fit. The Indian luxury hotel sector is witnessing significant product innovations, with a focus on enhancing guest experience and incorporating sustainable practices. Many hotels are incorporating smart technologies, such as automated check-in/check-out systems and personalized room controls, to provide seamless and efficient service. Furthermore, there's a growing emphasis on offering unique, culturally immersive experiences that cater to the preferences of discerning travelers. This focus on personalization, technological integration, and sustainability is crucial for securing a competitive edge in this dynamic market.

Report Scope & Segmentation Analysis

This report segments the Indian luxury hotel market by product type:

Business Hotels: This segment focuses on catering to business travelers and corporate events. Growth projections for this segment are dependent on economic conditions and business travel trends. The market size is estimated at xx Million in 2025.

Suite Hotels: Offers high-end accommodation with larger living spaces and added amenities. Growth is tied to the demand for extended-stay luxury options and is projected at xx Million in 2025.

Airport Hotels: Conveniently located near airports, this segment caters to travelers seeking comfortable accommodations before or after flights. Market size is projected at xx Million in 2025.

Resorts & Spas: This segment provides luxurious accommodations with leisure amenities and spa facilities, currently the largest segment, projected at xx Million in 2025.

Others: This category encompasses other types of luxury accommodations, like heritage hotels or boutique properties, projected at xx Million in 2025.

Key Drivers of Luxury Hotel Industry in India Growth

Several factors contribute to the growth of the Indian luxury hotel sector. These include rapid economic growth boosting disposable incomes and spending on luxury travel. Government initiatives promoting tourism, coupled with improved infrastructure (airports, roads, etc.) enhance accessibility. The increasing preference for unique and personalized experiences further fuels the demand for luxury accommodations. Moreover, the expanding middle class creates a larger pool of potential customers for luxury hotels.

Challenges in the Luxury Hotel Industry in India Sector

The Indian luxury hotel industry faces various challenges. Stringent regulations and bureaucratic hurdles can impede development. Supply chain disruptions, particularly in sourcing high-quality materials and skilled labor, impact operational efficiency. Intense competition, both from established chains and emerging boutique hotels, pressures margins and necessitates continuous innovation. Seasonal variations in tourism can also impact occupancy rates, requiring flexible pricing and promotional strategies. The industry is sensitive to global economic fluctuations.

Emerging Opportunities in Luxury Hotel Industry in India

The Indian luxury hotel sector presents significant opportunities. The growth of wellness tourism creates demand for specialized spa resorts and holistic experiences. The rise of sustainable tourism practices offers a chance to attract environmentally conscious travelers. Untapped niche markets, like heritage tourism and experiential travel, offer avenues for specialized hotel development. Technology integration can optimize operations and personalize guest experiences, boosting competitiveness and profitability.

Leading Players in the Luxury Hotel Industry in India Market

- Hyatt Corporation

- Kumarakom Lake Resort

- Oberoi Hotels

- ITC Hotels

- Fortune Hotels

- Rambagh Palace

- The Indian Hotels Company Limited (IHCL)

- Radisson Hotels

- Shangri La Hotels and Resorts

- The Park Hotels

- Marriott International Inc

- The Leela

Key Developments in Luxury Hotel Industry in India Industry

September 2022: ITC Hotels announced plans to launch more than 20 new properties within the next two years, significantly expanding its market share and targeting diverse customer segments.

2021: The Taj Group (IHCL) implemented a "zero-touch" service transformation, introducing digital solutions to enhance guest safety and provide contactless services across its Taj and Vivanta hotels.

Strategic Outlook for Luxury Hotel Industry in India Market

The Indian luxury hotel market exhibits substantial growth potential. Continued economic growth, infrastructure development, and increasing tourist arrivals will fuel demand. Strategic investments in technology, personalized experiences, and sustainable practices will be key for success. Hotels that offer authentic local experiences, coupled with high-quality service and advanced amenities, will be well-positioned to capture market share in the coming years. The market is poised for further consolidation and expansion, with opportunities for both established players and new entrants.

Luxury Hotel Industry in India Segmentation

-

1. Product Type

- 1.1. Business Hotel

- 1.2. Suit Hotels

- 1.3. Airport Hotel

- 1.4. Resorts & Spa

- 1.5. Others

Luxury Hotel Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Hotel Industry in India Regional Market Share

Geographic Coverage of Luxury Hotel Industry in India

Luxury Hotel Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Expenses by Domestic Travelers is fueling Luxurious Hotel Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Business Hotel

- 5.1.2. Suit Hotels

- 5.1.3. Airport Hotel

- 5.1.4. Resorts & Spa

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Business Hotel

- 6.1.2. Suit Hotels

- 6.1.3. Airport Hotel

- 6.1.4. Resorts & Spa

- 6.1.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Business Hotel

- 7.1.2. Suit Hotels

- 7.1.3. Airport Hotel

- 7.1.4. Resorts & Spa

- 7.1.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Business Hotel

- 8.1.2. Suit Hotels

- 8.1.3. Airport Hotel

- 8.1.4. Resorts & Spa

- 8.1.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Business Hotel

- 9.1.2. Suit Hotels

- 9.1.3. Airport Hotel

- 9.1.4. Resorts & Spa

- 9.1.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Luxury Hotel Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Business Hotel

- 10.1.2. Suit Hotels

- 10.1.3. Airport Hotel

- 10.1.4. Resorts & Spa

- 10.1.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hyatt Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kumarakom Lake Resort

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Oberoi Hotels

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ITC Hotels

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fortune Hotels

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rambagh Palace

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Indian Hotels Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Radisson Hotels*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shangri La Hotels and Resorts

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Park Hotels

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Marriott International Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Leela

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Hyatt Corporation

List of Figures

- Figure 1: Global Luxury Hotel Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Hotel Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Luxury Hotel Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Luxury Hotel Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Luxury Hotel Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Luxury Hotel Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 7: South America Luxury Hotel Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: South America Luxury Hotel Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Luxury Hotel Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Luxury Hotel Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Luxury Hotel Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Luxury Hotel Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Luxury Hotel Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Luxury Hotel Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Middle East & Africa Luxury Hotel Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Middle East & Africa Luxury Hotel Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Luxury Hotel Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Luxury Hotel Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Luxury Hotel Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Luxury Hotel Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Luxury Hotel Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Luxury Hotel Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Global Luxury Hotel Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Luxury Hotel Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Luxury Hotel Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 25: Global Luxury Hotel Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Luxury Hotel Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Luxury Hotel Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Luxury Hotel Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Hotel Industry in India?

The projected CAGR is approximately 10.06%.

2. Which companies are prominent players in the Luxury Hotel Industry in India?

Key companies in the market include Hyatt Corporation, Kumarakom Lake Resort, Oberoi Hotels, ITC Hotels, Fortune Hotels, Rambagh Palace, The Indian Hotels Company Limited, Radisson Hotels*List Not Exhaustive, Shangri La Hotels and Resorts, The Park Hotels, Marriott International Inc, The Leela.

3. What are the main segments of the Luxury Hotel Industry in India?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Expenses by Domestic Travelers is fueling Luxurious Hotel Industry.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

September 2022: ITC Hotel plans to launch more than 20 properties in the next two years. This will help the hotel to grow its market share and to capture various demographic segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Hotel Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Hotel Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Hotel Industry in India?

To stay informed about further developments, trends, and reports in the Luxury Hotel Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence