Key Insights

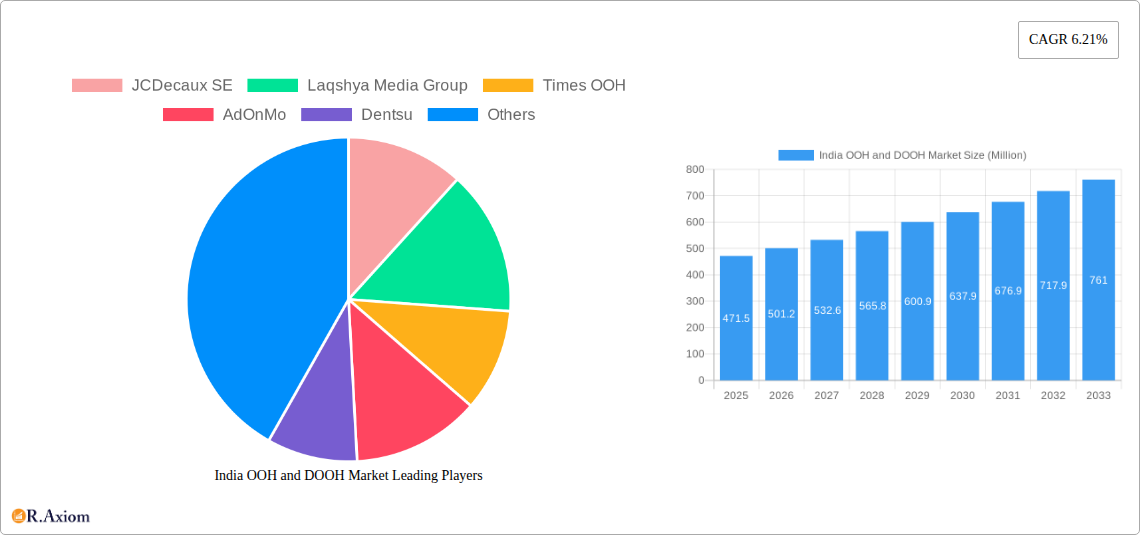

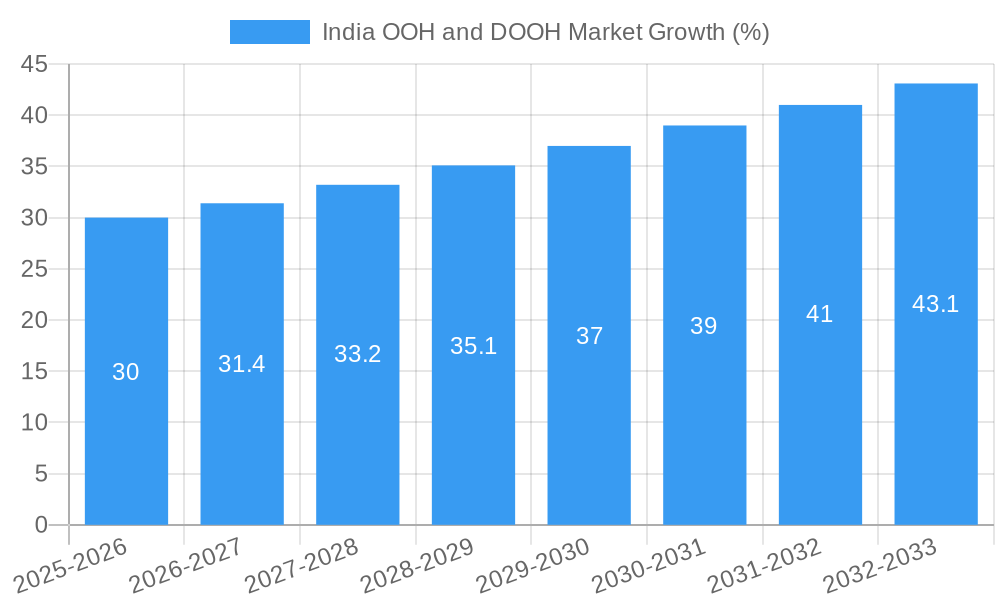

The India Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market presents a compelling growth story, projected to reach a market size of $471.5 million in 2025 and exhibit a Compound Annual Growth Rate (CAGR) of 6.21% from 2025 to 2033. This robust expansion is fueled by several key factors. Increasing urbanization and a burgeoning middle class are driving higher consumer spending and exposure to outdoor advertising. The adoption of digital technologies within the OOH sector, enabling targeted advertising campaigns and real-time data analysis, significantly enhances the effectiveness and appeal of DOOH for businesses. Furthermore, innovative formats like interactive billboards and programmatic DOOH buying are gaining traction, further boosting market growth. However, challenges remain, including regulatory hurdles related to advertising placement and the need for infrastructure development, especially in rural areas. Competition among established players like JCDecaux SE, Laqshya Media Group, and Times OOH, alongside emerging players, is intensifying. The market is segmented by advertising format (billboards, transit advertising, street furniture, etc.), location (urban vs. rural), and advertising type (static vs. dynamic). This diverse landscape presents both opportunities and challenges for existing and aspiring market participants.

The projected CAGR of 6.21% suggests a steady upward trajectory for the India OOH and DOOH market over the forecast period (2025-2033). To achieve this growth, companies must focus on innovation and adapt to evolving consumer preferences. The integration of technology is vital, enabling data-driven decision-making and personalized advertising experiences. Collaboration with local authorities to streamline regulations and facilitate infrastructure improvements will be crucial in unlocking further market potential. A strategic approach that balances expansion with sustainability and responsible advertising practices will be key to long-term success in this dynamic and rapidly growing market. Furthermore, leveraging the increasing smartphone penetration and data accessibility will help to enhance targeting and campaign effectiveness.

This detailed report provides a comprehensive analysis of the India Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market, encompassing historical data (2019-2024), the base year (2025), and a forecast period extending to 2033. The report offers actionable insights for industry stakeholders, investors, and businesses seeking to understand this dynamic market. The analysis incorporates key performance indicators (KPIs) such as market size, CAGR, market share, and examines the impact of recent industry developments.

India OOH and DOOH Market Concentration & Innovation

This section analyzes the competitive landscape of the Indian OOH and DOOH market, focusing on market concentration, innovation drivers, regulatory frameworks, and key industry trends. The market is characterized by a mix of large multinational players and domestic companies. While precise market share data for each player requires further investigation, we can observe a moderately concentrated market with a few dominant players. For example, JCDecaux SE, Laqshya Media Group, and Times OOH likely hold significant shares. However, the presence of numerous smaller players and the rapid emergence of new technologies indicate a dynamic competitive environment.

- Market Concentration: Moderately concentrated with a few dominant players and numerous smaller firms. Precise market share data is currently unavailable (xx%). Further research is necessary to provide a more precise quantification of the market concentration.

- Innovation Drivers: Technological advancements, particularly in digital display technologies, programmatic advertising, and data analytics, are key innovation drivers. Growing consumer demand for interactive and engaging advertising experiences further fuels innovation.

- Regulatory Frameworks: The regulatory environment plays a crucial role. Understanding and complying with relevant advertising standards and regulations is essential for market players. Further research is needed to detail the specific regulatory frameworks and their impact on market growth.

- Product Substitutes: Digital advertising channels (online, social media) represent the primary substitutes. The competitive landscape requires OOH and DOOH players to demonstrate their unique value proposition through innovation and data-driven targeting.

- End-User Trends: Changing consumer behavior, including increased mobility and urban migration, influences the demand for OOH and DOOH advertising. Preference for visually engaging and contextually relevant advertisements is on the rise.

- M&A Activities: The Indian OOH and DOOH market has witnessed several mergers and acquisitions (M&A) deals in recent years. The exact values of these deals are unavailable (xx Million) at this time. Further research is needed to provide precise figures.

India OOH and DOOH Market Industry Trends & Insights

The Indian OOH and DOOH market is experiencing robust growth, driven by factors such as rising urbanization, increasing disposable incomes, and the growing adoption of digital technologies. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and is projected to maintain a significant CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the increasing preference for visually impactful advertisements and the expanding reach of digital screens. The market penetration rate for DOOH is expected to increase significantly in the coming years, as more advertisers adopt this highly targeted and measurable advertising format. The competitive dynamics are characterized by ongoing technological advancements, innovative campaign strategies, and the emergence of new players. Consumer preferences are shifting toward immersive and interactive experiences.

Dominant Markets & Segments in India OOH and DOOH Market

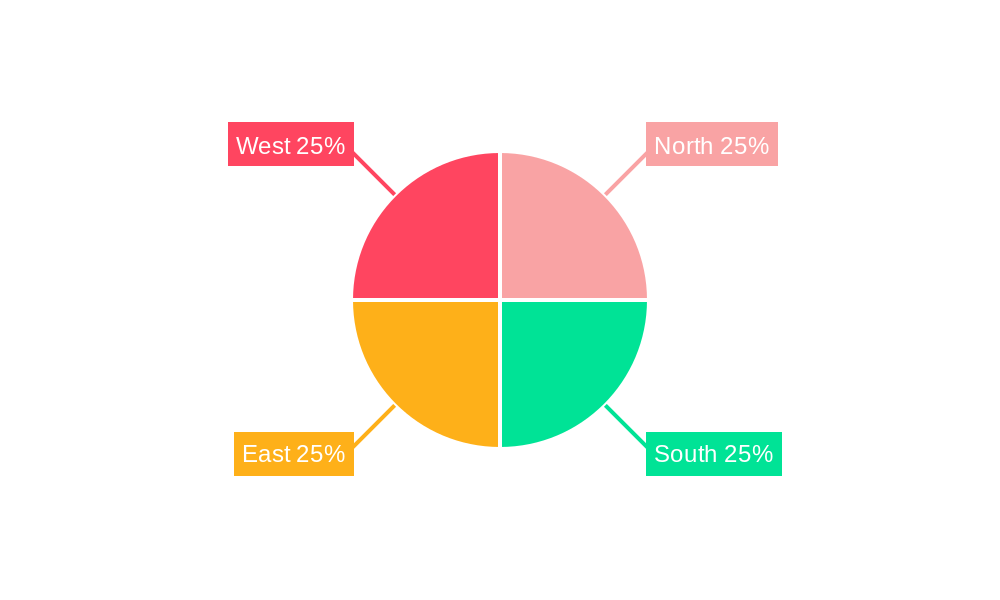

The Indian OOH and DOOH market is geographically diverse, with significant variations in growth rates across different regions. Metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai are expected to remain dominant due to high population density, increased advertising expenditure, and advanced infrastructure. However, other tier-1 and tier-2 cities are witnessing rapid expansion of OOH and DOOH advertising infrastructure, leading to increased market share.

- Key Drivers for Dominant Markets:

- High population density and purchasing power.

- Advanced infrastructure supporting digital installations.

- Favorable government policies supporting infrastructure development.

- High concentration of advertising agencies and media buyers.

The dominance of these markets stems from a combination of factors. The high population density in these metropolitan areas directly translates to higher potential reach for advertisers. Robust infrastructure, including well-developed transportation networks and a high concentration of commercial establishments, makes these areas ideal for deploying and maintaining OOH and DOOH advertising installations. Furthermore, a concentration of advertising agencies and media buyers in these cities fuels demand for innovative and effective OOH and DOOH campaigns.

India OOH and DOOH Market Product Developments

Recent product developments have centered around integrating advanced technologies to enhance targeting, measurement, and engagement. This includes the use of programmatic buying platforms, interactive digital displays, and data analytics to improve campaign effectiveness. New screen technologies, such as LED and high-definition screens, are also becoming more prevalent, offering advertisers increased visual appeal and impact. These improvements are designed to address advertisers' demand for more precise targeting and demonstrable return on investment (ROI).

Report Scope & Segmentation Analysis

This report segments the India OOH and DOOH market based on several key factors. The market segmentation is currently under development and complete details are unavailable. However, the segmentation is expected to include: format (billboards, transit, street furniture, digital displays), location (urban, rural), advertiser type (FMCG, retail, automotive, etc.), and technology (LED, LCD, etc.). Further research is required to provide definitive market size and growth projections for each segment.

Key Drivers of India OOH and DOOH Market Growth

Several factors are driving the growth of the India OOH and DOOH market:

- Technological Advancements: The adoption of digital technologies like programmatic buying, data analytics, and interactive displays significantly enhances targeting and measurement capabilities, attracting more advertisers.

- Economic Growth: Rising disposable incomes and increased consumer spending are increasing advertising budgets, particularly in the OOH and DOOH segment.

- Urbanization: Rapid urbanization leads to higher population density in urban areas, creating more opportunities for OOH and DOOH installations with increased visibility.

- Government Initiatives: Policies and regulations supporting infrastructure development further contribute to the growth of the sector.

Challenges in the India OOH and DOOH Market Sector

The Indian OOH and DOOH market faces several challenges:

- Regulatory Hurdles: Obtaining necessary permits and approvals for OOH and DOOH installations can be time-consuming and complex.

- Infrastructure Limitations: In some areas, lack of adequate infrastructure can hinder the deployment of DOOH installations.

- Competitive Pressure: The market is becoming increasingly competitive, with both established and emerging players vying for market share.

- Measurement and Reporting: Accurate and consistent measurement and reporting of campaign performance remains a challenge.

Emerging Opportunities in India OOH and DOOH Market

The Indian OOH and DOOH market offers exciting opportunities:

- Expansion into Tier 2 and 3 Cities: These cities offer significant untapped potential due to rising disposable incomes and increasing consumerism.

- Programmatic DOOH: The adoption of programmatic advertising platforms will enhance efficiency and targeting.

- Interactive and Experiential Advertising: Creating interactive campaigns enhances engagement and brand recall.

- Data-Driven Targeting: Utilizing data analytics to better target specific audience segments can significantly improve campaign effectiveness.

Leading Players in the India OOH and DOOH Market Market

- JCDecaux SE

- Laqshya Media Group

- Times OOH

- AdOnMo

- Dentsu

- ARMOUR Digital

- Ooh! Media Digital PTY Limited

- Mooving Walls

- PlayAds Advertisement Spaces Pvt Ltd

- Bellplus Media

- List Not Exhaustive

Key Developments in India OOH and DOOH Market Industry

- February 2024: AdOnMo was chosen as the sole DOOH partner for the Dadasaheb Phalke International Film Festival Awards 2024, showcasing the potential of DOOH in high-profile events.

- February 2024: Aditya Birla Finance launched a successful OOH campaign across 12 cities in partnership with Platinum Outdoor (Madison World), demonstrating the effectiveness of integrated OOH strategies.

Strategic Outlook for India OOH and DOOH Market Market

The future of the Indian OOH and DOOH market looks bright, with continued growth driven by technological innovation, expanding infrastructure, and rising advertising budgets. The increasing adoption of digital technologies, coupled with a focus on data-driven targeting and improved measurement capabilities, will further propel market growth. The market presents significant opportunities for both established players and new entrants, and the focus will be on delivering highly targeted, engaging, and measurable advertising campaigns to meet evolving consumer preferences.

India OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Others

-

2. Application

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Others (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-Based Media

-

3. End-User Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End Users

India OOH and DOOH Market Segmentation By Geography

- 1. India

India OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines

- 3.4. Market Trends

- 3.4.1. Ongoing Shift Toward Digital Advertising Expected to Boost Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India OOH and DOOH Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Others (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-Based Media

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JCDecaux SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Laqshya Media Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Times OOH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AdOnMo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dentsu

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ARMOUR Digital

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ooh! Media Digital PTY Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mooving Walls

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PlayAds Advertisement Spaces Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bellplus Media*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JCDecaux SE

List of Figures

- Figure 1: India OOH and DOOH Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India OOH and DOOH Market Share (%) by Company 2024

List of Tables

- Table 1: India OOH and DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India OOH and DOOH Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: India OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: India OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: India OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 7: India OOH and DOOH Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: India OOH and DOOH Market Volume Million Forecast, by End-User Industry 2019 & 2032

- Table 9: India OOH and DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India OOH and DOOH Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: India OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: India OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: India OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 15: India OOH and DOOH Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: India OOH and DOOH Market Volume Million Forecast, by End-User Industry 2019 & 2032

- Table 17: India OOH and DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India OOH and DOOH Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India OOH and DOOH Market?

The projected CAGR is approximately 6.21%.

2. Which companies are prominent players in the India OOH and DOOH Market?

Key companies in the market include JCDecaux SE, Laqshya Media Group, Times OOH, AdOnMo, Dentsu, ARMOUR Digital, Ooh! Media Digital PTY Limited, Mooving Walls, PlayAds Advertisement Spaces Pvt Ltd, Bellplus Media*List Not Exhaustive.

3. What are the main segments of the India OOH and DOOH Market?

The market segments include Type , Application , End-User Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 471.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines.

6. What are the notable trends driving market growth?

Ongoing Shift Toward Digital Advertising Expected to Boost Market Growth.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines.

8. Can you provide examples of recent developments in the market?

February 2024: The Dadasaheb Phalke International Film Festival Awards 2024, India's premier film accolade, was scheduled for February 20th, 2024, in Mumbai, Maharashtra. Organizers revealed Adonmo as the sole DOOH partner, marking a collaboration between cinematic excellence and innovative outdoor advertising.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the India OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence