Key Insights

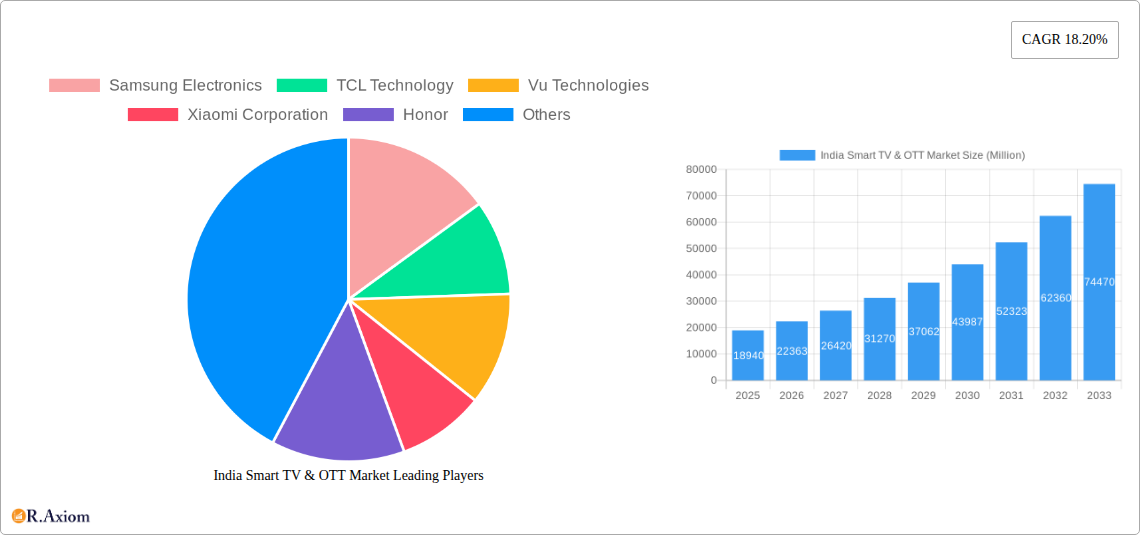

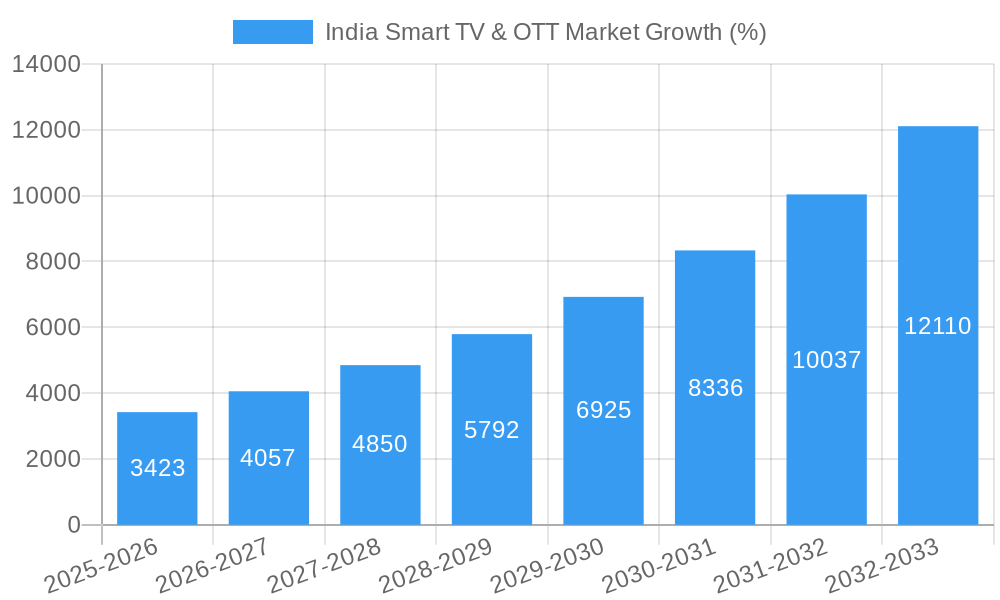

The India Smart TV and OTT market is experiencing robust growth, fueled by increasing internet and smartphone penetration, rising disposable incomes, and a preference for streaming entertainment. The market, valued at $18.94 billion in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 18.20% from 2025 to 2033. Key drivers include the affordability of smart TVs, particularly larger screen sizes, and the wide availability of affordable high-speed internet. The increasing popularity of subscription-based video-on-demand (SVOD) services further contributes to this growth. Consumer preferences are shifting towards larger screen sizes (above 55 inches) and advanced display technologies like OLED and QLED. The proliferation of OTT platforms offering diverse content catering to varied age groups and preferences further stimulates market expansion. Competition among established players like Samsung, LG, Sony, and emerging brands like Xiaomi and OnePlus intensifies, driving innovation and price reductions, ultimately benefiting consumers. The market is segmented by screen size, display type (OLED, QLED, LED), operating system (Android TV, webOS, etc.), and additional features (smart home integration, voice control). Similarly, the OTT segment is categorized by content type (movies, TV shows, live sports), subscription models (SVOD, AVOD, TVOD), and target audience demographics. While regulatory hurdles and infrastructure limitations in certain regions might pose some challenges, the overall growth trajectory remains significantly positive for the foreseeable future.

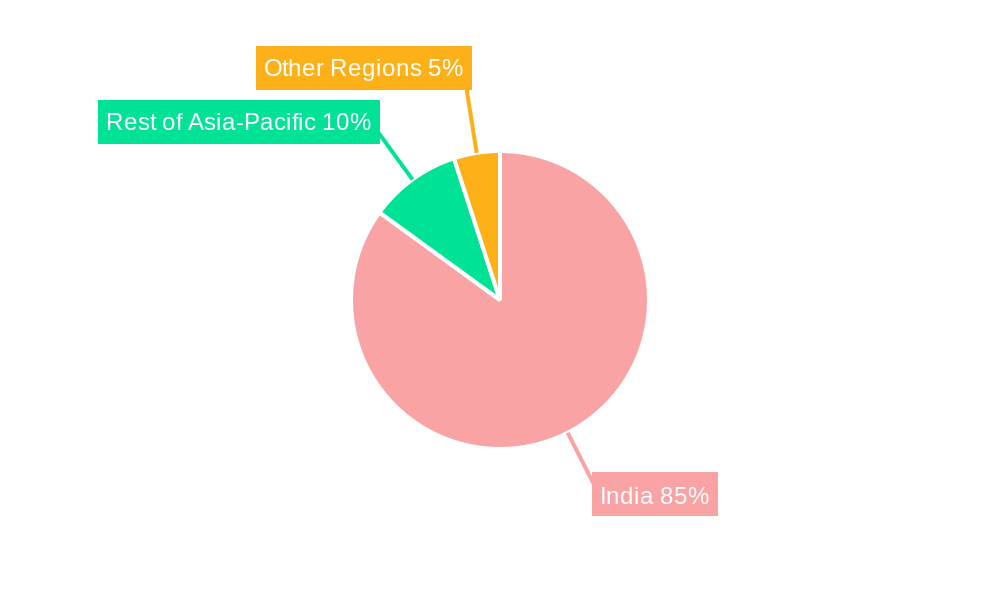

The dominance of the Asia-Pacific region, particularly India, is anticipated to continue. India's young and tech-savvy population is a key factor driving the adoption of smart TVs and OTT platforms. Government initiatives promoting digitalization and infrastructure development also support market expansion. The increasing preference for affordable, high-quality content fuels the growth of local OTT platforms, further enhancing competition and driving market penetration. However, challenges include the need for improved internet infrastructure in rural areas and the potential for piracy impacting the profitability of streaming services. Future growth will depend on addressing these challenges and continuing the trend of innovative product offerings and competitive pricing strategies by manufacturers and OTT providers.

India Smart TV & OTT Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Smart TV & OTT market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, growth drivers, challenges, and opportunities, providing actionable intelligence for industry stakeholders, investors, and businesses operating in this rapidly evolving sector. The report utilizes data from the historical period (2019-2024), the base year (2025), and forecasts up to 2033. Key players such as Samsung Electronics, TCL Technology, Vu Technologies, Xiaomi Corporation, Honor, Haier, OnePlus, Sansui, Panasonic Corporation, Sony Corporation, and LG Corporation are analyzed, although the list is not exhaustive. The report also segments the market by key parameters to reveal granular market trends and opportunities.

India Smart TV & OTT Market Concentration & Innovation

The Indian Smart TV and OTT market exhibits a moderately concentrated landscape, with a few dominant players commanding significant market share. Samsung Electronics and Xiaomi Corporation consistently rank among the top players, vying for leadership. However, the market is also characterized by significant competition from domestic and international brands such as TCL, Vu Technologies, and OnePlus, leading to intense price competition and continuous innovation. Market share fluctuations are common, influenced by factors like product launches, marketing campaigns, and consumer preferences. The estimated combined market share of the top five players in 2025 is xx%.

Several factors drive innovation: the increasing demand for higher resolution displays (4K, 8K), the integration of smart features (voice assistants, AI), and the growing popularity of OTT platforms. Regulatory frameworks, while generally supportive of market growth, also influence innovation through policies related to content regulation and data privacy. Product substitutes, such as projectors and laptops, present a degree of competition. However, Smart TVs' convenience and superior viewing experience often outweigh the substitutes’ advantages. The end-user trends reflect a preference for larger screen sizes, superior picture quality, and seamless streaming experiences. M&A activity has been moderate, with deal values in the range of xx Million in recent years, primarily focused on strengthening distribution networks and expanding content libraries. The ongoing consolidation signals a potential shift towards further market concentration in the coming years.

India Smart TV & OTT Market Industry Trends & Insights

The Indian Smart TV and OTT market is experiencing robust growth, driven by rising disposable incomes, increasing internet penetration, and the affordability of smart devices. The CAGR for the Smart TV market during the forecast period (2025-2033) is estimated at xx%, while the OTT market is projected to grow at a CAGR of xx%. Market penetration of Smart TVs is expected to reach xx% by 2033, driven by factors such as declining prices, improved specifications, and a preference for larger screen sizes. Technological disruptions, such as the adoption of 8K resolution and advancements in display technologies like OLED and QLED, are continually reshaping the market landscape. Consumers' preferences are shifting toward larger screens, improved picture quality, enhanced smart features (voice control, AI integration), and seamless integration with OTT platforms. Competitive dynamics are intense, with brands engaging in aggressive pricing strategies, product differentiation, and marketing campaigns. This competitive environment benefits consumers with more choices and innovation.

Dominant Markets & Segments in India Smart TV & OTT Market

Dominant Regions/Segments:

- Smart TVs: Urban areas in major metropolitan cities like Mumbai, Delhi, Bengaluru, and Chennai exhibit the highest Smart TV penetration due to higher disposable income and greater internet access.

- Screen Size: The demand for larger screen sizes (55 inches and above) is increasing rapidly, driven by improved affordability and consumer preference for immersive viewing experiences.

- Display Type: LED displays continue to dominate, though OLED and QLED displays are gaining traction in premium segments.

- Operating System: Android TV and Google TV are the most prevalent operating systems, offering a wide range of apps and services.

- OTT Platforms: Subscription Video on Demand (SVOD) is the dominant model, with platforms like Netflix, Amazon Prime Video, Disney+ Hotstar, and Zee5 enjoying significant popularity.

- Content Type: Local language content is driving significant growth, with a huge demand for regional movies, TV shows, and web series.

Key Drivers of Dominance:

- Economic Growth: India's growing middle class fuels the demand for premium electronic devices like Smart TVs.

- Improved Infrastructure: Increased internet penetration, particularly broadband and mobile data, is crucial for OTT platform adoption.

- Government Initiatives: Government initiatives supporting digital infrastructure and media content creation contribute to market expansion.

India Smart TV & OTT Market Product Developments

Recent product innovations focus on enhancing picture quality (8K resolution, HDR), improving smart features (AI-powered assistants, enhanced voice control), and expanding connectivity options. Mini-LED and Micro-LED technologies are gaining traction for their superior contrast and brightness. The integration of IoT (Internet of Things) capabilities is also gaining momentum, allowing Smart TVs to seamlessly interact with other smart home devices. These developments cater to the evolving consumer demand for enhanced entertainment experiences and seamless device integration.

Report Scope & Segmentation Analysis

Smart TVs: The report segments the Smart TV market by screen size (below 40 inches, 40-55 inches, above 55 inches), display type (LED, OLED, QLED), operating system (Android TV, WebOS, Tizen), and additional features (Smart features, voice assistant, HDR). Growth projections for each segment vary, with larger screen sizes and premium display technologies exhibiting faster growth. Competitive dynamics are intense across all segments, with leading players employing diverse strategies to gain market share.

OTT Platforms: The OTT market is segmented by content type (movies, TV shows, web series, live sports), subscription model (SVOD, AVOD, TVOD), and target audience (general audience, children, niche interests). Growth is robust across all segments, particularly in the SVOD and local language content segments. Competition is fierce, with platforms constantly innovating to retain and attract subscribers.

Key Drivers of India Smart TV & OTT Market Growth

Several key factors propel the India Smart TV and OTT market's growth. Firstly, rising disposable incomes and increasing urbanization are boosting consumer spending on entertainment and electronics. Secondly, expanding internet and broadband penetration is making OTT services accessible to a larger audience. Thirdly, the availability of affordable Smart TVs and data plans is driving adoption. Finally, the increasing popularity of local language content has made OTT services more appealing to a broader demographic.

Challenges in the India Smart TV & OTT Market Sector

The Indian Smart TV and OTT market faces several challenges. Content piracy remains a major concern, impacting the revenue of both content creators and streaming platforms. The digital divide, with limited internet access in rural areas, restricts market penetration. Furthermore, intense competition among players leads to price wars and pressure on profit margins. Supply chain disruptions and fluctuations in the cost of components also pose a significant challenge.

Emerging Opportunities in India Smart TV & OTT Market

The Indian Smart TV and OTT market offers significant opportunities. The expansion of 5G networks promises to enhance streaming experiences, driving further adoption. The growth of local language content continues to create new market segments and cater to underserved audiences. The integration of AI and other smart features into Smart TVs creates new avenues for innovation and differentiation. Furthermore, the increasing adoption of hyperlocal content and regional-language streaming services represents an untapped market opportunity.

Leading Players in the India Smart TV & OTT Market Market

- Samsung Electronics

- TCL Technology

- Vu Technologies

- Xiaomi Corporation

- Honor

- Haier

- OnePlus

- Sansui

- Panasonic Corporation

- Sony Corporation

- LG Corporation

Key Developments in India Smart TV & OTT Market Industry

- February 2022: T-Series, a leading Indian film studio, announced its foray into web series production for video streaming devices, signifying a significant expansion in OTT content creation.

- May 2022: The Kerala Government launched CSpace, a state-owned OTT platform offering movies, short films, and documentaries, indicating government support for the development of local content and platforms.

Strategic Outlook for India Smart TV & OTT Market Market

The future of the Indian Smart TV and OTT market is bright, driven by continued growth in internet penetration, rising disposable incomes, and the increasing demand for localized content. The focus on innovation, particularly in display technologies and smart features, will continue to shape the market. The integration of AI and IoT will further enhance the user experience and open new opportunities. The market will likely see further consolidation among players, with larger companies acquiring smaller ones to expand their reach and content libraries. The overall market potential remains significant, with considerable room for growth in both Smart TV penetration and OTT subscription rates.

India Smart TV & OTT Market Segmentation

- 1. OS Type (Tizen, WebOS, Android TV, etc.)

- 2. Price Range

India Smart TV & OTT Market Segmentation By Geography

- 1. India

India Smart TV & OTT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Large Volume of the Indian Households and Relative Less Levels of Penetration; Growing Spending Power and Growth in Smartphone Adoption to boost OTT Demand; Declining Unit Prices Coupled with Entry of Several Regional Players to Drive Bargaining Leverage of Buyers

- 3.3. Market Restrains

- 3.3.1. Manufacturers Faced with Taxation Challenges and Relatively Higher Replacement Rate

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Smart Devices Across IoT Ecosystem to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by OS Type (Tizen, WebOS, Android TV, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Price Range

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by OS Type (Tizen, WebOS, Android TV, etc.)

- 6. China India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 8. India India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific India Smart TV & OTT Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Samsung Electronics

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 TCL Technology

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Vu Technologies

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Xiaomi Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Honor

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Haier

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 OnePlus

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sansui*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Panasonic Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sony Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 LG Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Samsung Electronics

List of Figures

- Figure 1: India Smart TV & OTT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Smart TV & OTT Market Share (%) by Company 2024

List of Tables

- Table 1: India Smart TV & OTT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Smart TV & OTT Market Revenue Million Forecast, by OS Type (Tizen, WebOS, Android TV, etc.) 2019 & 2032

- Table 3: India Smart TV & OTT Market Revenue Million Forecast, by Price Range 2019 & 2032

- Table 4: India Smart TV & OTT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Smart TV & OTT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific India Smart TV & OTT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Smart TV & OTT Market Revenue Million Forecast, by OS Type (Tizen, WebOS, Android TV, etc.) 2019 & 2032

- Table 14: India Smart TV & OTT Market Revenue Million Forecast, by Price Range 2019 & 2032

- Table 15: India Smart TV & OTT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Smart TV & OTT Market?

The projected CAGR is approximately 18.20%.

2. Which companies are prominent players in the India Smart TV & OTT Market?

Key companies in the market include Samsung Electronics, TCL Technology, Vu Technologies, Xiaomi Corporation, Honor, Haier, OnePlus, Sansui*List Not Exhaustive, Panasonic Corporation, Sony Corporation, LG Corporation.

3. What are the main segments of the India Smart TV & OTT Market?

The market segments include OS Type (Tizen, WebOS, Android TV, etc.), Price Range.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Large Volume of the Indian Households and Relative Less Levels of Penetration; Growing Spending Power and Growth in Smartphone Adoption to boost OTT Demand; Declining Unit Prices Coupled with Entry of Several Regional Players to Drive Bargaining Leverage of Buyers.

6. What are the notable trends driving market growth?

Increasing Adoption of Smart Devices Across IoT Ecosystem to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Manufacturers Faced with Taxation Challenges and Relatively Higher Replacement Rate.

8. Can you provide examples of recent developments in the market?

May 2022: Kerala Government announced to launch of a state-owned over-the-top platform offering an array of movies, short films, and documentaries. The OTT platform's name is CSpace, an initiative of the Kerala State Film Development Corporation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Smart TV & OTT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Smart TV & OTT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Smart TV & OTT Market?

To stay informed about further developments, trends, and reports in the India Smart TV & OTT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence