Key Insights

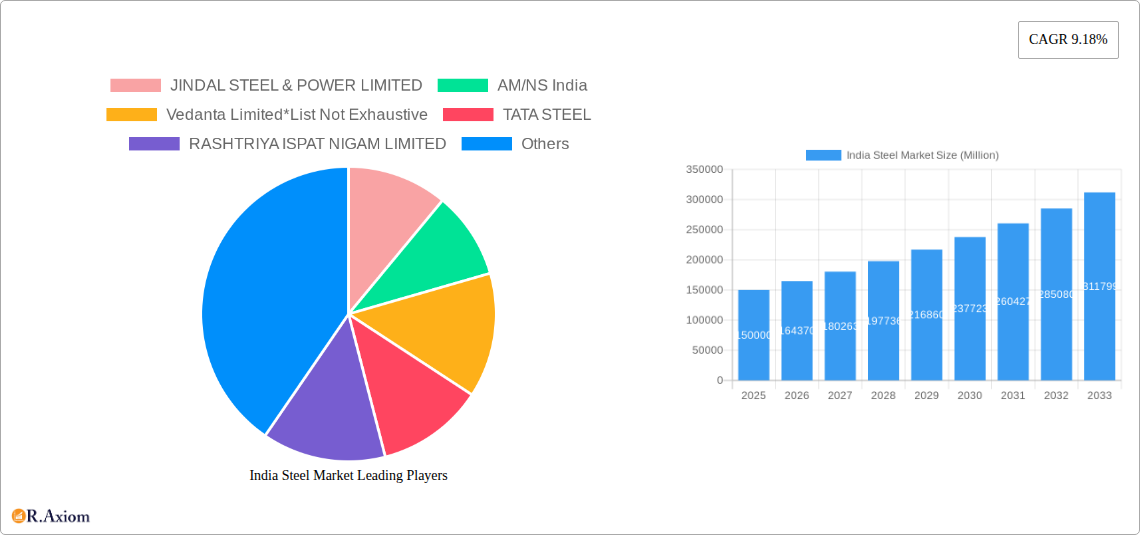

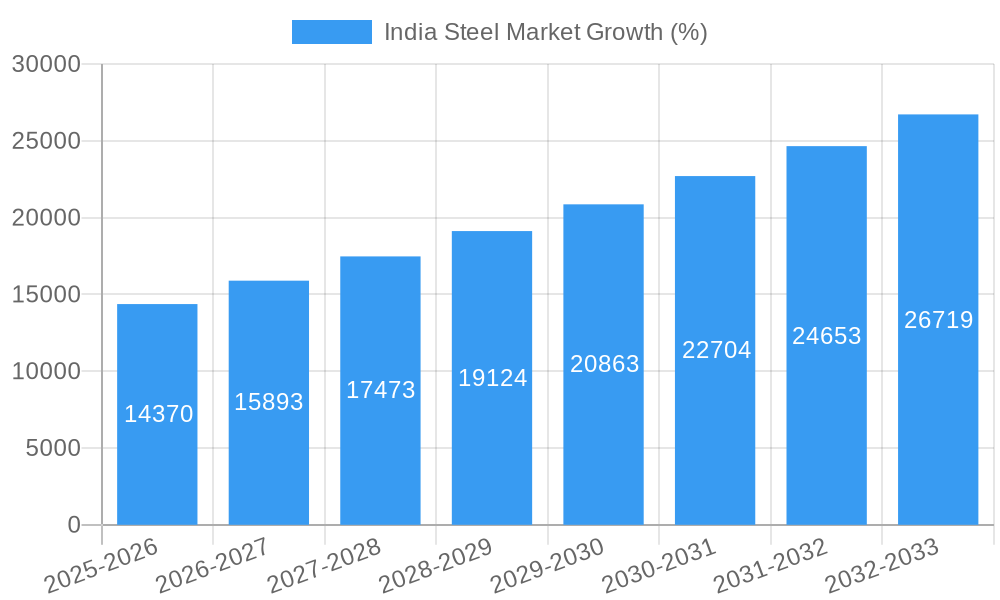

The India steel market, valued at approximately ₹X million in 2025 (assuming a logical estimation based on the provided CAGR and market size), is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.18% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning infrastructure development initiatives within India, particularly in construction and transportation, fuel significant demand for steel. Secondly, the government's focus on industrialization and "Make in India" policy further boosts consumption across various sectors like automotive, consumer goods, and energy. Technological advancements, including increased adoption of Electric Arc Furnaces (EAFs) for enhanced efficiency and reduced carbon emissions, also contribute to market growth. While challenges exist, such as fluctuating raw material prices and environmental concerns related to traditional steel production, the overall outlook remains positive due to strong domestic demand and government support. The market segmentation reveals a diverse landscape, with significant contributions from finished steel forms and diverse end-user industries. Leading players like JSW Steel, Tata Steel, SAIL, and Jindal Steel are at the forefront of this growth, investing heavily in capacity expansion and technological upgrades. The regional distribution shows promising opportunities across all regions, reflecting India's broad-based development.

The projected growth trajectory anticipates substantial expansion throughout the forecast period. The continued rise in construction activity, coupled with increasing urbanization and industrial output, promises sustained demand for steel. The strategic adoption of EAF technology suggests a potential for environmentally sustainable growth, attracting investors focused on ESG (environmental, social, and governance) compliance. While global economic headwinds could create short-term fluctuations, the long-term prospects for the India steel market remain strong, driven by the nation's economic dynamism and ongoing infrastructure development. Furthermore, the increasing preference for higher value-added steel products presents opportunities for producers to enhance profitability and attract a wider customer base. Competitive landscape analysis of major players across the various segments offers insights into potential market shares and strategic actions.

India Steel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indian steel market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, key players, technological advancements, and future growth prospects, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis and expert insights to present a clear and actionable overview of this rapidly evolving sector. The study period encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). All monetary values are expressed in Millions.

India Steel Market Market Concentration & Innovation

The Indian steel market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. However, the presence of numerous smaller players fosters competition. Key players include JINDAL STEEL & POWER LIMITED, AM/NS India, Vedanta Limited, TATA STEEL, RASHTRIYA ISPAT NIGAM LIMITED, NMDC Steel Limited, JSW STEEL LIMITED, Steel Authority of India Limited (SAIL), and Jindal Stainless LIMITED. Market share data for 2024 indicates that the top five players collectively hold approximately xx% of the market, reflecting a moderate level of concentration.

Innovation in the Indian steel industry is driven by the need to enhance efficiency, reduce costs, and meet evolving customer demands. This is evident in the adoption of advanced technologies like Electric Arc Furnaces (EAFs) alongside traditional Blast Furnace-Basic Oxygen Furnaces (BF-BOFs). Furthermore, the increasing focus on sustainability and environmental regulations is prompting investments in cleaner production technologies and resource-efficient processes. Recent M&A activities, such as AM/NS India's acquisition of Indian Steel Corporation (April 2023), highlight the strategic importance of expanding downstream capabilities and product portfolios. The total value of M&A deals in the sector during 2024 was approximately xx Million. Regulatory frameworks, including environmental regulations and import/export policies, significantly impact market dynamics. Product substitution remains a relatively low threat, although the increased use of alternative materials in certain applications warrants monitoring. End-user trends, particularly in the booming construction and automotive sectors, strongly influence steel demand.

India Steel Market Industry Trends & Insights

The Indian steel market is projected to experience robust growth over the forecast period (2025-2033). Several factors contribute to this positive outlook, including rising infrastructure development, rapid urbanization, growing industrial activity, and government initiatives promoting economic growth. The market is estimated to exhibit a Compound Annual Growth Rate (CAGR) of xx% during this period. Technological advancements, particularly the wider adoption of EAF technology for higher efficiency and flexibility, are reshaping the competitive landscape. Consumer preferences are shifting toward higher-quality, specialized steel products, driving innovation in product development and customization. The increasing penetration of advanced high-strength steels (AHSS) in the automotive sector showcases this trend. Intense competition among steel producers has resulted in price fluctuations and a focus on cost optimization and value-added services. Market penetration of BF-BOF technology remains significant, but EAF is gaining traction.

Dominant Markets & Segments in India Steel Market

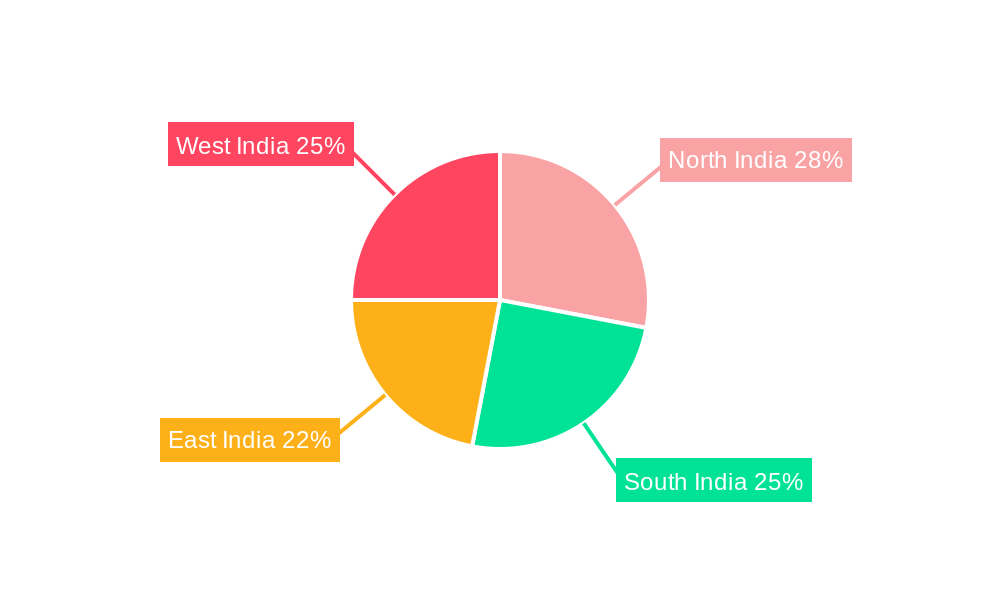

Leading Region: The western and southern regions of India are expected to dominate the steel market due to robust industrial activity and infrastructure development, including significant construction projects. These regions benefit from better infrastructure and proximity to major end-user industries.

Dominant Segments:

- Basic Form: Crude steel production is concentrated in areas with significant iron ore reserves and established steel manufacturing facilities, contributing to regional disparities in production capacity.

- Final Form: Finished steel segments, such as flat products (sheets and coils) and long products (bars and rods), experience varying demand based on end-user industry trends. The building and construction sector is a major driver of demand for long products, while automotive and manufacturing drive demand for flat products.

- Technology: BF-BOF technology retains a dominant share, but EAF is gaining traction due to its environmental benefits and flexibility. Other technologies occupy a smaller market share.

- End-User Industry: The building and construction sector accounts for the largest share of steel consumption, followed by the automotive and transportation sector. Growth in these segments fuels overall steel demand. Other end-user industries, such as tools and machinery, energy, and consumer goods, exhibit varying levels of steel consumption based on their respective growth trajectories.

Key Drivers of Dominance:

- Economic Policies: Government initiatives promoting infrastructure development and industrialization significantly impact steel demand.

- Infrastructure Development: Large-scale infrastructure projects, including road construction, building projects and urban renewal initiatives, are major drivers of steel consumption.

India Steel Market Product Developments

Recent product innovations in the Indian steel market focus on improving material properties, enhancing sustainability, and expanding applications. This includes the development of advanced high-strength steels (AHSS) for the automotive industry, higher-grade steel for construction, and specialized steel alloys for various applications. These advancements cater to growing demand for lighter, stronger, and more durable materials. The market is seeing increased use of recycled steel, contributing to the overall sustainability efforts. Competitive advantages are being gained through efficient production processes, superior product quality, and cost competitiveness.

Report Scope & Segmentation Analysis

This report segments the Indian steel market by basic form (crude steel, finished steel), technology (BF-BOF, EAF, other), and end-user industry (automotive, building & construction, tools & machinery, energy, consumer goods, others). Each segment's analysis includes growth projections, market size estimations (in Millions), and competitive dynamics. For example, the crude steel segment is projected to grow at a CAGR of xx%, driven primarily by capacity expansions. The building and construction sector dominates the end-user segment and is expected to maintain its leadership position due to sustained infrastructural growth.

Key Drivers of India Steel Market Growth

The Indian steel market's growth is propelled by several factors. Robust economic growth and government initiatives focused on infrastructure development significantly increase steel demand. The booming construction sector and the expanding automotive industry are key consumption drivers. Technological advancements, such as improvements in steel manufacturing processes and the wider adoption of EAF technology, enhance efficiency and sustainability. Favorable government policies, including tax incentives and supportive regulations, further stimulate growth.

Challenges in the India Steel Market Sector

The Indian steel industry faces significant challenges. Fluctuations in raw material prices, particularly iron ore, impact profitability. Intense competition among domestic and international players keeps margins under pressure. Stringent environmental regulations necessitate investments in cleaner technologies, increasing production costs. Supply chain disruptions can affect timely deliveries and production efficiency. The current import duties and trade policies impact the competitiveness of both domestic and international producers.

Emerging Opportunities in India Steel Market

Several opportunities exist within the Indian steel market. The growing demand for specialized steels and advanced materials in sectors like renewable energy and aerospace presents significant potential. Increased adoption of sustainable steel manufacturing practices and recycling initiatives enhances environmental credentials and provides a competitive edge. Expansion into new export markets presents growth potential, and increased focus on research and development to innovate new steel products further contributes to market growth.

Leading Players in the India Steel Market Market

- JINDAL STEEL & POWER LIMITED

- AM/NS India

- Vedanta Limited

- TATA STEEL

- RASHTRIYA ISPAT NIGAM LIMITED

- NMDC Steel Limited

- JSW STEEL LIMITED

- Steel Authority of India Limited (SAIL)

- Jindal Stainless LIMITED

Key Developments in India Steel Market Industry

- April 2023: AM/NS India received approval from India’s regulatory body (NCLT) to buy Indian Steel Corporation, strengthening its downstream capabilities and product portfolio. This acquisition is expected to significantly enhance market share and competitiveness.

- November 2022: JSW Group announced a INR 1 trillion (USD 12.08 Billion) investment in its Karnataka-based businesses over five years, boosting its production capacity and solidifying its position as a major player. This significant investment will further enhance its capacity and market competitiveness.

Strategic Outlook for India Steel Market Market

The Indian steel market's future looks promising, driven by sustained infrastructure development, industrial growth, and the increasing adoption of steel in various applications. Further investments in advanced technologies and sustainable practices will be crucial for maintaining competitiveness. Expansion into new markets and strategic alliances will be critical for companies to capitalize on the growth potential of this dynamic sector. The ongoing focus on infrastructure, coupled with the increasing demand for high-quality and specialized steel, presents significant opportunities for growth in the coming years.

India Steel Market Segmentation

-

1. Basic Form

- 1.1. Crude Steel

-

2. Final Form

- 2.1. Finished Steel

-

3. Technology

- 3.1. Blast Furnace-basic Oxygen Furnace (BF-BOF)

- 3.2. Electric Arc Furnace (EAF)

- 3.3. Other Technologies

-

4. End User Industry

- 4.1. Automotive and Transportation

- 4.2. Building and Construction

- 4.3. Tools and Machinery

- 4.4. Energy

- 4.5. Consumer Goods

- 4.6. Other En

India Steel Market Segmentation By Geography

- 1. India

India Steel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Policy Support by the Indian Government; Strong Influx of Investments in the Steel Sector; Increasing Urbanization and Increased Spending on Construction and Infrastructure Projects

- 3.3. Market Restrains

- 3.3.1. Low Percapita Steel Consumption; High Production Costs

- 3.4. Market Trends

- 3.4.1. Blast Furnace-Basic Oxygen Furnace (BF-BOF) Technology to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Steel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Basic Form

- 5.1.1. Crude Steel

- 5.2. Market Analysis, Insights and Forecast - by Final Form

- 5.2.1. Finished Steel

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Blast Furnace-basic Oxygen Furnace (BF-BOF)

- 5.3.2. Electric Arc Furnace (EAF)

- 5.3.3. Other Technologies

- 5.4. Market Analysis, Insights and Forecast - by End User Industry

- 5.4.1. Automotive and Transportation

- 5.4.2. Building and Construction

- 5.4.3. Tools and Machinery

- 5.4.4. Energy

- 5.4.5. Consumer Goods

- 5.4.6. Other En

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Basic Form

- 6. North India India Steel Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Steel Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Steel Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Steel Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 JINDAL STEEL & POWER LIMITED

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 AM/NS India

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Vedanta Limited*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 TATA STEEL

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 RASHTRIYA ISPAT NIGAM LIMITED

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NMDC Steel Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JSW STEEL LIMITED

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Steel Authority of India Limited (SAIL)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Jindal Stainless LIMITED

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 JINDAL STEEL & POWER LIMITED

List of Figures

- Figure 1: India Steel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Steel Market Share (%) by Company 2024

List of Tables

- Table 1: India Steel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Steel Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: India Steel Market Revenue Million Forecast, by Basic Form 2019 & 2032

- Table 4: India Steel Market Volume Million Forecast, by Basic Form 2019 & 2032

- Table 5: India Steel Market Revenue Million Forecast, by Final Form 2019 & 2032

- Table 6: India Steel Market Volume Million Forecast, by Final Form 2019 & 2032

- Table 7: India Steel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 8: India Steel Market Volume Million Forecast, by Technology 2019 & 2032

- Table 9: India Steel Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 10: India Steel Market Volume Million Forecast, by End User Industry 2019 & 2032

- Table 11: India Steel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: India Steel Market Volume Million Forecast, by Region 2019 & 2032

- Table 13: India Steel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Steel Market Volume Million Forecast, by Country 2019 & 2032

- Table 15: North India India Steel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: North India India Steel Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: South India India Steel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South India India Steel Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: East India India Steel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: East India India Steel Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: West India India Steel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: West India India Steel Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: India Steel Market Revenue Million Forecast, by Basic Form 2019 & 2032

- Table 24: India Steel Market Volume Million Forecast, by Basic Form 2019 & 2032

- Table 25: India Steel Market Revenue Million Forecast, by Final Form 2019 & 2032

- Table 26: India Steel Market Volume Million Forecast, by Final Form 2019 & 2032

- Table 27: India Steel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 28: India Steel Market Volume Million Forecast, by Technology 2019 & 2032

- Table 29: India Steel Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 30: India Steel Market Volume Million Forecast, by End User Industry 2019 & 2032

- Table 31: India Steel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: India Steel Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Steel Market?

The projected CAGR is approximately 9.18%.

2. Which companies are prominent players in the India Steel Market?

Key companies in the market include JINDAL STEEL & POWER LIMITED, AM/NS India, Vedanta Limited*List Not Exhaustive, TATA STEEL, RASHTRIYA ISPAT NIGAM LIMITED, NMDC Steel Limited, JSW STEEL LIMITED, Steel Authority of India Limited (SAIL), Jindal Stainless LIMITED.

3. What are the main segments of the India Steel Market?

The market segments include Basic Form, Final Form , Technology , End User Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Policy Support by the Indian Government; Strong Influx of Investments in the Steel Sector; Increasing Urbanization and Increased Spending on Construction and Infrastructure Projects.

6. What are the notable trends driving market growth?

Blast Furnace-Basic Oxygen Furnace (BF-BOF) Technology to Dominate the Market.

7. Are there any restraints impacting market growth?

Low Percapita Steel Consumption; High Production Costs.

8. Can you provide examples of recent developments in the market?

April 2023: AM/NS India received approval from India’s regulatory body (NCLT) to buy Indian Steel Corporation to enhance its downstream capabilities and broaden its product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Steel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Steel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Steel Market?

To stay informed about further developments, trends, and reports in the India Steel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence