Key Insights

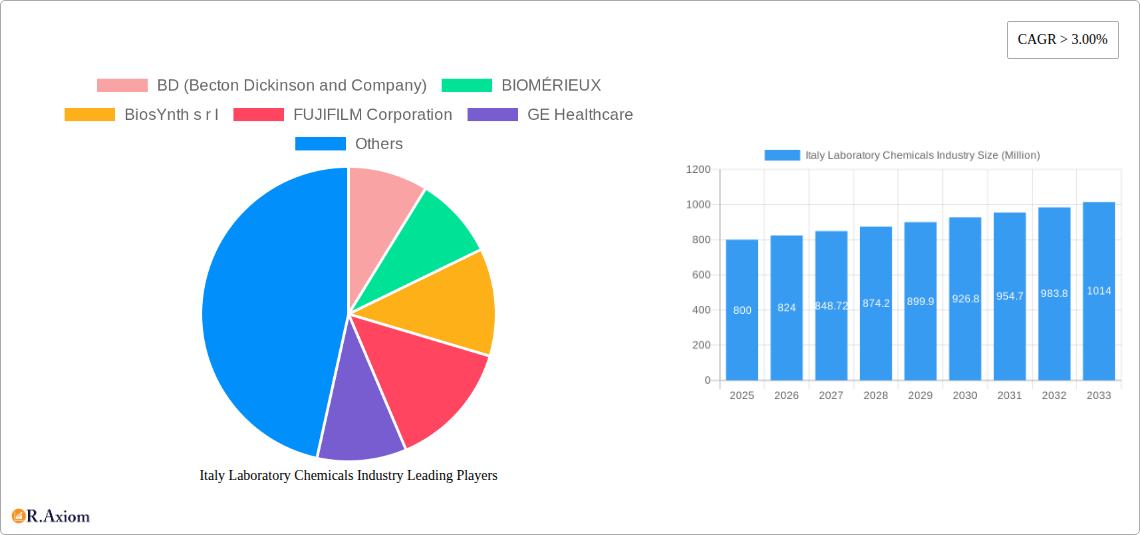

The Italian laboratory chemicals market is projected for significant expansion, with an estimated size of 4.1 billion in 2025. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.69% during the forecast period of 2025 to 2033. Key growth drivers include the robust expansion of Italy's pharmaceutical and biotechnology sectors, increased research and development activities in academic and governmental institutions, and growing environmental regulations. Demand is also stimulated by stringent quality control requirements in industries such as food and beverage, and the adoption of advanced analytical techniques and laboratory automation. Leading companies like BD, BioMérieux, and Thermo Fisher Scientific are strategically positioned to leverage these market trends. However, challenges such as raw material price volatility and complex regulatory compliance persist.

Italy Laboratory Chemicals Industry Market Size (In Billion)

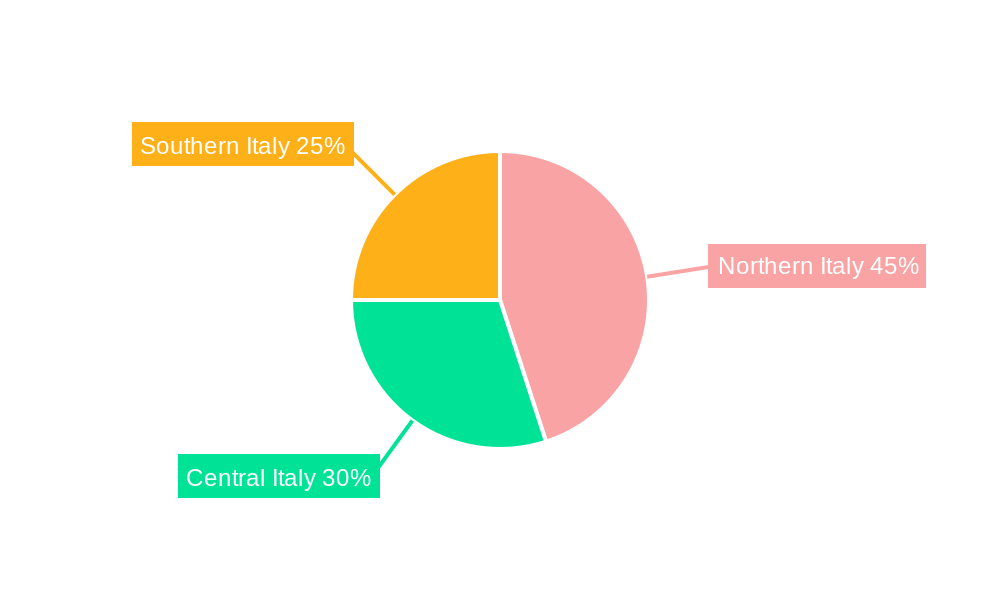

Despite existing constraints, the market is expected to experience substantial growth over the forecast period. Market segmentation is anticipated across chemical types (organic, inorganic, reagents), applications (pharmaceuticals, biotechnology, environmental testing), and end-users (research laboratories, hospitals, industrial facilities). Regional market dynamics in Italy are likely to mirror the distribution of research and industrial activities, with Northern Italy potentially dominating market share. Continued investment in research infrastructure and government support for scientific initiatives are expected to further bolster market growth, potentially exceeding 1 billion by 2033. Competitive strategies will prioritize innovation, product diversification, and strategic alliances to maintain market leadership in this evolving landscape.

Italy Laboratory Chemicals Industry Company Market Share

Italy Laboratory Chemicals Industry: Market Analysis & Forecast, 2025-2033

This report offers a comprehensive analysis of the Italy laboratory chemicals industry, detailing market size, growth drivers, challenges, opportunities, and key players. The analysis covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. Insights are derived from extensive primary and secondary research, providing actionable intelligence for industry stakeholders. The market is segmented by product type, application, and end-user.

Italy Laboratory Chemicals Industry Market Concentration & Innovation

The Italian laboratory chemicals market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players like BD (Becton Dickinson and Company), BIOMÉRIEUX, BiosYnth s r l, FUJIFILM Corporation, GE Healthcare, Merck KGaA, Avantor Inc, Thermo Fisher Scientific Inc, and DASIT Group SPA, among others, contribute significantly to overall market revenue. Precise market share data for individual companies is xx, but the top five players likely account for over 60% of the market.

Innovation in the Italian laboratory chemicals sector is driven by increasing demand for specialized chemicals, advancements in analytical techniques, and stringent regulatory requirements. The regulatory landscape, largely aligned with EU standards, encourages the development and adoption of sustainable and environmentally friendly chemicals. Product substitution is an ongoing process, with newer, more efficient and less hazardous chemicals gradually replacing older counterparts. The end-user trends reflect the growth of the pharmaceutical, biotechnology, and research sectors, driving the demand for high-purity and specialized chemicals. Mergers and acquisitions (M&A) activity remains moderate, with recent deals totaling approximately xx Million in value, mainly focused on consolidating market position and acquiring specialized technologies.

Italy Laboratory Chemicals Industry Industry Trends & Insights

The Italy laboratory chemicals market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by the expansion of the pharmaceutical and biotechnology sectors, increasing government investments in research and development (R&D), and rising demand for sophisticated analytical techniques. Technological advancements, such as the development of advanced materials and automation technologies are driving market penetration of new and improved products. Consumer preferences are shifting towards environmentally friendly and sustainable solutions, creating opportunities for eco-conscious chemical manufacturers. The competitive dynamics are characterized by intense rivalry among both domestic and multinational players, leading to pricing pressures and a focus on product differentiation. Market penetration of specialized reagents and kits is increasing significantly, indicating a move towards more streamlined and efficient laboratory processes.

Dominant Markets & Segments in Italy Laboratory Chemicals Industry

The Northern region of Italy dominates the laboratory chemicals market, accounting for approximately xx% of the total market value in 2025. This dominance is attributable to several key factors:

- Robust Pharmaceutical and Biotechnology Industry: The presence of major pharmaceutical companies and research institutions in this region drives high demand.

- Developed Infrastructure: Excellent infrastructure, including logistics and transportation networks, facilitates efficient distribution of chemicals.

- Government Support for R&D: Significant government investments in R&D activities in the Northern region contribute to increased demand.

- Skilled Workforce: A highly skilled workforce in scientific and technical fields ensures efficient operations and innovation.

Detailed analysis reveals that the pharmaceutical and life sciences sectors represent the most significant end-user segment, consuming approximately xx% of the laboratory chemicals produced in Italy. This segment's growth is strongly influenced by ongoing pharmaceutical research and the development of new therapeutics. Other significant segments include academia and contract research organizations (CROs), which contribute to the overall market growth.

Italy Laboratory Chemicals Industry Product Developments

Recent product innovations in the Italian laboratory chemicals market are focused on enhancing efficiency, improving safety, and reducing environmental impact. This includes the development of high-purity chemicals, specialized reagents for specific applications, and automated dispensing systems. New product development emphasizes tailored solutions for specific applications, aiming to improve analytical accuracy and reduce waste. These trends are driven by increasing customer demand for precision and sustainability.

Report Scope & Segmentation Analysis

This report segments the Italy laboratory chemicals market by product type (reagents, solvents, buffers, etc.), application (pharmaceutical, biotechnology, environmental testing, etc.), and end-user (pharmaceutical companies, research institutions, etc.). Growth projections for each segment vary but generally reflect the overall market CAGR. Market sizes are provided for each segment in the detailed report, along with an analysis of competitive dynamics within each segment. The impact of emerging technologies on each segment's future performance is assessed.

Key Drivers of Italy Laboratory Chemicals Industry Growth

The Italy laboratory chemicals market's growth is spurred by technological advancements, enabling the development of high-performance and specialized chemicals. Economic growth and increasing investments in R&D from both the public and private sectors further fuel market expansion. Stringent regulatory frameworks promoting safety and environmental responsibility also drive innovation and sustainable practices. Examples include EU directives on chemical safety and sustainability, incentivizing the adoption of eco-friendly products.

Challenges in the Italy Laboratory Chemicals Industry Sector

The industry faces challenges such as stringent regulatory compliance, necessitating significant investments in safety and environmental protection. Supply chain disruptions, particularly during periods of global uncertainty, can impact the availability and pricing of raw materials and finished products, potentially affecting profitability. Intense competition, particularly from multinational players, puts pressure on pricing and margins. These challenges collectively result in an estimated xx Million loss in revenue annually, based on xx.

Emerging Opportunities in Italy Laboratory Chemicals Industry

The market presents opportunities in the development and adoption of sustainable and eco-friendly chemicals. The growing demand for personalized medicine and advanced therapies is expected to drive demand for specialized reagents and kits. The increasing prevalence of contract research organizations (CROs) is creating new market segments for laboratory chemicals suppliers. These trends offer promising prospects for market expansion and growth in the coming years.

Leading Players in the Italy Laboratory Chemicals Industry Market

- BD (Becton Dickinson and Company)

- BIOMÉRIEUX

- BiosYnth s r l

- FUJIFILM Corporation

- GE Healthcare

- Merck KGaA

- Avantor Inc

- Thermo Fisher Scientific Inc

- DASIT Group SPA

- List Not Exhaustive

Key Developments in Italy Laboratory Chemicals Industry Industry

- December 2022: Merck announced a collaboration with Mersana Therapeutics to develop novel immunostimulatory antibody-drug conjugates. This collaboration signifies an expansion of Merck's involvement in cutting-edge therapeutic development, influencing the demand for related chemicals.

- January 2023: Merck completed the acquisition of M Chemicals Inc., a subsidiary of Mecaro Co. Ltd. This acquisition strengthens Merck's market position and portfolio, potentially leading to increased market share and altered competitive dynamics.

Strategic Outlook for Italy Laboratory Chemicals Industry Market

The Italy laboratory chemicals market is poised for significant growth, driven by continued expansion in pharmaceutical and biotechnology sectors, coupled with increasing R&D spending. Technological advancements, sustainability initiatives, and the emergence of new applications will further shape the market landscape. Companies adopting strategies focused on innovation, sustainable practices, and strong customer relationships are likely to experience above-average growth. The long-term outlook remains positive, with projections suggesting continued market expansion throughout the forecast period.

Italy Laboratory Chemicals Industry Segmentation

-

1. Type

- 1.1. Molecular Biology

- 1.2. Cytokine and Chemokine Testing

- 1.3. Carbohydrate Analysis

- 1.4. Immunochemistry

- 1.5. Cell Culture

- 1.6. Environmental Testing

- 1.7. Biochemistry

- 1.8. Other Types

-

2. Application

- 2.1. Industrial

- 2.2. Education

- 2.3. Government

- 2.4. Healthcare

Italy Laboratory Chemicals Industry Segmentation By Geography

- 1. Italy

Italy Laboratory Chemicals Industry Regional Market Share

Geographic Coverage of Italy Laboratory Chemicals Industry

Italy Laboratory Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Healthcare Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Expanding Healthcare Sector; Other Drivers

- 3.4. Market Trends

- 3.4.1. Industrial Application to Witness Substantial Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Laboratory Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Molecular Biology

- 5.1.2. Cytokine and Chemokine Testing

- 5.1.3. Carbohydrate Analysis

- 5.1.4. Immunochemistry

- 5.1.5. Cell Culture

- 5.1.6. Environmental Testing

- 5.1.7. Biochemistry

- 5.1.8. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial

- 5.2.2. Education

- 5.2.3. Government

- 5.2.4. Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BD (Becton Dickinson and Company)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BIOMÉRIEUX

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BiosYnth s r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FUJIFILM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GE Healthcare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Merck KGaA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avantor Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fisher Scientific Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DASIT Group SPA*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 BD (Becton Dickinson and Company)

List of Figures

- Figure 1: Italy Laboratory Chemicals Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Laboratory Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Italy Laboratory Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Laboratory Chemicals Industry?

The projected CAGR is approximately 6.69%.

2. Which companies are prominent players in the Italy Laboratory Chemicals Industry?

Key companies in the market include BD (Becton Dickinson and Company), BIOMÉRIEUX, BiosYnth s r l, FUJIFILM Corporation, GE Healthcare, Merck KGaA, Avantor Inc, Thermo Fisher Scientific Inc, DASIT Group SPA*List Not Exhaustive.

3. What are the main segments of the Italy Laboratory Chemicals Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Expanding Healthcare Sector; Other Drivers.

6. What are the notable trends driving market growth?

Industrial Application to Witness Substantial Growth.

7. Are there any restraints impacting market growth?

Expanding Healthcare Sector; Other Drivers.

8. Can you provide examples of recent developments in the market?

January 2023: Merck Completed the acquisition of M Chemicals Inc., the company recently incorporated by Mecaro Co. Ltd. to operate its chemical business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Laboratory Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Laboratory Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Laboratory Chemicals Industry?

To stay informed about further developments, trends, and reports in the Italy Laboratory Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence