Key Insights

The Functional Additives for Plastic Packaging Market is poised for significant expansion, driven by escalating consumer demand for enhanced product preservation, extended shelf life, and improved safety in food and beverage, pharmaceutical, and personal care applications. The market's robust growth trajectory is underpinned by the increasing adoption of advanced packaging solutions that offer features like barrier protection against oxygen and moisture, UV resistance, and antimicrobial properties. This surge in demand for high-performance plastic packaging is directly fueling the consumption of functional additives, including antioxidants, UV stabilizers, flame retardants, and processing aids. As regulatory frameworks become more stringent regarding food safety and waste reduction, the imperative for innovative packaging that minimizes spoilage and extends product usability will continue to drive market penetration for these specialized additives. Furthermore, the growing trend towards sustainable packaging solutions, while seemingly a challenge, also presents opportunities for functional additives that can improve the recyclability or biodegradability of plastic materials, or enable lighter-weight packaging with equivalent protective qualities. The market is expected to witness a compound annual growth rate (CAGR) of approximately 6.5% over the study period of 2019-2033, indicating sustained and vigorous market development.

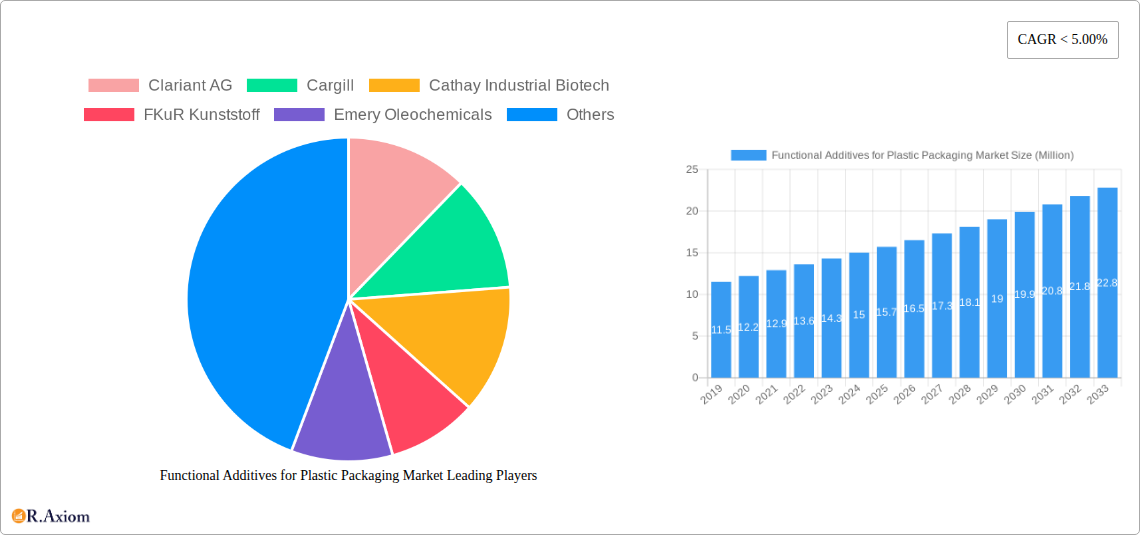

Functional Additives for Plastic Packaging Market Market Size (In Million)

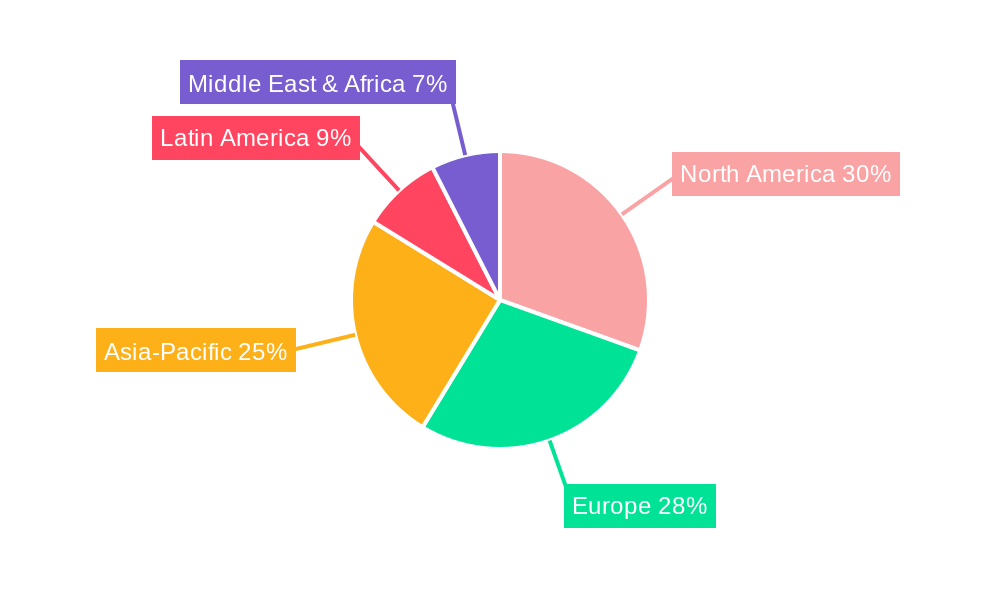

The estimated market size for Functional Additives for Plastic Packaging in 2025 is approximately $15.2 billion, reflecting a substantial and mature yet growing industry. This market size is projected to reach around $25.9 billion by 2033, demonstrating a strong upward trend fueled by innovation and evolving consumer and industry needs. Geographically, North America and Europe currently lead the market due to established industries and high consumer spending power, coupled with stringent quality and safety standards. However, the Asia-Pacific region is emerging as a key growth driver, owing to rapid industrialization, expanding middle-class populations, and a burgeoning demand for packaged goods across various sectors. The adoption of advanced manufacturing technologies and increasing investments in research and development by key market players are anticipated to further accelerate market growth. The competitive landscape is characterized by a mix of global chemical giants and specialized additive manufacturers, all vying to offer tailored solutions that address the specific performance requirements of diverse plastic packaging applications.

Functional Additives for Plastic Packaging Market Company Market Share

Sure, here is the SEO-optimized, detailed report description for Functional Additives for Plastic Packaging Market:

Functional Additives for Plastic Packaging Market Market Concentration & Innovation

The Functional Additives for Plastic Packaging Market is characterized by a moderate to high level of concentration, with a few key players holding significant market share. Innovation is a critical differentiator, driven by the increasing demand for enhanced plastic packaging performance, sustainability, and regulatory compliance. Companies are heavily investing in R&D to develop novel additives that improve barrier properties, extend shelf life, enhance recyclability, and provide unique functionalities like antimicrobial or antistatic protection. Regulatory frameworks, particularly concerning food contact materials and environmental impact, are shaping product development and market entry strategies. The threat of product substitutes, such as alternative packaging materials or advanced processing techniques, is constantly present, pushing additive manufacturers to innovate and demonstrate clear value propositions. End-user trends, including the rise of e-commerce and the demand for lightweight, durable packaging, are influencing the types of functional additives in demand. Mergers and acquisitions (M&A) activities are also shaping the competitive landscape, with strategic acquisitions aimed at expanding product portfolios, market reach, and technological capabilities. For instance, M&A deals valued in the hundreds of millions of dollars have been observed as larger players integrate specialized additive technologies.

Functional Additives for Plastic Packaging Market Industry Trends & Insights

The Functional Additives for Plastic Packaging Market is projected for robust growth, driven by a confluence of factors that enhance the performance, sustainability, and safety of plastic packaging solutions. The projected Compound Annual Growth Rate (CAGR) for the forecast period 2025-2033 is estimated at approximately 5.8%, with the market size expected to reach over $30,000 Million by 2033. This expansion is fueled by the escalating demand for high-performance packaging across diverse sectors, including food and beverage, pharmaceuticals, and personal care, where extended shelf life, enhanced barrier properties, and improved aesthetics are paramount. Technological disruptions are playing a pivotal role, with advancements in material science leading to the development of novel additives that offer superior functionality, such as bio-based plasticizers and biodegradable stabilizers, aligning with growing environmental consciousness. Consumer preferences are increasingly leaning towards packaging that is not only protective and convenient but also sustainable and safe, thereby creating a significant market pull for eco-friendly and health-conscious additive solutions. The market penetration of specialized functional additives is steadily increasing as manufacturers recognize their ability to differentiate products and meet stringent regulatory requirements. Competitive dynamics are intensifying, with a focus on product innovation, strategic partnerships, and vertical integration to secure raw material supply and expand market reach. The global market for functional additives, valued at approximately $18,500 Million in the base year 2025, is poised for significant expansion, driven by these interconnected trends. The increasing emphasis on food safety and the reduction of food waste further propogs the demand for additives that enhance packaging integrity.

Dominant Markets & Segments in Functional Additives for Plastic Packaging Market

The Asia-Pacific region is emerging as the dominant market for functional additives in plastic packaging, propelled by rapid industrialization, a burgeoning middle class, and expanding manufacturing capabilities. Within this region, China stands out as the leading country, driven by its colossal production of plastic packaging and significant domestic consumption. The Packaging end-user industry segment accounts for the largest share of the functional additives market, as it directly consumes a vast array of these compounds to impart essential properties to packaging materials.

Key drivers for the dominance of the Asia-Pacific region include:

- Favorable Economic Policies: Government initiatives promoting manufacturing and foreign investment have created a conducive environment for the plastic packaging industry.

- Infrastructure Development: Enhanced logistics and supply chain networks facilitate the efficient distribution of raw materials and finished goods.

- Growing Demand for Consumer Goods: An expanding population and rising disposable incomes fuel the demand for packaged consumer products, thereby increasing the consumption of functional additives.

Within the Functionality Type segmentation, Stabilizers represent a significant segment due to their crucial role in preventing degradation of plastics caused by heat, light, and oxygen, thereby extending the lifespan of packaging and ensuring product integrity. The demand for stabilizers is projected to grow at a healthy CAGR of approximately 5.5% during the forecast period.

The Packaging end-user industry segment’s dominance is further reinforced by:

- Food & Beverage Sector: This sector relies heavily on functional additives for barrier properties, preservation, and visual appeal. The market size for functional additives in this sector is estimated to be over $8,000 Million by 2033.

- E-commerce Growth: The exponential growth of e-commerce necessitates durable, protective, and often lightweight packaging solutions, driving demand for reinforcing agents and impact modifiers.

- Stringent Food Safety Regulations: Compliance with global food safety standards necessitates the use of additives that prevent contamination and spoilage.

Other significant segments contributing to market growth include Plasticizers for flexibility, Antimicrobial Agents for hygiene, and Antistatic Agents to prevent dust accumulation. The Medical Devices end-user industry also presents a growing segment, demanding high-purity and specialized functional additives for sterile and safe packaging. The projected market size for functional additives in the medical device sector is expected to reach over $1,500 Million by 2033.

Functional Additives for Plastic Packaging Market Product Developments

Product developments in the functional additives for plastic packaging market are increasingly focused on enhancing sustainability and performance. Innovations include bio-based plasticizers derived from renewable resources, offering a greener alternative to conventional phthalate-based options. Advancements in antimicrobial additives are providing enhanced protection against spoilage and contamination, crucial for food and medical packaging. Furthermore, the development of novel flame-retardants that are halogen-free and more environmentally benign is gaining traction, driven by stricter regulations. Companies are also innovating in areas like UV stabilizers and antioxidants to extend the shelf life and durability of plastic packaging, reducing waste. These developments aim to meet evolving consumer demands for safer, more sustainable, and higher-performing packaging solutions, offering competitive advantages through improved functionality and reduced environmental impact.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the functional additives for plastic packaging market, segmented by functionality type and end-user industry. The Functionality Type segments include Plasticizers, Antimicrobial Agents, Antistatic Agents, Flame-Retardants, Stabilizers, Reinforcing Agents, and Other Types. Each segment is analyzed for its market size, growth projections, and competitive dynamics. For instance, the Plasticizers segment is expected to grow at a CAGR of approximately 5.2%, driven by demand for flexible packaging solutions. The End-user Industry segments covered are Packaging, Electronics, Medical Devices, Textiles, Consumer Goods, and Other Applications. The Packaging segment, as the largest consumer, is further detailed with sub-segment analysis. The Medical Devices segment is projected for robust growth at a CAGR of around 6.5%, owing to increasing healthcare standards and demand for sterile packaging. Competitive dynamics within each segment are influenced by technological advancements, regulatory landscapes, and end-user preferences.

Key Drivers of Functional Additives for Plastic Packaging Market Growth

Several key drivers are fueling the growth of the functional additives for plastic packaging market. The escalating demand for enhanced plastic packaging performance, including improved barrier properties, extended shelf life, and increased durability, is a primary driver. The growing consumer preference for sustainable and eco-friendly packaging solutions is spurring the development and adoption of bio-based and recyclable additives. Stringent government regulations concerning food safety, product preservation, and environmental impact are compelling manufacturers to incorporate advanced functional additives. Technological advancements in material science are enabling the creation of innovative additives with novel functionalities, such as antimicrobial and antistatic properties. The expanding global food and beverage industry, coupled with the growth of e-commerce, further propels the demand for specialized packaging solutions.

Challenges in the Functional Additives for Plastic Packaging Market Sector

Despite its robust growth prospects, the functional additives for plastic packaging market faces several challenges. Regulatory hurdles and evolving compliance requirements across different regions can pose significant barriers to market entry and product development, especially for novel or specialized additives. Fluctuations in the prices of raw materials, often derived from petrochemical sources, can impact production costs and profitability. The increasing scrutiny on the environmental impact of plastics and the push for alternatives can create market uncertainty for certain additive types. Intense competition from established players and new entrants, coupled with the need for continuous R&D investment, exerts pressure on profit margins. Additionally, the potential for adverse health effects associated with certain additives, although often mitigated by strict regulations, can lead to consumer apprehension and demand for "free-from" solutions.

Emerging Opportunities in Functional Additives for Plastic Packaging Market

Emerging opportunities in the functional additives for plastic packaging market are centered around sustainability and specialized functionalities. The growing demand for biodegradable and compostable packaging is creating a significant market for additives that facilitate these end-of-life options. Advancements in nanotechnology are opening avenues for high-performance additives that offer superior barrier properties, UV protection, and antimicrobial activity at lower concentrations. The expanding pharmaceutical and medical device sectors present opportunities for high-purity, regulatory-compliant functional additives that ensure product safety and integrity. The increasing focus on lightweighting in automotive and aerospace applications, which indirectly impacts packaging for components, also presents niche opportunities. Furthermore, the development of smart packaging solutions that incorporate active or intelligent additives for monitoring freshness or providing real-time product information represents a significant future growth area.

Leading Players in the Functional Additives for Plastic Packaging Market Market

- Clariant AG

- Cargill

- Cathay Industrial Biotech

- FKuR Kunststoff

- Emery Oleochemicals

- PolyOne Corporation

- Kompuestos

- Teijin Limited

- Arkema S A

- Zhejiang Hisun Biomaterials

Key Developments in Functional Additives for Plastic Packaging Market Industry

- 2023/2024: Launch of a new line of bio-based plasticizers by Emery Oleochemicals, targeting sustainable packaging applications.

- 2023: Clariant AG announced expansion of its additive production capacity to meet rising demand for stabilizers in Asia.

- 2022: Arkema S A acquired a specialty additives company to strengthen its portfolio in high-performance flame retardants.

- 2022: Cargill introduced novel biodegradable polymers for flexible packaging, requiring specific functional additive compatibility.

- 2021: FKuR Kunststoff developed a new generation of compostable polymer additives for food packaging.

- 2020: PolyOne Corporation (now Avient) integrated enhanced antimicrobial additive technologies into its polymer solutions for medical devices.

Strategic Outlook for Functional Additives for Plastic Packaging Market Market

The strategic outlook for the functional additives for plastic packaging market remains highly positive, driven by relentless innovation and evolving market demands. Companies are strategically focusing on developing sustainable and bio-based additive solutions to align with global environmental initiatives and consumer preferences. Investments in R&D for advanced functionalities, such as enhanced barrier properties and antimicrobial capabilities, will be crucial for maintaining a competitive edge. Expansion into emerging economies, particularly in the Asia-Pacific region, presents significant growth catalysts. Strategic partnerships and collaborations will likely play a vital role in expanding market reach and technological expertise. The ability to navigate complex regulatory landscapes and demonstrate product safety and efficacy will be paramount for long-term success, positioning the market for sustained growth and transformation.

Functional Additives for Plastic Packaging Market Segmentation

-

1. Functionality Type

- 1.1. Plasticizers

- 1.2. Antimicrobial Agents

- 1.3. Antistatic Agents

- 1.4. Flame-Retardants

- 1.5. Stabilizers

- 1.6. Reinforcing Agents

- 1.7. Other Types

-

2. End-user Industry

- 2.1. Packaging

- 2.2. Electronics

- 2.3. Medical Devices

- 2.4. Textiles

- 2.5. Consumer Goods

- 2.6. Other Applications

Functional Additives for Plastic Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Functional Additives for Plastic Packaging Market Regional Market Share

Geographic Coverage of Functional Additives for Plastic Packaging Market

Functional Additives for Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Bio-based Plastics for Packaging Applications; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Growing Demand for Bio-based Plastics for Packaging Applications; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Demand for Packaging Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Functional Additives for Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Functionality Type

- 5.1.1. Plasticizers

- 5.1.2. Antimicrobial Agents

- 5.1.3. Antistatic Agents

- 5.1.4. Flame-Retardants

- 5.1.5. Stabilizers

- 5.1.6. Reinforcing Agents

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Packaging

- 5.2.2. Electronics

- 5.2.3. Medical Devices

- 5.2.4. Textiles

- 5.2.5. Consumer Goods

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Functionality Type

- 6. Asia Pacific Functional Additives for Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Functionality Type

- 6.1.1. Plasticizers

- 6.1.2. Antimicrobial Agents

- 6.1.3. Antistatic Agents

- 6.1.4. Flame-Retardants

- 6.1.5. Stabilizers

- 6.1.6. Reinforcing Agents

- 6.1.7. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Packaging

- 6.2.2. Electronics

- 6.2.3. Medical Devices

- 6.2.4. Textiles

- 6.2.5. Consumer Goods

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Functionality Type

- 7. North America Functional Additives for Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Functionality Type

- 7.1.1. Plasticizers

- 7.1.2. Antimicrobial Agents

- 7.1.3. Antistatic Agents

- 7.1.4. Flame-Retardants

- 7.1.5. Stabilizers

- 7.1.6. Reinforcing Agents

- 7.1.7. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Packaging

- 7.2.2. Electronics

- 7.2.3. Medical Devices

- 7.2.4. Textiles

- 7.2.5. Consumer Goods

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Functionality Type

- 8. Europe Functional Additives for Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Functionality Type

- 8.1.1. Plasticizers

- 8.1.2. Antimicrobial Agents

- 8.1.3. Antistatic Agents

- 8.1.4. Flame-Retardants

- 8.1.5. Stabilizers

- 8.1.6. Reinforcing Agents

- 8.1.7. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Packaging

- 8.2.2. Electronics

- 8.2.3. Medical Devices

- 8.2.4. Textiles

- 8.2.5. Consumer Goods

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Functionality Type

- 9. South America Functional Additives for Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Functionality Type

- 9.1.1. Plasticizers

- 9.1.2. Antimicrobial Agents

- 9.1.3. Antistatic Agents

- 9.1.4. Flame-Retardants

- 9.1.5. Stabilizers

- 9.1.6. Reinforcing Agents

- 9.1.7. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Packaging

- 9.2.2. Electronics

- 9.2.3. Medical Devices

- 9.2.4. Textiles

- 9.2.5. Consumer Goods

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Functionality Type

- 10. Middle East and Africa Functional Additives for Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Functionality Type

- 10.1.1. Plasticizers

- 10.1.2. Antimicrobial Agents

- 10.1.3. Antistatic Agents

- 10.1.4. Flame-Retardants

- 10.1.5. Stabilizers

- 10.1.6. Reinforcing Agents

- 10.1.7. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Packaging

- 10.2.2. Electronics

- 10.2.3. Medical Devices

- 10.2.4. Textiles

- 10.2.5. Consumer Goods

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Functionality Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Clariant AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cargill

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cathay Industrial Biotech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FKuR Kunststoff

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emery Oleochemicals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PolyOne Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kompuestos

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Teijin Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arkema S A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zhejiang Hisun Biomaterials*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Clariant AG

List of Figures

- Figure 1: Global Functional Additives for Plastic Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Functional Additives for Plastic Packaging Market Revenue (Million), by Functionality Type 2025 & 2033

- Figure 3: Asia Pacific Functional Additives for Plastic Packaging Market Revenue Share (%), by Functionality Type 2025 & 2033

- Figure 4: Asia Pacific Functional Additives for Plastic Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Functional Additives for Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Functional Additives for Plastic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Functional Additives for Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Functional Additives for Plastic Packaging Market Revenue (Million), by Functionality Type 2025 & 2033

- Figure 9: North America Functional Additives for Plastic Packaging Market Revenue Share (%), by Functionality Type 2025 & 2033

- Figure 10: North America Functional Additives for Plastic Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Functional Additives for Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Functional Additives for Plastic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Functional Additives for Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Functional Additives for Plastic Packaging Market Revenue (Million), by Functionality Type 2025 & 2033

- Figure 15: Europe Functional Additives for Plastic Packaging Market Revenue Share (%), by Functionality Type 2025 & 2033

- Figure 16: Europe Functional Additives for Plastic Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Functional Additives for Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Functional Additives for Plastic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Functional Additives for Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Functional Additives for Plastic Packaging Market Revenue (Million), by Functionality Type 2025 & 2033

- Figure 21: South America Functional Additives for Plastic Packaging Market Revenue Share (%), by Functionality Type 2025 & 2033

- Figure 22: South America Functional Additives for Plastic Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Functional Additives for Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Functional Additives for Plastic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Functional Additives for Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Functional Additives for Plastic Packaging Market Revenue (Million), by Functionality Type 2025 & 2033

- Figure 27: Middle East and Africa Functional Additives for Plastic Packaging Market Revenue Share (%), by Functionality Type 2025 & 2033

- Figure 28: Middle East and Africa Functional Additives for Plastic Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Functional Additives for Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Functional Additives for Plastic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Functional Additives for Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Functionality Type 2020 & 2033

- Table 2: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Functionality Type 2020 & 2033

- Table 5: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Functionality Type 2020 & 2033

- Table 13: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Functionality Type 2020 & 2033

- Table 19: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Functionality Type 2020 & 2033

- Table 27: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Functionality Type 2020 & 2033

- Table 33: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Functional Additives for Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Functional Additives for Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Functional Additives for Plastic Packaging Market?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the Functional Additives for Plastic Packaging Market?

Key companies in the market include Clariant AG, Cargill, Cathay Industrial Biotech, FKuR Kunststoff, Emery Oleochemicals, PolyOne Corporation, Kompuestos, Teijin Limited, Arkema S A, Zhejiang Hisun Biomaterials*List Not Exhaustive.

3. What are the main segments of the Functional Additives for Plastic Packaging Market?

The market segments include Functionality Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Bio-based Plastics for Packaging Applications; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand for Packaging Applications.

7. Are there any restraints impacting market growth?

; Growing Demand for Bio-based Plastics for Packaging Applications; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Functional Additives for Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Functional Additives for Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Functional Additives for Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Functional Additives for Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence