Key Insights

The Iranian Property & Casualty (P&C) insurance market presents a dynamic landscape, shaped by unique economic conditions and regulatory frameworks. Despite challenges, the sector demonstrates considerable growth potential. For the historical period (2019-2024), the market likely experienced a compound annual growth rate (CAGR) of 4.6%, driven by increasing risk awareness and a growing middle class, tempered by limited insurance penetration. The market size in the base year 2024 was an estimated $2.99 billion.

Iran Property & Casualty Insurance Market Market Size (In Billion)

Projected for the forecast period (2025-2033), the Iranian P&C insurance market is anticipated to achieve a CAGR of 5-7%. Growth drivers include governmental initiatives to formalize the insurance sector, infrastructure development necessitating comprehensive coverage, and a potential increase in per capita income. While economic uncertainties and inflation may moderate growth, strategic focus on specialized products and navigation of the regulatory environment will be key for insurers. The market is poised for significant expansion by 2033, reflecting these evolving trends.

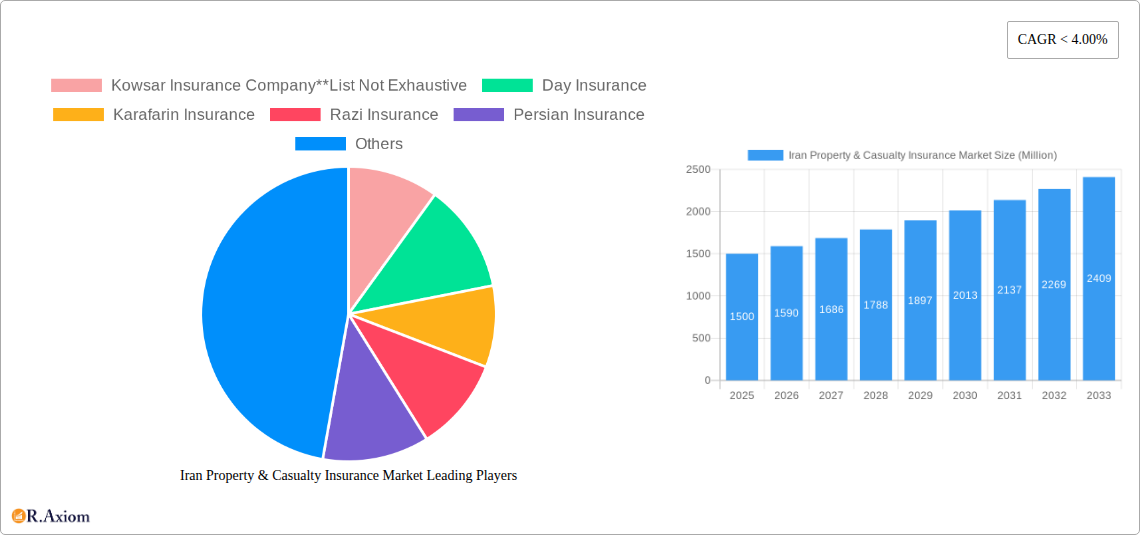

Iran Property & Casualty Insurance Market Company Market Share

Iran Property & Casualty Insurance Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Iranian Property & Casualty (P&C) insurance market, covering historical performance (2019-2024), current market dynamics (2025), and future projections (2025-2033). It offers actionable insights for insurers, investors, and other stakeholders seeking to understand and navigate this dynamic market. The report incorporates extensive data analysis, highlighting key segments, growth drivers, challenges, and opportunities.

Iran Property & Casualty Insurance Market Market Concentration & Innovation

The Iranian P&C insurance market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. In 2025, the top five insurers are estimated to hold approximately xx% of the total market. This concentration is driven by factors such as established brand recognition, extensive distribution networks, and strong financial backing. However, there’s increasing competition from newer entrants, driven by market liberalization initiatives. Innovation remains a key focus, with insurers investing in digital technologies, such as telematics and AI-powered claims processing, to improve efficiency and customer experience. Regulatory frameworks, although evolving, pose some challenges to rapid innovation. The impact of sanctions and the existing geopolitical situation has constrained foreign investment and technology transfer. Market M&A activity remains relatively low compared to other emerging markets, with only xx deals valued at a total of approximately $xx Million recorded in the past five years. This limited M&A activity is primarily due to regulatory hurdles and economic sanctions. Product substitution, such as the emergence of microinsurance solutions, are gaining traction, particularly within the underserved rural populations. End-user trends show a rising demand for personalized insurance products and digital channels for purchasing and service management.

Iran Property & Casualty Insurance Market Industry Trends & Insights

The Iranian P&C insurance market is projected to register a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing insurance awareness, rising disposable incomes, and government initiatives promoting insurance penetration. However, challenges persist, including macroeconomic instability, sanctions, and a relatively low insurance penetration rate compared to regional benchmarks. Technological disruptions are reshaping the industry, with digitalization impacting every aspect, from underwriting and claims management to customer interaction. Consumer preferences are shifting towards convenient and digital-first experiences, requiring insurers to adapt their offerings and operational models. Competitive dynamics are intense, with both established players and new entrants vying for market share. This leads to price wars and innovation in product offerings and service delivery models. Market penetration remains relatively low at xx% in 2025, indicating significant untapped potential for growth. The growing middle class, coupled with increasing urbanization and the associated risks, further fuels market expansion.

Dominant Markets & Segments in Iran Property & Casualty Insurance Market

By Product Type: Motor insurance (comprising Motor PD and Motor TPL) dominates the market, accounting for approximately xx% of the total premium in 2025. This is driven by the rising number of vehicles and increasing awareness of motor insurance necessity. Fire insurance holds a significant share, driven by the growing construction sector. The Liability insurance segment is witnessing moderate growth fueled by increasing regulations and liability consciousness. Other P&C segments like Marine, Aviation, and Engineering insurance hold relatively smaller but growing market shares.

By Distribution Channel: Agents remain the dominant distribution channel, leveraging established relationships and extensive reach within the country. However, direct sales and online channels are gaining traction, particularly among younger demographics. Brokers play a significant role in the commercial insurance space, while banks are starting to expand their insurance distribution activities.

Key drivers for the dominant segments include robust economic growth (albeit fluctuating due to sanctions), government regulations mandating insurance for specific risks (like motor vehicles), and increasing infrastructure development. The relatively underdeveloped nature of certain segments (e.g., marine and aviation) presents substantial opportunities for expansion.

Iran Property & Casualty Insurance Market Product Developments

Recent product innovations focus on the development of tailored insurance products catering to specific customer needs and risk profiles. The increasing use of technology is leading to the development of innovative products, like usage-based insurance (UBI) for motor insurance. This trend helps improve pricing accuracy and risk assessment. Moreover, insurers are incorporating technological advancements to enhance the customer journey, including online platforms for policy purchasing, claims filing, and customer service. This enhanced customer experience is key to gaining a competitive edge in this evolving market.

Report Scope & Segmentation Analysis

This report segments the Iranian P&C insurance market by product type (Fire Insurance, Motor PD, Motor TPL, Liability Insurance, Marine, Aviation & Engineering, Other P&C) and distribution channel (Direct Sales, Agents, Brokers, Banks, Other Distribution Channel). Each segment’s market size, growth projections, and competitive landscape are analyzed. For instance, the Motor insurance segment is expected to experience robust growth, driven by the increasing number of vehicles, while the Marine and Aviation insurance segments present notable untapped growth potential. The distribution channel analysis reveals the dominance of agents, but also the increasing relevance of digital channels. Competitive dynamics within each segment are detailed, revealing market share distribution among key players.

Key Drivers of Iran Property & Casualty Insurance Market Growth

The Iranian P&C insurance market's growth is propelled by several factors. Firstly, the increasing awareness of insurance among the population drives demand for various products. Secondly, the country's burgeoning middle class with rising disposable incomes creates a larger pool of potential customers. Thirdly, favorable government policies supporting the insurance sector are creating a more conducive regulatory environment. Finally, infrastructure development, such as new roads and buildings, increases exposure to insurable risks.

Challenges in the Iran Property & Casualty Insurance Market Sector

Several challenges hinder the market's growth. Economic sanctions significantly impact the industry's access to global reinsurance markets and advanced technologies, thus constraining growth potential. Furthermore, macroeconomic instability and currency fluctuations create uncertainty for insurers and investors. Lastly, a lack of comprehensive consumer awareness about insurance products poses a barrier to market penetration. These challenges have resulted in the current market size of approximately $xx Million in 2025, with growth potentially hindered by these factors.

Emerging Opportunities in Iran Property & Casualty Insurance Market

Significant opportunities exist for growth in the Iranian P&C market. The increasing adoption of digital technologies presents opportunities for insurers to reach new customer segments and optimize operations. Furthermore, the development of niche insurance products tailored to the specific needs of various customer segments holds promise. Lastly, expansion into underserved regions and the development of microinsurance products can significantly contribute to market growth.

Leading Players in the Iran Property & Casualty Insurance Market Market

- Kowsar Insurance Company

- Day Insurance

- Karafarin Insurance

- Razi Insurance

- Persian Insurance

- Asia Insurance

- Alborz Insurance

- Pasargad Insurance Company

- Moallem Insurance Company

- Iran Insurance Company

Key Developments in Iran Property & Casualty Insurance Market Industry

- 2022 Q4: Introduction of a new online insurance platform by Iran Insurance Company.

- 2023 Q2: Pasargad Insurance Company launched a new motor insurance product with telematics integration.

- 2024 Q1: Regulatory changes aimed at streamlining the licensing process for new insurance companies.

Strategic Outlook for Iran Property & Casualty Insurance Market Market

The Iranian P&C insurance market holds considerable long-term growth potential. Continued economic development, coupled with growing insurance awareness and technological advancements, will drive market expansion. Insurers that adapt to the changing consumer preferences, invest in digital technologies, and develop innovative products will be well-positioned to capture significant market share. The removal or easing of sanctions could unlock even greater growth.

Iran Property & Casualty Insurance Market Segmentation

-

1. Product Type

- 1.1. Fire Insurance

- 1.2. Motor PD

- 1.3. Motor TPL

- 1.4. Liability Insurance

- 1.5. Marine, Aviation & Engineering

- 1.6. Other P&C

-

2. Distribution Channel

- 2.1. Direct Sales

- 2.2. Agents

- 2.3. Brokers

- 2.4. Banks

- 2.5. Other Distribution Channel

Iran Property & Casualty Insurance Market Segmentation By Geography

- 1. Iran

Iran Property & Casualty Insurance Market Regional Market Share

Geographic Coverage of Iran Property & Casualty Insurance Market

Iran Property & Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in consumer spending on buying Asian artworks; The rise in virtual art gallery market

- 3.3. Market Restrains

- 3.3.1. The rising prices of the artwork

- 3.4. Market Trends

- 3.4.1. The Premium Written for Various segment of Property and Casualty Insurance is on Rise.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Property & Casualty Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fire Insurance

- 5.1.2. Motor PD

- 5.1.3. Motor TPL

- 5.1.4. Liability Insurance

- 5.1.5. Marine, Aviation & Engineering

- 5.1.6. Other P&C

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct Sales

- 5.2.2. Agents

- 5.2.3. Brokers

- 5.2.4. Banks

- 5.2.5. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kowsar Insurance Company**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Day Insurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Karafarin Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Razi Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Persian Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Asia Insurance

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alborz Insurance

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pasargad Insurance Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Moallem Insurance Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Iran Insurance Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kowsar Insurance Company**List Not Exhaustive

List of Figures

- Figure 1: Iran Property & Casualty Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Iran Property & Casualty Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Iran Property & Casualty Insurance Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Iran Property & Casualty Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Iran Property & Casualty Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Iran Property & Casualty Insurance Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Iran Property & Casualty Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Iran Property & Casualty Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Property & Casualty Insurance Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Iran Property & Casualty Insurance Market?

Key companies in the market include Kowsar Insurance Company**List Not Exhaustive, Day Insurance, Karafarin Insurance, Razi Insurance, Persian Insurance, Asia Insurance, Alborz Insurance, Pasargad Insurance Company, Moallem Insurance Company, Iran Insurance Company.

3. What are the main segments of the Iran Property & Casualty Insurance Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.99 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in consumer spending on buying Asian artworks; The rise in virtual art gallery market.

6. What are the notable trends driving market growth?

The Premium Written for Various segment of Property and Casualty Insurance is on Rise..

7. Are there any restraints impacting market growth?

The rising prices of the artwork.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Property & Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Property & Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Property & Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Iran Property & Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence