Key Insights

The Japan Protein Market is projected for significant expansion, expected to reach a market size of 182.1 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15.5% from 2025 to 2033. This upward trajectory is driven by increasing health and wellness consciousness, rising demand for protein-enriched foods and beverages, and expanding applications in personal care and cosmetics. Japan's aging demographic is a key driver for specialized nutritional supplements, including elderly and medical nutrition products. The burgeoning sports nutrition sector, fueled by demand for performance enhancement and recovery, also significantly contributes to market growth.

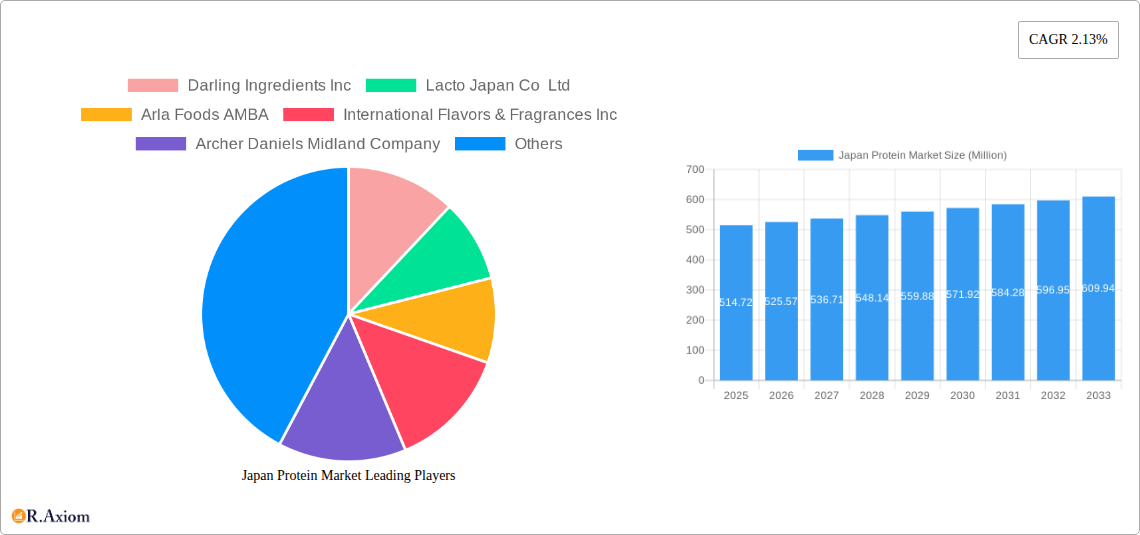

Japan Protein Market Market Size (In Million)

Market segmentation highlights the rising prominence of plant-based proteins, particularly pea and soy protein, aligning with consumer preference for sustainable diets. Animal proteins, including whey and egg protein, maintain a strong presence due to their nutritional benefits and widespread use in bakery and dairy. The animal feed segment remains a consistent contributor to market value, supporting the livestock industry. Leading companies like Darling Ingredients Inc., Archer Daniels Midland Company, and Morinaga Milk Industry Co., Ltd. are actively innovating. Emerging trends such as novel protein sources and protein integration into convenience foods are set to shape the future of the Japan Protein Market.

Japan Protein Market Company Market Share

Japan Protein Market: Comprehensive Analysis & Growth Forecast (2019-2033)

This in-depth report offers a panoramic view of the Japan Protein Market, meticulously analyzing key segments, dominant trends, and strategic outlook from 2019 to 2033. With a base year of 2025 and a comprehensive forecast period extending to 2033, this study provides actionable insights for stakeholders navigating the dynamic protein landscape. Leveraging high-traffic keywords such as "Japan protein market," "plant-based protein Japan," "animal protein Japan," "insect protein Japan," "whey protein Japan," and "collagen Japan," this report aims to maximize search visibility and engagement for industry professionals.

Japan Protein Market Market Concentration & Innovation

The Japan Protein Market is characterized by a moderate level of market concentration, with a few large multinational corporations and established domestic players holding significant market share. However, the market is also ripe with innovation, driven by increasing consumer demand for healthier, sustainable, and ethically sourced protein alternatives. Key innovation drivers include advancements in food technology, precision fermentation, and the development of novel plant-based and microbial protein sources. Regulatory frameworks in Japan, while evolving, generally support food safety and quality standards, encouraging innovation in product development. Product substitutes are proliferating, particularly within the plant-based and alternative protein sectors, offering consumers a wider array of choices. End-user preferences are rapidly shifting towards functional ingredients, plant-derived proteins, and proteins supporting specific health and wellness goals. Mergers and acquisitions (M&A) are also playing a role in shaping the market, with recent deals indicating a trend towards consolidating expertise and expanding market reach. For instance, the estimated M&A deal value in the broader Asia-Pacific protein sector has seen significant growth in recent years, reflecting strategic investments in this burgeoning market.

- Market Concentration: Moderate, with key players dominating segments.

- Innovation Drivers: Food technology advancements, sustainable sourcing, precision fermentation, health-conscious product development.

- Regulatory Frameworks: Emphasis on food safety and quality, fostering innovation.

- Product Substitutes: Growing availability of plant-based, microbial, and alternative protein options.

- End-User Trends: Demand for functional, sustainable, and health-specific protein solutions.

- M&A Activities: Strategic investments to gain market share and technological capabilities.

Japan Protein Market Industry Trends & Insights

The Japan Protein Market is poised for substantial growth, driven by a confluence of factors including evolving consumer preferences, a growing health and wellness consciousness, and increasing awareness of environmental sustainability. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This robust growth trajectory is underpinned by several key trends. Firstly, the escalating demand for plant-based proteins continues to be a dominant force, fueled by concerns over animal welfare, environmental impact, and the perception of plant proteins as healthier alternatives. This surge in plant-based protein consumption is driving significant market penetration in the Food and Beverages and Supplements sectors. Secondly, the expanding elderly population in Japan and the increasing focus on preventative healthcare are boosting the demand for specialized nutritional products, including those rich in protein, catering to elderly nutrition and medical nutrition segments. Thirdly, the global trend towards sustainable food systems is resonating strongly in Japan, leading to increased investment and interest in alternative protein sources like insect protein and algae protein, which offer a significantly lower environmental footprint. Technological disruptions, such as advancements in precision fermentation for producing dairy and egg proteins without animals, are also set to reshape the market by offering more sustainable and potentially cost-effective solutions. Competitive dynamics are intensifying as both domestic and international players vie for market share, leading to product diversification and innovative marketing strategies. The overall market penetration of protein-enhanced products across various consumer categories is expected to rise significantly in the coming years, reflecting the increasing integration of protein into daily diets.

Dominant Markets & Segments in Japan Protein Market

The Japan Protein Market exhibits dominance across several key segments, driven by distinct consumer demands and market dynamics. Within the Source segmentation, Animal protein remains a significant contributor, largely propelled by the sustained demand for Whey Protein and Milk Protein in the dairy and supplements industries, alongside the enduring popularity of Collagen in the beauty and wellness sectors. The market size for Animal protein is estimated to be around XX Million in the base year of 2025. However, the Plant protein segment is exhibiting remarkable growth, projected to be the fastest-growing source category, reaching an estimated XX Million by 2033. This surge is primarily attributed to the rising popularity of Soy Protein, Pea Protein, and Rice Protein in functional foods, beverages, and meat alternatives. The End-User segmentation reveals a strong presence of the Food and Beverages sector, with specific sub-segments like Dairy and Dairy Alternative Products, and Meat/Poultry/Seafood and Meat Alternative Products demonstrating substantial market share. The projected market size for Food and Beverages is around XX Million in 2025. The Supplements sector, particularly Sport/Performance Nutrition and Baby Food and Infant Formula, is also a critical growth engine, valued at approximately XX Million in 2025, driven by health-conscious consumers and evolving dietary needs. The Animal Feed segment, while substantial, is expected to witness moderate growth compared to the human consumption-focused segments. The growing adoption of insect protein in animal feed formulations is a notable trend.

- Dominant Source Segments:

- Animal Protein: Sustained demand for Whey Protein, Milk Protein, Collagen.

- Plant Protein: Rapid growth driven by Soy Protein, Pea Protein, Rice Protein in functional foods and alternatives.

- Dominant End-User Segments:

- Food and Beverages: Driven by Dairy/Dairy Alternatives and Meat/Meat Alternatives.

- Supplements: Fueled by Sport/Performance Nutrition and Baby Food/Infant Formula.

- Key Drivers of Dominance:

- Economic Policies: Supportive policies for food innovation and health product development.

- Consumer Preferences: Increasing health consciousness, preference for plant-based and functional foods.

- Technological Advancements: Development of novel protein extraction and processing techniques.

- Lifestyle Trends: Growing emphasis on fitness, wellness, and sustainable living.

- Infrastructure: Robust supply chains for sourcing and distribution of protein ingredients.

Japan Protein Market Product Developments

Product innovations in the Japan Protein Market are intensely focused on enhancing nutritional profiles, improving taste and texture, and catering to specific dietary needs and preferences. The development of plant-based alternatives that closely mimic the sensory attributes of animal-derived products is a significant trend. Innovations in protein extraction and purification technologies are enabling the creation of high-purity ingredients with improved functionalities. Furthermore, the integration of novel protein sources, such as insect and algae proteins, into food products and supplements is gaining traction, offering sustainable and nutrient-rich options. Competitive advantages are being carved out through the development of allergen-free protein formulations, reduced sugar content, and the incorporation of functional ingredients for targeted health benefits, such as gut health and immune support.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Japan Protein Market across several key segmentation dimensions. The Source segmentation includes Animal (Casein and Caseinates, Collagen, Egg Protein, Gelatin, Insect Protein, Milk Protein, Whey Protein, Other Animal Protein), Microbial (Algae Protein, Mycoprotein), and Plant (Hemp Protein, Pea Protein, Potato Protein, Rice Protein, Soy Protein, Wheat Protein, Other Plant Protein). The End-User segmentation encompasses Animal Feed, Personal Care and Cosmetics, Food and Beverages (Bakery, Breakfast Cereals, Condiments/Sauces, Confectionery, Dairy and Dairy Alternative Products, Meat/Poultry/Seafood and Meat Alternative Products, RTE/RTC Food Products, Snacks), and Supplements (Baby Food and Infant Formula, Elderly Nutrition and Medical Nutrition, Sport/Performance Nutrition). Each segment is analyzed for its market size, growth projections, and competitive dynamics, providing a detailed understanding of the market landscape. The Plant Protein segment is projected to witness a CAGR of approximately 9.2% from 2025 to 2033, while the Supplements sector is expected to grow at a CAGR of around 8.1%.

Key Drivers of Japan Protein Market Growth

Several critical factors are propelling the growth of the Japan Protein Market.

- Growing Health Consciousness: Japanese consumers are increasingly prioritizing health and wellness, leading to a higher demand for protein-rich foods and supplements for muscle health, satiety, and overall well-being.

- Rising Popularity of Plant-Based Diets: A significant shift towards plant-based diets, driven by environmental concerns, ethical considerations, and perceived health benefits, is fueling the demand for plant-derived proteins like soy, pea, and rice.

- Technological Advancements: Innovations in protein extraction, processing, and the development of novel protein sources (e.g., precision fermentation, insect protein) are expanding product offerings and improving affordability.

- Aging Population and Specialized Nutrition: The increasing elderly demographic necessitates specialized nutritional products, including high-protein formulations to combat sarcopenia and support overall health.

- Government Initiatives and Sustainability Focus: Growing awareness and government support for sustainable food systems are driving interest and investment in alternative protein sources with lower environmental footprints.

Challenges in the Japan Protein Market Sector

Despite robust growth, the Japan Protein Market faces several challenges.

- High Production Costs for Novel Proteins: The initial high cost of producing and scaling up novel protein sources like insect and algae protein can hinder widespread adoption.

- Consumer Perception and Acceptance: Overcoming traditional consumer preferences and building trust in less conventional protein sources, such as insect protein, requires significant educational efforts and marketing.

- Regulatory Hurdles and Labeling Standards: Navigating complex and evolving regulatory frameworks for novel ingredients and ensuring clear, consumer-friendly labeling can pose challenges for market entry and expansion.

- Supply Chain Volatility: Dependence on global supply chains for certain raw materials and the impact of geopolitical events or climate change on agricultural yields can create supply chain vulnerabilities.

- Competition from Established Dairy and Meat Industries: The established infrastructure and strong consumer loyalty towards traditional dairy and meat products present a significant competitive barrier for alternative protein players.

Emerging Opportunities in Japan Protein Market

The Japan Protein Market presents numerous exciting opportunities for growth and innovation.

- Expansion of Plant-Based Product Innovation: Continued development of plant-based ingredients and finished products with improved taste, texture, and functionality will capture a larger market share.

- Growth in Functional Foods and Beverages: Integrating protein into everyday food and beverage items, offering added health benefits beyond basic nutrition, represents a significant opportunity.

- Development of Sustainable Insect and Algae Protein Applications: Further research and development into the widespread application of insect and algae proteins in animal feed, food, and even cosmetic products can unlock new market segments.

- Personalized Nutrition Solutions: Leveraging protein's role in targeted health outcomes, there's an opportunity to develop personalized protein blends for specific dietary needs, fitness goals, and age groups.

- Strategic Partnerships and Collaborations: Collaborations between ingredient manufacturers, food producers, and technology providers can accelerate innovation and market penetration.

Leading Players in the Japan Protein Market Market

- Darling Ingredients Inc.

- Lacto Japan Co Ltd.

- Arla Foods AMBA

- International Flavors & Fragrances Inc.

- Archer Daniels Midland Company

- Bunge Limited

- Nitta Gelatin Inc.

- Nagata Group Holdings ltd.

- Fuji Oil Holdings Inc.

- Morinaga Milk Industry Co Ltd.

Key Developments in Japan Protein Market Industry

- June 2023: Megmilk Snow Brand, a prominent Japanese dairy company, joined forces with Agrocorp International, a global agrifood supplier headquartered in Singapore. Their partnership is set to manufacture and distribute plant-based ingredients, with the overarching goal of promoting sustainable food production not only in Malaysia and Japan but also in various other locations throughout Asia.

- March 2023: Marubeni unveiled a strategic alliance with Ynsect, the world's leading manufacturer and distributor of insect protein. This collaboration signifies Marubeni's entry into the Japanese market, with a primary focus on contributing to the development of a sustainable aquaculture industry and a resilient food supply chain in Japan.

- January 2022: The Fooditive Group, a Dutch ingredient manufacturer, introduced its groundbreaking vegan casein powder for the food and beverage industry across Asia, including Japan. This animal-free dairy protein is crafted using precision fermentation techniques and is poised to be incorporated into a wide array of cow milk alternative products.

Strategic Outlook for Japan Protein Market Market

The strategic outlook for the Japan Protein Market is exceptionally promising, driven by persistent consumer demand for healthier, more sustainable, and ethically produced food options. The market is anticipated to experience continued robust growth, fueled by innovation in plant-based and alternative protein technologies. Key growth catalysts include the increasing integration of protein into mainstream food products, the development of specialized nutritional solutions for aging populations and athletes, and the growing adoption of novel, eco-friendly protein sources. Strategic collaborations and investments in R&D will be crucial for market players to capitalize on emerging opportunities and maintain a competitive edge. The focus on circular economy principles and sustainable sourcing will further shape market strategies, ensuring long-term viability and consumer trust.

Japan Protein Market Segmentation

-

1. Source

-

1.1. Animal

- 1.1.1. Casein and Caseinates

- 1.1.2. Collagen

- 1.1.3. Egg Protein

- 1.1.4. Gelatin

- 1.1.5. Insect Protein

- 1.1.6. Milk Protein

- 1.1.7. Whey Protein

- 1.1.8. Other Animal Protein

-

1.2. Microbial

- 1.2.1. Algae Protein

- 1.2.2. Mycoprotein

-

1.3. Plant

- 1.3.1. Hemp Protein

- 1.3.2. Pea Protein

- 1.3.3. Potato Protein

- 1.3.4. Rice Protein

- 1.3.5. Soy Protein

- 1.3.6. Wheat Protein

- 1.3.7. Other Plant Protein

-

1.1. Animal

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Confectionery

- 2.3.5. Dairy and Dairy Alternative Products

- 2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.3.7. RTE/RTC Food Products

- 2.3.8. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Japan Protein Market Segmentation By Geography

- 1. Japan

Japan Protein Market Regional Market Share

Geographic Coverage of Japan Protein Market

Japan Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Health and Fitness Consciousness Among Japanese; Increasing Demand for Meat Analogues

- 3.3. Market Restrains

- 3.3.1. Higher Production Costs and Limited Capacities

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Meat Analogues

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal

- 5.1.1.1. Casein and Caseinates

- 5.1.1.2. Collagen

- 5.1.1.3. Egg Protein

- 5.1.1.4. Gelatin

- 5.1.1.5. Insect Protein

- 5.1.1.6. Milk Protein

- 5.1.1.7. Whey Protein

- 5.1.1.8. Other Animal Protein

- 5.1.2. Microbial

- 5.1.2.1. Algae Protein

- 5.1.2.2. Mycoprotein

- 5.1.3. Plant

- 5.1.3.1. Hemp Protein

- 5.1.3.2. Pea Protein

- 5.1.3.3. Potato Protein

- 5.1.3.4. Rice Protein

- 5.1.3.5. Soy Protein

- 5.1.3.6. Wheat Protein

- 5.1.3.7. Other Plant Protein

- 5.1.1. Animal

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Confectionery

- 5.2.3.5. Dairy and Dairy Alternative Products

- 5.2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.7. RTE/RTC Food Products

- 5.2.3.8. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Darling Ingredients Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lacto Japan Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arla Foods AMBA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Flavors & Fragrances Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniels Midland Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bunge Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nitta Gelatin Inc *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nagata Group Holdings ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fuji Oil Holdings Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Morinaga Milk Industry Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: Japan Protein Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Japan Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Protein Market Revenue million Forecast, by Source 2020 & 2033

- Table 2: Japan Protein Market Volume k Tons Forecast, by Source 2020 & 2033

- Table 3: Japan Protein Market Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Japan Protein Market Volume k Tons Forecast, by End-User 2020 & 2033

- Table 5: Japan Protein Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Japan Protein Market Volume k Tons Forecast, by Region 2020 & 2033

- Table 7: Japan Protein Market Revenue million Forecast, by Source 2020 & 2033

- Table 8: Japan Protein Market Volume k Tons Forecast, by Source 2020 & 2033

- Table 9: Japan Protein Market Revenue million Forecast, by End-User 2020 & 2033

- Table 10: Japan Protein Market Volume k Tons Forecast, by End-User 2020 & 2033

- Table 11: Japan Protein Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Japan Protein Market Volume k Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Protein Market?

The projected CAGR is approximately 15.5%.

2. Which companies are prominent players in the Japan Protein Market?

Key companies in the market include Darling Ingredients Inc, Lacto Japan Co Ltd, Arla Foods AMBA, International Flavors & Fragrances Inc, Archer Daniels Midland Company, Bunge Limited, Nitta Gelatin Inc *List Not Exhaustive, Nagata Group Holdings ltd, Fuji Oil Holdings Inc, Morinaga Milk Industry Co Ltd.

3. What are the main segments of the Japan Protein Market?

The market segments include Source, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 182.1 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Health and Fitness Consciousness Among Japanese; Increasing Demand for Meat Analogues.

6. What are the notable trends driving market growth?

Increasing Demand for Meat Analogues.

7. Are there any restraints impacting market growth?

Higher Production Costs and Limited Capacities.

8. Can you provide examples of recent developments in the market?

June 2023: Megmilk Snow Brand, a prominent Japanese dairy company, joined forces with Agrocorp International, a global agrifood supplier headquartered in Singapore. Their partnership is set to manufacture and distribute plant-based ingredients, with the overarching goal of promoting sustainable food production not only in Malaysia and Japan but also in various other locations throughout Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in k Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Protein Market?

To stay informed about further developments, trends, and reports in the Japan Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence