Key Insights

The global lab automation market within the drug discovery industry is experiencing robust growth, driven by the increasing demand for high-throughput screening, reduced manual errors, and accelerated drug development timelines. The market's expansion is fueled by significant advancements in automation technologies, including sophisticated liquid handlers, robotic arms, and integrated software solutions that streamline complex laboratory processes. The rising adoption of automation across various stages of drug discovery, from early-stage research to clinical trials, is a major contributing factor. Furthermore, the increasing prevalence of chronic diseases and the consequent need for novel therapeutic interventions are bolstering the market's growth trajectory. Major players like Tecan, Siemens, and Thermo Fisher Scientific are actively investing in R&D and strategic acquisitions to consolidate their market share and introduce innovative solutions.

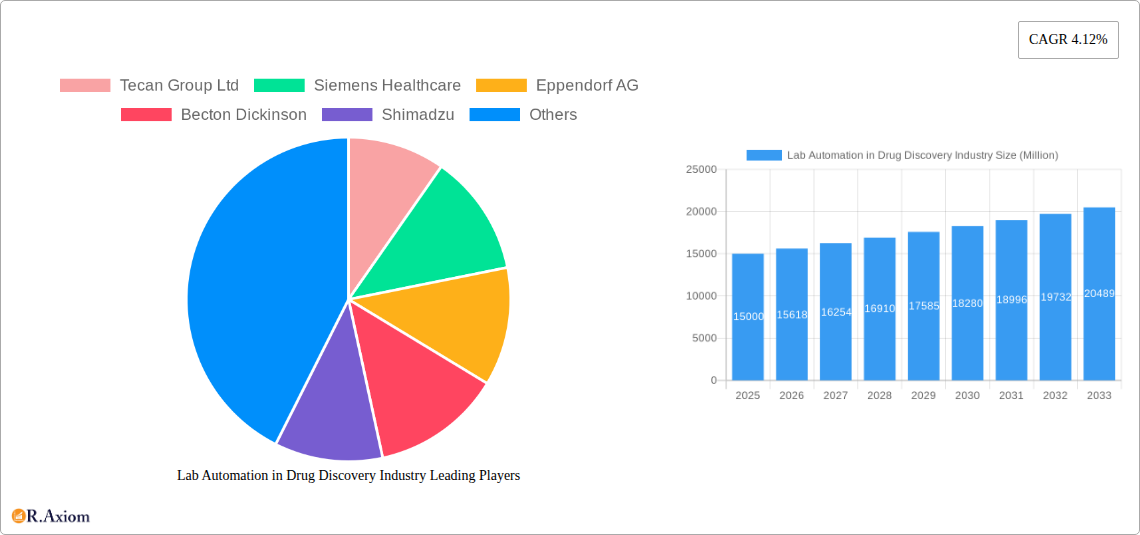

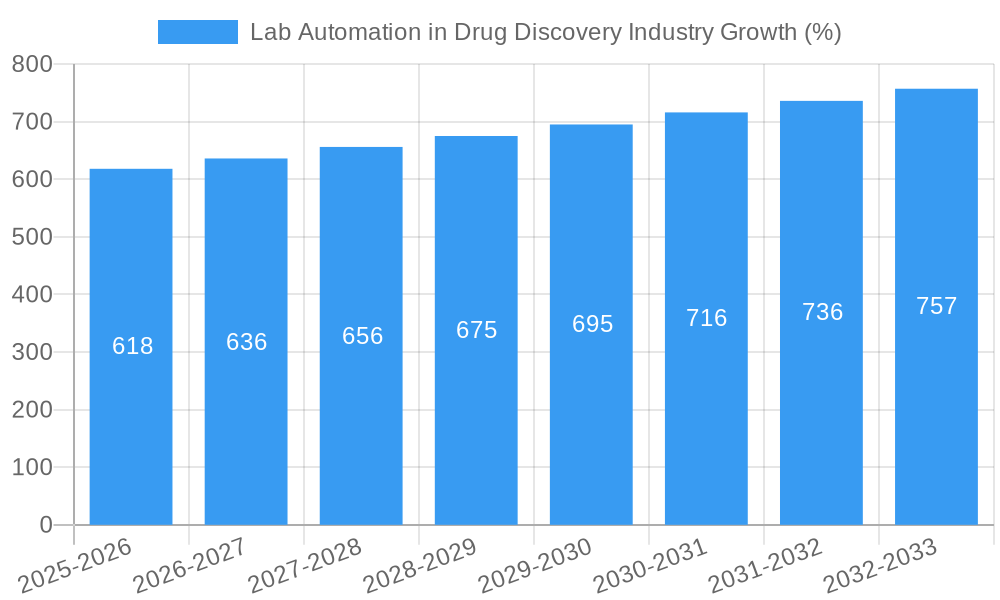

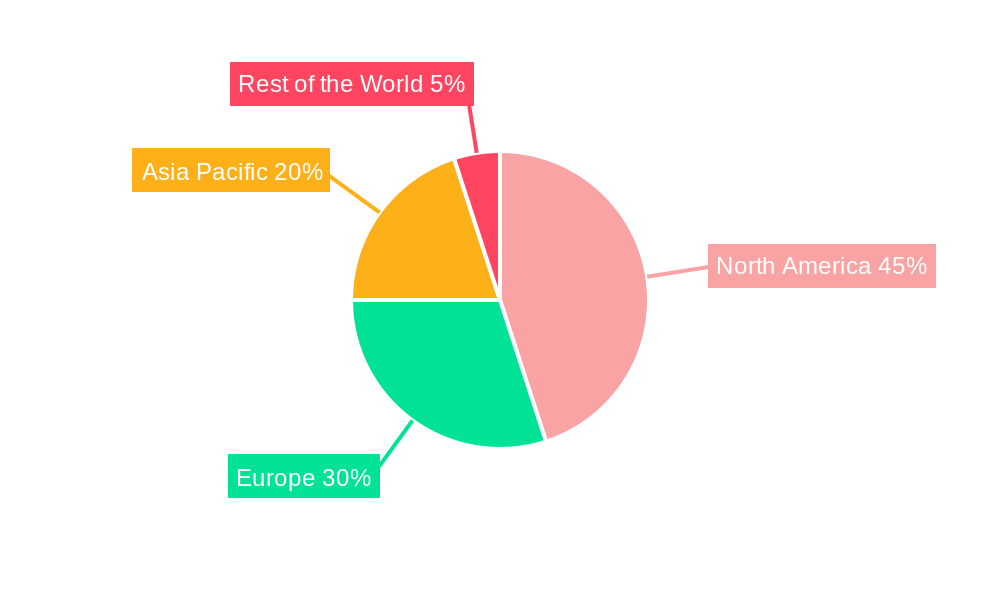

Despite the promising outlook, certain challenges remain. The high initial investment costs associated with implementing automated systems and the need for skilled personnel to operate and maintain them are potential restraints. However, the long-term cost savings resulting from improved efficiency and reduced human error are likely to outweigh these initial investments. The market is segmented by equipment type, with automated liquid handlers and plate handlers currently dominating the market share, followed by robotic arms and AS/RS systems. The software segment is witnessing exponential growth as integrated platforms enhance data management and workflow optimization. Geographic segmentation reveals North America as the leading market, followed by Europe and Asia Pacific, with the latter witnessing rapid expansion driven by increasing R&D investments and growing pharmaceutical industries in emerging economies. Based on a 4.12% CAGR and a 2025 market size (assumed to be $15 Billion for illustrative purposes), the market is projected to exhibit substantial growth throughout the forecast period (2025-2033).

Lab Automation in Drug Discovery Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Lab Automation in Drug Discovery Industry, offering actionable insights for stakeholders across the value chain. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report projects market trends and growth opportunities until 2033. Key players such as Tecan Group Ltd, Siemens Healthcare, Eppendorf AG, Becton Dickinson, Shimadzu, Perkinelmer, Beckman Coulter, Synchron Lab Automation (MolGen), Thermo Fisher Scientific, Roche Holding AG, Agilent Technologies, Aurora Biome, Bio-Rad, and Hudson Robotics are thoroughly analyzed.

Lab Automation in Drug Discovery Industry Market Concentration & Innovation

The Lab Automation in Drug Discovery market exhibits moderate concentration, with a few major players holding significant market share. However, the landscape is dynamic, with continuous innovation driving market expansion. The top 10 companies account for approximately xx% of the global market in 2025, with a combined revenue of approximately $xx Million. Mergers and acquisitions (M&A) play a crucial role in shaping the competitive landscape. For example, in recent years, we’ve observed M&A deals valued at $xx Million, primarily driven by companies seeking to expand their product portfolios and geographical reach.

- Market Concentration: Top 10 players holding approximately xx% market share in 2025.

- Innovation Drivers: Technological advancements in robotics, AI, and software integration.

- Regulatory Frameworks: Stringent regulatory requirements impacting product development and approval timelines.

- Product Substitutes: Limited substitutes exist; however, cost-effective manual methods represent a potential competitive threat.

- End-User Trends: Growing demand for higher throughput, increased efficiency, and reduced human error in drug discovery processes.

- M&A Activities: Significant M&A activity observed, with deal values totaling approximately $xx Million in the past five years.

Lab Automation in Drug Discovery Industry Industry Trends & Insights

The Lab Automation in Drug Discovery market is experiencing robust growth, driven by several key factors. Technological advancements, such as the integration of artificial intelligence (AI) and machine learning (ML) into lab automation systems, are significantly enhancing efficiency and throughput. Furthermore, the increasing prevalence of high-throughput screening (HTS) and drug repurposing initiatives is boosting demand. The market is expected to exhibit a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market value of approximately $xx Million by 2033. Market penetration of automated liquid handlers, for instance, is estimated to reach xx% by 2033, indicating significant market uptake. The competitive landscape is characterized by intense competition among established players and emerging innovative companies. This is further intensified by a shift towards personalized medicine, requiring increased automation to handle the complexity of tailored drug discovery processes.

Dominant Markets & Segments in Lab Automation in Drug Discovery Industry

North America currently holds the largest market share in the global lab automation in drug discovery industry, driven by strong pharmaceutical R&D investments and the presence of numerous leading pharmaceutical companies. Within the equipment segment, Automated Liquid Handlers constitute the largest market share, projected to reach $xx Million by 2033.

- Key Drivers of North American Dominance:

- Robust pharmaceutical R&D spending.

- High adoption rate of advanced technologies.

- Favorable regulatory environment.

- Automated Liquid Handlers: Largest market segment due to their wide application in various drug discovery workflows. High demand is projected to drive this segment to $xx Million by 2033.

- Automated Plate Handlers: Essential for high-throughput screening, contributing significantly to market growth. Expected to reach $xx Million by 2033.

- Robotic Arms: Used for flexible automation tasks, exhibiting steady growth.

- Automated Storage & Retrieval Systems (AS/RS): Crucial for efficient sample management, showing considerable growth potential.

- Software: Integral component facilitating workflow management and data analysis; Expected to reach $xx Million by 2033.

- Analyzers: High demand driven by the need for rapid and accurate analysis in drug discovery.

Lab Automation in Drug Discovery Industry Product Developments

Recent product innovations are focused on enhancing precision, throughput, and ease of use. The integration of artificial intelligence (AI) and machine learning (ML) algorithms for data analysis and process optimization is a significant trend. New liquid handlers offer improved accuracy, smaller footprints, and user-friendly interfaces. The emergence of modular and adaptable systems allows for flexible customization to meet diverse laboratory needs. This adaptability is a crucial competitive advantage, catering to the unique requirements of various drug discovery projects.

Report Scope & Segmentation Analysis

This report segments the Lab Automation in Drug Discovery market by equipment type: Automated Liquid Handlers, Automated Plate Handlers, Robotic Arms, Automated Storage & Retrieval Systems (AS/RS), Software, and Analyzers. Each segment is analyzed based on market size, growth projections, and competitive dynamics. For example, the Automated Liquid Handlers segment shows the highest growth potential due to its versatile applications in various stages of drug discovery. Similarly, the software segment is exhibiting high growth due to the increasing need for efficient data management and analysis. Market sizes for each segment are projected for the forecast period, with detailed competitive analysis for each.

Key Drivers of Lab Automation in Drug Discovery Industry Growth

Several factors are driving market growth:

- Rising R&D Spending: Increased investment in drug discovery fuels demand for efficient automation solutions.

- Technological Advancements: AI, ML, and robotics are enhancing automation capabilities.

- Growing Demand for High-Throughput Screening: HTS requires efficient automation for processing large sample volumes.

- Stringent Regulatory Compliance: Automation ensures accurate and reliable data, critical for regulatory compliance.

Challenges in the Lab Automation in Drug Discovery Industry Sector

The industry faces challenges such as:

- High Initial Investment Costs: Implementing lab automation systems can be expensive.

- Integration Complexity: Integrating various automated systems within a lab can be technically complex.

- Skill Gaps: Trained personnel are needed to operate and maintain automated systems.

- Data Security & Integrity Concerns: Safeguarding sensitive data is critical.

Emerging Opportunities in Lab Automation in Drug Discovery Industry

Emerging opportunities lie in:

- Miniaturization and Microfluidics: Reducing assay volumes and costs.

- Cloud-Based Data Management: Improving data accessibility and collaboration.

- Artificial Intelligence and Machine Learning Integration: Enabling advanced data analysis and predictive modeling.

Leading Players in the Lab Automation in Drug Discovery Industry Market

- Tecan Group Ltd

- Siemens Healthcare

- Eppendorf AG

- Becton Dickinson

- Shimadzu

- Perkinelmer

- Beckman Coulter

- Synchron Lab Automation (MolGen)

- Thermo Fisher Scientific

- Roche Holding AG

- Agilent Technologies

- Aurora Biome

- Bio-Rad

- Hudson Robotics

Key Developments in Lab Automation in Drug Discovery Industry Industry

- March 2023: Eppendorf launched the new generation epMotion automated liquid handler, enhancing precision and user experience. This launch strengthens Eppendorf's position in the liquid handling segment.

- February 2023: Automata unveiled the LINQ integrated laboratory automation platform, improving lab throughput through robotic integration. This innovative platform disrupts traditional lab workflows.

Strategic Outlook for Lab Automation in Drug Discovery Market

The Lab Automation in Drug Discovery market is poised for sustained growth, driven by technological advancements, increasing R&D spending, and the growing demand for high-throughput screening. The integration of AI and ML, coupled with the development of more user-friendly and adaptable systems, will create significant opportunities for market expansion. Companies focused on innovation and strategic partnerships will be best positioned to capitalize on this growth.

Lab Automation in Drug Discovery Industry Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage & Retrieval Systems (AS/RS)

- 1.5. Software

- 1.6. Analyzers

Lab Automation in Drug Discovery Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Lab Automation in Drug Discovery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Innovations Leading to Device Miniaturization and Increased Throughput

- 3.3. Market Restrains

- 3.3.1. High Capital Requirements for Setup

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handlers are Expected to Account for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage & Retrieval Systems (AS/RS)

- 5.1.5. Software

- 5.1.6. Analyzers

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage & Retrieval Systems (AS/RS)

- 6.1.5. Software

- 6.1.6. Analyzers

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage & Retrieval Systems (AS/RS)

- 7.1.5. Software

- 7.1.6. Analyzers

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Pacific Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage & Retrieval Systems (AS/RS)

- 8.1.5. Software

- 8.1.6. Analyzers

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Rest of the World Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage & Retrieval Systems (AS/RS)

- 9.1.5. Software

- 9.1.6. Analyzers

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. North America Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Tecan Group Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Siemens Healthcare

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Eppendorf AG

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Becton Dickinson

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Shimadzu

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Perkinelmer

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Beckman Coulter

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Synchron Lab Automation (MolGen)

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Thermo Fisher Scientific

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Roche Holding AG

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Agilent Technologies

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Aurora Biome

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Bio-Rad

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Hudson Robotics

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 Tecan Group Ltd

List of Figures

- Figure 1: Global Lab Automation in Drug Discovery Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Lab Automation in Drug Discovery Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 11: North America Lab Automation in Drug Discovery Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 12: North America Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lab Automation in Drug Discovery Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 15: Europe Lab Automation in Drug Discovery Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 16: Europe Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Lab Automation in Drug Discovery Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 19: Asia Pacific Lab Automation in Drug Discovery Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 20: Asia Pacific Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Lab Automation in Drug Discovery Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 23: Rest of the World Lab Automation in Drug Discovery Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 24: Rest of the World Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Lab Automation in Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Lab Automation in Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Lab Automation in Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Lab Automation in Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 13: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 15: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 17: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 19: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Drug Discovery Industry?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the Lab Automation in Drug Discovery Industry?

Key companies in the market include Tecan Group Ltd, Siemens Healthcare, Eppendorf AG, Becton Dickinson, Shimadzu, Perkinelmer, Beckman Coulter, Synchron Lab Automation (MolGen), Thermo Fisher Scientific, Roche Holding AG, Agilent Technologies, Aurora Biome, Bio-Rad, Hudson Robotics.

3. What are the main segments of the Lab Automation in Drug Discovery Industry?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Innovations Leading to Device Miniaturization and Increased Throughput.

6. What are the notable trends driving market growth?

Automated Liquid Handlers are Expected to Account for the Largest Market Share.

7. Are there any restraints impacting market growth?

High Capital Requirements for Setup.

8. Can you provide examples of recent developments in the market?

March 2023: Eppendorf announced the release of the new generation of the epMotion automated liquid handler at the 2023 SLAS conference in San Diego, CA, USA. The epMotion offers unparalleled precision and accuracy in liquid handling, with a user-friendly interface and customizable protocols. The new design includes a sleek, compact form and improved ergonomics for comfortable and efficient use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Drug Discovery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Drug Discovery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Drug Discovery Industry?

To stay informed about further developments, trends, and reports in the Lab Automation in Drug Discovery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence