Key Insights

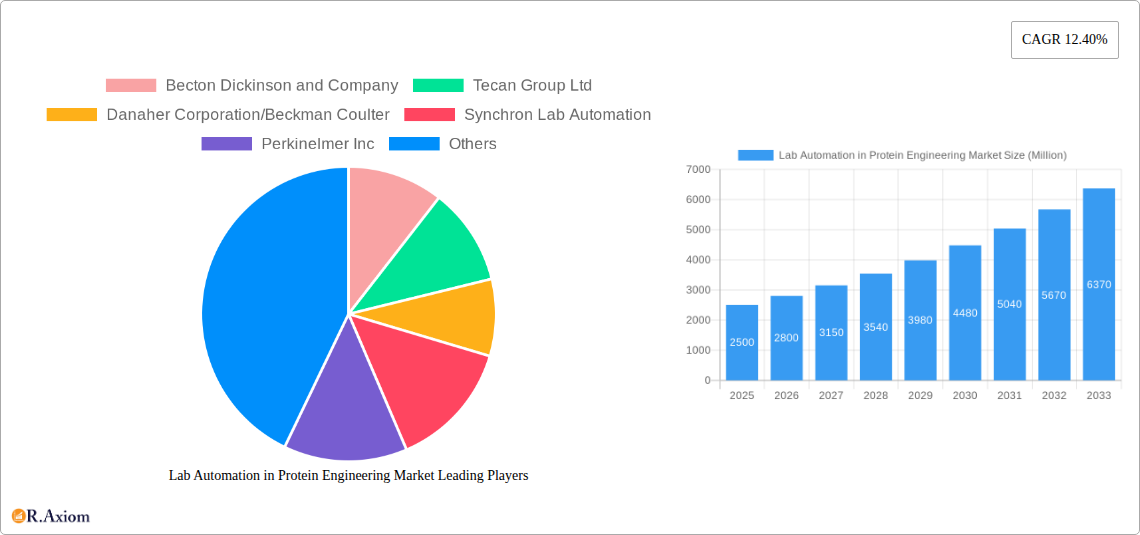

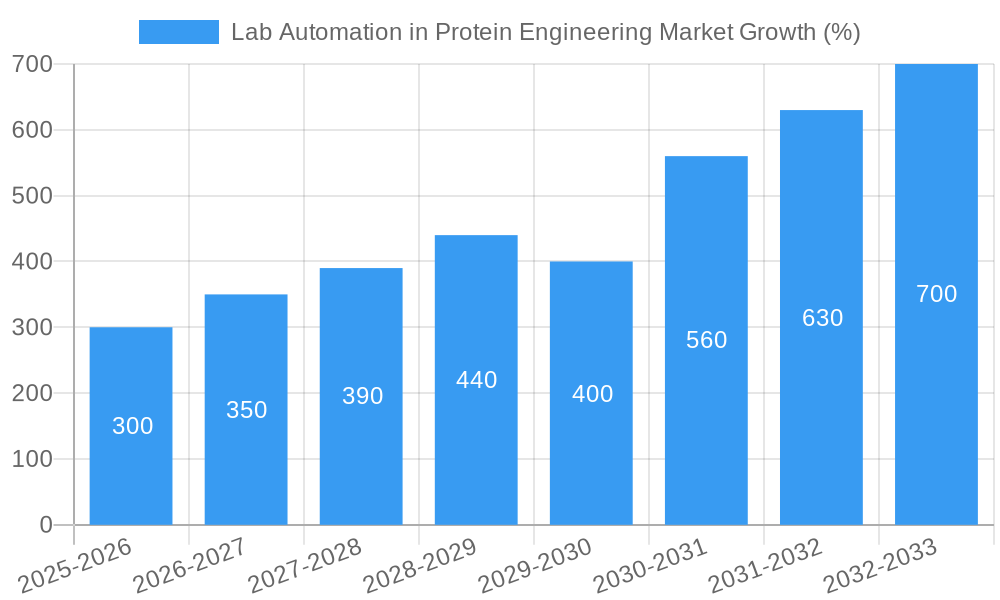

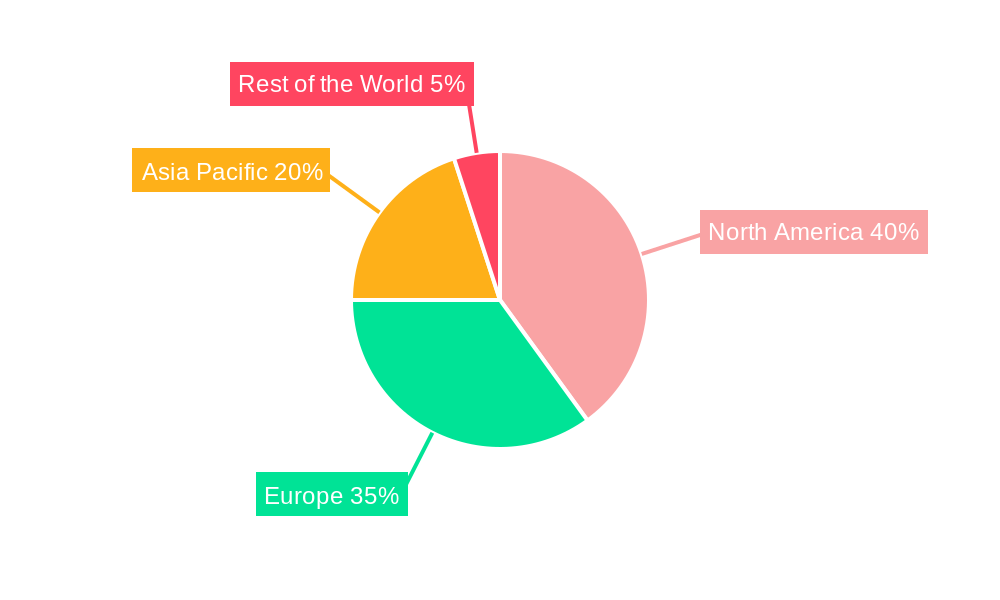

The lab automation in protein engineering market is experiencing robust growth, driven by the increasing demand for high-throughput screening and automation in drug discovery and development. The market's Compound Annual Growth Rate (CAGR) of 12.40% from 2019 to 2024 signifies significant investment in automated solutions for protein engineering tasks. This growth is fueled by the need to accelerate research timelines, reduce manual errors, and improve the efficiency and reproducibility of experiments. Key segments within the market, such as automated liquid handlers and automated plate handlers, are experiencing particularly strong growth due to their versatile applications in protein expression, purification, and characterization. The adoption of robotics and automated storage and retrieval systems (AS/RS) is further enhancing productivity and reducing operational costs, attracting significant investment from major players. Leading companies like Becton Dickinson, Tecan, Danaher, and Thermo Fisher Scientific are heavily involved, constantly innovating and expanding their product portfolios to cater to the rising demand. The market is geographically diverse, with North America and Europe currently holding significant shares, but the Asia-Pacific region shows strong potential for future growth given the increasing investments in research and development within the region.

The continued advancement of technologies like artificial intelligence (AI) and machine learning (ML) in protein engineering is poised to further accelerate market expansion. Integration of AI and ML in automated systems is anticipated to enhance experimental design, data analysis, and the overall efficiency of protein engineering workflows. This will create new opportunities for market players specializing in advanced analytical tools and software solutions. However, the high initial investment costs associated with implementing automated systems and the need for specialized training could pose challenges to market penetration, especially among smaller research labs. Nevertheless, the long-term benefits of increased throughput, improved data quality, and reduced operational costs outweigh these initial hurdles, making the outlook for lab automation in protein engineering highly promising.

Lab Automation in Protein Engineering Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Lab Automation in Protein Engineering Market, covering market size, segmentation, growth drivers, challenges, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to project the market's trajectory through the forecast period (2025-2033). The total market value is projected to reach xx Million by 2033.

Lab Automation in Protein Engineering Market Market Concentration & Innovation

The Lab Automation in Protein Engineering Market exhibits a moderately concentrated landscape, with several major players holding significant market share. While precise figures are proprietary to the full report, companies like Thermo Fisher Scientific, Danaher Corporation/Beckman Coulter, and Becton Dickinson and Company command substantial portions of the market. This concentration is partly due to the high capital investment required for R&D and manufacturing sophisticated lab automation systems.

Market Concentration Metrics (Illustrative):

- Top 5 Players Market Share: xx% (2025)

- Top 10 Players Market Share: xx% (2025)

Innovation Drivers:

- Increasing demand for high-throughput screening and automation in drug discovery and development.

- Advancements in robotics, artificial intelligence (AI), and machine learning (ML) are driving the development of more sophisticated and efficient automation solutions.

- Growing adoption of liquid handling robots and automated plate handlers for increased accuracy and speed.

Regulatory Frameworks & M&A Activities:

The market is influenced by regulatory bodies like the FDA (for life sciences applications). M&A activities are frequent, with larger companies acquiring smaller, specialized firms to expand their product portfolios and technological capabilities. Recent deal values have ranged from xx Million to xx Million, depending on the size and strategic importance of the acquired company.

Product Substitutes & End-User Trends:

Manual methods remain a substitute, but their limitations in throughput and accuracy drive adoption of automation. End-user trends favor integrated solutions, cloud connectivity, and enhanced data analysis capabilities.

Lab Automation in Protein Engineering Market Industry Trends & Insights

The Lab Automation in Protein Engineering Market is experiencing robust growth, driven by several factors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increasing demand for improved efficiency, reduced labor costs, enhanced data quality, and the need for higher throughput in various applications, notably within the pharmaceutical, biotechnology, and academic research sectors. Market penetration of automated solutions continues to grow as more laboratories recognize the advantages of automation. Technological disruptions, such as the integration of AI and cloud-based platforms, are enhancing the capabilities of automation systems, while increasing affordability is making these technologies accessible to a broader range of laboratories. Competitive dynamics are marked by continuous innovation, partnerships, and strategic acquisitions aimed at securing market share and expanding product offerings.

Dominant Markets & Segments in Lab Automation in Protein Engineering Market

The North American region currently holds the largest market share, followed by Europe and Asia Pacific. This dominance is attributed to factors including:

- North America: High R&D spending in the pharmaceutical and biotechnology industries, robust regulatory frameworks supporting innovation, and early adoption of advanced technologies.

- Europe: Strong presence of major players and a mature life sciences sector with high automation adoption rates.

- Asia Pacific: Rapid economic growth, increasing R&D investment, and a rising number of contract research organizations (CROs) are driving market expansion.

Segment Dominance:

- Automated Liquid Handlers: This segment holds the largest market share due to its wide applicability across various protein engineering workflows, from sample preparation to reagent dispensing.

- Automated Plate Handlers: Growing adoption in high-throughput screening and combinatorial chemistry applications, driving significant segment growth.

- Robotic Arms: Increasingly integrated into automated workstations for enhanced flexibility and handling capabilities.

- Automated Storage and Retrieval Systems (AS/RS): Crucial for managing large sample libraries and reagents, particularly in large-scale protein engineering projects.

- Other Equipment: This segment includes various specialized equipment such as automated incubators, centrifuges, and imaging systems which are crucial supporting components within a complete automated protein engineering workflow.

Lab Automation in Protein Engineering Market Product Developments

Recent product innovations emphasize enhanced throughput, improved accuracy, and seamless integration with existing laboratory information management systems (LIMS). The market is witnessing a trend toward modular and customizable automation systems that can be tailored to specific needs. This allows labs to scale their automation efforts as required. This trend aligns with the increasing demand for flexible and efficient solutions that address diverse applications within protein engineering. The integration of AI and ML for data analysis and process optimization is further differentiating offerings in this competitive landscape.

Report Scope & Segmentation Analysis

This report segments the Lab Automation in Protein Engineering Market by Equipment type:

- Automated Liquid Handlers: This segment is projected to grow at a CAGR of xx% from 2025 to 2033, driven by increasing demand for high-throughput liquid handling in protein engineering applications. Competitive dynamics are shaped by technological advancements and continuous improvement in precision and speed.

- Automated Plate Handlers: Expected to grow at a CAGR of xx% during the forecast period, driven by the growth of high-throughput screening in drug discovery and other research areas. Competition is focused on features like speed, capacity, and integration capabilities.

- Robotic Arms: This segment's growth is projected at a CAGR of xx%, fueled by the growing need for flexible and adaptable automation in complex protein engineering workflows. Competition is focused on flexibility, precision, and ease of use.

- Automated Storage and Retrieval Systems (AS/RS): Growth is projected at a CAGR of xx%, driven by the need for efficient management of large sample libraries in high-throughput settings. Competitive factors center around storage capacity, retrieval speed, and overall system reliability.

- Other Equipment: This segment includes various other pieces of automated equipment; growth is projected at a CAGR of xx%.

Key Drivers of Lab Automation in Protein Engineering Market Growth

Technological advancements (AI, robotics), increasing R&D spending in biotechnology and pharmaceuticals, the growing need to improve efficiency and reduce manual errors, and regulatory compliance needs are key drivers of the market's growth. Government initiatives promoting research and development further fuel market expansion.

Challenges in the Lab Automation in Protein Engineering Market Sector

High initial investment costs, the need for skilled personnel for operation and maintenance, the complexity of integrating different automation systems, and regulatory compliance requirements pose significant challenges. Supply chain disruptions can also impact the availability of components and equipment, affecting production and delivery timelines. Furthermore, intense competition from established players may limit market entry for new companies.

Emerging Opportunities in Lab Automation in Protein Engineering Market

Emerging opportunities lie in the integration of AI and machine learning for improved process optimization and data analysis, the development of miniaturized and portable automation systems, and the expansion into emerging markets like personalized medicine and biomanufacturing. The development of customized solutions tailored to specific needs within the protein engineering workflow is also presenting a significant growth opportunity.

Leading Players in the Lab Automation in Protein Engineering Market Market

- Becton Dickinson and Company

- Tecan Group Ltd

- Danaher Corporation/Beckman Coulter

- Synchron Lab Automation

- Perkinelmer Inc

- F Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc

- Eli Lilly and Company

- Siemens Healthineers AG

- Agilent Technologies Inc

- Hudson Robotics Inc

Key Developments in Lab Automation in Protein Engineering Market Industry

- October 2022: Thermo Fisher Scientific launches the EXTREVA ASE Accelerated Solvent Extractor, a fully automated sample preparation system. This significantly streamlines workflows and improves efficiency in various analytical applications.

- March 2022: Beckman Coulter Life Sciences introduces the CellMek SPS, a fully automated sample preparation system for clinical flow cytometry, improving workflow efficiency and reducing manual errors.

Strategic Outlook for Lab Automation in Protein Engineering Market Market

The Lab Automation in Protein Engineering Market is poised for continued growth, driven by technological advancements and increasing demand for automation in various industries. Future opportunities lie in developing innovative solutions that address unmet needs, improving integration with existing lab systems, and expanding into new applications. The market's future potential is significant, especially with the continued convergence of automation, AI, and big data analytics within life sciences research and development.

Lab Automation in Protein Engineering Market Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (AS/RS)

- 1.5. Other Equipment

Lab Automation in Protein Engineering Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Lab Automation in Protein Engineering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated

- 3.3. Market Restrains

- 3.3.1. Expensive Initial Setup

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handler Equipment Accounted for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.5. Other Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5. Other Equipment

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 7.1.5. Other Equipment

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Pacific Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 8.1.5. Other Equipment

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Rest of the World Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 9.1.5. Other Equipment

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. North America Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Becton Dickinson and Company

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Tecan Group Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Danaher Corporation/Beckman Coulter

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Synchron Lab Automation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Perkinelmer Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 F Hoffmann-La Roche Ltd*List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Thermo Fisher Scientific Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Eli Lilly and Company

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Siemens Healthineers AG

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Agilent Technologies Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Hudson Robotics Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Lab Automation in Protein Engineering Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 11: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 12: North America Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 15: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 16: Europe Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 19: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 20: Asia Pacific Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Lab Automation in Protein Engineering Market Revenue (Million), by Equipment 2024 & 2032

- Figure 23: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 24: Rest of the World Lab Automation in Protein Engineering Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Lab Automation in Protein Engineering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 13: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 15: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 17: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 19: Global Lab Automation in Protein Engineering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Protein Engineering Market?

The projected CAGR is approximately 12.40%.

2. Which companies are prominent players in the Lab Automation in Protein Engineering Market?

Key companies in the market include Becton Dickinson and Company, Tecan Group Ltd, Danaher Corporation/Beckman Coulter, Synchron Lab Automation, Perkinelmer Inc, F Hoffmann-La Roche Ltd*List Not Exhaustive, Thermo Fisher Scientific Inc, Eli Lilly and Company, Siemens Healthineers AG, Agilent Technologies Inc, Hudson Robotics Inc.

3. What are the main segments of the Lab Automation in Protein Engineering Market?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated.

6. What are the notable trends driving market growth?

Automated Liquid Handler Equipment Accounted for the Largest Market Share.

7. Are there any restraints impacting market growth?

Expensive Initial Setup.

8. Can you provide examples of recent developments in the market?

October 2022 - Thermo Fisher Scientific releases the first fully automated, all-in-one sample preparation system. The new EXTREVA ASE Accelerated Solvent Extractor from Thermo Scientific is the first system to automatically extract and concentrate analytes of interest from solid and semi-solid samples, such as persistent organic pollutants (POPs), polycyclic aromatic hydrocarbons (PAHs), or pesticides, in a single instrument, obviating the need for manual sample transfer for a walk-away sample-to-vial workflow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Protein Engineering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Protein Engineering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Protein Engineering Market?

To stay informed about further developments, trends, and reports in the Lab Automation in Protein Engineering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence