Key Insights

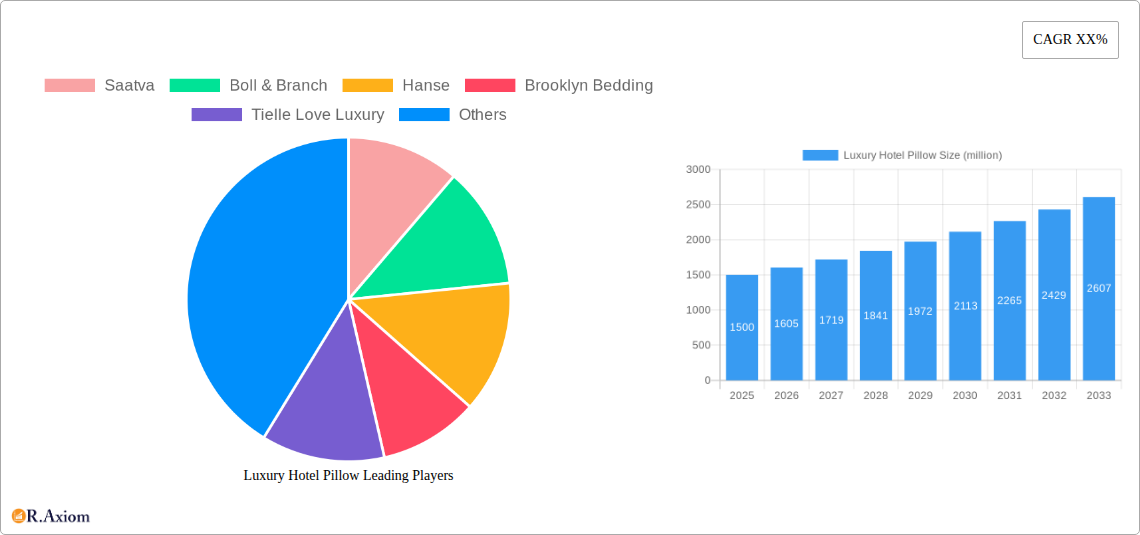

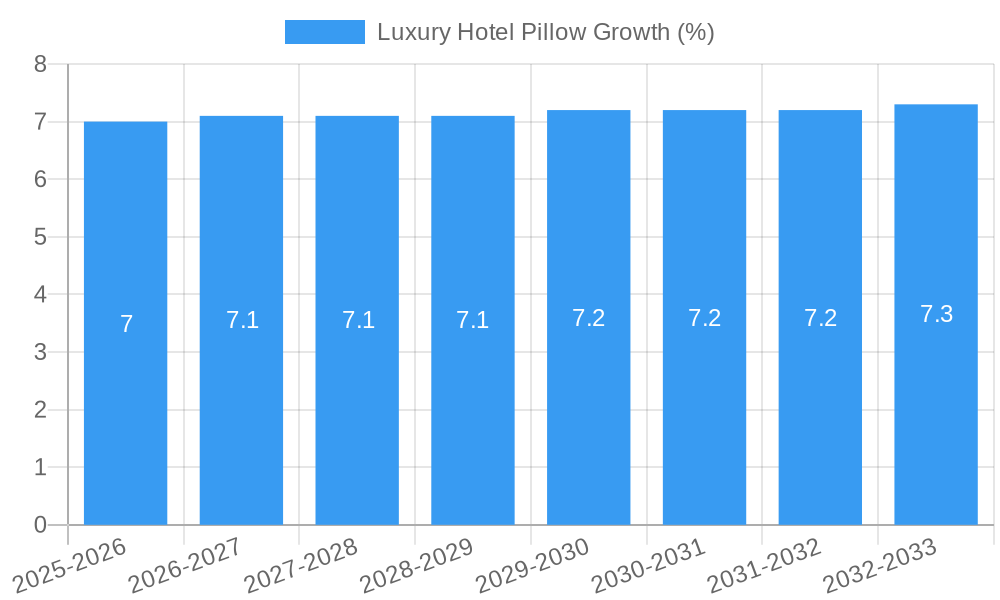

The global Luxury Hotel Pillow market is poised for significant expansion, projected to reach approximately $1,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This robust growth is primarily fueled by the burgeoning luxury hospitality sector, driven by increasing disposable incomes and a global surge in experiential travel. High-end hotels are increasingly prioritizing guest comfort and personalized experiences, recognizing the pillow as a critical component in delivering superior sleep quality. This demand is further amplified by the growing awareness among affluent consumers about the health and wellness benefits associated with premium bedding. The market is characterized by a strong emphasis on innovation, with manufacturers investing in advanced materials and ergonomic designs. Key drivers include the rising popularity of ultra-luxury hotels, boutique accommodations, and wellness retreats, all of which cater to discerning travelers seeking unparalleled comfort and quality. The development of hypoallergenic, temperature-regulating, and ergonomically superior pillows is a significant trend, appealing to a health-conscious clientele.

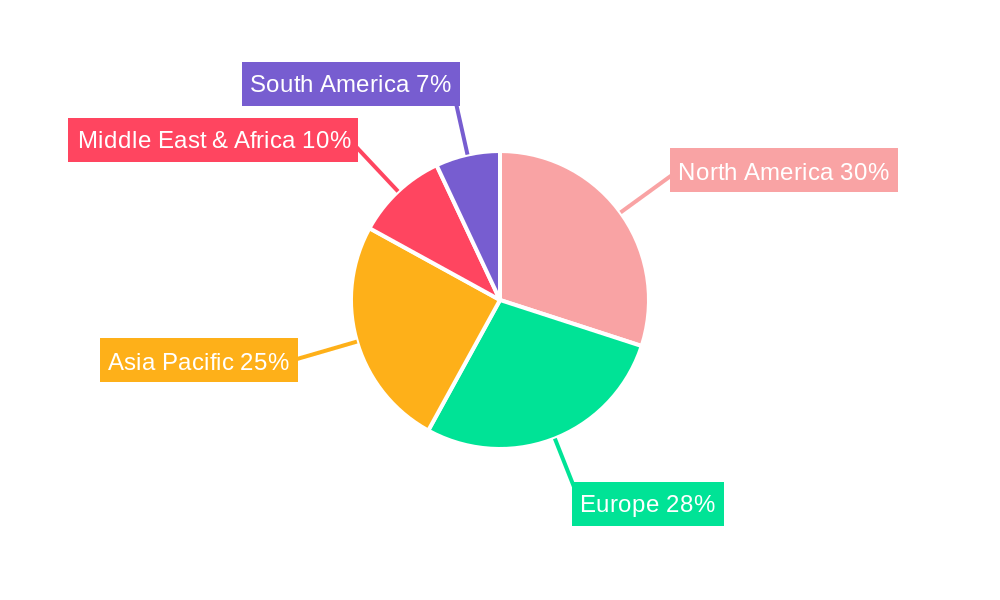

The market for luxury hotel pillows is segmented by application into High-End Hotels and Top Luxury Hotels, with the former representing a larger share due to its broader reach within the luxury segment. In terms of product types, Feather Pillows continue to hold a dominant position, cherished for their natural softness and loft. However, Latex Pillows are experiencing considerable growth due to their supportive properties and hypoallergenic nature, aligning with wellness trends. Special Padded Pillows and other innovative designs are also gaining traction as hotels seek to offer unique comfort solutions. Geographically, North America, led by the United States, and Europe, with key markets like the United Kingdom, Germany, and France, are the largest consumers of luxury hotel pillows, driven by established luxury tourism infrastructure and high consumer spending power. The Asia Pacific region, particularly China and emerging ASEAN markets, presents significant future growth potential as its luxury hotel sector rapidly expands. Restraints such as the high cost of premium materials and intense competition among established players are present, but the unwavering demand for elevated guest experiences in the luxury hospitality sector is expected to overcome these challenges, ensuring sustained market growth.

Absolutely! Here is the detailed report description for the Luxury Hotel Pillow Market, optimized for SEO and incorporating the provided details and structure:

Luxury Hotel Pillow Market Concentration & Innovation

The luxury hotel pillow market, valued at over $10 million in the historical period, demonstrates a moderate level of concentration. Key players such as Saatva, Boll & Branch, Hanse, Brooklyn Bedding, and Tielle Love Luxury collectively hold a significant market share, estimated at over $6 million in the base year. Innovation is a critical driver, with companies continuously investing in research and development to enhance comfort, support, and hypoallergenic properties. The market is influenced by evolving regulatory frameworks focusing on material safety and sustainability, adding complexity for manufacturers. Product substitutes, including traditional bedding options and lower-tier hotel amenities, represent a constant competitive pressure. End-user trends indicate a strong preference for premium materials, personalized comfort, and eco-friendly options, driving a demand for advanced pillow technologies. Mergers and acquisitions (M&A) activities, though not extensively documented in the public domain for this niche, are expected to see a deal value of over $5 million within the forecast period as larger hospitality suppliers seek to expand their premium offerings.

- Market Share (Base Year 2025): Leading players account for over 70% of the market value.

- M&A Deal Value (Forecast Period): Projected over $5 million for strategic acquisitions.

- Innovation Focus: Hypoallergenic materials, sustainable sourcing, advanced ergonomic designs.

Luxury Hotel Pillow Industry Trends & Insights

The luxury hotel pillow industry is experiencing robust growth, driven by several interconnected factors. The escalating demand for premium travel experiences, particularly within the high-end hotels and top luxury hotel segments, is the primary catalyst. Consumers are increasingly willing to pay a premium for enhanced comfort and perceived value, making the quality of in-room amenities, especially bedding, a key differentiator. Technological advancements in material science are revolutionizing pillow construction. Innovations like advanced memory foam, specialized down alternatives, and cooling gel infusions are not only enhancing comfort but also addressing specific guest needs, such as temperature regulation and allergy concerns. The market penetration of these advanced pillow types is steadily increasing, reflecting a shift from conventional feather pillows. Consumer preferences are evolving beyond basic comfort to encompass factors like sustainability, ethical sourcing, and personalized sleep solutions, pushing manufacturers to develop eco-friendly and customizable pillow options. Competitive dynamics are characterized by a blend of established luxury bedding brands and specialized hotel suppliers vying for market share. Companies like Cozy Earth, Quince, and Tempur-Pedic are leveraging their brand reputation and direct-to-consumer expertise to influence the hotel supply chain. The industry is also witnessing a growing importance of online reviews and guest satisfaction scores, where pillow comfort plays a significant role, thereby intensifying the focus on quality. The projected Compound Annual Growth Rate (CAGR) for the luxury hotel pillow market is estimated at over 8% during the forecast period, driven by these evolving trends and the sustained demand for opulent hospitality experiences.

Dominant Markets & Segments in Luxury Hotel Pillow

The luxury hotel pillow market exhibits clear dominance across specific regions and segments, driven by distinct economic, infrastructural, and consumer preference factors. North America, particularly the United States, currently holds a dominant position, supported by a mature luxury hospitality sector and a high disposable income demographic that values premium products. The extensive presence of high-end hotels and top luxury hotel chains in this region fuels consistent demand for superior quality pillows.

- Dominant Region: North America, with an estimated market share exceeding 40% of the global luxury hotel pillow market.

- Key Drivers: High concentration of luxury hotel brands, strong consumer spending power on premium goods, established distribution networks for hospitality supplies.

- Infrastructure: Well-developed logistics and supply chain infrastructure ensuring timely delivery to hotels across the continent.

- Economic Policies: Favorable economic conditions and investment in the tourism and hospitality sectors.

Within segments, the High-End Hotels application segment is the largest, accounting for approximately 65% of the market value. These establishments prioritize guest comfort and experience, viewing high-quality pillows as an integral part of their brand promise. The Top Luxury Hotel segment, while smaller in number, commands a higher per-unit value, often demanding bespoke or ultra-premium pillow solutions.

- Dominant Application Segment: High-End Hotels.

- Drivers: Focus on guest satisfaction, brand reputation management, repeat bookings driven by superior amenities.

- Market Size (Base Year 2025): Estimated at over $7 million.

In terms of product types, the Feather Pillow segment continues to hold a significant, albeit evolving, market share, often blended with down for enhanced loft and comfort, estimated at over $3 million in the base year. However, the Latex Pillow segment is experiencing rapid growth due to its hypoallergenic properties, durability, and excellent support, projected to grow at a CAGR of over 10% during the forecast period. The Special Padded Pillow category, encompassing innovative materials and designs, is also gaining traction, catering to niche comfort preferences and therapeutic needs.

- Dominant Type Segment (Historically): Feather Pillow.

- Fastest Growing Type Segment: Latex Pillow.

- Drivers: Increasing awareness of allergies, demand for durable and supportive sleep solutions, natural and sustainable material appeal.

- Market Size (Base Year 2025): Estimated at over $4 million and growing.

Luxury Hotel Pillow Product Developments

The luxury hotel pillow market is characterized by a continuous stream of product innovations aimed at enhancing guest comfort and addressing specific needs. Companies are focusing on advanced materials such as temperature-regulating gels embedded in memory foam, premium down alternatives offering superior loft and hypoallergenic properties, and sustainably sourced natural fibers. These developments aim to provide exceptional support, unparalleled softness, and improved breathability. Competitive advantages are being built on unique filling technologies, ergonomic designs that promote proper spinal alignment, and certifications for hypoallergenic and eco-friendly materials. The market fit is achieved by aligning these innovations with the discerning expectations of high-end hotels and their affluent clientele.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global luxury hotel pillow market. The segmentation covers key application areas, including High-End Hotels and Top Luxury Hotel establishments, and distinct product types such as Feather Pillow, Latex Pillow, Special Padded Pillow, and Other pillow categories.

- High-End Hotels: This segment is projected to maintain its leading position throughout the forecast period, driven by the consistent demand from a large number of establishments focused on guest satisfaction. Market size in the base year is estimated at over $7 million.

- Top Luxury Hotel: While a smaller segment in terms of the number of establishments, this segment commands a higher average selling price, contributing significantly to the overall market value. Growth is expected to be driven by bespoke and ultra-premium offerings.

- Feather Pillow: This segment, traditionally a cornerstone of luxury bedding, is expected to see steady growth, with a focus on higher-quality down and blended fillings. Market size in the base year is estimated at over $3 million.

- Latex Pillow: This segment is poised for significant expansion, driven by increasing consumer awareness of allergies, demand for natural and sustainable materials, and the inherent benefits of latex in terms of durability and support. Projected growth is robust, with a market size of over $4 million in the base year.

- Special Padded Pillow: This dynamic segment encompasses innovative fillings and constructions designed to meet specific comfort and therapeutic needs, including cooling technologies, orthopedic support, and customizable firmness. Its growth is expected to be driven by niche market demand.

- Other: This category includes various niche pillow types and emerging technologies not specifically classified, contributing to the market's diversity.

Key Drivers of Luxury Hotel Pillow Growth

The luxury hotel pillow market's growth is propelled by a confluence of factors that enhance demand and innovation. The escalating global tourism and hospitality industry, particularly the proliferation of luxury accommodations, directly fuels the need for high-quality bedding. A significant driver is the increasing consumer expectation for personalized comfort and enhanced sleep experiences, compelling hotels to invest in premium amenities. Technological advancements in material science, leading to the development of hypoallergenic, temperature-regulating, and ergonomically superior pillow fillings, are reshaping product offerings. Furthermore, sustainability and ethical sourcing are becoming paramount, influencing purchasing decisions for both consumers and hotel brands seeking eco-conscious options. The growing emphasis on guest reviews and online reputation management also incentivizes hotels to prioritize comfort elements like pillows.

Challenges in the Luxury Hotel Pillow Sector

Despite its growth trajectory, the luxury hotel pillow sector faces several impediments. Intense competition from a multitude of brands, including both established luxury names and newer direct-to-consumer entities, creates pricing pressures and necessitates continuous innovation. Supply chain complexities, particularly for sourcing high-quality natural materials like down and ethically produced latex, can lead to cost fluctuations and availability issues. Evolving consumer preferences and the demand for specialized comfort can also pose a challenge, requiring manufacturers to adapt quickly to new trends. Furthermore, the stringent quality control and durability standards required for hospitality use add to production costs and complexity. Ensuring consistency in quality across large orders for hotel chains is a significant operational hurdle.

Emerging Opportunities in Luxury Hotel Pillow

The luxury hotel pillow market is ripe with emerging opportunities. The growing demand for sustainable and eco-friendly products presents a significant avenue for brands focusing on organic materials, recycled fillings, and environmentally responsible manufacturing processes. The expansion of wellness tourism and the increasing guest focus on sleep quality create opportunities for specialized pillows designed for therapeutic benefits, such as cervical support or cooling properties. The rise of boutique hotels and unique, experience-driven accommodations also presents a market for customizable and artisanal pillow offerings that align with their distinct brand identities. Furthermore, the integration of smart technologies, such as sensors for sleep tracking or adjustable firmness, represents a futuristic frontier for innovation.

Leading Players in the Luxury Hotel Pillow Market

- Saatva

- Boll & Branch

- Hanse

- Brooklyn Bedding

- Tielle Love Luxury

- Cozy Earth

- Quince

- Tempur-Pedic

- Downia

- JiangSu Canasin Weaving

- Anhui Honren

- Jiangsu SiDefu Textile

Key Developments in Luxury Hotel Pillow Industry

- 2023/07: Launch of innovative cooling gel-infused latex pillows by a leading manufacturer, targeting hotels seeking advanced guest comfort solutions.

- 2023/11: Major hotel group partners with a sustainable bedding brand to supply eco-friendly luxury pillows across its properties, signaling a shift towards environmental consciousness.

- 2024/02: Acquisition of a specialized pillow filling technology company by a large hospitality supplier, aimed at enhancing its premium product portfolio.

- 2024/05: Introduction of a new line of hypoallergenic feather and down pillows with advanced mite-resistant treatments, addressing a key guest concern.

- 2024/09: Increased investment in direct-to-consumer sales channels by luxury pillow brands, influencing their strategies for the hospitality sector.

Strategic Outlook for Luxury Hotel Pillow Market

The strategic outlook for the luxury hotel pillow market is exceptionally positive, driven by sustained demand from the expanding global luxury hospitality sector. Key growth catalysts include the increasing consumer focus on sleep quality and personalized comfort, pushing hotels to invest in premium amenities. Innovations in material science, particularly in sustainable and performance-driven fillings, will continue to shape product development. Opportunities lie in catering to the growing wellness tourism segment, developing eco-conscious product lines, and exploring smart pillow technologies. Strategic partnerships between pillow manufacturers and hotel chains, alongside a focus on direct-to-consumer channels influencing B2B strategies, will be crucial for market players aiming for long-term success and increased market share. The estimated market value of over $15 million by the end of the forecast period highlights the sector's significant growth potential.

Luxury Hotel Pillow Segmentation

-

1. Application

- 1.1. High-End Hotels

- 1.2. Top Luxury Hotel

-

2. Types

- 2.1. Feather Pillow

- 2.2. Latex Pillow

- 2.3. Special Padded Pillow

- 2.4. Other

Luxury Hotel Pillow Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Hotel Pillow REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Hotel Pillow Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. High-End Hotels

- 5.1.2. Top Luxury Hotel

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Feather Pillow

- 5.2.2. Latex Pillow

- 5.2.3. Special Padded Pillow

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Luxury Hotel Pillow Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. High-End Hotels

- 6.1.2. Top Luxury Hotel

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Feather Pillow

- 6.2.2. Latex Pillow

- 6.2.3. Special Padded Pillow

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Luxury Hotel Pillow Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. High-End Hotels

- 7.1.2. Top Luxury Hotel

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Feather Pillow

- 7.2.2. Latex Pillow

- 7.2.3. Special Padded Pillow

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Luxury Hotel Pillow Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. High-End Hotels

- 8.1.2. Top Luxury Hotel

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Feather Pillow

- 8.2.2. Latex Pillow

- 8.2.3. Special Padded Pillow

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Luxury Hotel Pillow Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. High-End Hotels

- 9.1.2. Top Luxury Hotel

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Feather Pillow

- 9.2.2. Latex Pillow

- 9.2.3. Special Padded Pillow

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Luxury Hotel Pillow Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. High-End Hotels

- 10.1.2. Top Luxury Hotel

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Feather Pillow

- 10.2.2. Latex Pillow

- 10.2.3. Special Padded Pillow

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Saatva

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Boll & Branch

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hanse

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brooklyn Bedding

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tielle Love Luxury

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cozy Earth

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Quince

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tempur-Pedic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Downia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JiangSu Canasin Weaving

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Anhui Honren

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Jiangsu SiDefu Textile

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Saatva

List of Figures

- Figure 1: Global Luxury Hotel Pillow Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Luxury Hotel Pillow Revenue (million), by Application 2024 & 2032

- Figure 3: North America Luxury Hotel Pillow Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Luxury Hotel Pillow Revenue (million), by Types 2024 & 2032

- Figure 5: North America Luxury Hotel Pillow Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Luxury Hotel Pillow Revenue (million), by Country 2024 & 2032

- Figure 7: North America Luxury Hotel Pillow Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Luxury Hotel Pillow Revenue (million), by Application 2024 & 2032

- Figure 9: South America Luxury Hotel Pillow Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Luxury Hotel Pillow Revenue (million), by Types 2024 & 2032

- Figure 11: South America Luxury Hotel Pillow Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Luxury Hotel Pillow Revenue (million), by Country 2024 & 2032

- Figure 13: South America Luxury Hotel Pillow Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Luxury Hotel Pillow Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Luxury Hotel Pillow Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Luxury Hotel Pillow Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Luxury Hotel Pillow Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Luxury Hotel Pillow Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Luxury Hotel Pillow Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Luxury Hotel Pillow Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Luxury Hotel Pillow Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Luxury Hotel Pillow Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Luxury Hotel Pillow Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Luxury Hotel Pillow Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Luxury Hotel Pillow Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Luxury Hotel Pillow Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Luxury Hotel Pillow Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Luxury Hotel Pillow Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Luxury Hotel Pillow Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Luxury Hotel Pillow Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Luxury Hotel Pillow Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Luxury Hotel Pillow Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Luxury Hotel Pillow Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Luxury Hotel Pillow Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Luxury Hotel Pillow Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Luxury Hotel Pillow Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Luxury Hotel Pillow Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Luxury Hotel Pillow Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Luxury Hotel Pillow Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Luxury Hotel Pillow Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Luxury Hotel Pillow Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Luxury Hotel Pillow Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Luxury Hotel Pillow Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Luxury Hotel Pillow Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Luxury Hotel Pillow Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Luxury Hotel Pillow Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Luxury Hotel Pillow Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Luxury Hotel Pillow Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Luxury Hotel Pillow Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Luxury Hotel Pillow Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Luxury Hotel Pillow Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Hotel Pillow?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Luxury Hotel Pillow?

Key companies in the market include Saatva, Boll & Branch, Hanse, Brooklyn Bedding, Tielle Love Luxury, Cozy Earth, Quince, Tempur-Pedic, Downia, JiangSu Canasin Weaving, Anhui Honren, Jiangsu SiDefu Textile.

3. What are the main segments of the Luxury Hotel Pillow?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Hotel Pillow," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Hotel Pillow report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Hotel Pillow?

To stay informed about further developments, trends, and reports in the Luxury Hotel Pillow, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence