Key Insights

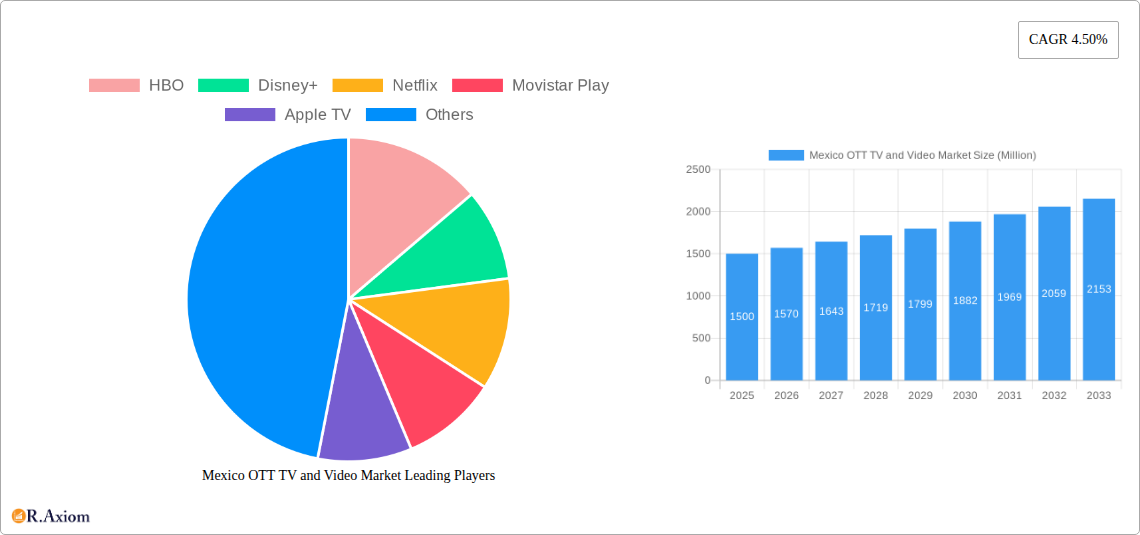

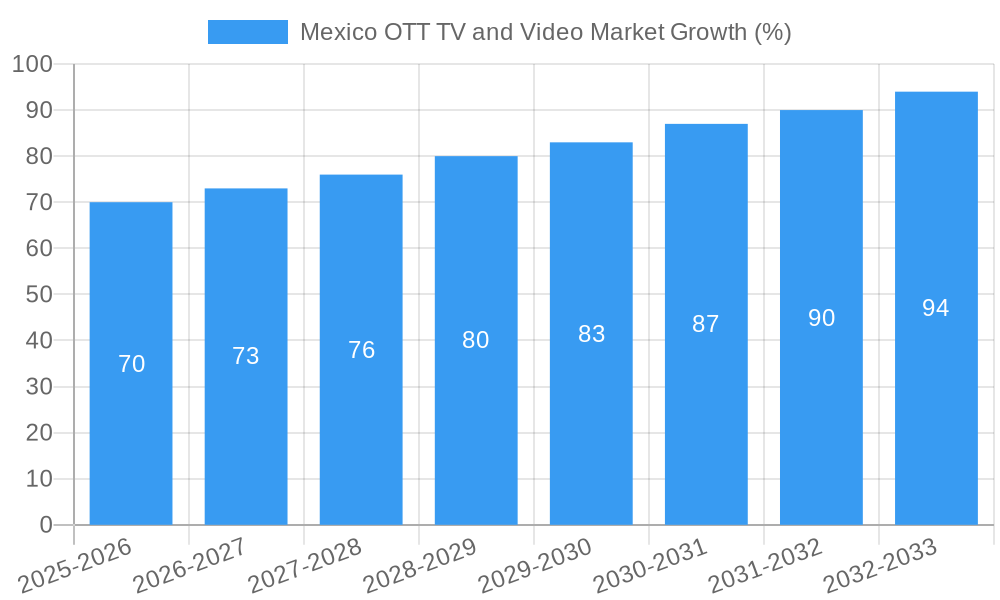

The Mexico OTT TV and Video market exhibits robust growth, projected to reach a substantial size by 2033. A compound annual growth rate (CAGR) of 4.50% from 2025 to 2033 indicates a consistently expanding market driven by increasing internet penetration, affordability of smartphones and data plans, and rising consumer preference for on-demand entertainment. The dominance of subscription video on demand (SVOD) services like Netflix, Disney+, and HBO Max is undeniable, fueled by their extensive content libraries and user-friendly interfaces. However, the market also sees significant contributions from transactional video on demand (TVOD) and advertising-based video on demand (AVOD) services catering to diverse consumer preferences and budgets. The presence of prominent local players like Movistar Play and Blim alongside international giants underscores the competitive landscape. Growth is further spurred by the increasing adoption of smart TVs and other connected devices, enhancing accessibility and viewing experience.

Despite the positive trajectory, challenges remain. Competition among streaming platforms necessitates continuous investment in original content and technological advancements. Concerns about piracy and the need for robust content licensing agreements are also crucial factors. The market's future trajectory hinges on successful navigation of these challenges, effective content localization strategies catering to Mexican audiences, and innovative approaches to monetization, potentially through bundled services or dynamic pricing models. The market segmentation by source (SVOD, TVOD, DTO, AVOD) provides valuable insights for strategic decision-making and targeted marketing campaigns. A detailed analysis of these segments and the competitive dynamics will help stakeholders capitalize on the market's immense potential and address future uncertainties.

Mexico OTT TV and Video Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico OTT TV and Video market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's growth trajectory, competitive dynamics, and emerging opportunities. The study incorporates detailed segmentation by source (SVOD, TVOD, DTO, AVOD), revealing key market trends and drivers.

Mexico OTT TV and Video Market Concentration & Innovation

This section analyzes the level of market concentration in Mexico's OTT TV and video sector, examining the market share held by key players such as Netflix, HBO, Disney+, and others. We explore the innovative drivers shaping the industry, including technological advancements, evolving consumer preferences, and regulatory changes. The impact of mergers and acquisitions (M&A) activities, including deal values and their influence on market dynamics, is also assessed. The report further investigates the regulatory frameworks governing the industry, the presence of substitute products, and prevailing end-user trends.

- Market Share Analysis: Detailed breakdown of market share for key players in 2025 (e.g., Netflix xx%, Disney+ xx%, HBO Max xx%).

- M&A Activity: Analysis of significant M&A deals in the historical period (2019-2024) and their impact on market concentration. xx Million USD in M&A deals are projected for 2025.

- Innovation Drivers: Examination of factors driving innovation, such as the rise of 4K/8K content, increased demand for personalized content, and expansion of mobile viewing.

- Regulatory Landscape: Discussion of the existing regulatory environment and its impact on market growth and competition.

Mexico OTT TV and Video Market Industry Trends & Insights

This section delves into the key industry trends shaping the Mexico OTT TV and Video market. We examine the market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) and project the CAGR for the forecast period (2025-2033). The analysis encompasses market growth drivers, including rising internet penetration, increasing smartphone adoption, and changing consumer viewing habits. We also address technological disruptions, such as the emergence of new streaming platforms and innovations in video delivery technologies. Furthermore, we analyze consumer preferences, including content consumption patterns and demand for specific genres. The competitive landscape, including strategies employed by key players, is comprehensively explored. Market penetration rates for various OTT platforms are also analyzed.

Dominant Markets & Segments in Mexico OTT TV and Video Market

This section identifies the dominant segments within the Mexico OTT TV and Video market, focusing on the breakdown by source: SVOD, TVOD, DTO, and AVOD. We analyze the factors contributing to the dominance of each segment, including economic policies, infrastructure development, and consumer behavior.

- SVOD (Subscription Video on Demand): Dominance analysis, key drivers (e.g., affordability, diverse content libraries), and growth projections. Market size in 2025 is estimated at xx Million USD.

- TVOD (Transactional Video on Demand): Dominance analysis, key drivers (e.g., preference for new releases), and growth projections. Market size in 2025 is estimated at xx Million USD.

- DTO (Download to Own): Dominance analysis, key drivers (e.g., ownership preference), and growth projections. Market size in 2025 is estimated at xx Million USD.

- AVOD (Ad-supported Video on Demand): Dominance analysis, key drivers (e.g., free access, increasing ad revenue), and growth projections. Market size in 2025 is estimated at xx Million USD.

Mexico OTT TV and Video Market Product Developments

This section summarizes recent product innovations and technological advancements in the Mexico OTT TV and Video market. We highlight new features, applications, and the competitive advantages they offer. The discussion focuses on how these innovations meet evolving market demands and consumer preferences. The adoption rates of these new technologies and their impact on market share are also examined.

Report Scope & Segmentation Analysis

This report segments the Mexico OTT TV and Video market by source: SVOD, TVOD, DTO, and AVOD. Each segment's growth projections, market size (in Million USD) for 2025, and competitive dynamics are analyzed.

- SVOD: Growth projections, market size in 2025, and competitive landscape.

- TVOD: Growth projections, market size in 2025, and competitive landscape.

- DTO: Growth projections, market size in 2025, and competitive landscape.

- AVOD: Growth projections, market size in 2025, and competitive landscape.

Key Drivers of Mexico OTT TV and Video Market Growth

This section outlines the primary factors driving the growth of the Mexico OTT TV and Video market. These include technological advancements (e.g., improved streaming technologies, wider device compatibility), economic factors (e.g., rising disposable incomes, increasing internet penetration), and supportive regulatory environments.

Challenges in the Mexico OTT TV and Video Market Sector

This section addresses the key challenges hindering the growth of the Mexico OTT TV and Video market. These include regulatory hurdles (e.g., content licensing restrictions), supply chain issues (e.g., infrastructure limitations in certain regions), and intense competitive pressures (e.g., price wars, content acquisition battles). The quantitative impact of these challenges is assessed.

Emerging Opportunities in Mexico OTT TV and Video Market

This section highlights emerging trends and opportunities in the Mexico OTT TV and Video market. These include the expansion into underserved markets, the adoption of new technologies (e.g., VR/AR integration), and evolving consumer preferences (e.g., demand for localized content).

Leading Players in the Mexico OTT TV and Video Market Market

- HBO

- Disney+

- Netflix

- Movistar Play

- Apple TV

- Blim

- Crackle

- Claro Video

- Amazon Prime Video

Key Developments in Mexico OTT TV and Video Market Industry

- March 2022: Launch of TelevisaUnivision's ViX streaming service, offering a large library of Spanish-language content, including free ad-supported options. This significantly impacted the market by introducing a major free, ad-supported competitor and increasing competition in the Spanish-language streaming market.

Strategic Outlook for Mexico OTT TV and Video Market Market

The Mexico OTT TV and Video market shows strong potential for continued growth driven by increasing internet penetration, smartphone adoption, and evolving consumer preferences. The entry of new players and the expansion of existing services will further fuel competition and innovation. Opportunities exist for companies to capitalize on the growing demand for localized content and innovative streaming technologies.

Mexico OTT TV and Video Market Segmentation

-

1. Source

- 1.1. SVOD

-

1.2. TVOD

- 1.2.1. Rental

- 1.2.2. Download to Own (DTO)

- 1.3. AVOD

Mexico OTT TV and Video Market Segmentation By Geography

- 1. Mexico

Mexico OTT TV and Video Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Penetration of Smart TVs and the Presence of Major OTT Providers

- 3.3. Market Restrains

- 3.3.1. Payment for Premium OTT Take-up; Challenges and Costs of Licensing Premium Quality Content

- 3.4. Market Trends

- 3.4.1. OTT industry is expected to register a significant growth in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico OTT TV and Video Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. SVOD

- 5.1.2. TVOD

- 5.1.2.1. Rental

- 5.1.2.2. Download to Own (DTO)

- 5.1.3. AVOD

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 HBO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Disney+

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Netflix

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Movistar Play

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Apple TV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Blim

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Crackle

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Claro Video

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amazon Prime Video

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 HBO

List of Figures

- Figure 1: Mexico OTT TV and Video Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico OTT TV and Video Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico OTT TV and Video Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico OTT TV and Video Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Mexico OTT TV and Video Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Mexico OTT TV and Video Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Mexico OTT TV and Video Market Revenue Million Forecast, by Source 2019 & 2032

- Table 6: Mexico OTT TV and Video Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico OTT TV and Video Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Mexico OTT TV and Video Market?

Key companies in the market include HBO, Disney+, Netflix, Movistar Play, Apple TV, Blim, Crackle, Claro Video, Amazon Prime Video.

3. What are the main segments of the Mexico OTT TV and Video Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Penetration of Smart TVs and the Presence of Major OTT Providers.

6. What are the notable trends driving market growth?

OTT industry is expected to register a significant growth in the market.

7. Are there any restraints impacting market growth?

Payment for Premium OTT Take-up; Challenges and Costs of Licensing Premium Quality Content.

8. Can you provide examples of recent developments in the market?

March 2022: TelevisaUnivision's new streaming service ViX, which brings the world's largest offering of Spanish-language entertainment, news, and sports content, became available to all users in the United States, Mexico, and most Spanish-speaking Latin America. ViX users can stream original programming and top live sports and news free of charge in the first broadcast-quality ad-supported offering for Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico OTT TV and Video Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico OTT TV and Video Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico OTT TV and Video Market?

To stay informed about further developments, trends, and reports in the Mexico OTT TV and Video Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence