Key Insights

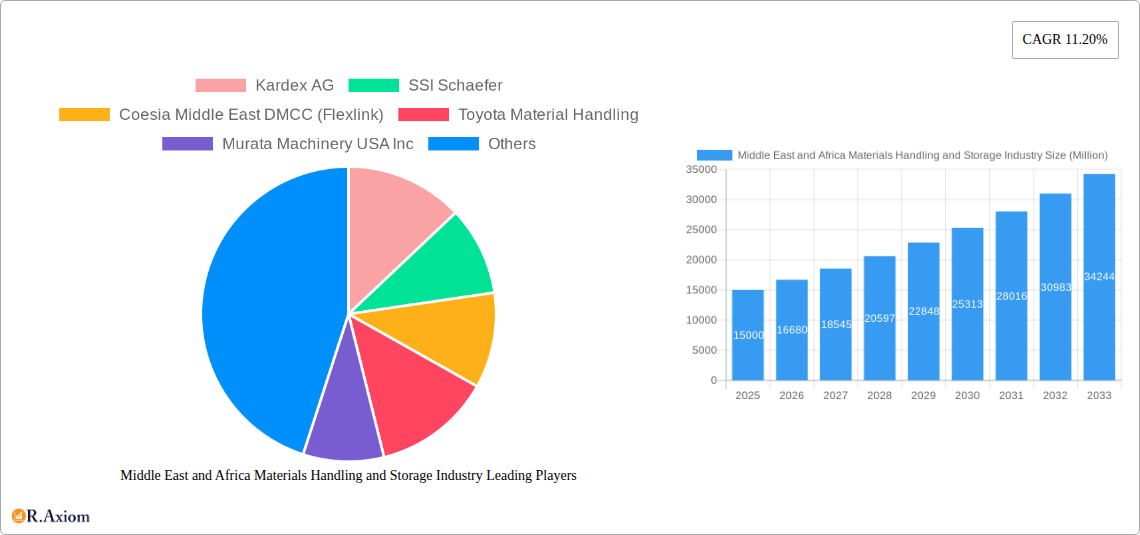

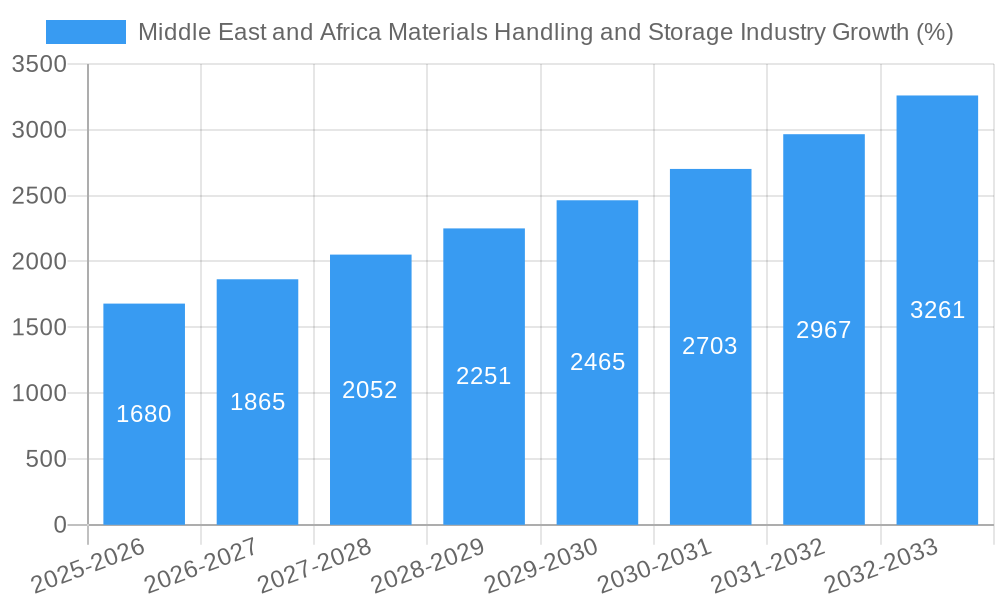

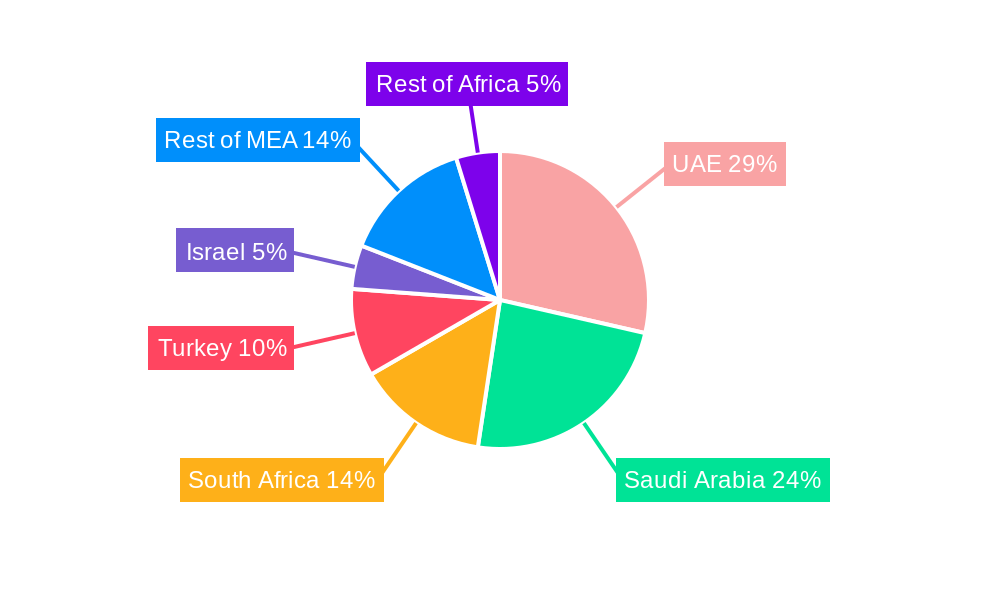

The Middle East and Africa (MEA) materials handling and storage industry is experiencing robust growth, driven by the expansion of e-commerce, the rise of automated warehousing solutions, and significant investments in infrastructure development across the region. A Compound Annual Growth Rate (CAGR) of 11.20% indicates a thriving market, projected to reach substantial value in the coming years. Key growth drivers include the increasing adoption of automated guided vehicle systems (AGVs), automated storage and retrieval systems (AS/RS), and advanced robotics for improved efficiency and reduced operational costs within logistics and manufacturing sectors. The automotive, retail, and transportation & logistics industries are major contributors to market demand, while the healthcare and life sciences sectors are emerging as significant growth segments. The UAE and Saudi Arabia are currently the leading markets, fueled by large-scale infrastructure projects and government initiatives to modernize supply chains. However, South Africa, Turkey, and Israel are also exhibiting promising growth potential. Market restraints include the relatively high initial investment costs associated with advanced automation technologies and a skilled labor shortage in certain regions, potentially slowing down adoption in some segments. However, government support for technological advancements and skilled worker training programs are expected to mitigate these challenges. The industry is segmented by equipment type (AGVs, AS/RS, conveyor systems, robotic systems), end-user application, type of operation (packaging, assembly, storage, etc.), and geographic location, offering diverse investment and growth opportunities. Expansion into untapped markets within Africa and further penetration into existing markets in the Middle East are key strategic avenues for industry players. The forecast period (2025-2033) promises significant expansion, making the MEA materials handling and storage sector a lucrative and dynamic market.

The competitive landscape features a mix of global and regional players. Established international companies such as Kardex AG, SSI Schaefer, and Dematic Group compete alongside regional players, catering to the specific needs of the MEA market. The market's growth trajectory is influenced by factors such as increasing urbanization, rising consumer spending, and the growing need for efficient supply chain management. The focus is shifting toward more sustainable and intelligent solutions, driving the demand for advanced technologies that optimize energy consumption and improve operational efficiency. Government regulations promoting automation and technological advancements further contribute to market expansion. The diverse range of segments and the substantial growth potential make the MEA materials handling and storage market an attractive destination for both established and emerging players.

Middle East and Africa Materials Handling and Storage Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa Materials Handling and Storage industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive landscapes, and future growth prospects. The report leverages a robust data set to deliver actionable intelligence for informed decision-making.

Middle East and Africa Materials Handling and Storage Industry Market Concentration & Innovation

The Middle East and Africa materials handling and storage market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While precise market share figures for individual companies are proprietary and vary depending on the specific segment, key players like Kardex AG, SSI Schaefer, Coesia Middle East DMCC (Flexlink), Toyota Material Handling, Murata Machinery USA Inc, Mecalux S.A., Dematic Group, PCM ME (FZC), Swisslog Holdings AG, and Beumer Group dominate various segments. Innovation is driven by the increasing adoption of automation technologies, particularly in the Automated Guided Vehicle Systems (AGV) and Automated Storage & Retrieval Systems (AS/RS) segments.

Regulatory frameworks, though varying across countries, are generally supportive of technological advancements within the industry. Substitute products, such as manual handling systems, are gradually being replaced by automated solutions due to efficiency and cost-saving benefits. End-user trends favor increased automation to boost productivity, reduce labor costs, and enhance supply chain resilience. M&A activity within the sector has been moderate, with deal values averaging around xx Million USD annually in recent years, driven largely by strategic acquisitions aimed at expanding market share and technological capabilities.

Middle East and Africa Materials Handling and Storage Industry Industry Trends & Insights

The Middle East and Africa materials handling and storage market is experiencing robust growth, driven by a surge in e-commerce, rapid industrialization, and the expansion of logistics infrastructure across the region. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, exceeding the global average. Market penetration of automated systems is steadily increasing, particularly in sectors like transportation and logistics, manufacturing, and retail, where demand for efficiency and speed is high. Technological disruptions are reshaping the industry landscape, with the integration of AI, IoT, and robotics enhancing operational efficiency and creating new opportunities. Consumer preferences are shifting towards customized solutions and integrated systems, demanding greater flexibility and scalability from providers. Competitive dynamics are characterized by intense competition amongst established players and the emergence of innovative startups offering niche solutions.

Dominant Markets & Segments in Middle East and Africa Materials Handling and Storage Industry

Leading Region: The UAE and Saudi Arabia are the dominant markets in the Middle East and Africa region, driven by robust economic growth, significant investments in infrastructure, and a burgeoning e-commerce sector. South Africa holds significant potential, yet it lags slightly behind the UAE and Saudi Arabia due to infrastructure challenges.

Dominant Segments:

- Equipment: Automated Storage and Retrieval Systems (AS/RS) and Automated Guided Vehicle Systems (AGVs) are experiencing the highest growth, driven by the need for increased warehouse efficiency and automation.

- End-user Application: The Transportation & Logistics segment leads the market due to its inherent reliance on efficient material handling and storage solutions. The growth of e-commerce is a major driver in this segment.

- Type of Operation: Storage & Handling is the largest segment, reflecting the critical role of warehousing and inventory management across various industries.

Key Drivers for Dominant Markets:

- UAE & Saudi Arabia: Strong government support for infrastructure development, investment in logistics hubs, and the growth of free zones.

- South Africa: Focus on industrial efficiency and supply chain optimization amidst regional economic growth.

The dominance of these markets and segments is attributable to a combination of factors including government initiatives, economic growth, and evolving business needs.

Middle East and Africa Materials Handling and Storage Industry Product Developments

Recent product innovations focus on improving efficiency, safety, and sustainability. The integration of artificial intelligence (AI) and the Internet of Things (IoT) in AGV systems and AS/RS allows for real-time monitoring, predictive maintenance, and optimized workflows. Robotic systems are increasingly integrated into conveyor and sortation systems to enhance speed and precision. These developments offer significant competitive advantages, improving operational efficiency and reducing costs for end-users, perfectly aligning with the growing demand for optimized supply chains in the region.

Report Scope & Segmentation Analysis

This report segments the Middle East and Africa materials handling and storage market across several key parameters:

- Equipment: AGV Systems, AS/RS, Conveyor & Sortation Systems, Robotic Systems. Each segment shows varying growth rates, with AGV and AS/RS experiencing faster growth than conventional systems.

- End-user Application: Automotive, Retail, Transportation & Logistics, Healthcare & Lifesciences, Manufacturing, Energy, Other. Market size varies significantly across applications. Transportation and Logistics is currently the largest.

- Type of Operation: Packaging, Assembly, Storage & Handling, Distribution, Transportation, Other. Storage & Handling segment dominates due to the importance of warehousing in modern supply chains.

- Country: UAE, Saudi Arabia, South Africa, Turkey, Israel, Other Countries. Growth projections differ based on individual country economic conditions and infrastructure development.

Competitive dynamics within each segment vary, with some experiencing intense competition and others enjoying more niche dominance.

Key Drivers of Middle East and Africa Materials Handling and Storage Industry Growth

The growth of the Middle East and Africa materials handling and storage industry is fueled by a confluence of factors: rapid economic growth in several key markets, increasing investments in logistics infrastructure (e.g., the expansion of ports and airports), the boom of e-commerce, government initiatives to support industrialization, and the rising adoption of automation technologies to boost productivity and efficiency.

Challenges in the Middle East and Africa Materials Handling and Storage Industry Sector

The industry faces challenges such as infrastructure limitations in some regions, supply chain disruptions impacting the availability of components, and price volatility of raw materials. Additionally, skilled labor shortages and the high initial investment costs associated with automated systems pose significant barriers to entry for smaller players. Regulatory inconsistencies across different countries further complicate market expansion.

Emerging Opportunities in Middle East and Africa Materials Handling and Storage Industry

Significant opportunities lie in the increasing adoption of automation, especially in sectors currently under-penetrated by advanced technologies. The growth of e-commerce continues to drive demand for efficient last-mile delivery solutions. The development of smart warehousing, utilizing data analytics and AI for optimized inventory management, presents a substantial area for growth.

Leading Players in the Middle East and Africa Materials Handling and Storage Industry Market

- Kardex AG

- SSI Schaefer

- Coesia Middle East DMCC (Flexlink)

- Toyota Material Handling

- Murata Machinery USA Inc

- Mecalux S A

- Dematic Group

- PCM ME (FZC)

- Swisslog Holdings AG

- Beumer Group

Key Developments in Middle East and Africa Materials Handling and Storage Industry Industry

- August 2022: DP World UAE's agreement to build two new food processing units in Dubai significantly boosts the demand for materials handling and storage solutions within the F&B sector. This development reinforces Dubai's position as a major trade hub.

- May 2022: The USD 10 billion industrial partnership between Egypt, Jordan, and the UAE promises significant investments in various sectors, creating substantial opportunities for materials handling and storage providers.

Strategic Outlook for Middle East and Africa Materials Handling and Storage Industry Market

The Middle East and Africa materials handling and storage market is poised for sustained growth, driven by the ongoing expansion of e-commerce, industrialization, and infrastructure development. The increasing adoption of automation technologies will further fuel market expansion, presenting significant opportunities for companies offering innovative and efficient solutions. The focus on sustainable and environmentally friendly solutions will also shape the industry's future trajectory.

Middle East and Africa Materials Handling and Storage Industry Segmentation

-

1. Equipment

-

1.1. Automated Guided Vehicle Systems (AGV Systems)

- 1.1.1. Unit Load Carriers

- 1.1.2. Tow Vehicles

- 1.1.3. Pallet Trucks

- 1.1.4. Assembly Line Vehicles

- 1.1.5. Fork Lift Vehicles

- 1.1.6. Clamp Vehicles

- 1.1.7. Other AGV Systems

-

1.2. Automated Storage & Retrieval Systems (AS/RS)

- 1.2.1. Unit Load AS/RS

- 1.2.2. Mini Load AS/RS

- 1.2.3. Carousel Type AS/RS

- 1.2.4. Robotic AS/RS

- 1.2.5. Tunnel Style Systems

- 1.2.6. Other AS/RS

-

1.3. Conveyor and Sortation Systems

- 1.3.1. Belt

- 1.3.2. Screw

- 1.3.3. Overhead

- 1.3.4. Crescent

- 1.3.5. Roller

- 1.3.6. Other Conveyor and Sortation Systems

-

1.4. Robotic Systems

- 1.4.1. Palletizing

- 1.4.2. Pick & Place Service

- 1.4.3. Case Packing

- 1.4.4. Other Robotic Systems

-

1.1. Automated Guided Vehicle Systems (AGV Systems)

-

2. End-user Application

- 2.1. Automotive

- 2.2. Retail

- 2.3. Transportation & Logistics

- 2.4. Healthcare & Lifesciences

- 2.5. Manufacturing

- 2.6. Energy

- 2.7. Other End-user Applications

-

3. Type of Operation

- 3.1. Packaging

- 3.2. Assembly

- 3.3. Storage & Handling

- 3.4. Distribution

- 3.5. Transportation

- 3.6. Other Types of Operation

Middle East and Africa Materials Handling and Storage Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Materials Handling and Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Established e-commerce Industry

- 3.3. Market Restrains

- 3.3.1. High Cost of Infrastructure set up

- 3.4. Market Trends

- 3.4.1. Growing E-commerce in Middle East and Africa is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Materials Handling and Storage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Guided Vehicle Systems (AGV Systems)

- 5.1.1.1. Unit Load Carriers

- 5.1.1.2. Tow Vehicles

- 5.1.1.3. Pallet Trucks

- 5.1.1.4. Assembly Line Vehicles

- 5.1.1.5. Fork Lift Vehicles

- 5.1.1.6. Clamp Vehicles

- 5.1.1.7. Other AGV Systems

- 5.1.2. Automated Storage & Retrieval Systems (AS/RS)

- 5.1.2.1. Unit Load AS/RS

- 5.1.2.2. Mini Load AS/RS

- 5.1.2.3. Carousel Type AS/RS

- 5.1.2.4. Robotic AS/RS

- 5.1.2.5. Tunnel Style Systems

- 5.1.2.6. Other AS/RS

- 5.1.3. Conveyor and Sortation Systems

- 5.1.3.1. Belt

- 5.1.3.2. Screw

- 5.1.3.3. Overhead

- 5.1.3.4. Crescent

- 5.1.3.5. Roller

- 5.1.3.6. Other Conveyor and Sortation Systems

- 5.1.4. Robotic Systems

- 5.1.4.1. Palletizing

- 5.1.4.2. Pick & Place Service

- 5.1.4.3. Case Packing

- 5.1.4.4. Other Robotic Systems

- 5.1.1. Automated Guided Vehicle Systems (AGV Systems)

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Automotive

- 5.2.2. Retail

- 5.2.3. Transportation & Logistics

- 5.2.4. Healthcare & Lifesciences

- 5.2.5. Manufacturing

- 5.2.6. Energy

- 5.2.7. Other End-user Applications

- 5.3. Market Analysis, Insights and Forecast - by Type of Operation

- 5.3.1. Packaging

- 5.3.2. Assembly

- 5.3.3. Storage & Handling

- 5.3.4. Distribution

- 5.3.5. Transportation

- 5.3.6. Other Types of Operation

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. South Africa Middle East and Africa Materials Handling and Storage Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa Materials Handling and Storage Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa Materials Handling and Storage Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa Materials Handling and Storage Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa Materials Handling and Storage Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa Materials Handling and Storage Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Kardex AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SSI Schaefer

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Coesia Middle East DMCC (Flexlink)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Toyota Material Handling

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Murata Machinery USA Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Mecalux S A

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dematic Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 PCM ME (FZC)*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Swisslog Holdings AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Beumer Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Kardex AG

List of Figures

- Figure 1: Middle East and Africa Materials Handling and Storage Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Materials Handling and Storage Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Materials Handling and Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Materials Handling and Storage Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: Middle East and Africa Materials Handling and Storage Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 4: Middle East and Africa Materials Handling and Storage Industry Revenue Million Forecast, by Type of Operation 2019 & 2032

- Table 5: Middle East and Africa Materials Handling and Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East and Africa Materials Handling and Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East and Africa Materials Handling and Storage Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 14: Middle East and Africa Materials Handling and Storage Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 15: Middle East and Africa Materials Handling and Storage Industry Revenue Million Forecast, by Type of Operation 2019 & 2032

- Table 16: Middle East and Africa Materials Handling and Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Saudi Arabia Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Kuwait Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Oman Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bahrain Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Jordan Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Lebanon Middle East and Africa Materials Handling and Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Materials Handling and Storage Industry?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the Middle East and Africa Materials Handling and Storage Industry?

Key companies in the market include Kardex AG, SSI Schaefer, Coesia Middle East DMCC (Flexlink), Toyota Material Handling, Murata Machinery USA Inc, Mecalux S A, Dematic Group, PCM ME (FZC)*List Not Exhaustive, Swisslog Holdings AG, Beumer Group.

3. What are the main segments of the Middle East and Africa Materials Handling and Storage Industry?

The market segments include Equipment, End-user Application, Type of Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Established e-commerce Industry.

6. What are the notable trends driving market growth?

Growing E-commerce in Middle East and Africa is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

High Cost of Infrastructure set up.

8. Can you provide examples of recent developments in the market?

August 2022: DP World UAE announced an agreement with multinational firms to build two new food processing units in Dubai. DP World UAE's Food and Agriculture Terminal at the Jebel Ali Port has positioned Dubai as a key gateway for global trade in the F&B sector. Dubai's external foodstuff trade jumped 11% year-on-year to reach AED 57 billion (USD 15.52 billion) in 2021 compared to AED 51.4 billion (USD 14 billion) in 2020.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Materials Handling and Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Materials Handling and Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Materials Handling and Storage Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Materials Handling and Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence