Key Insights

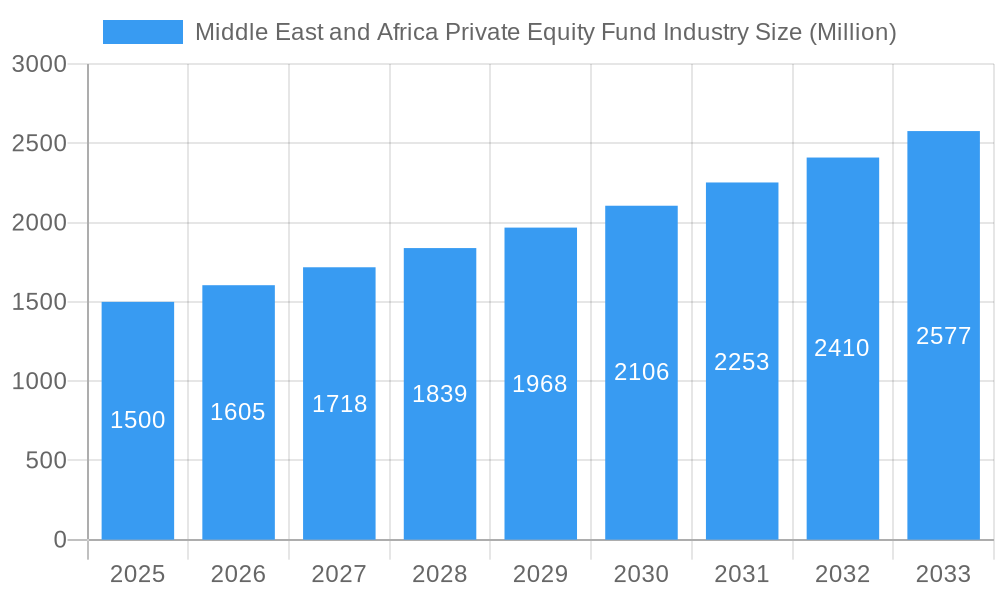

The Middle East and Africa (MEA) private equity fund industry is poised for significant expansion, with an estimated market size of $21,063.4 million by 2025. Projections indicate a Compound Annual Growth Rate (CAGR) of 6.41% from the base year 2025 through 2033. This growth trajectory is underpinned by strategic capital deployment from major sovereign wealth funds and a supportive entrepreneurial ecosystem across key MEA nations. Investment activity is increasingly concentrated in high-growth sectors such as technology, healthcare, and renewable energy, aligning with global market trends. Despite prevailing economic volatility and geopolitical considerations, the long-term economic outlook and portfolio diversification strategies signal a positive trajectory for the region's private equity landscape.

Middle East and Africa Private Equity Fund Industry Market Size (In Billion)

The MEA private equity market features a competitive environment with both established global firms and emerging regional players actively seeking investment opportunities. Key intermediaries and advisory firms, including Colliers International Middle East and Ascension Capital Partners, are instrumental in facilitating deal flow. The evolving sophistication of regional investors and the emergence of specialized sector-focused funds are further intensifying market dynamics. While granular segment data is limited, current trends suggest a strong emphasis on growth-stage investments, complemented by early-stage ventures and the expansion of established businesses. Continued foreign direct investment and the development of local capital markets are anticipated to be pivotal drivers for the sustained growth of the MEA private equity sector.

Middle East and Africa Private Equity Fund Industry Company Market Share

Middle East & Africa Private Equity Fund Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa Private Equity Fund industry, covering market dynamics, key players, growth drivers, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period encompasses 2019-2024. This report is essential for investors, fund managers, industry stakeholders, and anyone seeking a comprehensive understanding of this dynamic market.

Middle East and Africa Private Equity Fund Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities within the Middle East and Africa Private Equity Fund industry. The market exhibits a moderately concentrated structure with a few dominant players, such as Investcorp and Mubadala, commanding significant market share. However, a growing number of smaller, niche players are emerging, fostering competition and innovation.

The industry is driven by several factors, including increasing foreign direct investment (FDI), a growing entrepreneurial landscape, and supportive government policies in several key regions. Regulatory frameworks vary across the region, influencing investment decisions and operational strategies. While product substitutes are limited, the increasing popularity of alternative investment vehicles presents some competitive pressure. End-user trends indicate a growing demand for diversified portfolios and higher returns, pushing private equity firms to offer innovative investment strategies and solutions.

M&A activity has been significant, with deal values reaching xx Million in 2024. Key transactions include:

- 2022: Colliers International Middle East's expansion through Eltizam Asset Management Group's acquisition of Falcon Investments LLC.

- 2022: BluePeak Private Capital's investment in Grit Real Estate Income Group Limited.

Further analysis reveals that the average market share of the top 5 players is approximately xx%, indicating room for both consolidation and the rise of new players. The average deal value for M&A transactions in the past five years has been xx Million, signifying a robust level of activity.

Middle East and Africa Private Equity Fund Industry Industry Trends & Insights

The Middle East and Africa private equity market is experiencing robust growth, driven by several key factors. The region's burgeoning economies, coupled with supportive government initiatives and substantial infrastructure development projects, are attracting significant investments. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was estimated at xx%, and is projected to reach xx% between 2025 and 2033. This expansion is further fueled by rising disposable incomes, increased consumer spending, and a growing middle class, creating attractive opportunities for private equity investments across various sectors.

Technological advancements are reshaping the landscape, with the adoption of fintech solutions enhancing efficiency and transparency. Data analytics and artificial intelligence (AI) are playing an increasingly crucial role in investment decision-making. Consumer preferences are shifting toward sustainable and ethical investments, prompting private equity firms to incorporate environmental, social, and governance (ESG) factors into their investment strategies. Competitive dynamics are characterized by increasing competition among both established players and new entrants. Market penetration continues to rise, particularly in high-growth sectors such as technology, healthcare, and renewable energy. The shift in preference towards sustainable and ethical investments is leading to a greater focus on impact investing and ESG considerations.

Dominant Markets & Segments in Middle East and Africa Private Equity Fund Industry

The Middle East and Africa private equity market presents significant opportunities across numerous countries and sectors. However, certain regions and segments exhibit more pronounced growth and dominance. The United Arab Emirates (UAE) and South Africa currently lead the pack, fueled by robust economic growth, favorable regulatory environments, and the presence of established private equity firms.

Key Drivers of Dominance:

- UAE: Strong government support for FDI, well-developed infrastructure, strategic location, and diversified economy.

- South Africa: Established financial markets, relatively mature private equity ecosystem, and diverse investment opportunities across various sectors.

Other countries such as Egypt, Kenya, and Nigeria show promising growth potential, driven by expanding economies and growing private sector activity. Sectoral dominance is spread across real estate, technology, healthcare, and consumer goods, reflecting the diverse investment landscape of the region. While real estate and technology currently capture the lion's share of investments, other sectors are witnessing increased interest.

Middle East and Africa Private Equity Fund Industry Product Developments

The Middle East and Africa private equity industry is witnessing a surge in product innovation, driven by technological advancements and evolving investor preferences. Private equity firms are increasingly offering specialized funds focused on specific sectors or investment strategies, catering to niche demands. The integration of fintech solutions has simplified fund administration, improved transparency, and enhanced efficiency. Furthermore, the rising popularity of impact investing has led to the development of funds specifically designed to promote social and environmental sustainability. These developments showcase the industry's adaptability and responsiveness to both technological progress and evolving market needs.

Report Scope & Segmentation Analysis

This report segments the Middle East and Africa private equity market based on fund strategy (e.g., buyout, growth equity, venture capital), investment sector (e.g., real estate, technology, healthcare), and geographic location (by country). Each segment's market size, growth projections, and competitive dynamics are comprehensively analyzed, offering detailed insights into the unique characteristics of each segment. Growth projections vary across segments, with technology and healthcare experiencing particularly rapid expansion. The competitive landscape also varies based on specific segments, with some attracting more competition than others.

Key Drivers of Middle East and Africa Private Equity Fund Industry Growth

Several factors are fueling the growth of the Middle East and Africa private equity industry. Government initiatives promoting FDI and economic diversification are attracting significant capital inflows. The region's burgeoning entrepreneurial ecosystem is fostering innovation and generating attractive investment opportunities. Furthermore, technological advancements are improving operational efficiency, enhancing transparency, and facilitating access to new markets. The increasing adoption of ESG principles is also shaping investment strategies.

Challenges in the Middle East and Africa Private Equity Fund Industry Sector

Despite its immense potential, the Middle East and Africa private equity industry faces certain challenges. Regulatory complexities and inconsistencies across different countries can create barriers to investment. Political instability and macroeconomic volatility in some regions present significant risks. Competition for attractive investment opportunities is also intensifying. Limited access to accurate and reliable market data and difficulties in assessing risk are also hindering the industry’s growth.

Emerging Opportunities in Middle East and Africa Private Equity Fund Industry

The Middle East and Africa private equity industry presents numerous emerging opportunities. Growth in the technology and healthcare sectors presents lucrative prospects. The rising middle class and increased consumer spending are creating new market segments. The adoption of digital technologies and innovative investment strategies can further enhance efficiency and attract greater investor interest. Furthermore, the increasing focus on ESG factors opens opportunities for impact investing and sustainable development.

Leading Players in the Middle East and Africa Private Equity Fund Industry Market

- Investcorp

- Mubadala

- Hyatt Group

- Olive Rock Partners

- Colliers International Middle East

- Ascension Capital Partners

- Saint Capital Fund

- BluePeak Private Capital

- Sigma Capital Holding

- Vantage Capital

List Not Exhaustive

Key Developments in Middle East and Africa Private Equity Fund Industry Industry

- January 2022: Colliers International Middle East expands its footprint in the MENA region through the acquisition of Falcon Investments LLC by Eltizam Asset Management Group.

- January 2022: BluePeak Private Capital invests in Grit Real Estate Income Group Limited, supporting the development of industrial and healthcare facilities in East Africa.

Strategic Outlook for Middle East and Africa Private Equity Fund Industry Market

The future of the Middle East and Africa private equity market appears bright. Continued economic growth, supportive government policies, and technological advancements will drive sustained expansion. The increasing focus on sustainability and impact investing will reshape investment strategies. The sector's ability to adapt to evolving market dynamics and capitalize on emerging opportunities will determine its future success. The forecast suggests a significant increase in both investment volume and deal size over the next decade, making the region an increasingly attractive destination for private equity investments.

Middle East and Africa Private Equity Fund Industry Segmentation

-

1. Industry / Sector

- 1.1. Utilities

- 1.2. Oil & Gas

- 1.3. Financials

- 1.4. Technology

- 1.5. Healthcare

- 1.6. Consumer Goods & Services

- 1.7. Others

-

2. Investment Type

- 2.1. Venture Capital

- 2.2. Growth

- 2.3. Buyout

- 2.4. Others

Middle East and Africa Private Equity Fund Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Private Equity Fund Industry Regional Market Share

Geographic Coverage of Middle East and Africa Private Equity Fund Industry

Middle East and Africa Private Equity Fund Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Capital Deployment in Africa

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Private Equity Fund Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Industry / Sector

- 5.1.1. Utilities

- 5.1.2. Oil & Gas

- 5.1.3. Financials

- 5.1.4. Technology

- 5.1.5. Healthcare

- 5.1.6. Consumer Goods & Services

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Investment Type

- 5.2.1. Venture Capital

- 5.2.2. Growth

- 5.2.3. Buyout

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Industry / Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Investcorp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mubadala

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyaat Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Olive Rock Partners

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Colliers International Middle East

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ascension Capital Partners

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saint Capital Fund

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BluePeak Private Capital

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sigma Capital Holding

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vantage Capital**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Investcorp

List of Figures

- Figure 1: Middle East and Africa Private Equity Fund Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Private Equity Fund Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Industry / Sector 2020 & 2033

- Table 2: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Investment Type 2020 & 2033

- Table 3: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Industry / Sector 2020 & 2033

- Table 5: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Investment Type 2020 & 2033

- Table 6: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Private Equity Fund Industry?

The projected CAGR is approximately 6.41%.

2. Which companies are prominent players in the Middle East and Africa Private Equity Fund Industry?

Key companies in the market include Investcorp, Mubadala, Hyaat Group, Olive Rock Partners, Colliers International Middle East, Ascension Capital Partners, Saint Capital Fund, BluePeak Private Capital, Sigma Capital Holding, Vantage Capital**List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Private Equity Fund Industry?

The market segments include Industry / Sector, Investment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 21063.4 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Capital Deployment in Africa.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In Jan 2022, Colliers, a services and investment management firm, improved its footprint in the Middle East and North Africa (MENA) with Eltizam Asset Management Group's (Eltizam) acquisition of Falcon Investments LLC, an associate partner that has been doing business in the region as Colliers since 1995. Colliers benefits from the competence in core real estate transactions and advisory services offered by Eltizam and the asset management services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Private Equity Fund Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Private Equity Fund Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Private Equity Fund Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Private Equity Fund Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence