Key Insights

The Middle East plant protein market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several key factors. Increasing health consciousness among consumers, coupled with rising demand for vegetarian and vegan diets, is fueling the adoption of plant-based protein sources. The region's burgeoning food and beverage industry, particularly within the burgeoning sports nutrition sector, further contributes to market expansion. Furthermore, the growing awareness of the environmental benefits of plant-based protein sources over traditional animal protein is driving this transition. Soy protein currently holds a significant market share, owing to its established presence and wide range of applications. However, other plant proteins like pea and hemp are gaining traction due to their perceived health benefits and functional properties. Government initiatives promoting sustainable food systems and diversification of food sources are also expected to bolster market growth. Challenges such as fluctuating raw material prices and the need for improved processing and infrastructure to meet increasing demand remain.

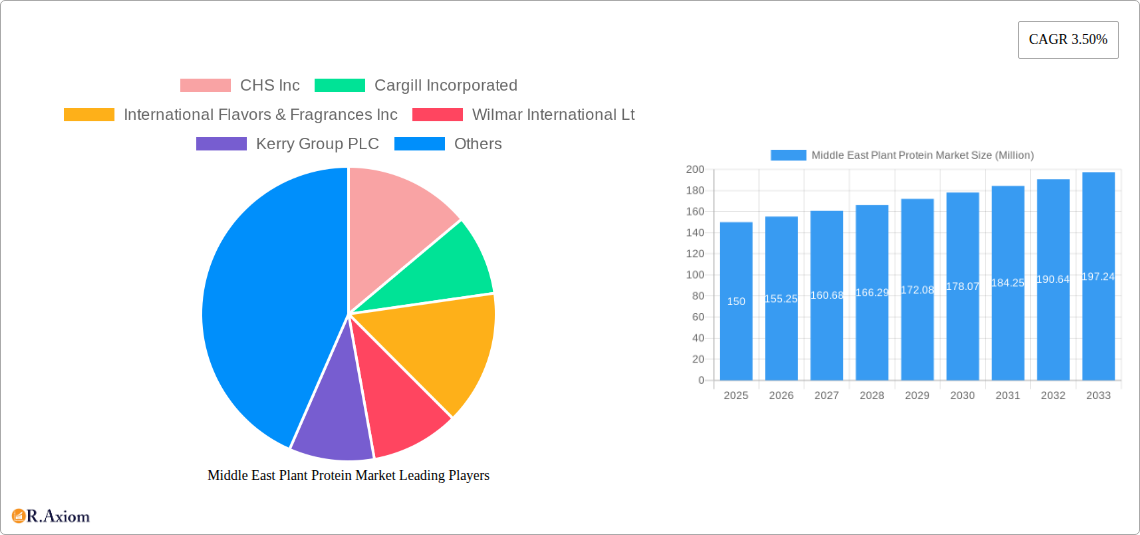

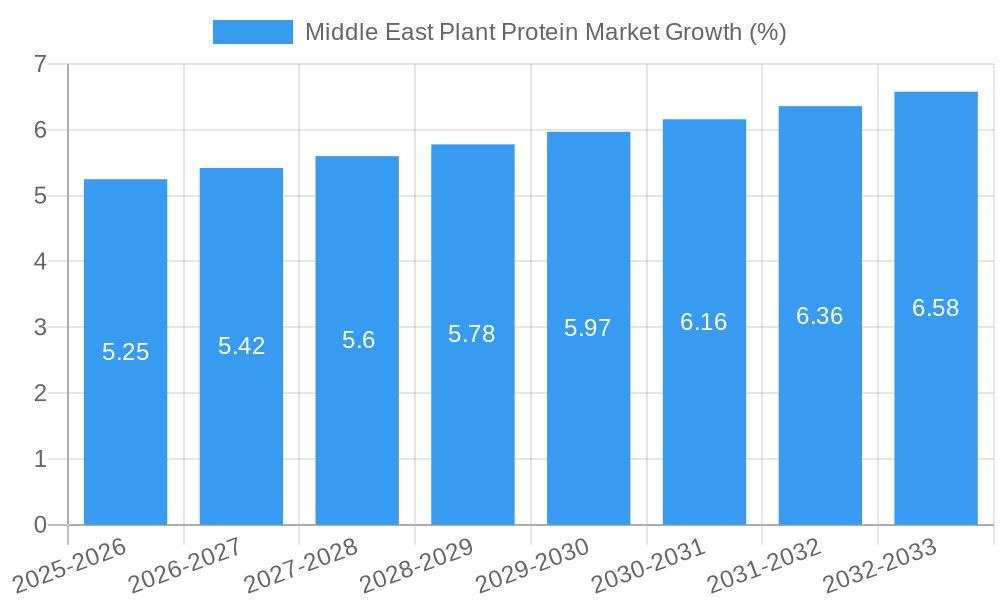

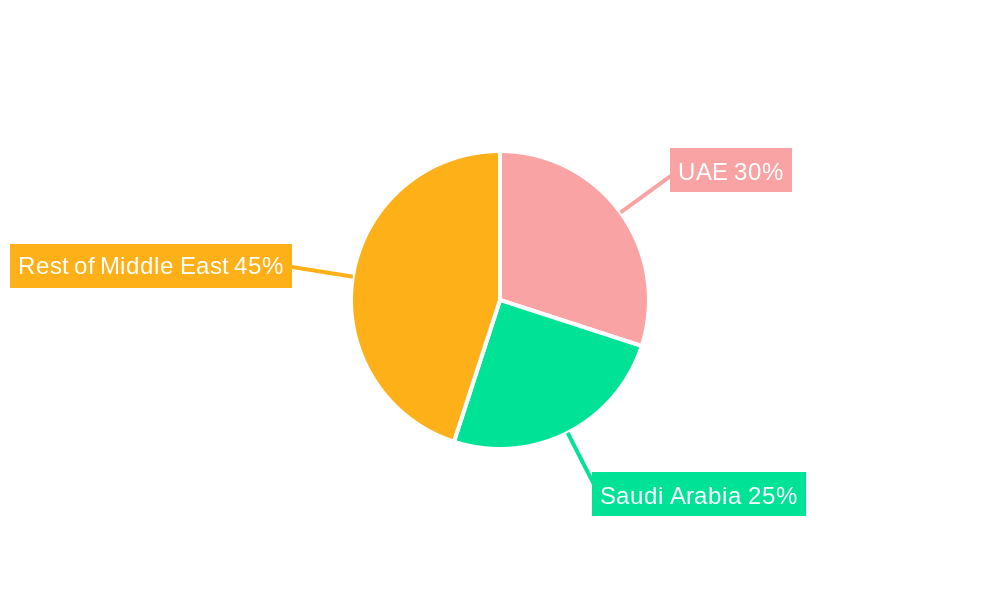

Geographic variations within the Middle East market exist. The UAE and Saudi Arabia are currently leading the market due to higher disposable incomes and a more established infrastructure for food processing and distribution. However, other nations in the region, such as Qatar and Oman, show significant potential for future growth. The market segmentation reveals that the food and beverage sector is the largest consumer of plant protein, followed by the animal feed and sports nutrition segments. The forecast period of 2025-2033 anticipates a CAGR of 3.50%, suggesting a substantial increase in market size by 2033. Key players such as CHS Inc, Cargill, and Kerry Group are actively competing within the market, focusing on product innovation and strategic partnerships to capture market share. Future growth hinges on successful product diversification, enhanced distribution networks, and catering to the evolving preferences of the Middle East consumer base.

Middle East Plant Protein Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Middle East plant protein market, offering actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this study unravels market dynamics, growth drivers, challenges, and future opportunities. The report segments the market by protein type (Hemp Protein, Pea Protein, Potato Protein, Rice Protein, Soy Protein, Wheat Protein, Other Plant Protein), end-user (Animal Feed, Food and Beverages, Sport/Performance Nutrition), and country (Iran, Saudi Arabia, United Arab Emirates, Rest of Middle East). The market size is estimated at xx Million in 2025 and is projected to experience significant growth during the forecast period (2025-2033).

Middle East Plant Protein Market Concentration & Innovation

The Middle East plant protein market exhibits a moderately concentrated landscape, with key players like CHS Inc, Cargill Incorporated, International Flavors & Fragrances Inc, Wilmar International Ltd, Kerry Group PLC, and Axiom Foods Inc holding significant market share. However, the presence of several regional and smaller players indicates a competitive environment. Market share data for each company is currently unavailable (xx). Innovation is a key driver, spurred by rising consumer demand for healthier and sustainable food options. This is reflected in the increasing focus on developing novel plant-based protein sources and improved processing technologies.

- Regulatory Frameworks: Government initiatives promoting food security and sustainable agriculture are fostering market growth. However, specific regulations concerning labeling, food safety, and import/export can create challenges.

- Product Substitutes: Traditional animal-based protein sources remain the primary competitors. However, the increasing awareness of health and environmental benefits of plant-based alternatives is driving market share gains for plant proteins.

- End-User Trends: The food and beverage sector dominates the market, driven by the growing popularity of plant-based meat alternatives, dairy substitutes, and protein-enhanced foods. The sport/performance nutrition segment is also showing strong growth potential.

- M&A Activities: Recent mergers and acquisitions, such as the DuPont/IFF merger in 2021, demonstrate the increasing consolidation within the industry. These deals often involve substantial investments, with values currently unavailable (xx Million).

Middle East Plant Protein Market Industry Trends & Insights

The Middle East plant protein market is experiencing robust growth, driven by several factors. The rising adoption of vegan and vegetarian diets, along with increasing health consciousness among consumers, is fueling demand. Technological advancements in plant-based protein extraction and processing have improved the taste, texture, and functionality of plant-based products, making them more appealing to consumers. A shift towards healthier lifestyles, combined with increasing disposable incomes in certain regions, are further contributing to market expansion. The CAGR for the period 2025-2033 is projected to be xx%. Market penetration is currently estimated at xx% and is expected to increase significantly during the forecast period. Competitive dynamics are characterized by innovation, product diversification, and strategic partnerships.

Dominant Markets & Segments in Middle East Plant Protein Market

Leading Region: The United Arab Emirates and Saudi Arabia currently represent the largest markets within the Middle East, driven by factors like higher disposable incomes, a thriving food and beverage sector, and a focus on health and wellness. Iran is also expected to play a more considerable role as it develops its economy further.

Leading Protein Type: Soy protein currently holds the largest market share, followed by pea protein, due to its cost-effectiveness and wide applications. However, other plant proteins, such as hemp and rice protein, are gaining popularity due to their unique nutritional profiles.

Leading End-User: The Food and Beverages segment is the dominant end-user, driving majority of the market demand. The Sport/Performance Nutrition segment shows significant growth potential owing to increasing awareness around plant-based protein sources for athletes.

Key Drivers:

- Economic Policies: Government initiatives supporting agriculture and food processing are stimulating market growth.

- Infrastructure: Improvements in cold chain infrastructure and logistics networks are enhancing the accessibility of plant-based proteins.

Middle East Plant Protein Market Product Developments

Significant advancements in plant protein processing technologies are improving product quality and expanding applications. New formulations are focusing on enhancing taste, texture, and nutritional value, catering to diverse consumer preferences. The emergence of plant-based meat alternatives and dairy substitutes is driving innovation in this market. Key competitive advantages are derived from proprietary processing methods, unique ingredient blends, and strong brand recognition.

Report Scope & Segmentation Analysis

This report offers a granular segmentation of the Middle East plant protein market, analyzing each segment's growth trajectory and competitive dynamics. The market is segmented by protein type (Hemp, Pea, Potato, Rice, Soy, Wheat, Other), end-user (Animal Feed, Food & Beverage, Sport/Performance Nutrition), and country (Iran, Saudi Arabia, UAE, Rest of Middle East). Each segment showcases its own distinct growth projections based on current market size and predicted CAGR. Competitive landscapes are discussed for each segment, taking into account pricing strategies and marketing tactics.

Key Drivers of Middle East Plant Protein Market Growth

The market's robust growth is fueled by several factors. The rising prevalence of vegetarianism and veganism, coupled with growing health awareness, is driving strong demand. Technological advancements enhancing product quality and functionality are also contributing. Favorable government policies promoting sustainable agriculture and food security further incentivize market expansion. Increasing disposable incomes within the region add additional momentum.

Challenges in the Middle East Plant Protein Market Sector

Several factors pose challenges to the market's growth. Supply chain disruptions can impact the availability and affordability of raw materials. Fluctuations in commodity prices can affect profitability. Furthermore, stringent regulatory requirements related to labeling, food safety, and import/export can create hurdles for businesses. The competition from established animal-based protein sources also poses a significant challenge.

Emerging Opportunities in Middle East Plant Protein Market

The market presents several promising opportunities. The growing demand for functional foods and beverages enriched with plant proteins creates significant potential. The rising interest in sustainable and ethically sourced ingredients offers advantages for plant-based proteins. Developing novel plant protein sources and exploring new applications in emerging food categories also presents further avenues for growth. Finally, expansion into untapped markets within the region and addressing unmet consumer needs are critical for increased market penetration.

Leading Players in the Middle East Plant Protein Market Market

- CHS Inc

- Cargill Incorporated

- International Flavors & Fragrances Inc (IFF Website)

- Wilmar International Ltd (Wilmar Website)

- Kerry Group PLC (Kerry Website)

- Axiom Foods Inc

Key Developments in Middle East Plant Protein Market Industry

- January 2022: Kerry Group opened a new state-of-the-art facility in Jeddah, Saudi Arabia, representing a USD 90 Million investment and signifying a substantial commitment to the Middle East market.

- June 2021: Axiom Foods launched a new pea protein designed for meat replacement and extension, offering a cost-effective solution with enhanced nutritional value.

- February 2021: The merger of DuPont's Nutrition & Biosciences and IFF strengthened the combined company's position in the soy protein market.

Strategic Outlook for Middle East Plant Protein Market Market

The Middle East plant protein market is poised for continued robust growth, driven by evolving consumer preferences, technological innovation, and supportive government policies. Opportunities exist for companies to expand their product portfolios, invest in R&D, and leverage strategic partnerships to gain a competitive edge. The increasing focus on sustainability and health will further accelerate market expansion. The long-term potential of this market is substantial, promising significant returns for businesses that successfully navigate the evolving landscape.

Middle East Plant Protein Market Segmentation

-

1. Protein Type

- 1.1. Hemp Protein

- 1.2. Pea Protein

- 1.3. Potato Protein

- 1.4. Rice Protein

- 1.5. Soy Protein

- 1.6. Wheat Protein

- 1.7. Other Plant Protein

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Middle East Plant Protein Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Plant Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Hemp Protein

- 5.1.2. Pea Protein

- 5.1.3. Potato Protein

- 5.1.4. Rice Protein

- 5.1.5. Soy Protein

- 5.1.6. Wheat Protein

- 5.1.7. Other Plant Protein

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. United Arab Emirates Middle East Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 CHS Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cargill Incorporated

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 International Flavors & Fragrances Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Wilmar International Lt

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kerry Group PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Axiom Foods Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 CHS Inc

List of Figures

- Figure 1: Middle East Plant Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Plant Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Plant Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Plant Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 3: Middle East Plant Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Middle East Plant Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East Plant Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Arab Emirates Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Saudi Arabia Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Qatar Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Israel Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Egypt Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Oman Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Middle East Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East Plant Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 14: Middle East Plant Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Middle East Plant Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Saudi Arabia Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Arab Emirates Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Israel Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Qatar Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kuwait Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Oman Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Bahrain Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Jordan Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Lebanon Middle East Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Plant Protein Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Middle East Plant Protein Market?

Key companies in the market include CHS Inc, Cargill Incorporated, International Flavors & Fragrances Inc, Wilmar International Lt, Kerry Group PLC, Axiom Foods Inc.

3. What are the main segments of the Middle East Plant Protein Market?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

January 2022: Kerry, the largest taste and nutrition company, officially opened a new 21,500-square-foot state-of-the-art facility at its Jeddah location in Saudi Arabia. The company has invested more than USD 90 million in the region, and this new facility is one of the most modern and efficient, which produces great tasting, nutritious, and sustainable food ingredients which will be distributed throughout the Middle East.June 2021: Axiom Foods launched a new pea protein, made from Pisum sativum yellow peas, that is majorly used as a meat replacement and a meat extender. It reduces the cost of nuggets, patties, and meatballs while adding nutritional content, protein, and juiciness.February 2021: DuPont's Nutrition & Biosciences and the ingredient company IFF announced their merger in 2021. The combined company will continue to operate under the name IFF. The complementary portfolios give the company leadership positions within a range of ingredients, including soy protein.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Plant Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Plant Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Plant Protein Market?

To stay informed about further developments, trends, and reports in the Middle East Plant Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence