Key Insights

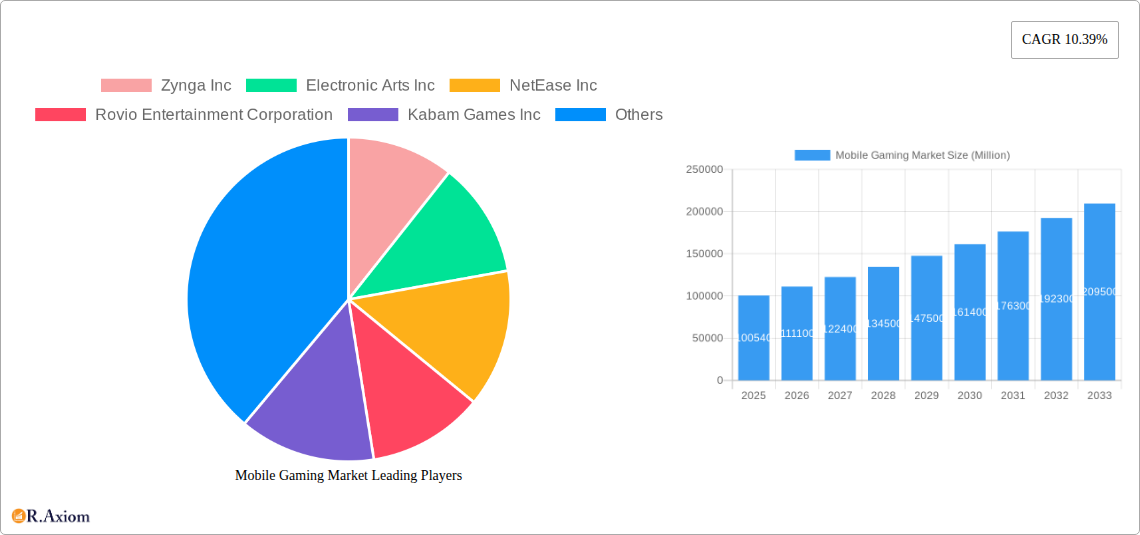

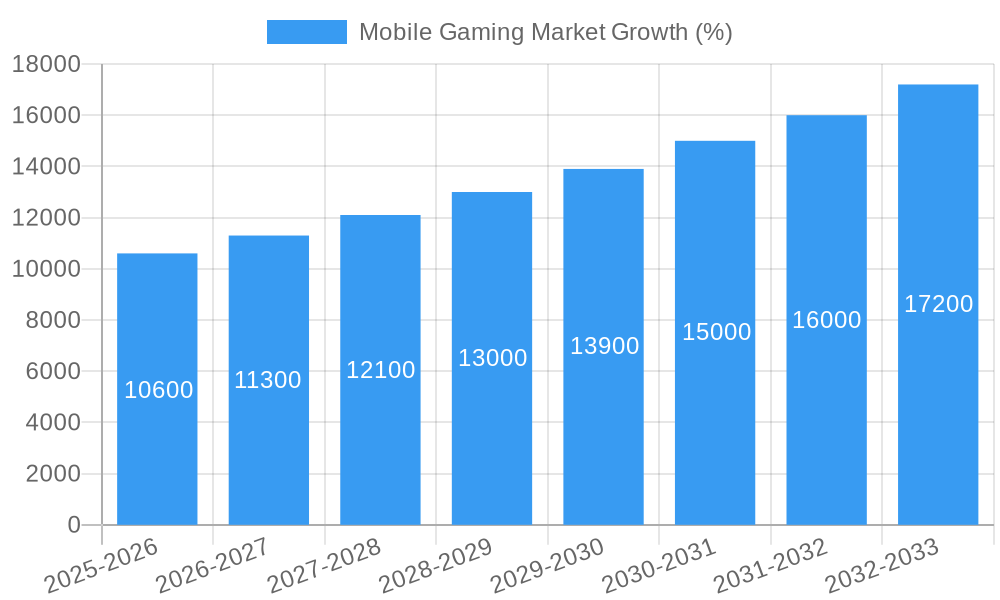

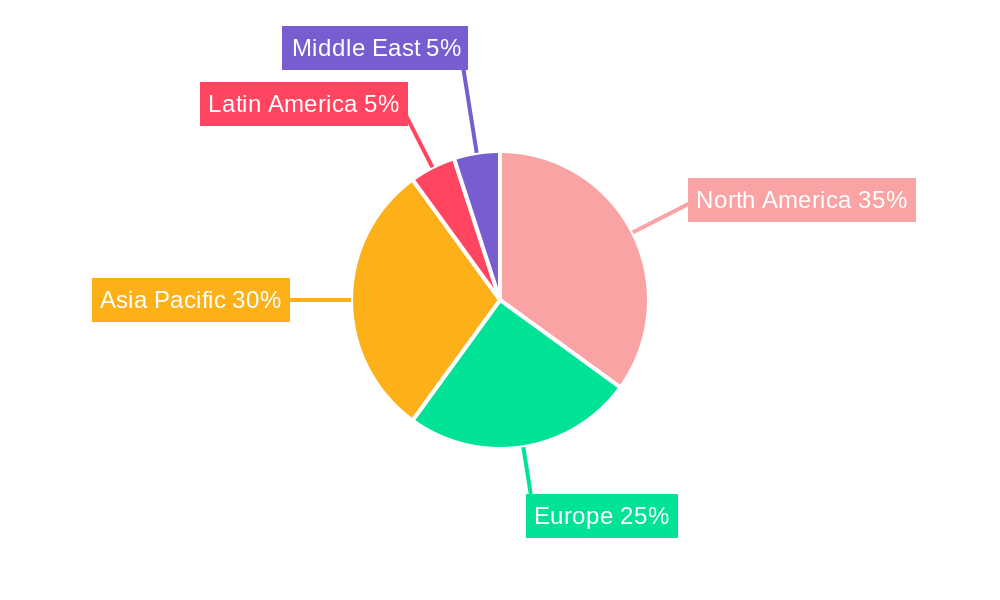

The global mobile gaming market, valued at $100.54 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.39% from 2025 to 2033. This robust expansion is driven by several key factors. The increasing penetration of smartphones, coupled with enhanced internet connectivity, particularly in emerging markets, fuels wider accessibility to mobile games. Furthermore, the continuous evolution of game technology, including advanced graphics, immersive gameplay, and innovative monetization strategies (in-app purchases, paid apps, and advertising), significantly contributes to market growth. The popularity of esports and the rise of cloud gaming further enhance the attractiveness and accessibility of mobile gaming, attracting a broader audience base. Key market segments include in-app purchases, which are projected to remain the dominant revenue generator, followed by advertising and paid apps. Platform-wise, Android and iOS continue to be the major players, with third-party Android app stores in regions like China playing an increasingly crucial role. Leading companies like Tencent, NetEase, Activision Blizzard, and Electronic Arts dominate the competitive landscape, constantly innovating and expanding their game portfolios to cater to evolving player preferences. The Asia-Pacific region, particularly China, India, and Japan, is expected to witness substantial growth, given its large and rapidly expanding mobile gaming user base.

Regional variations in market penetration and spending patterns will continue to shape the market's trajectory. While North America and Europe maintain robust market shares, fueled by high average revenue per user (ARPU), the Asia-Pacific region's rapid growth in user acquisition will propel its market share in the coming years. The market will also witness increased competition and consolidation among gaming companies, leading to strategic partnerships, mergers, and acquisitions. Challenges such as regulatory hurdles in certain regions, concerns regarding in-app purchases, and the ever-evolving preferences of gamers will present ongoing opportunities for innovation and adaptation. The long-term forecast suggests a continuously expanding market, driven by technological advancements and the sustained popularity of mobile gaming across diverse demographics and geographic locations.

This detailed report provides a comprehensive analysis of the global mobile gaming market, covering historical data (2019-2024), the base year (2025), and forecast estimations (2025-2033). It delves into market dynamics, key players, emerging trends, and future growth prospects, offering actionable insights for industry stakeholders. The report's value lies in its detailed segmentation, in-depth analysis of leading companies, and projection of future market trends, providing a complete picture of this rapidly evolving sector.

Mobile Gaming Market Market Concentration & Innovation

This section analyzes the competitive landscape of the mobile gaming market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities.

The mobile gaming market is characterized by a high degree of concentration, with a few dominant players commanding significant market share. For example, Tencent Holdings Limited and NetEase Inc. hold a substantial portion of the Asian market, while companies like Activision Blizzard Inc. and Electronic Arts Inc. dominate in the Western markets. Precise market share figures vary by region and segment, however, a general trend shows a concentration among the top 10 players accounting for over xx% of global revenue in 2024.

Several factors drive innovation within the mobile gaming industry. These include:

- Technological advancements: Improvements in mobile hardware, graphics processing, and network capabilities continuously enhance the gaming experience, pushing the boundaries of game design and complexity.

- Evolving consumer preferences: The growing demand for immersive, social, and personalized gaming experiences fuels the development of new game mechanics, genres, and monetization models.

- Increased competition: The highly competitive market environment pushes companies to innovate and deliver unique and engaging gaming experiences to retain and attract players.

M&A activity within the mobile gaming sector has been significant, reflecting the industry's consolidation and the pursuit of growth through acquisitions. Recent deals have involved significant investments, with deal values in the range of xx Million. These mergers and acquisitions frequently involve the purchase of smaller, innovative studios or game development teams to acquire specialized expertise, intellectual property, or existing player bases.

Regulatory frameworks, particularly those related to data privacy and consumer protection, play a significant role in shaping the mobile gaming market. Compliance with these regulations is crucial for companies operating within the industry. Additionally, the market is influenced by the presence of substitute products and entertainment options, such as social media platforms and streaming services. Finally, understanding evolving end-user trends is vital for predicting the future trajectory of the market.

Mobile Gaming Market Industry Trends & Insights

The mobile gaming market is experiencing robust growth, driven by several key factors. The increasing penetration of smartphones globally, coupled with improved mobile internet infrastructure, has expanded the potential player base significantly. A rising disposable income, particularly in emerging markets, further fuels the market's growth.

Technological disruptions, such as the rise of cloud gaming and the integration of augmented reality (AR) and virtual reality (VR) technologies, are transforming the gaming landscape. These innovations are expected to further drive market growth in the coming years. Consumer preferences are evolving towards more immersive, social, and personalized gaming experiences, leading to the development of innovative game genres and monetization models. For example, the increasing popularity of esports and competitive gaming creates new avenues for revenue generation and fan engagement.

The competitive dynamics within the mobile gaming market are intense. Established players are facing challenges from smaller, more agile companies and the emergence of new competitors. This competition pushes innovation and enhances the overall quality and variety of mobile games available to consumers. The Compound Annual Growth Rate (CAGR) for the mobile gaming market during the forecast period (2025-2033) is estimated to be xx%, indicating a substantial expansion in market size and revenue generation. The market penetration rate is expected to reach xx% by 2033 across major global markets.

Dominant Markets & Segments in Mobile Gaming Market

The Asia-Pacific region is currently the dominant market for mobile gaming, driven by several factors:

- Large and growing smartphone user base: The region boasts a massive and rapidly expanding population of smartphone users.

- High mobile internet penetration: Widespread access to high-speed mobile internet enables seamless gaming experiences.

- Strong gamer culture: A vibrant and engaged gaming culture fuels high demand for mobile games.

- Government support for the digital economy: Government initiatives promoting the growth of the digital economy create a favorable environment for the mobile gaming industry.

By monetization type, in-app purchases currently constitute the largest segment, accounting for xx% of the market in 2024. The popularity of free-to-play games with in-app purchase options drives this segment's dominance. Paid apps contribute a smaller but still significant share, particularly for high-quality, premium games that offer a complete experience without in-app purchases. Advertising-based monetization also holds a considerable share of the market, offering developers an alternative revenue stream through in-game advertisements or sponsored content.

In terms of platform, Android holds a larger market share than iOS globally. This is largely due to the higher penetration of Android devices, particularly in emerging markets. However, iOS users tend to spend more on in-app purchases, leading to higher average revenue per user (ARPU) on this platform. Third-party app stores play a significant role, especially in regions where Google Play is not the dominant platform. These stores provide alternative distribution channels for developers and cater to the specific preferences of users in those regions.

Mobile Gaming Market Product Developments

Recent years have witnessed significant product innovations in the mobile gaming market, driven by technological advancements and evolving consumer preferences. These include the rise of cloud gaming services, which enable gamers to stream high-quality games without needing powerful mobile devices. The integration of augmented reality (AR) and virtual reality (VR) technologies further enhances the gaming experience, blurring the lines between the physical and virtual worlds. Furthermore, innovations in game mechanics, genres, and user interfaces cater to a broader range of preferences and expectations. The success of these products depends on seamlessly integrating innovative technology with a clear understanding of market needs and trends.

Report Scope & Segmentation Analysis

This report analyzes the mobile gaming market using a comprehensive segmentation approach. The market is segmented by monetization type, encompassing In-app Purchases, Paid Apps, and Advertising. In-app purchases are expected to experience significant growth, driven by the popularity of free-to-play games. Paid apps will maintain a steady but smaller segment of the market, dominated by high-quality, premium games. Advertising-based monetization will continue to offer alternative revenue channels for developers, albeit with a smaller growth rate compared to in-app purchases.

Further segmentation considers the platform, dividing the market into Android, iOS, and Other Third-party Stores. Android's larger market share is predicted to maintain but with a relatively lower growth rate than iOS, which will likely see higher average revenue per user (ARPU) and growth rates. Third-party stores, particularly in emerging markets, will remain a significant distribution channel, representing a growing share of the overall market, largely concentrated in Asia and developing regions. Competitive dynamics vary across these segments, with fierce competition among major players in established markets and emerging opportunities for smaller players in niche segments.

Key Drivers of Mobile Gaming Market Growth

The growth of the mobile gaming market is propelled by several factors:

- Technological advancements: The continual improvement in mobile hardware, graphics, and network technologies enhances gaming experiences.

- Rising smartphone penetration: Increasing global smartphone adoption expands the potential user base.

- Enhanced internet access: Wider availability of high-speed internet improves game accessibility and playability.

- Consumer preferences for mobile gaming: Mobile gaming's convenience and accessibility fuel its growing popularity.

Challenges in the Mobile Gaming Market Sector

The mobile gaming sector faces several challenges:

- Intense competition: The highly competitive market necessitates continuous innovation to maintain market share.

- Monetization complexities: Balancing player engagement with effective monetization strategies remains a challenge.

- Regulatory changes: Adapting to evolving regulations concerning data privacy and content restrictions is crucial.

- User acquisition costs: The increasing cost of acquiring new players puts pressure on profitability.

Emerging Opportunities in Mobile Gaming Market

The mobile gaming market presents several exciting opportunities:

- Expansion into new markets: Untapped potential exists in developing economies with increasing smartphone usage.

- Technological advancements: Exploring emerging technologies such as cloud gaming and AR/VR can enhance gaming experiences.

- Growth of esports: The expanding esports market offers opportunities for engagement and monetization.

- Personalized gaming: Catering to individual player preferences through personalized gaming experiences presents a growth path.

Leading Players in the Mobile Gaming Market Market

- Zynga Inc

- Electronic Arts Inc

- NetEase Inc

- Rovio Entertainment Corporation

- Kabam Games Inc

- Activision Blizzard Inc

- GungHo Online Entertainment Inc ( SoftBank Group)

- Tencent Holdings Limited

- Nintendo Co Ltd

- NCsoft Corporation

Key Developments in Mobile Gaming Market Industry

- November 2023: Pley partnered with Tilting Point to distribute Homesteads: Dream Farm on a web browser platform, broadening the game's reach.

- May 2024: Pudgy Penguins collaborated with Mythical Games to create a web3-enabled mobile game, showcasing the integration of blockchain technology in gaming.

Strategic Outlook for Mobile Gaming Market Market

The future of the mobile gaming market is bright, driven by continued technological advancements, expanding internet access, and the growing popularity of mobile gaming globally. The integration of new technologies, such as AR/VR and cloud gaming, will further enhance the gaming experience and attract new players. The market's growth will be fueled by increased consumer spending, particularly in emerging markets. Strategic partnerships and mergers and acquisitions will continue to shape the competitive landscape, leading to greater innovation and diversification of offerings. By strategically adapting to evolving consumer preferences and technological disruptions, mobile gaming companies are poised for robust growth in the years to come.

Mobile Gaming Market Segmentation

-

1. Monetization Type

- 1.1. In-app Purchases

- 1.2. Paid Apps

- 1.3. Advertising

-

2. Platform

- 2.1. Android

- 2.2. iOS

- 2.3. Other Th

Mobile Gaming Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Peru

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

Mobile Gaming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration; Growth in Cloud Adoption

- 3.3. Market Restrains

- 3.3.1. User Privacy and Security Issues Along with Government Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Smartphone Penetration is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Monetization Type

- 5.1.1. In-app Purchases

- 5.1.2. Paid Apps

- 5.1.3. Advertising

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Android

- 5.2.2. iOS

- 5.2.3. Other Th

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Monetization Type

- 6. North America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Monetization Type

- 6.1.1. In-app Purchases

- 6.1.2. Paid Apps

- 6.1.3. Advertising

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Android

- 6.2.2. iOS

- 6.2.3. Other Th

- 6.1. Market Analysis, Insights and Forecast - by Monetization Type

- 7. Europe Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Monetization Type

- 7.1.1. In-app Purchases

- 7.1.2. Paid Apps

- 7.1.3. Advertising

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Android

- 7.2.2. iOS

- 7.2.3. Other Th

- 7.1. Market Analysis, Insights and Forecast - by Monetization Type

- 8. Asia Pacific Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Monetization Type

- 8.1.1. In-app Purchases

- 8.1.2. Paid Apps

- 8.1.3. Advertising

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Android

- 8.2.2. iOS

- 8.2.3. Other Th

- 8.1. Market Analysis, Insights and Forecast - by Monetization Type

- 9. Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Monetization Type

- 9.1.1. In-app Purchases

- 9.1.2. Paid Apps

- 9.1.3. Advertising

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Android

- 9.2.2. iOS

- 9.2.3. Other Th

- 9.1. Market Analysis, Insights and Forecast - by Monetization Type

- 10. Middle East Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Monetization Type

- 10.1.1. In-app Purchases

- 10.1.2. Paid Apps

- 10.1.3. Advertising

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Android

- 10.2.2. iOS

- 10.2.3. Other Th

- 10.1. Market Analysis, Insights and Forecast - by Monetization Type

- 11. United Arab Emirates Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Monetization Type

- 11.1.1. In-app Purchases

- 11.1.2. Paid Apps

- 11.1.3. Advertising

- 11.2. Market Analysis, Insights and Forecast - by Platform

- 11.2.1. Android

- 11.2.2. iOS

- 11.2.3. Other Th

- 11.1. Market Analysis, Insights and Forecast - by Monetization Type

- 12. North America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Italy

- 14. Asia Pacific Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 15. Latin America Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Mexico

- 15.1.3 Peru

- 16. Middle East Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. United Arab Emirates Mobile Gaming Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1. Saudi Arabia

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Zynga Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Electronic Arts Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 NetEase Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Rovio Entertainment Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Kabam Games Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Activision Blizzard Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 GungHo Online Entertainment Inc ( SoftBank Group)

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Tencent Holdings Limited

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Nintendo Co Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 NCsoft Corporation

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Zynga Inc

List of Figures

- Figure 1: Mobile Gaming Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mobile Gaming Market Share (%) by Company 2024

List of Tables

- Table 1: Mobile Gaming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 3: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 4: Mobile Gaming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: South Korea Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Peru Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Saudi Arabia Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 27: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 28: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 32: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 33: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Germany Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: United Kingdom Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Italy Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 39: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 40: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 46: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 47: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Brazil Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Mexico Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Peru Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 52: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 53: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Mobile Gaming Market Revenue Million Forecast, by Monetization Type 2019 & 2032

- Table 55: Mobile Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 56: Mobile Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Saudi Arabia Mobile Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Gaming Market?

The projected CAGR is approximately 10.39%.

2. Which companies are prominent players in the Mobile Gaming Market?

Key companies in the market include Zynga Inc, Electronic Arts Inc, NetEase Inc, Rovio Entertainment Corporation, Kabam Games Inc, Activision Blizzard Inc, GungHo Online Entertainment Inc ( SoftBank Group), Tencent Holdings Limited, Nintendo Co Ltd, NCsoft Corporation.

3. What are the main segments of the Mobile Gaming Market?

The market segments include Monetization Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 100.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration; Growth in Cloud Adoption.

6. What are the notable trends driving market growth?

Increasing Smartphone Penetration is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

User Privacy and Security Issues Along with Government Regulations.

8. Can you provide examples of recent developments in the market?

May 2024: Pudgy Penguins, the brand development company known for its globally recognized Pudgy Penguins characters, partnered with the next-generation gaming technology studio Mythical Games to co-create an innovative mobile video game with web3 capabilities. The partnership brought together the creators of the widely acclaimed Pudgy Penguins characters and the gaming studio responsible for two of the blockchain's most successful games: NFL Rivals and Blankos Block Party.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Gaming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Gaming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Gaming Market?

To stay informed about further developments, trends, and reports in the Mobile Gaming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence