Key Insights

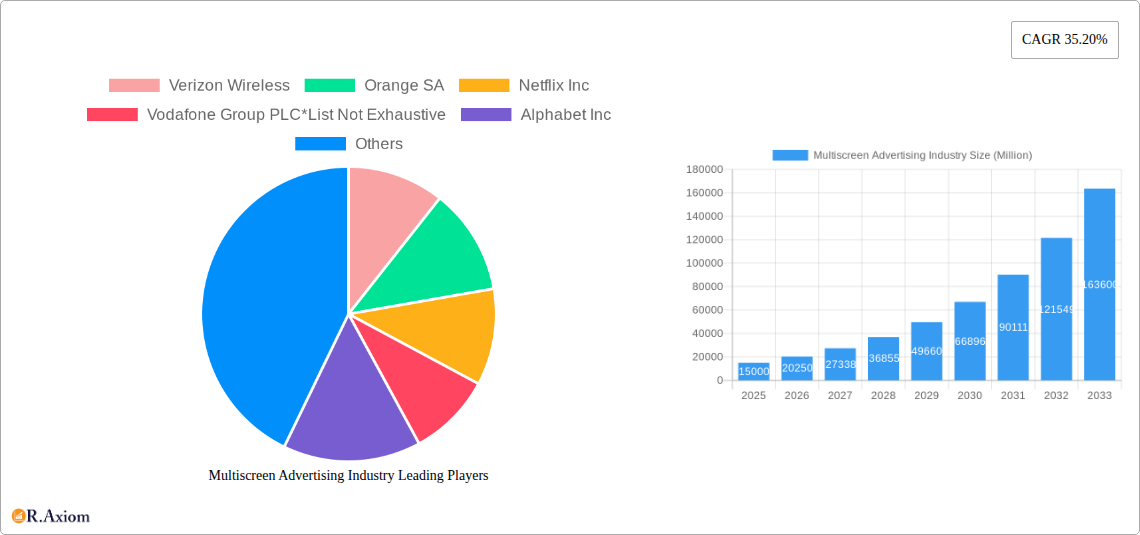

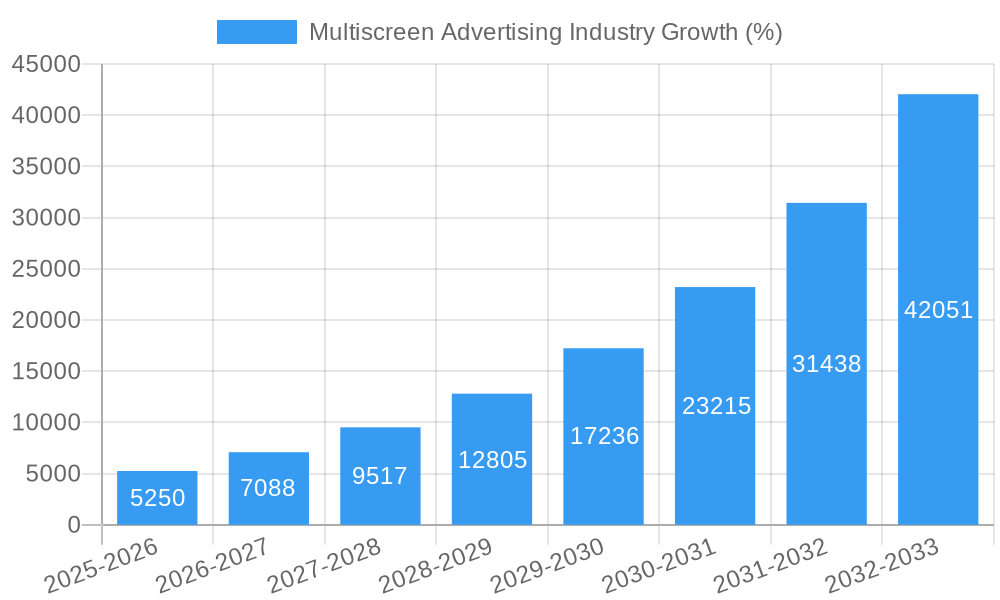

The multiscreen advertising industry is experiencing explosive growth, fueled by the proliferation of connected devices and the increasing consumption of digital media across various platforms. With a Compound Annual Growth Rate (CAGR) of 35.20% from 2019 to 2024, the market demonstrates significant potential. This expansion is driven by several key factors: the rise of streaming services, which necessitate innovative advertising strategies; the increasing sophistication of programmatic advertising, allowing for targeted and personalized campaigns; and the growing adoption of interactive ad formats that engage viewers more effectively. The segmentation of the market into static, dynamic, and interactive content, coupled with platform diversification across television, desktops/laptops, mobile/tablets, gaming consoles, and other platforms, reveals diverse opportunities for advertisers and media companies alike. Major players like Verizon, Netflix, and Google are heavily invested, further solidifying the industry's prominence.

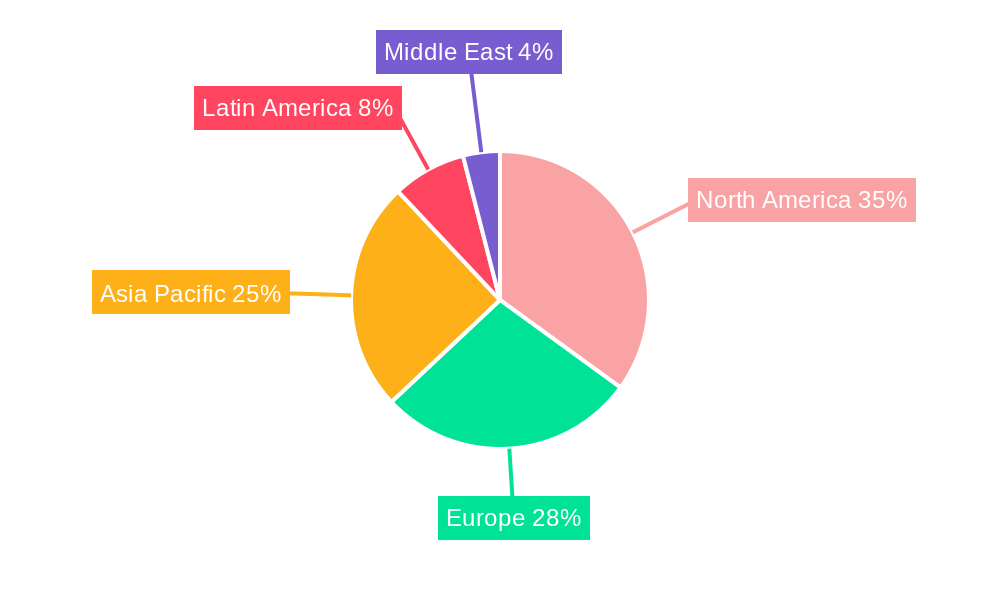

The forecast period (2025-2033) suggests continued substantial growth. While precise figures for the market size are unavailable, a logical estimation, considering the existing CAGR and the intensifying competition and technological advancements, points to a consistently expanding market. The competitive landscape features both established telecommunication giants and specialized streaming platforms, leading to continuous innovation and strategic partnerships. Geographic expansion, particularly in emerging markets within Asia-Pacific and Latin America, contributes significantly to the overall growth. Restraining factors include concerns about ad blocking, data privacy regulations, and the need for consistent measurement and attribution across diverse platforms. However, these challenges are likely to be overcome through industry collaboration and technological advancements, ensuring the continued ascendancy of multiscreen advertising in the coming years.

Multiscreen Advertising Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the multiscreen advertising industry, encompassing market size, segmentation, growth drivers, challenges, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report leverages extensive primary and secondary research to deliver actionable insights for industry stakeholders, including major players like Verizon Wireless, Orange SA, Netflix Inc, Vodafone Group PLC, Alphabet Inc, NTT DoCoMo Inc, Microsoft Corporation, Roku Inc, Sky Mobile, and AT&T Inc. (List not exhaustive). The market is segmented by content type (Static, Dynamic, Interactive) and platform (Television, Desktop/Laptop, Mobile/Tablet, Gaming Consoles, Other Platforms). The report projects a market value of xx Million by 2033.

Multiscreen Advertising Industry Market Concentration & Innovation

The multiscreen advertising market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. For instance, Alphabet Inc. and Meta Platforms, Inc. (formerly Facebook) control a substantial portion of the digital advertising segment. However, the increasing number of niche players and innovative technologies are leading to fragmentation. Market share data for 2025 estimates Alphabet Inc. at approximately 25% and Meta at approximately 20%, while the remainder is distributed among other players. Innovation is driven by advancements in programmatic advertising, AI-powered targeting, and the rise of connected TV (CTV) advertising. Regulatory frameworks, such as GDPR and CCPA, are significantly impacting data privacy and ad targeting. The emergence of ad blockers and alternative advertising models pose challenges as substitutes. End-user trends toward personalized and engaging ad experiences are shaping the industry's evolution. M&A activities are frequent, with deal values exceeding xx Million annually in recent years. Examples include [Insert example of an M&A deal with deal value, if available, otherwise replace with "xx Million deal example pending"]. This trend is expected to continue as larger players consolidate their market positions and smaller companies seek strategic partnerships.

Multiscreen Advertising Industry Industry Trends & Insights

The multiscreen advertising industry is experiencing robust growth, fueled by several key factors. The increasing penetration of smartphones and smart TVs, coupled with rising internet usage, is driving the expansion of the market. The shift towards connected TV (CTV) advertising is witnessing a CAGR of approximately xx% during the forecast period (2025-2033). This growth is primarily attributed to the increasing availability of OTT platforms and the enhanced targeting capabilities of CTV advertising. Technological advancements, such as AI and machine learning, are enhancing ad personalization and effectiveness. Consumers are increasingly demanding personalized ad experiences, leading to a shift away from traditional banner ads towards interactive and video formats. The competitive landscape is characterized by intense rivalry among established players and emerging startups. Market penetration of programmatic advertising is expected to reach xx% by 2033, indicating its growing dominance. However, challenges such as ad fraud and brand safety concerns remain. The overall market is projected to witness a CAGR of xx% during the forecast period, reaching a value of xx Million by 2033.

Dominant Markets & Segments in Multiscreen Advertising Industry

The North American region currently dominates the multiscreen advertising market, driven by high internet penetration, strong consumer spending, and advanced technological infrastructure. Within this region, the United States holds the largest market share. Key drivers include robust economic policies that foster technological advancement and a well-established digital advertising ecosystem.

By Type of Content: Dynamic advertising is the most dominant segment due to its ability to personalize ad content and engagement. Interactive advertising is growing rapidly, with increasing adoption of gamified ads and interactive video ads.

By Platform: Mobile/Tablet advertising holds the largest market share, given the widespread adoption of mobile devices and high user engagement. However, Television and CTV advertising are experiencing rapid growth, driven by higher viewership and the availability of advanced targeting options. Gaming consoles present a rapidly growing yet niche market characterized by high audience engagement and potential for immersive advertising.

This dominance is likely to persist throughout the forecast period, although the growth rates of other regions, particularly in Asia-Pacific and Europe, are expected to be significantly higher. Factors such as growing internet and smartphone penetration, and increasing digital literacy in these regions are key drivers.

Multiscreen Advertising Industry Product Developments

Recent product innovations in the multiscreen advertising industry focus heavily on enhancing user experience and improving targeting capabilities. The increased adoption of programmatic advertising, coupled with advancements in data analytics and AI-powered solutions, allows advertisers to deliver highly targeted and personalized ads across various screens. Interactive video formats, augmented reality (AR) ads, and gamified ad experiences are gaining traction, offering improved engagement and brand recall. These innovations are not only catering to evolving consumer preferences but also address the need for greater ad transparency and accountability. The focus is on delivering a seamless and unified ad experience across devices while ensuring brand safety and respecting user privacy.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the multiscreen advertising market based on the following segmentations:

By Type of Content:

Static: This segment includes traditional banner ads and static image ads, offering straightforward advertising but with limited engagement potential. Growth is expected to remain stable but comparatively lower than dynamic and interactive segments.

Dynamic: This encompasses ads that change or adapt based on user data, offering personalized experiences. This segment is experiencing the highest growth rate.

Interactive: This involves ads that allow user interaction, driving higher engagement. This is a high-growth segment, driven by technological innovation.

By Platform:

Television: This includes traditional TV advertising and emerging CTV advertising. The segment shows strong growth, especially in CTV.

Desktop/Laptop: This segment remains significant, though its growth is slower compared to mobile.

Mobile/Tablet: This is the largest and fastest-growing segment, due to high device penetration and usage.

Gaming Consoles: This is a niche but rapidly expanding segment, with high user engagement.

Other Platforms: This includes smart speakers, wearables, and other connected devices. This segment presents substantial emerging opportunities.

Key Drivers of Multiscreen Advertising Industry Growth

The multiscreen advertising industry’s growth is primarily driven by:

Technological advancements: AI, machine learning, and big data analytics enable highly targeted and personalized advertising.

Rising smartphone and internet penetration: Increased access to the internet and mobile devices fuels advertising opportunities.

Growth of OTT platforms and connected TVs (CTV): The expansion of streaming services provides new advertising inventory.

Changing consumer preferences: Consumers demand engaging and personalized ad experiences.

Challenges in the Multiscreen Advertising Industry Sector

The industry faces several challenges, including:

Ad fraud and brand safety concerns: Fake clicks and inappropriate ad placements negatively impact campaigns. Estimated annual losses due to ad fraud amount to xx Million.

Data privacy regulations: GDPR, CCPA, and other regulations restrict data usage, affecting targeting.

Increased competition: The market is highly competitive, with numerous players vying for market share.

Ad blocking technologies: Consumers utilize ad blockers, leading to reduced ad visibility.

Emerging Opportunities in Multiscreen Advertising Industry

Emerging opportunities include:

Expansion into new markets: Untapped potential exists in developing economies.

Adoption of advanced technologies: AR/VR, blockchain, and metaverse advertising offer innovative formats.

Growth of addressable TV advertising: Targeted advertising on TV expands reach and effectiveness.

Leading Players in the Multiscreen Advertising Industry Market

- Verizon Wireless

- Orange SA

- Netflix Inc

- Vodafone Group PLC

- Alphabet Inc

- NTT DoCoMo Inc

- Microsoft Corporation

- Roku Inc

- Sky Mobile

- AT&T Inc

Key Developments in Multiscreen Advertising Industry Industry

- 2022-Q4: Increased investment in CTV advertising by major players.

- 2023-Q1: Launch of new interactive ad formats by several technology companies.

- 2023-Q2: Significant merger between two prominent ad tech companies (xx Million deal).

Strategic Outlook for Multiscreen Advertising Industry Market

The future of the multiscreen advertising industry is bright. The convergence of multiple screens, coupled with rapid technological advancements and changing consumer behavior, presents significant growth opportunities. Focus on personalized, engaging, and transparent advertising experiences will be crucial for success. The industry will witness continued innovation in ad formats, targeting techniques, and measurement methodologies. Companies that successfully adapt to evolving consumer preferences and regulatory frameworks will be best positioned for long-term growth and profitability. The market's potential is vast, promising significant returns for companies that invest strategically in research and development, talent acquisition, and innovative marketing solutions.

Multiscreen Advertising Industry Segmentation

-

1. Type of Content

- 1.1. Static

- 1.2. Dynamic

- 1.3. Interactive

-

2. Platform

- 2.1. Television

- 2.2. Desktop/Laptop

- 2.3. Mobile/Tablet

- 2.4. Gaming Consoles

- 2.5. Other Platforms

Multiscreen Advertising Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Multiscreen Advertising Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 35.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Shifting Trends Towards Mobile Media Consumption; Ability to Target Relevant or Personalized Ads

- 3.3. Market Restrains

- 3.3.1. ; Intrusive Nature of Ads on User Experience; Rising Adoption of Ad-blockers on Devices

- 3.4. Market Trends

- 3.4.1. Mobile/Tablet Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Content

- 5.1.1. Static

- 5.1.2. Dynamic

- 5.1.3. Interactive

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Television

- 5.2.2. Desktop/Laptop

- 5.2.3. Mobile/Tablet

- 5.2.4. Gaming Consoles

- 5.2.5. Other Platforms

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Content

- 6. North America Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Content

- 6.1.1. Static

- 6.1.2. Dynamic

- 6.1.3. Interactive

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Television

- 6.2.2. Desktop/Laptop

- 6.2.3. Mobile/Tablet

- 6.2.4. Gaming Consoles

- 6.2.5. Other Platforms

- 6.1. Market Analysis, Insights and Forecast - by Type of Content

- 7. Europe Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Content

- 7.1.1. Static

- 7.1.2. Dynamic

- 7.1.3. Interactive

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Television

- 7.2.2. Desktop/Laptop

- 7.2.3. Mobile/Tablet

- 7.2.4. Gaming Consoles

- 7.2.5. Other Platforms

- 7.1. Market Analysis, Insights and Forecast - by Type of Content

- 8. Asia Pacific Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Content

- 8.1.1. Static

- 8.1.2. Dynamic

- 8.1.3. Interactive

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Television

- 8.2.2. Desktop/Laptop

- 8.2.3. Mobile/Tablet

- 8.2.4. Gaming Consoles

- 8.2.5. Other Platforms

- 8.1. Market Analysis, Insights and Forecast - by Type of Content

- 9. Latin America Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Content

- 9.1.1. Static

- 9.1.2. Dynamic

- 9.1.3. Interactive

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Television

- 9.2.2. Desktop/Laptop

- 9.2.3. Mobile/Tablet

- 9.2.4. Gaming Consoles

- 9.2.5. Other Platforms

- 9.1. Market Analysis, Insights and Forecast - by Type of Content

- 10. Middle East Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Content

- 10.1.1. Static

- 10.1.2. Dynamic

- 10.1.3. Interactive

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Television

- 10.2.2. Desktop/Laptop

- 10.2.3. Mobile/Tablet

- 10.2.4. Gaming Consoles

- 10.2.5. Other Platforms

- 10.1. Market Analysis, Insights and Forecast - by Type of Content

- 11. North America Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Multiscreen Advertising Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Verizon Wireless

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Orange SA

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Netflix Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Vodafone Group PLC*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Alphabet Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 NTT DoCoMo Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Microsoft Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Roku Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Sky Mobile

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 AT&T Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Verizon Wireless

List of Figures

- Figure 1: Global Multiscreen Advertising Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Multiscreen Advertising Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Multiscreen Advertising Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Multiscreen Advertising Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Multiscreen Advertising Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Multiscreen Advertising Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Multiscreen Advertising Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Multiscreen Advertising Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Multiscreen Advertising Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Multiscreen Advertising Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Multiscreen Advertising Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Multiscreen Advertising Industry Revenue (Million), by Type of Content 2024 & 2032

- Figure 13: North America Multiscreen Advertising Industry Revenue Share (%), by Type of Content 2024 & 2032

- Figure 14: North America Multiscreen Advertising Industry Revenue (Million), by Platform 2024 & 2032

- Figure 15: North America Multiscreen Advertising Industry Revenue Share (%), by Platform 2024 & 2032

- Figure 16: North America Multiscreen Advertising Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Multiscreen Advertising Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Multiscreen Advertising Industry Revenue (Million), by Type of Content 2024 & 2032

- Figure 19: Europe Multiscreen Advertising Industry Revenue Share (%), by Type of Content 2024 & 2032

- Figure 20: Europe Multiscreen Advertising Industry Revenue (Million), by Platform 2024 & 2032

- Figure 21: Europe Multiscreen Advertising Industry Revenue Share (%), by Platform 2024 & 2032

- Figure 22: Europe Multiscreen Advertising Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Multiscreen Advertising Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Multiscreen Advertising Industry Revenue (Million), by Type of Content 2024 & 2032

- Figure 25: Asia Pacific Multiscreen Advertising Industry Revenue Share (%), by Type of Content 2024 & 2032

- Figure 26: Asia Pacific Multiscreen Advertising Industry Revenue (Million), by Platform 2024 & 2032

- Figure 27: Asia Pacific Multiscreen Advertising Industry Revenue Share (%), by Platform 2024 & 2032

- Figure 28: Asia Pacific Multiscreen Advertising Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Multiscreen Advertising Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Multiscreen Advertising Industry Revenue (Million), by Type of Content 2024 & 2032

- Figure 31: Latin America Multiscreen Advertising Industry Revenue Share (%), by Type of Content 2024 & 2032

- Figure 32: Latin America Multiscreen Advertising Industry Revenue (Million), by Platform 2024 & 2032

- Figure 33: Latin America Multiscreen Advertising Industry Revenue Share (%), by Platform 2024 & 2032

- Figure 34: Latin America Multiscreen Advertising Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Multiscreen Advertising Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Multiscreen Advertising Industry Revenue (Million), by Type of Content 2024 & 2032

- Figure 37: Middle East Multiscreen Advertising Industry Revenue Share (%), by Type of Content 2024 & 2032

- Figure 38: Middle East Multiscreen Advertising Industry Revenue (Million), by Platform 2024 & 2032

- Figure 39: Middle East Multiscreen Advertising Industry Revenue Share (%), by Platform 2024 & 2032

- Figure 40: Middle East Multiscreen Advertising Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Multiscreen Advertising Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Multiscreen Advertising Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Multiscreen Advertising Industry Revenue Million Forecast, by Type of Content 2019 & 2032

- Table 3: Global Multiscreen Advertising Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 4: Global Multiscreen Advertising Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Multiscreen Advertising Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Multiscreen Advertising Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Multiscreen Advertising Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Multiscreen Advertising Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Multiscreen Advertising Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Multiscreen Advertising Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Multiscreen Advertising Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Multiscreen Advertising Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Multiscreen Advertising Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Multiscreen Advertising Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Multiscreen Advertising Industry Revenue Million Forecast, by Type of Content 2019 & 2032

- Table 16: Global Multiscreen Advertising Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 17: Global Multiscreen Advertising Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Multiscreen Advertising Industry Revenue Million Forecast, by Type of Content 2019 & 2032

- Table 19: Global Multiscreen Advertising Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 20: Global Multiscreen Advertising Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Multiscreen Advertising Industry Revenue Million Forecast, by Type of Content 2019 & 2032

- Table 22: Global Multiscreen Advertising Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 23: Global Multiscreen Advertising Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Multiscreen Advertising Industry Revenue Million Forecast, by Type of Content 2019 & 2032

- Table 25: Global Multiscreen Advertising Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 26: Global Multiscreen Advertising Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Multiscreen Advertising Industry Revenue Million Forecast, by Type of Content 2019 & 2032

- Table 28: Global Multiscreen Advertising Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 29: Global Multiscreen Advertising Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Multiscreen Advertising Industry?

The projected CAGR is approximately 35.20%.

2. Which companies are prominent players in the Multiscreen Advertising Industry?

Key companies in the market include Verizon Wireless, Orange SA, Netflix Inc, Vodafone Group PLC*List Not Exhaustive, Alphabet Inc, NTT DoCoMo Inc, Microsoft Corporation, Roku Inc, Sky Mobile, AT&T Inc.

3. What are the main segments of the Multiscreen Advertising Industry?

The market segments include Type of Content, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Shifting Trends Towards Mobile Media Consumption; Ability to Target Relevant or Personalized Ads.

6. What are the notable trends driving market growth?

Mobile/Tablet Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; Intrusive Nature of Ads on User Experience; Rising Adoption of Ad-blockers on Devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Multiscreen Advertising Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Multiscreen Advertising Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Multiscreen Advertising Industry?

To stay informed about further developments, trends, and reports in the Multiscreen Advertising Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence