Key Insights

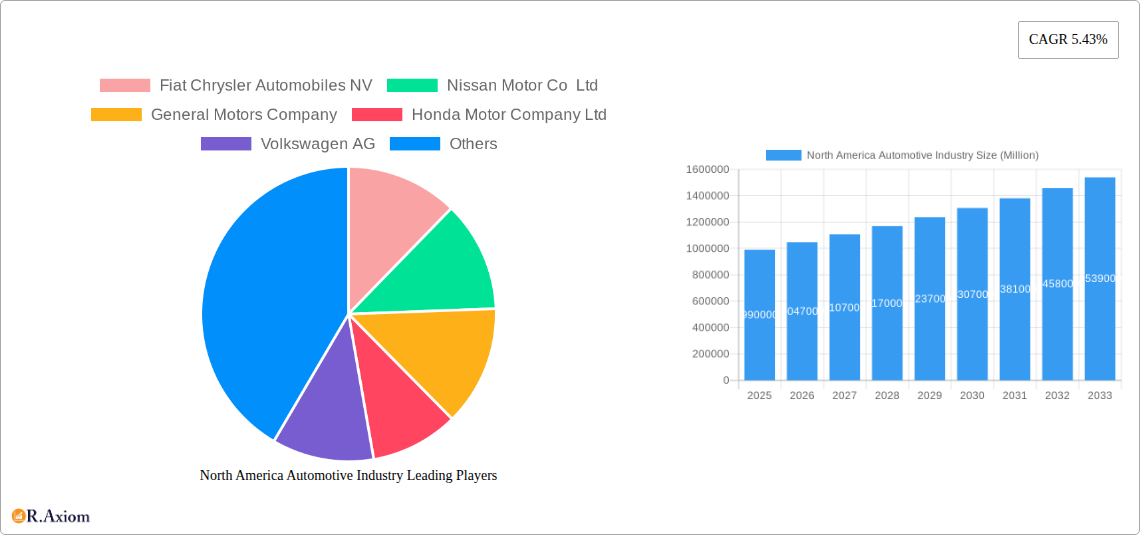

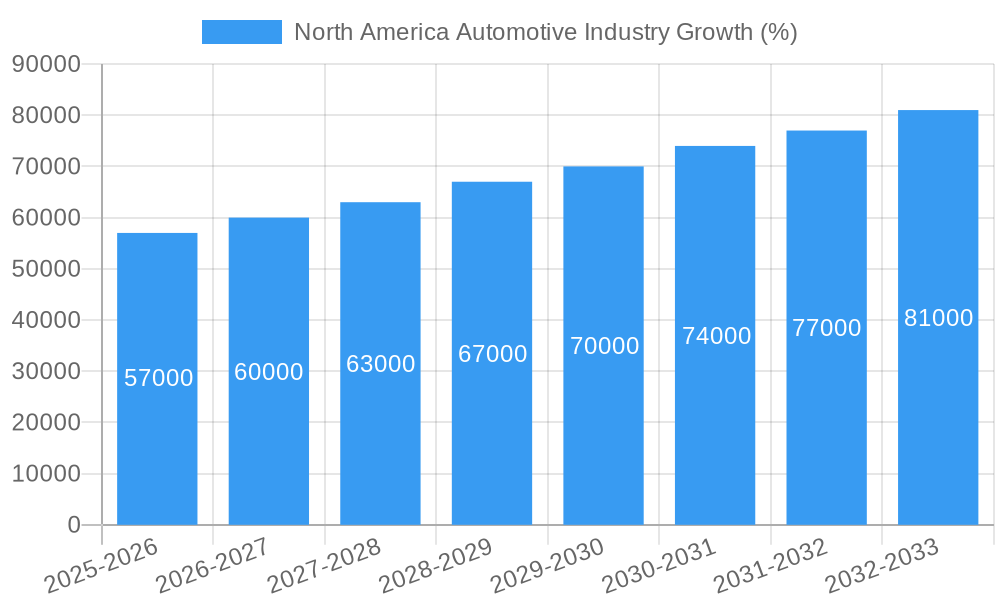

The North American automotive industry, valued at approximately $0.99 trillion in 2025, is projected to experience robust growth, driven by several key factors. A compound annual growth rate (CAGR) of 5.43% from 2025 to 2033 indicates a significant expansion of the market. This growth is fueled by increasing consumer demand for SUVs and light trucks, reflecting shifting preferences towards larger vehicles offering enhanced space and versatility. Technological advancements, such as the integration of advanced driver-assistance systems (ADAS) and the rise of electric vehicles (EVs), are also major contributors. Government incentives aimed at promoting EV adoption and stricter emission regulations are further stimulating innovation and market expansion within the sector. However, challenges remain, including the ongoing semiconductor chip shortage impacting production and supply chain disruptions causing delays and increased costs. Furthermore, fluctuating fuel prices and economic uncertainty can influence consumer purchasing decisions, potentially moderating growth in certain segments.

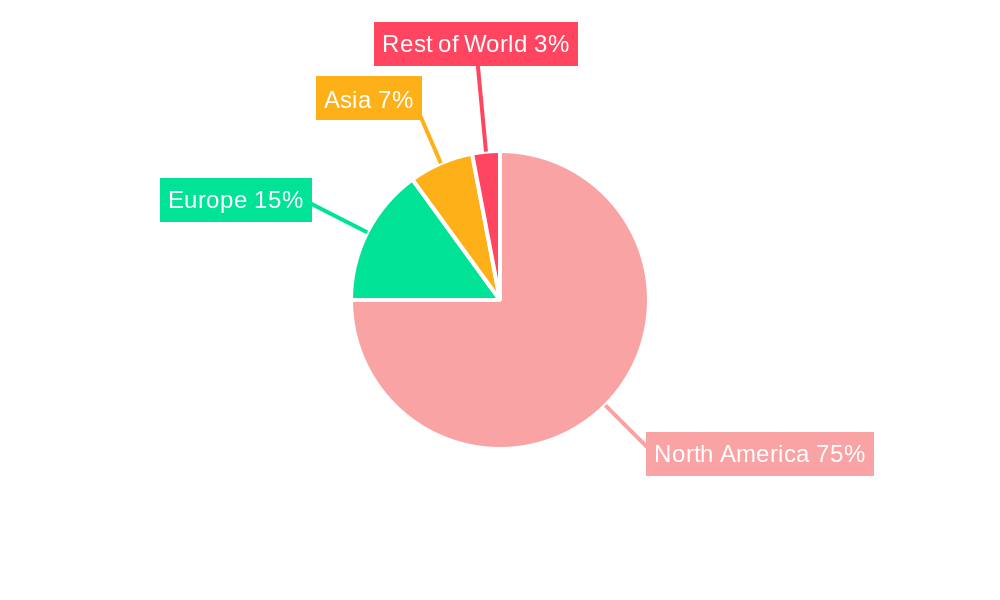

The segmentation within the North American automotive market reveals diverse growth trajectories. Passenger cars are expected to witness steady growth, albeit potentially slower than the overall market average, due to the increasing popularity of SUVs and trucks. The commercial vehicle segment, encompassing heavy-duty trucks and buses, is anticipated to benefit from robust infrastructure development and growth in e-commerce, driving demand for freight transportation. The light commercial vehicle segment, particularly two-wheelers, will experience a moderate growth, influenced by factors such as urban mobility solutions and rising fuel costs. Key players, including established automakers like Ford, GM, and Toyota, alongside emerging EV manufacturers like Tesla, are strategically positioning themselves to capitalize on these market trends. Competition is intense, necessitating continuous innovation and adaptation to changing consumer preferences and technological advancements. The North American market, particularly the United States, Canada, and Mexico, represents a significant portion of global automotive sales, making it a highly attractive and competitive landscape.

North America Automotive Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American automotive industry, covering market size, segmentation, key players, trends, and future prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, suppliers, investors, and policymakers.

North America Automotive Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the North American automotive industry, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a moderate level of concentration, with a few dominant players and a large number of smaller players.

- Market Share: General Motors, Ford, and Stellantis (formerly Fiat Chrysler Automobiles NV) hold a significant portion of the market share, though the exact figures fluctuate yearly. Tesla's market share in the electric vehicle segment is rapidly increasing. Other major players, including Toyota, Honda, and Volkswagen, also hold substantial market share, contributing to a complex competitive dynamics. Precise market share data for 2024 is xx Million and expected to be xx Million in 2025.

- Innovation Drivers: The industry is driven by technological advancements, particularly in electric vehicles (EVs), autonomous driving, and connected car technologies. Government regulations promoting fuel efficiency and emission reduction further propel innovation.

- Regulatory Frameworks: Stringent emission standards, safety regulations, and fuel economy mandates significantly influence industry strategies. These regulations are pushing the adoption of EVs and alternative fuel vehicles.

- Product Substitutes: Public transportation, ride-sharing services, and bicycles are emerging as potential substitutes, particularly in urban areas. This shift in consumer preferences influences vehicle demand.

- End-User Trends: A growing preference for SUVs and crossovers, along with increased demand for fuel-efficient and environmentally friendly vehicles, is shaping the industry’s trajectory.

- M&A Activities: The automotive industry has seen significant M&A activity in recent years, with deal values reaching into the billions. These activities are driven by consolidation efforts, technological advancements, and access to new markets. The total value of M&A deals in 2024 is estimated at xx Million, showing a xx% growth compared to the previous year.

North America Automotive Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the North American automotive industry. Market growth is driven by several factors, including rising disposable incomes, population growth, and urbanization. Technological disruptions, particularly the rise of EVs and autonomous vehicles, are transforming the industry. Consumer preferences are shifting towards SUVs, crossovers, and electric vehicles. The competitive landscape is intense, with established players facing challenges from new entrants and disruptive technologies. The Compound Annual Growth Rate (CAGR) for the industry during the forecast period (2025-2033) is projected to be xx%, driven by factors such as increasing demand for electric and autonomous vehicles and expanding infrastructure supporting these technologies. Market penetration of EVs is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in North America Automotive Industry

The United States remains the dominant market in North America, owing to its large population, high disposable incomes, and well-developed automotive infrastructure. California, Texas, and Florida are key states within the US market showing consistently high demand. The passenger car segment currently holds the largest market share, but the light commercial vehicle segment is anticipated to experience significant growth in the coming years. Two-wheelers have a significant market share with considerable potential in urban areas.

- Key Drivers:

- Economic Policies: Government incentives for EV adoption and infrastructure development are driving growth in related segments.

- Infrastructure: The expansion of charging stations and supporting infrastructure are vital for EV market penetration.

- Consumer Preferences: The growing preference for SUVs, crossovers, and fuel-efficient vehicles is significantly impacting market dynamics.

North America Automotive Industry Product Developments

The automotive industry is witnessing rapid product innovation, driven by technological advancements. Electric vehicles (EVs), autonomous driving features, and advanced driver-assistance systems (ADAS) are key areas of focus. Companies are continuously seeking to enhance vehicle connectivity, infotainment systems, and safety features to meet evolving consumer demands. The market is also seeing an increase in the development of light commercial vehicles focusing on efficiency and sustainability.

Report Scope & Segmentation Analysis

This report segments the North American automotive market by vehicle type: passenger cars, commercial vehicles, and light commercial vehicles (including two-wheelers).

- Passenger Cars: This segment is further segmented by vehicle type (sedan, SUV, crossover, etc.) and powertrain (gasoline, diesel, hybrid, electric). The market is expected to grow at a CAGR of xx% during the forecast period. Competition is intense, with numerous established and emerging players.

- Commercial Vehicles: This segment encompasses heavy-duty trucks, buses, and other commercial vehicles. The market is projected to grow at a CAGR of xx% due to increasing freight transportation and infrastructure development.

- Light Commercial Vehicles (Including Two-Wheelers): This segment includes pickups, vans, and two-wheelers (motorcycles, scooters). It is expected to grow at a CAGR of xx% during the forecast period, driven by urbanization and the rise of e-commerce deliveries.

Key Drivers of North America Automotive Industry Growth

Several factors are driving the growth of the North American automotive industry. These include technological advancements in electric and autonomous vehicles, supportive government policies, and rising disposable incomes. The expanding infrastructure for charging stations is essential to boosting EV sales. The increasing demand for comfortable, technologically advanced vehicles is a significant growth driver. Furthermore, growth in light commercial vehicles is driven by booming e-commerce and last-mile delivery services.

Challenges in the North America Automotive Industry Sector

The North American automotive industry faces various challenges, including supply chain disruptions, semiconductor shortages, rising raw material costs, and intense competition. Stringent environmental regulations and the rising cost of compliance add to these challenges. The impact of these challenges on profitability and production capacity is significant, potentially affecting the industry's overall growth in the short-term. The total estimated financial impact of these challenges in 2024 was xx Million.

Emerging Opportunities in North America Automotive Industry

The North American automotive market offers several emerging opportunities. The growth of electric and autonomous vehicles presents substantial potential for innovation and investment. The increasing demand for connected car technologies and the expansion of mobility services create further avenues for growth. The development of sustainable and efficient automotive solutions aligns with environmental concerns, providing significant opportunities.

Leading Players in the North America Automotive Industry Market

- Stellantis (formerly Fiat Chrysler Automobiles NV)

- Nissan Motor Co Ltd

- General Motors Company

- Honda Motor Company Ltd

- Volkswagen AG

- Daimler AG

- Hyundai Motor Company

- BMW AG

- Tesla Inc

- Groupe Renault

- Harley-Davidson

- Toyota Motor Corporation

- Yamaha Motor Co Ltd

- Ford Motor Company

Key Developments in North America Automotive Industry Industry

- July 2022: Cadillac unveiled the Celestiq show car, showcasing the brand's commitment to handcrafted, all-electric vehicles. This highlights the shift towards luxury electric vehicles.

- July 2022: Amazon's deployment of Rivian electric delivery vehicles signifies the growing adoption of EVs in the logistics sector and strengthens the demand for electric commercial vehicles.

- January 2022: Tesla's nickel supply agreement with Talon Metals Corp. underscores the importance of securing battery material supply chains for the sustainable production of electric vehicles.

Strategic Outlook for North America Automotive Industry Market

The North American automotive industry is poised for significant growth in the coming years. The ongoing shift towards electric and autonomous vehicles, coupled with supportive government policies and expanding infrastructure, presents considerable opportunities. Companies that can adapt to these changes and embrace innovation will be well-positioned to succeed. The focus on sustainability and the development of new mobility solutions will continue to shape the industry's strategic direction.

North America Automotive Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

-

1.2. Commercial Vehicles

- 1.2.1. Medium and Heavy Commercial Vehicles

- 1.2.2. Light Commercial Vehicles

- 1.3. Two-Wheelers

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Automotive Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. Rising Electric Mobility to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.2.1. Medium and Heavy Commercial Vehicles

- 5.1.2.2. Light Commercial Vehicles

- 5.1.3. Two-Wheelers

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States North America Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.1.2.1. Medium and Heavy Commercial Vehicles

- 6.1.2.2. Light Commercial Vehicles

- 6.1.3. Two-Wheelers

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Canada North America Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.1.2.1. Medium and Heavy Commercial Vehicles

- 7.1.2.2. Light Commercial Vehicles

- 7.1.3. Two-Wheelers

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Rest of North America North America Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.1.2.1. Medium and Heavy Commercial Vehicles

- 8.1.2.2. Light Commercial Vehicles

- 8.1.3. Two-Wheelers

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. United States North America Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Fiat Chrysler Automobiles NV

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nissan Motor Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 General Motors Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Honda Motor Company Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Volkswagen AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Daimler AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Hyundai Motor Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BMW AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Tesla Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Groupe Renault

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Harley-Davidson

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Toyota Motor Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Yamaha Motor Co Ltd*List Not Exhaustive

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Ford Motor Company

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Fiat Chrysler Automobiles NV

List of Figures

- Figure 1: North America Automotive Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Automotive Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Automotive Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Automotive Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: North America Automotive Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Automotive Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Automotive Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Automotive Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: North America Automotive Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Automotive Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: North America Automotive Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Automotive Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: North America Automotive Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Industry?

The projected CAGR is approximately 5.43%.

2. Which companies are prominent players in the North America Automotive Industry?

Key companies in the market include Fiat Chrysler Automobiles NV, Nissan Motor Co Ltd, General Motors Company, Honda Motor Company Ltd, Volkswagen AG, Daimler AG, Hyundai Motor Company, BMW AG, Tesla Inc, Groupe Renault, Harley-Davidson, Toyota Motor Corporation, Yamaha Motor Co Ltd*List Not Exhaustive, Ford Motor Company.

3. What are the main segments of the North America Automotive Industry?

The market segments include Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

Rising Electric Mobility to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

July 2022: Cadillac unveiled the Celestiq show car, a vision of innovation that previews the brand's future handcrafted and all-electric flagship sedan. The Ultium-based electric show car previews some of the materials, innovative technologies, and hand-crafted attention to detail harnessed to express Cadillac's vision for the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Industry?

To stay informed about further developments, trends, and reports in the North America Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence