Key Insights

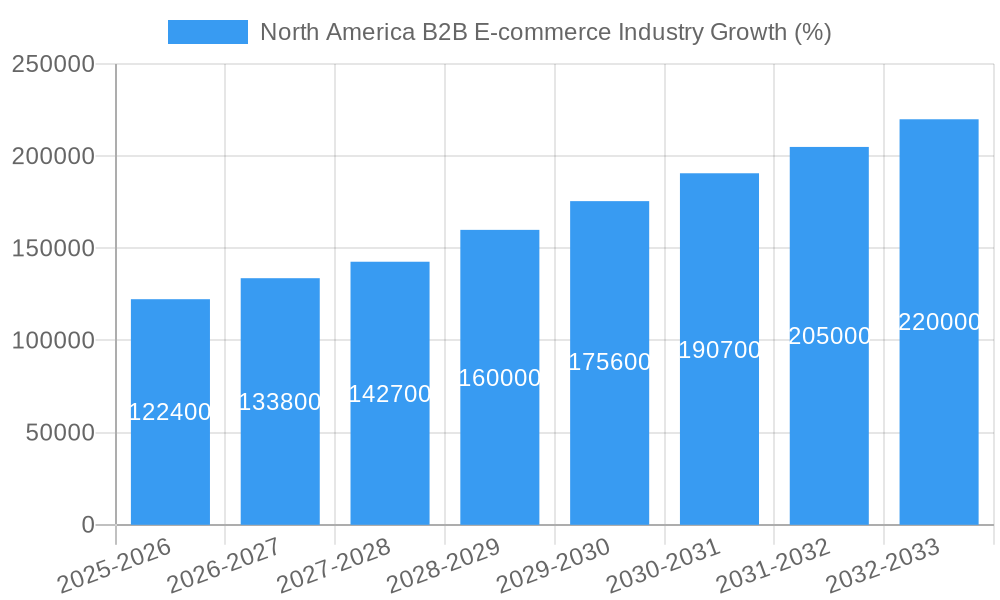

The North American B2B e-commerce market is experiencing robust growth, driven by the increasing adoption of digital technologies by businesses and the inherent advantages of online marketplaces. The market's expansion is fueled by several key factors: a rising preference for streamlined procurement processes, the ability to access a wider supplier base, enhanced inventory management capabilities, and the need for greater cost efficiencies. Businesses are increasingly embracing e-commerce platforms to improve operational effectiveness, expand their reach, and respond quickly to evolving market demands. While the exact market size for 2025 is not provided, considering a CAGR of 10.20% and a stated market size (XX) at a later point in the study period, a reasonable estimation for 2025 could be placed within the range of $1 trillion to $1.5 trillion. This estimation considers the rapid digital transformation within various industries and strong growth across segments.

The market is segmented by sales channel, with both direct sales and marketplace sales contributing significantly. Marketplace platforms like Amazon Business, Alibaba, and others offer advantages in terms of reach and streamlined operations. However, direct sales remain vital for businesses with established customer relationships and specialized product offerings. Regional analysis, focusing on North America (United States, Canada, Mexico, and Rest of North America), shows a high concentration of activity in the United States, driven by its robust economy and established digital infrastructure. The continued expansion of high-speed internet access and the increasing adoption of mobile commerce are expected to further accelerate growth across all segments throughout the forecast period (2025-2033). While challenges remain, such as the need for robust cybersecurity measures and ensuring seamless integration with existing business systems, the overall outlook for North American B2B e-commerce remains exceedingly positive.

North America B2B E-commerce Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the North American B2B e-commerce industry, covering market size, growth drivers, key players, emerging trends, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market.

North America B2B E-commerce Industry Market Concentration & Innovation

The North American B2B e-commerce landscape is characterized by a mix of established giants and emerging players. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller companies compete in niche segments. Innovation is a key driver, fueled by advancements in technologies like AI, machine learning, and blockchain, improving supply chain efficiency and personalization. Regulatory frameworks, such as data privacy regulations (e.g., CCPA, GDPR), significantly impact operations. Product substitutes, including traditional offline channels and alternative online platforms, exert competitive pressure. End-user trends towards digital transformation and improved supply chain visibility are reshaping the market. Mergers and acquisitions (M&A) activity has been robust, with deal values exceeding xx Million in recent years, driving consolidation and expansion.

- Market Share: Amazon Business holds the largest market share (estimated at xx%), followed by Alibaba.com (xx%), and other players with significantly smaller shares.

- M&A Activity: Significant M&A activity was observed between 2019 and 2024, with a total deal value exceeding xx Million. These deals focused on expanding market reach, acquiring technology, and strengthening supply chain capabilities.

North America B2B E-commerce Industry Industry Trends & Insights

The North American B2B e-commerce market exhibits robust growth, driven by the increasing adoption of digital technologies by businesses of all sizes. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Market penetration is increasing as more businesses embrace online platforms for procurement and sales. Technological disruptions, such as the rise of mobile commerce and the integration of AI-powered tools, are reshaping customer experience and operational efficiency. Consumer preferences are shifting towards personalized experiences, seamless integration with existing systems, and enhanced security features. Competitive dynamics are intense, with players vying for market share through innovation, pricing strategies, and strategic partnerships.

Dominant Markets & Segments in North America B2B E-commerce Industry

The United States dominates the North American B2B e-commerce market, driven by strong economic conditions, advanced digital infrastructure, and a high density of businesses. Within the market, Marketplace Sales currently holds a larger share compared to Direct Sales, owing to the benefits of broader reach and reduced operational burden for sellers.

Key Drivers for Marketplace Sales Dominance:

- Ease of Access: Reduced barriers to entry for sellers.

- Wide Reach: Access to a vast pool of potential buyers.

- Established Trust: Leveraging the reputation of established platforms.

Key Drivers for Direct Sales Growth:

- Brand Control: Maintaining direct relationships with customers.

- Data Ownership: Collecting valuable customer data for marketing and insights.

- Pricing Flexibility: Direct control over pricing strategies.

The shift in dominance towards Marketplace Sales is expected to continue in the forecast period, though Direct Sales will witness steady growth.

North America B2B E-commerce Industry Product Developments

Recent product innovations have focused on enhancing user experience, improving supply chain management, and leveraging data analytics for improved decision-making. The integration of AI and machine learning is enabling personalized recommendations, predictive analytics, and automation of various processes. New applications are emerging in diverse sectors, such as manufacturing, healthcare, and retail. These developments provide significant competitive advantages, enabling businesses to streamline operations, improve efficiency, and gain insights to drive growth.

Report Scope & Segmentation Analysis

This report segments the North American B2B e-commerce market by Channel:

Direct Sales: This segment encompasses businesses selling directly to their customers through their own e-commerce platforms. The market is expected to experience a steady CAGR of xx% during 2025-2033, driven by the need for brand control and customer relationship management. Competitive dynamics are shaped by investments in technology and customer experience.

Marketplace Sales: This segment involves businesses selling their products on third-party platforms like Amazon Business and Alibaba.com. The segment is projected to have a CAGR of xx% from 2025-2033 due to the benefits of increased reach and reduced operational costs. Competition is fierce due to the large number of sellers.

Key Drivers of North America B2B E-commerce Industry Growth

Several factors contribute to the growth of the North American B2B e-commerce industry. Technological advancements, including improved e-commerce platforms and enhanced logistics, streamline transactions and delivery. Strong economic conditions across North America fuel business investment in technology and digital transformation. Favorable government policies and regulations fostering e-commerce adoption also play a significant role.

Challenges in the North America B2B E-commerce Industry Sector

The industry faces challenges, including high initial investment costs for e-commerce infrastructure and cybersecurity threats. Supply chain disruptions and logistical complexities can impact businesses, particularly during times of economic uncertainty. Intense competition among e-commerce players requires ongoing innovation and adaptation.

Emerging Opportunities in North America B2B E-commerce Industry

Several opportunities exist, including expanding into underserved niches, leveraging emerging technologies such as the Metaverse and Blockchain to enhance transparency and security in transactions. Growing cross-border e-commerce opens new markets and opportunities to cater to international clients. Personalized marketing strategies and improved customer service provide avenues to enhance customer retention and loyalty.

Leading Players in the North America B2B E-commerce Industry Market

- EC21 Inc

- Alibaba Group Holding Ltd

- DIYTrade com

- EWORLDTRADE Inc

- WEGOTRADE Inc

- Newegg Business Inc

- KOMPASS

- ASOS Marketplace Limited

- ThomasNet Inc

- BlueCart Inc

- Amazon com Inc (Amazon Business)

Key Developments in North America B2B E-commerce Industry Industry

December 2021: Alibaba.com launched the Alibaba.com Grants Program, providing USD 10,000 grants to 50 small businesses and offering access to digitalization resources. This boosted small business participation in B2B e-commerce.

March 2022: Xeeva partnered with Amazon Business, enabling seamless integration between Xeeva's procure-to-pay system and Amazon's marketplace. This streamlined procurement processes for Xeeva's clients, improving efficiency and potentially boosting Amazon Business's market share.

Strategic Outlook for North America B2B E-commerce Industry Market

The North American B2B e-commerce market is poised for continued growth, fueled by technological advancements, increasing digital adoption among businesses, and supportive economic conditions. Opportunities exist to expand market reach into underpenetrated segments and develop innovative solutions that address specific industry challenges. Companies that prioritize customer experience, leverage data analytics, and adapt to evolving technological trends will be well-positioned for success in this dynamic market.

North America B2B E-commerce Industry Segmentation

-

1. Channel

- 1.1. Direct Sales

- 1.2. Marketplace Sales

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Product

- 3.1. Hybrid seeds

- 3.2. Conventional seeds

North America B2B E-commerce Industry Segmentation By Geography

- 1. United States

- 2. Canada

North America B2B E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Digital Experience of Modern B2B Buyers; Digitalization of Retail Business to Online Operations; Rising Popularity of Specialized B2B Online Marketplace

- 3.3. Market Restrains

- 3.3.1. Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution

- 3.4. Market Trends

- 3.4.1. Popularity of Retail Business Operations Online to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America B2B E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Direct Sales

- 5.1.2. Marketplace Sales

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Hybrid seeds

- 5.3.2. Conventional seeds

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. United States North America B2B E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 6.1.1. Direct Sales

- 6.1.2. Marketplace Sales

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Hybrid seeds

- 6.3.2. Conventional seeds

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 7. Canada North America B2B E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 7.1.1. Direct Sales

- 7.1.2. Marketplace Sales

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Hybrid seeds

- 7.3.2. Conventional seeds

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 8. United States North America B2B E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 9. Canada North America B2B E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 10. Mexico North America B2B E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of North America North America B2B E-commerce Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 EC21 Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Alibaba Group Holding Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 DIYTrade com

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 EWORLDTRADE Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 WEGOTRADE Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Newegg Business Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 KOMPASS

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ASOS Marketplace Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ThomasNet Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BlueCart Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Amazon com Inc (Amazon Business)

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 EC21 Inc

List of Figures

- Figure 1: North America B2B E-commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America B2B E-commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: North America B2B E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America B2B E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America B2B E-commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 4: North America B2B E-commerce Industry Volume K Unit Forecast, by Channel 2019 & 2032

- Table 5: North America B2B E-commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America B2B E-commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: North America B2B E-commerce Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 8: North America B2B E-commerce Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 9: North America B2B E-commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America B2B E-commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: North America B2B E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America B2B E-commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States North America B2B E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America B2B E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada North America B2B E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America B2B E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America B2B E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America B2B E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America B2B E-commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America B2B E-commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: North America B2B E-commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 22: North America B2B E-commerce Industry Volume K Unit Forecast, by Channel 2019 & 2032

- Table 23: North America B2B E-commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: North America B2B E-commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 25: North America B2B E-commerce Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 26: North America B2B E-commerce Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 27: North America B2B E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America B2B E-commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: North America B2B E-commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 30: North America B2B E-commerce Industry Volume K Unit Forecast, by Channel 2019 & 2032

- Table 31: North America B2B E-commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: North America B2B E-commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 33: North America B2B E-commerce Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 34: North America B2B E-commerce Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 35: North America B2B E-commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America B2B E-commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America B2B E-commerce Industry?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the North America B2B E-commerce Industry?

Key companies in the market include EC21 Inc, Alibaba Group Holding Ltd, DIYTrade com, EWORLDTRADE Inc, WEGOTRADE Inc, Newegg Business Inc, KOMPASS, ASOS Marketplace Limited, ThomasNet Inc, BlueCart Inc, Amazon com Inc (Amazon Business).

3. What are the main segments of the North America B2B E-commerce Industry?

The market segments include Channel, Geography , Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Digital Experience of Modern B2B Buyers; Digitalization of Retail Business to Online Operations; Rising Popularity of Specialized B2B Online Marketplace.

6. What are the notable trends driving market growth?

Popularity of Retail Business Operations Online to Drive the Market.

7. Are there any restraints impacting market growth?

Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution.

8. Can you provide examples of recent developments in the market?

March 2022 - Xeeva announced a partnership with Amazon Business, allowing Xeeva's Procure to Pay customers the flexibility of using Amazon to search and order directly within the P2P purchasing environment. Xeeva customers would no longer need to exit the P2P solution for searching Amazon for competitive pricing. The collaboration will allow users to search Amazon directly inside the P2P solution with the simple click of a button and instantly add desired items to their Xeeva shopping cart.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America B2B E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America B2B E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America B2B E-commerce Industry?

To stay informed about further developments, trends, and reports in the North America B2B E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence