Key Insights

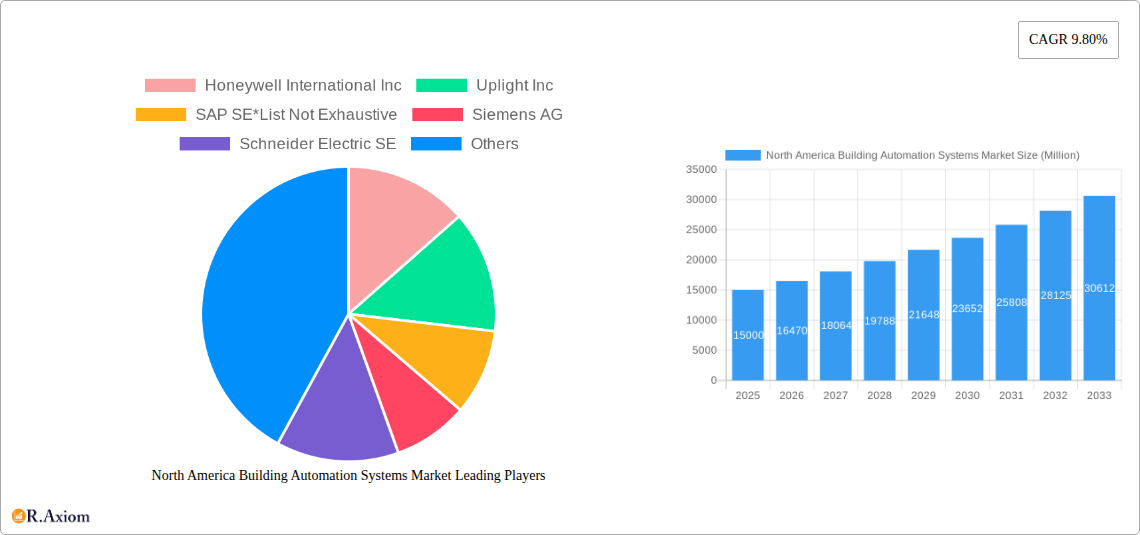

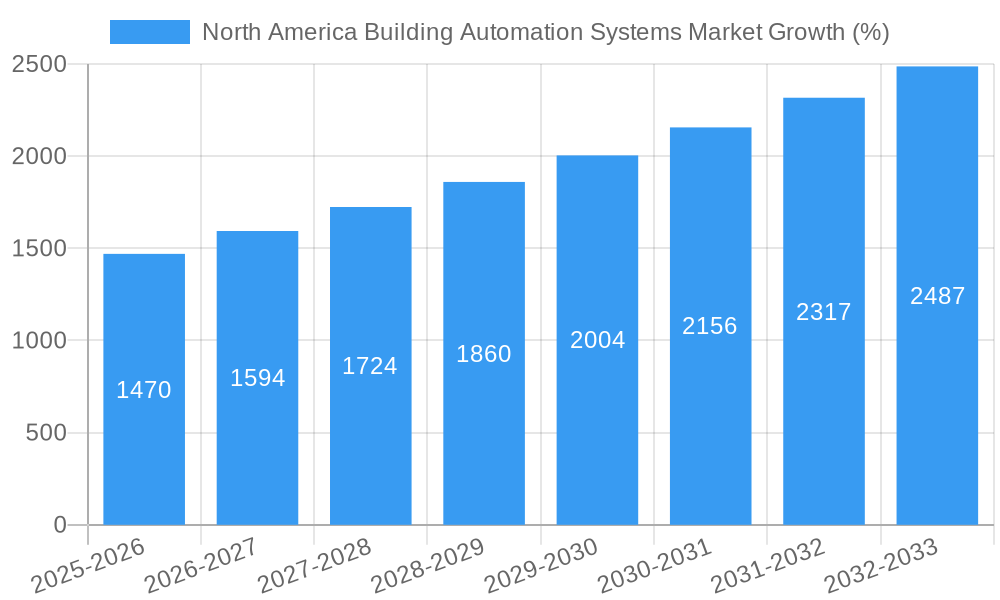

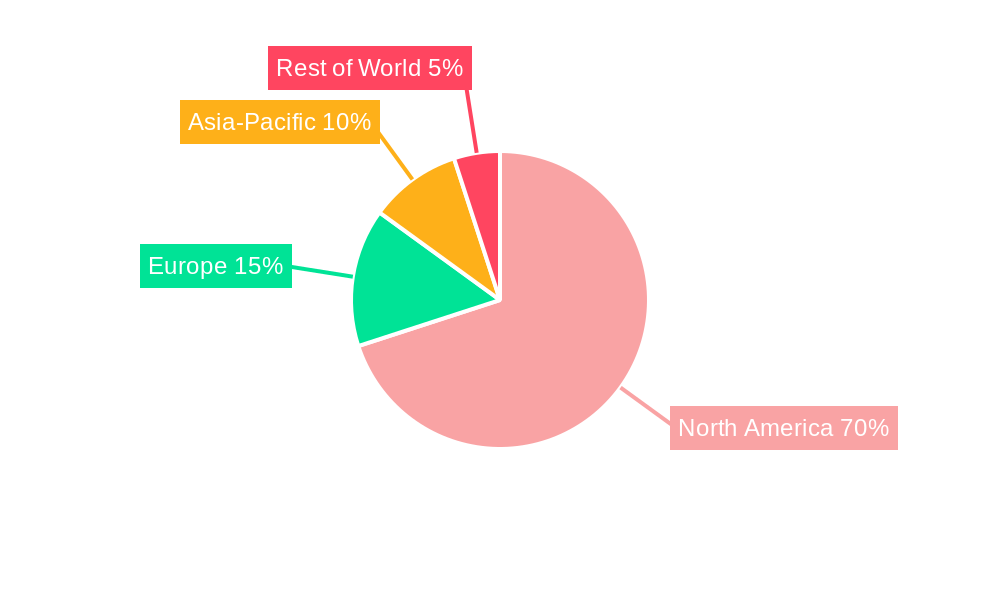

The North America Building Automation Systems (BAS) market, currently valued at approximately $XX million (assuming a logical estimation based on available data and industry averages for similar markets and considering the provided CAGR of 9.80%), is experiencing robust growth. Driven by increasing energy efficiency mandates, the rising adoption of smart building technologies, and the expanding need for improved operational efficiency across residential, commercial, and industrial sectors, the market is poised for significant expansion. Key growth drivers include the integration of IoT devices, advancements in cloud-based solutions offering remote monitoring and control, and the increasing demand for data-driven insights to optimize building performance. The market is segmented by component (hardware, software, and services), end-user (residential, commercial, and industrial), and geography (United States and Canada, with Mexico and the Rest of North America representing smaller yet growing segments). Competition is fierce, with established players like Honeywell International Inc., Johnson Controls International PLC, and Siemens AG vying for market share alongside emerging technology providers offering innovative solutions. The continued focus on sustainability and the decreasing cost of BAS technologies are expected to further fuel market expansion throughout the forecast period (2025-2033).

Despite this positive outlook, the market faces certain restraints. High initial investment costs for implementing comprehensive BAS solutions can be a barrier for smaller businesses or residential properties. Furthermore, concerns regarding data security and the complexities of integrating various systems from different vendors may impede widespread adoption. However, the long-term cost savings associated with energy efficiency improvements and optimized building operations are expected to outweigh these challenges, driving sustained market growth. The strong presence of major technology players and continued technological innovation suggest a positive outlook for the North American BAS market, with a projected CAGR of 9.80% potentially leading to substantial market expansion by 2033. The United States is expected to retain the largest market share due to its advanced infrastructure and significant investments in smart city initiatives.

North America Building Automation Systems Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the North America Building Automation Systems market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, encompassing historical data from 2019 to 2024. The report utilizes a robust methodology to assess market size, growth drivers, challenges, and opportunities, projecting a xx Million market value by 2033.

North America Building Automation Systems Market Market Concentration & Innovation

This section analyzes the competitive landscape of the North America Building Automation Systems market, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is moderately concentrated, with key players such as Honeywell International Inc, Johnson Control International PLC, and Siemens AG holding significant market share, estimated at xx%, xx%, and xx%, respectively, in 2025. However, the presence of numerous smaller players indicates a competitive environment.

Innovation is driven by increasing demand for energy efficiency, sustainability, and improved building performance. Regulatory frameworks, such as energy efficiency standards and building codes, significantly influence market growth. The emergence of smart building technologies and IoT solutions presents both opportunities and challenges for existing players. The adoption of cloud-based platforms and analytics is transforming the industry, leading to more efficient building management. Recent M&A activities, totaling an estimated xx Million in deal value in the last 5 years, reflect the strategic consolidation within the sector. Furthermore, the increasing adoption of smart building technologies is replacing traditional building automation systems, driving innovation and competition within the market.

North America Building Automation Systems Market Industry Trends & Insights

The North America Building Automation Systems market is experiencing robust growth, driven by several key factors. The increasing focus on energy efficiency and sustainability, coupled with stringent environmental regulations, is a significant driver. The rising adoption of smart building technologies and the Internet of Things (IoT) is transforming the industry. Technological advancements such as AI, machine learning, and cloud computing are enabling sophisticated building management systems, improving operational efficiency and reducing energy consumption. The market is characterized by a high CAGR of xx% during the forecast period (2025-2033), reaching a projected xx Million market value in 2033. The penetration of smart building systems in commercial buildings is steadily increasing. Consumer preferences are shifting towards sustainable and technologically advanced solutions, furthering market growth. Competitive dynamics are shaped by technological innovation, pricing strategies, and strategic partnerships.

Dominant Markets & Segments in North America Building Automation Systems Market

By Country: The United States dominates the North American market, accounting for approximately xx% of the total market value in 2025 due to its large commercial building stock and higher adoption rate of smart building technologies. Canada, although smaller, is also experiencing significant growth driven by government initiatives and investments in green building infrastructure.

By Component: The hardware segment currently holds the largest share of the market, primarily due to high initial investments in infrastructure and systems. However, the software and services segments are witnessing faster growth, propelled by increasing demand for data analytics, remote monitoring, and cloud-based solutions. The hardware segment is expected to maintain a significant market share throughout the forecast period, but the software and services sector will likely exhibit a higher CAGR of xx%.

By End-user: The commercial sector is the largest end-user segment, driven by the high concentration of commercial buildings and the need for efficient management of energy and resources. The industrial sector is also showing strong growth, driven by the increasing need for automation and optimization of industrial processes. The residential segment, although smaller, is projected to grow at a faster rate due to increasing adoption of smart home technologies and energy-efficient solutions. The strong growth in the commercial sector is primarily fueled by the increasing demand for energy efficiency and improved building performance among business owners and property managers.

North America Building Automation Systems Market Product Developments

Recent product developments focus on enhancing building efficiency and user experience. The integration of IoT, AI, and cloud computing is a major trend, allowing for real-time monitoring, data analytics, and predictive maintenance. Building automation systems are becoming increasingly user-friendly with intuitive interfaces and mobile apps. These new solutions provide substantial competitive advantages by optimizing building performance, enhancing energy savings, and enabling proactive issue management.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North American Building Automation Systems market segmented by country (United States, Canada), component (hardware, software, services), and end-user (residential, commercial, industrial). Each segment's market size, growth projections, and competitive dynamics are thoroughly examined. The United States segment holds the largest market share in terms of both value and volume, followed by Canada. Within components, hardware constitutes the biggest segment, while the software and services segments are exhibiting the highest growth rates. The commercial sector accounts for the largest portion of end-user demand.

Key Drivers of North America Building Automation Systems Market Growth

The market's growth is fueled by several key factors, including increasing energy costs, stringent environmental regulations promoting energy efficiency, and the rising adoption of smart building technologies. Government initiatives and incentives supporting green building practices are significantly driving market growth. The growing demand for advanced building management systems to optimize operations and reduce costs is another key factor. Furthermore, advancements in IoT, AI, and cloud computing are fostering innovation and market expansion.

Challenges in the North America Building Automation Systems Market Sector

The market faces several challenges, including high initial investment costs, interoperability issues between different systems, and a lack of skilled professionals for installation and maintenance. Cyber security concerns related to connected building systems and the complexity of integrating legacy systems also pose significant challenges. Supply chain disruptions and the rising cost of raw materials can further hinder market growth. The high initial investment costs limit adoption, especially in smaller buildings.

Emerging Opportunities in North America Building Automation Systems Market

The market presents several emerging opportunities. The increasing adoption of smart building technologies, including IoT, AI, and big data analytics, offers potential for enhanced efficiency and automation. The growth of the green building sector and rising demand for sustainable solutions present significant opportunities for eco-friendly building automation systems. Moreover, the development of innovative financing models to reduce upfront costs can drive market expansion. The integration of renewable energy sources with building automation systems opens up new avenues for growth.

Leading Players in the North America Building Automation Systems Market Market

- Honeywell International Inc

- Uplight Inc

- SAP SE

- Siemens AG

- Schneider Electric SE

- Elster Group GmbH

- Oracle Corporation

- Johnson Control International PLC

- Greenwave Systems Inc

- Panasonic Corporation

Key Developments in North America Building Automation Systems Market Industry

March 2023: Siemens Smart Infrastructure introduced Connect Box, an open and simple IoT solution for managing small to medium-sized buildings, enhancing energy efficiency by up to 30% and significantly improving indoor air quality. This launch expands market access to smaller businesses and institutions.

March 2023: According to the EIA, by 2050, carbon dioxide emissions in the United States are forecasted to decline across all sectors compared to 2022 levels. This long-term trend strengthens the market demand for energy-efficient building automation solutions.

Strategic Outlook for North America Building Automation Systems Market Market

The North America Building Automation Systems market exhibits strong potential for future growth. Continued technological innovation, coupled with increasing demand for energy efficiency and sustainable building practices, will drive market expansion. The integration of AI, IoT, and big data analytics will play a crucial role in shaping future market trends. Companies adopting proactive strategies focusing on innovation, strategic partnerships, and expanding their service offerings will be best positioned to capture market share and drive growth in this dynamic sector.

North America Building Automation Systems Market Segmentation

-

1. Component

-

1.1. Hardware

- 1.1.1. Controllers

- 1.1.2. Field Devices

- 1.1.3. Other Components

- 1.2. Software

- 1.3. Services

-

1.1. Hardware

-

2. End-user

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

North America Building Automation Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Building Automation Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Initiatives and Directives for Energy and Operational Efficiency; Surge in demand for HVAC housing owing to rapid population growth

- 3.3. Market Restrains

- 3.3.1. High Installation Costs Coupled with Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Increasing Initiatives and Directives for Energy and Operational Efficiency to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Building Automation Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Controllers

- 5.1.1.2. Field Devices

- 5.1.1.3. Other Components

- 5.1.2. Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. United States North America Building Automation Systems Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Building Automation Systems Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Building Automation Systems Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Building Automation Systems Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Uplight Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SAP SE*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Schneider Electric SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Elster Group GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Oracle Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Johnson Control International PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Greenwave Systems Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Building Automation Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Building Automation Systems Market Share (%) by Company 2024

List of Tables

- Table 1: North America Building Automation Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Building Automation Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: North America Building Automation Systems Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: North America Building Automation Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Building Automation Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Building Automation Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Building Automation Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Building Automation Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Building Automation Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Building Automation Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 11: North America Building Automation Systems Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 12: North America Building Automation Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Building Automation Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Building Automation Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Building Automation Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Building Automation Systems Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the North America Building Automation Systems Market?

Key companies in the market include Honeywell International Inc, Uplight Inc, SAP SE*List Not Exhaustive, Siemens AG, Schneider Electric SE, Elster Group GmbH, Oracle Corporation, Johnson Control International PLC, Greenwave Systems Inc, Panasonic Corporation.

3. What are the main segments of the North America Building Automation Systems Market?

The market segments include Component, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Initiatives and Directives for Energy and Operational Efficiency; Surge in demand for HVAC housing owing to rapid population growth.

6. What are the notable trends driving market growth?

Increasing Initiatives and Directives for Energy and Operational Efficiency to Drive the Market.

7. Are there any restraints impacting market growth?

High Installation Costs Coupled with Maintenance Costs.

8. Can you provide examples of recent developments in the market?

March 2023: Siemens Smart Infrastructure introduced Connect Box, an open and simple IoT solution for managing small to medium-sized buildings. The Connect Box is a user-friendly method of building performance monitoring that enhances energy efficiency by up to 30% and significantly improves indoor air quality in small to medium-sized buildings such as schools, retail shops, apartments, or small offices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Building Automation Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Building Automation Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Building Automation Systems Market?

To stay informed about further developments, trends, and reports in the North America Building Automation Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence