Key Insights

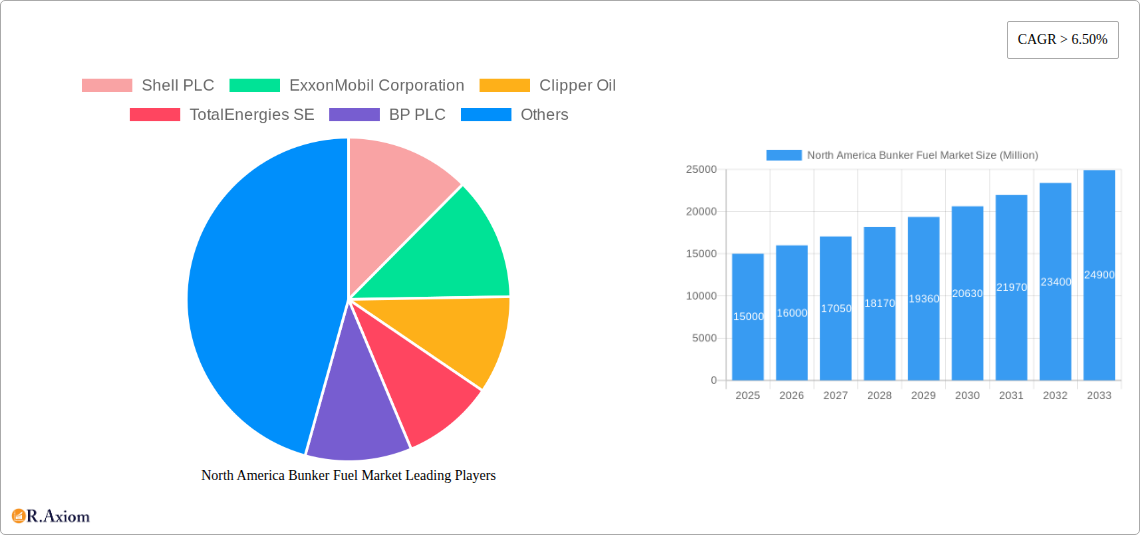

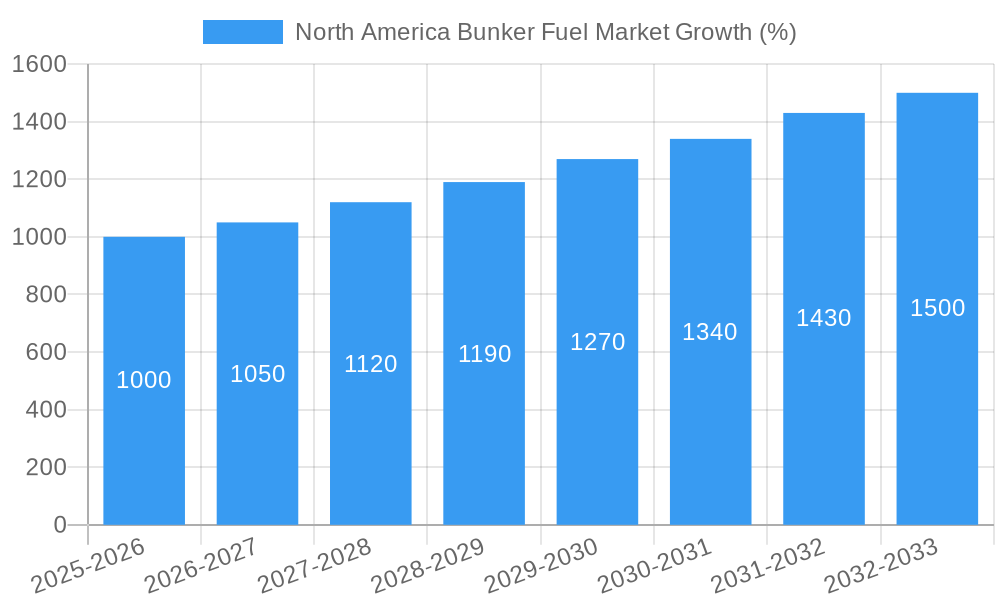

The North American bunker fuel market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 6.5% CAGR through 2033. This expansion is driven primarily by increasing maritime trade activity within the region, particularly along the heavily trafficked coasts of the United States and Canada. The rising demand for efficient and environmentally friendly fuel options is another significant factor, pushing the adoption of Very Low Sulfur Fuel Oil (VLSFO) and Liquefied Natural Gas (LNG) as cleaner alternatives to High Sulfur Fuel Oil (HSFO). Container and tanker vessels constitute the largest segments within the market, reflecting the dominant role of these vessel types in North American shipping. However, stricter environmental regulations are likely to present both challenges and opportunities. While these regulations increase costs in the short term, they stimulate innovation and investment in cleaner fuel technologies, ultimately shaping the market's future trajectory.

The market segmentation reveals a dynamic landscape. While VLSFO currently holds a significant market share due to stricter emission standards, LNG adoption is gaining momentum, fueled by its significantly lower carbon footprint. The shift towards LNG is expected to accelerate in the coming years, albeit gradually, due to infrastructure limitations and higher initial investment costs. Furthermore, the market is influenced by fluctuating crude oil prices, geopolitical events, and regional economic growth. Companies like Shell, ExxonMobil, and BP are key players, strategically positioning themselves to capitalize on the evolving market dynamics and cater to the rising demand for environmentally sustainable fuels. The growth trajectory anticipates considerable market expansion across different vessel types, with a noticeable increase in demand for cleaner bunker fuels driven by both regulatory pressures and environmental consciousness.

North America Bunker Fuel Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the North America Bunker Fuel Market, covering the period from 2019 to 2033. It offers in-depth insights into market trends, segment performance, competitive dynamics, and future growth prospects, making it an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis and industry expertise to deliver actionable intelligence for navigating this evolving market.

North America Bunker Fuel Market Market Concentration & Innovation

The North America bunker fuel market exhibits a moderately concentrated landscape, dominated by major multinational players such as Shell PLC, ExxonMobil Corporation, BP PLC, Chevron Corporation, and TotalEnergies SE. These companies hold a significant market share, estimated at xx% collectively in 2025, owing to their extensive distribution networks, established customer relationships, and substantial investment in research and development. However, smaller players and specialized suppliers also contribute to the market’s diversity. Innovation is driven primarily by the stringent environmental regulations aimed at reducing sulfur emissions, pushing the industry towards cleaner fuel options like Very Low Sulfur Fuel Oil (VLSFO) and Liquefied Natural Gas (LNG).

- Market Share: Shell PLC holds an estimated xx% market share in 2025, followed by ExxonMobil Corporation with xx%. Other major players such as BP PLC, Chevron Corporation, and TotalEnergies SE collectively hold approximately xx%.

- M&A Activity: The market has witnessed moderate M&A activity in recent years, with deal values ranging from xx Million to xx Million USD, primarily focused on expanding distribution networks and securing fuel supplies. These activities have contributed to market consolidation and increased competitive intensity.

- Regulatory Framework: Stringent environmental regulations, including IMO 2020, are significant drivers of innovation and market shifts, prompting the adoption of cleaner fuel types.

- Product Substitutes: The emergence of alternative fuels, such as LNG and biofuels, poses both a challenge and an opportunity, impacting the demand for traditional bunker fuels.

- End-User Trends: The growing preference for cleaner fuels among shipping companies and the increasing adoption of LNG as a marine fuel are reshaping market dynamics.

North America Bunker Fuel Market Industry Trends & Insights

The North America bunker fuel market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by the increasing global trade volume, the expansion of shipping activities, and the growing demand for efficient and environmentally friendly fuels. Technological advancements, such as the development of alternative fuels and improved fuel efficiency technologies, are also contributing to market growth. However, fluctuations in crude oil prices and evolving environmental regulations present significant challenges. The market penetration of VLSFO is steadily increasing, driven by stricter sulfur emission limits. Consumer preferences are shifting towards cleaner and more sustainable fuel options, impacting the demand for High Sulfur Fuel Oil (HSFO). The competitive landscape is characterized by intense competition among major players, focused on price competitiveness, fuel quality, and service offerings.

Dominant Markets & Segments in North America Bunker Fuel Market

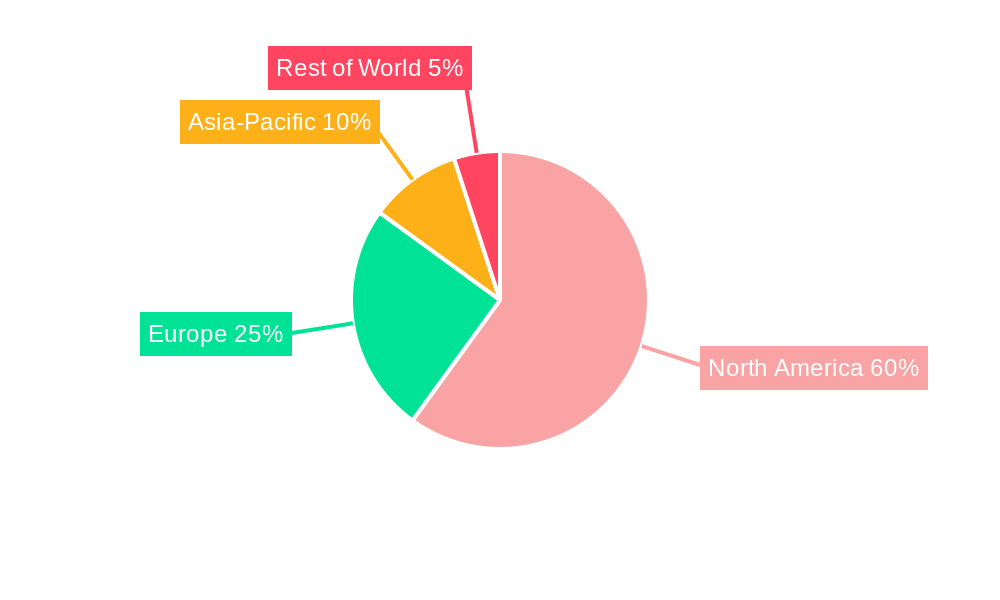

- Leading Region/Country: The US East Coast is the dominant market segment due to its high concentration of ports and significant shipping activities.

- Fuel Type: VLSFO is the fastest-growing fuel type due to stricter environmental regulations, while the demand for HSFO is declining. MGO continues to hold a significant share, primarily for smaller vessels and specific operational requirements. LNG adoption is steadily increasing.

- Vessel Type: Tankers and container ships are the major consumers of bunker fuel, driven by the high volume of cargo transported.

Key Drivers:

- Economic Policies: Government policies supporting sustainable shipping and incentives for adopting cleaner fuels are driving market growth.

- Infrastructure Development: Investments in port infrastructure and the development of LNG bunkering facilities are contributing to the expansion of the market.

The dominance of the US East Coast is primarily attributed to the high volume of shipping activities, the presence of numerous major ports, and the strategic location facilitating global trade. The shift towards VLSFO is a direct consequence of the IMO 2020 regulations and growing environmental awareness. The relatively slower growth of LNG adoption is influenced by the higher initial investment costs associated with LNG bunkering infrastructure.

North America Bunker Fuel Market Product Developments

Recent product innovations primarily focus on the development and adoption of cleaner and more efficient fuels to meet stringent environmental regulations. The introduction of biofuels and other alternative fuel solutions are gaining traction, aiming to reduce greenhouse gas emissions and improve overall environmental performance. These innovations offer competitive advantages in terms of environmental compliance and potentially cost-effectiveness in the long run, aligning with the market's increasing demand for sustainable fuel options. The integration of digital technologies for improved fuel management and optimization is also emerging as a key area of innovation.

Report Scope & Segmentation Analysis

The report comprehensively segments the North America bunker fuel market based on fuel type (HSFO, VLSFO, MGO, LNG, Other Fuel Types) and vessel type (Containers, Tankers, General Cargo, Bulk Carrier, Other Vessel Types). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed. For example, the VLSFO segment shows strong growth potential due to the enforcement of stricter emission regulations, while the LNG segment, although still relatively smaller, showcases significant future prospects aligned with sustainability goals. The market size for each segment is detailed, along with competitive landscapes illustrating the presence and strategies of key players within each specific segment.

Key Drivers of North America Bunker Fuel Market Growth

Several factors are driving the North America bunker fuel market's growth. Increased global trade and the consequent rise in shipping activities form the primary driver. Stringent environmental regulations, such as IMO 2020, mandating lower sulfur content in fuel, are pushing the adoption of cleaner alternatives like VLSFO and LNG. Technological advancements leading to more efficient engines and fuel-saving technologies contribute to market expansion. Furthermore, government incentives and policies promoting sustainable shipping also influence market growth.

Challenges in the North America Bunker Fuel Market Sector

The North America bunker fuel market faces several challenges. Fluctuations in crude oil prices significantly impact fuel costs and overall market stability. Stringent environmental regulations, while driving innovation, also present compliance complexities and potentially high investment costs for fuel producers and shippers. The supply chain's vulnerability to disruptions and geopolitical events adds another layer of complexity. The intense competition among major players adds pressure to profit margins and necessitates continuous innovation and cost optimization.

Emerging Opportunities in North America Bunker Fuel Market

Several emerging opportunities exist within the North America bunker fuel market. The growing demand for cleaner fuels creates significant opportunities for producers and suppliers of VLSFO and LNG. The development and adoption of biofuels and other sustainable alternatives open new avenues for growth. Technological advancements in fuel efficiency and optimized engine designs provide further potential. Expanding the LNG bunkering infrastructure offers substantial growth opportunities, as does the exploration of hydrogen as a potential future marine fuel.

Leading Players in the North America Bunker Fuel Market Market

- Shell PLC

- ExxonMobil Corporation

- Clipper Oil

- TotalEnergies SE

- BP PLC

- Chevron Corporation

- Repsol SA

Key Developments in North America Bunker Fuel Market Industry

- September 2021: Chevron USA Inc. and Caterpillar Inc. announced a collaboration to develop hydrogen demonstration projects for transportation and stationary power, including marine vessels. This signals a significant shift towards alternative fuels and highlights the industry's focus on decarbonization.

Strategic Outlook for North America Bunker Fuel Market Market

The North America bunker fuel market is poised for significant growth, driven by the expansion of global trade, the increasing demand for cleaner fuels, and technological advancements. The transition towards low-sulfur and alternative fuels will continue to shape market dynamics. Companies that successfully navigate the challenges of environmental regulations and adapt to evolving consumer preferences are expected to thrive. Investing in research and development of sustainable fuel alternatives and upgrading infrastructure will be crucial for long-term success in this market.

North America Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Liquefied Natural Gas (LNG)

- 1.5. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Bunker Fuel Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Declining Price of Solar Panels and Installation Costs4.; Increasing Adoption of Solar PV Systems4.; Rising Environmental Concerns About the Use of Fossil Fuels

- 3.3. Market Restrains

- 3.3.1. 4.; Transmission and Distribution Losses4.; A Lack of a Solidified Renewable Energy Policy

- 3.4. Market Trends

- 3.4.1. Very Low Sulfur Fuel Oil (VLSFO) Expected to be the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Liquefied Natural Gas (LNG)

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. United States North America Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. High Sulfur Fuel Oil (HSFO)

- 6.1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 6.1.3. Marine Gas Oil (MGO)

- 6.1.4. Liquefied Natural Gas (LNG)

- 6.1.5. Other Fuel Types

- 6.2. Market Analysis, Insights and Forecast - by Vessel Type

- 6.2.1. Containers

- 6.2.2. Tankers

- 6.2.3. General Cargo

- 6.2.4. Bulk Carrier

- 6.2.5. Other Vessel Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Canada North America Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. High Sulfur Fuel Oil (HSFO)

- 7.1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 7.1.3. Marine Gas Oil (MGO)

- 7.1.4. Liquefied Natural Gas (LNG)

- 7.1.5. Other Fuel Types

- 7.2. Market Analysis, Insights and Forecast - by Vessel Type

- 7.2.1. Containers

- 7.2.2. Tankers

- 7.2.3. General Cargo

- 7.2.4. Bulk Carrier

- 7.2.5. Other Vessel Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Rest of North America North America Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. High Sulfur Fuel Oil (HSFO)

- 8.1.2. Very Low Sulfur Fuel Oil (VLSFO)

- 8.1.3. Marine Gas Oil (MGO)

- 8.1.4. Liquefied Natural Gas (LNG)

- 8.1.5. Other Fuel Types

- 8.2. Market Analysis, Insights and Forecast - by Vessel Type

- 8.2.1. Containers

- 8.2.2. Tankers

- 8.2.3. General Cargo

- 8.2.4. Bulk Carrier

- 8.2.5. Other Vessel Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. United States North America Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Bunker Fuel Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Shell PLC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ExxonMobil Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Clipper Oil

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 TotalEnergies SE

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BP PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Chevron Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Repsol SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 Shell PLC

List of Figures

- Figure 1: North America Bunker Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Bunker Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: North America Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Bunker Fuel Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: North America Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: North America Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 5: North America Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 6: North America Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 7: North America Bunker Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Bunker Fuel Market Volume metric tonnes Forecast, by Geography 2019 & 2032

- Table 9: North America Bunker Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Bunker Fuel Market Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 11: North America Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 13: United States North America Bunker Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Bunker Fuel Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Bunker Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Bunker Fuel Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Bunker Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Bunker Fuel Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Bunker Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Bunker Fuel Market Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 21: North America Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 22: North America Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 23: North America Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 24: North America Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 25: North America Bunker Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Bunker Fuel Market Volume metric tonnes Forecast, by Geography 2019 & 2032

- Table 27: North America Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 29: North America Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 30: North America Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 31: North America Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 32: North America Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 33: North America Bunker Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Bunker Fuel Market Volume metric tonnes Forecast, by Geography 2019 & 2032

- Table 35: North America Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 37: North America Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 38: North America Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 39: North America Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 40: North America Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 41: North America Bunker Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Bunker Fuel Market Volume metric tonnes Forecast, by Geography 2019 & 2032

- Table 43: North America Bunker Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Bunker Fuel Market Volume metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Bunker Fuel Market?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the North America Bunker Fuel Market?

Key companies in the market include Shell PLC, ExxonMobil Corporation, Clipper Oil, TotalEnergies SE, BP PLC, Chevron Corporation, Repsol SA.

3. What are the main segments of the North America Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Declining Price of Solar Panels and Installation Costs4.; Increasing Adoption of Solar PV Systems4.; Rising Environmental Concerns About the Use of Fossil Fuels.

6. What are the notable trends driving market growth?

Very Low Sulfur Fuel Oil (VLSFO) Expected to be the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

4.; Transmission and Distribution Losses4.; A Lack of a Solidified Renewable Energy Policy.

8. Can you provide examples of recent developments in the market?

In September 2021, Chevron USA Inc., a subsidiary of Chevron Corporation, and Caterpillar Inc. announced a collaborative agreement to develop hydrogen demonstration projects in transportation and stationary power applications, including prime power. The goal of the collaboration is to confirm the feasibility and performance of hydrogen for use as a commercially viable alternative to traditional fuels for line-haul rail and marine vessels. The collaboration also seeks to demonstrate hydrogen's use in prime power.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the North America Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence