Key Insights

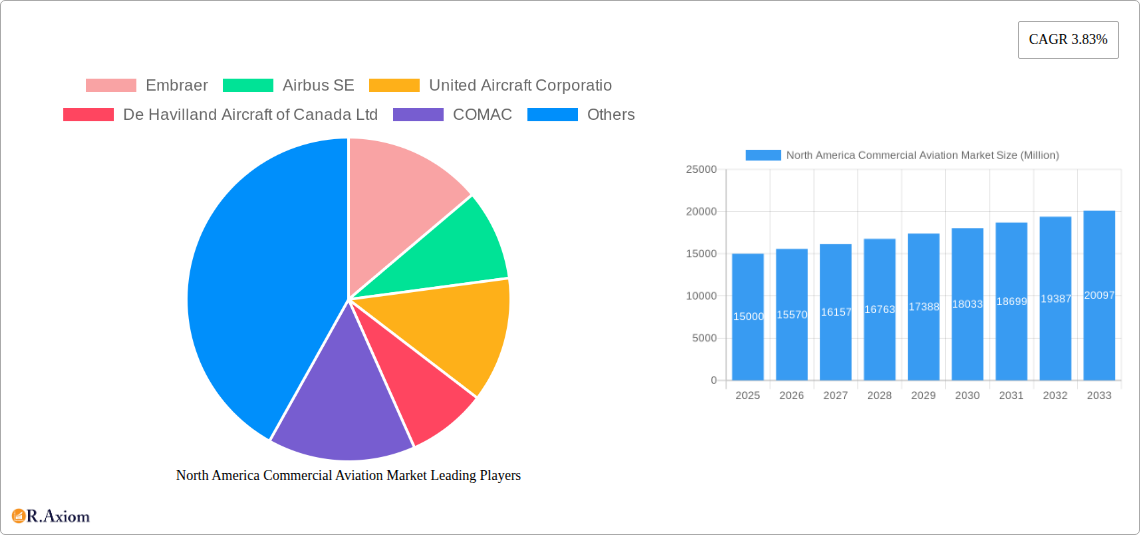

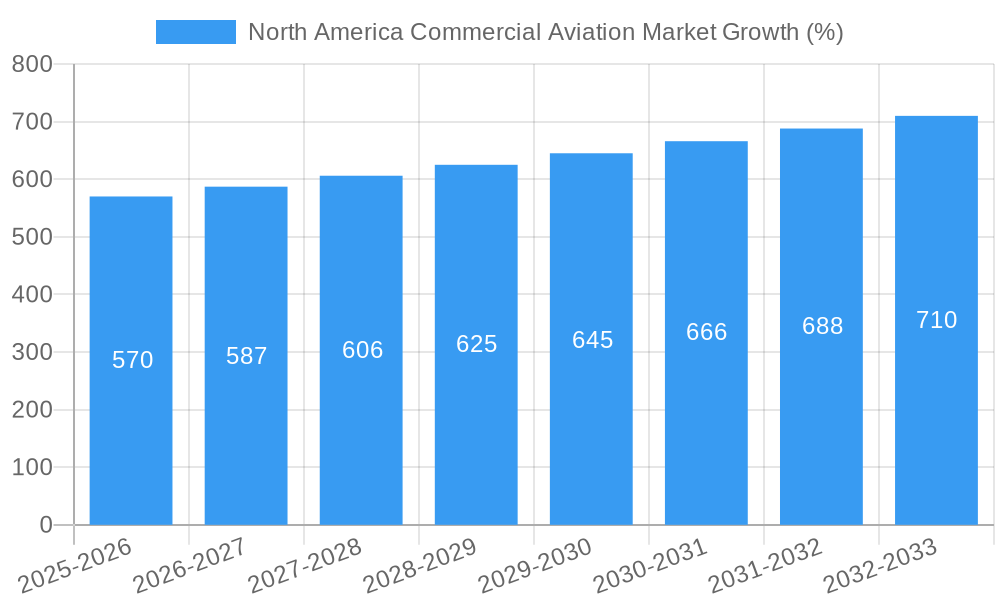

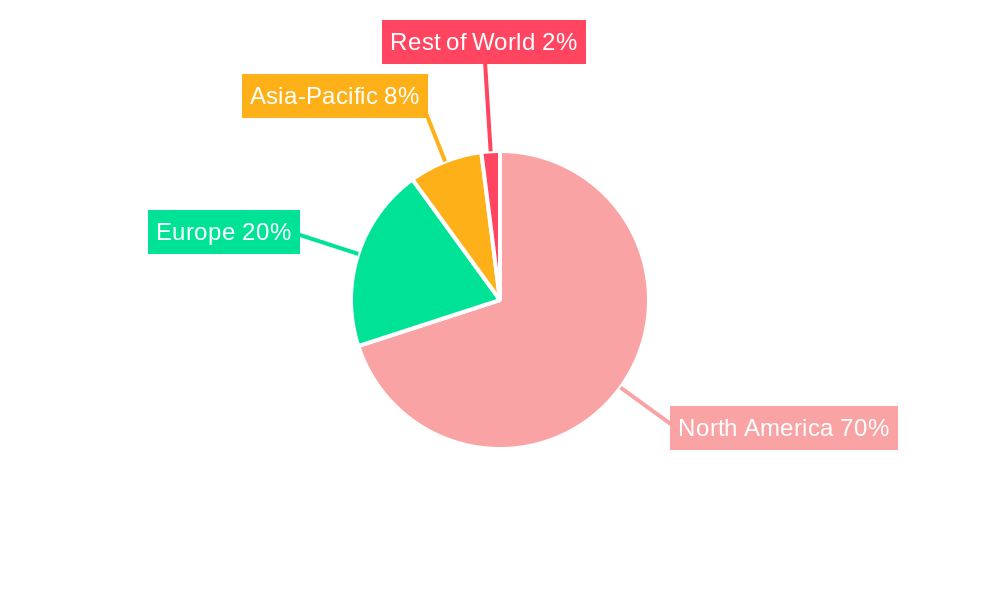

The North American commercial aviation market, encompassing passenger and freighter aircraft, is poised for steady growth throughout the forecast period (2025-2033). Driven by factors such as increasing passenger traffic, robust air cargo demand fueled by e-commerce expansion, and a growing need for efficient and modernized fleets, the market is projected to exhibit a compound annual growth rate (CAGR) of 3.83%. Key players like Boeing, Airbus, Embraer, and De Havilland are strategically positioned to capitalize on this growth, focusing on fuel-efficient aircraft and technological advancements to meet environmental regulations and operational efficiency demands. The market segmentation reveals significant contributions from the United States, followed by Canada and Mexico, with the Rest of North America demonstrating promising albeit smaller growth potential. The robust air travel infrastructure in the US, coupled with increased tourism and business travel, acts as a major growth catalyst. Canada and Mexico are also experiencing growth in their aviation sectors, albeit at a slightly slower pace due to factors such as economic conditions and infrastructure development. The market's sustained growth is however subject to potential constraints, such as fluctuating fuel prices, geopolitical instability, and the overall economic climate.

The competitive landscape is characterized by intense competition among established players and new entrants. Boeing and Airbus dominate the large aircraft segment, while Embraer and De Havilland cater to the regional jet market. The presence of COMAC and ATR introduces an element of competition, offering alternatives and further shaping market dynamics. Future market success will hinge on manufacturers' ability to adapt to evolving customer needs, implement sustainable technologies, and maintain a robust supply chain while navigating global economic uncertainties. The market's segmentation by aircraft type (passenger and freighter) provides insights into the distinct growth trajectories within the broader aviation sector, allowing companies to strategize their investments accordingly. Continuous innovation in aircraft design, enhanced safety features, and integration of advanced technologies will be paramount to the success of players in this market.

This in-depth report provides a comprehensive analysis of the North America commercial aviation market, covering the period 2019-2033. It delves into market dynamics, competitive landscapes, technological advancements, and future growth prospects, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report utilizes robust data and forecasts to deliver actionable intelligence for navigating this dynamic sector.

North America Commercial Aviation Market Market Concentration & Innovation

The North American commercial aviation market exhibits a high degree of concentration, primarily dominated by a few major players. The Boeing Company and Airbus SE hold significant market share, commanding a combined xx% in 2025 (estimated). This duopoly significantly shapes market dynamics, influencing pricing strategies, technological advancements, and overall market growth. However, regional players like Embraer and De Havilland Aircraft of Canada Ltd contribute significantly to specific segments. Innovation is driven by the continuous need for fuel efficiency, enhanced safety features, and technological integrations. The regulatory framework, primarily governed by the Federal Aviation Administration (FAA) in the US and Transport Canada, plays a crucial role in shaping innovation trajectories. Substitute products, primarily involving alternative modes of transportation (high-speed rail) and technological advancements in air taxi services, pose a moderate threat to market growth. End-user trends indicate a growing demand for sustainable aviation practices and enhanced passenger experience, creating opportunities for innovation. Significant M&A activity, with deal values exceeding xx Million in the last five years, further demonstrates the competitive landscape and the pursuit of market consolidation. Market share fluctuations due to M&A activities have led to several shifts in market leadership. For example, the acquisition of xx by xx resulted in a xx% increase in market share.

- Market Concentration: High, with Boeing and Airbus leading.

- Innovation Drivers: Fuel efficiency, safety enhancements, technological integration.

- Regulatory Framework: FAA (US), Transport Canada.

- Product Substitutes: High-speed rail, air taxi services.

- End-User Trends: Sustainability, enhanced passenger experience.

- M&A Activity: Significant activity with deals exceeding xx Million in the last five years.

North America Commercial Aviation Market Industry Trends & Insights

The North America commercial aviation market is poised for significant growth, driven by a confluence of factors. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033), driven by an expanding passenger base, increasing disposable incomes, and robust economic growth in key regions. Technological disruptions, such as the adoption of advanced materials and sustainable aviation fuels (SAFs), are reshaping the industry landscape. The rise of low-cost carriers has significantly impacted market penetration, altering the competitive dynamic, and influencing pricing strategies. Consumer preferences are shifting towards enhanced connectivity, personalized in-flight experiences, and sustainability considerations. The competitive dynamics are characterized by intense rivalry amongst major manufacturers, forcing them to innovate and differentiate their offerings. Market penetration of fuel-efficient aircraft is expected to reach xx% by 2033, driven by regulatory pressures to reduce carbon emissions. Technological advancements like AI-powered predictive maintenance and autonomous flight systems will also shape future industry trends. The expansion of e-commerce and related air freight activities further contribute to the growth.

Dominant Markets & Segments in North America Commercial Aviation Market

The United States remains the dominant market in North America, accounting for xx% of the total market size in 2025 (estimated), primarily due to its large population, extensive route networks, and robust economy. The passenger aircraft segment holds the largest market share, driven by the burgeoning demand for air travel.

United States:

- Key Drivers: Large population, extensive route networks, robust economy.

- Dominance Analysis: The US market's size and infrastructure facilitate high passenger volume and freight transportation.

Canada:

- Key Drivers: Well-developed infrastructure, growing tourism sector.

- Dominance Analysis: Canada's robust aviation industry supports a sizable domestic market, although less significant than the US.

Mexico:

- Key Drivers: Growing tourism, expanding domestic air travel.

- Dominance Analysis: Mexico's market is growing, but at a slower rate than the US and Canada.

Rest of North America:

- Key Drivers: Regional growth in tourism and business travel.

- Dominance Analysis: This segment's growth is influenced by the economic performance of smaller markets within North America.

Passenger Aircraft: This segment is the largest due to the high demand for passenger transportation, and further fuelled by the growth in low-cost carriers.

Freighter Aircraft: While smaller in market share compared to passenger aircraft, it's experiencing steady growth due to e-commerce and global trade expansion.

North America Commercial Aviation Market Product Developments

Recent product innovations focus on fuel efficiency, enhanced passenger experience, and advanced technological integrations. Manufacturers are incorporating lightweight composite materials, advanced aerodynamics, and more efficient engines to reduce fuel consumption and emissions. In-flight entertainment systems are becoming increasingly sophisticated, offering personalized content and connectivity options. The integration of advanced sensors and data analytics is enabling predictive maintenance and improved operational efficiency. These advancements are crucial for capturing market share in a highly competitive environment and aligning with growing consumer demand for sustainability and enhanced travel experiences.

Report Scope & Segmentation Analysis

This report provides a detailed analysis across various market segments.

By Sub Aircraft Type: Passenger Aircraft and Freighter Aircraft. Passenger Aircraft is projected to dominate due to increased travel demand while Freighter aircraft is experiencing growth due to e-commerce.

By Country: United States, Canada, Mexico, and Rest of North America. The United States will remain the largest market due to the factors mentioned previously.

Each segment is analyzed based on its market size, growth projections, and competitive dynamics, providing a comprehensive overview of the North American commercial aviation market.

Key Drivers of North America Commercial Aviation Market Growth

Several factors are driving the growth of the North American commercial aviation market. These include:

- Economic growth: Rising disposable incomes and increased business travel fuel demand.

- Technological advancements: Fuel-efficient aircraft and advanced technologies enhance efficiency.

- Favorable government policies: Regulatory frameworks that support the aviation industry.

- Growing tourism: Increased tourism creates higher air travel demand.

- E-commerce boom: Fueling demand for air freight services.

Challenges in the North America Commercial Aviation Market Sector

The sector faces several challenges including:

- High fuel prices: Significant impact on operating costs and profitability.

- Stringent regulatory compliance: Compliance costs and potential delays in approvals.

- Supply chain disruptions: Impacting aircraft production and maintenance schedules.

- Geopolitical uncertainties: Affecting air travel demand and investment decisions.

- Competition: Intense competition amongst established and emerging players.

Emerging Opportunities in North America Commercial Aviation Market

Emerging opportunities include:

- Sustainable aviation fuels (SAFs): Growing market for environmentally friendly fuels.

- Air taxi services: Expanding urban air mobility solutions.

- Advanced air traffic management systems: Enhancing efficiency and safety.

- Digital transformation: Improving operational efficiency and passenger experience through data analytics and AI.

- Expansion in underserved markets: Opportunities to serve regional airports and remote areas.

Leading Players in the North America Commercial Aviation Market Market

- Embraer

- Airbus SE

- United Aircraft Corporation

- De Havilland Aircraft of Canada Ltd

- COMAC

- ATR

- The Boeing Company

Key Developments in North America Commercial Aviation Market Industry

- June 2023: Boeing received 40 737 Max 8s orders from Avolon, indicating strong demand for narrow-body aircraft.

- June 2023: Air Algérie signed a contract for seven wide-body aircraft, boosting the wide-body segment.

- June 2023: Delta Air Lines' talks with Airbus for A350 and A330neo orders signal potential significant market share shifts.

Strategic Outlook for North America Commercial Aviation Market Market

The North American commercial aviation market exhibits strong growth potential, driven by continued economic expansion, technological advancements, and the increasing demand for air travel. Strategic investments in sustainable technologies, advanced air traffic management, and digital transformation are crucial for maximizing future market opportunities. The industry will likely see increased consolidation and collaboration, particularly in areas such as sustainable aviation fuels and urban air mobility. Companies that successfully adapt to evolving consumer preferences and regulatory changes will be best positioned to capitalize on long-term growth prospects.

North America Commercial Aviation Market Segmentation

-

1. Sub Aircraft Type

- 1.1. Freighter Aircraft

-

1.2. Passenger Aircraft

- 1.2.1. Narrowbody Aircraft

- 1.2.2. Widebody Aircraft

North America Commercial Aviation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Commercial Aviation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Commercial Aviation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 5.1.1. Freighter Aircraft

- 5.1.2. Passenger Aircraft

- 5.1.2.1. Narrowbody Aircraft

- 5.1.2.2. Widebody Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 6. United States North America Commercial Aviation Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Commercial Aviation Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Commercial Aviation Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Commercial Aviation Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Embraer

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Airbus SE

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 United Aircraft Corporatio

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 De Havilland Aircraft of Canada Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 COMAC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ATR

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Boeing Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Embraer

List of Figures

- Figure 1: North America Commercial Aviation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Commercial Aviation Market Share (%) by Company 2024

List of Tables

- Table 1: North America Commercial Aviation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Commercial Aviation Market Revenue Million Forecast, by Sub Aircraft Type 2019 & 2032

- Table 3: North America Commercial Aviation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: North America Commercial Aviation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States North America Commercial Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada North America Commercial Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico North America Commercial Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America North America Commercial Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: North America Commercial Aviation Market Revenue Million Forecast, by Sub Aircraft Type 2019 & 2032

- Table 10: North America Commercial Aviation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States North America Commercial Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America Commercial Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America Commercial Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Commercial Aviation Market?

The projected CAGR is approximately 3.83%.

2. Which companies are prominent players in the North America Commercial Aviation Market?

Key companies in the market include Embraer, Airbus SE, United Aircraft Corporatio, De Havilland Aircraft of Canada Ltd, COMAC, ATR, The Boeing Company.

3. What are the main segments of the North America Commercial Aviation Market?

The market segments include Sub Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: Boeing received solid 40 737 Max 8s orders from Irish aircraft leasing company Avolon.June 2023: Air Algérie, the national airline of Algeria, signed a contract to purchase seven wide-body aircraft to support commercial development.June 2023: Delta Air Lines Inc. is in talks with Airbus SE (AIR.PA) for a jumbo jet order. Orders include both A350 and A330neo dual-aisle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Commercial Aviation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Commercial Aviation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Commercial Aviation Market?

To stay informed about further developments, trends, and reports in the North America Commercial Aviation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence